The global XPS (extruded polystyrene) foam board market has experienced steady growth, driven by rising demand for high-performance insulation materials in construction, infrastructure, and industrial applications. According to Grand View Research, the global insulation materials market was valued at USD 58.7 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030, with XPS foam boards playing a key role due to their superior thermal resistance, moisture resistance, and compressive strength. Mordor Intelligence further highlights that the growing emphasis on energy efficiency in buildings and government regulations promoting sustainable construction are accelerating the adoption of XPS insulation across residential and commercial sectors. As demand rises, a select group of manufacturers has emerged as market leaders, leveraging innovation, scale, and global distribution networks to maintain competitive advantage. Below, we examine the top 8 XPS foam boards manufacturers shaping the industry’s future.

Top 8 Xps Foam Boards Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

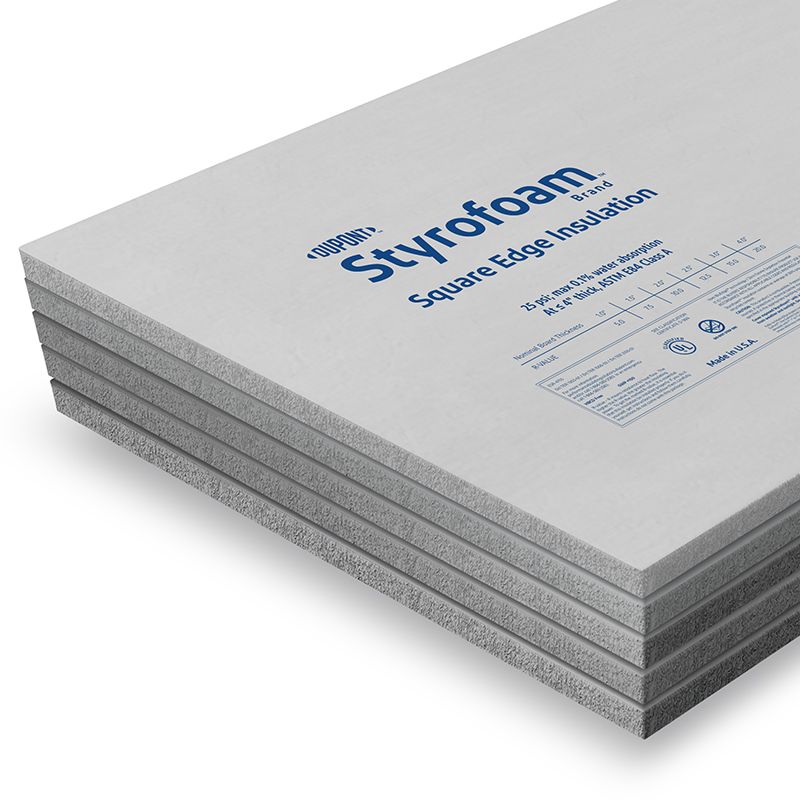

#1 Styrofoam™ Brand XPS Insulation

Domain Est. 1987

Website: dupont.com

Key Highlights: Its unique closed-cell structure and rigid foam board technology enables XPS to meet core thermal, moisture, air and vapor performance requirements. The history ……

#2 XPSA

Domain Est. 2002

Website: xpsa.com

Key Highlights: The Extruded Polystyrene Foam Association (XPSA) is a trade association representing manufacturers of Extruded Polystyrene Foam (XPS) insulation products and ……

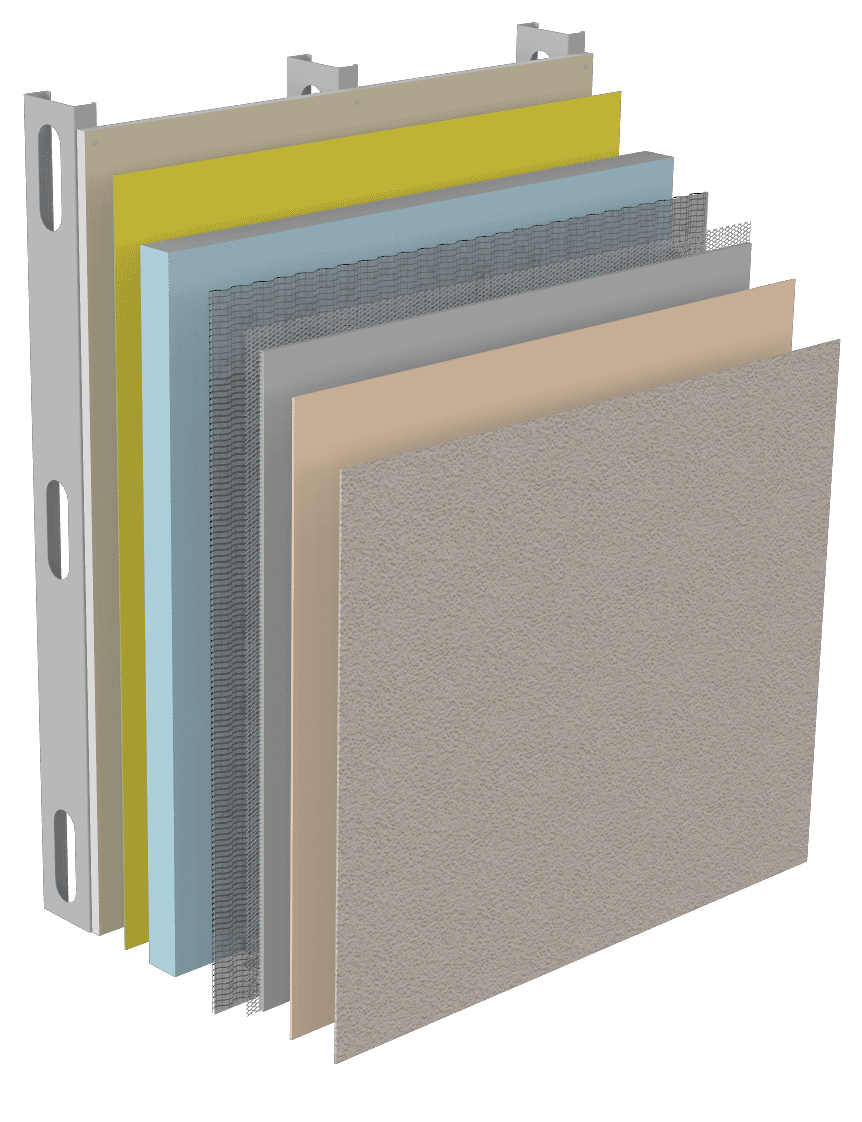

#3 Insulation Board

Domain Est. 1996

Website: kingspan.com

Key Highlights: Our expansive selection of rigid insulation board technologies includes XPS, vacuum insulated panels (VIPs), and phenolic foam….

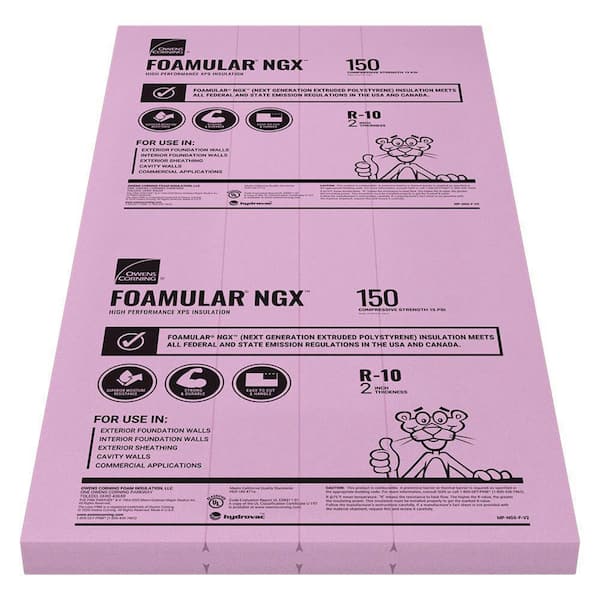

#4 foamular® ngx® 150

Domain Est. 1996

Website: owenscorning.com

Key Highlights: NGX foam insulation provides durable and moisture-resistant thermal performance. These rigid foam boards are all-purpose foam panel insulation for masonry ……

#5 DuPont™ Styrofoam™ Brand Panel Core 20 XPS Foam Insulation

Domain Est. 1996

Website: dryvit.com

Key Highlights: A key component in the Dryvit Outsulation X system, this extruded polystyrene (XPS) foam board is scored longitudinally at 16-inch and 24-inch centers, making ……

#6 SOPRA

Domain Est. 2002

Website: soprema.us

Key Highlights: SOPRA-XPS 30 is a thermal insulation board made of rigid extruded polystyrene with shiplap or square edges on its four sides. Contact an expert….

#7 PNP

Domain Est. 2022

Website: pnpinsulation.com

Key Highlights: Universal type of boards with a smooth surface, recommended for thermal insulation of plinths, walls (except for plaster systems), floors, roofs, as a filler ……

#8 XPS Foam Boards

Website: xps.supply

Key Highlights: XPS Foam Boards (47); XPS Foam Boards (Full Truckload) (4). Contact Info. 1510 Bauer Blvd, Akron OH 44305. Phone: 844-771-4185 … Page load link. Go to Top….

Expert Sourcing Insights for Xps Foam Boards

H2: 2026 Market Trends for XPS Foam Boards

The global market for Extruded Polystyrene (XPS) foam boards is poised for significant evolution by 2026, driven by a confluence of sustainability mandates, technological advancements, regional regulatory shifts, and competitive pressures. While maintaining its stronghold in thermal insulation, XPS faces both challenges and opportunities that will reshape its trajectory.

1. Regulatory and Sustainability Pressures Intensify (H2.1):

By 2026, environmental regulations will be the dominant force shaping the XPS market. Key trends include:

* HFC Phase-Down Acceleration: The global phase-down of high-GWP (Global Warming Potential) HFCs (like HFC-134a) used as blowing agents is accelerating under the Kigali Amendment and regional regulations (e.g., EU F-Gas Regulation, US AIM Act). By 2026, the vast majority of new XPS production in major markets (North America, EU) will have transitioned to low-GWP alternatives. Hydrofluoroolefins (HFOs) like HFO-1234ze and hydrocarbons (e.g., isopentane) are leading replacements, significantly reducing the product’s carbon footprint and embodied carbon.

* Focus on Embodied Carbon & EPDs: Building codes (e.g., California’s Buy Clean, EU’s upcoming CBAM) and green building standards (LEED v5, BREEAM, Living Building Challenge) will place increasing emphasis on material embodied carbon. Manufacturers will need robust Environmental Product Declarations (EPDs) demonstrating lower lifecycle impacts, pushing innovation in raw material sourcing and energy efficiency.

* Circularity Initiatives: While challenging due to chemical structure, pressure for recyclability will grow. Expect pilot programs and R&D in mechanical recycling (reprocessing scrap into low-value products) and chemical recycling (depolymerization back to styrene monomer) to gain traction, though widespread commercial viability by 2026 remains limited.

2. Performance and Innovation Drive Differentiation (H2.2):

Competition will center on enhanced performance and new functionalities:

* Improved Thermal Performance: Despite the blowing agent shift, manufacturers will focus on optimizing cell structure and additives to maintain or slightly improve long-term thermal resistance (LTTR). Expect R-values to stabilize or see marginal gains post-transition.

* Enhanced Physical Properties: Demand for higher compressive strength (especially for below-grade and roofing applications) and improved dimensional stability will continue. Innovations in polymer blends and processing will target these attributes.

* Functional Additives: Integration of additives for fire safety (improved flame retardants meeting stricter codes), moisture resistance (though inherent), and potentially antimicrobial properties for specific applications will be key differentiators.

* Hybrid & Multi-Functional Boards: Development of XPS boards with integrated facers (e.g., reflective foils, reinforced facers) or combined with other materials (e.g., mineral wool layers) to create multi-functional insulation solutions will increase, offering simplified installation and enhanced performance.

3. Regional Market Dynamics and Competitive Landscape (H2.3):

Growth and challenges will vary significantly by region:

* North America & Europe: Mature markets focused on renovation and energy retrofits (driven by government incentives like IRA in the US, REPowerEU). Growth will be steady but moderated by intense competition from alternative insulation (mineral wool, PIR/PUR, cellulose) and stringent regulations. The transition to low-GWP blowing agents will be largely complete, consolidating the position of major players (Owens Corning, Kingspan, Saint-Gobain, Armacell) who invested early.

* Asia-Pacific (Excluding China): Significant growth potential, particularly in India, Southeast Asia, and Australia, driven by urbanization, rising construction, and increasing energy efficiency awareness. However, adoption of low-GWP technologies may lag behind the West due to cost sensitivity and regulatory timelines. Local manufacturers may face pressure to upgrade.

* China: The world’s largest XPS market, but facing a complex transition. Government policies are pushing for lower-GWP alternatives, but the sheer scale and existing infrastructure using HFCs mean the shift will be gradual. Domestic producers are developing HFO-based solutions, but cost competitiveness remains crucial. Environmental enforcement will be a key variable.

* Emerging Markets (Latin America, Middle East, Africa): Growth driven by basic insulation needs in construction. HFC-based XPS will likely remain prevalent due to lower cost, though international pressure and potential technology transfer may accelerate change post-2026.

4. Economic and Supply Chain Factors (H2.4):

Raw Material Volatility: Prices for polystyrene resin (derived from benzene/ethylene) will remain susceptible to fluctuations in oil and gas markets, impacting XPS production costs.

* Transition Costs: The capital expenditure required for switching blowing agents and potentially modifying production lines will have been largely incurred by 2026, but the operational costs of new blowing agents (especially HFOs) may remain higher than legacy HFCs, influencing pricing.

* Supply Chain Resilience:* Post-pandemic lessons and geopolitical tensions will drive efforts for more regionalized supply chains and inventory management, reducing reliance on single sources.

Conclusion (H2.5):

By 2026, the XPS foam board market will be fundamentally transformed by the near-completion of the low-GWP blowing agent transition in key regions. Sustainability, driven by regulation and market demand, will be paramount. Success will depend on manufacturers’ ability to deliver high-performance, lower-embodied-carbon products while managing costs in a competitive landscape. Innovation will focus on performance optimization, functional enhancements, and nascent circularity solutions. While facing strong competition from alternative insulations, XPS will retain significant market share, particularly in applications demanding high moisture resistance and compressive strength, but its future growth is intrinsically linked to its successful environmental transformation.

Common Pitfalls When Sourcing XPS Foam Boards: Quality and Intellectual Property Concerns

Sourcing extruded polystyrene (XPS) foam boards can be cost-effective, but it comes with significant risks related to product quality and intellectual property (IP) infringement. Being aware of these pitfalls is crucial for ensuring performance, compliance, and long-term project success.

Poor Material Quality and Performance

One of the most frequent challenges is receiving XPS boards that fail to meet required technical specifications. Substandard materials may exhibit lower compressive strength, inconsistent density, or reduced thermal resistance (higher lambda values), leading to compromised insulation performance and structural integrity. These deficiencies often stem from manufacturers cutting corners—using recycled or inferior-grade polystyrene, improper foaming agents, or inadequate extrusion processes. The result can be boards that degrade quickly, absorb moisture, or fail under load, increasing long-term costs due to repairs or system failure.

Misrepresentation of Technical Specifications

Suppliers—especially those in less regulated markets—may exaggerate or falsify product data. Common misrepresentations include inflating R-values, compressive strength ratings, or fire resistance classifications. These claims are often not backed by independent, accredited testing. Without proper verification through third-party certifications (such as ASTM, EN, or ISO standards), buyers risk specifying materials that underperform in real-world applications, potentially violating building codes and exposing projects to liability.

Lack of Traceability and Consistent Batch Quality

Many low-cost XPS suppliers lack robust quality control systems, resulting in significant variability between production batches. This inconsistency makes it difficult to ensure uniform performance across a project. Additionally, a lack of traceability—such as batch numbers, manufacturing dates, or material origin—complicates accountability in case of defects or failures. This opacity can delay remediation and increase risk, particularly in large-scale construction.

Intellectual Property Infringement

Sourcing XPS foam boards from unauthorized or counterfeit manufacturers poses serious IP risks. Reputable brands invest heavily in proprietary formulations, extrusion technologies, and branding. Counterfeit or imitation products may copy patented designs, logos, or performance claims without authorization. Purchasing such products—even unknowingly—can expose buyers to legal action, shipment seizures, or reputational damage, especially in markets with strict IP enforcement like the EU or North America.

Absence of Compliance and Certification

Genuine, high-performance XPS boards are typically backed by comprehensive certifications, including Environmental Product Declarations (EPDs), fire safety approvals (e.g., UL, FM), and building code compliance (e.g., ICC-ES). Many low-cost suppliers either lack these certifications or provide forged documentation. Using non-compliant materials can result in failed inspections, project delays, and potential liability in the event of fire or structural issues.

Supply Chain and Warranty Risks

Unverified suppliers may offer no long-term warranties or after-sales support. If performance issues arise years later, recourse is often impossible. Additionally, unreliable supply chains can lead to delivery delays, inconsistent availability, or sudden discontinuation of products—jeopardizing project timelines and continuity.

Conclusion

To avoid these pitfalls, buyers should conduct thorough due diligence: verify supplier credentials, request independent test reports, confirm IP legitimacy, and prioritize vendors with transparent manufacturing practices and recognized certifications. Investing in quality and authenticity upfront mitigates long-term risks and ensures the durability and compliance of insulation systems.

Logistics & Compliance Guide for XPS Foam Boards

Overview

Extruded Polystyrene (XPS) foam boards are widely used in construction for insulation due to their thermal resistance, moisture resistance, and structural strength. Proper logistics and compliance management are essential to ensure safe handling, transportation, regulatory adherence, and environmental responsibility throughout the supply chain.

Regulatory Compliance

XPS foam boards are subject to various international, national, and regional regulations. Key compliance areas include:

- Fire Safety Standards: Comply with building codes such as the International Building Code (IBC) and fire performance standards like ASTM E84 (surface burning characteristics) and NFPA 286 (room corner test). Flame retardants used in XPS must meet regulatory thresholds.

- Environmental Regulations: Adhere to EPA, REACH (EU), and RoHS directives regarding chemical usage, especially concerning HBCD (hexabromocyclododecane), which is restricted or banned in many regions.

- Volatile Organic Compounds (VOCs): Ensure low VOC emissions per standards such as California Section 01350 or GREENGUARD Certification for indoor air quality.

- Energy & Insulation Standards: Meet energy code requirements (e.g., IECC, ASHRAE 90.1) for R-value performance and installation guidelines.

Packaging & Handling

Proper packaging and handling preserve product integrity and ensure safety:

- Protective Wrapping: Boards should be shrink-wrapped or banded to prevent moisture absorption, dust accumulation, and physical damage.

- Stacking & Palletization: Use sturdy pallets and stack boards evenly to avoid warping. Limit stack height per manufacturer recommendations.

- Handling Equipment: Use forklifts or pallet jacks with wide forks to prevent crushing. Avoid dragging or dropping packages.

- Labeling: Include product specifications, fire ratings, batch numbers, and handling instructions (e.g., “This Side Up,” “Protect from Moisture”).

Transportation Guidelines

Safe and efficient transportation requires adherence to logistics best practices:

- Load Securing: Use straps, load locks, or corner boards to secure pallets and prevent shifting during transit.

- Weather Protection: Cover loads with waterproof tarps or use enclosed trailers to protect against rain and snow.

- Temperature Considerations: Avoid prolonged exposure to extreme heat (>75°C/167°F), which may cause deformation.

- Hazard Classification: While generally non-hazardous, confirm local regulations for flammable materials during transport. Some jurisdictions may require documentation if flame retardants exceed thresholds.

Storage Requirements

Optimal storage conditions maintain product performance:

- Indoor Storage: Preferable to prevent UV degradation and moisture absorption.

- Dry, Well-Ventilated Area: Keep away from direct sunlight, heat sources, and open flames.

- Off the Ground: Store on pallets or racks to avoid moisture wicking from concrete floors.

- Limited Stacking Height: Follow manufacturer guidelines to prevent compression damage.

- Fire Safety: Store away from combustible materials and ensure fire extinguishers are accessible.

Environmental & Sustainability Compliance

Sustainable logistics and compliance with circular economy principles are increasingly important:

- Recycling Programs: Partner with recyclers capable of processing polystyrene. Some XPS can be recycled into new insulation or construction products.

- Waste Management: Follow local disposal regulations; landfilling may be restricted in certain areas.

- Carbon Footprint Reporting: Track and report emissions associated with production and transportation to comply with environmental disclosure programs (e.g., EPDs – Environmental Product Declarations).

Documentation & Traceability

Maintain comprehensive records to support compliance and quality assurance:

- Safety Data Sheets (SDS): Provide up-to-date SDS per GHS standards for all XPS products.

- Certificates of Compliance: Include fire test reports, R-value certifications, and environmental declarations.

- Batch Tracking: Implement systems to trace material origin, production date, and distribution for recalls or audits.

Training & Personnel Safety

Ensure personnel are trained in:

- Safe manual handling to prevent injury

- Fire response procedures

- Proper use of personal protective equipment (PPE) when cutting or installing

- Recognition of hazardous conditions during storage and transport

Conclusion

Effective logistics and compliance for XPS foam boards require a proactive approach integrating safety, regulatory adherence, and environmental responsibility. By following these guidelines, stakeholders can ensure product performance, legal compliance, and sustainable operations across the supply chain.

Conclusion for Sourcing XPS Foam Boards:

Sourcing extruded polystyrene (XPS) foam boards requires a strategic approach that balances performance, cost, sustainability, and supply chain reliability. XPS boards are valued for their high thermal resistance, moisture resistance, and structural strength, making them ideal for insulation in roofing, walls, and below-grade applications. When sourcing, key considerations include product quality and consistency, adherence to industry standards (such as ASTM C578), R-value performance, and environmental impact, including the use of blowing agents with lower global warming potential.

Establishing relationships with reputable manufacturers and suppliers—both domestic and international—ensures consistent material availability and compliance with building codes. Additionally, evaluating logistics, lead times, and bulk pricing can significantly influence project timelines and overall costs. Sustainability-focused projects may benefit from suppliers offering recycled content or more eco-friendly production methods.

Ultimately, successful sourcing of XPS foam boards requires due diligence in supplier selection, clear communication of specifications, and ongoing evaluation of market trends and regulatory changes. By prioritizing quality, efficiency, and environmental responsibility, stakeholders can secure reliable and high-performing insulation materials that meet project requirements and long-term sustainability goals.