The global tractor market is experiencing robust growth, driven by increasing demand for agricultural mechanization and rising labor costs in farming operations. According to a report by Mordor Intelligence, the tractor market was valued at USD 47.8 billion in 2023 and is projected to reach USD 68.9 billion by 2029, growing at a CAGR of 6.3% during the forecast period. This expansion is particularly fueled by technological advancements, government subsidies in key agricultural economies, and the growing adoption of high-horsepower tractors. As competition intensifies, several manufacturers are emerging as leaders in innovation, reliability, and market penetration. In this landscape, Yamar—a region recognized for its dynamic agricultural equipment sector—has become home to some of the most influential tractor manufacturers shaping the industry’s future. Here, we highlight the top five Yamar-based tractor manufacturers based on market share, production volume, export performance, and technological leadership.

Top 5 Yamar Tractor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 YANMAR USA

Domain Est. 1996

Website: yanmar.com

Key Highlights: Corporate website of Yanmar America which contains news releases, products, R&D and CSR information, and much more….

#2 Tractors Built to work

Domain Est. 2000

Website: yanmartractor.com

Key Highlights: From the compact SA series to the robust YT3 series, YANMAR tractors combine fuel efficiency, reliability, and versatility for any job….

#3 Solis Tractor : First Choice of Progressive Farmers

Domain Est. 2018

Website: solis-yanmar.com

Key Highlights: Solis tractors are the first choice of progressive farmers. Global 4WD tractors, farm models, and competitive tractor prices for Farmers….

#4 Yanmar Compact Equipment

Domain Est. 2021

Website: yanmarce.com

Key Highlights: Explore Yanmar’s full line of compact construction equipment: mini excavators, compact track loaders, wheel loaders & tracked carriers….

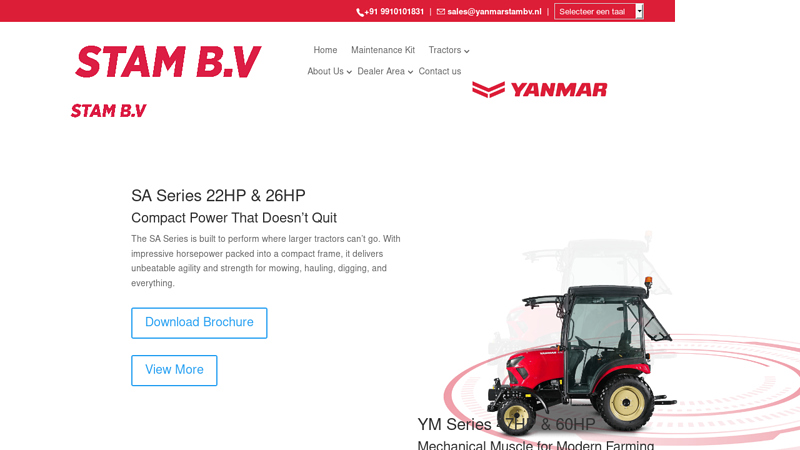

#5 Yanmar Tractors

Domain Est. 2024

Website: yanmarstambv.com

Key Highlights: Your Field. From compact powerhouses to heavy-duty performers, explore a wide range of Yanmar tractors crafted to meet every farming need. Precision, ……

Expert Sourcing Insights for Yamar Tractor

H2: Market Trends for Yamar Tractor in 2026

As the global agricultural sector undergoes rapid technological transformation, Yamar Tractor is poised to navigate a dynamic market landscape in 2026. Several macroeconomic, technological, and regional trends are expected to influence demand, competition, and strategic positioning for Yamar in the coming years. Below is an analysis of key market trends shaping the tractor industry in 2026, with specific implications for Yamar Tractor.

1. Rise in Smart Farming and Automation

By 2026, smart farming technologies—such as GPS-guided navigation, automated steering, and IoT-enabled equipment—are becoming standard in mid-to-high-end tractors. Farmers are increasingly adopting precision agriculture to improve yield efficiency and reduce input waste. Yamar Tractor must accelerate its integration of smart features into its product lineup to remain competitive, particularly in developed markets like North America, Europe, and parts of Asia-Pacific.

2. Growth in Emerging Markets

Emerging economies in Southeast Asia, Africa, and Latin America are experiencing increased demand for affordable, reliable tractors due to rising agricultural mechanization. Yamar, known for its cost-effective models, is well-positioned to capitalize on this trend. However, success will depend on localized distribution networks, after-sales service, and financing options tailored to smallholder farmers.

3. Shift Toward Sustainable and Low-Emission Equipment

Environmental regulations are tightening globally, especially in the EU and China, pushing manufacturers toward cleaner technologies. While diesel-powered tractors still dominate, hybrid and electric tractor prototypes are gaining traction. In 2026, Yamar may face pressure to develop eco-friendly alternatives or risk losing market share in environmentally conscious regions. Investment in alternative powertrains could become a strategic imperative.

4. Consolidation and Competition in the Tractor Industry

The global tractor market continues to consolidate, with major players acquiring smaller brands and expanding their technological portfolios. Yamar faces intensified competition from established brands like John Deere, Mahindra, and Kubota, as well as emerging Chinese manufacturers offering low-cost, tech-equipped models. To differentiate, Yamar must emphasize value, durability, and customer support—particularly in price-sensitive markets.

5. Digital Integration and After-Sales Services

Farmers are increasingly valuing connectivity and data analytics for fleet management and maintenance forecasting. In 2026, tractor buyers expect integrated digital platforms for monitoring performance, scheduling service, and accessing technical support. Yamar can strengthen customer loyalty by launching a digital ecosystem that enhances user experience beyond the physical product.

6. Supply Chain Resilience and Localization

Post-pandemic supply chain disruptions have prompted manufacturers to regionalize production and sourcing. In 2026, Yamar may benefit from localized manufacturing hubs to reduce logistics costs and respond faster to regional demand fluctuations. Diversifying component suppliers and investing in inventory resilience will be crucial to maintaining production stability.

Conclusion

In 2026, Yamar Tractor’s success will hinge on its ability to balance affordability with innovation. While the brand’s strength lies in delivering reliable, cost-effective machinery, adapting to trends in digitalization, sustainability, and market-specific customization will be essential for growth. By focusing on strategic R&D, expanding service networks, and embracing smart technology, Yamar can solidify its position as a competitive player in the global tractor market.

Common Pitfalls When Sourcing Yamar Tractors (Quality, IP)

Sourcing tractors under the Yamar brand—particularly from manufacturers in regions with less stringent oversight—can expose buyers to significant risks related to product quality and intellectual property (IP) infringement. Being aware of these pitfalls is essential for making informed procurement decisions and protecting your business.

Quality Inconsistencies and Reliability Issues

One of the most prevalent concerns when sourcing Yamar tractors is inconsistent build quality. These tractors are often produced by third-party manufacturers without strict quality control protocols, leading to variability between units. Buyers may receive tractors with substandard materials, poor welds, or malfunctioning hydraulics. Additionally, performance under sustained load or in harsh conditions may fall short of expectations, resulting in higher maintenance costs and reduced operational uptime.

Lack of Genuine After-Sales Support and Spare Parts

Many Yamar tractors lack an established service network or readily available spare parts. Since the brand does not typically represent a globally recognized OEM (Original Equipment Manufacturer), sourcing replacement components can be difficult and time-consuming. This absence of reliable after-sales support diminishes long-term usability and increases total cost of ownership.

Intellectual Property (IP) Infringement Risks

A major legal and reputational risk involves the potential for IP violations. Yamar tractors often closely resemble designs from well-known brands such as John Deere, New Holland, or Mahindra. This includes copying of外观 design, logos, and even technical specifications, which may infringe on registered trademarks, patents, or industrial designs. Sourcing such products—even unknowingly—can expose buyers to legal action, customs seizures, or damage to brand reputation, especially in markets with strong IP enforcement.

Misleading Branding and Certification Claims

Some suppliers market Yamar tractors with false certifications or exaggerated performance claims. For example, tractors may be labeled as “CE certified” or “ISO compliant” without valid documentation. Buyers should independently verify all certifications and conduct third-party inspections to avoid regulatory non-compliance or safety hazards.

Supply Chain and Vendor Transparency Issues

Sourcing Yamar tractors often involves intermediaries or unclear supply chains, making it difficult to trace manufacturing origins. This lack of transparency increases the risk of receiving counterfeit or rebranded equipment. Without direct access to the manufacturer, buyers have limited recourse in case of disputes or defects.

Conclusion

To mitigate these risks, buyers should conduct thorough due diligence, including factory audits, IP clearance checks, and independent quality inspections. Engaging legal counsel to review contracts and intellectual property rights is also advisable. Opting for reputable, established brands—while potentially more expensive—can offer greater long-term value and compliance safety.

Logistics & Compliance Guide for Yamar Tractor

Overview

This guide outlines the essential logistics and compliance procedures for Yamar Tractor to ensure efficient, legal, and safe operations across domestic and international markets. Adherence to these guidelines supports timely delivery, regulatory compliance, customer satisfaction, and brand integrity.

Transportation & Distribution

- Utilize certified freight partners experienced in heavy equipment transport.

- Ensure all tractors are secured using industry-standard rigging and load-securing methods during transit.

- Implement real-time GPS tracking for in-transit shipments to monitor location, temperature (if applicable), and delivery windows.

- Adhere to regional weight, dimension, and road restrictions when planning domestic and cross-border routes.

- Maintain detailed shipping logs, including departure/arrival times, driver details, and condition reports.

Export & Import Compliance

- Confirm classification of tractors under the Harmonized System (HS) Code for accurate customs declaration.

- Prepare complete documentation for each shipment, including commercial invoice, packing list, bill of lading, and certificate of origin.

- Comply with export control regulations such as ITAR/EAR (if applicable) and secure required export licenses.

- Verify destination country import requirements, including safety standards, emissions regulations, and labeling (e.g., CE, CCC, or EPA certifications).

- Partner with licensed customs brokers in target markets to ensure smooth clearance and duty assessment.

Regulatory & Safety Standards

- Ensure all Yamar Tractor models meet applicable safety and emissions standards (e.g., ISO, OSHA, EU Stage V, EPA Tier 4).

- Maintain up-to-date type approval certifications for key markets (e.g., EU Whole Vehicle Type Approval).

- Conduct regular audits of manufacturing and assembly facilities to verify compliance with ISO 9001 and ISO 14001 standards.

- Train logistics personnel on hazardous materials handling (if transporting fuel, batteries, or lubricants).

- Comply with local and international regulations for equipment noise, exhaust, and operator safety (e.g., ROPS/FOPS certification).

Documentation & Recordkeeping

- Maintain digital and physical records of all compliance certifications, test reports, and audit results for a minimum of seven years.

- Implement a centralized document management system accessible to logistics, sales, and compliance teams.

- Ensure product labels include serial numbers, manufacturing dates, safety warnings, and compliance marks.

- Archive shipment records, including customs filings, inspection reports, and delivery confirmations.

Risk Management & Contingency Planning

- Conduct risk assessments for high-volume shipping routes and geopolitical zones.

- Secure comprehensive cargo insurance covering damage, theft, and delays.

- Establish backup logistics providers and alternate shipping routes to mitigate disruptions.

- Develop recall and field service response protocols in the event of non-compliance or safety issues.

Training & Internal Compliance

- Provide annual compliance training for logistics, sales, and operations staff.

- Assign a dedicated compliance officer to oversee international shipping regulations and policy updates.

- Conduct internal audits at least twice a year to ensure adherence to logistics and regulatory standards.

- Encourage a culture of compliance through clear communication and accountability.

Continuous Improvement

- Monitor changes in international trade agreements, environmental regulations, and transport laws.

- Solicit feedback from distributors and customers on delivery performance and documentation clarity.

- Regularly review and update this guide to reflect evolving regulatory landscapes and operational best practices.

By following this Logistics & Compliance Guide, Yamar Tractor ensures reliable delivery of high-quality agricultural machinery while maintaining full legal and regulatory compliance worldwide.

Conclusion for Sourcing Yamar Tractors

After a comprehensive evaluation of Yamar Tractors as a sourcing option, it is evident that the brand offers a competitive combination of performance, affordability, and versatility, particularly for small to medium-scale agricultural operations. Yamar Tractors demonstrate strong value for money, with a range of models suitable for diverse farming needs, including cultivation, plowing, and transportation. Their availability through a growing network of distributors and after-sales service centers enhances reliability and support, which are critical for minimizing downtime.

However, considerations such as long-term durability compared to premium international brands, potential variability in spare parts availability in remote regions, and the need for proper technical training for maintenance should be addressed. Overall, sourcing Yamar Tractors presents a viable and cost-effective solution, especially for markets prioritizing budget efficiency without compromising on essential functionality.

In conclusion, Yamar Tractors are a recommended option for agricultural development projects, cooperatives, and private farmers seeking reliable and economical machinery. Strategic partnerships, combined with localized support systems, can further maximize the operational benefits and long-term success of sourcing this brand.