The global wood manufacturing market is experiencing steady growth, driven by increasing demand in construction, furniture, and industrial applications. According to Grand View Research, the global engineered wood products market was valued at USD 155.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is fueled by rising urbanization, sustainability initiatives, and advancements in wood processing technologies. Meanwhile, Mordor Intelligence projects the global woodworking machinery market—key to wood manufacturing—to grow at a CAGR of over 5% during the forecast period of 2023–2028, underscoring increasing automation and precision in production. As industry demand intensifies, a select group of manufacturers has emerged as leaders, combining scale, innovation, and supply chain efficiency to dominate the sector. Below, we explore the top 7 wood manufacturing manufacturers shaping the future of this dynamic industry.

Top 7 Woods Manufacturing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Woods Manufacturing Company, Inc.

Domain Est. 2002

Website: woodsmfg.com

Key Highlights: Woods Manufacturing Company, Inc. has specialized in precision screw machine & turned products and components for a wide variety of industries and applications….

#2 Wood Component Manufacturers Association

Domain Est. 2005

Website: wcma.com

Key Highlights: The WCMA cultivates a member network through exposure to innovations, industry promotion, trends and information, and peer learning….

#3 Southwire

Domain Est. 1994

Website: southwire.com

Key Highlights: Choose Southwire for your wire and cable needs – we offer high-performance products that are built to last….

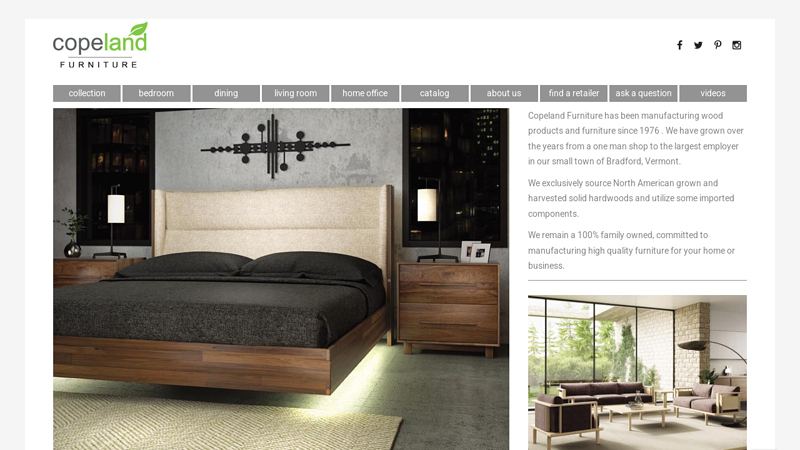

#4 Copeland Furniture

Domain Est. 1999 | Founded: 1976

Website: copelandfurniture.com

Key Highlights: Copeland Furniture has been manufacturing wood products and furniture since 1976. We have grown over the years from a one man shop to the largest employer….

#5 WOODS™

Domain Est. 2000

Website: woods.ca

Key Highlights: Designed in Canada with over 130 years of outfitting adventure, WOODS™ develops durable outdoor equipment, apparel, and footwear with versatile, ……

#6 Northwood MFG

Domain Est. 2003

Website: northwoodmfg.com

Key Highlights: Home page for the Northwood Manufacturing Official web page. Here you will find the best quality trailers, campers, and 5th wheels….

#7 Oregon Tool

Domain Est. 2004

Website: oregontool.com

Key Highlights: We invite you to join us in the celebration and to learn more about our proud history, including the beginnings of the Oregon®, Woods®, and ICS® brands….

Expert Sourcing Insights for Woods Manufacturing

H2: Projected 2026 Market Trends for Woods Manufacturing

As Woods Manufacturing prepares for 2026, several key market trends are expected to shape its strategic direction, operational performance, and competitive positioning. These trends span technological innovation, sustainability demands, supply chain evolution, labor dynamics, and shifting customer expectations.

-

Accelerated Digital Transformation and Industry 4.0 Adoption

By 2026, Woods Manufacturing is projected to deepen its integration of smart manufacturing technologies. The adoption of IoT-enabled machinery, AI-driven predictive maintenance, and real-time data analytics will enhance production efficiency and reduce downtime. Digital twins and advanced simulation tools will likely be employed to optimize design and prototyping processes, especially in custom fabrication and precision metalwork—core segments for Woods. -

Sustainability and Regulatory Compliance

Environmental, Social, and Governance (ESG) criteria will play a pivotal role in 2026. Regulatory pressures and customer demand for eco-friendly practices will push Woods to invest in energy-efficient equipment, reduce carbon emissions, and adopt circular manufacturing principles—such as recycling scrap metal and minimizing waste. Certifications like ISO 14001 and compliance with evolving environmental regulations (e.g., EPA guidelines, state-level clean manufacturing mandates) will be critical for maintaining market access and brand reputation. -

Supply Chain Resilience and Nearshoring

Ongoing geopolitical instability and supply chain disruptions will drive Woods Manufacturing toward nearshoring and supplier diversification. By 2026, the company is likely to strengthen regional supplier networks in North America, reducing reliance on overseas sourcing. Increased use of blockchain for supply chain transparency and procurement automation will enhance traceability and responsiveness, especially for raw materials like steel, aluminum, and specialty alloys. -

Labor Market Shifts and Workforce Development

The skilled labor shortage in advanced manufacturing will persist into 2026. Woods will need to prioritize workforce development through apprenticeships, partnerships with technical colleges, and upskilling programs focused on robotics, CNC operations, and data literacy. Automation will offset labor gaps but will require a higher proportion of tech-savvy employees, shifting the company’s hiring and training strategies. -

Customization and On-Demand Manufacturing

Customers—particularly in industrial equipment, construction, and transportation sectors—will increasingly demand customized, low-volume, high-mix production. In response, Woods is expected to expand its flexible manufacturing systems (FMS) to support agile production runs and faster turnaround times. Additive manufacturing (3D metal printing) may be selectively adopted for prototyping and complex components. -

Competitive Landscape and Market Consolidation

The industrial manufacturing sector may see continued consolidation by 2026, with larger players acquiring niche fabricators. Woods Manufacturing will need to differentiate through superior quality, innovation, and customer service. Emphasis on vertical integration—such as in-house finishing, coating, or assembly services—could provide a competitive edge. -

Economic and Policy Influences

Federal and state incentives for domestic manufacturing (e.g., under the CHIPS and Science Act or infrastructure spending) could benefit Woods through tax credits or grants for capital investment. However, inflationary pressures on raw material costs and interest rates may impact margins, necessitating dynamic pricing models and cost-control initiatives.

In summary, by 2026, Woods Manufacturing will operate in a more automated, sustainable, and customer-centric industrial environment. Success will depend on strategic investments in technology, talent, and supply chain agility, positioning the company as a resilient and innovative leader in the evolving manufacturing landscape.

Common Pitfalls When Sourcing from Woods Manufacturing: Quality and Intellectual Property Risks

Logistics & Compliance Guide for Woods Manufacturing

This comprehensive guide outlines the key logistics processes and compliance requirements essential for the efficient and lawful operation of Woods Manufacturing. Adherence to these guidelines ensures timely delivery, cost control, regulatory compliance, and supply chain resilience.

Supply Chain Overview

Woods Manufacturing’s supply chain spans raw material procurement, in-house production, inventory management, warehousing, and distribution to domestic and international customers. Key partners include timber suppliers, hardware vendors, third-party logistics (3PL) providers, freight carriers, and customs brokers. All operations are coordinated through the Enterprise Resource Planning (ERP) system to maintain end-to-end visibility.

Procurement & Supplier Management

All raw materials (e.g., sustainably sourced lumber, fasteners, finishes) must be procured from pre-qualified suppliers vetted for environmental compliance, labor practices, and quality standards. Purchase orders must include specifications for material certifications (e.g., FSC or PEFC for wood). Supplier performance is reviewed quarterly, with non-compliant vendors subject to corrective action or termination.

Inventory Management

Finished goods and raw materials are tracked in real time using barcode scanning and integrated with the ERP system. Safety stock levels are maintained based on demand forecasting and lead times. Cycle counts are performed weekly, with annual physical inventories reconciled to financial records. Obsolete or damaged inventory is quarantined and dispositioned per environmental and waste disposal regulations.

Warehousing Standards

All warehousing operations follow OSHA safety standards. Materials are stored using the First-In, First-Out (FIFO) method to prevent aging and damage. Flammable finishes and adhesives are stored in approved, ventilated cabinets with secondary containment. Temperature and humidity levels are monitored daily in climate-controlled areas. Security measures include surveillance, access logs, and inventory audits.

Transportation & Distribution

Shipments are dispatched via ground freight for domestic deliveries and ocean/air freight for international orders. Carrier selection is based on cost, reliability, and compliance history. All shipments require accurate packing lists, commercial invoices, and bill of lading documentation. Real-time tracking is provided to customers through the logistics portal. Delivery performance is measured against on-time delivery (OTD) KPIs.

Export Compliance

International shipments comply with U.S. Department of Commerce Export Administration Regulations (EAR) and relevant destination country import requirements. A validated product classification (ECCN) is assigned to each item. Export licenses are obtained when required. The Automated Export System (AES) is used to file Electronic Export Information (EEI) for shipments over $2,500 or requiring a license. Denied Party Screening is conducted prior to every export.

Import Compliance

Imported materials (e.g., specialized hardware) adhere to U.S. Customs and Border Protection (CBP) regulations. All shipments include accurate Harmonized System (HS) codes, country of origin declarations, and supporting documents. Woods Manufacturing maintains an Importer Security Filing (ISF) compliance process and works with licensed customs brokers to ensure timely clearance. Anti-dumping and countervailing duties are monitored and paid as applicable.

Environmental & Safety Regulations

Woods Manufacturing complies with EPA regulations regarding hazardous materials handling, air emissions, and waste disposal. All employees involved in handling chemicals are trained under OSHA’s Hazard Communication Standard (HazCom). Spill response kits are available in production and storage areas. SDS (Safety Data Sheets) are maintained and accessible. Sustainable forestry practices and chain-of-custody documentation are maintained for all wood products.

Recordkeeping & Audits

All logistics and compliance records—including shipping documents, customs filings, inventory logs, training records, and audit reports—are retained for a minimum of five years, in accordance with federal and international requirements. Internal audits are conducted semi-annually, with external compliance audits performed annually by a third-party auditor.

Continuous Improvement

Logistics and compliance performance is reviewed monthly by the Operations and Legal teams. Key metrics include on-time delivery, inventory accuracy, customs clearance time, and compliance incident rate. Identified gaps are addressed through process updates, staff training, or technology enhancements to ensure ongoing alignment with regulatory standards and business objectives.

Conclusion for Sourcing in Wood Manufacturing:

In conclusion, effective sourcing in the wood manufacturing industry is critical to ensuring sustainability, cost-efficiency, and product quality. By establishing strong relationships with ethical and reliable suppliers, manufacturers can secure high-quality raw materials while supporting responsible forestry practices. Strategic sourcing allows for better supply chain resilience, reduced environmental impact, and compliance with certification standards such as FSC or PEFC. Furthermore, considering factors such as geographic proximity, material availability, and market fluctuations enables businesses to maintain competitiveness in a dynamic global market. Ultimately, a well-structured and sustainable sourcing strategy not only enhances operational efficiency but also strengthens brand reputation and long-term viability in the wood manufacturing sector.