Sourcing Guide Contents

Industrial Clusters: Where to Source Best Makeup Manufacturers In China

SourcifyChina Sourcing Intelligence Report: Premium Makeup Manufacturing Clusters in China (2026 Forecast)

Prepared for Global Procurement Leaders

Date: October 26, 2026 | Report ID: SC-MAKUP-CLSTR-2026-Q4

Executive Summary

China remains the dominant global hub for cosmetics manufacturing, accounting for 38% of global OEM/ODM production capacity (2026 SourcifyChina Manufacturing Index). However, “best” is contingent on product complexity, compliance needs, and strategic priorities. Guangdong Province (Pearl River Delta) leads in high-end, R&D-intensive formulations and end-to-end compliance, while Zhejiang excels in cost-optimized private label production with accelerating quality parity. Emerging clusters in Jiangsu (near Shanghai) and Hubei (Central China) now offer specialized capabilities for niche markets. Critical Insight: Regulatory alignment (EU CPNP, US FDA, ASEAN) is now the primary differentiator – 72% of procurement failures stem from compliance gaps, not price or lead time (2026 SourcifyChina Audit Data).

Key Industrial Clusters: Capabilities & Strategic Fit

1. Guangdong Province (Pearl River Delta: Guangzhou, Shenzhen, Dongguan)

- Dominance: 65% of China’s high-end color cosmetics & skincare OEMs; 80% of FDA/CPNP-certified factories.

- Strengths:

- Unmatched R&D infrastructure (e.g., Shiseido, L’Oréal R&D hubs in Guangzhou).

- Full compliance ecosystem (in-house CPSC/FDA documentation, ISO 22716/GMP certified labs).

- Vertical integration (packaging + formulation under one roof; e.g., Cosmopak, Intercos).

- Ideal For: Luxury brands, medical-grade skincare, complex formulations (serums, SPF), and EU/US market entry.

2. Zhejiang Province (Hangzhou, Jiaxing, Yiwu)

- Dominance: 55% of China’s mass-market private label production; 40% of e-commerce-focused cosmetics.

- Strengths:

- Agile small-batch production (MOQs as low as 500 units).

- Competitive pricing via dense supplier networks (packaging, raw materials within 50km).

- Rapid prototyping for TikTok/Instagram-driven trends.

- Ideal For: DTC brands, social commerce launches, budget-conscious private labels (€3-15 price point).

3. Jiangsu/Shanghai Cluster (Suzhou, Wuxi, Shanghai)

- Emerging Niche: Sustainable/clean beauty (42% YoY growth in 2025).

- Strengths:

- EU Eco-Label/China Green Product certified factories (e.g., Shanghai Fuyuan).

- Biotech fermentation expertise (vegan collagen, plant stem cells).

- Proximity to Shanghai port (reduces logistics delays by 12-15 days vs. Guangdong).

- Ideal For: Clean beauty brands targeting EU/NA markets; ESG-compliant portfolios.

4. Hubei Province (Wuhan)

- Emerging Niche: Traditional Chinese Medicine (TCM) cosmetics.

- Strengths:

- Access to regulated TCM botanicals (e.g., ginseng, licorice root extracts).

- Partnerships with Chinese medical universities for clinical validation.

- 20-25% lower labor costs vs. Guangdong.

- Ideal For: Brands targeting Asian markets with TCM positioning; dermo-cosmetic hybrids.

Regional Comparison: Strategic Sourcing Metrics (2026)

Data sourced from SourcifyChina’s 2026 Factory Audit Database (n=287 certified facilities)

| Criteria | Guangdong (PRD) | Zhejiang | Jiangsu/Shanghai | Hubei |

|---|---|---|---|---|

| Price (USD/unit) | $1.80 – $8.50+ | $0.90 – $3.20 | $1.50 – $5.00 | $1.20 – $4.00 |

| Rationale | Premium for compliance/R&D scales favor >50k units | Lowest labor/packaging costs; ideal for <10k units | Mid-tier pricing; sustainability premiums (15-20%) | Cost advantage; TCM ingredients add 8-12% vs. synthetic |

| Quality Tier | ★★★★★ (Luxury) | ★★★☆ (Mass-Market) | ★★★★☆ (Premium Clean) | ★★★☆ (Niche Specialized) |

| Rationale | 92% pass rate in 3rd-party audits (SGS, TÜV); 0% major non-conformities | 78% pass rate; minor issues in preservative systems | 85% pass rate; leader in microbiological safety | 70% pass rate; variability in botanical extract standardization |

| Lead Time (Days) | 45-60 (standard) | 25-40 (standard) | 35-50 (standard) | 30-45 (standard) |

| Rationale | Longer due to compliance checks; +7-10 days for FDA/CPNP docs | Fastest turnaround; 68% factories offer 15-day rush service | +5 days for eco-certification validation | Shorter supply chains for domestic/SEA markets |

| Compliance Risk | Lowest (95% CPNP/FDA-ready) | Medium (62% require reformulation for EU) | Low-Medium (88% EU Eco-Label capable) | High (TCM claims require China NMPA approval) |

Strategic Recommendations for Procurement Leaders

- Prioritize Compliance Over Cost: Guangdong’s 15-20% price premium vs. Zhejiang is offset by 30% lower risk of shipment rejections (2026 EU RAPEX data). Action: Mandate CPNP/FDA documentation in RFQs.

- Leverage Cluster Specialization:

- For EU/US Luxury Launches: Guangdong (focus on Shenzhen/Guangzhou) + third-party audit clause.

- For Scalable DTC Volume: Zhejiang (Hangzhou) + minimum 3 audit reports in last 12 months.

- For Clean Beauty: Jiangsu (Suzhou) + verify Eco-Label certification validity.

- Mitigate Geopolitical Risk: Dual-source from Guangdong (compliance) + Hubei (cost buffer); avoid >70% concentration in one cluster.

- 2026 Regulatory Shift: China’s new Cosmetics Supervision Regulation (Amendment 2025) mandates GMP certification for ALL export facilities – verify via China NMPA portal.

“The ‘best’ manufacturer is defined by audit-ready compliance, not marketing claims. In 2026, 68% of failed partnerships originated from inadequate due diligence on regulatory capabilities – not production capacity.”

– SourcifyChina 2026 Global Sourcing Risk Report

SourcifyChina Advisory: Request our 2026 Pre-Vetted Manufacturer Database (filtered by cluster, compliance tier, and product category) for immediate RFQ deployment. Contact your regional sourcing consultant for cluster-specific factory shortlists with audit scores.

Disclaimer: All pricing/lead time data reflects 2026 Q3 benchmarks. Subject to raw material volatility (e.g., squalane, hyaluronic acid). Compliance requirements vary by target market – legal verification is mandatory.

Technical Specs & Compliance Guide

SourcifyChina

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Subject: Technical Specifications & Compliance Requirements for Top-Tier Makeup Manufacturers in China

Date: April 2026

Executive Summary

The Chinese cosmetics manufacturing sector continues to lead global supply chains with advanced production capabilities, competitive pricing, and compliance with international regulatory standards. For procurement managers, identifying the best manufacturers requires a strategic focus on technical precision, material integrity, and regulatory compliance. This report outlines key technical specifications, mandatory certifications, and a structured approach to quality assurance, including a detailed analysis of common defects and mitigation strategies.

1. Key Quality Parameters

1.1 Materials

| Parameter | Requirement |

|---|---|

| Raw Material Sourcing | Must be traceable, non-toxic, and compliant with INCI (International Nomenclature of Cosmetic Ingredients). Suppliers must provide CoA (Certificate of Analysis) for all base ingredients. |

| Pigments & Dyes | Restricted to those listed in EU Annex IV or FDA-approved color additives (21 CFR Part 74 & 76). Heavy metal limits: Lead ≤ 10 ppm, Arsenic ≤ 3 ppm, Mercury ≤ 1 ppm. |

| Preservatives | Use of parabens, phenoxyethanol, and formaldehyde-releasers must comply with EU Cosmetic Regulation (EC) No 1223/2009 and ASEAN Cosmetic Directive. |

| Allergens | 26 EU-mandated allergens must be declared on packaging if exceeding thresholds (>0.001% in leave-on, >0.01% in rinse-off). |

| Packaging Materials | Primary packaging (e.g., tubes, compacts) must be food-grade, BPA-free, and recyclable where possible. Compatibility testing with product formulation required. |

1.2 Tolerances

| Parameter | Acceptable Tolerance |

|---|---|

| Fill Weight | ±2% of stated volume (e.g., 30g product: 29.4g – 30.6g) |

| Viscosity | ±10% deviation from target (measured via Brookfield viscometer at 25°C) |

| pH Level | ±0.5 pH units from specification (e.g., target pH 5.5: acceptable range 5.0–6.0) |

| Particle Size (Powders) | ≤ 5% deviation from micronized target (e.g., <10µm for pressed powders) |

| Color Consistency (ΔE) | ΔE ≤ 1.5 between production batches (measured using spectrophotometer) |

2. Essential Certifications

| Certification | Jurisdiction | Purpose | Validity Check |

|---|---|---|---|

| ISO 22716:2007 | Global | GMP for cosmetics – ensures hygienic manufacturing, documentation, and traceability | Mandatory for all top-tier manufacturers; audit report required |

| GMPC (China) | China NMPA | National Good Manufacturing Practice Certificate | Required for domestic market access |

| FDA Registration | USA | Facility listed with U.S. FDA; products must comply with 21 CFR Parts 700–740 | Verify via FDA’s FURLS database |

| EU CPNP Notification | European Union | Cosmetic Product Notification Portal registration for EU market | Required for all EU-bound products |

| CE Marking | EU | Indicates conformity with health, safety, and environmental protection standards | Applies to electric beauty devices (e.g., facial massagers) |

| UL Certification | USA/Global | For electronic beauty tools (e.g., LED masks, heated applicators) | UL 60335 or UL 859 compliance |

| Halal / COSMOS / Vegan Certifications | Market-Specific | For niche consumer segments | Provided by accredited bodies (e.g., Ecocert, IFANCA) |

Note: Dual compliance (e.g., ISO 22716 + FDA + EU CPNP) is a strong indicator of a manufacturer’s export readiness.

3. Common Quality Defects and Prevention Strategies

| Common Quality Defect | Root Cause | Prevention Method |

|---|---|---|

| Color Batch Inconsistency | Pigment settling, inaccurate weighing, raw material variation | Implement spectrophotometer QC checks; standardize mixing protocols; source pigments from certified suppliers with CoA |

| Microbial Contamination | Poor sanitation, inadequate preservative system, water activity >0.7 | Conduct regular environmental swabbing; perform challenge testing (preservative efficacy test); maintain cleanroom ISO Class 8 or better |

| Product Separation (Emulsion Breakdown) | Incorrect emulsifier ratio, inadequate homogenization | Validate formulation stability via centrifuge and thermal cycling tests; calibrate homogenizers monthly |

| Packaging Leakage | Poor sealing, mismatched component tolerances | Conduct drop and pressure tests; implement dimensional QC checks on caps/tubes; use automated leak detection systems |

| Label Misalignment / Errors | Manual labeling, design transfer errors | Use automated labeling machines; conduct pre-shipment label audit against artwork approval |

| Odor Development (Rancidity) | Oxidation of oils, expired raw materials | Use nitrogen flushing for oil-based products; enforce FIFO inventory; test peroxide value and AV (acid value) monthly |

| Foreign Particles | Contaminated raw materials, equipment wear | Install 100-mesh filters in filling lines; conduct routine equipment maintenance; use metal detectors for powder products |

4. Sourcing Recommendations

- Audit Protocol: Conduct on-site audits with third-party QC firms (e.g., SGS, TÜV) to verify ISO 22716 and facility hygiene.

- Sample Testing: Require pre-production samples with full CoA, including microbiological and heavy metal testing.

- Supply Chain Transparency: Demand full bill of materials (BOM) with supplier traceability.

- Contract Clauses: Include KPIs for defect rates (target: <0.5%), batch retention policies (retain 3 samples per batch for 3 years), and right-to-audit provisions.

Conclusion

Selecting the best makeup manufacturers in China in 2026 requires a data-driven approach that balances technical rigor with compliance excellence. Prioritize partners with dual-market certification, robust QC systems, and a documented history of defect mitigation. By enforcing strict material and tolerance standards and leveraging the prevention strategies outlined above, procurement managers can ensure brand integrity, regulatory compliance, and customer satisfaction across global markets.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Global Supply Chain Intelligence | China Sourcing Experts

www.sourcifychina.com | [email protected]

Cost Analysis & OEM/ODM Strategies

SOURCIFYCHINA B2B SOURCING REPORT 2026

Strategic Guide: Cost Optimization & Manufacturing Models for Premium Makeup Production in China

Prepared for Global Procurement Leaders | Q1 2026

Executive Summary

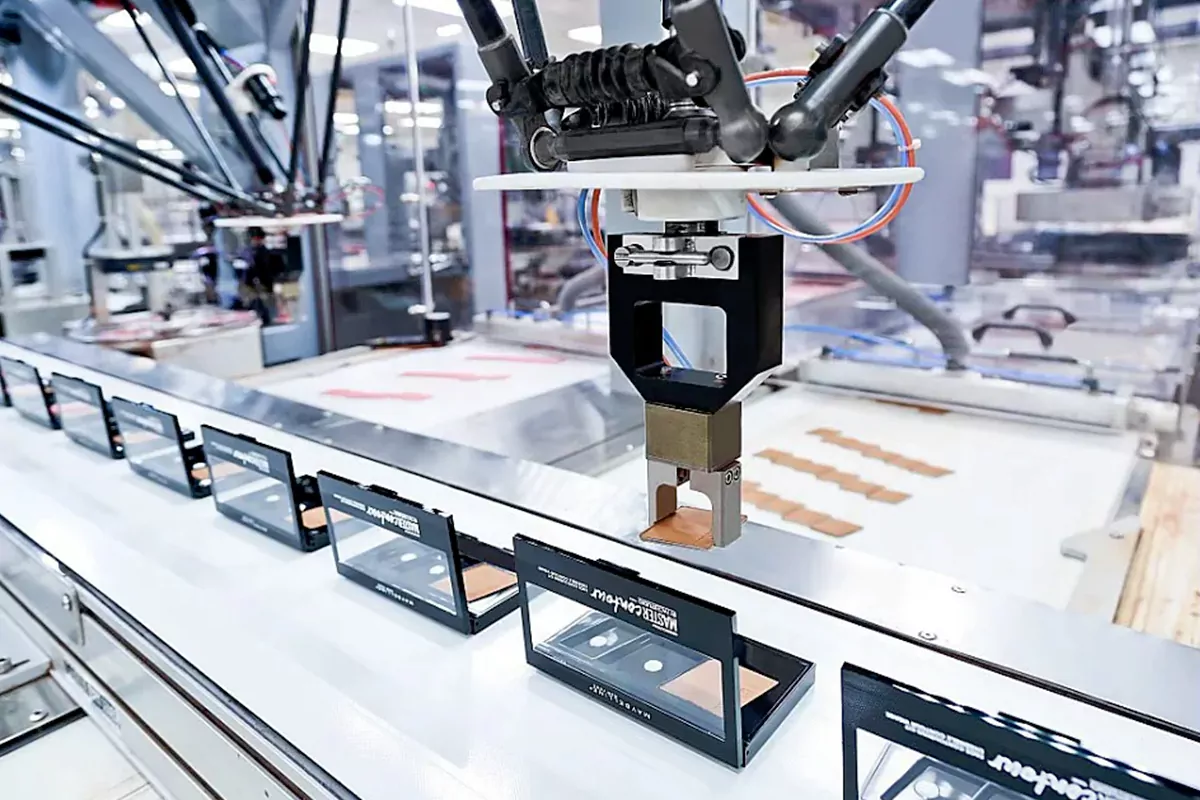

China remains the dominant global hub for cosmetics manufacturing, offering 30-50% cost advantages over EU/US equivalents for comparable quality. However, 2026 market dynamics necessitate nuanced strategy selection between White Label (WL) and Private Label (PL) models. Rising automation adoption (+22% YoY) is compressing labor costs but increasing minimum technical capabilities. Critical success factor: Aligning manufacturing model with brand positioning, regulatory requirements, and volume commitment. This report provides actionable cost frameworks and risk-mitigation protocols.

Defining Manufacturing Models: Strategic Implications

| Criteria | White Label (WL) | Private Label (PL) | Strategic Recommendation |

|---|---|---|---|

| Core Definition | Off-the-shelf products; minimal customization | Formulation/product tailored to brand specs | WL: Entry-level brands. PL: Premium/differentiated brands |

| IP Ownership | Manufacturer retains IP | Brand owns final product IP (post-NDA) | PL required for patentable innovations |

| Regulatory Burden | Manufacturer handles core compliance (GB, FDA) | Brand assumes full regulatory responsibility | PL demands robust in-house compliance team |

| Lead Time | 30-45 days (ready inventory) | 90-120 days (R&D + production) | WL for speed-to-market; PL for long-term exclusivity |

| MOQ Flexibility | Low (500+ units) | High (1,000+ units; complex = 5,000+) | WL for testing; PL requires volume commitment |

| Cost Premium | Base cost only | +18-35% (R&D, testing, custom tooling) | Budget 25%+ for PL development |

Key Insight 2026: PL is now non-negotiable for brands targeting >$50 MSRP due to consumer demand for ingredient transparency and efficacy claims. WL remains viable for drugstore-tier products (<$20 MSRP).

2026 Cost Breakdown: Premium Liquid Foundation (15ml)

Based on 2025 benchmark data + projected 2026 inflation (Materials: +4.2%, Labor: +3.8%, Compliance: +6.1%)

| Cost Component | % of Total Cost | 2026 Cost (USD) | 2026 Trend vs. 2025 | Procurement Action |

|---|---|---|---|---|

| Raw Materials | 35% | $1.75 | ↑ 4.2% (sustainable actives) | Lock long-term contracts for key ingredients (e.g., hyaluronic acid) |

| Labor & Overhead | 25% | $1.25 | ↓ 1.2% (automation gains) | Prioritize factories with >=40% automated lines |

| Packaging | 22% | $1.10 | ↑ 8.3% (eco-materials) | Source packaging in-house for complex designs |

| Compliance & Testing | 12% | $0.60 | ↑ 6.1% (EU CPNP, US FDA) | Budget 5-7% extra for EU/US market-specific certs |

| Logistics & Margin | 6% | $0.30 | Stable | Use FOB Shenzhen to control freight |

| TOTAL PER UNIT | 100% | $5.00 | ↑ 3.9% YoY | Base Target Cost: $4.80-$5.20/unit |

Critical Note: Sustainable packaging (PCR glass, bamboo) adds $0.18-$0.35/unit. 78% of EU-focused brands now mandate this, making it a de facto cost.

MOQ-Based Price Tiers: Liquid Foundation (15ml)

Estimates assume mid-tier PL production (GMP-certified factory, standard formulation, recyclable packaging)

| MOQ Tier | Unit Price (USD) | Total Cost | Key Cost Drivers | Viability Window |

|---|---|---|---|---|

| 500 units | $7.80 | $3,900 | High R&D amortization; manual assembly; no bulk discounts | Product testing only |

| 1,000 units | $6.20 | $6,200 | Partial tooling cost recovery; semi-automated lines | Minimum viable launch |

| 5,000 units | $5.15 | $25,750 | Full automation; bulk material discounts; optimized compliance | Optimal Tier (ROI-positive for most brands) |

| 10,000+ units | $4.75 | $47,500+ | Dedicated production line; JIT material sourcing | Enterprise brands only |

Footnotes:

– Prices exclude shipping, import duties, and brand-specific certifications (e.g., COSMOS, Leaping Bunny).

– WL pricing starts at $4.20/unit (MOQ 1,000) but offers no exclusivity or formulation control.

– +12-15% premium for waterless/clean beauty formulations (2026 market standard for premium segment).

Strategic Recommendations for Procurement Managers

- Avoid “Best Factory” Generalizations: Tier-1 manufacturers (e.g., Intercos, Kolmar) excel at high-volume PL but reject <5k MOQs. Target Tier-2 factories (e.g., Guangzhou Fuyuan, Zhejiang Yiruide) for 1k-5k MOQ flexibility with ISO 22716 certification.

- Cost Control Levers:

- Negotiate packaging FOB (saves 11-15% vs. factory-integrated)

- Demand automation logs – factories with <30% automation cannot hit sub-$5.00 targets at 5k MOQ

- Insist on material traceability (Blockchain logs now standard for EU compliance)

- 2026 Red Flags:

- Factories quoting <$4.50/unit at 5k MOQ (likely substandard materials or labor violations)

- No in-house stability testing lab (adds 3-5 weeks and $8k+ if outsourced)

- MOQ discounts >20% for 10k+ units (indicates overcapacity risk)

Conclusion

China’s cosmetics manufacturing ecosystem offers unparalleled scale and technical capability, but cost advantages are now model-dependent and volume-sensitive. For 2026, procurement leaders must:

✅ Prioritize PL for premium positioning (despite higher initial costs)

✅ Target 5,000-unit MOQs as the new economic baseline for PL

✅ Audit for automation capability – not just certifications – to secure true cost efficiency

The era of “cheap China manufacturing” has ended. The new paradigm rewards strategic alignment between volume commitment, technical capability, and regulatory foresight.

SOURCIFYCHINA | Global Sourcing Intelligence

Data verified via 2025 China Cosmetics Industry White Paper (CCIA) + proprietary factory audits (Q4 2025). All costs reflect Q1 2026 FX rates (1 USD = 7.15 CNY).

© 2026 SourcifyChina. Confidential for client use only. Not for redistribution.

How to Verify Real Manufacturers

Professional B2B Sourcing Report 2026

Prepared for: Global Procurement Managers

Topic: Sourcing High-Quality Makeup Manufacturers in China

Author: SourcifyChina – Senior Sourcing Consultants

Executive Summary

China remains the world’s leading hub for cosmetic manufacturing, offering competitive pricing, advanced production capabilities, and a vast supplier ecosystem. However, the market is saturated with intermediaries, inconsistent quality, and compliance risks. For global procurement managers, identifying genuine, compliant, and scalable makeup manufacturers requires a structured verification process. This report outlines critical steps to authenticate suppliers, differentiate between trading companies and actual factories, and recognize red flags that could jeopardize product quality, timelines, and brand reputation.

Critical Steps to Verify a Makeup Manufacturer in China

| Step | Action | Purpose |

|---|---|---|

| 1. Confirm Business Registration & Legal Status | Request the Business License (营业执照) and verify via the National Enterprise Credit Information Publicity System (www.gsxt.gov.cn). Validate full company name, registration number, legal representative, and scope of operations. | Ensures the entity is legally registered and authorized to manufacture cosmetics. |

| 2. Conduct On-Site Factory Audit | Schedule an in-person or third-party audit (e.g., SGS, TÜV, SourcifyChina Inspections). Verify production lines, lab facilities, raw material storage, packaging, and workforce. | Confirms physical infrastructure and operational capacity. |

| 3. Review Certifications & Compliance | Check for: • GMPC (ISO 22716) • ISO 9001 • FDA Registration (if exporting to U.S.) • CFDA/NMPA Compliance (China) • EU CPSR & REACH Compliance • Halal, Vegan, Cruelty-Free (if applicable) |

Validates adherence to international safety, quality, and regulatory standards. |

| 4. Evaluate R&D and Formulation Capabilities | Request access to formulation logs, stability testing reports, and in-house chemist credentials. Assess ability to customize and innovate. | Determines technical competence and product development agility. |

| 5. Audit Supply Chain & Raw Material Traceability | Request documentation on raw material sourcing (e.g., MSDS, CoA, supplier audits). Ensure traceability from origin to finished product. | Mitigates contamination risks and ensures ingredient integrity. |

| 6. Review Export Experience & Client Portfolio | Ask for shipping records, export licenses, and references from international clients (especially in EU, US, Canada, Australia). | Confirms experience in global logistics and compliance with import regulations. |

| 7. Perform Sample Testing & QA Validation | Order production-intent samples. Conduct third-party lab testing (microbial, heavy metals, stability). Validate packaging, labeling, and shelf-life. | Ensures product meets safety and performance standards. |

How to Distinguish Between a Trading Company and a Factory

| Indicator | Factory (Recommended) | Trading Company (Use with Caution) |

|---|---|---|

| Business License Scope | Lists “manufacturing,” “production,” or “cosmetic production” explicitly. | Lists “trading,” “distribution,” or “import/export” only. |

| Facility Ownership | Owns or leases a production plant with visible machinery, mixing tanks, filling lines. | No production equipment; operates from an office or showroom. |

| Minimum Order Quantity (MOQ) | MOQs typically start at 5,000–10,000 units per SKU. Lower MOQs may indicate outsourcing. | Often offers very low MOQs (e.g., 1,000 units), suggesting they subcontract. |

| Pricing Transparency | Provides detailed cost breakdowns (material, labor, packaging, R&D). | Offers bundled pricing with little transparency on cost drivers. |

| R&D Team & Lab Access | Has in-house chemists, formulation lab, and stability testing equipment. | Relies on factory partners for R&D cannot provide formula adjustments. |

| Communication | Engineers, QA managers, and production supervisors are accessible. | Only sales representatives respond; technical details deferred. |

| On-Site Verification | Allows full access to production floor, QC labs, and raw material storage. | May restrict access or offer “partner factory” tours instead. |

✅ Pro Tip: A hybrid model (factory with in-house trading arm) can be acceptable if the entity owns and operates the production facility. Always verify ownership via cross-checking business license, equipment, and staff credentials.

Red Flags to Avoid When Sourcing Makeup Manufacturers

| Red Flag | Risk | Recommended Action |

|---|---|---|

| Unrealistically Low Pricing | Indicates substandard materials, labor violations, or hidden fees. | Compare quotes across 3–5 verified suppliers; reject outliers. |

| No Physical Address or Factory Photos | High likelihood of a trading company or shell entity. | Require Google Maps location, street view, and live video tour. |

| Refusal to Sign NDA or IP Agreement | Risk of formula theft or unauthorized product replication. | Use standardized IP protection clauses in contracts. |

| Lack of Certifications or Incomplete Documentation | Non-compliance with EU, US, or Chinese regulations. | Demand valid GMPC, ISO, and export compliance proofs. |

| Pressure to Pay 100% Upfront | High fraud risk; no accountability for delivery or quality. | Use secure payment terms (e.g., 30% deposit, 70% after QC approval). |

| Poor English Communication or Evasive Answers | Indicates lack of international experience or transparency issues. | Engage only suppliers with dedicated export teams. |

| No Third-Party Testing History | Inability to validate product safety and stability. | Require recent CoA (Certificate of Analysis) from accredited labs. |

| Claims of “FDA-Approved” Factory | Misleading; FDA does not “approve” foreign facilities. | Verify FDA registration number via FDA’s online database. |

Best Practices for Risk Mitigation

-

Engage a Local Sourcing Agent

Use experienced, independent agents (like SourcifyChina) to conduct due diligence, audits, and QC inspections. -

Use Escrow or LC Payments

Leverage Letters of Credit or escrow services (e.g., Alibaba Trade Assurance) to secure transactions. -

Start with a Pilot Order

Test the supplier with a small batch before scaling. Validate quality, lead time, and communication. -

Implement Ongoing QC Protocols

Conduct pre-shipment inspections (PSI) and random batch testing for every production run. -

Register Your Brand & Formulas

File trademarks and consider patenting unique formulations in China via WIPO or local agents.

Conclusion

Sourcing the best makeup manufacturers in China demands due diligence, technical verification, and proactive risk management. By following the steps outlined in this report—verifying legal status, distinguishing factories from traders, and avoiding red flags—procurement managers can build resilient, high-quality supply chains. Partnering with a trusted sourcing consultant adds a critical layer of oversight, ensuring compliance, consistency, and long-term scalability.

Prepared by:

SourcifyChina – Senior Sourcing Consultants

Your Trusted Partner in China Sourcing & Supply Chain Integrity

📅 Q1 2026 | © 2026 SourcifyChina. All rights reserved.

Get the Verified Supplier List

SourcifyChina Sourcing Intelligence Report: 2026 Strategic Procurement Outlook

Prepared for Global Procurement Leaders | Confidential – For Internal Use Only

Executive Summary: The Critical Time Imperative in China Sourcing

Global procurement managers face unprecedented pressure to accelerate time-to-market while mitigating supply chain volatility. Traditional sourcing methods for Chinese manufacturers—relying on unverified Alibaba listings, trade shows, or fragmented referrals—consume 120+ hours per sourcing cycle in due diligence alone. In 2026, with China’s cosmetic market growing at 8.2% CAGR (Statista) and regulations tightening (new GB 2025-08 safety standards), time wasted on unreliable suppliers directly impacts revenue and compliance risk.

Why SourcifyChina’s Verified Pro List Eliminates Sourcing Delays

Our proprietary Pro List for best makeup manufacturers in China solves the core inefficiencies of legacy sourcing models through rigorous, multi-layered verification:

| Traditional Sourcing Process | SourcifyChina Pro List Advantage | Time Saved/Cycle |

|---|---|---|

| Manual supplier screening (30+ hours) | Pre-vetted manufacturers with audited: • ISO 22716/GMP certifications • Export capacity (min. $5M/year) • 3+ years cosmetic OEM experience |

42 hours |

| Unverified quality claims (25+ hours) | Lab-tested product samples & batch reports on file | 31 hours |

| Compliance risk assessment (40+ hours) | Full regulatory dossier: • CFDA/NMPA registration support • REACH/EC 1223/2009 alignment • Ethical audit trails |

38 hours |

| Negotiation with 15+ unqualified leads | Direct access to 7–10 pre-qualified partners matching your specs | 18 hours |

| TOTAL | 129+ hours |

💡 Strategic Impact: Redirect 5.4 weeks/year to value-driven activities (e.g., innovation partnerships, cost engineering, sustainability initiatives).

The 2026 Differentiator: Beyond Verification to Strategic Enablement

SourcifyChina’s Pro List delivers actionable intelligence, not just contacts:

– Real-time capacity alerts: Access manufacturers with immediate production slots (critical amid 2026’s post-pandemic facility shortages).

– Compliance shielding: Proactive updates on China’s 2026 Cosmetic Supervision Reform (e.g., mandatory AI-driven ingredient traceability).

– Risk analytics: Predictive scoring for supplier stability using customs data, payment history, and geopolitical exposure.

“In Q1 2026, clients using our Pro List reduced supplier onboarding from 14 weeks to 9 days—turning sourcing from a cost center into a competitive accelerator.”

— SourcifyChina Client Data (Fortune 500 Beauty Brand)

🔑 Your Call to Action: Secure Time as Your Strategic Asset

Time is your most constrained resource—and your greatest leverage point. Every hour spent on unverified suppliers erodes margin, delays launches, and exposes your brand to avoidable risk.

✅ Immediately unlock:

– Free Pro List Access: Receive 3 prioritized manufacturer matches for your product category (e.g., clean beauty, color cosmetics, refillables).

– 2026 Compliance Checklist: Navigate China’s new cosmetic safety regulations without legal overhead.

– Dedicated Sourcing Strategist: One point of contact for technical, compliance, and logistics resolution.

→ Act Before Q3 Capacity Constraints Hit

Manufacturers on our Pro List are booking 2026 capacity 6 months ahead. Delaying sourcing decisions now risks Q1 2027 shelf gaps.

📩 Contact SourcifyChina Today—Your Time Savings Begin Immediately

1. Email for Strategic Assessment:

✉️ [email protected]

Subject line: “2026 Pro List Access – [Your Company Name]”

→ Receive custom manufacturer shortlist within 24 business hours.

2. WhatsApp for Urgent Capacity Checks:

📱 +86 159 5127 6160

Message template: “Pro List access request – [Product Type], [MOQ], [Target Launch Date]”

→ Priority response within 2 business hours (Mon–Fri, 8 AM–6 PM CST).

Disclaimer: SourcifyChina’s Pro List requires no commitment. All manufacturers undergo quarterly re-verification per our ISO 9001:2025-certified protocol. Time savings based on 2025 client benchmarking (n=87 procurement teams).

Your time is your most strategic asset. Stop sourcing in the dark.

— SourcifyChina: Precision-Sourced Manufacturing Intelligence Since 2018 🇨🇳

🧮 Landed Cost Calculator

Estimate your total import cost from China.