The U.S. wind turbine manufacturing sector is experiencing robust growth, fueled by increasing demand for renewable energy and supportive federal policies. According to a 2023 report by Mordor Intelligence, the United States wind energy market is projected to grow at a CAGR of over 8.4% from 2023 to 2028, driven by expanding onshore wind capacity and rising investments in grid infrastructure. Complementing this outlook, Grand View Research estimates that the global wind turbine market, in which U.S. manufacturers play a pivotal role, reached USD 117.5 billion in 2022 and is expected to expand at a compound annual growth rate of 7.9% through 2030. With the Inflation Reduction Act further accelerating domestic clean energy production, American wind turbine manufacturers are scaling operations to meet both national decarbonization goals and export opportunities. This data-driven momentum sets the stage for identifying the top 10 U.S.-based wind turbine manufacturers leading innovation, production volume, and technological advancement in the sector.

Top 10 Wind Turbine Usa Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 We are LM Wind Power

Domain Est. 2009

Website: lmwindpower.com

Key Highlights: LM Wind Power is a pioneer in advancing wind turbine blade technology and setting new standards for sustainability, efficiency, and digital industrialization….

#2 Arcosa Towers

Domain Est. 2018

Website: arcosatowers.com

Key Highlights: Arcosa Wind Towers, Inc. is a leading manufacturer of structural wind towers in North America. We focus on excellence, offering premier value to our ……

#3 Wind turbine manufacturing and service

Domain Est. 1997

Website: us.vestas.com

Key Highlights: Vestas is a wind turbine manufacturer and a global leader in the renewable energy industry for sustainable energy solutions….

#4 GOLDWIND

Domain Est. 2000

Website: goldwind.com

Key Highlights: Goldwind is a global leader in clean energy, energy conservation, and environmental protection. As a world-top wind turbine manufacturer, we are committed ……

#5 Wind Turbines

Domain Est. 2017

Website: envision-group.com

Key Highlights: Envision Energy is the first in the industry to develop smart turbine with its exclusive core technology of smart control,advanced measurement method, expert ……

#6 Deriva Energy

Domain Est. 2023

Website: derivaenergy.com

Key Highlights: We are a leading developer, owner, and operator of clean energy projects in the US, with the experience and knowledge to meet your needs for renewable power.Missing: manufacturers…

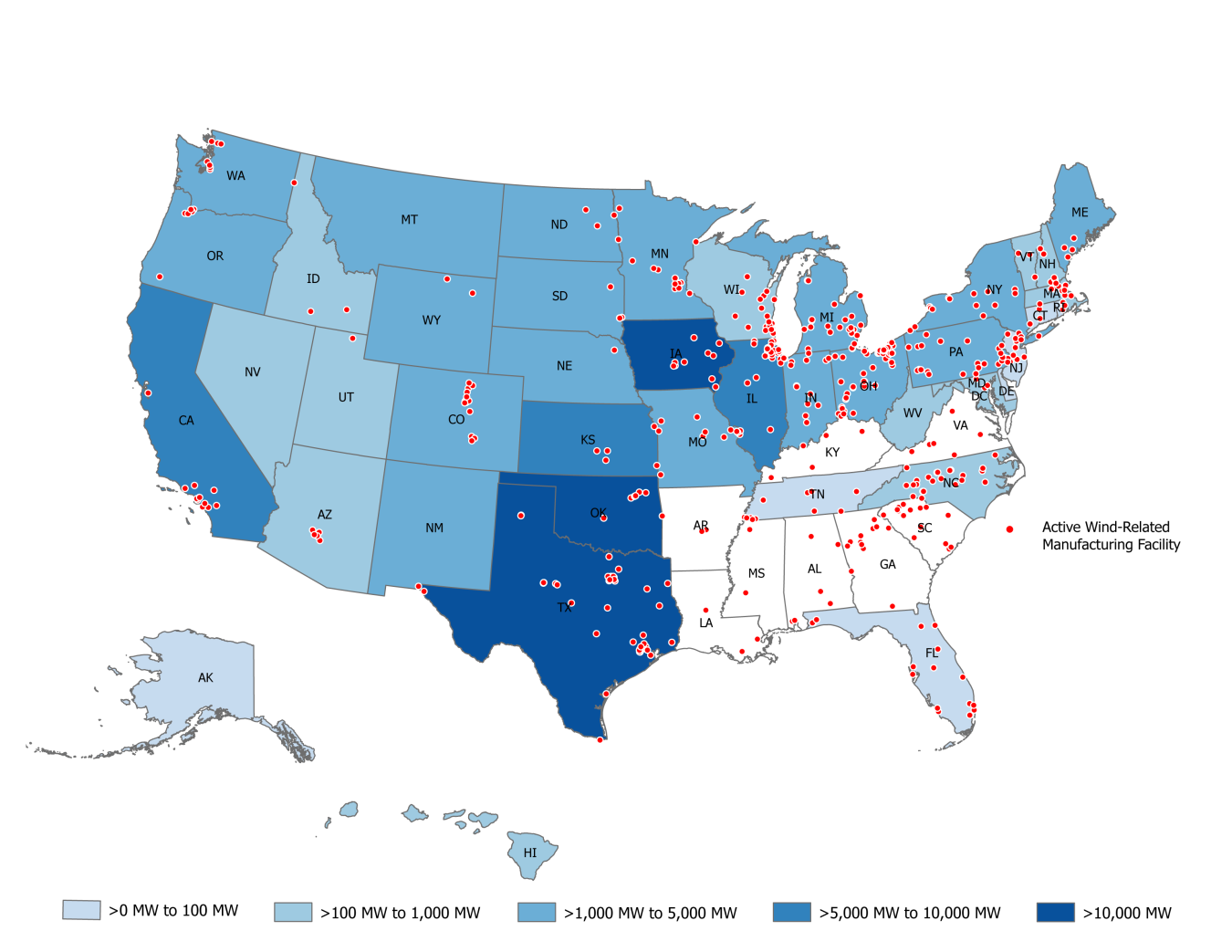

#7 Wind Manufacturing and Supply Chain

Domain Est. 1999

Website: energy.gov

Key Highlights: There are more than 500 US manufacturing facilities specializing in wind components such as blades, towers, and generators, as well as turbine assembly across ……

#8 Ventower

Domain Est. 2009

Website: ventower.com

Key Highlights: The company offers superiority in diversified steel manufacturing of wind turbine towers, welded storage tanks, pressure vessels and complex structural steel ……

#9 Wind turbines

Domain Est. 2012

Website: ewtdirectwind.com

Key Highlights: EWT’s DIRECTWIND range of 225kW to 1MW wind turbines is designed and built to provide the most cost-effective long term power….

#10 Flower Turbines

Domain Est. 2013

Website: flowerturbines.com

Key Highlights: Our vertical axis wind turbines are the perfect solution to your energy needs. Combining beauty with function, our sustainable energy solutions deliver ……

Expert Sourcing Insights for Wind Turbine Usa

2026 Market Trends for Wind Turbines in the USA: A Hydrogen-Enhanced Outlook (H2 Perspective)

The U.S. wind turbine market in 2026 is poised for significant evolution, driven by policy tailwinds, technological advancements, and growing integration with the emerging hydrogen economy. While standalone wind power growth remains substantial, the interplay between wind energy and hydrogen (H2) production is emerging as a critical trend shaping market dynamics, project economics, and long-term strategic planning.

1. Accelerated Deployment Driven by Policy and Demand:

* Inflation Reduction Act (IRA) Impact: The IRA’s decade-long extension of the Production Tax Credit (PTC) and Investment Tax Credit (ITC), along with bonus credits for domestic content, prevailing wages, and siting in energy communities, will continue to be the primary driver. This stability boosts investor confidence and project bankability, leading to a significant ramp-up in new wind farm installations and repowering of older sites by 2026.

* Corporate Power Purchase Agreements (PPAs): Corporate demand for clean energy, driven by ESG goals and decarbonization targets, will remain a major force. Large tech and industrial companies are expected to sign increasingly large and complex wind PPAs, often seeking direct integration or off-take agreements for co-located green hydrogen facilities.

* State-Level Renewable Portfolio Standards (RPS): Ambitious RPS targets in key states (e.g., California, New York, Illinois) will mandate further wind capacity additions, ensuring a robust pipeline of projects through 2026.

2. Technological Advancements and Scale:

* Larger, More Efficient Turbines: The trend towards larger turbines (onshore 6-8MW+, offshore 15MW+) will continue, reducing the Levelized Cost of Energy (LCOE) and increasing project viability, especially in areas with lower wind resources or higher land costs.

* Offshore Wind Maturation: The U.S. offshore wind market will see its first significant commercial-scale projects (e.g., Vineyard Wind 1, South Fork) operational by 2026, providing crucial operational data and supply chain development. While facing permitting and transmission challenges, the sector will gain momentum, establishing a foundation for future growth. Turbine technology specifically designed for harsh offshore environments will be critical.

* Digitalization and AI: Advanced analytics, AI for predictive maintenance, and digital twins will become standard, optimizing turbine performance, reducing O&M costs, and extending asset life.

3. The Rising Star: Wind-to-Hydrogen (H2) Integration (H2 Focus):

This is where the H2 lens is most critical for understanding 2026 trends:

* Addressing Grid Congestion and Curtailment: As wind capacity grows, especially in resource-rich but transmission-constrained regions (e.g., Great Plains, Texas), curtailment (wasting excess generation) becomes a major economic and efficiency concern. Wind-to-Hydrogen (P2G – Power-to-Gas) offers a vital solution. Excess wind electricity, particularly during low-demand periods or high-wind events, can be diverted to electrolyzers to produce green hydrogen. This acts as a dispatchable energy storage and grid balancing mechanism, transforming curtailment into a valuable product.

* Creating New Revenue Streams: For wind project developers and owners, selling green hydrogen (or the Power Purchase Agreement for the electricity specifically used for H2 production) provides a diversified revenue stream beyond the traditional electricity market. This improves project economics and resilience against electricity price volatility. By 2026, we will see the first commercial-scale wind farms explicitly designed or retrofitted to co-produce significant volumes of green H2.

* Driving Electrolyzer Deployment and Cost Reduction: The demand signal from wind farms for green H2 production will accelerate the deployment of electrolyzer capacity. This scale-up, combined with technological learning, will drive down electrolyzer capital costs, making the wind-H2 value chain more economical. Expect pilot and demonstration projects to transition towards larger commercial deployments by 2026.

* Focus on Hard-to-Abate Sectors: Green hydrogen produced from wind power is targeted at decarbonizing sectors where direct electrification is difficult: heavy-duty transport (trucks, trains, potentially marine), industrial processes (steel, chemicals, refining), and potentially seasonal energy storage. Policy support (like IRA hydrogen production tax credits – 45V) specifically for clean hydrogen will make wind-powered H2 increasingly competitive for these applications.

* Project Siting and Planning: Future wind farm development will increasingly consider proximity to potential hydrogen offtakers (e.g., industrial hubs, ports, transportation corridors) and access to water (for electrolysis) and pipeline infrastructure (for H2 transport). “Green hydrogen hubs” supported by federal funding may catalyze co-location.

* Hybrid Systems: The concept of hybrid renewable plants (wind + solar + battery storage + electrolysis) will gain traction by 2026. Wind provides high-capacity factor generation, solar complements diurnal patterns, batteries handle short-term fluctuations, and electrolyzers absorb excess power for long-duration storage (as H2), creating highly flexible and valuable energy assets.

4. Supply Chain and Workforce Challenges:

* Domestic Manufacturing: The IRA’s domestic content bonuses will drive significant investment in U.S. wind turbine component manufacturing (towers, nacelles, blades) and, crucially, electrolyzer manufacturing. However, scaling up domestic capacity by 2026 will be challenging, potentially leading to bottlenecks.

* Transmission Bottleneck: The lack of adequate, modern transmission infrastructure remains the single largest non-technical barrier. Building new lines takes years. Wind-to-H2 offers a partial mitigation strategy by reducing the need to transmit every kilowatt-hour, but cannot fully replace the need for expanded grids.

* Skilled Workforce: The rapid expansion of both wind and the nascent hydrogen sector will intensify competition for skilled labor (technicians, engineers, project managers). Workforce development programs will be crucial.

Conclusion for 2026:

The U.S. wind turbine market in 2026 will be characterized by strong growth fueled by policy and corporate demand, technological scale-up, and the critical emergence of wind-to-hydrogen integration. While grid constraints persist, the synergy between wind power and green hydrogen production will become a defining trend. Wind farms will increasingly be viewed not just as electricity generators, but as multi-product clean energy hubs. The ability to produce green hydrogen will enhance project economics, reduce curtailment, create valuable new markets, and position wind energy as a cornerstone of the broader U.S. clean energy and decarbonization strategy, particularly for hard-to-abate sectors. The success of this H2 integration pathway will be a key determinant of the wind market’s long-term trajectory beyond 2026.

Common Pitfalls in Sourcing Wind Turbines in the USA: Quality and Intellectual Property Concerns

Sourcing wind turbines in the United States offers advantages such as proximity, regulatory familiarity, and support for domestic manufacturing. However, companies—especially international buyers or new market entrants—can encounter significant pitfalls related to quality assurance and intellectual property (IP) protection. Being aware of these risks is critical to ensuring long-term project success and minimizing legal and operational exposure.

Quality Assurance Challenges

One of the primary concerns when sourcing wind turbines in the U.S. is ensuring consistent product quality across suppliers and production batches. The wind energy supply chain involves multiple tiers of manufacturers, from major OEMs to component suppliers, increasing the risk of variability.

-

Inconsistent Manufacturing Standards: While major U.S. turbine manufacturers adhere to international standards (e.g., IEC 61400), smaller domestic suppliers or secondary vendors may lack rigorous quality control processes. This can lead to premature component failures, such as blade delamination or gearbox issues, especially under harsh environmental conditions.

-

Supply Chain Fragmentation: The U.S. turbine industry relies on a mix of domestic fabrication and imported components. Inconsistencies in material sourcing or oversight can compromise final product integrity. For example, forged steel components imported from third-party vendors may not meet specified metallurgical properties if quality audits are inadequate.

-

Lack of Long-Term Performance Data: Emerging U.S.-based turbine manufacturers or rebranded designs may not have sufficient field performance history. Buyers risk investing in unproven technology that may underperform or require costly retrofits.

Intellectual Property Risks

Intellectual property (IP) is a critical but often overlooked aspect of sourcing wind turbines, particularly when engaging with U.S. suppliers or joint ventures.

-

Unclear IP Ownership in Custom Designs: When working with U.S. suppliers on customized turbine configurations or control systems, contracts may fail to explicitly define IP ownership. This can lead to disputes over rights to design improvements, software algorithms, or performance data—especially if the supplier retains rights to modifications.

-

Risk of Infringement: Some U.S. suppliers—particularly smaller firms or startups—may use technologies that inadvertently infringe on existing patents held by major OEMs (e.g., GE, Vestas, Siemens Gamesa). Buyers could face legal exposure if their purchased turbines incorporate infringing components, even unknowingly.

-

Software and Control System Licensing: Modern turbines rely heavily on proprietary control software. Buyers may assume they receive full使用权 (usage rights), but restrictive licensing agreements can limit serviceability, third-party maintenance, or data access. This creates long-term operational dependencies and increases lifecycle costs.

-

Reverse Engineering and Technology Leakage: When sourcing from U.S. manufacturers with global supply chains, there is a risk that technical specifications or design details could be exposed to unauthorized parties, particularly if component manufacturing is outsourced overseas without adequate contractual safeguards.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Conduct thorough due diligence on suppliers’ quality certifications (e.g., ISO 9001, IECRE).

– Require third-party inspections and performance testing before delivery.

– Include clear IP clauses in procurement contracts, specifying ownership, licensing terms, and indemnification for infringement claims.

– Engage legal counsel experienced in energy technology and U.S. IP law during contract negotiations.

By proactively addressing quality and IP concerns, stakeholders can reduce risk and ensure reliable, legally sound wind turbine procurement in the U.S. market.

Logistics & Compliance Guide for Wind Turbines in the USA

Overview of Wind Turbine Transportation and Regulation

Transporting wind turbines across the United States involves complex logistical planning and strict adherence to federal, state, and local regulations. Given the size and weight of turbine components—such as blades, nacelles, towers, and hubs—moving them from manufacturing sites to wind farms requires specialized equipment and permits. This guide outlines key considerations for logistics and compliance to ensure safe, timely, and legal delivery.

Key Components and Their Transportation Challenges

Wind turbine components are among the largest cargo transported on U.S. roads. Blades can exceed 80 meters in length, tower sections can be 4–5 meters in diameter, and nacelles may weigh over 100 tons. These dimensions present challenges including route restrictions, bridge clearances, turning radii, and road weight limits. Transporters must plan routes carefully, often requiring road modifications or off-peak travel.

Federal and State Regulatory Framework

While the U.S. Department of Transportation (USDOT) sets baseline standards for commercial vehicle operations, individual states regulate oversize/overweight (OS/OW) permits, routing, and escort requirements. The Federal Highway Administration (FHWA) oversees the National Network for highways designated for OS/OW loads, but state-specific rules still apply. Compliance with both federal safety standards (e.g., FMCSA regulations) and state-level permitting is mandatory.

Permitting Process for Oversize Loads

Each state requires specific permits for transporting wind turbine components. Permit applications typically include detailed load dimensions, weight distribution, route maps, and proof of insurance. Some states use centralized online systems (e.g., Permits by Net in Texas), while others require manual submissions. Processing times vary—planning months in advance is recommended, especially for multi-state routes.

Route Planning and Engineering Assessments

Route selection is critical and often involves engineering assessments to evaluate road strength, bridge load capacity, overhead clearances, and turning radius at intersections. GPS-based route optimization tools and drone surveys help identify potential obstacles. Coordination with local authorities may be needed to temporarily remove signs, traffic signals, or utility lines.

Escort and Pilot Vehicle Requirements

Most states require pilot or escort vehicles when transporting wind turbine components. Typically, one pilot vehicle leads to warn traffic and confirm clearances, while a second follows to manage rear visibility and communicate with the driver. Escort requirements vary by state and load dimensions—some states mandate certified pilots with specific training.

Timing and Travel Restrictions

Many states impose travel restrictions on OS/OW loads, such as prohibiting movement during rush hours, weekends, or holidays. Night transport may be allowed in some areas to reduce traffic impact. Weather conditions can also affect travel schedules, especially in mountainous or northern regions where winter conditions limit road access.

Infrastructure and Site Access Considerations

Delivering components to remote wind farm sites often requires upgrading local roads or constructing temporary access roads. Coordination with landowners, local governments, and environmental agencies is essential. Temporary road reinforcements using steel mats or gravel may be needed to support heavy loads and prevent damage.

Environmental and Safety Compliance

Projects must comply with environmental regulations under the National Environmental Policy Act (NEPA) and state equivalents. This includes minimizing impacts on wetlands, wildlife habitats, and waterways during transport and site preparation. All operations must follow OSHA safety standards and site-specific safety plans to protect workers and the public.

Insurance and Liability Management

Carriers and project developers must secure comprehensive insurance coverage, including general liability, cargo, and auto liability for OS/OW transport. Given the high value of turbine components (often exceeding $1M per piece), proper documentation, tracking, and chain-of-custody protocols are essential to mitigate risk.

Intermodal Transport Options

While most components travel by road, intermodal solutions may be used. For example, blades or tower sections can be shipped via rail to a hub near the project site, then transferred to specialized trailers for final delivery. Barge transport is occasionally used for coastal or river-accessible sites, reducing overland distance and associated costs.

Stakeholder Coordination and Community Engagement

Successful logistics operations require coordination with multiple stakeholders: manufacturers, freight carriers, state DOTs, local governments, utility companies, law enforcement, and community representatives. Proactive engagement helps address concerns, secure necessary approvals, and minimize disruptions to local traffic and businesses.

Recordkeeping and Documentation

Maintaining accurate records is critical for compliance and audit purposes. Documentation should include permits, route approvals, inspection reports, vehicle maintenance logs, driver qualifications (CDLs), and incident reports. Digital logbooks and GPS tracking systems enhance transparency and accountability.

Conclusion and Best Practices

Efficient and compliant wind turbine logistics in the U.S. demand meticulous planning, regulatory knowledge, and strong coordination. Best practices include early engagement with permitting authorities, use of experienced OS/OW carriers, real-time tracking, and contingency planning for delays. By following this guide, stakeholders can ensure timely delivery while maintaining safety and legal compliance.

In conclusion, sourcing wind turbine manufacturers in the USA presents a strategic opportunity for domestic and international stakeholders seeking reliable, high-quality, and technologically advanced renewable energy solutions. With a strong industrial base, supportive federal and state policies, and a growing emphasis on clean energy infrastructure, the U.S. is home to several reputable manufacturers such as General Electric (GE Vernova), Vestas (operating extensively in the U.S.), and Nordex USA. These companies offer a range of turbine models suited for various applications, from utility-scale wind farms to community and distributed energy projects.

Key advantages of sourcing from U.S.-based manufacturers include reduced supply chain risks, compliance with domestic content requirements like the Buy American Act and Inflation Reduction Act (IRA) incentives, faster deployment timelines, and strong after-sales support. Additionally, partnering with established U.S. manufacturers supports job creation, promotes energy independence, and aligns with sustainability goals.

However, buyers should conduct thorough due diligence, comparing product performance, pricing, warranty terms, and service networks. Emerging domestic suppliers and technological innovations in offshore wind also present new opportunities worth exploring.

Ultimately, sourcing wind turbines from U.S. manufacturers is not only a sound business decision but also a forward-looking investment in the nation’s clean energy future.