The global wireless control systems market is experiencing robust expansion, driven by increasing demand for automation across industrial, commercial, and residential sectors. According to Grand View Research, the market size was valued at USD 16.2 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 9.8% from 2024 to 2030. This growth is fueled by the rising adoption of the Internet of Things (IoT), advancements in wireless communication protocols like Zigbee, Z-Wave, and Wi-Fi 6, and the push toward energy-efficient building management systems. Additionally, Mordor Intelligence forecasts the market to register a CAGR of over 9.5% during the period 2023–2028, citing growing smart city initiatives and industrial digitization as key contributors. As connectivity standards mature and cybersecurity measures improve, manufacturers are scaling innovation in interoperability, real-time monitoring, and cloud integration. In this evolving landscape, ten companies have emerged as leaders—shaping the future of wireless control through technological prowess, global reach, and strong R&D investment.

Top 10 Wireless Control Systems Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Industrial remote control

Domain Est. 1998

Website: tele-radio.com

Key Highlights: Industrial remote control leaders for machinery and industry. We provide high-quality radio remote controls to manufacturers around the world….

#2 PowerG Wireless Technology

Domain Est. 1995

Website: johnsoncontrols.com

Key Highlights: Backed with PowerG wireless technology, the wireless devices offer best intrusion security through remote monitoring receptive to real-time incidents….

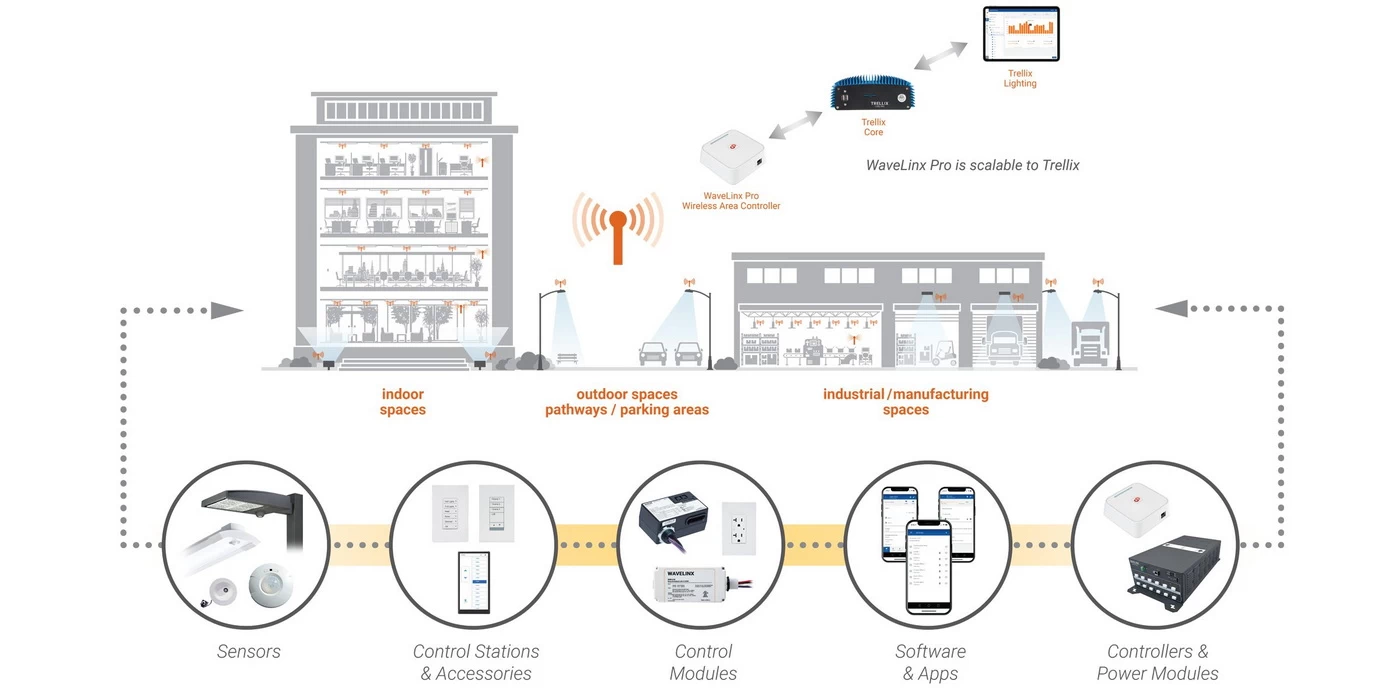

#3 Synapse Wireless

Domain Est. 2013

Website: synapsewireless.com

Key Highlights: Synapse Wireless is a scalable turnkey solution, SimplySnap, is an easy-to-deploy wireless lighting control and industrial energy management system….

#4 Wireless

Domain Est. 1988

Website: process.honeywell.com

Key Highlights: We offer consultative solutions that solve every situation in your plant and facilitate business objectives in the fastest, most cost-effective way….

#5 X10.COM

Domain Est. 1995

Website: x10.com

Key Highlights: Free delivery over $49.98 30-day returnsX10 began manufacturing home automation components in the late 1970’s and has been the de facto standard since its inception. Other products…

#6 Control Systems

Domain Est. 1997

Website: niceforyou.com

Key Highlights: Control your automation systems with Nice control devices: from transmitters and sensors to apps and voice control, a world of possibilities….

#7 Reliable Controls

Domain Est. 1998

Website: reliablecontrols.com

Key Highlights: Reliable Controls specializes in the design and manufacture of Internet-connected BACnet building automation systems and building control products….

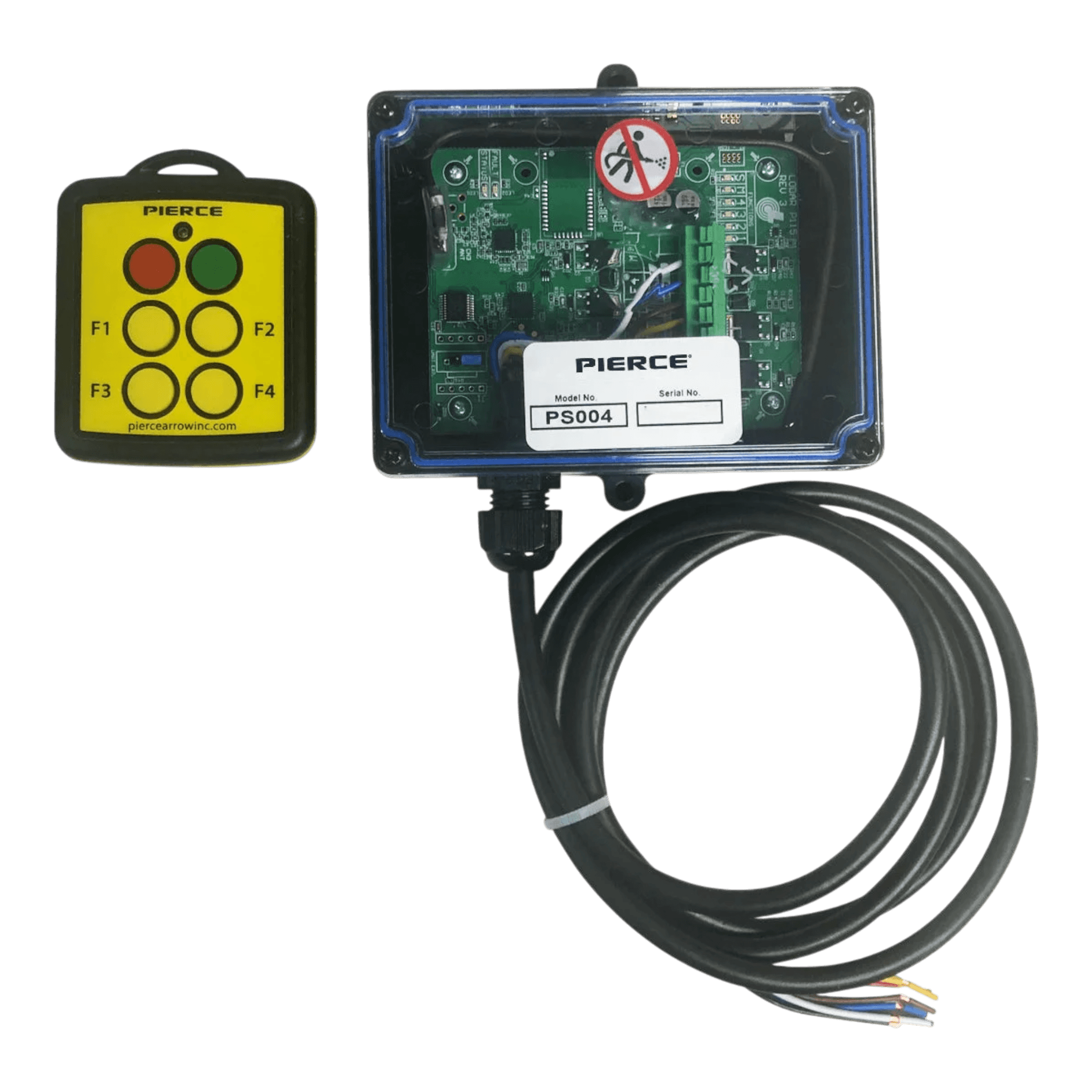

#8 Hydraulic Controls & Control Systems: Wireless: Kar

Domain Est. 2000

Website: kar-tech.com

Key Highlights: Kar-Tech is the world-leader in the manufacturing and design of wireless hydraulic control systems. We are more than that: we do controls for hydraulics….

#9 Cambium Networks

Domain Est. 2011

Website: cambiumnetworks.com

Key Highlights: Cambium Networks offers secure and reliable wireless broadband and Wi-Fi solutions with real-time cloud management around the world….

#10 Smart and Business Control + Automation

Domain Est. 2012

Website: rticontrol.com

Key Highlights: RTI creates intuitive smart home and commercial control and automation solutions. Explore the entire selection of RTI control and automation solutions, ……

Expert Sourcing Insights for Wireless Control Systems

H2: 2026 Market Trends for Wireless Control Systems

By 2026, the Wireless Control Systems (WCS) market is poised for transformative growth, driven by technological convergence, evolving industrial demands, and a relentless push toward automation and sustainability. Key trends shaping the landscape include:

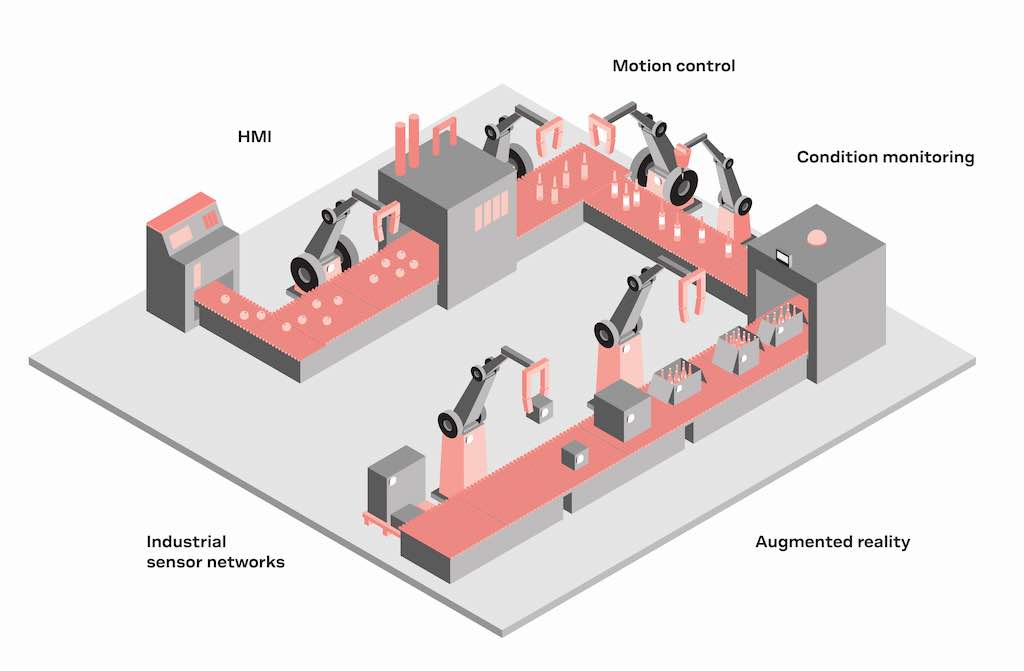

1. Dominance of IIoT and Industry 4.0 Integration:

The integration of Wireless Control Systems into the Industrial Internet of Things (IIoT) framework will be paramount. WCS will act as the nervous system for smart factories, enabling real-time data collection from sensors and actuators. This seamless connectivity will fuel predictive maintenance, optimize production lines, and enhance overall operational efficiency, making WCS indispensable in Industry 4.0 ecosystems.

2. Proliferation of 5G and Private Networks:

The widespread rollout of 5G, particularly private 5G networks, will revolutionize WCS. Ultra-low latency, high reliability, and massive device connectivity will overcome historical limitations of wireless in critical control applications. This enables high-precision tasks like robotics control, remote operation in hazardous environments, and augmented reality (AR) guidance, significantly expanding WCS applicability in manufacturing, logistics, and energy.

3. Convergence of IT and OT Security:

As wireless networks bridge the gap between Information Technology (IT) and Operational Technology (OT), cybersecurity will be a top priority. Expect stringent adoption of zero-trust architectures, advanced encryption (e.g., AES-256), and embedded security protocols (like those in Wi-Fi 6E/7 and 5G). Vendors will integrate security by design, and regulatory compliance (e.g., NIST, IEC 62443) will become a key differentiator.

4. Rise of AI-Driven Optimization and Predictive Control:

Artificial Intelligence (AI) and Machine Learning (ML) will move beyond data analysis to actively control systems. AI algorithms will analyze vast streams of wireless sensor data to predict equipment failures, dynamically optimize energy consumption, and autonomously adjust control parameters in real-time, leading to unprecedented levels of efficiency and resilience.

5. Expansion into New Verticals and Applications:

While industrial automation remains core, WCS adoption will surge in new areas:

* Smart Buildings & Cities: Integrated control of HVAC, lighting, security, and infrastructure (streetlights, parking).

* Agriculture 4.0: Precision irrigation, livestock monitoring, and autonomous machinery control.

* Energy & Utilities: Smart grid management, remote monitoring of renewable assets (solar/wind farms), and distributed energy resource control.

* Healthcare: Wireless monitoring and control in medical devices and smart hospital environments.

6. Standardization and Interoperability Focus:

Fragmentation will drive demand for open standards (e.g., OPC UA over TSN, Matter for consumer IoT, IEEE 802.11be/Wi-Fi 7) to ensure seamless communication between devices from different vendors. Interoperability will be crucial for large-scale deployments and multi-vendor ecosystems, reducing integration costs and complexity.

7. Advancements in Low-Power Wide-Area Networks (LPWAN):

Technologies like NB-IoT, LTE-M, and LoRaWAN will continue to grow, particularly for applications requiring long-range, low-bandwidth communication with minimal power consumption. This will enable massive sensor deployments in remote or hard-to-reach locations (e.g., environmental monitoring, asset tracking, utility metering).

8. Sustainability and Energy Efficiency as Key Drivers:

The energy efficiency inherent in modern wireless protocols (e.g., Bluetooth LE, Zigbee 3.0) and the role of WCS in optimizing energy use (e.g., in smart grids and buildings) will align strongly with global ESG (Environmental, Social, Governance) goals. Energy harvesting technologies will also mature, enabling battery-free wireless sensors in niche applications.

In conclusion, by 2026, Wireless Control Systems will transition from convenience to critical infrastructure. The market will be defined by intelligent, secure, high-performance wireless networks enabling autonomous, efficient, and sustainable operations across diverse industries, underpinned by 5G, AI, and robust standardization.

Common Pitfalls When Sourcing Wireless Control Systems

Sourcing wireless control systems offers numerous benefits, such as scalability and reduced installation costs. However, organizations often encounter significant challenges related to quality and intellectual property (IP) that can undermine project success. Being aware of these pitfalls is crucial for making informed procurement decisions.

Quality-Related Pitfalls

Inconsistent Performance and Reliability

One of the most prevalent issues is inconsistent system performance across different environments. Wireless signals can be affected by interference, physical obstructions, and electromagnetic noise. Low-quality systems may lack robust error correction, adaptive frequency hopping, or signal strength optimization, leading to dropped connections, latency, or complete system failures in industrial or dense urban settings.

Poor Component Durability and Build Quality

Inferior hardware components—such as low-grade antennas, substandard circuitry, or inadequate enclosures—can result in premature system failure, especially in harsh environments (e.g., high temperature, humidity, or vibration). Sourcing from manufacturers without rigorous quality control processes increases the risk of receiving products with short lifespans or inconsistent batch quality.

Lack of Interoperability and Standard Compliance

Many low-cost wireless control systems claim compatibility with standards like Zigbee, Z-Wave, or Wi-Fi but fail to fully adhere to specifications. This can lead to integration issues with other devices or platforms, reduced network efficiency, and challenges in future system expansions. Poor firmware implementation can further exacerbate these issues.

Insufficient Testing and Certification

Reputable systems undergo rigorous electromagnetic compatibility (EMC), safety, and regulatory testing (e.g., FCC, CE). Sourcing from vendors that skip or falsify certifications can result in non-compliant systems that pose safety risks or fail regulatory audits, leading to costly recalls or operational shutdowns.

Intellectual Property (IP)-Related Pitfalls

Use of Unlicensed or Infringing Technology

Some suppliers incorporate third-party IP—such as proprietary communication protocols, firmware, or software algorithms—without proper licensing. Purchasing such systems exposes the end-user to legal liability, including infringement lawsuits, product seizures, or forced redesigns, particularly in international markets.

Unclear or Poorly Defined IP Ownership

Contracts may fail to specify who owns the IP in custom-developed firmware, configurations, or integrations. This ambiguity can prevent future modifications, upgrades, or transfers to other vendors. It may also restrict the ability to troubleshoot or maintain the system independently.

Vendor Lock-In Through Proprietary Protocols

Some manufacturers use closed, proprietary communication protocols to lock customers into their ecosystem. This limits flexibility, increases long-term costs, and creates dependency on a single vendor for support and spare parts. It also complicates integration with third-party systems and hinders digital transformation initiatives.

Inadequate Documentation and Source Code Access

Lack of access to technical documentation, API references, or (in some cases) source code can severely limit troubleshooting, customization, and security audits. This is especially problematic if the supplier goes out of business or discontinues support, leaving the system vulnerable or obsolete.

Mitigation Strategies

To avoid these pitfalls, organizations should:

– Conduct thorough due diligence on suppliers, including audits of quality management systems (e.g., ISO 9001) and IP compliance.

– Require proof of regulatory certifications and independent testing reports.

– Include clear IP clauses in contracts specifying ownership, licensing rights, and access to documentation.

– Prioritize open standards and interoperability to reduce vendor dependency.

– Engage third-party experts for technical validation before finalizing procurement.

By proactively addressing quality and IP concerns, organizations can ensure reliable, secure, and sustainable deployment of wireless control systems.

Logistics & Compliance Guide for Wireless Control Systems

This guide outlines key logistics considerations and compliance requirements for the deployment, operation, and maintenance of wireless control systems across industries such as manufacturing, energy, building automation, and industrial IoT.

Regulatory Compliance

Ensure adherence to national and international regulations governing wireless communication, safety, and data handling. Key regulatory bodies and standards include:

- FCC (Federal Communications Commission) – Regulates radio frequency devices in the U.S. Certification (e.g., FCC ID) is required for wireless equipment operating in regulated bands.

- CE Marking (Europe) – Indicates conformity with health, safety, and environmental protection standards for products sold within the European Economic Area. Relevant directives include RED (Radio Equipment Directive) and EMC (Electromagnetic Compatibility).

- IC (Innovation, Science and Economic Development Canada) – Canadian regulatory body requiring certification for radio equipment.

- RoHS & REACH (EU) – Restriction of Hazardous Substances and chemical safety regulations impacting component materials.

- Industry-Specific Standards – Such as IEC 61508 (functional safety), ISA/IEC 62443 (industrial cybersecurity), and NEMA or UL standards for environmental and electrical safety.

Spectrum and Frequency Management

Wireless control systems must operate within legally allocated frequency bands to avoid interference and ensure reliable operation.

- Licensed vs. Unlicensed Bands:

- Unlicensed bands (e.g., 2.4 GHz, 5.8 GHz, 900 MHz) are widely used but prone to interference.

- Licensed bands (e.g., private LTE/5G) offer dedicated spectrum and enhanced reliability for critical applications.

- Frequency Coordination – Conduct site surveys and spectrum analysis to identify congestion and select optimal channels.

- Duty Cycle and Power Limits – Comply with regional regulations on transmission power and duty cycle to avoid interference and ensure coexistence.

Cybersecurity and Data Protection

Wireless control systems are vulnerable to cyber threats. Implement robust security measures in line with compliance frameworks.

- Encryption – Use strong encryption (e.g., WPA3, AES-128/256) for data in transit and at rest.

- Authentication & Access Control – Enforce role-based access and multi-factor authentication (MFA) for system access.

- Compliance with Cybersecurity Standards:

- NIST Cybersecurity Framework

- ISO/IEC 27001

- IEC 62443 for industrial automation and control systems

- Regular Security Audits & Patch Management – Monitor for vulnerabilities and ensure timely firmware and software updates.

Environmental and Operational Logistics

Deployment logistics must account for physical and environmental factors affecting wireless performance.

- Site Assessment – Evaluate line-of-sight, interference sources (e.g., metal structures, motors), temperature, humidity, and ingress protection (IP) requirements.

- Power Supply & Backup – Ensure reliable power for gateways, access points, and sensors. Consider battery life, PoE (Power over Ethernet), or solar options for remote deployments.

- Mounting and Enclosure Requirements – Use weatherproof and corrosion-resistant enclosures for outdoor installations. Follow IP65/IP67 standards where applicable.

Supply Chain and Inventory Management

Maintain compliance and continuity through responsible sourcing and inventory control.

- Component Traceability – Track components for compliance with RoHS, conflict minerals (e.g., Dodd-Frank Act), and country-of-origin requirements.

- Vendor Qualification – Source equipment only from certified manufacturers with valid regulatory approvals.

- Spare Parts & Obsolescence Planning – Maintain inventory of critical spares and monitor product end-of-life (EOL) notices to avoid service disruptions.

Installation, Commissioning, and Documentation

Proper installation and documentation support compliance and long-term reliability.

- Qualified Personnel – Use certified technicians for installation and configuration to ensure code compliance and safety.

- As-Built Documentation – Maintain updated network diagrams, frequency plans, security configurations, and compliance certificates.

- Testing and Validation – Perform signal strength tests, latency checks, and failover validation during commissioning.

Maintenance and Regulatory Renewals

Ongoing compliance requires regular maintenance and regulatory updates.

- Scheduled Inspections – Conduct periodic checks of antennas, connections, power systems, and cybersecurity configurations.

- Regulatory Recertification – Monitor expiration dates of certifications (e.g., FCC, CE) and renew as necessary, especially after hardware modifications.

- Change Management – Document and assess compliance impact for any system upgrades or reconfigurations.

Training and Personnel Compliance

Ensure staff are trained on safety, operational, and regulatory protocols.

- Safety Training – Include RF exposure safety (e.g., FCC OET Bulletin 65), lockout/tagout (LOTO), and electrical safety.

- Compliance Awareness – Train personnel on data privacy, cybersecurity policies, and environmental regulations relevant to their roles.

By following this guide, organizations can ensure that wireless control systems are deployed and operated safely, securely, and in full compliance with applicable regulations and industry best practices.

In conclusion, sourcing wireless control systems offers significant advantages in terms of flexibility, scalability, and cost-efficiency for modern industrial, commercial, and residential applications. The ability to remotely monitor and manage operations enhances operational efficiency, reduces wiring costs, and simplifies system integration and maintenance. However, successful sourcing requires careful consideration of factors such as reliability, security, interoperability, and compatibility with existing infrastructure. Evaluating vendors based on technical support, product certifications, and long-term sustainability is essential to ensure a robust and future-proof solution. With the continued advancement of wireless technologies like Wi-Fi, Zigbee, LoRa, and 5G, investing in a well-sourced wireless control system positions organizations to leverage smarter, more responsive, and adaptive control environments. Ultimately, strategic sourcing of wireless control systems not only meets current automation needs but also supports innovation and growth in an increasingly connected world.