The global wire mesh welded market is experiencing steady growth, driven by increasing demand across construction, agriculture, industrial filtration, and infrastructure sectors. According to Grand View Research, the global welded wire mesh market size was valued at USD 45.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030. This growth is fueled by rising construction activities, especially in emerging economies, and the growing adoption of prefabricated and modular building techniques that rely heavily on welded wire mesh for reinforcement. Additionally, Mordor Intelligence projects a similar trajectory, highlighting infrastructure development and government initiatives in regions like Asia-Pacific and the Middle East as key market drivers. As demand surges, the competitive landscape has intensified, leading to innovation in corrosion resistance, customization, and production efficiency among leading manufacturers. In this dynamic environment, identifying the top-performing wire mesh welded manufacturers becomes crucial for procurement managers and project planners aiming to ensure quality, reliability, and cost-effectiveness in their supply chains.

Top 10 Wire Mesh Welded Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 National Welded Wire Mesh Fencing

Domain Est. 2007

Website: maxstop.com

Key Highlights: C.E. Shepherd is one of the most well-known national welded wire fence manufacturers in the United States — and beyond. We are the largest producer of wire mesh ……

#2 Our Products Welded Wire Mesh

Domain Est. 1995

Website: riverdale.com

Key Highlights: Riverdale Mills is one of the largest manufacturers of welded wire mesh in the world, known for its Galvanized After Welding (GAW) and PVC coated mesh products….

#3 Insteel Industries Inc.

Domain Est. 1996

Website: insteel.com

Key Highlights: We manufacture and market prestressed concrete strand and welded wire … mesh, concrete pipe reinforcement and standard welded wire reinforcement….

#4 Welded mesh

Domain Est. 1997

Website: moreda.com

Key Highlights: MRT welded mesh offers a very wide range of uses. We have progressive meshes, squared meshes and badger fence….

#5 Wire Mesh Manufacturers

Domain Est. 2001

Website: wire-cloth.net

Key Highlights: We maintain an extensive inventory of woven & welded wire cloth specifications. Also, our weaving capabilities allow us to manufacture various wire mesh styles….

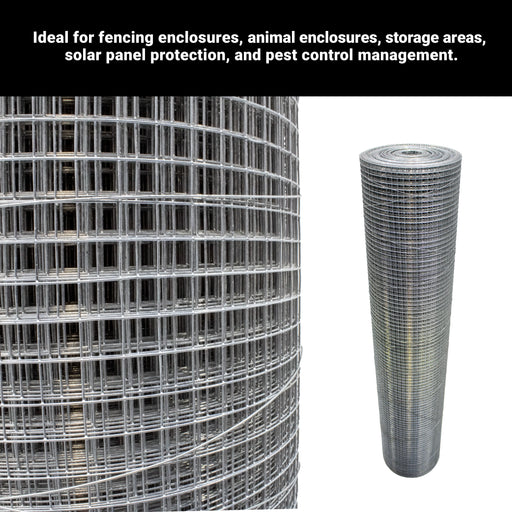

#6 Welded Wire Mesh

Domain Est. 1998

Website: directmetals.com

Key Highlights: Direct Metals is the best place to buy wire mesh. Our welded wire mesh is economical and versatile with a clean appearance and uniform grid patterns….

#7 Delta Wire

Domain Est. 1999

Website: deltawire.com

Key Highlights: Delta Wire & Mfg. offers a variety of welded wire mesh sizes, configurations and gauges to suit almost any need. Made from bright drawn mild steel….

#8 OK Brand

Domain Est. 2002

Website: okbrand.com

Key Highlights: Welded Wire Reinforcement · Standard Welded Wire Reinforcement · Fabricated Mesh · Retaining Wall Mesh · Erosion Control Mesh · Mine Mesh · Pipe Fabric · Wire ……

#9 Custom Manufactured Woven & Welded Wire Mesh

Domain Est. 2007

Website: darbywiremesh.com

Key Highlights: Darby offers custom manufacturing in both welded & woven wire mesh. Metals & alloys include stainless steel, aluminum, plain steel, galvanized & copper ……

#10 Welded Wire Mesh

Domain Est. 2008

Website: psm-mfg.com

Key Highlights: High-quality welded wire mesh from PSM. Available in mild steel, stainless, galvanized, and PVC coated. Standard and custom sizes. Facilities in San Antonio ……

Expert Sourcing Insights for Wire Mesh Welded

H2: Projected 2026 Market Trends for Welded Wire Mesh

The global welded wire mesh market is poised for steady growth by 2026, driven by rising demand across construction, agriculture, industrial manufacturing, and infrastructure development sectors. Key trends shaping the market include technological advancements in automated welding processes, increased focus on sustainable building materials, and the expansion of smart construction practices.

One significant trend is the growing adoption of welded wire mesh in pre-fabricated and modular construction, particularly in emerging economies. This shift is fueled by the material’s durability, cost-efficiency, and rapid installation capabilities, which align with the construction industry’s push for faster project completion. Additionally, government initiatives promoting urbanization and affordable housing in regions like Asia-Pacific and Africa are expected to boost demand.

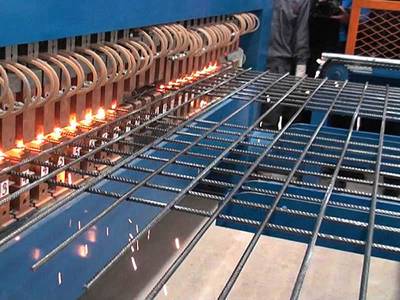

Technological innovation is another critical driver. Manufacturers are investing in high-tensile steel and corrosion-resistant coatings (such as galvanization and PVC coating) to enhance product lifespan and performance in harsh environments. Automation in production lines has improved consistency and reduced labor costs, enabling scalability to meet increasing global demand.

Sustainability concerns are also influencing market dynamics. Welded wire mesh is increasingly favored for its recyclability and reduced material waste compared to traditional reinforcement methods. Green building certifications, such as LEED and BREEAM, are encouraging the use of such materials in eco-friendly construction projects.

Regionally, Asia-Pacific is anticipated to dominate the market by 2026 due to rapid industrialization and infrastructure investments in countries like China, India, and Indonesia. North America and Europe will maintain strong demand, supported by infrastructure renewal programs and stringent safety regulations in construction.

In conclusion, the 2026 outlook for the welded wire mesh market is positive, with growth underpinned by technological progress, sustainability trends, and robust demand from key end-use industries. Companies that innovate in material quality, production efficiency, and environmental performance are likely to gain a competitive edge.

Common Pitfalls When Sourcing Wire Mesh Welded (Quality, IP)

Sourcing Wire Mesh Welded for industrial or construction applications requires careful attention to both quality standards and IP (Ingress Protection) ratings. Overlooking key factors can lead to product failure, safety hazards, or increased lifecycle costs. Below are common pitfalls to avoid:

Inadequate Specification of Material Quality

One of the most frequent mistakes is failing to clearly define material specifications such as wire diameter tolerance, steel grade (e.g., low carbon steel, stainless steel grades like 304 or 316), surface finish (e.g., galvanized, PVC-coated), and weld strength. Suppliers may offer lower-grade materials that meet basic requirements but fail under real-world conditions like corrosion or mechanical stress.

Ignoring Weld Integrity and Uniformity

Poor welding can compromise the structural integrity of the mesh. Pitfalls include inconsistent weld points, weak fusion, or burnt wires. Without proper quality control—such as visual inspection or destructive testing—substandard mesh may pass initial checks but fail prematurely in service.

Overlooking Dimensional Accuracy

Tolerances in mesh aperture (opening size) and overall panel dimensions are critical. Inaccurate mesh can lead to fitment issues, compromised filtration, or inadequate support in construction. Always verify that the supplier adheres to international standards like ISO 15630 or ASTM A185.

Misunderstanding IP Rating Requirements

Many buyers assume standard welded mesh offers environmental protection, but IP ratings (e.g., IP54, IP68) require specific design and sealing. Using uncoated or improperly sealed mesh in wet or dusty environments leads to rapid degradation. Ensure the mesh is tested and certified for the intended IP level, especially in enclosures or outdoor applications.

Failing to Verify Coating Quality

For corrosion resistance, coatings like hot-dip galvanizing or PVC must be uniformly applied and meet thickness standards (e.g., ASTM A123). Thin or patchy coatings result in premature rust. Request coating thickness reports and adhesion test results from suppliers.

Selecting Based on Price Alone

Choosing the cheapest option often leads to hidden costs from early replacement, maintenance, or system failure. A holistic cost analysis—including durability, maintenance, and lifecycle—should guide procurement decisions.

Lack of Traceability and Documentation

Reputable suppliers provide mill test certificates, inspection reports, and compliance documentation. Sourcing without these increases the risk of receiving non-conforming or counterfeit materials, especially in regulated industries.

Not Conducting Supplier Audits or Site Visits

Remote sourcing without verifying the manufacturer’s production capabilities, quality management systems (e.g., ISO 9001), or testing facilities can expose buyers to inconsistent quality. On-site audits or third-party inspections help ensure reliability.

Avoiding these pitfalls ensures that Wire Mesh Welded meets both performance expectations and environmental protection needs, delivering long-term value and safety.

Logistics & Compliance Guide for Wire Mesh Welded

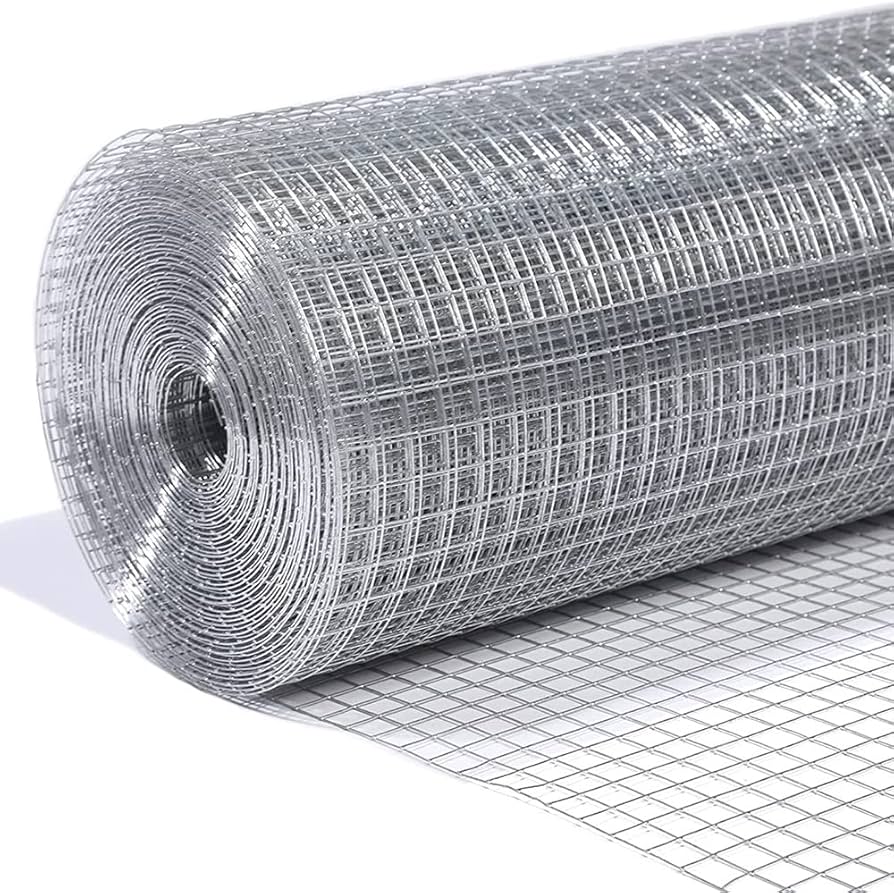

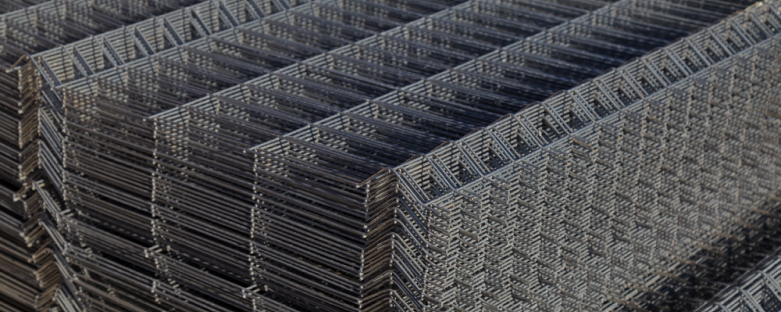

Product Overview and Specifications

Wire mesh welded, also known as welded wire fabric (WWF) or welded wire mesh (WWM), is a prefabricated assembly of steel wires electrically welded at intersections to form a grid pattern. It is widely used in construction (reinforcement), agriculture, filtration, fencing, and industrial applications. Key specifications include wire diameter, mesh size (aperture), material type (e.g., low-carbon steel, stainless steel, galvanized), surface treatment (e.g., PVC-coated, hot-dip galvanized), roll or sheet dimensions, and tensile strength. Accurate specification documentation is critical for compliance and logistics planning.

Packaging and Handling Requirements

Proper packaging ensures product integrity during transit. Wire mesh welded is typically supplied in flat sheets or rolled configurations. Sheets should be stacked neatly on wooden pallets, banded securely, and wrapped in moisture-resistant plastic or shrink film. Rolls must be wound tightly, end-capped, and strapped to prevent uncoiling. Labeling must include product ID, dimensions, weight, batch number, and handling instructions (e.g., “This Side Up,” “Protect from Moisture”). Manual and mechanical handling procedures should avoid bending, kinking, or abrasion; forklifts with wide forks or lifting beams are recommended.

Transportation and Freight Considerations

Wire mesh welded is heavy and bulky, requiring careful load planning. Road transport via flatbed or enclosed trailers is common, with cargo secured using straps or load locks to prevent shifting. For international shipments, containerized ocean freight (20’ or 40’ dry containers) is standard; weight distribution must comply with container and vessel limits. Air freight is generally cost-prohibitive except for urgent, small-volume orders. Consider dimensional weight and stacking limitations when optimizing container or truck loading. Choose freight partners experienced in handling steel products.

Import/Export Regulations and Documentation

Compliance with international trade regulations is mandatory. Required documentation includes commercial invoice, packing list, bill of lading/air waybill, certificate of origin, and material test reports (MTRs). Export controls may apply depending on destination; verify if any dual-use or steel product restrictions exist. Importers must comply with local standards such as ASTM A185/A184 (USA), BS 4483 (UK), or ISO 6935-3 (international). Harmonized System (HS) Code 7314.31 or 7314.39 typically applies to welded wire mesh. Confirm tariff classifications and potential anti-dumping duties with customs brokers.

Quality and Safety Compliance Standards

Adherence to quality and safety standards ensures product performance and legal compliance. Key standards include:

– ASTM A185/A184 – Standard for welded steel wire reinforcement

– ISO 6935-3 – Steel for the reinforcement of concrete – Welded fabric

– EN 10223-3 – European standard for steel wire and wire products

Material test reports (MTRs) must verify chemical composition and mechanical properties. For galvanized products, compliance with ASTM A90/A641 or ISO 1461 is required. Safety data sheets (SDS) should be provided where applicable, especially for coated or treated meshes. Regular third-party inspections can support compliance verification.

Environmental and Sustainability Compliance

Environmental regulations affect coatings, waste, and lifecycle management. Galvanizing processes must comply with local emissions standards (e.g., EPA regulations in the U.S.). PVC-coated meshes may be subject to REACH (EU) or TSCA (U.S.) regulations regarding restricted substances. Recyclability of steel wire mesh supports sustainability goals; provide end-of-life disposal guidance. Carbon footprint reporting and adherence to environmental management systems (e.g., ISO 14001) enhance compliance and market access.

Storage and Inventory Management

Stored wire mesh must be protected from corrosion and physical damage. Keep material indoors on elevated, dry pallets, away from moisture and corrosive chemicals. Rolls should be stored vertically to prevent deformation; sheets should remain flat and supported. Implement a first-in, first-out (FIFO) inventory system to prevent long-term storage issues. Monitor environmental conditions (humidity, temperature) in storage areas, especially for non-galvanized or coated products.

Regulatory Certification and Traceability

Maintain full traceability from raw material to final product. Each batch should be assigned a unique identifier linked to MTRs, production records, and inspection reports. Certifications such as ISO 9001 (quality management), ISO 14001 (environmental), and OHSAS 18001/ISO 45001 (safety) demonstrate compliance readiness. For construction applications, third-party certification (e.g., ICC-ES, CE marking) may be required. Digital traceability systems (e.g., barcoding, ERP integration) improve accuracy and audit preparedness.

Incident Response and Non-Conformance Handling

Establish procedures for managing non-compliant shipments or product failures. Document and investigate deviations (e.g., incorrect mesh size, weld defects, corrosion). Notify affected parties and regulatory bodies as required. Implement corrective and preventive actions (CAPA) to address root causes. Maintain records of all incidents and resolutions for audit and compliance purposes. Coordinate with insurers and logistics providers where claims are involved.

Conclusion and Best Practices

Successful logistics and compliance for wire mesh welded require integrated planning across packaging, transport, regulatory, and quality domains. Partner with certified suppliers, use standardized documentation, invest in traceability systems, and stay updated on international trade regulations. Regular staff training on handling and compliance procedures ensures consistent performance and minimizes risk throughout the supply chain.

Conclusion for Sourcing Welded Wire Mesh

Sourcing welded wire mesh requires a strategic approach that balances quality, cost, supplier reliability, and compliance with industry standards. After evaluating various suppliers, material specifications, and fabrication requirements, it is evident that selecting the right welded wire mesh involves more than just minimizing procurement costs. Key factors such as mesh size, wire gauge, coating type (e.g., galvanized, PVC-coated), tensile strength, and weld integrity significantly influence performance in applications ranging from construction and fencing to industrial screening and agricultural use.

Partnering with reputable suppliers who provide consistent quality, certifications (such as ASTM or ISO), and timely delivery is essential to ensure project efficiency and long-term durability. Additionally, establishing clear communication and specifications during the sourcing process minimizes the risk of errors and rework. Bulk purchasing, long-term contracts, and regional supplier assessments can further enhance cost-effectiveness and supply chain resilience.

In conclusion, a well-structured sourcing strategy for welded wire mesh not only supports project requirements but also contributes to operational reliability, safety, and cost optimization. Continuous evaluation and supplier performance monitoring will ensure sustained value and quality in future procurement cycles.