The global footwear market, driven by increasing consumer demand for comfortable, functional, and affordable casual footwear, continues to expand at a steady pace. According to Grand View Research, the global casual footwear market was valued at approximately USD 105.6 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. A key contributor within this segment is the rise of foam-based casual footwear, with Crocs—a leader in innovative resin-based designs—exemplifying strong brand and product appeal. As demand for cost-effective alternatives increases, particularly in emerging markets, the wholesale manufacturing ecosystem for Crocs-style footwear has expanded rapidly. Mordor Intelligence reports that the global footwear market is expected to grow at a CAGR of over 5.2% between 2023 and 2028, further fueled by e-commerce penetration and changing lifestyle preferences. This growth has led to the emergence of specialized wholesale manufacturers producing Crocs-inspired designs at scale. Below are the top four wholesale Crocs manufacturers leveraging this momentum, combining production efficiency, material innovation, and global distribution networks to meet rising demand.

Top 4 Wholesale Crocs Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Resources

Domain Est. 1996

Website: investors.crocs.com

Key Highlights: Crocs Inc.’s corporate headquarters are in Broomfield, CO. To support our global operations, we have established regional headquarters in Broomfield and ……

#2 About Crocs

Domain Est. 2005

Website: crocs.com.sg

Key Highlights: All Crocs™ shoes are uniquely designed and manufactured using the company’s proprietary closed-cell resin, Croslite™, a technology that gives each pair of shoes ……

#3 Contact Us

Website: crocs.eu

Key Highlights: Mail · Drop us a line with your comments, concerns, or compliments. · Crocs Retail, Inc. 7477 East Dry Creek Parkway Niwot, CO 80503. USA….

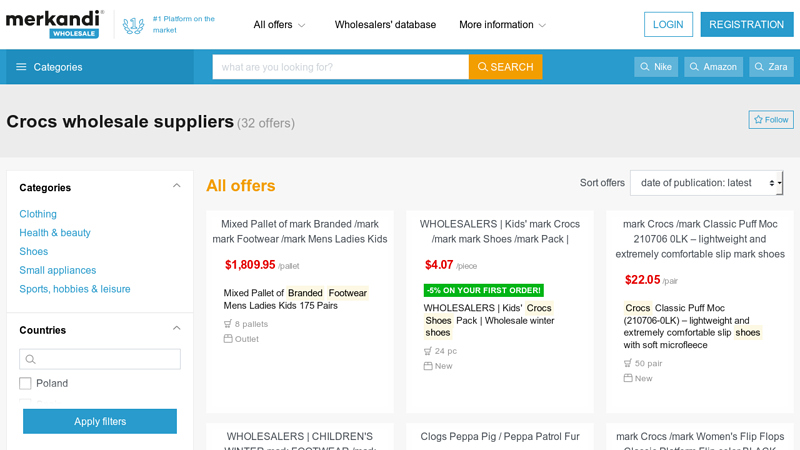

#4 Crocs wholesale

Domain Est. 2013

Website: merkandi.us

Key Highlights: 30-day returnsOn our B2B trading platform, you’ll find bargains on a variety of wholesalers from around the world. You can buy bulk Crocs in different sizes and colors here….

Expert Sourcing Insights for Wholesale Crocs

H2: 2026 Market Trends for Wholesale Crocs

As we approach 2026, the wholesale market for Crocs is expected to experience several key shifts driven by evolving consumer behaviors, sustainability demands, global retail dynamics, and continued brand innovation. These trends are shaping how retailers, distributors, and Crocs itself approach the wholesale distribution model.

1. Continued Growth in Global Demand

The global demand for Crocs is projected to remain strong through 2026, particularly in emerging markets across Asia-Pacific, Latin America, and parts of Africa. As middle-class populations expand and lifestyles become more casual, Crocs’ comfort-driven, functional footwear appeals to a broad demographic. Wholesale distributors are capitalizing on this by expanding distribution networks into underserved regions, especially through e-commerce partnerships and regional retail alliances.

2. Rise of Private Label and Customization Programs

By 2026, wholesale buyers are increasingly seeking customization and private-label options. Educational institutions, healthcare systems, hospitality chains, and corporate wellness programs are turning to Crocs for branded footwear solutions. In response, Crocs is expanding its wholesale customization platforms, allowing bulk buyers to add logos, select colors, and design specialized versions—enhancing brand loyalty and repeat wholesale orders.

3. Sustainability and Ethical Sourcing Expectations

Sustainability is becoming a non-negotiable factor in wholesale purchasing decisions. By H2 2026, wholesale partners will demand greater transparency in sourcing, manufacturing, and end-of-life recyclability. Crocs’ “Closing the Loop” recycling program—which encourages customers to return worn clogs—is expected to become a key selling point in wholesale negotiations. Wholesalers are favoring brands with verifiable ESG (Environmental, Social, and Governance) commitments, pushing Crocs to emphasize its Croslite™ material recyclability and reduced carbon footprint initiatives.

4. Shift Toward Omnichannel Wholesale Models

The line between wholesale and direct-to-consumer (DTC) is blurring. In 2026, successful wholesale strategies for Crocs include integrated omnichannel support—providing drop-shipping capabilities, shared inventory systems, and co-branded digital marketing. Major retailers are demanding seamless integration with their e-commerce platforms, and Crocs is responding by enhancing B2B portals with real-time stock visibility, AI-driven demand forecasting, and automated reordering tools.

5. Impact of Inflation and Supply Chain Resilience

Persistent macroeconomic volatility in 2026—ranging from fluctuating raw material costs to geopolitical supply chain disruptions—is prompting wholesalers to prioritize reliability and flexibility. Crocs has responded by diversifying manufacturing across Vietnam, India, and Mexico, reducing dependency on single regions. This geographic agility enhances delivery timelines and cost predictability, making Crocs a more attractive wholesale partner amid uncertain market conditions.

6. Expansion into Niche and Functional Segments

Wholesale demand is growing beyond classic clogs into performance and specialty footwear. By 2026, Crocs is expected to increase wholesale offerings in categories such as slip-resistant healthcare clogs, outdoor-ready sandals, and youth athletic styles. These niche products command higher margins and appeal to institutional buyers like hospitals, schools, and outdoor retailers—expanding the brand’s wholesale footprint.

7. Influence of Resale and Circular Economy Models

The secondhand market for Crocs is gaining traction, with platforms like Poshmark and ThredUp seeing increased listings. While not a direct wholesale channel, this trend influences new product demand and lifecycle management. Some wholesale partners are exploring take-back programs in collaboration with Crocs, reinforcing brand sustainability and customer engagement—key value points in B2B negotiations.

Conclusion

By H2 2026, the wholesale Crocs market will be characterized by increased customization, sustainability imperatives, and strategic partnerships built on supply chain resilience and digital integration. Distributors and retailers that align with Crocs’ innovation and ethical vision are likely to benefit from strong demand and brand loyalty. As Crocs strengthens its position as both a lifestyle and functional footwear brand, its wholesale ecosystem will continue to evolve—balancing scalability with personalization in a competitive global marketplace.

Common Pitfalls When Sourcing Wholesale Crocs: Quality and Intellectual Property Concerns

Logistics & Compliance Guide for Wholesale Crocs

Understanding Crocs Product Lines and Specifications

Crocs offers a diverse range of footwear including clogs, sandals, boots, and specialty styles across men’s, women’s, and children’s categories. Each product line has unique sizing, packaging, and seasonal considerations. Accurate catalog management, including SKU identification and material composition (e.g., Croslite™ foam), is essential for inventory and compliance tracking.

Order Fulfillment and Minimum Order Quantities (MOQs)

Wholesale partners must meet Crocs’ MOQs, which vary by region, distribution channel, and product line. Orders are typically placed via authorized distributor portals or directly with Crocs’ wholesale team. Lead times range from 4–12 weeks depending on seasonality and stock availability. Confirm delivery timelines and fulfillment windows at the time of order placement.

Shipping, Freight, and Distribution Channels

Crocs supports multiple shipping methods:

– FCL (Full Container Load): Recommended for large volume orders.

– LCL (Less than Container Load): Suitable for smaller orders.

– Air Freight: For urgent or time-sensitive deliveries (higher cost).

All shipments must comply with Incoterms (typically FOB or DDP), and carriers must meet Crocs’ logistics partner standards. Proper labeling, barcoding, and shipment documentation are mandatory.

Import Compliance and Customs Clearance

Ensure all import documentation is complete and accurate, including:

– Commercial invoice

– Packing list

– Bill of lading/air waybill

– Certificate of Origin

– FDA or CPSC documentation (if applicable)

Crocs footwear is typically classified under HS Code 6402.99 (rubber/plastic footwear). Confirm tariff rates and import regulations in the destination country. Partners are responsible for duty payments and customs clearance unless specified under DDP terms.

Product Safety and Regulatory Requirements

Crocs comply with international safety standards including:

– U.S.: Consumer Product Safety Improvement Act (CPSIA), ASTM F2913 slip-resistance standards

– EU: REACH, RoHS, and CE marking requirements

– Canada: Health Canada standards, labeling in English and French

Ensure all products meet local safety regulations and that testing certifications are available upon request.

Labeling and Brand Compliance

All wholesale shipments must adhere to Crocs’ brand standards:

– Original packaging with correct sizing tags and care instructions

– UPC/EAN barcodes on individual units

– No unauthorized modifications or repackaging

– Compliance with country-specific language and labeling laws (e.g., fiber content, country of origin)

Inventory Management and Returns Policy

Maintain accurate stock levels through regular audits and use of inventory management systems. Crocs’ wholesale returns policy is typically restrictive—damaged or defective goods may be eligible for replacement; excess or non-defective inventory is generally non-returnable. Coordinate returns through your account manager with proper authorization (RMA).

Sustainability and Packaging Regulations

Crocs promotes sustainable practices. Packaging must meet environmental regulations in the destination market (e.g., EU Packaging Waste Directive). Minimize plastic use where possible and ensure recyclability. Participate in take-back or recycling programs if available in your region.

Recordkeeping and Audit Preparedness

Maintain records of all transactions, compliance documentation, and shipment details for a minimum of 7 years. Crocs or third-party auditors may conduct compliance reviews. Ensure traceability from order to delivery for all wholesale activities.

Contact and Support

For logistics or compliance inquiries, contact your designated Crocs Wholesale Account Manager or reach out to:

– Global Logistics Support: [email protected]

– Compliance & Regulatory Affairs: [email protected]

– Wholesale Portal: https://wholesale.crocs.com (login required)

Conclusion for Sourcing Wholesale Crocs

Sourcing wholesale Crocs can be a profitable venture for retailers, resellers, or e-commerce entrepreneurs, given the brand’s global popularity, comfort-driven design, and strong market demand across all age groups. However, it is essential to approach the process strategically and with due diligence.

Key considerations include ensuring authenticity by sourcing from authorized distributors or directly through Crocs’ official wholesale channels, as unauthorized suppliers may offer counterfeit or low-quality products that can damage your brand reputation and lead to legal issues. Establishing a legitimate business entity and meeting minimum order requirements are typically necessary steps to qualify for wholesale pricing.

Additionally, evaluating shipping costs, import regulations (especially for international orders), and inventory management will help maximize profitability. Building long-term relationships with reliable suppliers ensures consistent product availability and potential benefits such as early access to new models or promotional discounts.

In summary, sourcing wholesale Crocs successfully involves balancing cost-efficiency with authenticity and reliability. By partnering with legitimate suppliers and staying informed about market trends and distribution policies, businesses can leverage the enduring appeal of Crocs to build a sustainable and competitive footwear offering.