The global worm gear drive market is experiencing steady expansion, driven by increasing demand for reliable and high-torque transmission solutions across industrial automation, material handling, and energy sectors. According to Grand View Research, the global gearboxes market, which includes worm gear drives, was valued at USD 35.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. Mordor Intelligence further projects that the worm drive segment will benefit significantly from rising investments in infrastructure and manufacturing automation, particularly in emerging economies. With efficiency, compact design, and self-locking capabilities making worm drives a preferred choice in critical applications, the competitive landscape is shaped by innovation, precision engineering, and global supply chain strength. Here are the top six wormdrive manufacturers leading this growth trajectory through technological advancement and market reach.

Top 6 Wormdrive Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Factory Reconditioned Dewalt FLEXVOLT 60V MAX Lithium

Domain Est. 2007

Website: cpooutlets.com

Key Highlights: Rating 4.0 (1) · Free delivery over $149 · 30-day returnsFactory Reconditioned Dewalt FLEXVOLT 60V MAX Lithium-Ion Direct Drive 7-1/4 in. Cordless Worm Drive Style Saw (Tool O…

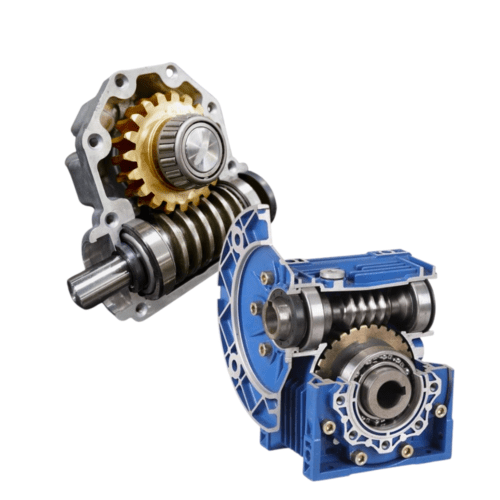

#2 worm

Domain Est. 2019

Website: worm-drive.com

Key Highlights: As one of the leading worm drive manufacturers, mechanical product suppliers, and factories, we supply worm drives and many other products. Find worm drive ……

#3 High Quality Worm Drive Manufacturer,Supplier

Domain Est. 2019

Website: worm-drive.top

Key Highlights: A worm drive is a type of gear arrangement that can be used to transmit power and motion between two rotating shafts at a right angle to each other….

#4 SiteOne

Domain Est. 1995

Website: siteone.com

Key Highlights: Free delivery 30-day returnsSiteOne is the green industry’s No. 1 destination for landscape supplies, irrigation tools and agronomic maintenance. Learn about our Partners Program….

#5 High-Performance Cutting

Domain Est. 1996

Website: skil.com

Key Highlights: Whether you’re cutting metal, wood, concrete, or all of the above, these saws deliver high-performance cutting, legendary power, and exceptional quality….

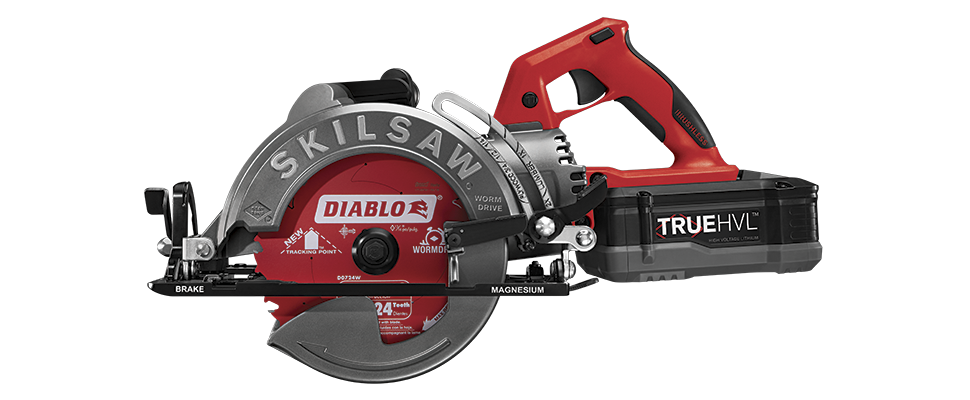

#6 Skilsaw Releases First Ever Cordless Worm Drive Saw

Domain Est. 2015

Website: constructionjunkie.com

Key Highlights: The new cordless worm drive is that it looks nearly identical to the trusted Mag 77. It features include an all magnesium base, a brushless motor, electronic ……

Expert Sourcing Insights for Wormdrive

H2: Market Trends Shaping the Worm Drive Industry in 2026

As we approach 2026, the worm drive market is undergoing significant transformation driven by technological advancements, shifts in industrial automation, and growing demand for energy-efficient mechanical solutions. Worm drives—known for their high torque output, compact design, and self-locking capabilities—continue to play a critical role in industries such as manufacturing, robotics, automotive, aerospace, and renewable energy. The following analysis outlines key market trends anticipated to define the worm drive landscape in 2026.

1. Rising Demand in Automation and Robotics

The global push toward Industry 4.0 and smart manufacturing is accelerating the adoption of precision motion control components. Worm drives are increasingly favored in robotic joints, automated assembly lines, and CNC machinery due to their ability to provide smooth, backlash-free motion and precise positioning. By 2026, the integration of worm drives in collaborative robots (cobots) and industrial automation systems is expected to see compound annual growth of over 7%, especially in Asia-Pacific markets like China, Japan, and South Korea.

2. Expansion in Renewable Energy Applications

Worm drives are finding new applications in solar tracking systems and wind turbine pitch control mechanisms. Their reliability under high load and resistance to back-driving make them ideal for outdoor, harsh-environment operations. With global investments in renewable energy projected to exceed $1.7 trillion by 2026, demand for durable and efficient worm gear solutions is set to grow, particularly in solar farms requiring single- and dual-axis tracking systems.

3. Adoption of Advanced Materials and Coatings

To improve efficiency and reduce wear—historically a limitation of worm drives—manufacturers are leveraging advanced materials such as synthetic polymers, case-hardened steels, and low-friction coatings (e.g., PTFE and DLC—diamond-like carbon). These innovations enhance thermal performance and longevity, making worm drives more competitive against helical and bevel gear systems. By 2026, high-efficiency worm drives with efficiency levels exceeding 90% are expected to gain market share, especially in energy-sensitive applications.

4. Integration with IoT and Predictive Maintenance

Smart worm drive systems embedded with sensors and connectivity modules are emerging as a key trend. These intelligent gearboxes enable real-time monitoring of temperature, load, vibration, and lubrication levels. Integrated with IoT platforms, they support predictive maintenance strategies, reducing downtime and operational costs. Major industrial OEMs are partnering with tech providers to launch condition-monitoring-ready worm drive units by 2026, particularly in Europe and North America.

5. Sustainability and Energy Efficiency Regulations

Stricter global energy efficiency standards, such as the IE4 and upcoming IE5 motor efficiency classifications, are pushing manufacturers to optimize entire drive systems. While traditional worm drives have lower efficiency compared to other gear types, new designs featuring optimized helix angles, improved lubrication systems, and hybrid gear trains are helping bridge the gap. Regulatory compliance will be a strong driver for innovation, especially in the EU and North America.

6. Regional Market Shifts and Supply Chain Localization

The worm drive market is witnessing a shift toward regional production hubs to mitigate supply chain disruptions and reduce logistics costs. In 2026, localized manufacturing is expected to rise in India, Mexico, and Eastern Europe, supported by government incentives and nearshoring trends. This decentralization will enhance responsiveness to regional industrial demands and reduce dependency on traditional manufacturing centers.

7. Competitive Landscape and Strategic Consolidation

The market is becoming increasingly competitive, with key players such as SEW-Eurodrive, Bonfiglioli, Sumitomo Drive Technologies, and Nexen Group expanding their product portfolios through R&D and strategic acquisitions. By 2026, consolidation is expected to accelerate, particularly in the mid-tier segment, as companies aim to offer integrated electromechanical solutions combining motors, drives, and controls.

Conclusion

By 2026, the worm drive market will be defined by innovation in materials, intelligence, and sustainability. While challenges related to efficiency and heat dissipation persist, ongoing technological improvements are positioning worm drives as critical components in next-generation industrial and energy systems. Companies that invest in smart integration, energy efficiency, and application-specific customization are likely to lead the market in this evolving landscape.

Common Pitfalls When Sourcing Worm Drive Components (Quality, IP)

When sourcing worm drive components—such as worm gears, worm shafts, or complete worm gearboxes—several critical pitfalls can impact performance, longevity, and legal compliance. Two of the most significant areas to watch are quality inconsistencies and intellectual property (IP) risks.

Poor Quality Control and Material Deficiencies

One of the most frequent challenges in sourcing worm drives, particularly from low-cost regions or unverified suppliers, is inconsistent quality. Poorly manufactured worm gears may suffer from:

- Inaccurate tooth profiles: Leading to increased backlash, noise, and premature wear.

- Substandard materials: Use of inferior-grade steels or improper heat treatment, reducing load capacity and durability.

- Inadequate surface finishes: Resulting in higher friction, heat generation, and reduced efficiency.

- Lack of precision machining: Causing misalignment and uneven load distribution.

These quality issues compromise the efficiency and service life of the gear system, often leading to unplanned downtime and increased maintenance costs.

Intellectual Property (IP) Infringement Risks

Sourcing worm drives from non-authorized or generic manufacturers can expose companies to significant IP risks:

- Counterfeit or cloned designs: Some suppliers replicate patented designs from well-known brands (e.g., SEW, Nord, Bonfiglioli) without licensing, potentially violating patents or trademarks.

- Use of proprietary gear geometries: Certain worm profiles (e.g., double-enveloping, Hindley) are protected by IP; unauthorized replication can lead to legal disputes.

- Lack of traceability and documentation: Reputable suppliers provide certification and design documentation; their absence can signal IP violations or poor engineering practices.

Using infringing components may result in legal liability, product recalls, or damage to brand reputation.

Mitigation Strategies

To avoid these pitfalls:

- Source from reputable, certified suppliers with verifiable quality management systems (e.g., ISO 9001).

- Request material certifications and test reports (e.g., hardness, metallurgical analysis).

- Conduct design and patent reviews to ensure components do not infringe on existing IP.

- Use NDAs and clear contractual terms when sharing technical specifications with suppliers.

Proactively addressing quality and IP concerns ensures reliable performance and legal compliance in worm drive applications.

Logistics & Compliance Guide for Wormdrive

Overview

This guide outlines the essential logistics and compliance protocols for Wormdrive operations. Adherence to these standards ensures efficient delivery, regulatory compliance, and risk mitigation across all supply chain activities.

Shipping & Transportation

Ensure all shipments are coordinated through approved carriers with verified track records in reliability and compliance. Use real-time tracking systems for end-to-end visibility. Maintain accurate shipping documentation, including packing lists, bills of lading, and delivery confirmations. Temperature-sensitive or hazardous materials must be transported in accordance with relevant regulations (e.g., IATA, IMDG, or DOT standards where applicable).

Inventory Management

Implement a centralized inventory tracking system to monitor stock levels, turnover rates, and storage conditions. Conduct regular cycle counts and annual physical audits to reconcile records. Segregate expired, damaged, or recalled products immediately and follow internal disposal procedures in compliance with environmental regulations.

Customs & International Trade Compliance

For cross-border shipments, ensure all documentation (commercial invoices, certificates of origin, export licenses) is complete and accurate. Classify products using correct HS codes and verify compliance with trade sanctions, export controls (e.g., EAR, ITAR), and restricted party screening. Assign designated personnel trained in international trade laws to oversee customs clearance.

Regulatory Compliance

Stay current with local, national, and international regulations affecting logistics operations, including but not limited to:

– Occupational Safety and Health Administration (OSHA) standards

– Environmental Protection Agency (EPA) guidelines for hazardous materials

– Food and Drug Administration (FDA) requirements for applicable goods

– General Data Protection Regulation (GDPR) for shipment data involving EU customers

Documentation & Recordkeeping

Maintain digital records of all logistics transactions for a minimum of seven years, unless otherwise required by law. This includes shipping logs, compliance certifications, training records, and audit reports. Ensure data is stored securely with controlled access and regular backups.

Vendor & Partner Compliance

Require all logistics partners (carriers, warehouses, 3PLs) to comply with Wormdrive’s code of conduct and relevant regulatory standards. Conduct periodic audits and require compliance certifications (e.g., ISO 9001, ISO 14001). Include compliance clauses in all service agreements.

Risk Management & Incident Response

Establish a risk assessment framework to identify vulnerabilities in the supply chain, such as geopolitical issues, natural disasters, or cyber threats. Develop and regularly update a logistics incident response plan, including procedures for delays, lost shipments, and regulatory violations. Report significant incidents to compliance leadership within 24 hours.

Training & Accountability

Provide mandatory logistics and compliance training for all relevant staff upon onboarding and annually thereafter. Topics must include safety procedures, documentation requirements, and ethical conduct. Designate a Logistics Compliance Officer to oversee adherence and serve as the point of contact for compliance inquiries.

Audits & Continuous Improvement

Schedule internal and third-party audits at least annually to evaluate compliance performance. Use audit findings to implement corrective actions and enhance logistics processes. Track key performance indicators (KPIs) such as on-time delivery rate, accuracy of customs filings, and incident frequency to drive continuous improvement.

Conclusion for Sourcing Worm Drive:

Sourcing the appropriate worm drive requires a careful evaluation of technical specifications, quality standards, supplier reliability, and total cost of ownership. Worm drives are critical components in various mechanical systems, offering high torque output, compact design, and self-locking capabilities, making their correct selection and supply essential for optimal performance and longevity.

After assessing potential suppliers, it is evident that a balance between cost-effectiveness and technical compatibility must be struck. Key considerations include material quality, gear ratio accuracy, efficiency ratings, and compliance with industry standards (e.g., ISO, DIN). Additionally, lead times, after-sales support, and the supplier’s track record in delivering consistent quality play a pivotal role in the decision-making process.

In conclusion, successful sourcing of worm drives hinges on a strategic approach that prioritizes long-term reliability and performance over short-term cost savings. Partnering with reputable suppliers who offer technical expertise, customization options, and strong supply chain continuity ensures that the selected worm drives meet operational demands and contribute to the overall efficiency and durability of the machinery they serve.