The global engineered wood products market, particularly the segment focused on laminated wood, has experienced robust growth in recent years, driven by rising demand for sustainable building materials and advanced structural solutions. According to Grand View Research, the global engineered wood market was valued at USD 124.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030. This growth is fueled by increasing adoption in residential and commercial construction, where laminated wood products such as glued laminated timber (glulam) and laminated veneer lumber (LVL) offer superior strength, dimensional stability, and design flexibility compared to traditional solid timber. Furthermore, growing emphasis on green building certifications and carbon footprint reduction is accelerating the shift toward mass timber solutions. In this expanding landscape, manufacturers specializing in wood for laminating are scaling up production, investing in innovative bonding technologies, and broadening their geographic reach. As the industry evolves, the following nine companies have emerged as key players, distinguished by technological innovation, product quality, global reach, and market influence.

Top 9 Wood For Laminating Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

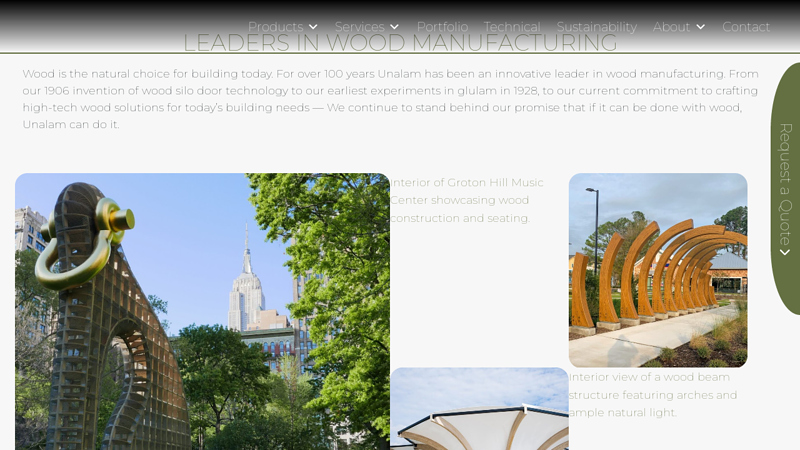

#1 Unalam: Glulam Beam Manufacturers

Domain Est. 1999 | Founded: 1906

Website: unalam.com

Key Highlights: Since 1906, Unalam has been a leader in custom glulam beam manufacturing and laminated wood solutions for architects, builders, and engineers across the ……

#2 Manufacturers and Suppliers – WoodWorks

Domain Est. 2002

Website: woodworks.org

Key Highlights: Manufacturers long span open-web trusses, I-Joists, laminated veneer lumber, prefabricated wall panels, and supplies hybrid mass timber solutions nationwide….

#3 Freres Engineered Wood

Domain Est. 2020

Website: frereswood.com

Key Highlights: Mass Ply Panel (MPP) is a patented, massive, large scale, structural composite lumber based panel designed as an alternative to Cross Laminated Timber (CLT)….

#4 Lumber, Plywood, MDF Boards

Domain Est. 1996

Website: timberproducts.com

Key Highlights: Timber Products has the expertise to provide top quality lumber, plywood, MDF boards and more! 100+ years of industry leadership!…

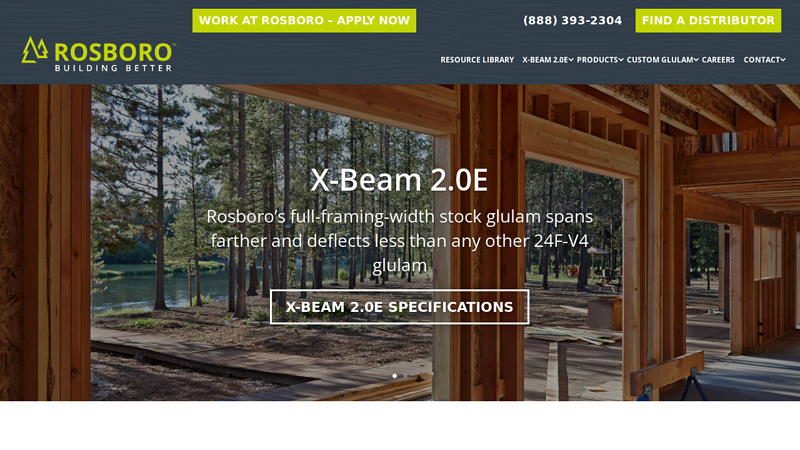

#5 Rosboro

Domain Est. 1998

Website: rosboro.com

Key Highlights: Rosboro glulam is the industry leader in Engineered Wood Products offering affordable cost, strength, ease of installation, and durability….

#6 Genesis Products

Domain Est. 2002

Website: genesisproductsinc.com

Key Highlights: Genesis Products optimizes design, performance and value by integrating high-performance laminate materials to create smarter solutions for every space….

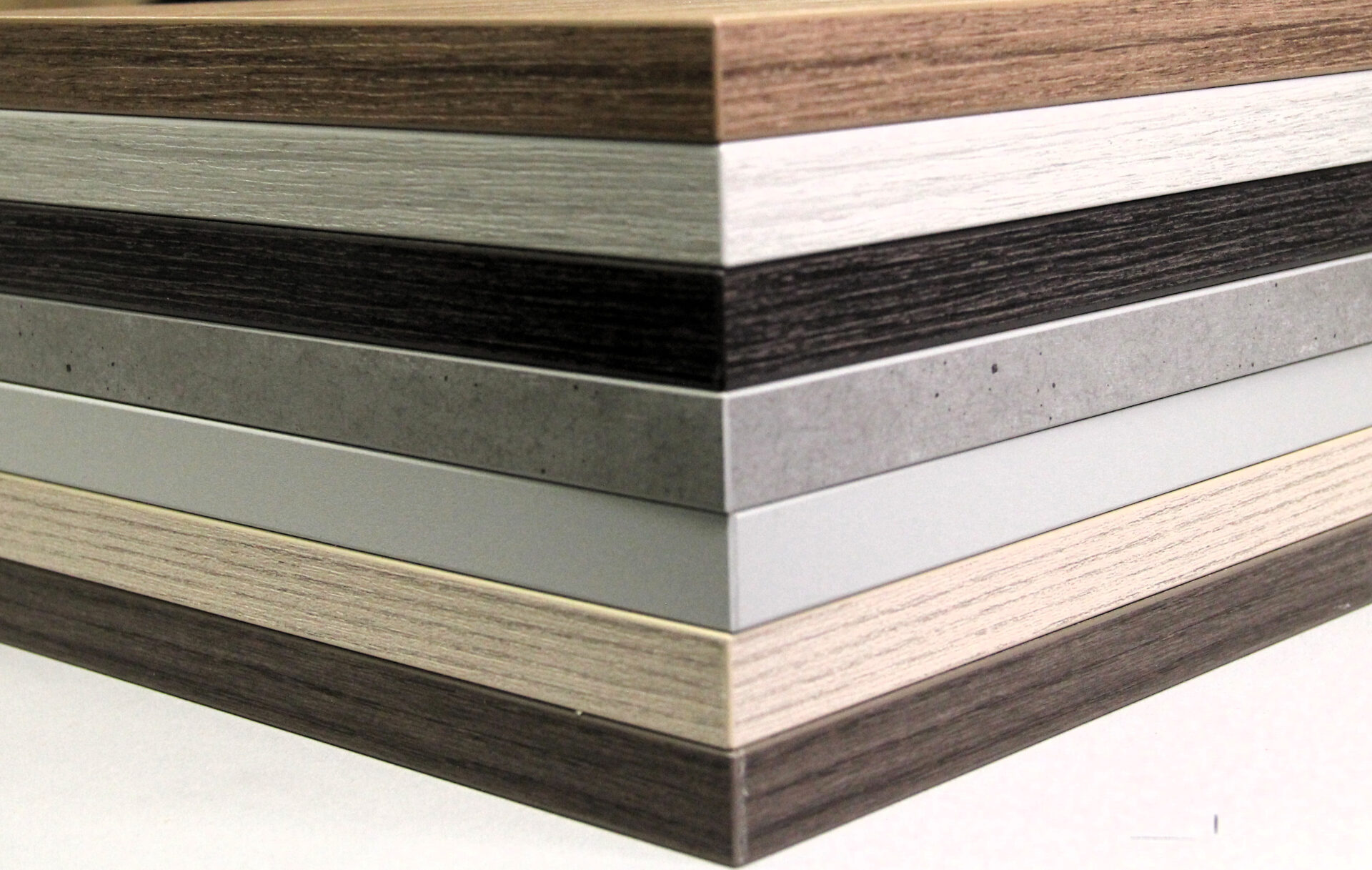

#7 Laminated Components Supplier » Komponents Laminated …

Domain Est. 2004

Website: komponents.com

Key Highlights: We produce assembled products and parts made from various wood cores and laminates, including Melamine clad panels (MCP), high-pressure laminate (HPL), FENIX ……

#8 American Laminates

Domain Est. 2006

Website: americanlaminates.com

Key Highlights: Available in various size panels, edge banded shelving, line-bored or grooved sides. Click on any color below to see a larger view or order individual samples….

#9 STEVENSWOOD®

Domain Est. 2014

Website: stevens-wood.com

Key Highlights: Discover STEVENSWOOD® Thermally Fused Laminate (TFL) and High-Pressure Laminates (HPL). Premium panels with stunning designs for durable, stylish interiors….

Expert Sourcing Insights for Wood For Laminating

H2 2026 Market Trends for Wood Used in Laminating

The market for wood used in laminating—primarily veneers and engineered wood substrates like plywood, MDF (Medium-Density Fiberboard), and particleboard—is poised for dynamic shifts in H2 2026, driven by sustainability, technology, and evolving consumer and industrial demands. Here’s a detailed analysis of key trends expected during this period:

1. Sustainability and Circular Economy Acceleration

- Increased Demand for FSC/PEFC-Certified Wood: Regulatory pressures in the EU (e.g., EUDR – EU Deforestation Regulation) and consumer preference will push laminating wood suppliers to ensure full traceability and certification. Non-compliant wood will face market exclusion.

- Rise of Recycled and Waste-Derived Substrates: Manufacturers will increasingly use recycled wood fibers in MDF and particleboard production to meet ESG goals and reduce virgin timber dependency.

- Bio-Based Adhesives Integration: Formaldehyde-free and soy-based resins will gain traction, especially in residential and health-sensitive applications (e.g., healthcare, schools), aligning with green building standards like LEED and WELL.

2. Innovation in Engineered Wood Products

- Enhanced Performance Laminated Veneer Lumber (LVL) and CLT (Cross-Laminated Timber): Growth in mass timber construction will boost demand for laminated structural wood, increasing the need for high-quality, defect-free veneers.

- Thermo-Hydro-Mechanically Modified Woods: Woods treated via thermal or steam processes will see increased use due to improved stability, durability, and aesthetic versatility, reducing the need for chemical treatments.

3. Digitalization and Precision in Production

- AI-Driven Veneer Matching and Grading: Automated optical sorting and AI-powered defect detection will optimize yield and ensure consistent quality in high-end laminating applications (e.g., luxury furniture, architectural panels).

- Customization via Digital Printing on Wood Veneers: Demand for personalized wood finishes will grow, enabled by direct digital printing on veneer surfaces, allowing unique patterns without additional laminates.

4. Geopolitical and Supply Chain Resilience

- Diversification of Supply Sources: Ongoing trade tensions and logistics disruptions will prompt laminating wood buyers to diversify sourcing—shifting from traditional suppliers (e.g., Southeast Asia, Russia) toward South America (e.g., Brazil, Chile) and Africa (e.g., Gabon, Cameroon), provided sustainability standards are met.

- Nearshoring in North America and Europe: To reduce carbon footprint and improve lead times, there will be increased investment in regional veneer peeling and substrate manufacturing, especially in Eastern Europe and the U.S. South.

5. Consumer and Design Trends Influencing Demand

- Biophilic Design Momentum: Interior design trends emphasizing natural materials will sustain demand for real wood veneers over plastic laminates in commercial and residential interiors.

- Matte and Textured Finishes: Preference for tactile, non-reflective wood surfaces will drive innovation in embossed laminating techniques and surface treatments.

6. Price Volatility and Raw Material Constraints

- Softwood and Hardwood Supply Pressures: Climate change impacts (droughts, wildfires) and reduced timber harvests in key regions (e.g., Canada, Germany) may constrain supply, leading to price volatility in H2 2026.

- Increased Competition from Alternative Materials: Advances in wood-plastic composites (WPC) and bamboo-based laminates may pressure traditional wood markets, especially in moisture-prone applications.

Conclusion

H2 2026 will be a pivotal period for the wood laminating sector, marked by a strong push toward sustainable, traceable, and technologically advanced materials. Companies that invest in certification, digital production, and circular supply chains will gain competitive advantage. Strategic sourcing, innovation in adhesives and surface treatments, and responsiveness to green building standards will be critical success factors in navigating this evolving landscape.

Common Pitfalls Sourcing Wood for Laminating (Quality, IP)

Sourcing the right wood for laminating is critical to the structural integrity, appearance, and long-term performance of the final product—whether it’s for furniture, beams, or engineered wood products. However, several common pitfalls can compromise both quality and intellectual property (IP) protection if not carefully managed.

Poor Wood Quality and Inconsistent Material Properties

One of the most frequent issues when sourcing laminated wood is inconsistent or substandard quality of the raw timber. Variations in moisture content, density, grain orientation, and presence of defects (such as knots, splits, or warp) can lead to delamination, warping, or structural failure. Using wood with high or uneven moisture content risks internal stresses during glue curing, resulting in poor bond strength. Additionally, mixing different wood species or grades within a single laminate can create imbalances in expansion and contraction, weakening the final product.

Lack of Traceability and Certification

Failing to secure wood from certified sustainable sources (e.g., FSC or PEFC) not only raises environmental and ethical concerns but may also lead to compliance issues in regulated markets. Without proper documentation and traceability, businesses risk reputational damage and legal complications, especially when marketing products as “eco-friendly” or “sustainably sourced.” This lack of traceability can also complicate quality control and recalls if defects emerge post-production.

Inadequate Glue Compatibility and Bonding Standards

The adhesive used in lamination must be compatible with the specific wood species and end-use conditions (e.g., interior vs. exterior, humidity exposure). Sourcing wood without considering glue penetration, surface pH, or extractives that inhibit bonding can result in weak laminates. Furthermore, failing to follow industry standards (such as ANSI, EN, or ASTM) for bonding performance undermines product reliability and may void warranties.

Intellectual Property Risks in Custom or Engineered Designs

When developing proprietary laminated wood products—such as custom veneer patterns, hybrid composites, or performance-enhanced laminates—there’s a risk of IP theft during the sourcing and manufacturing process. Sharing design details with overseas suppliers or unvetted vendors without non-disclosure agreements (NDAs) or proper contractual safeguards can lead to unauthorized replication or reverse engineering. Additionally, using patented lamination techniques or wood treatments without licensing can expose companies to infringement claims.

Overlooking Regional and Seasonal Supply Variability

Wood characteristics vary by region, season, and harvest time. Relying on a single supplier without contingency plans can disrupt production if supply is affected by weather, political issues, or regulatory changes. Seasonal fluctuations in wood availability may force substitutions that compromise consistency in color, grain, or mechanical properties, affecting both aesthetics and performance.

Failure to Audit Suppliers and Manufacturing Practices

Many companies source laminated wood components from third-party mills or offshore manufacturers without conducting regular audits. This can lead to undetected deviations in quality control, use of non-approved materials, or poor manufacturing practices. Without on-site verification, it’s difficult to ensure that laminating processes (such as press time, temperature, and clamping pressure) meet required specifications.

Conclusion

To avoid these pitfalls, businesses should establish rigorous sourcing protocols, prioritize certified and traceable suppliers, validate material compatibility, protect IP through legal safeguards, and conduct regular quality audits. Proactive management of both material quality and intellectual property ensures durable, reliable laminated wood products and safeguards competitive advantage.

Logistics & Compliance Guide for Wood for Laminating

Overview

Wood used for laminating—such as veneer, plywood, or laminated strand lumber—requires careful handling, storage, and documentation throughout the supply chain. This guide outlines essential logistics and compliance considerations to ensure quality, regulatory adherence, and supply chain efficiency.

Classification and Harmonized System (HS) Codes

Correct classification is critical for international trade compliance. Common HS codes for laminating wood include:

– 4408: Wood veneer sheets and boards; for plywood or laminated wood

– 4412: Plywood, veneered panels, and similar laminated wood

– 4407: Wood in the rough, sawn or chipped, suitable for laminating (e.g., flitches)

Always verify the exact code with local customs authorities, as classifications may vary by species, dimensions, and treatment.

Phytosanitary and ISPM 15 Requirements

- ISPM 15 Compliance: Wood packaging materials (e.g., pallets, crates) must be heat-treated or fumigated and bear the official ISPM 15 mark.

- Phytosanitary Certificates: Required when exporting raw or minimally processed wood to many countries to prevent pest spread. Issued by national plant protection organizations.

- Debarked Wood: Some countries require debarked wood to minimize pest risk—verify destination-specific rules.

Import/Export Documentation

Ensure the following documents accompany shipments:

– Commercial invoice (with accurate product description, value, and origin)

– Packing list

– Bill of lading or air waybill

– Phytosanitary certificate (if applicable)

– Certificate of origin (for preferential tariffs under trade agreements)

– Fumigation certificate (if required)

Transportation and Handling

- Moisture Control: Maintain relative humidity between 35–50% during transit to prevent warping or checking.

- Protection from Weather: Use waterproof packaging and covered transport; avoid direct exposure to rain or sunlight.

- Stacking and Support: Load veneer bundles or panels on flat, stable surfaces; use dunnage to prevent sagging or edge damage.

- Temperature Management: Avoid extreme temperatures; prolonged exposure to heat or cold can affect adhesive performance in pre-laminated products.

Storage Conditions

- Store indoors in a dry, well-ventilated area.

- Elevate materials off the floor using pallets to prevent moisture absorption.

- Rotate stock using FIFO (First In, First Out) to minimize aging effects.

- Keep away from direct heat sources and high-humidity zones.

Regulatory Compliance

- Lacey Act (USA): Requires declaration of wood species and origin; prohibits trade in illegally sourced wood. Use due diligence to verify legal harvest and chain of custody.

- EU Timber Regulation (EUTR): Prohibits placing illegally harvested timber on the EU market. Requires risk assessment and mitigation in supply chains.

- CITES: Applies if wood species are listed (e.g., certain rosewoods). Requires permits for international trade.

Chain of Custody Certification

For premium or sustainable markets, maintain certification such as:

– FSC® (Forest Stewardship Council)

– PEFC™ (Programme for the Endorsement of Forest Certification)

Ensure all handlers in the supply chain are certified where required and documentation is traceable.

Labeling and Marking

- Clearly label packages with product type, species, thickness, grade, moisture content, and treatment status.

- Include handling instructions (e.g., “Keep Dry,” “This Side Up”).

- Mark certified wood with appropriate labels (e.g., FSC logo with license code).

Risk Mitigation and Best Practices

- Partner with reputable suppliers who provide full compliance documentation.

- Conduct regular audits of logistics providers and storage facilities.

- Use moisture meters to verify wood condition upon receipt.

- Train staff on handling protocols and compliance requirements.

Summary

Effective logistics and compliance for laminating wood depend on accurate classification, proper documentation, environmental control, and adherence to international regulations. Proactive management ensures product quality, avoids customs delays, and supports sustainable sourcing.

In conclusion, sourcing wood for laminating requires careful consideration of several key factors to ensure quality, consistency, and sustainability. It is essential to select species with suitable mechanical properties, dimensional stability, and compatibility with adhesives to achieve strong, durable laminated products. Consistent moisture content, clear grading, and minimal defects are critical for uniform performance and smooth processing. Additionally, sourcing from reputable suppliers who follow sustainable forestry practices supports environmental responsibility and long-term material availability. By prioritizing quality, traceability, and sustainability in wood sourcing, manufacturers can produce high-performance laminated wood products that meet both structural and aesthetic demands.