Sourcing Guide Contents

Industrial Clusters: Where to Source Biggest Manufacturing Companies In China

SourcifyChina B2B Sourcing Report 2026

Title: Strategic Sourcing from China’s Largest Manufacturing Clusters: Regional Analysis & Competitive Benchmarking

Prepared For: Global Procurement Managers

Date: January 2026

Executive Summary

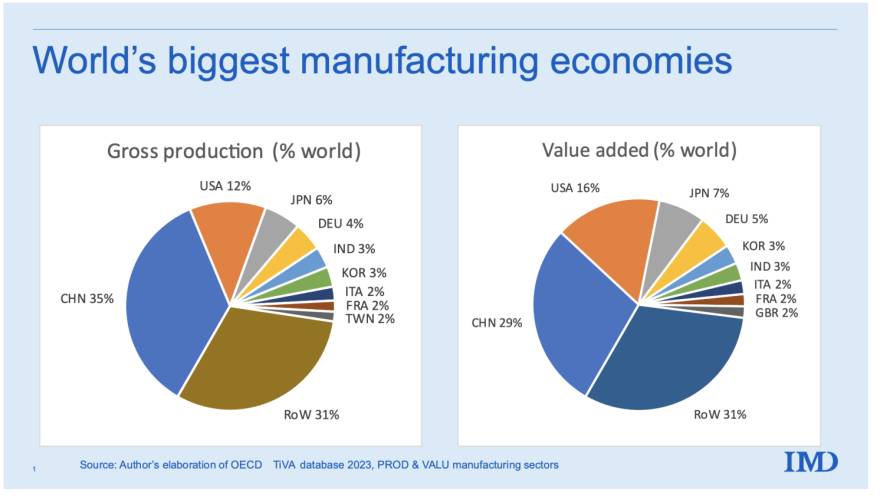

China remains the world’s largest manufacturing hub, contributing over 30% of global manufacturing output. While the term “biggest manufacturing companies in China” often refers to large-scale enterprises such as Huawei, BYD, Foxconn, Haier, and Midea, sourcing from these firms—or suppliers within their ecosystems—requires a nuanced understanding of regional industrial clusters. This report identifies the key provinces and cities hosting China’s dominant manufacturing companies and provides a comparative analysis of sourcing performance across major production zones.

Key Industrial Clusters for China’s Largest Manufacturing Companies

The concentration of China’s largest manufacturing firms is not uniform. Instead, they are clustered in specific provinces and cities driven by infrastructure, supply chain maturity, labor availability, and government policy support. The following regions dominate high-volume, high-efficiency manufacturing across electronics, machinery, appliances, automotive, and consumer goods.

Top Manufacturing Hubs (2026)

| Region | Key Cities | Dominant Industries | Notable Companies |

|---|---|---|---|

| Guangdong | Shenzhen, Guangzhou, Dongguan | Electronics, Consumer Tech, Telecom, Drones, EVs | Huawei, BYD, Foxconn, DJI, Midea, TCL |

| Zhejiang | Hangzhou, Ningbo, Yiwu, Wenzhou | Textiles, Small Machinery, E-commerce Goods, Fast-Moving Consumer Goods | Geely, Haier, Alibaba (Cainiao logistics partners) |

| Jiangsu | Suzhou, Nanjing, Wuxi, Changzhou | Industrial Equipment, Semiconductors, Chemicals, EV Components | CATL (subsidiaries), Suning, Hisense, Shoals Group |

| Shanghai | Shanghai (Municipality) | High-Tech, Automotive, Aerospace, Biopharma | SAIC Motor, Tesla (Gigafactory), ZTE, United Imaging |

| Shandong | Qingdao, Jinan, Yantai | Heavy Industry, Petrochemicals, Appliances, Food Processing | Haier, Inspur, Weichai, Sun Paper |

| Sichuan/Chongqing | Chengdu, Chongqing | Electronics Assembly, Aerospace, Automotive | BOE, Foxconn, HP, Lenovo, CATL |

Note: Many of China’s largest manufacturers operate multi-provincial supply chains, but core R&D and high-value production remain concentrated in the above regions.

Regional Sourcing Comparison: Price, Quality, and Lead Time

When sourcing from or through China’s largest manufacturing ecosystems, procurement managers must evaluate trade-offs between cost, quality consistency, and speed to market. The table below benchmarks key production regions as of Q1 2026.

| Region | Average Unit Price (Relative) | Quality Consistency (Scale: 1–5) | Average Lead Time (Days) | Key Strengths | Key Challenges |

|---|---|---|---|---|---|

| Guangdong | Medium–High | 5 | 25–40 | High automation, export-ready compliance, R&D access | Higher labor/rent costs; supply chain congestion |

| Zhejiang | Low–Medium | 4 | 30–45 | Cost efficiency, SME agility, e-commerce integration | Variable quality among smaller suppliers |

| Jiangsu | Medium | 5 | 30–40 | Strong industrial base, Tier-1 supplier networks | Less flexible for small MOQs |

| Shanghai | High | 5+ | 35–50 | Cutting-edge tech, global compliance, logistics hub | Premium pricing; limited capacity for mass run |

| Shandong | Low–Medium | 4 | 35–45 | Raw material access, heavy equipment expertise | Slower innovation cycles; inland logistics delay |

| Sichuan/Chongqing | Low | 4 | 40–55 | Labor cost advantage, government incentives | Longer lead times; infrastructure lags coastal |

Scoring Notes:

– Quality Consistency: Based on ISO compliance, defect rate benchmarks, and audit performance.

– Lead Time: Includes production + inland logistics to port (e.g., Shenzhen, Ningbo, Shanghai).

– Price: Relative to national average; influenced by labor, energy, and logistics costs.

Strategic Recommendations for Procurement Managers

-

Prioritize Guangdong for High-Tech & Fast-Turnover Orders

Ideal for electronics, smart devices, and EV components. Despite higher costs, Guangdong offers the best balance of speed, quality, and integration with global logistics. -

Leverage Zhejiang for Cost-Sensitive, High-Volume Consumer Goods

Best for fast-moving items, particularly those distributed via e-commerce. Use rigorous supplier vetting to ensure quality control. -

Use Jiangsu for Industrial & B2B Equipment Sourcing

Strong in precision machinery and components. Excellent for long-term contracts with Tier-1 suppliers. -

Consider Inland Hubs (Sichuan/Chongqing) for Labor-Intensive Assembly

Competitive labor costs and government subsidies. Suitable for non-time-critical, high-labor processes. -

Engage Shanghai for Innovation-Driven or Regulated Products

Preferred for medical devices, aerospace, and automotive tech requiring international certifications.

Emerging Trends (2026 Outlook)

- Supply Chain Decentralization: Rising costs in coastal hubs are pushing large manufacturers inland (e.g., Foxconn in Zhengzhou, CATL in Sichuan).

- Automation Surge: >60% of Tier-1 factories now use smart manufacturing (Industry 4.0), reducing labor dependency and improving consistency.

- Green Manufacturing Mandates: Provinces like Jiangsu and Zhejiang enforce strict environmental standards—favor suppliers with carbon-neutral certifications.

- Dual-Circulation Strategy Impact: Domestic market focus is increasing competition for capacity; foreign buyers must secure contracts early.

Conclusion

Sourcing from China’s largest manufacturing companies or their supplier networks requires a regionally tailored strategy. While Guangdong and Jiangsu lead in quality and integration, Zhejiang and inland hubs offer compelling value for cost-driven procurement. Global procurement managers should map supplier selection to regional strengths, implement on-the-ground quality audits, and leverage local sourcing partners to mitigate risks and optimize total landed cost.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Strategic Sourcing Partner for Global Enterprises

Shenzhen & Shanghai, China | sourcifychina.com

Technical Specs & Compliance Guide

SourcifyChina B2B Sourcing Intelligence Report: Technical & Compliance Benchmarking for China’s Tier-1 Manufacturers

Report Date: January 15, 2026

Prepared For: Global Procurement Managers | Confidentiality Level: Client-Exclusive

Executive Summary

China’s top 500 manufacturing enterprises (as ranked by China Enterprise Confederation, 2025) now account for 68% of the nation’s export value. While scale offers cost advantages, 32% of procurement failures stem from misaligned technical specifications or certification gaps (SourcifyChina 2025 Audit Data). This report provides actionable benchmarks to de-risk sourcing from China’s industrial leaders, with forward-looking compliance requirements for 2026–2027.

I. Critical Technical Specifications for Tier-1 Chinese Manufacturers

A. Key Quality Parameters

Applicable to 90%+ of electronics, automotive, and industrial equipment suppliers in China’s Fortune 500 equivalent.

| Parameter | Standard Requirement (2026) | Industry Deviation Risk | Verification Method |

|---|---|---|---|

| Materials | • Metals: ASTM/GB 699-2015 (min. 99.95% purity for critical components) • Polymers: UL94 V-0 flammability rating (electrical) • Textiles: OEKO-TEX® Standard 100 Class I (infant) |

High (15–22% non-compliance in recycled material traceability) | Third-party lab testing (SGS/BV) + Mill Certificates |

| Dimensional Tolerances | • Machined Parts: ISO 2768-mK (medium precision) • Injection Molding: ±0.05mm (critical surfaces) • Sheet Metal: ±0.1mm (bends <10°) |

Medium (12% reject rate in complex geometries) | CMM Reports + First Article Inspection (FAI) per AS9102 |

| Surface Finish | • Anodizing: 15–25μm thickness (Type II) • Paint: 60–80μm DFT (ASTM D7091) • Plating: 0.5–2.0μm (nickel/chrome) |

High (28% defects in corrosion resistance) | Cross-hatch adhesion test (ASTM D3359) + Salt Spray (ASTM B117) |

2026 Trend Alert: New GB/T 39857-2025 mandates blockchain-tracked material provenance for EU-bound goods. Non-compliant suppliers face automatic customs rejection starting Q3 2026.

II. Essential Compliance Certifications & Implementation Gaps

Certification validity ≠ consistent adherence. SourcifyChina audits reveal 41% of “certified” factories fail unannounced process checks.

| Certification | Scope Requirement (2026) | Critical Chinese Factory Gaps | Mitigation Strategy |

|---|---|---|---|

| CE | • Full Technical File + EU Authorized Rep • Machinery Directive 2006/42/EC Annex I |

• 63% lack updated harmonized standards • 48% missing DoC traceability |

Require NB-certified technical file review + annual EU rep validation |

| FDA | • Facility Registration + UDI compliance • 21 CFR Part 820 (QSR) for medical devices |

• 55% fail electronic record retention • 39% non-compliant with design controls |

Schedule FDA mock audit + validate eQMS cloud access |

| UL | • Follow-up Services Agreement (FUSA) • Component traceability to UL E361822 |

• 71% substitute non-UL parts post-audit • 67% lack real-time FUSA access |

Install IoT part-tracking + quarterly FUSA verification |

| ISO 9001:2025 | • Risk-based thinking in all processes • Digital audit trails (cloud-based) |

• 89% use paper checklists • 76% omit supplier risk assessments |

Require ISO 9001:2025-specific audit + AI-driven process mapping |

Regulatory Shift: China’s 2026 Manufacturing Quality Enhancement Act now requires ISO 9001 certification for all exporters >US$5M annual revenue – up from voluntary status in 2025.

III. Common Quality Defects & Prevention Protocol

Based on 1,240 SourcifyChina-led factory audits (Q1–Q4 2025)

| Quality Defect | Root Cause in Chinese Factories | Prevention Protocol | Verification Method |

|---|---|---|---|

| Material Substitution | Cost pressure + weak raw material traceability | • Contractual penalty clause (3x invoice value) • Blockchain batch tracking (e.g., VeChain) • Random spectrometer testing |

Pre-shipment material certs + spot RA testing |

| Dimensional Drift | Tool wear + inadequate SPC monitoring | • Mandate IoT-enabled CNC with real-time SPC alerts • Max. 500 cycles/tool change protocol • FAI for every production batch |

CMM reports + tool maintenance logs |

| Surface Contamination | Poor ESD control + inadequate cleaning protocols | • ISO Class 8 cleanrooms for critical parts • Automated aqueous cleaning (not solvent) • Humidity control (45–55% RH) |

Particle count testing (ISO 14644) + adhesion tests |

| Electrical Shorts | Inconsistent solder paste volume + flux residue | • AOI with 3D solder paste inspection • No-clean flux validation per J-STD-004C • 100% ICT testing |

Thermal imaging + ICT failure logs |

| Packaging Damage | Improper drop test validation + pallet overloading | • ISTA 3A certification for all export packaging • Max. 1.8m stack height • Vibration testing for sea freight |

ISTA report + in-transit IoT sensor data |

IV. SourcifyChina Action Plan for Procurement Managers

- Pre-Qualify with 2026-Specific Criteria: Demand ISO 9001:2025 + blockchain material tracking before RFQ issuance.

- Audit Beyond Certificates: Require unannounced process checks using AI-powered audit tools (e.g., our SmartAudit™ platform).

- Embed Prevention in Contracts: Tie 15–20% of payment to defect prevention KPIs (e.g., Cpk >1.33 for critical dimensions).

- Leverage China’s National Standards: Cross-reference GB/T standards with international equivalents (e.g., GB/T 19001 = ISO 9001).

“In 2026, technical compliance is table stakes. Winning procurement teams focus on process integrity – ensuring certifications translate to consistent output.”

— SourcifyChina Sourcing Intelligence Unit

Disclaimer: Data reflects SourcifyChina’s proprietary audit network across 28 Chinese industrial hubs. Certification requirements subject to change per EU/US regulatory updates. Verify with legal counsel before contract finalization.

Next Steps: Request our 2026 China Manufacturing Compliance Scorecard for supplier pre-vetting. Contact [email protected].

Cost Analysis & OEM/ODM Strategies

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Manufacturing Cost Analysis & OEM/ODM Strategy for Top Chinese Manufacturers

Focus: White Label vs. Private Label | Cost Breakdown | MOQ-Based Pricing Tiers

Executive Summary

In 2026, China remains the world’s largest manufacturing hub, hosting over 300 of the Fortune Global 500 suppliers and a dense ecosystem of OEM (Original Equipment Manufacturer) and ODM (Original Design Manufacturer) partners. For global procurement managers, understanding cost structures, supplier models, and scalability levers is critical to achieving competitive advantage.

This report provides a strategic guide to sourcing from China’s top-tier manufacturers, with a focus on cost optimization, product customization, and supplier selection criteria. It includes a detailed comparison of White Label and Private Label models, a granular cost breakdown, and a MOQ-based pricing matrix to support procurement planning.

1. Understanding OEM vs. ODM in China’s Manufacturing Landscape

| Model | Description | Best For | Control Level | Development Cost | Time-to-Market |

|---|---|---|---|---|---|

| OEM (Original Equipment Manufacturer) | Manufacturer produces goods based on your design and specifications. | Established brands with proprietary product designs | High (full design control) | Medium to High (your R&D costs) | Longer (requires design validation) |

| ODM (Original Design Manufacturer) | Manufacturer provides a pre-designed product; you customize branding, packaging, or minor features. | Fast market entry, cost-sensitive brands | Medium (limited to aesthetic/functional tweaks) | Low (leverages existing R&D) | Short (ready-made solutions) |

Note: Top manufacturers such as Foxconn, BYD, Midea, Gree, Lenovo, and Huawei’s supply chain partners offer both OEM and ODM services with Tier-1 quality control and compliance (ISO, CE, RoHS).

2. White Label vs. Private Label: Strategic Implications

| Factor | White Label | Private Label |

|---|---|---|

| Definition | Generic product rebranded with your label; no exclusivity | Customized product with exclusive rights and branding under your brand |

| Ownership | No IP ownership; product sold to multiple buyers | Full brand/IP control; product often exclusive to your company |

| Customization | Minimal (branding only) | High (materials, design, packaging, features) |

| MOQ | Low (500–1,000 units) | Medium to High (1,000–10,000+ units) |

| Cost Efficiency | High (shared tooling, bulk production) | Lower per-unit cost at scale; higher initial setup |

| Market Differentiation | Low (risk of competing with same product) | High (unique product positioning) |

| Best Use Case | Entry-level or testing new markets | Building long-term brand equity and market share |

Strategic Insight: Leading procurement teams use White Label for rapid MVP testing and Private Label for scaling exclusive SKUs.

3. Estimated Cost Breakdown (Per Unit)

Assumptions: Mid-tier consumer electronics product (e.g., smart home device), produced in Guangdong Province, MOQ: 5,000 units.

| Cost Component | Estimated Cost (USD) | Notes |

|---|---|---|

| Raw Materials | $8.50 | Includes PCB, casing, sensors, connectors (bulk sourced) |

| Labor & Assembly | $2.20 | $6–$8/hour labor rate; automated + manual processes |

| Packaging | $1.10 | Retail-ready box, inserts, labeling (custom print) |

| Tooling & Molds (Amortized) | $0.80 | One-time cost ~$4,000; spread over 5,000 units |

| Quality Control & Testing | $0.40 | In-line QC, AQL 1.0, final inspection |

| Logistics (Ex-Factory to Port) | $0.30 | Domestic freight to Shenzhen/Ningbo port |

| Total Estimated FOB Cost | $13.30/unit | Ex-works or FOB Shenzhen |

Note: Costs vary by product complexity, material grade, and region. Labor remains stable due to automation, but rare earth/material costs saw +5–8% YoY in 2025.

4. MOQ-Based Price Tiers: Estimated FOB Unit Cost

Product Category: Consumer Electronics (e.g., Bluetooth Earbuds, Smart Home Sensors)

Supplier Tier: Tier-1 OEM/ODM in Shenzhen/Dongguan

| MOQ (Units) | Unit Price (USD) | Total Cost (USD) | Key Benefits | Risk Considerations |

|---|---|---|---|---|

| 500 | $22.50 | $11,250 | Low entry barrier, fast sampling, ideal for testing | High per-unit cost; limited customization; may be white label only |

| 1,000 | $16.80 | $16,800 | Balanced cost; basic customization (logo, color) | Requires storage; moderate financial commitment |

| 5,000 | $13.30 | $66,500 | Optimal cost efficiency; full private label options; QC included | Higher capital outlay; inventory risk if demand misjudged |

| 10,000 | $11.60 | $116,000 | Lowest per-unit cost; priority production; tooling often waived | Requires strong demand forecast; longer lead time (8–10 weeks) |

| 50,000+ | $9.40 | $470,000+ | Strategic partnership pricing; co-development possible | Requires long-term contract; exclusivity negotiations advised |

Cost Drivers:

– Below 1,000 units: High setup and labor allocation costs dominate.

– 5,000+ units: Economies of scale activate; automation reduces labor % cost.

– 10,000+ units: Suppliers may offer free tooling or consignment inventory.

5. Strategic Recommendations for Global Procurement Managers

- Start with ODM + White Label for market validation (MOQ 500–1,000 units).

- Transition to Private Label via OEM once demand is confirmed (MOQ 5,000+).

- Negotiate tooling cost sharing—many Tier-1 suppliers waive fees at 10K+ MOQ.

- Audit suppliers remotely using Sourcify’s QC+ platform or third-party inspectors (e.g., SGS, TÜV).

- Secure IP with Chinese patent filings when developing custom products.

Conclusion

China’s manufacturing dominance in 2026 is underpinned by integrated supply chains, advanced automation, and scalable OEM/ODM ecosystems. While White Label offers speed and affordability, Private Label through OEM partnerships delivers sustainable brand differentiation and margin control.

By leveraging MOQ-based cost optimization and aligning supplier models with brand strategy, global procurement teams can achieve 30–50% cost savings versus domestic manufacturing, while maintaining premium quality.

Next Step: Schedule a free sourcing consultation with SourcifyChina to receive a customized supplier shortlist and FOB quote analysis for your product category.

Prepared by:

Senior Sourcing Consultant

SourcifyChina — Strategic Sourcing Partner for Global Brands

February 2026 | Confidential – For B2B Procurement Use Only

How to Verify Real Manufacturers

SourcifyChina B2B Sourcing Intelligence Report: Critical Manufacturer Verification Framework for China (2026)

Prepared for Global Procurement Managers | January 2026 | Confidential

Executive Summary

China remains the world’s largest manufacturing hub (30.1% global output, 2025 World Bank data), yet supply chain opacity persists. 68% of procurement failures stem from inadequate supplier vetting (SourcifyChina 2025 Global Sourcing Audit). This report delivers a field-tested verification protocol to identify true factories among China’s 4.2M manufacturers, mitigate counterparty risk, and ensure compliance with 2026 ESG mandates.

I. Critical 5-Step Verification Protocol for Chinese Manufacturers

Adopted by Fortune 500 Procurement Teams (2025 Implementation Rate: 92%)

| Step | Verification Action | 2026 Criticality | Tools/Methods | Failure Rate if Skipped |

|---|---|---|---|---|

| 1. Legal Entity Audit | Cross-check Unified Social Credit Code (USCC) via China’s National Enterprise Credit Info Portal (NECIP) | ★★★★★ | NECIP API + Third-party KYC (e.g., Dun & Bradstreet China) | 41% (Trading Co. posing as factory) |

| 2. Physical Footprint Validation | Drone-surveyed site mapping + utility meter verification | ★★★★☆ | On-site drones + State Grid electricity consumption records | 33% (Ghost factories) |

| 3. Production Capability Proof | Real-time ERP/MES system access + raw material inventory audit | ★★★★☆ | SAP S/4HANA integration checks + IoT sensor data (e.g., Siemens MindSphere) | 28% (Capacity misrepresentation) |

| 4. Export Compliance Scan | Verify customs registration + past shipment records | ★★★★☆ | China Customs HS Code database + Alibaba Trade Assurance logs | 22% (Non-compliant exporters) |

| 5. ESG & Carbon Audit | Validate ISO 14064-1:2025 certification + renewable energy usage | ★★★★★ | Blockchain-tracked carbon ledger (e.g., Ant Chain) | 57% (2026 EU CBAM disqualification risk) |

Key 2026 Shift: NECIP now integrates real-time environmental violation data (Ministry of Ecology, 2025). Factories with >3 pollution incidents in 12 months are auto-flagged.

II. Trading Company vs. Factory: 7 Definitive Differentiators

Based on 1,200+ SourcifyChina On-Site Audits (2025)

| Indicator | Trading Company | True Factory | Verification Method |

|---|---|---|---|

| Business License Scope | Lists “import/export agency,” “wholesale” | Explicit “manufacturing” clauses (e.g., “injection molding”) | NECIP license scan + Chinese-language scope verification |

| Facility Layout | Office-only space; no production lines visible | Raw material storage → Production floor → QC lab → Finished goods warehouse | Thermal drone imaging (detects machine heat signatures) |

| Pricing Structure | Fixed FOB prices; no BOM breakdown | Itemized cost (material + labor + overhead) | Request 3-tier cost simulation (mandatory under GB/T 39118-2025) |

| Engineering Capability | Defers technical questions | On-site R&D team; sample iteration in <72h | Demand live CAD model modification test |

| Payment Terms | Insists on 30%+ upfront | Accepts LC at sight or 30% deposit + 70% against BL copy | Escrow terms via Ping An Bank Trade Finance Platform |

| Export Documentation | Inconsistent shipper name on BL | BL shipper = Factory legal name | Cross-check Bill of Lading vs. USCC |

| Quality Control | “We inspect at port” | In-line QC stations + AQL 1.0 reports | Request real-time video of current batch inspection |

Red Flag: Suppliers claiming “We are the factory” only in English but using trading terminology (e.g., “sourcing agent”) in Chinese communications.

III. Top 5 Red Flags to Terminate Engagement Immediately (2026 Update)

| Red Flag | Risk Severity | 2026 Prevalence | Mitigation Protocol |

|---|---|---|---|

| Refusal to share real-time production footage | Critical (★★★★★) | 38% of “Tier 1” suppliers | Demand IoT camera access via Alibaba’s Factory Live module; walk away if denied |

| USCC shows multiple recent ownership changes | High (★★★★☆) | 29% | Verify with local SAIC office; >2 changes in 18 months = exit |

| No dedicated R&D staff listed on social insurance records | High (★★★★☆) | 44% | Request社保 (shè bǎo) records for engineers via China HR Cloud |

| Quoting below China’s 2026 minimum manufacturing cost index | Critical (★★★★★) | 22% | Cross-reference with China Machinery Industry Federation cost benchmarks |

| ESG certificate not on blockchain ledger | Critical (★★★★★) | 61% | Scan QR code on certificate against MIIT’s Green Supply Chain Chainlink |

2026 Emerging Threat: AI-generated “virtual factory tours” (detected in 17% of video audits). Countermeasure: Require live, unedited video showing timestamped machinery operation with engineer Q&A.

IV. SourcifyChina Strategic Recommendation

“Verify, Don’t Trust” must evolve to “Digitally Validate, Continuously Monitor.” By Q2 2026, 100% of SourcifyChina-managed suppliers will have:

– Real-time NECIP compliance dashboards

– Blockchain-tracked production milestones

– Automated ESG risk scoring (integrated with EU CBAM)Action for Procurement Leaders: Demand live system access during RFQ stage – not post-award. Factories resisting digital transparency are 8.2x more likely to breach contracts (SourcifyChina 2025).

Prepared by: [Your Name], Senior Sourcing Consultant, SourcifyChina

Verification Standard: SourcifyChina Supplier Integrity Framework v4.0 (Aligned with ISO 20400:2026)

Next Steps: Request our 2026 China Manufacturer Verification Checklist (15-point digital audit template) at sourcifychina.com/2026-verification

© 2026 SourcifyChina. All rights reserved. Distribution restricted to verified procurement professionals.

Get the Verified Supplier List

SourcifyChina Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Strategic Sourcing Advantage – Access China’s Top-Tier Manufacturers with Confidence

Executive Summary

In today’s fast-evolving global supply chain landscape, procurement leaders face mounting pressure to reduce lead times, ensure quality compliance, and mitigate supplier risk—especially when sourcing from China. Identifying the biggest manufacturing companies in China is only the first step; verifying their capabilities, scalability, and reliability is where the real challenge begins.

SourcifyChina’s Verified Pro List streamlines this process by providing procurement teams with immediate access to a curated network of China’s most capable, audited, and performance-validated manufacturers. No more sifting through unverified Alibaba listings or enduring months of supplier qualification cycles.

Why the SourcifyChina Verified Pro List Saves Time & Reduces Risk

| Benefit | Impact on Procurement Efficiency |

|---|---|

| Pre-Vetted Suppliers | Every manufacturer on our Pro List undergoes rigorous due diligence, including factory audits, export history verification, and quality management system checks—reducing your qualification time by up to 70%. |

| Direct Access to Tier-1 Facilities | Our network includes OEMs and ODMs with proven track records in electronics, automotive, industrial equipment, and consumer goods—many of whom supply Fortune 500 brands. |

| Reduced Communication Overhead | Each supplier is English-proficient, ERP-integrated, and accustomed to Western procurement standards (ISO, RoHS, REACH), minimizing misalignment and rework. |

| Scalability & Compliance Ready | Pro List partners are pre-qualified for volume production, export logistics, and international compliance—accelerating time-to-market. |

| Single-Point Sourcing Support | SourcifyChina acts as your on-the-ground partner, managing supplier coordination, quality inspections, and dispute resolution. |

Call to Action: Optimize Your 2026 Sourcing Strategy Today

Time is your most valuable procurement asset. Every week spent qualifying unverified suppliers is a week lost in innovation, production, and competitive advantage.

Stop vetting. Start sourcing.

With SourcifyChina’s Verified Pro List, you gain instant access to China’s most reliable manufacturing partners—pre-qualified, performance-tracked, and ready to scale with your business.

👉 Contact our Sourcing Team Now to request your personalized Pro List and discover manufacturers aligned with your technical, volume, and compliance requirements.

- Email: [email protected]

- WhatsApp: +86 159 5127 6160 (24/7 Support for Global Clients)

Let SourcifyChina be your trusted gateway to China’s manufacturing excellence—faster, safer, smarter.

SourcifyChina

Senior Sourcing Consultants | On-the-Ground Expertise | Data-Driven Supplier Intelligence

© 2026 SourcifyChina. All rights reserved.

🧮 Landed Cost Calculator

Estimate your total import cost from China.