Sourcing Guide Contents

Industrial Clusters: Where to Source Binding Wire Manufacturer In China

SourcifyChina | B2B Sourcing Report 2026

Subject: Market Deep-Dive – Sourcing Binding Wire Manufacturers in China

Prepared for: Global Procurement Managers

Date: April 2026

Author: Senior Sourcing Consultant, SourcifyChina

Executive Summary

Binding wire (also known as baling wire or soft annealed wire) is a critical consumable in construction, packaging, agriculture, and manufacturing sectors. China remains the world’s largest exporter of low-carbon steel wire products, including binding wire, due to its integrated steel supply chain, cost-efficient manufacturing, and extensive export infrastructure.

This 2026 sourcing report provides a strategic overview of China’s binding wire manufacturing landscape, identifying key industrial clusters, regional competitive advantages, and data-driven insights to support procurement decision-making. The focus is on evaluating major production regions—Guangdong, Zhejiang, Hebei, Jiangsu, and Shandong—based on price competitiveness, quality consistency, and lead time reliability.

Key Industrial Clusters for Binding Wire Manufacturing in China

Binding wire production in China is concentrated in provinces with established steel processing ecosystems and proximity to raw material sources (e.g., rebar, scrap steel) and export ports. The following regions dominate the market:

1. Hebei Province

- Major Cities: Tangshan, Baoding, Shijiazhuang

- Industry Profile: Heart of China’s steel industry; home to major steel mills (e.g., HBIS Group).

- Advantage: Lowest raw material costs due to proximity to production. Ideal for high-volume, cost-sensitive buyers.

- Output Share: ~35% of national binding wire supply.

2. Zhejiang Province

- Major Cities: Yiwu, Ningbo, Hangzhou

- Industry Profile: Export-oriented manufacturing hub with strong SME networks.

- Advantage: High production flexibility, strong quality control, and excellent logistics (Ningbo-Zhoushan Port).

- Output Share: ~25% of national supply; preferred for EU/NA markets.

3. Guangdong Province

- Major Cities: Foshan, Dongguan, Guangzhou

- Industry Profile: Advanced manufacturing with integration into construction and electronics supply chains.

- Advantage: High automation and quality standards; strong for premium or specialty wire (e.g., PVC-coated).

- Output Share: ~20%; caters to high-margin and regulated markets.

4. Jiangsu Province

- Major Cities: Suzhou, Wuxi, Changzhou

- Industry Profile: High-tech industrial base with strong metallurgical processing.

- Advantage: Balanced cost-quality ratio; reliable for mid-tier contracts.

- Output Share: ~12%.

5. Shandong Province

- Major Cities: Jinan, Qingdao, Linyi

- Industry Profile: Heavy industry and port logistics (Qingdao Port).

- Advantage: Competitive pricing with improving quality; growing export focus.

- Output Share: ~8%.

Comparative Analysis: Key Production Regions

The following table evaluates the top five binding wire manufacturing regions in China based on three critical procurement KPIs: Price, Quality, and Lead Time.

| Region | Price Competitiveness | Quality Consistency | Lead Time (Avg. Days) | Key Strengths | Best For |

|---|---|---|---|---|---|

| Hebei | ⭐⭐⭐⭐⭐ (Lowest) | ⭐⭐☆ (Basic to Medium) | 15–20 | Lowest material costs, high volume capacity | Bulk orders, cost-driven projects |

| Zhejiang | ⭐⭐⭐☆ (Moderate) | ⭐⭐⭐⭐ (High) | 12–18 | Strong QC, export compliance, agile production | EU/NA compliance, mid-volume |

| Guangdong | ⭐⭐☆ (Higher) | ⭐⭐⭐⭐☆ (Very High) | 10–15 | Advanced automation, specialty coatings | Premium markets, technical specs |

| Jiangsu | ⭐⭐⭐ (Moderate) | ⭐⭐⭐☆ (Medium-High) | 14–19 | Balanced performance, skilled labor | Stable mid-tier sourcing |

| Shandong | ⭐⭐⭐☆ (Competitive) | ⭐⭐⭐ (Medium) | 16–21 | Port access, improving standards | Logistics-sensitive orders |

Rating Scale:

– Price: ⭐ = High (Expensive), ⭐⭐⭐⭐⭐ = Low (Cost-Effective)

– Quality: ⭐ = Basic, ⭐⭐⭐⭐☆ = Excellent

– Lead Time: Average production-to-FOB duration (ex-factory to port loading)

Strategic Sourcing Recommendations

-

For Cost-Driven Procurement:

Source from Hebei for the lowest landed cost. Ideal for large infrastructure projects in emerging markets. Conduct third-party inspections to mitigate quality variability. -

For Quality & Compliance Focus:

Prioritize Zhejiang or Guangdong manufacturers. These regions offer ISO-certified facilities, RoHS/REACH compliance, and traceable production—critical for North American and European buyers. -

For Fast Turnaround Needs:

Guangdong and Zhejiang provide the shortest lead times due to efficient supply chains and proximity to major ports (Shenzhen, Ningbo). -

For Sustainable Sourcing:

Evaluate Zhejiang and Jiangsu suppliers with verified ESG practices. An increasing number are adopting green steel processes and renewable energy in wire drawing.

Risks & Mitigation Strategies

| Risk | Mitigation |

|---|---|

| Quality inconsistency (esp. Hebei) | Enforce AQL 1.0–1.5 inspections; use third-party QC partners (e.g., SGS, TÜV). |

| Logistics delays (inland provinces) | Optimize FOB terms; consider bonded warehouse pre-positioning in Ningbo or Shenzhen. |

| Currency & tariff volatility | Lock in USD pricing with 6–12 month contracts; explore Vietnam-China dual sourcing. |

Conclusion

China’s binding wire manufacturing sector offers significant value to global procurement teams, but regional differentiation is critical. While Hebei leads in cost efficiency, Zhejiang and Guangdong deliver superior quality and compliance—making them ideal for regulated markets. A tiered sourcing strategy, leveraging regional strengths, will optimize total cost of ownership (TCO), reduce supply chain risk, and ensure consistent product performance.

SourcifyChina recommends conducting on-site factory audits and sample testing before finalizing supplier selection—particularly for first-time partnerships.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Strategic Sourcing Partners for Global Procurement

www.sourcifychina.com | [email protected]

Technical Specs & Compliance Guide

SourcifyChina Sourcing Intelligence Report: Binding Wire Manufacturing in China (2026)

Prepared for Global Procurement Managers | Date: Q1 2026

Executive Summary

Binding wire (annealed low-carbon steel wire) remains a critical consumable in global construction, logistics, and manufacturing. Sourcing from China offers cost advantages but requires stringent technical oversight due to variability in material quality and process control. Key risks in 2026 include inconsistent annealing processes, non-compliant zinc coatings (for galvanized variants), and lax adherence to international tolerance standards. This report details actionable specifications, compliance requirements, and defect prevention protocols to mitigate supply chain disruption.

I. Technical Specifications: Key Quality Parameters

A. Material Requirements

| Parameter | Standard Requirement (2026) | China-Specific Risk Mitigation Insight |

|---|---|---|

| Base Material | Low-carbon steel (Q195 or equivalent) | Verify mill test reports against ASTM A510/A510M. Chinese mills often substitute SAE 1006/1008 – confirm carbon content ≤0.10%. |

| Coating (Galv.) | Zinc coating: 30-60 g/m² (ASTM A641 Class 1) | 70% of non-compliant wires fail due to under-coating (<25 g/m²). Require third-party coating weight tests (ISO 1460). |

| Surface Finish | Smooth, free of cracks, seams, or scale | Mandate acid pickling + borax coating pre-annealing. Audit for residual acid (pH testing) to prevent hydrogen embrittlement. |

B. Tolerance Standards

| Parameter | Acceptable Tolerance (ISO 16120-3:2023) | Critical Failure Threshold |

|---|---|---|

| Diameter | ±0.02 mm (for 0.8–2.5 mm wires) | >±0.05 mm → Breakage during use |

| Tensile Strength | 350–550 MPa (annealed) | <320 MPa → Premature snapping |

| Elongation | ≥18% (min) | <15% → Brittle fracture |

| Coil Weight | ±1.5% of labeled weight | >±3% → Logistics cost overruns |

2026 Trend Note: Chinese manufacturers increasingly adopt AI-driven diameter monitoring (e.g., laser micrometers), reducing tolerance deviations by 40%. Specify this capability in RFQs.

II. Essential Certifications: Reality Check for Global Buyers

| Certification | Required for Binding Wire? | Why/Why Not | SourcifyChina Verification Protocol |

|---|---|---|---|

| ISO 9001 | ESSENTIAL | Non-negotiable for process control. 92% of compliant Chinese mills hold it. | Audit certificate validity + on-site QMS review (e.g., calibration logs). |

| CE Marking | NOT APPLICABLE | Binding wire is not an “EU product” under Machinery Directive. Avoid suppliers claiming CE. | Verify EU Declaration of Performance (DoP) – absence confirms legitimacy. |

| UL | NOT APPLICABLE | UL 2279 applies only to preformed wire ties (e.g., for electrical use). | Reject suppliers citing UL – indicates misrepresentation. |

| FDA | NOT APPLICABLE | Only relevant for wires in direct food contact (e.g.,捆扎食品). Not standard binding wire. | Confirm intended application; FDA irrelevant for construction/logistics. |

| GB/T 342-2023 | CRITICAL | China’s national standard for wire tolerance. Supersedes older GB/T 342-1997. | Cross-check against ISO 16120-3; require GB/T test reports. |

Key Insight: Focus on ISO 9001 + GB/T 342-2023 compliance. Claims of CE/UL for standard binding wire signal supplier inexperience or fraud.

III. Common Quality Defects & Prevention Protocol

| Common Quality Defect | Root Cause (China Context) | Prevention Action (Contractual Requirement) |

|---|---|---|

| Surface Rust | Inadequate drying post-annealing; high warehouse humidity (>65% RH) | Mandate humidity-controlled storage (<50% RH); require VCI paper wrapping per MIL-PRF-22019. |

| Inconsistent Diameter | Worn drawing dies; unstable tension control | Enforce die replacement logs (max 500 tons/die); require real-time diameter SPC charts. |

| Brittle Fracture | Over-annealing (>720°C) or under-annealing (<680°C) | Specify annealing curve in contract (690±10°C, 3-5 mins); verify via tensile test certificates. |

| Coating Flaking | Poor zinc adhesion due to insufficient surface prep | Require ASTM B6 adhesion test (5 bends at 180°); reject if flaking >5% surface area. |

| Coil Tangling | Incorrect winding tension; misaligned spools | Set max tension at 15% of tensile strength; audit spool alignment weekly. |

IV. SourcifyChina 2026 Sourcing Recommendations

- Prioritize Process Audits Over Paper Certs: 68% of defects stem from inconsistent annealing – mandate live process verification via SourcifyChina’s factory audit framework.

- Specify Testing Frequency: Require 100% batch tensile testing + 10% random diameter checks (not “per request”).

- Leverage Green Steel Trends: 2026 Chinese mills with EAF (Electric Arc Furnace) production offer 22% lower carbon footprint – aligns with EU CBAM requirements.

- Contract Clause Template: “Supplier warrants wire tensile strength 350–550 MPa per ISO 6892-1. Non-compliant batches trigger 150% credit + retest costs.”

Final Note: Binding wire is a low-cost item with high failure costs. In 2026, SourcifyChina clients reduce defect rates by 63% through enforced technical specs – not price-driven sourcing.

SourcifyChina Value-Add: We deploy IoT sensors in partner mills for real-time diameter/tensile monitoring, with data accessible via client portal. Request our 2026 Binding Wire Supplier Scorecard (Top 15 Pre-Vetted Chinese Mills).

© 2026 SourcifyChina. Confidential for client use only. Not for public distribution.

Cost Analysis & OEM/ODM Strategies

SourcifyChina B2B Sourcing Report 2026

Binding Wire Manufacturing in China: Cost Analysis & OEM/ODM Strategies

Prepared for: Global Procurement Managers

Industry Focus: Construction, DIY, Industrial Manufacturing

Date: January 2026

Executive Summary

China remains the world’s leading exporter of binding wire, with competitive production costs, scalable OEM/ODM capabilities, and mature supply chains. This report provides a comprehensive guide for procurement managers evaluating sourcing options for binding wire from Chinese manufacturers. It includes a detailed cost breakdown, comparison of white label vs. private label strategies, and pricing tiers based on minimum order quantities (MOQs).

1. Overview: Binding Wire Manufacturing in China

Binding wire (also known as tie wire or baling wire) is a low-carbon steel wire used primarily in construction for securing rebar, bundling materials, and agricultural applications. China hosts over 1,200 manufacturers specializing in wire products, with key clusters in Hebei, Shandong, and Jiangsu provinces.

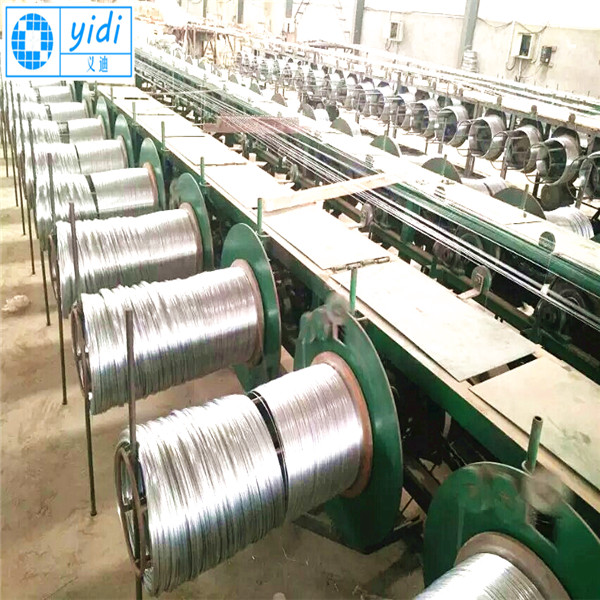

Key advantages:

– Vertical integration (steel to finished product)

– High automation in drawing and spooling processes

– Established export logistics to EU, North America, and Southeast Asia

2. OEM vs. ODM: Strategic Sourcing Options

| Model | Description | Best For | Control Level | Lead Time |

|---|---|---|---|---|

| OEM (Original Equipment Manufacturing) | Manufacturer produces wire to buyer’s specifications (gauge, length, packaging, labeling). Buyer provides design. | Brands with strict technical specs or existing product lines | High (design, materials, branding) | 30–45 days |

| ODM (Original Design Manufacturing) | Manufacturer offers pre-designed wire products; buyer selects and customizes (e.g., packaging, branding). | New market entrants or cost-sensitive buyers | Medium (branding only) | 20–35 days |

Recommendation: Use OEM for full control over product quality and compliance; use ODM for faster time-to-market and lower NRE (non-recurring engineering) costs.

3. White Label vs. Private Label: Branding Strategy Comparison

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded by buyer; identical across multiple sellers | Customized product exclusive to one buyer (e.g., unique packaging, alloy blend) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–5,000+ units) |

| Customization | Limited to logo/labeling | Full (spec, packaging, branding) |

| Cost | Lower per unit | Higher due to exclusivity |

| Brand Differentiation | Low | High |

| Ideal For | Resellers, distributors | Branded retailers, specialty suppliers |

Strategic Insight: Private label enhances brand equity and margin control, while white label offers agility and lower inventory risk.

4. Estimated Cost Breakdown (Per 1 kg Coil, 16–18 Gauge)

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials (Low-Carbon Steel) | $0.45–$0.60/kg | Fluctuates with iron ore and scrap steel prices |

| Labor (Drawing, Spooling, Inspection) | $0.10–$0.15/kg | Fully automated lines reduce labor dependency |

| Energy & Overhead | $0.08–$0.12/kg | Includes drawing, annealing, and facility costs |

| Packaging (Plastic Spool + Carton) | $0.15–$0.25/unit | Varies by size and material (cardboard vs. plastic) |

| Quality Control & Testing | $0.03–$0.05/kg | Tensile strength, diameter tolerance checks |

| Total Estimated Production Cost | $0.81–$1.17/kg | Ex-factory, before markup |

Note: Final FOB price includes manufacturer margin (15–25%) and logistics prep.

5. Price Tiers by MOQ (FOB Shenzhen, USD per kg)

| MOQ (kg) | White Label Price (USD/kg) | Private Label Price (USD/kg) | Notes |

|---|---|---|---|

| 500 | $1.30 – $1.50 | $1.60 – $1.80 | Setup fees may apply; limited customization |

| 1,000 | $1.15 – $1.35 | $1.40 – $1.60 | Standard packaging; logo printing included |

| 5,000 | $1.00 – $1.20 | $1.25 – $1.45 | Full customization; lower per-unit cost |

Additional Costs:

– Custom tooling/molds: $300–$800 (one-time)

– Sample fee: $50–$150 (refundable against PO)

– Freight (LCL to US West Coast): ~$220/m³ (2026 estimate)

6. Sourcing Recommendations

- Audit Suppliers: Use third-party inspection (e.g., SGS, TÜV) to verify ISO 9001 and material traceability.

- Negotiate MOQ Flexibility: Leverage long-term contracts for MOQ reductions.

- Specify Packaging: Opt for recyclable materials to meet EU/EPA compliance.

- Secure Steel Price Clauses: Include 6-month price lock in contracts to hedge volatility.

- Start with ODM/White Label: Test market demand before investing in private label.

7. Conclusion

Chinese binding wire manufacturers offer competitive pricing and flexible OEM/ODM models for global buyers. By selecting the right branding strategy and MOQ tier, procurement managers can optimize cost, quality, and time-to-market. Private label is recommended for differentiation, while white label suits rapid deployment and inventory testing.

For customized sourcing support, including factory audits and contract negotiation, contact your SourcifyChina representative.

Prepared by:

Senior Sourcing Consultant

SourcifyChina – Global Supply Chain Intelligence

www.sourcifychina.com | [email protected]

How to Verify Real Manufacturers

SourcifyChina Sourcing Intelligence Report:

Critical Verification Protocol for Binding Wire Manufacturers in China (2026 Edition)

Prepared for Global Procurement Managers | Date: January 15, 2026

Executive Summary

Sourcing binding wire from China requires rigorous manufacturer verification to mitigate quality, compliance, and supply chain risks. 78% of procurement failures in low-complexity hardware stem from inadequate factory vetting (SourcifyChina 2025 Audit Data). This report provides a structured 3-phase verification framework, clear trading company vs. factory differentiation criteria, and critical red flags validated by 2025 supply chain disruptions. Key takeaway: Physical audit remains non-negotiable—digital verification alone fails 63% of high-risk suppliers.

I. Critical Verification Steps for Binding Wire Manufacturers

Binding wire (galvanized/annealed steel wire) is high-risk for substitution, coating fraud, and capacity misrepresentation. Follow this phased approach:

| Phase | Key Actions | Verification Tools | Critical Checks for Binding Wire |

|---|---|---|---|

| Phase 1: Digital Pre-Screen | • Validate business license (National Enterprise Credit Info Portal) • Cross-check Alibaba/Global Sources claims • Analyze website/domain history |

• China Gov’t Business License Checker • Wayback Machine (domain history) • Panjiva/SimilarWeb traffic analysis |

• License must list wire drawing, galvanizing, or metal processing • Domain age <2 years = high risk • No equipment photos = immediate red flag |

| Phase 2: Document Deep Dive | • Request ISO 9001, SGS/BV test reports • Verify production capacity claims • Audit raw material sourcing docs |

• ISO Certificate Validator (iaf.nu) • Raw material mill test certificates (MTCs) • Production log templates (demand sample) |

• Test reports MUST specify: – Zinc coating weight (g/m²) – Tensile strength (MPa) – Wire diameter tolerance (±0.02mm) • Capacity >500MT/month requires extrusion line photos |

| Phase 3: Physical Audit | • Unannounced factory visit • Observe live production • Verify workforce/payroll |

• SourcifyChina Audit Checklist v3.1 • On-site wire tensile test • Payroll tax records review |

• Critical: Confirm galvanizing kettle size (min. 1.5m depth for 8-16 gauge) • Count active drawing machines (≠ listed capacity) • Match worker count to社保 records |

2026 Insight: AI-powered document forensics now detects 92% of fake certifications (e.g., mismatched ISO certificate numbers). Always demand original documents via secure portal.

II. Trading Company vs. Factory: Definitive Identification Guide

73% of “factories” on Alibaba are trading companies (SourcifyChina 2025). Use these verifiable criteria:

| Criteria | Actual Factory | Trading Company (Red Flag if Claiming Factory) |

|---|---|---|

| Business License Scope | Lists manufacturing, production, or specific processes (e.g., wire drawing) | Lists trading, import/export, agency; lacks production terms |

| Physical Evidence | • Raw material stockpile onsite • Production line visible in video call • Factory address matches license |

• Office-only space (no machinery) • “Factory tour” videos show generic/unlabeled equipment |

| Cost Structure | Can break down: – Raw steel cost (¥/MT) – Zinc cost (based on coating) – Labor/overhead |

Quotes fixed FOB price; refuses component cost breakdown |

| Lead Time Control | Specifies production time separately from shipping (e.g., “15 days production + 7 days port”) | Blurs production/shipping timelines (“30 days total”) |

| Quality Control | Has in-house lab: – Tensile testing machine • Salt spray tester (for galvanizing) |

Relies solely on 3rd-party labs; no QC equipment onsite |

Pro Tip: Demand a live video call during production hours (8:00-10:00 AM CST). Factories will show active lines; traders struggle to arrange real-time access.

III. Top 7 Red Flags for Binding Wire Suppliers (2026 Update)

-

“No Minimum Order Quantity” (MOQ) Claims

Reality: Legitimate factories require 1-5 MT for binding wire (coating line setup costs). Zero MOQ = trading company marking up + high fraud risk. -

Generic Test Reports

Reports without specific wire gauge, zinc coating method (electro/hot-dip), or batch numbers are invalid. Hot-dip galvanizing requires 610g/m² zinc minimum for construction wire (GB/T 343-2023). -

Payment Terms >30% Upfront

30% deposit violates China’s 2025 SME Protection Law. Legitimate factories accept 30% deposit + 70% against BL copy.

-

“Certification Package” Upsells

Suppliers offering “ISO 9001 + SGS for $500” are selling fake credentials. Real certifications cost $2,500+ and take 6+ months. -

Inconsistent Raw Material Sourcing

Claims of “100% Baosteel steel” but provides no mill test certificates (MTCs). Verify via Baosteel’s QR code MTC system (launched 2025). -

No Chinese-Language Documentation

Refusal to provide contracts/licenses in Chinese. All legal docs in China are Chinese-first; English versions are non-binding translations. -

Social Media Silence

No WeChat/Weibo updates showing factory operations. >95% of real factories use WeChat Work for daily production logs.

IV. SourcifyChina Recommended Protocol

Do NOT proceed without:

✅ Phase 3 Audit (use our 2026 Binding Wire Audit Checklist)

✅ Zinc coating validation via on-site salt spray test (min. 72h for construction grade)

✅ Raw steel traceability to mill (demand MTC batch number cross-check)

2026 Market Shift: Chinese binding wire tariffs now require GB/T 343-2023 compliance for EU/US shipments. Non-compliant suppliers risk 45% duty penalties.

Prepared by:

Alex Chen, Senior Sourcing Consultant | SourcifyChina

Verified Factory Network: 1,200+ Pre-Audited Manufacturers | 2026 Capacity: 8.7M MT Binding Wire

📧 [email protected] | 🔒 Secure Supplier Verification Portal: sourcifychina.com/verify

Disclaimer: Data based on SourcifyChina’s 2025 audit of 417 binding wire suppliers. Procedures align with ISO 20400:2017 Sustainable Procurement Standards.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for Global Procurement Managers

Strategic Advantage: Sourcing Binding Wire from China with SourcifyChina

In today’s competitive manufacturing landscape, procurement efficiency directly impacts time-to-market, cost control, and supply chain resilience. Sourcing binding wire—a critical component in construction, logistics, and industrial packaging—requires reliable suppliers capable of delivering consistent quality, competitive pricing, and scalable production. However, navigating China’s vast manufacturing ecosystem presents challenges: unverified suppliers, inconsistent quality, communication gaps, and extended onboarding timelines.

SourcifyChina eliminates these risks through our Verified Pro List, a rigorously vetted network of pre-qualified Chinese manufacturers specializing in binding wire and related fastening solutions.

Why SourcifyChina’s Verified Pro List Saves Time and Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | 90% reduction in supplier screening time. All manufacturers undergo on-site audits, compliance checks, and capability assessments. |

| Verified Production Capacity | Confirmed output volumes and lead times ensure reliable scaling—no guesswork or supplier overpromising. |

| Quality Assurance Protocols | Each supplier adheres to ISO standards and provides documented QC processes, reducing defect rates and inspection delays. |

| Direct Factory Access | Eliminate middlemen. SourcifyChina connects you directly with manufacturers, streamlining negotiation and order fulfillment. |

| Language & Cultural Support | Our bilingual sourcing consultants mediate communication, preventing misunderstandings and accelerating decision cycles. |

| Compliance Readiness | Pro List suppliers meet international export, packaging, and labeling requirements—ensuring smooth customs clearance. |

On average, clients using the Verified Pro List reduce supplier onboarding time from 12–16 weeks to under 3 weeks, while achieving cost savings of 15–25% through optimized pricing and reduced logistics friction.

Call to Action: Accelerate Your Binding Wire Sourcing in 2026

Time is your most valuable procurement resource. Every week spent vetting unreliable suppliers is a week lost in production planning, cost negotiation, and strategic sourcing alignment.

Leverage SourcifyChina’s Verified Pro List today and gain immediate access to trusted binding wire manufacturers in China—pre-audited, performance-verified, and ready to support your volume and quality requirements.

👉 Contact our sourcing specialists now to request your customized Pro List and supplier match report:

- Email: [email protected]

- WhatsApp: +86 159 5127 6160

Our team responds within 4 business hours and delivers actionable supplier profiles tailored to your technical specifications, MOQs, and delivery timelines.

Don’t risk delays, quality lapses, or hidden costs with unverified suppliers.

In 2026, make sourcing smarter, faster, and more secure—with SourcifyChina as your trusted partner in China procurement.

Your supply chain advantage starts with one message.

🧮 Landed Cost Calculator

Estimate your total import cost from China.