The global wholesale jewelry market is experiencing robust growth, driven by rising consumer demand for culturally rich and affordable accessories, particularly in the fast-expanding ethnic wear segment. According to Mordor Intelligence, the global jewelry market was valued at USD 305.5 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2029, with India emerging as a key manufacturing and export hub. As one of the world’s largest producers of handcrafted and gold jewelry, India accounts for over 12% of global jewelry production, bolstered by skilled artisanal labor and deep-rooted craftsmanship traditions. The domestic wholesale jewelry manufacturing sector has further benefited from increased e-commerce adoption and rising international demand for intricately designed, cost-competitive pieces. This data-backed momentum underscores India’s strategic position in the global supply chain, making its top wholesale manufacturers critical partners for retailers, fashion brands, and distributors seeking scalable, high-quality sourcing solutions.

Top 10 Wholesale Indian Jewelry Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Nagosa Jewelry

Domain Est. 2020

Website: nagosajewelry.com

Key Highlights: Discover 925 silver jewelry wholesale, gold-plated jewelry manufacturing & wholesale supply at Nagosa Jewelry. OEM/ODM Service Available….

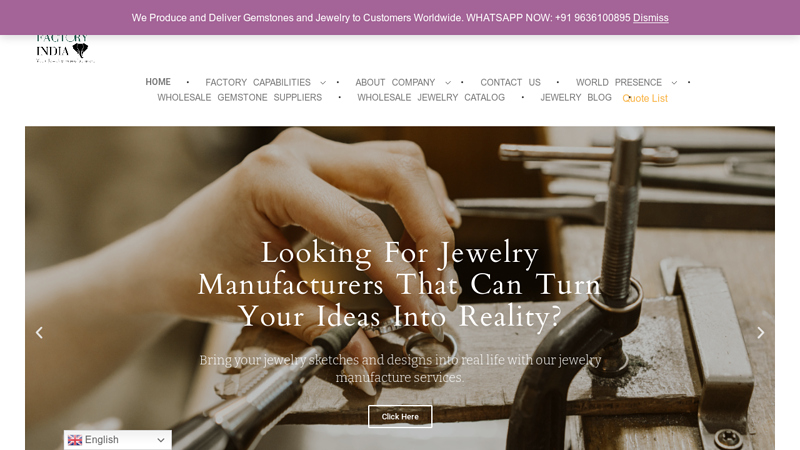

#2 Custom Jewelry Manufacturers and Jewelry Wholesale suppliers …

Domain Est. 2021

Website: gemfactoryindia.com

Key Highlights: Gem Factory India is a premier Custom Jewellery Manufacturer and wholesale gemstone supplier in India. Recognized by world-class jewelry designers and renowned ……

#3 Manufacturer, Wholesaler & Supplier of Fine Sterling Silver Jewelry …

Domain Est. 2001

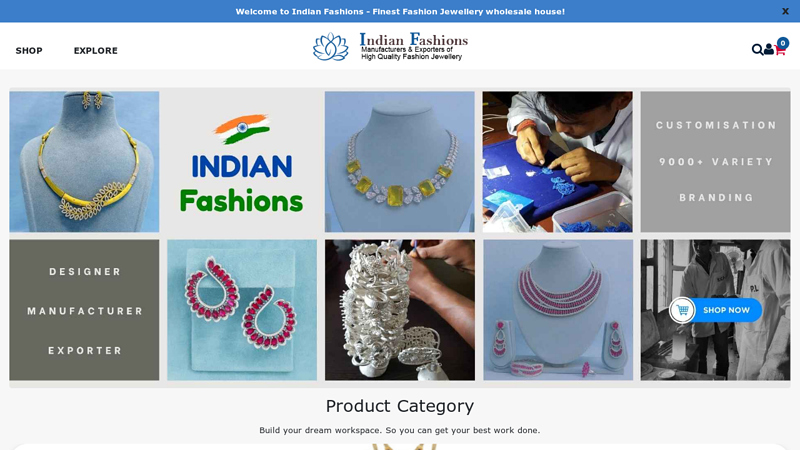

#4 Indian Fashions

Domain Est. 2004

Website: indian-jewellery.com

Key Highlights: International Designs| Wholesale Fine Fashion & Wedding Jewellery| Exact Diamond Replicas| In stock 7000+ Designs| Worldwide Delivery| Popular in USA ……

#5 Emerald Jewel Industry India Ltd

Domain Est. 2007

Website: ejindia.com

Key Highlights: India’s Largest Jewelry Manufacturer. Exquisite Gold Collections. Discover Now. Sparkling Silver Collections. Discover Now. Platinum Jewellery Collections….

#6 Alex Jewellery

Domain Est. 2013

Website: alexjewellery.com

Key Highlights: Alex Jewellery is a trusted jewellery exporter. We specialise in gold-plated and gold-filled designs, including 3-tone bangles, necklaces, and earrings….

#7 Trusted Wholesale 925 Silver Jewelry Manufacturer and Supplier …

Domain Est. 2015

Website: akratijewelsinc.com

Key Highlights: AkratijewelsInc is India’s largest online wholesale silver jewelry manufacturer and supplier, offering top-quality 925 silver jewelry for bulk buyers and ……

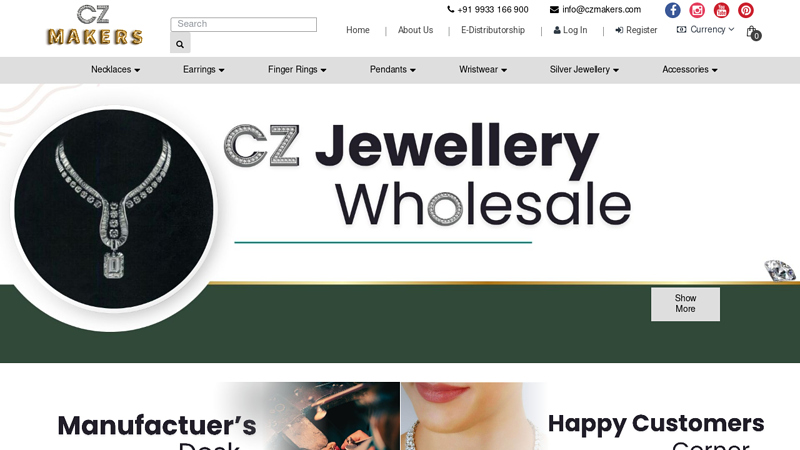

#8 CZ Makers

Domain Est. 2017 | Founded: 2009

Website: czmakers.com

Key Highlights: CZ Makers is the Manufacturer and Wholesaler of High quality Handcrafted CZ/AD Jewelry and Fashion Jewelry, Exporting since 2009. … India; +91 9933 166 900 ……

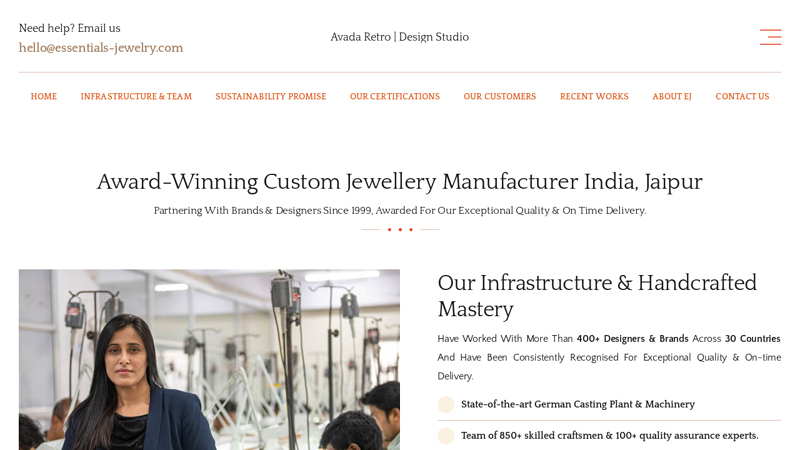

#9 Award Winning Custom Jewellery Manufacturer

Domain Est. 2020

Website: essentials-jewelry.com

Key Highlights: EJ is an Award-Winning Custom Jewelry Manufacturer in India, Jaipur. Have Worked With More Than 400+ Designers & Brands Across 30 Countries….

#10 Jewellery Wholesalers in India

Domain Est. 2024

Website: jewellerywholesalersindia.com

Key Highlights: Discover dazzling imported imitation jewelry at wholesale prices! We offer stunning collections directly from manufacturers. High quality, vast selection….

Expert Sourcing Insights for Wholesale Indian Jewelry

2026 Market Trends in Wholesale Indian Jewelry

The wholesale Indian jewelry market is poised for dynamic growth and transformation by 2026, shaped by shifting consumer preferences, technological advancements, and evolving global trade dynamics. Understanding these key trends is essential for wholesalers, manufacturers, and retailers aiming to capture value in this vibrant sector.

Rising Demand for Lightweight and Fashion-Forward Designs

Consumers, especially millennials and Gen Z, are increasingly favoring lightweight, wearable, and contemporary Indian jewelry over traditional heavy pieces. This shift is driving demand for jadau lite, oxidized silver, temple jewelry with modern twists, and fusion designs blending Indian motifs with global aesthetics. Wholesalers are adapting by expanding collections that balance cultural authenticity with everyday wearability.

Growth of E-Commerce and Digital B2B Platforms

By 2026, digital wholesale channels are expected to dominate transaction volume. B2B marketplaces, virtual trade shows, and AI-driven inventory platforms will enable smaller retailers and international buyers to access Indian jewelry collections with greater ease. Wholesalers investing in digital catalogs, 3D product visualization, and seamless online ordering systems will gain a competitive edge.

Emphasis on Ethical Sourcing and Sustainability

Global consumers and retailers are demanding transparency in material sourcing. Wholesalers who adopt certified ethical practices—such as using recycled gold, conflict-free gemstones, and supporting artisan welfare—will appeal to eco-conscious markets in North America, Europe, and the Middle East. Sustainability credentials will increasingly influence purchasing decisions.

Expansion into International and Niche Markets

While domestic demand remains strong, Indian jewelry wholesalers are targeting high-growth international markets. The diaspora in the U.S., U.K., UAE, and Australia continues to drive demand, while emerging markets in Southeast Asia and Africa present new opportunities. Additionally, niche segments such as bridal couture jewelry and personalized pieces are gaining traction.

Integration of Technology in Design and Production

By 2026, technologies like CAD/CAM, 3D printing, and AI-assisted design tools will be standard in wholesale manufacturing. These innovations reduce production time, lower costs, and allow for rapid prototyping of trending designs. Wholesalers leveraging technology will be better positioned to respond quickly to market demands and offer customization at scale.

Influence of Cultural Revival and Regional Craftsmanship

There is a growing appreciation for India’s diverse regional jewelry heritage—Kundan from Rajasthan, Totem from Odisha, or Meenakari from Punjab. Wholesalers highlighting authentic craftsmanship, artisan collaborations, and storytelling in their product lines will differentiate themselves in a crowded market.

Price Sensitivity and Demand for Mid-Tier Gold and Alternatives

With fluctuating gold prices, there’s increasing demand for mid-range gold jewelry (14K–18K) and alternative materials such as silver, alloy, and gold-plated pieces. Wholesalers offering quality products at accessible price points will capture a broader customer base, especially in price-sensitive markets.

In summary, the 2026 wholesale Indian jewelry landscape will be defined by innovation, inclusivity, and adaptability. Success will favor those who blend tradition with modernity, embrace digital transformation, and commit to sustainable and ethical practices.

Common Pitfalls When Sourcing Wholesale Indian Jewelry (Quality and Intellectual Property)

Sourcing wholesale Indian jewelry can be highly profitable, but it comes with significant risks—especially concerning quality consistency and intellectual property (IP) infringement. Being aware of these common pitfalls helps importers, retailers, and distributors make informed decisions and avoid costly mistakes.

Inconsistent Quality Standards

One of the biggest challenges in sourcing Indian jewelry is the lack of standardized quality control across suppliers. Many artisans and small manufacturers produce pieces by hand, leading to variations in craftsmanship, materials, and finishing. Buyers may receive batches with inconsistent plating thickness, gemstone clarity, or metal purity—even when ordering the same design. This inconsistency can damage your brand reputation and lead to customer complaints and returns.

Misrepresentation of Materials

Some suppliers may mislabel or exaggerate the materials used in their jewelry. For example, items may be advertised as “925 sterling silver” or “gold-plated” but contain lower-grade alloys or insufficient plating. Similarly, semi-precious stones may be sold as higher-value varieties or enhanced treatments (like dyeing or heat treatment) may not be disclosed. Always request material certifications and conduct third-party lab testing when possible.

Lack of IP Compliance and Design Infringement

Indian jewelry often draws from rich cultural motifs, traditional patterns, and regional craftsmanship. However, some manufacturers reproduce designs that are protected under intellectual property laws—either as registered designs, trademarks, or under traditional knowledge protections. Sourcing jewelry that copies branded or patented designs (even unintentionally) can expose your business to legal action, seizures at customs, or forced recalls.

Additionally, using sacred symbols, religious iconography, or tribal art without proper authorization or cultural sensitivity can lead to public backlash and reputational damage, even if not legally actionable.

Counterfeit or Imitation Pieces

The market includes counterfeit versions of popular Indian jewelry styles, such as Kundan, Jadau, or Meenakari, which may use inferior techniques and materials. These imitations may look authentic at first glance but deteriorate quickly. Worse, passing off such pieces as genuine traditional craftsmanship misleads consumers and undermines the value of authentic artisan work.

Poor Craftsmanship and Durability Issues

Handmade jewelry is prized for its artistry, but not all craftsmanship meets export or retail standards. Weak soldering, loose settings, or fragile chains increase the risk of breakage during shipping or customer use. Without proper quality audits, buyers may end up with products that don’t meet durability expectations, leading to higher return rates and warranty claims.

Limited Traceability and Ethical Concerns

Many suppliers operate through informal networks, making it difficult to trace the origin of materials or verify ethical labor practices. There may be risks related to child labor, unsafe working conditions, or environmentally harmful processes (such as improper handling of chemicals in plating). These issues can pose compliance risks, especially for businesses operating in markets with strict import regulations (e.g., EU, US).

Inadequate Packaging and Presentation

Wholesale jewelry may arrive with minimal or damaged packaging, which can affect perceived value. Poor packaging also increases the risk of tarnishing, scratching, or tangling during transit. If you plan to resell directly to consumers, unattractive or non-branded packaging may require additional investment to repackage.

No Contracts or Legal Protections

Many small-scale Indian suppliers operate on verbal agreements or informal terms. Without a written contract specifying quality expectations, delivery timelines, IP rights, and dispute resolution mechanisms, buyers have little recourse if things go wrong. Always establish clear terms and consider working with agents or sourcing companies that provide legal and logistical support.

Conclusion

To mitigate these risks, conduct thorough due diligence: visit suppliers in person or hire third-party inspectors, request material certifications, verify design originality, and use legally binding contracts. Partnering with reputable, ethical suppliers who respect both quality and intellectual property ensures sustainable success in the wholesale Indian jewelry market.

Logistics & Compliance Guide for Wholesale Indian Jewelry

Understanding Indian Jewelry Export Regulations

Before shipping wholesale Indian jewelry internationally, it’s essential to comply with India’s export laws. The Directorate General of Foreign Trade (DGFT) governs export procedures under the Foreign Trade Policy (FTP). Most jewelry items fall under the “Free Export” category, meaning no export license is required. However, jewelry containing certain materials—such as gold, silver, precious stones, or items of archaeological or artistic value—may require special documentation.

Exporters must register with the DGFT and obtain an Import-Export Code (IEC), which is mandatory for all export activities. Additionally, the Goods and Services Tax Identification Number (GSTIN) must be linked to export operations for proper tax compliance.

Customs Documentation Requirements

Accurate documentation is critical for smooth customs clearance. Key documents include:

- Commercial Invoice: Must detail product description, value, quantity, HS code, buyer/seller information, and payment terms.

- Packing List: Specifies dimensions, weight, and contents of each package.

- Bill of Lading (B/L) or Air Waybill (AWB): Serves as the contract of carriage and proof of shipment.

- Certificate of Origin: May be required by importing countries for tariff benefits under trade agreements.

- Insurance Certificate: Recommended to cover loss or damage during transit.

For jewelry containing precious metals or gemstones, a valuation certificate from an authorized assayer or gemological laboratory (such as GCI or IGI India) may be necessary to confirm authenticity and value.

Classification Using HS Codes

Proper Harmonized System (HS) code classification ensures correct duty assessment and regulatory compliance. Common HS codes for Indian jewelry include:

- 7113 – Articles of jewelry and parts thereof, of precious metals.

- 7115 – Articles of precious or semi-precious stones (e.g., loose stones).

- 7116 – Imitation jewelry made with non-precious metals or materials.

Using the correct 8-digit Indian tariff code (based on the HS system) helps avoid customs delays and ensures accurate GST and export duty calculations.

Compliance with Precious Metals and Gemstone Regulations

The export of gold, silver, and precious stones is regulated under the Customs Act, 1962 and rules issued by the Government of India. Exporters must:

- Obtain certification from a recognized assaying and hallmarking center for gold and silver items (Bureau of Indian Standards – BIS hallmarking is recommended).

- Declare the carat, weight, and purity of precious metals.

- Provide gemstone identification reports from accredited labs when exporting loose or set gemstones.

- Comply with anti-money laundering (AML) and Know Your Customer (KYC) norms, especially for high-value transactions.

Packaging and Shipping Best Practices

Wholesale jewelry shipments require secure, discreet, and tamper-evident packaging to prevent theft and damage. Best practices include:

- Using sealed, non-descriptive outer packaging without logos or jewelry references.

- Including moisture-proof lining and cushioning to protect delicate pieces.

- Labeling packages with handling instructions (e.g., “Fragile,” “This Side Up”).

- Choosing insured and trackable shipping services (e.g., DHL, FedEx, or specialized logistics providers).

For high-value consignments, consider using courier services with bonded transport and real-time tracking.

Import Regulations in Target Markets

Compliance doesn’t end at export—importing countries have their own rules. Key considerations include:

- United States: Complies with FTC Jewelry Guides; requires country of origin marking and karat stamping for gold.

- European Union: Follows REACH and RoHS regulations; restricts certain metals (e.g., nickel) and requires CE marking for some products.

- GCC Countries (UAE, Saudi Arabia, etc.): Require BIS or equivalent hallmarking and may impose import duties based on metal value.

Always verify the destination country’s customs policies, duty rates, and labeling requirements before shipping.

Tax and Duty Implications

While India generally does not impose export duties on jewelry, exporters can benefit from duty drawback schemes or GST refunds under the Letter of Undertaking (LUT) or bond mechanism. Ensure all GST returns (GSTR-1 and GSTR-3B) are filed timely to claim refunds.

Importing countries may levy VAT, GST, or customs duties based on the declared value. Use Incoterms (e.g., FOB, CIF, DDP) clearly in contracts to define responsibility for duties and taxes.

Anti-Counterfeiting and Intellectual Property

Indian jewelry designs may be protected under the Designs Act, 2000. Register original designs to prevent counterfeiting. Avoid using trademarks, logos, or cultural symbols (e.g., religious motifs) that could infringe on intellectual property rights in foreign markets.

Record Keeping and Audit Compliance

Maintain detailed records for at least five years, including:

- Export invoices and shipping documents

- Certificates of authenticity and hallmarking

- GST filings and duty drawback claims

- KYC documents of buyers

These records are essential for audits by Indian customs, GST authorities, or international regulators.

Partnering with Reliable Logistics Providers

Work with freight forwarders and customs brokers experienced in jewelry shipments. They can assist with:

- Proper classification and documentation

- Customs clearance in both origin and destination countries

- Risk assessment and insurance procurement

- Regulatory updates and compliance alerts

Select partners with strong security protocols and global reach to ensure timely and safe delivery.

By adhering to these logistics and compliance guidelines, wholesalers can minimize risks, avoid penalties, and build trust in the international marketplace for authentic Indian jewelry.

In conclusion, sourcing wholesale Indian jewelry presents a profitable and culturally rich opportunity for retailers, resellers, and e-commerce entrepreneurs. With its intricate designs, use of precious metals and gemstones, and deep-rooted craftsmanship, Indian jewelry appeals to a global market seeking authenticity and elegance. To ensure success, it is essential to partner with reputable suppliers—whether based in India or internationally—by conducting thorough research, verifying product quality, assessing MOQs, and understanding import regulations and ethical sourcing practices. Attending trade shows, leveraging online B2B platforms, and building long-term relationships with artisans or exporters can further enhance reliability and access to unique, in-demand pieces. When done strategically, sourcing wholesale Indian jewelry not only offers strong profit margins but also supports traditional craftsmanship and sustainable business growth.