The global wind turbine market is experiencing robust growth, driven by increasing investments in renewable energy and aggressive decarbonization targets worldwide. According to a report by Mordor Intelligence, the wind turbine market was valued at USD 78.91 billion in 2023 and is projected to reach USD 111.73 billion by 2029, growing at a compound annual growth rate (CAGR) of 6.05% during the forecast period. This expansion is fueled by technological advancements, falling levelized costs of wind energy, and supportive government policies across key regions such as North America, Europe, and Asia-Pacific. As demand for clean energy escalates, leading manufacturers are scaling production, innovating in offshore and onshore turbine design, and expanding their global footprint. In this competitive landscape, a select group of companies are leading the charge in capacity, efficiency, and market share—shaping the future of wind energy. Here’s a data-driven look at the top 10 wind turbine manufacturers at the forefront of this energy transition.

Top 10 Wind Turbines Companies Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 We are LM Wind Power

Domain Est. 2009

Website: lmwindpower.com

Key Highlights: LM Wind Power is a pioneer in advancing wind turbine blade technology and setting new standards for sustainability, efficiency, and digital industrialization….

#2 Wind turbine manufacturing and service

Domain Est. 1997

Website: us.vestas.com

Key Highlights: Vestas is a wind turbine manufacturer and a global leader in the renewable energy industry for sustainable energy solutions….

#3 Nordex SE

Domain Est. 2000

Website: nordex-online.com

Key Highlights: The Nordex Group is one of the world´s leading OEM´s with 40 years of experience in manufacturing highly efficient wind turbines for global onshore markets….

#4 GOLDWIND

Domain Est. 2000

Website: goldwind.com

Key Highlights: Goldwind is a global leader in clean energy, energy conservation, and environmental protection. As a world-top wind turbine manufacturer, we are committed ……

#5 Wind Turbines

Domain Est. 2017

Website: envision-group.com

Key Highlights: Envision Energy is the first in the industry to develop smart turbine with its exclusive core technology of smart control,advanced measurement method, expert ……

#6 ENERCON

Website: enercon.de

Key Highlights: Your leading manufacturer and service provider for onshore wind turbines | We are a partner you can rely on for your wind farm projects all over the world….

#7 Solar Turbines

Domain Est. 1996

Website: solarturbines.com

Key Highlights: We provide best-in-class energy solutions with turbomachinery for power generation and motor driven compression products and packages in the 1-39 megawatt range ……

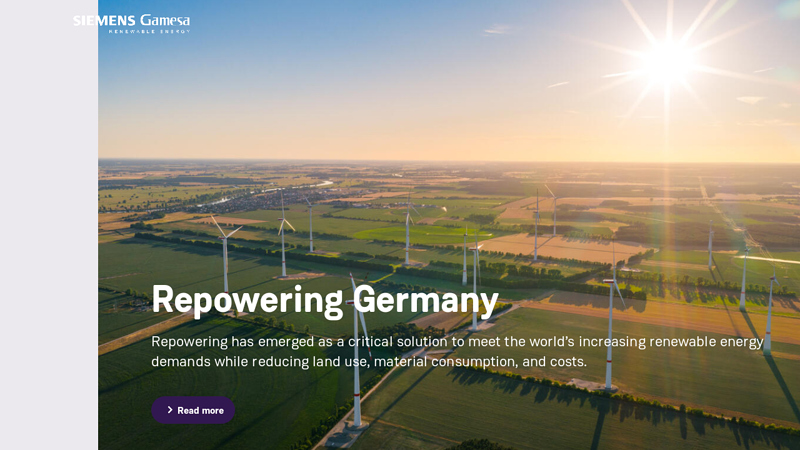

#8 Siemens Gamesa wind energy

Domain Est. 2017

Website: siemensgamesa.com

Key Highlights: Operating in 81 countries, Siemens Gamesa offers an extensive range of onshore wind turbine technologies to cover all wind classes and site conditions….

#9 Renewable offshore wind for Rhode Island and Connecticut

Domain Est. 2017

Website: revolution-wind.com

Key Highlights: Revolution Wind is the first commercial-scale offshore wind project in Rhode Island and Connecticut, creating thousands of jobs and powering our clean ……

#10 Deriva Energy

Domain Est. 2023

Website: derivaenergy.com

Key Highlights: We are a leading developer, owner, and operator of clean energy projects in the US, with the experience and knowledge to meet your needs for renewable power….

Expert Sourcing Insights for Wind Turbines Companies

H2: Market Trends Shaping Wind Turbine Companies in 2026

By 2026, the global wind turbine industry is poised for significant transformation, driven by technological advancements, policy shifts, supply chain evolution, and increasing competition. Key trends shaping the market include:

1. Accelerated Demand Driven by Global Decarbonization Goals

Governments worldwide are intensifying efforts to meet climate targets under the Paris Agreement and national net-zero commitments. The IEA and IRENA project wind energy capacity additions to grow at a compound annual growth rate (CAGR) of 8–10% through 2026. Major markets like the U.S. (Inflation Reduction Act), EU (Green Deal Industrial Plan), and China (14th Five-Year Plan) are offering robust policy support, driving procurement and investment in onshore and offshore wind projects.

2. Offshore Wind Expansion and Technological Scaling

Offshore wind is emerging as a critical growth vector. By 2026, offshore installations are expected to account for over 15% of total annual wind capacity additions. Turbine manufacturers are racing to deploy larger, more efficient models—15–18 MW turbines are becoming standard—with floating offshore technology gaining traction in deep-water regions like the U.S. West Coast and Japan. This shift demands innovations in foundation design, grid integration, and installation logistics.

3. Supply Chain Resilience and Localization Pressures

Geopolitical risks and trade policies are pushing wind turbine companies to localize manufacturing and component sourcing. The U.S. and EU are emphasizing domestic content requirements to reduce reliance on Asian supply chains. By 2026, companies like Vestas, Siemens Gamesa, and GE Vernova are expanding regional hubs in North America and Eastern Europe, while investing in local blade, tower, and nacelle production to meet regulatory incentives and reduce logistics costs.

4. Digitalization and AI Integration for Performance Optimization

Wind turbine OEMs are increasingly integrating AI, machine learning, and digital twins into turbine design and operations. Predictive maintenance, real-time performance monitoring, and automated control systems are improving capacity factors and reducing operational expenditures (OPEX). By 2026, digital platforms will be a key differentiator, enabling longer asset life, lower LCOE (Levelized Cost of Energy), and enhanced service contracts.

5. Consolidation and Competitive Intensification

The market is witnessing consolidation among tier-2 and tier-3 manufacturers due to pricing pressure and R&D costs. Meanwhile, Chinese OEMs like Goldwind, Envision, and Mingyang are expanding globally, offering competitive pricing and vertically integrated supply chains. Western companies are responding through strategic partnerships, joint ventures, and technology licensing to maintain market share.

6. Focus on Sustainability and Circular Economy

Environmental, social, and governance (ESG) criteria are influencing procurement decisions. By 2026, turbine manufacturers are prioritizing recyclable blade materials, low-carbon manufacturing, and end-of-life decommissioning solutions. Companies investing in blade recycling technologies and sustainable composite materials will gain favor with ESG-conscious investors and utilities.

Conclusion

The 2026 landscape for wind turbine companies will be defined by scale, innovation, and adaptability. Success will depend on navigating regulatory complexity, embracing digital transformation, securing resilient supply chains, and delivering cost-competitive, sustainable solutions in an increasingly crowded and dynamic market.

Common Pitfalls When Sourcing Wind Turbine Companies: Quality and Intellectual Property Risks

Sourcing wind turbines from manufacturers—especially international suppliers—exposes buyers to significant risks related to product quality and intellectual property (IP) protection. Failure to adequately address these concerns can lead to project delays, increased costs, performance shortfalls, and legal exposure. Below are key pitfalls to avoid.

Quality Assurance Challenges

One of the most prevalent risks in sourcing wind turbines is inconsistent or substandard product quality. Buyers may encounter turbines that fail to meet performance specifications, reliability standards, or safety certifications.

-

Inadequate Manufacturing Standards: Some suppliers, particularly in emerging markets, may not adhere to internationally recognized quality management systems (e.g., ISO 9001) or industry-specific standards like IEC 61400. This can result in turbines with premature mechanical failures or reduced energy output.

-

Lack of Third-Party Certification: Relying on self-certified claims without independent verification from bodies such as DNV, TÜV, or GL can lead to overestimated performance and lifespan projections.

-

Component Sourcing Risks: Turbine manufacturers may source critical components (e.g., gearboxes, bearings, power electronics) from lower-tier suppliers to cut costs, compromising the overall system reliability.

-

Insufficient Testing and Validation: Some suppliers may skip full-scale prototype testing or fail to conduct site-specific load analysis, leading to turbines poorly suited to the operational environment.

To mitigate these issues, buyers should require detailed quality documentation, conduct factory audits, and mandate third-party type certification before procurement.

Intellectual Property Infringement and Protection

Wind turbine technology involves complex engineering and proprietary designs, making IP a critical concern when sourcing from certain regions or lesser-known manufacturers.

-

Use of Copied or Reverse-Engineered Designs: Some manufacturers may produce turbines that closely mimic patented technologies from leading OEMs (e.g., Vestas, Siemens Gamesa, GE). Purchasing such equipment exposes the buyer to legal liability for contributory infringement, even if unintentional.

-

Unclear IP Ownership: Contracts that fail to clarify IP rights—especially for custom designs or software controls—can lead to disputes over ownership, service rights, or future modifications.

-

Lack of Legal Recourse in Jurisdictions with Weak IP Enforcement: Sourcing from countries with underdeveloped IP legal frameworks may make it difficult to pursue claims in case of infringement, leaving buyers without remedies.

-

Embedded Software and Control Systems: Modern turbines rely on proprietary control algorithms and monitoring software. Unauthorized use or replication of such software can violate licensing agreements and compromise system performance and cybersecurity.

To protect against IP risks, buyers should conduct due diligence on the supplier’s design origins, require IP warranties in contracts, and consult legal experts to ensure compliance with international IP laws.

Conclusion

Successfully sourcing wind turbine companies requires more than competitive pricing and delivery timelines. A thorough evaluation of quality assurance processes and IP integrity is essential to ensure long-term project viability, regulatory compliance, and protection against legal and technical risks. Due diligence, third-party validations, and strong contractual safeguards are critical components of a robust procurement strategy.

Logistics & Compliance Guide for Wind Turbine Companies

Understanding the Unique Challenges of Wind Turbine Logistics

Wind turbine components—such as blades, towers, nacelles, and hubs—are characterized by their massive size, weight, and fragility. Transporting these oversized loads requires meticulous planning and coordination. Key logistical challenges include limited transport routes, bridge weight restrictions, narrow roads, and the need for specialized equipment such as multi-axle trailers and cranes. Additionally, offshore projects introduce marine logistics complexities including port infrastructure, vessel availability, and weather dependencies.

Regulatory and Compliance Frameworks

Wind turbine companies must comply with a wide range of national and international regulations. These include transportation laws governing oversized loads (e.g., U.S. DOT regulations, EU Directive 96/53/EC), environmental standards (e.g., EPA, EU Emissions Trading System), and safety protocols (e.g., OSHA, ISO 45001). Import/export compliance is critical for global operations, requiring adherence to customs regulations, Incoterms, and trade sanctions. Environmental impact assessments (EIAs) and permitting are mandatory in most jurisdictions before construction or transportation can begin.

Route Planning and Infrastructure Assessment

Effective route surveying is essential to identify viable transportation corridors. This includes evaluating road conditions, turning radii, overhead clearance, and load-bearing capacity of bridges. Companies often collaborate with local authorities and engineering firms to conduct feasibility studies and obtain necessary transport permits. For offshore projects, port assessments are required to ensure adequate quay strength, crane capacity, and storage space for staging components prior to installation.

Transportation Modes and Equipment Selection

Selecting the appropriate transportation method depends on distance, geography, and project scale. Overland transport typically involves specialized flatbed trailers and pilot vehicles. For long distances, rail may be used where infrastructure allows. Offshore logistics rely on heavy-lift vessels, jack-up installation ships, and crew transfer vessels (CTVs). Equipment selection must consider load dynamics, weather exposure, and route constraints to prevent damage and delays.

Customs and International Trade Compliance

Global wind projects require strict adherence to customs procedures. Accurate classification under the Harmonized System (HS) codes, proper valuation, and documentation (e.g., commercial invoices, packing lists, certificates of origin) are essential. Companies must also monitor changes in trade policies, tariffs, and anti-dumping measures—especially relevant given the global supply chain for turbine components manufactured across Asia, Europe, and the Americas.

Environmental and Sustainability Compliance

Wind energy projects must align with environmental regulations throughout their lifecycle. This includes managing noise, protecting wildlife (e.g., avian and bat conservation), and minimizing habitat disruption during transport and construction. Compliance with ISO 14001 and adherence to local environmental protection laws are standard. Additionally, companies are increasingly expected to demonstrate sustainability in their logistics operations through carbon footprint tracking and use of low-emission transport solutions.

Safety and Risk Management Protocols

Safety is paramount when handling large, heavy components. Comprehensive risk assessments should be conducted for all logistical operations. Training for transport crews, crane operators, and on-site personnel must follow industry standards. Emergency response plans, including spill containment and accident recovery, should be in place. Insurance coverage must reflect the high value and risk associated with turbine components during transit and storage.

Stakeholder Coordination and Permitting

Successful logistics execution requires coordination among multiple stakeholders: turbine manufacturers, logistics providers, port authorities, government agencies, and local communities. Securing permits for oversized loads, road closures, or marine operations often involves lengthy approval processes. Early engagement with regulators and public consultation can help mitigate opposition and streamline approvals.

Digital Tools and Supply Chain Visibility

Leveraging digital technologies enhances logistics efficiency and compliance. GPS tracking, route optimization software, and digital twin simulations help monitor shipments and anticipate disruptions. Blockchain can improve documentation transparency and customs clearance. Integrated supply chain platforms provide real-time visibility, enabling proactive management of delays and regulatory requirements.

Continuous Improvement and Auditing

Wind turbine companies should establish a compliance management system with regular internal audits and third-party reviews. Lessons learned from past projects should inform future planning. Staying updated on evolving regulations—such as new EU Green Deal initiatives or U.S. Inflation Reduction Act provisions—is crucial for maintaining compliance and competitive advantage.

In conclusion, sourcing wind turbines requires a strategic evaluation of several key factors, including technological capability, product reliability, cost efficiency, after-sales service, and compliance with international standards. Leading wind turbine manufacturers such as Vestas, Siemens Gamesa, GE Renewable Energy, Goldwind, and Envision offer proven technologies and global support networks, making them strong contenders for large-scale and commercial projects. Emerging manufacturers may provide cost advantages and innovation, particularly in specific regional markets.

The choice of supplier should align with project-specific needs—such as turbine size, site conditions (onshore vs. offshore), grid requirements, and long-term maintenance plans. Additionally, considerations around supply chain resilience, delivery timelines, and local content requirements can significantly influence sourcing decisions.

Ultimately, a comprehensive sourcing strategy that balances performance, cost, and sustainability goals will help ensure the successful deployment and operation of wind energy projects, supporting the broader transition to renewable energy. Engaging in thorough due diligence, obtaining multiple bids, and fostering strong supplier relationships are essential steps toward achieving optimal outcomes in wind turbine procurement.