The U.S. wind power sector has experienced robust growth over the past decade, driven by federal incentives, declining technology costs, and increasing demand for clean energy. According to Grand View Research, the U.S. wind energy market was valued at approximately USD 35.6 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 7.2% from 2024 to 2030. Mordor Intelligence reinforces this trajectory, highlighting that rising investments in offshore wind projects and modernization of onshore infrastructure are key catalysts for industry expansion. As domestic wind capacity surpasses 140 gigawatts (GW)—making the U.S. one of the largest wind energy markets globally—the manufacturing segment plays a pivotal role in supplying turbines, components, and digital solutions. Against this backdrop, a select group of manufacturers are leading innovation, scalability, and deployment efficiency. Here are the top 10 wind power manufacturers in the U.S., shaping the future of renewable energy through technological advancement and strategic market presence.

Top 10 Wind Power In Usa Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 We are LM Wind Power

Domain Est. 2009

Website: lmwindpower.com

Key Highlights: LM Wind Power is a pioneer in advancing wind turbine blade technology and setting new standards for sustainability, efficiency, and digital industrialization….

#2 Arcosa Towers

Domain Est. 2018

Website: arcosatowers.com

Key Highlights: Arcosa Wind Towers, Inc. is a leading manufacturer of structural wind towers in North America. We focus on excellence, offering premier value to our ……

#3 Wind turbine manufacturing and service

Domain Est. 1997

Website: us.vestas.com

Key Highlights: Vestas is a wind turbine manufacturer and a global leader in the renewable energy industry for sustainable energy solutions….

#4 GOLDWIND

Domain Est. 2000

Website: goldwind.com

Key Highlights: Goldwind is a global leader in clean energy, energy conservation, and environmental protection. As a world-top wind turbine manufacturer, we are committed ……

#5 Wind Turbines

Domain Est. 2017

Website: envision-group.com

Key Highlights: Envision Energy is the first in the industry to develop smart turbine with its exclusive core technology of smart control,advanced measurement method, expert ……

#6 Deriva Energy

Domain Est. 2023

Website: derivaenergy.com

Key Highlights: We are a leading developer, owner, and operator of clean energy projects in the US, with the experience and knowledge to meet your needs for renewable power.Missing: manufacturers…

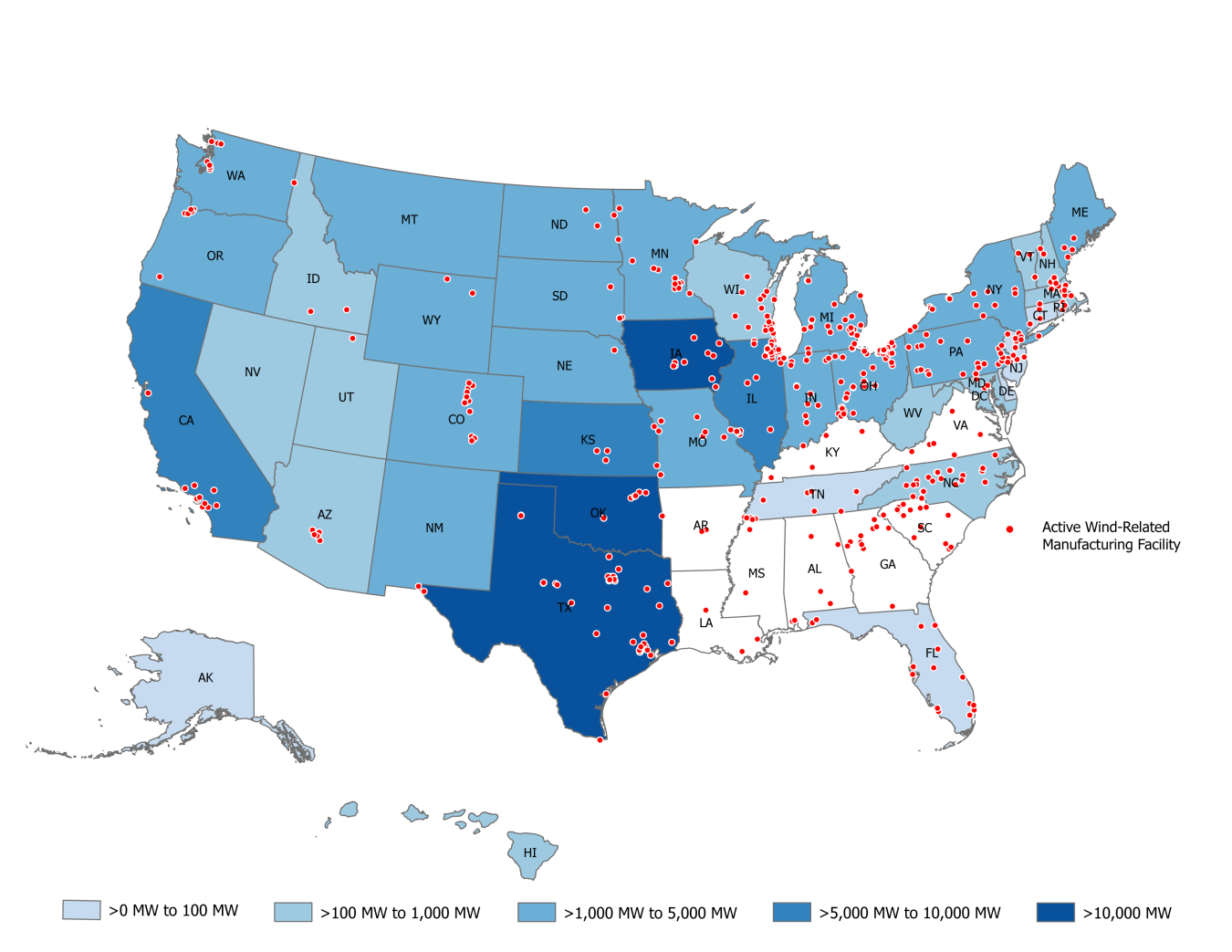

#7 Wind Manufacturing and Supply Chain

Domain Est. 1999

Website: energy.gov

Key Highlights: There are more than 500 US manufacturing facilities specializing in wind components such as blades, towers, and generators, as well as turbine assembly across ……

#8 Ørsted

Domain Est. 2004

Website: us.orsted.com

Key Highlights: Ørsted is a leading clean energy company that develops, constructs, and operates renewable projects, including wind, solar, and battery storage….

#9 Wind turbines

Domain Est. 2012

Website: ewtdirectwind.com

Key Highlights: EWT’s DIRECTWIND range of 225kW to 1MW wind turbines is designed and built to provide the most cost-effective long term power….

#10 100% renewable offshore wind energy for New York

Domain Est. 2019

Website: sunrisewindny.com

Key Highlights: Sunrise Wind is America’s largest offshore wind farm, powering nearly 600000 New York homes, creating hundreds of good jobs, and accelerating the state’s ……

Expert Sourcing Insights for Wind Power In Usa

H2: Wind Power Market Trends in the USA (2026)

As the United States advances toward its clean energy goals, the wind power sector is poised for significant transformation and growth by 2026. Driven by federal policy support, technological innovation, supply chain developments, and increasing demand for decarbonization, the wind energy market is expected to solidify its role as a cornerstone of the U.S. energy transition. This analysis explores key market trends shaping the wind power industry in the U.S. through 2026.

1. Accelerated Deployment of Onshore Wind

Onshore wind continues to be the dominant segment of the U.S. wind market, with robust growth anticipated through 2026. According to the U.S. Energy Information Administration (EIA), wind capacity additions are expected to grow steadily, driven by falling levelized costs and increasing corporate power purchase agreements (PPAs). States such as Texas, Iowa, Oklahoma, and Kansas remain leaders in installed capacity, while new markets in the Midwest and Great Plains are expanding due to improved grid integration and transmission planning.

The Inflation Reduction Act (IRA) of 2022 provides long-term tax incentives—such as the Production Tax Credit (PTC) and Investment Tax Credit (ITC)—which are instrumental in de-risking investments and spurring development. By 2026, analysts project over 150 GW of cumulative onshore wind capacity in the U.S., up from approximately 140 GW in 2023.

2. Offshore Wind Gains Momentum

Offshore wind is transitioning from early-stage development to commercial-scale deployment. By 2026, the U.S. is expected to have over 5 GW of operational offshore wind capacity, with major projects like Vineyard Wind 1 (Massachusetts), South Fork Wind (New York), and Coastal Virginia Offshore Wind (CVOW) coming online. The Biden administration’s goal of 30 GW of offshore wind by 2030 is catalyzing state-level procurement, port infrastructure investments, and supply chain development.

Key trends in offshore wind by 2026 include:

– Increased use of larger, more efficient turbines (15+ MW) to improve project economics.

– Expansion of offshore wind hubs in the Northeast and Mid-Atlantic, with emerging interest along the Gulf Coast and West Coast.

– Strengthening of domestic manufacturing, including nacelle assembly, tower production, and vessel construction, supported by IRA domestic content bonuses.

3. Technological Innovation and Digitalization

By 2026, wind turbine technology will continue to evolve, with taller towers, longer blades, and smart control systems enhancing energy capture and reliability. Artificial intelligence (AI) and machine learning are being integrated into predictive maintenance and performance optimization, reducing downtime and operational costs.

Digital twin technology and advanced forecasting tools will enable better grid integration and participation in energy markets. These innovations improve wind’s value proposition, especially in competitive power markets where flexibility and dispatchability are increasingly important.

4. Grid Modernization and Transmission Expansion

Grid constraints remain a critical challenge for wind development, particularly in remote, high-wind regions. However, by 2026, several major transmission projects—such as the Plains & Eastern Clean Line (under revised planning) and regional interties in the Midwest and Southwest—are expected to enhance grid access.

The Federal Energy Regulatory Commission (FERC) Order 1920, finalized in 2023, mandates regional transmission planning and cost allocation for long-term needs, facilitating investment in backbone infrastructure. These developments will unlock new wind resources and improve delivery to load centers.

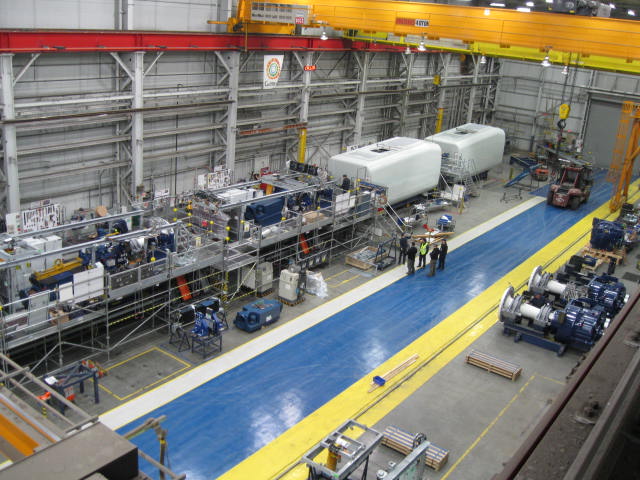

5. Supply Chain Resilience and Domestic Manufacturing

The U.S. wind industry is working to reduce reliance on imported components, especially from Asia. The IRA’s domestic content bonus (10% adder to tax credits) is accelerating investments in domestic turbine blade, tower, and nacelle manufacturing. By 2026, several new factories are expected to come online, particularly in the Gulf Coast and Great Lakes regions.

However, challenges remain in securing rare earth materials and scaling up a skilled workforce. Partnerships between industry, government, and labor unions are expected to expand training programs and apprenticeships ahead of 2026.

6. Corporate and Utility Demand

Corporate procurement of wind energy remains strong, with major technology, manufacturing, and retail firms committing to 100% renewable energy. By 2026, corporate PPAs are expected to account for over 30% of new wind capacity additions.

Utilities are also integrating more wind into their resource plans in response to state Renewable Portfolio Standards (RPS) and cost competitiveness. Wind-plus-storage hybrid projects are becoming more common, improving dispatchability and grid reliability.

7. Environmental and Community Considerations

Environmental reviews and community engagement are increasingly central to project development. By 2026, developers are expected to adopt more proactive stakeholder engagement, addressing concerns around land use, wildlife impacts (particularly birds and bats), and visual aesthetics.

Indigenous and rural communities are gaining a stronger voice in project siting, with growing emphasis on equitable benefit-sharing models, such as community ownership and local revenue agreements.

Conclusion

By 2026, the U.S. wind power market is on track for sustained growth, supported by favorable policy, technological advancement, and strong demand. Onshore wind will remain the backbone of renewable expansion, while offshore wind begins to scale meaningfully. Challenges related to transmission, supply chain, and social license will require coordinated solutions. Overall, wind energy is set to play a pivotal role in achieving national climate targets and enhancing energy security in the coming years.

Common Pitfalls Sourcing Wind Power in the USA (Quality, IP)

Sourcing wind power in the United States offers significant environmental and economic benefits, but organizations must navigate several potential pitfalls—particularly concerning power quality and intellectual property (IP) considerations. Understanding these challenges is crucial for ensuring reliable, compliant, and secure energy procurement.

Quality-Related Pitfalls

1. Intermittency and Grid Stability Concerns

Wind energy is inherently variable, leading to fluctuations in power supply. This intermittency can affect the quality of power delivered, especially if not properly managed through grid integration technologies or backup systems. Buyers relying on consistent power quality for sensitive operations (e.g., data centers, manufacturing) may face disruptions without adequate contingency planning.

2. Voltage Fluctuations and Frequency Regulation

Wind farms can introduce voltage sags, surges, or frequency deviations, especially during rapid changes in wind speed or turbine start-up/shutdown. If not mitigated through power electronics and grid-supportive inverters, these fluctuations can damage equipment or degrade performance for end users.

3. Power Factor and Harmonic Distortions

Poorly designed or maintained wind installations may contribute to harmonic distortions or low power factor, reducing overall power quality. This can lead to inefficiencies, increased losses, and potential penalties from utilities unless corrected with filtering or compensation equipment.

4. Lack of Performance Guarantees in PPAs

Power Purchase Agreements (PPAs) sometimes lack stringent quality-of-supply clauses. Buyers may assume consistent performance but fail to secure contractual guarantees for voltage stability, frequency response, or uptime, leaving them exposed to subpar power delivery.

Intellectual Property (IP) Pitfalls

1. Proprietary Technology in Turbine Design and Control Systems

Wind turbine manufacturers often embed proprietary software and control algorithms in their systems. When sourcing power from third-party wind farms, buyers may have limited visibility or access to these systems, raising concerns about transparency, maintenance, and long-term performance optimization.

2. Data Ownership and Monitoring Access

Operational data from wind farms—such as output metrics, downtime logs, and predictive maintenance insights—are valuable and often protected as trade secrets. Buyers may find themselves unable to access detailed performance data needed for audits, ESG reporting, or integration planning, limiting their ability to verify claims or optimize usage.

3. Technology Licensing and Restrictions in Offtake Agreements

Some PPAs or turbine supply agreements include IP clauses that restrict how energy or associated data can be used. For example, co-located energy users (e.g., on-site wind installations) might face limitations on replicating or benchmarking system performance due to licensing constraints.

4. Risk of IP Infringement in Custom Projects

For organizations developing or co-developing wind projects, especially with emerging technologies (e.g., floating offshore turbines, AI-driven forecasting), there’s a risk of inadvertently infringing on patented designs or software. Comprehensive IP due diligence is essential to avoid litigation or project delays.

Mitigation Strategies

- Include robust power quality specifications in PPAs, with penalties for non-compliance.

- Require access to real-time performance data and regular reporting.

- Conduct technical audits and due diligence on turbine OEMs and project developers.

- Consult legal experts to review IP clauses and ensure data rights and usage freedoms.

- Integrate energy storage or hybrid systems to stabilize supply and improve quality.

By proactively addressing quality and IP concerns, organizations can secure reliable, high-performing wind power while protecting their operational and legal interests.

Logistics & Compliance Guide for Wind Power in the USA

Overview of Wind Power Logistics in the United States

The wind power industry in the United States has experienced significant growth over the past decade, driven by federal incentives, state renewable energy mandates, and declining technology costs. Logistics plays a crucial role in the successful deployment of wind energy projects, from transporting massive turbine components to ensuring compliance with federal, state, and local regulations. This guide outlines key logistics considerations and compliance requirements for wind power development across the country.

Key Components and Transportation Challenges

Wind turbine components—such as blades, towers, nacelles, and hubs—are large, heavy, and often customized, posing unique logistical challenges. Typical blade lengths now exceed 60 meters, and nacelles can weigh over 100 tons. Transporting these components requires:

- Specialized heavy-haul trailers and equipment

- Route planning to avoid low bridges, narrow roads, and weak bridges

- Coordination with state departments of transportation (DOTs) for permits

- Temporary road modifications or detours

Transportation typically involves a mix of over-the-road trucking, rail, and limited barge use, depending on project location and infrastructure availability.

Federal and State Permitting Requirements

Wind power projects must comply with a range of federal and state regulations. Key compliance areas include:

Federal Energy Regulatory Commission (FERC)

While FERC primarily regulates transmission and wholesale electricity markets, interconnection to the grid often requires FERC jurisdiction, especially for larger projects.

Department of Transportation (DOT)

The Federal Motor Carrier Safety Administration (FMCSA) oversees commercial vehicle safety standards. States regulate oversize/overweight loads, but must align with federal motor carrier safety rules.

Environmental Regulations

Projects must comply with environmental laws, including:

– National Environmental Policy Act (NEPA): Requires environmental impact assessments for federal actions, such as permitting on federal lands or using federal funding.

– Migratory Bird Treaty Act (MBTA) and Endangered Species Act (ESA): Impose restrictions to protect wildlife, particularly birds and bats.

– Clean Air and Clean Water Acts: Apply during construction and operation phases.

State and Local Permitting

Each state has its own permitting process for wind development, often involving:

– Zoning and land use approvals

– Noise and setback regulations

– Interconnection standards

– Certificate of Public Convenience and Necessity (CPCN) in some states

Local opposition can delay or block projects, making community engagement a critical compliance and logistical factor.

Interconnection and Grid Access

Connecting wind farms to the electrical grid involves technical, procedural, and regulatory steps:

– Submitting interconnection requests to the regional transmission organization (RTO) or independent system operator (ISO)

– Completing feasibility and system impact studies

– Meeting reliability standards set by the North American Electric Reliability Corporation (NERC)

Delays in interconnection queues can impact project timelines and financing.

Customs and Import Compliance for Foreign Components

Many turbine components are manufactured overseas. Importers must comply with U.S. Customs and Border Protection (CBP) regulations, including:

– Proper tariff classification and valuation

– Compliance with Section 301 tariffs on certain Chinese imports

– Documentation for duty drawback and trade preference programs

Supply chain disruptions and trade policies can influence logistics planning and costs.

Workforce and Safety Compliance

Wind project logistics involve high-risk activities, necessitating compliance with:

– Occupational Safety and Health Administration (OSHA) standards

– Crane and rigging safety protocols

– Training and certification for heavy equipment operators

Ensuring worker safety is both a legal requirement and a logistical priority.

Conclusion and Best Practices

Success in wind power logistics and compliance requires:

– Early engagement with regulators, communities, and transportation authorities

– Detailed route surveys and permit applications

– Risk management for supply chain and regulatory delays

– Use of experienced logistics providers with wind industry expertise

By proactively addressing logistical challenges and complying with regulatory requirements, developers can ensure timely, cost-effective, and sustainable wind energy deployment across the United States.

In conclusion, sourcing wind power manufacturers in the USA presents a strategic opportunity for businesses and utilities aiming to expand renewable energy capacity and support domestic clean energy development. The U.S. is home to a robust and innovative wind energy manufacturing sector, with key players offering advanced turbines, components, and technology solutions. Favorable government incentives, such as the Inflation Reduction Act (IRA), coupled with growing demand for sustainable energy, make domestic sourcing both economically and environmentally advantageous.

However, challenges such as supply chain constraints, skilled labor shortages, and regional variability in manufacturing capabilities should be carefully evaluated. To ensure success, stakeholders should conduct thorough due diligence, prioritize manufacturers with proven track records and certifications, and consider long-term partnerships that support scalability and reliability.

Ultimately, sourcing wind power equipment from U.S.-based manufacturers not only strengthens energy independence and reduces carbon emissions but also contributes to job creation and technological leadership in the global clean energy transition.