The global dry ice market is experiencing steady expansion, driven by increasing demand across industries such as food and beverage, healthcare, pharmaceuticals, and logistics. According to Mordor Intelligence, the dry ice market was valued at approximately USD 1.17 billion in 2023 and is projected to grow at a CAGR of over 6.5% from 2024 to 2029. This growth is largely fueled by the rising need for cold chain solutions, particularly in vaccine distribution and frozen food transportation, where dry ice’s ability to maintain ultra-low temperatures without residue offers a critical advantage. Additionally, industrial applications including blast cleaning and oil and gas operations continue to bolster demand. As reliance on temperature-sensitive supply chains grows, so does the importance of reliable wholesale dry ice manufacturers capable of delivering consistent quality and scalable supply. The following list highlights the top 10 wholesale dry ice manufacturers leading the charge in production capacity, technological innovation, and geographic reach—key players shaping the future of this expanding market.

Top 10 Wholesale Dry Ice Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Dry Ice Production Solutions & Technology

Domain Est. 1996

Website: coldjet.com

Key Highlights: Cold Jet is an OEM of dry ice production solutions & technology allowing you to simplify your cooling and processing operations with dry ice….

#2 Reddy Ice

Domain Est. 1998

Website: reddyice.com

Key Highlights: The largest ice manufacturer in the US offers 5, 7, & 16 lbs bags of ice for home use, parties, events, and more. Find the list of ice delivery locations ……

#3 Page

Domain Est. 1999

Website: homecityice.com

Key Highlights: Home City Ice is an ice manufacturer and delivery service with a local feel and attention to detail but with the resources and network of a large company….

#4 AAA ICE

Domain Est. 2001

Website: aaaice.com

Key Highlights: We have the lowest prices in town for ice, ice sculptures and ice luges. Call for delivery 7 days a week | 24 hours a day. We’re the oldest ice manufacturer in ……

#5 Arctic Dry Ice

Domain Est. 2004

Website: arcticdryice.com

Key Highlights: Premium Quality Dry Ice Manufacturer. Wholesale and Retail Sales. 1-800-444-0980. Arctic Dry Ice – Dry Ice Pellets in VT, NH and ME. Dry Ice is More Versatile ……

#6 Airgas Dry Ice

Domain Est. 1995

Website: airgas.com

Key Highlights: Make Airgas your number one commercial dry ice supplier for Food Production, Life Sciences, Healthcare, Shipping & Home Delivery and Dry Ice Blasting….

#7 Arctic Glacier® Premium Ice

Domain Est. 1999

Website: arcticglacier.com

Key Highlights: Whether it’s snow scenes, ice sculptures or event rentals, we have a range of specialized ice products, solutions and services available in select regions….

#8 Continental Carbonic

Domain Est. 2003

Website: continentalcarbonic.com

Key Highlights: We can quickly react to customers’ needs for all types of food grade dry ice including standard block, cut block, airline cut and blasting dry ice (high density ……

#9 the ice house

Domain Est. 2006

Website: wholesaleice.com

Key Highlights: Cylindrical ice cubes that are tailor-made to maintain cold beverages at their frostiest. Approximately 20 inches wide x 9 inches deep x 7 inches tall ……

#10 Mixology Ice

Domain Est. 2015

Website: mixologyice.com

Key Highlights: $10 deliveryExplore the Wholesale Ice app for exclusive bulk discounts, efficient delivery, and personalized support. Order larger quantities conveniently….

Expert Sourcing Insights for Wholesale Dry Ice

H2: Projected 2026 Market Trends for Wholesale Dry Ice

The global wholesale dry ice market is poised for notable growth and transformation by 2026, driven by expanding industrial applications, advancements in cold chain logistics, and increasing demand across various end-use sectors. Key trends shaping the market include:

-

Rising Demand in Food and Beverage Sector

The food and beverage industry remains the largest consumer of dry ice, especially for preserving perishable goods during transportation. With the surge in e-commerce and direct-to-consumer frozen food delivery services, demand for reliable, non-melting cooling solutions like dry ice is expected to climb significantly by 2026. Regional expansions in emerging markets will further amplify this trend. -

Growth in Pharmaceutical and Healthcare Logistics

The need for ultra-cold chain solutions, particularly for vaccines (e.g., mRNA-based therapeutics) and biologics, continues to fuel dry ice consumption. As global healthcare systems emphasize distribution resilience, dry ice—capable of maintaining temperatures as low as -78.5°C—will remain a critical component in temperature-sensitive shipments, supporting market expansion. -

Expansion of Industrial Cleaning and Manufacturing Applications

Dry ice blasting, a non-abrasive cleaning method used in automotive, aerospace, and electronics manufacturing, is gaining traction due to its eco-friendly and solvent-free nature. Increased adoption of sustainable manufacturing practices is expected to boost demand from industrial users, contributing to wholesale volume growth. -

Supply Chain and Production Consolidation

The dry ice market is witnessing consolidation among producers to achieve economies of scale and improve distribution efficiency. By 2026, larger players are likely to dominate regional wholesale markets, investing in CO₂ recovery technologies and automated production units to meet rising demand and reduce costs. -

Sustainability Pressures and CO₂ Sourcing Challenges

Dry ice is a byproduct of industrial CO₂ emissions, often sourced from ammonia or ethanol production. Fluctuations in CO₂ supply due to plant shutdowns or environmental regulations could impact dry ice availability and pricing. Companies are increasingly exploring carbon capture and utilization (CCU) technologies to ensure sustainable and stable feedstock, a trend expected to accelerate by 2026. -

Technological Advancements in Packaging and Handling

Innovations in insulated packaging and dry ice monitoring systems (e.g., IoT-enabled temperature tracking) are improving safety and reducing sublimation losses during transit. These advancements will enhance efficiency in wholesale logistics and open new opportunities in last-mile delivery applications. -

Regional Market Diversification

While North America and Europe currently lead in dry ice consumption, Asia-Pacific—particularly China, India, and Southeast Asia—is projected to experience the highest compound annual growth rate (CAGR) through 2026, driven by industrialization and expanding cold chain infrastructure.

In conclusion, the 2026 wholesale dry ice market will be shaped by heightened demand in life sciences and food logistics, technological innovation, and sustainability-driven supply chain adaptations. Stakeholders who invest in scalable production, CO₂ source resilience, and efficient distribution networks are best positioned to capitalize on these evolving trends.

Common Pitfalls When Sourcing Wholesale Dry Ice (Quality, IP)

Sourcing wholesale dry ice requires careful attention to both product quality and intellectual property (IP) considerations, particularly if you’re incorporating it into proprietary processes, packaging, or resale. Overlooking these aspects can lead to operational disruptions, safety risks, and legal exposure.

Quality-Related Pitfalls

Inconsistent Purity and Contamination Risks

Low-grade dry ice may contain impurities from substandard liquid CO₂ sources, such as industrial byproducts with residual oils, solvents, or moisture. Contaminated dry ice can compromise sensitive applications—like food preservation, pharmaceutical shipping, or laboratory use—leading to spoilage, failed sterility protocols, or safety hazards.

Improper Sizing and Form Factor

Dry ice comes in pellets, slices, blocks, and nuggets, each suited to specific cooling needs. Sourcing the wrong form (e.g., large blocks when fine pellets are required for even cooling) reduces efficiency and increases waste. Inconsistent sizing from unreliable suppliers also leads to unpredictable sublimation rates and poor temperature control.

Poor Packaging and Insufficient Cold Chain Management

Dry ice sublimates rapidly—typically losing 5% to 10% per day in standard coolers. Inadequate insulation, improper sealing, or delayed delivery results in significant product loss before it reaches your facility. This not only increases costs but can jeopardize time-sensitive shipments or events.

Unreliable Supply and Lead Time Delays

Dry ice has a short shelf life and is often produced on-demand. Suppliers with limited production capacity or poor logistics planning may fail to meet volume requirements or delivery windows, disrupting operations in industries like medical transport or event catering.

Intellectual Property (IP) and Legal Pitfalls

Unauthorized Use of Branded Packaging or Designs

Reselling dry ice in custom-labeled containers or insulated packaging that mimics or copies a competitor’s trademarked design can lead to IP infringement claims. Even if the dry ice itself is generic, the packaging may be protected under trademark or trade dress law.

Revealing Proprietary Processes in Supply Agreements

When working with suppliers on custom solutions (e.g., specific pellet sizes for a patented cooling system), disclosing technical details without proper non-disclosure agreements (NDAs) risks exposing trade secrets. Suppliers may inadvertently—or intentionally—share sensitive information with competitors.

Lack of Clear IP Ownership in Co-Developed Solutions

If you collaborate with a supplier to develop a new form, packaging method, or application for dry ice (e.g., a patented insulated container), failing to define IP ownership in the contract can lead to disputes. Without clear agreements, the supplier may claim joint or full rights to innovations you funded or conceptualized.

Misuse of Trademarked Terminology in Marketing

Using terms like “Dry Ice” generically is acceptable, but referencing a competitor’s trademarked brand (e.g., “similar to Penguin Dry Ice”) in promotional materials can lead to trademark infringement claims, especially if it creates consumer confusion.

Avoiding these pitfalls requires thorough due diligence: verify supplier certifications (e.g., FDA-compliant for food-grade CO₂), insist on quality specifications in contracts, use NDAs when sharing sensitive information, and consult legal counsel to ensure packaging and branding do not violate IP rights.

Logistics & Compliance Guide for Wholesale Dry Ice

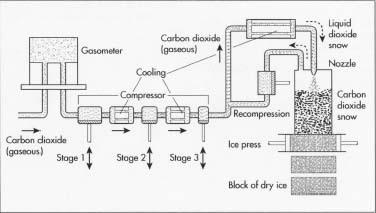

Understanding Dry Ice Properties and Hazards

Dry ice is solid carbon dioxide (CO₂) with a surface temperature of -78.5°C (-109.3°F). It sublimates directly from a solid to a gas without passing through a liquid phase. This unique property presents specific handling, storage, and transportation challenges. Key hazards include severe frostbite on contact with skin, asphyxiation in confined spaces due to CO₂ gas displacement of oxygen, and potential pressure buildup in sealed containers leading to explosions. Awareness of these risks is critical for safe wholesale operations.

Regulatory Framework and Compliance Requirements

Wholesale dry ice is subject to multiple regulatory standards due to its classification as a hazardous material. In the United States, the Department of Transportation (DOT) regulates dry ice under 49 CFR as a Class 9 Miscellaneous Hazardous Material (UN 1845). Internationally, the International Air Transport Association (IATA) Dangerous Goods Regulations and the International Maritime Dangerous Goods (IMDG) Code apply for air and sea transport, respectively. Compliance includes proper packaging, labeling, documentation, and training for all personnel involved in handling and shipping.

Packaging and Containment Standards

Dry ice must be packaged in containers designed to allow safe venting of CO₂ gas while maintaining thermal insulation. Non-vented or airtight containers are strictly prohibited due to explosion risks. Approved packaging includes insulated containers such as expanded polystyrene (Styrofoam) boxes with vent holes or specialized dry ice shippers. The packaging must be strong enough to withstand normal handling and prevent leakage of solid CO₂. Each container must be clearly marked with “Dry Ice” or “Carbon Dioxide, Solid” and the net weight of dry ice it contains.

Labeling and Marking Requirements

All dry ice shipments must display appropriate hazard labels and markings. For domestic and international transport, packages must bear the Class 9 Miscellaneous Hazard label and a “Dry Ice” handling label. If shipped by air, the shipper must declare the net quantity of dry ice and specify whether the package contains more than 2.5 kg (5.5 lbs), which triggers additional IATA requirements. Proper marking ensures recognition by handlers and compliance with transportation safety protocols.

Transportation and Shipping Protocols

When shipping dry ice, carriers must be informed of the hazardous nature of the cargo. Ground transportation requires vehicles with adequate ventilation to prevent CO₂ accumulation. For air transport, dry ice is permitted as both cargo and in refrigerated packages but is subject to quantity limits per aircraft and container. Passenger aircraft typically allow up to 200 kg per package, while cargo aircraft may allow higher quantities with proper documentation. Shippers must complete a Shipper’s Declaration for Dangerous Goods when required and ensure drivers or handlers are trained in hazardous materials procedures.

Storage Best Practices

Dry ice should be stored in well-ventilated, insulated freezers or containers specifically designed for dry ice. Avoid storing in standard freezers or walk-in coolers, as CO₂ buildup can damage equipment or create unsafe atmospheres. Storage areas must have functioning CO₂ monitors and adequate airflow to prevent oxygen displacement. Inventory should be rotated using the first-in, first-out (FIFO) principle to minimize sublimation losses. Always store upright and away from direct sunlight or heat sources.

Handling and Worker Safety Procedures

Personnel must wear appropriate personal protective equipment (PPE), including insulated gloves, safety goggles, and long-sleeved clothing to prevent frostbite. Handling should occur in well-ventilated areas, and enclosed spaces must be monitored for oxygen levels. Training programs must cover emergency procedures, including response to CO₂ exposure symptoms such as dizziness, shortness of breath, or headache. Never enter a confined space suspected of CO₂ contamination without proper respiratory protection and monitoring.

Documentation and Recordkeeping

Accurate documentation is essential for regulatory compliance. Required records include shipping manifests, hazardous materials training certifications, safety data sheets (SDS) for dry ice, and logs of storage conditions and inventory. For international shipments, export declarations and customs documentation may also be required. Maintain records for a minimum of two years, or as mandated by local regulations, to ensure traceability and audit readiness.

Emergency Response and Incident Management

Develop and implement an emergency response plan for dry ice-related incidents, including exposure, spillage, or container rupture. Equip storage and transport areas with CO₂ detectors, oxygen monitors, and emergency ventilation systems. Train staff in evacuation procedures and first response, including moving affected individuals to fresh air and seeking medical attention for suspected asphyxiation. Establish communication protocols with local emergency services to inform them of on-site dry ice storage.

Environmental and Sustainability Considerations

While dry ice sublimation releases CO₂, it is often a byproduct of industrial processes and does not contribute additional carbon to the atmosphere when sourced responsibly. Wholesalers should partner with suppliers that utilize recovered CO₂ and promote reusable or recyclable packaging. Minimize waste through accurate forecasting and efficient logistics to reduce unnecessary production and transportation emissions.

Training and Certification Requirements

All employees involved in the handling, packaging, or shipping of dry ice must undergo regular hazardous materials training compliant with DOT, IATA, or IMDG standards, depending on the mode of transport. Training should be refreshed every 1–3 years and include practical components on labeling, emergency procedures, and regulatory updates. Maintain training records and ensure supervisors are certified to oversee compliance activities.

Auditing and Continuous Compliance

Conduct regular internal audits to verify adherence to logistics and safety protocols. Review shipping documentation, inspect packaging integrity, and evaluate storage conditions. Use audit findings to update standard operating procedures and enhance staff training. Stay informed about changes in regulations through industry associations and regulatory updates to maintain continuous compliance in wholesale dry ice operations.

In conclusion, sourcing wholesale dry ice requires careful consideration of several key factors to ensure reliability, cost-efficiency, and safety. Identifying reputable suppliers with consistent product quality and dependable delivery schedules is essential, especially for businesses with high-volume or time-sensitive needs. Evaluating logistics, such as proximity to manufacturing facilities and proper insulated transportation, helps maintain the integrity of the dry ice during transit. Additionally, comparing pricing structures, minimum order requirements, and available forms (e.g., pellets, blocks) allows for informed decision-making tailored to specific operational demands. Establishing long-term relationships with suppliers can lead to better pricing, priority service, and improved supply chain stability. By conducting thorough research and due diligence, businesses can secure a sustainable and efficient dry ice supply that supports their cold chain requirements and overall operational success.