The global biomass gasification market is experiencing robust growth, driven by rising demand for renewable energy and clean power generation solutions. According to a report by Mordor Intelligence, the biomass gasification market was valued at USD 29.2 billion in 2023 and is projected to reach USD 46.7 billion by 2029, growing at a CAGR of 8.1% during the forecast period. This expansion is fueled by increasing adoption of wood gasifiers in residential, commercial, and industrial applications—particularly in off-grid and rural electrification projects. With wood serving as a widely available and sustainable feedstock, manufacturers are innovating to improve efficiency, emissions performance, and scalability. As the industry evolves, several key players have emerged as leaders in wood gasifier technology, setting benchmarks in design, reliability, and integration with combined heat and power (CHP) systems. Below, we examine the top 10 wood gasifier manufacturers shaping the future of decentralized and renewable energy.

Top 10 Wood Gasifier Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Powermax Renewable Energy

Domain Est. 2017

Website: powermaxgasifiers.com

Key Highlights: Powermax designs biomass, coal & waste gasification systems converting feedstock into electricity, steam, and heat. Proven technology worldwide….

#2 Valmet Gasifier for biomass and waste

Domain Est. 1991

Website: valmet.com

Key Highlights: Valmet Gasifier (formerly Valmet CFB Gasifier) combines technologies and services for effectively converting biomass, recycled materials and waste into a ……

#3 Napoleon Fireplaces Overview

Domain Est. 1995

Website: napoleon.com

Key Highlights: Napoleon fireplaces, stoves, and inserts are built to provide high-quality, lifetime use and keep you warm and safe even if the power goes out….

#4 Majestic Products

Domain Est. 1996

Website: majesticproducts.com

Key Highlights: For over 125 years, Majestic has stood for outstanding durability, stunning looks and long-lasting performance in wood and gas fireplaces….

#5 Stoves

Domain Est. 1999

Website: lopistoves.com

Key Highlights: Lopi wood, pellet, and gas heating appliances have been North America’s favorite choice in fire for over 40 years….

#6 Gasification Systems

Domain Est. 1999

Website: energy.gov

Key Highlights: Modular gasification-based energy conversion plants that are flexibly right-sized, configured, and sited to take advantage of local labor pools and utilize ……

#7 Travis Industries

Domain Est. 2004

Website: travisindustries.com

Key Highlights: Travis Industries, the largest, privately-owned wood, pellet and gas stove, insert and fireplace company in America and encompasses four high-quality brands….

#8 Fireplace Xtrordinair: Fireplaces

Domain Est. 2005

Website: fireplacex.com

Key Highlights: Fireplace Xtrordinair offers a wide variety of premium wood and gas burning fireplaces and inserts, in both traditional and contemporary styles….

#9 Stûv America: Stoves and fireplaces

Domain Est. 2006

Website: stuvamerica.com

Key Highlights: Stûv stoves and fireplaces combine contemporary design, performance and efficiency, whether it be wood, gas or pellet units….

#10 Global engineering and consulting for energy and materials

Domain Est. 2017

Website: woodplc.com

Key Highlights: Wood: Global leader in engineering consulting, shaping the future of energy and materials with innovative solutions across 60 countries….

Expert Sourcing Insights for Wood Gasifier

H2: Market Trends for Wood Gasifiers in 2026

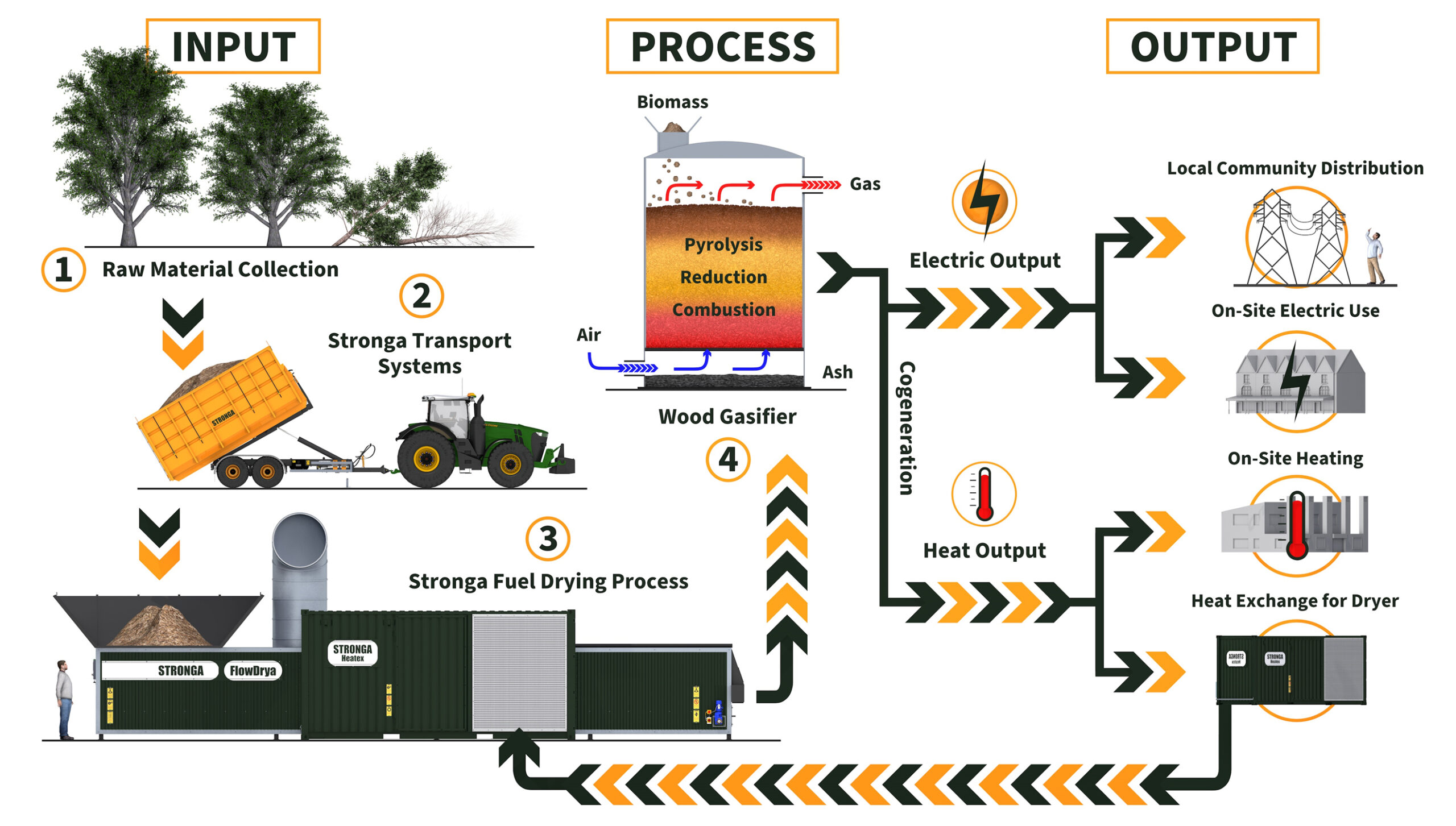

As the global energy landscape evolves in response to climate change, energy security concerns, and the push for decarbonization, wood gasifiers are poised to play an increasingly strategic role in the renewable energy sector by 2026. These systems, which convert biomass (primarily wood and woody residues) into combustible syngas through thermochemical gasification, are gaining traction due to advancements in technology, supportive policy frameworks, and growing demand for decentralized and sustainable energy solutions.

Below is an analysis of key market trends shaping the wood gasifier industry in 2026:

1. Rising Demand for Decentralized Renewable Energy

By 2026, decentralized energy systems are expected to account for a larger share of global power generation, especially in rural and off-grid regions. Wood gasifiers offer a reliable and scalable solution for local energy production, particularly in forest-rich regions such as Scandinavia, Central Europe, Southeast Asia, and parts of North America. In developing economies, wood gasifiers are increasingly being adopted for community-level power generation, agro-processing, and rural electrification, reducing dependence on diesel generators and improving energy access.

2. Integration with Circular Economy and Waste-to-Energy Models

Wood gasifiers are becoming integral components of circular economy strategies. Municipalities and industries are leveraging forest residues, sawdust, wood chips, and agricultural waste as feedstock, turning low-value biomass into high-value energy. In 2026, waste-to-energy gasification projects are expanding, supported by stricter waste regulations and incentives for biomass utilization. This trend is particularly strong in the EU and Canada, where landfill diversion policies and carbon pricing enhance the economic viability of wood gasification.

3. Technological Advancements and Efficiency Improvements

Innovation in gasifier design—including downdraft, fluidized bed, and staged gasification systems—has led to higher syngas quality, reduced tar formation, and improved conversion efficiency. By 2026, smart monitoring, IoT integration, and AI-based optimization are being deployed to enhance operational reliability and reduce maintenance costs. Hybrid systems that combine gasifiers with internal combustion engines, Stirling engines, or fuel cells are also gaining popularity, offering higher electrical efficiency and flexible output.

4. Policy Support and Carbon Incentives

National and regional policies are a major driver of wood gasifier adoption. The European Green Deal, U.S. Inflation Reduction Act (IRA), and similar initiatives in Japan and South Korea include provisions for biomass energy and carbon capture incentives. In 2026, wood gasification projects benefit from renewable energy credits, carbon offset programs, and feed-in tariffs, particularly when coupled with carbon capture (bioenergy with carbon capture and storage—BECCS). These policies improve return on investment and attract private funding.

5. Growth in Combined Heat and Power (CHP) Applications

Wood gasifiers are increasingly used in CHP (or cogeneration) systems, especially in district heating networks, greenhouses, and industrial facilities. By simultaneously producing electricity and thermal energy, CHP systems achieve total efficiencies of over 80%. In colder climates such as Germany, Finland, and Canada, demand for wood gasifier-based CHP units is rising as industries seek to reduce fossil fuel consumption and comply with emissions regulations.

6. Competition and Complementarity with Other Bioenergy Technologies

While wood gasifiers face competition from other biomass technologies such as direct combustion and anaerobic digestion, their ability to produce clean syngas for multiple applications (power, heat, and synthetic fuels) gives them a unique advantage. In 2026, wood gasification is seen as complementary to biogas and hydrogen economies—syngas can be upgraded to substitute natural gas (SNG) or serve as a precursor for green hydrogen production via reforming processes.

7. Supply Chain and Feedstock Sustainability Concerns

Despite growth, the market faces challenges related to feedstock availability, logistics, and sustainability. Overharvesting and land-use conflicts could undermine the environmental benefits of wood gasification. In response, certification schemes (e.g., FSC, PEFC) and sustainability standards are being adopted to ensure responsible sourcing. By 2026, companies are increasingly investing in short-rotation coppice plantations and agroforestry systems to secure long-term feedstock supply.

8. Emerging Markets and Regional Growth

While Europe remains the largest market for wood gasifiers due to mature policy frameworks and high energy prices, significant growth is expected in Southeast Asia (Thailand, Vietnam), India, and Sub-Saharan Africa. These regions benefit from abundant biomass resources and growing energy demand. International development agencies and climate funds are supporting pilot projects and capacity-building initiatives to scale up wood gasification in these areas.

Conclusion

By 2026, the wood gasifier market is characterized by technological maturity, policy alignment, and increasing integration into low-carbon energy systems. Driven by energy decentralization, circular economy principles, and climate goals, wood gasifiers are transitioning from niche applications to mainstream renewable energy solutions. However, long-term success will depend on sustainable feedstock management, cost competitiveness, and continued innovation. With supportive frameworks and strategic investment, wood gasification is set to become a cornerstone of the bioenergy revolution in the mid-2020s.

When sourcing a wood gasifier system—especially one intended to produce hydrogen (H₂) for energy applications—there are several common pitfalls related to quality and intellectual property (IP). Using hydrogen as the target output adds complexity, so due diligence is critical. Below is a detailed breakdown of key pitfalls and how to mitigate them:

🔹 1. Quality-Related Pitfalls

❌ 1.1. Poor Gasifier Design & Low Hydrogen Yield

- Pitfall: Many commercial or DIY wood gasifiers are designed for syngas (CO + H₂) primarily for direct combustion, not optimized for high-purity H₂ production.

- Issue: These systems yield low H₂ concentration (typically 10–20%), requiring costly downstream purification.

- Solution:

- Look for dual-stage gasifiers (gasification + reforming) or auto-thermal reforming (ATR) systems.

- Prioritize technologies with catalytic steam reforming to boost H₂ output.

- Request gas composition data (from third-party lab tests) showing H₂%, CO%, CH₄%, and tar levels.

❌ 1.2. High Tar Production

- Pitfall: Biomass gasification produces tars that clog engines, catalysts, and pipelines—especially problematic for H₂ purification.

- Issue: Poorly engineered systems lack effective tar-cracking mechanisms.

- Solution:

- Insist on integrated tar reduction (e.g., catalytic cracker, cyclone + ceramic filter + scrubber).

- Verify tar content in syngas (< 50 mg/Nm³ is acceptable for H₂ processing).

❌ 1.3. Inadequate Material Quality & Durability

- Pitfall: Some suppliers use thin-gauge steel or uncoated materials that corrode or fail under high heat.

- Issue: Short lifespan, safety risks, and downtime.

- Solution:

- Confirm use of refractory-lined reactors and high-grade stainless steel (e.g., 310S).

- Ask for warranty, maintenance logs, and site references.

❌ 1.4. Lack of Automation & Control Systems

- Pitfall: Manual systems are inefficient and unsafe for continuous H₂ production.

- Issue: Inconsistent gas quality affects downstream H₂ processing (e.g., PSA units).

- Solution:

- Require automated feed systems, O₂/temperature sensors, and PLC controls.

- Ensure compatibility with H₂ purification units (e.g., PSA, membranes).

❌ 1.5. Poor Syngas Conditioning

- Pitfall: Raw syngas contains moisture, particulates, and contaminants that damage catalysts in H₂ processors.

- Solution:

- Ensure the system includes multi-stage cleaning: cyclone → filter → scrubber → condenser.

- Confirm dew point control and particulate removal specs.

🔹 2. Intellectual Property (IP) Pitfalls

❌ 2.1. Unprotected or Infringing Technology

- Pitfall: Some suppliers use copied or reverse-engineered designs without valid IP rights.

- Issue: Risk of legal challenges, especially if you scale or export.

- Solution:

- Conduct IP due diligence: Ask for patents, trademarks, or licensing agreements.

- Search patent databases (e.g., WIPO, USPTO) for keywords like “wood gasifier hydrogen”, “biomass reforming”.

❌ 2.2. Hidden Licensing Requirements

- Pitfall: Certain catalytic processes or reactor designs may be patented, requiring royalty payments.

- Issue: You may unknowingly violate IP by replicating or modifying the system.

- Solution:

- Request a technology license agreement if applicable.

- Clarify whether you’re allowed to maintain, modify, or resell the technology.

❌ 2.3. Lack of Technical Documentation & Know-How Transfer

- Pitfall: Suppliers may withhold operational manuals, engineering drawings, or catalyst formulations.

- Issue: Limits your ability to operate, maintain, or improve the system.

- Solution:

- Contractually require full technical package (P&IDs, control logic, maintenance procedures).

- Include training and on-site commissioning in the purchase agreement.

❌ 2.4. Open-Source vs. Proprietary Confusion

- Pitfall: Some “open-source” gasifiers (e.g., from forums or NGOs) lack performance validation.

- Issue: May not scale or produce sufficient H₂ purity.

- Solution:

- Use open designs only for prototyping.

- For commercial H₂ production, prefer validated, proprietary systems with performance guarantees.

🔹 3. Strategic Recommendations When Sourcing

| Area | Recommendation |

|——|—————-|

| Supplier Vetting | Choose suppliers with proven H₂-focused installations, not just general gasifiers. |

| Performance Guarantees | Require guaranteed H₂ yield (Nm³/kg biomass) and purity (>99% after purification). |

| Modularity | Opt for modular systems that integrate with PSA units or fuel cells. |

| Feedstock Flexibility | Confirm compatibility with your local biomass (e.g., wood chips, agricultural waste). |

| Compliance | Ensure design meets safety (ASME, CE) and emissions standards. |

✅ Summary: Key Actions to Avoid Pitfalls

- Demand H₂-specific performance data—not just syngas output.

- Verify tar reduction and gas cleaning capabilities.

- Audit the supplier’s IP status and request documentation.

- Insist on full technical transfer and training.

- Test the system on-site or review third-party validation.

By focusing on hydrogen optimization, system quality, and IP transparency, you can avoid costly mistakes and build a reliable, scalable wood-to-hydrogen solution.

It appears there may be some confusion in your request: a wood gasifier does not use hydrogen (H₂) as a fuel input—it produces a mixture of gases, including hydrogen, from wood or biomass through a process called gasification. However, I can provide a comprehensive logistics and compliance guide for a wood gasifier, including information on hydrogen (H₂) production and handling where relevant.

Below is a detailed guide covering logistics, safety, environmental compliance, and operational considerations for wood gasifiers, emphasizing the role of hydrogen in the syngas output.

🌲 Logistics & Compliance Guide for Wood Gasifiers

(Including H₂ Considerations)

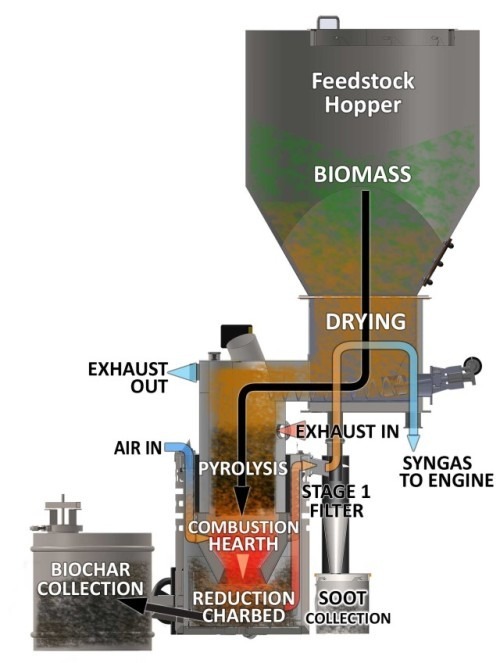

1. What Is a Wood Gasifier?

A wood gasifier converts dry biomass (wood chips, pellets, agricultural waste) into a combustible gas mixture called syngas (synthesis gas) through high-temperature, low-oxygen gasification.

Typical Syngas Composition:

– 15–20% Hydrogen (H₂)

– 15–20% Carbon Monoxide (CO)

– 8–12% Carbon Dioxide (CO₂)

– 2–5% Methane (CH₄)

– Balance: Nitrogen (N₂), water vapor, tars

✅ Note: H₂ is a byproduct of gasification, not a fuel input.

2. Logistics Planning

A. Feedstock Management

- Source: Use sustainably harvested wood (e.g., forest thinnings, sawmill residues, agricultural waste).

- Moisture Content: ≤ 20% recommended for efficient gasification.

- Size & Form: Chips or pellets (2–5 cm) for consistent feeding.

- Storage:

- Dry, covered area to prevent moisture absorption.

- Fire-safe distance from gasifier and electrical systems.

- Pests and mold prevention.

B. Transportation

- Local Sourcing Preferred: Minimize transport emissions and cost.

- Containers: Use covered trailers or silos to protect biomass.

- Tracking: Maintain logs of source, moisture, batch quality.

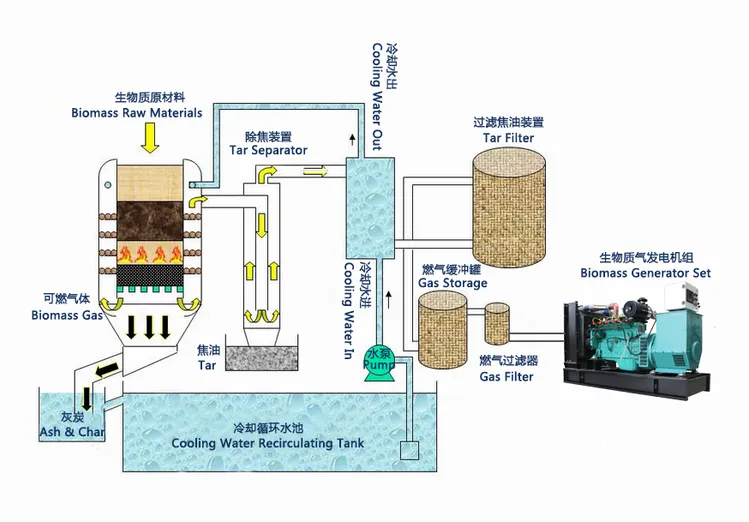

C. Syngas Handling & Use

- Cooling & Filtration: Syngas must be cooled and cleaned (tar removal, particulate filters) before use.

- Storage: Generally used on-demand; syngas is rarely stored due to flammability and instability.

- If stored, use low-pressure gas holders or buffer tanks with inert gas purging.

- Hydrogen Utilization: H₂ in syngas can be used:

- Directly in internal combustion engines (dual-fuel or converted).

- In fuel cells (if purified—requires additional processing like PSA).

- For heating or combined heat and power (CHP).

3. Compliance & Regulatory Requirements

A. Environmental Regulations

✅ Air Emissions (EPA or Local Equivalent)

- Regulated Pollutants:

- CO, NOₓ, VOCs, particulate matter (PM), tar emissions.

- Permits Required:

- Air Quality Permit (e.g., Title V in the U.S.).

- Non-Hazardous Waste Handling Permit (for ash).

- Emission Controls:

- Use cyclones, scrubbers, and filters.

- Monitor emissions regularly.

✅ Carbon & Sustainability Compliance

- Carbon Neutrality: Biomass is generally considered carbon-neutral under IPCC and EU RED II.

- Sustainability Certification: Consider FSC, PEFC, or biomass sustainability standards if selling energy commercially.

B. Hydrogen (H₂) Safety Compliance

Although H₂ is part of syngas, not stored pure:

– Flammability Risk: H₂ has a wide flammability range (4–75% in air) and low ignition energy.

– Ventilation: Ensure gasifier enclosures are well-ventilated to prevent H₂ accumulation.

– Leak Detection: Install combustible gas detectors (H₂/CO sensors).

– Standards:

– NFPA 55 (Compressed and liquefied gases)

– NFPA 86 (Ovens and furnaces)

– OSHA 29 CFR 1910.106 (Flammable liquids and gases)

C. Electrical & Mechanical Safety

- Explosion-Proof Equipment: Use in zones where syngas may leak.

- Pressure Relief Valves: On gas lines and filters.

- Emergency Shutoffs: Manual and automatic (e.g., fire, gas leak).

- Compliance with:

- NEC (National Electrical Code)

- ASME Boiler and Pressure Vessel Code (if applicable)

D. Waste Handling

- Biochar/Ash:

- Typically non-toxic; can be used as soil amendment (check heavy metal content).

- Dispose of according to local solid waste regulations.

- Tar Waste:

- Classified as hazardous in some jurisdictions.

- Store in sealed containers; dispose via licensed hazardous waste handler.

4. Safety Protocols

A. Hydrogen-Specific Hazards

- Odorless & Colorless: Requires gas detection systems.

- Buoyancy: H₂ rises quickly—ventilation at ceiling level is critical.

- Embrittlement: Avoid using carbon steel in high-H₂ concentration systems unless rated.

B. General Gasifier Safety

- Purge Procedures: Use nitrogen or CO₂ to purge system before maintenance.

- Lockout/Tagout (LOTO): During servicing.

- Training: Operators must be trained in:

- Gasification process

- Emergency response

- Fire suppression (Class B extinguishers)

5. Installation & Site Requirements

- Location:

- Outdoors or in a well-ventilated, explosion-ventilated building.

- Fire-rated separation from occupied structures.

- Foundation: Stable, non-combustible base.

- Utilities:

- Electricity (for augers, blowers, controls)

- Water (for scrubbers, cooling)

- Setbacks: Follow local fire codes (typically 10–30 ft from property lines).

6. Monitoring & Maintenance

| System | Frequency | Notes |

|——-|———-|——-|

| Gas filters | Weekly | Replace or clean based on pressure drop |

| Ash removal | Daily | Prevent blockage |

| Syngas quality | Continuous (optional) | Use gas analyzer to monitor H₂, CO levels |

| Safety systems | Monthly | Test gas detectors, alarms, vents |

7. Documentation & Recordkeeping

Maintain records for:

– Feedstock sources and quality

– Emissions monitoring

– Maintenance logs

– Operator training

– Regulatory permits and inspections

8. International Considerations

- EU: Comply with Industrial Emissions Directive (IED) and REACH.

- USA: EPA, OSHA, state air boards (e.g., CARB in California).

- Canada: CEPA, provincial environmental agencies.

- ISO Standards: Consider ISO 18135 (solid biofuels sampling), ISO 17225 (fuel quality).

9. Future-Proofing: H₂ Separation & Use

If you aim to extract pure H₂ from syngas:

– Requires gas upgrading:

– Tar reforming

– Water-gas shift reaction (to boost H₂)

– Pressure Swing Adsorption (PSA) or membranes

– Applications:

– Fuel cells

– Green hydrogen markets

– Compliance: Additional regulations apply (e.g., hydrogen pipeline codes, DOT 49 CFR for transport).

Summary Checklist

✅ Sustainable biomass sourcing

✅ Moisture-controlled feedstock storage

✅ Proper syngas filtration and cooling

✅ Gas detection (H₂, CO) and ventilation

✅ Air quality and safety permits

✅ Ash and tar waste management

✅ Operator training and emergency plans

✅ Regular maintenance and emissions monitoring

Need Help With?

- Permit applications?

- H₂ purification system design?

- Emissions modeling?

Let me know your country and scale (residential, commercial, industrial), and I can tailor the guide further.

This guide assumes general use in North America. Always consult local authorities and engineers before installation.

Conclusion for Sourcing a Wood Gasifier:

Sourcing a wood gasifier requires careful consideration of technical specifications, fuel availability, intended application (e.g., heating, electricity generation, or cooking), and local regulations. After evaluating various suppliers, models, and construction options—whether commercially manufactured units or custom-built designs—it becomes clear that reliability, efficiency, and safety must be prioritized. Locally available resources, maintenance requirements, and long-term sustainability also play critical roles in the decision-making process. Ultimately, selecting the right wood gasifier involves balancing cost-effectiveness with performance, ensuring it meets both immediate energy needs and environmental goals. A well-sourced gasifier not only contributes to energy independence but also supports the shift toward cleaner, renewable energy systems, especially in off-grid or rural settings.