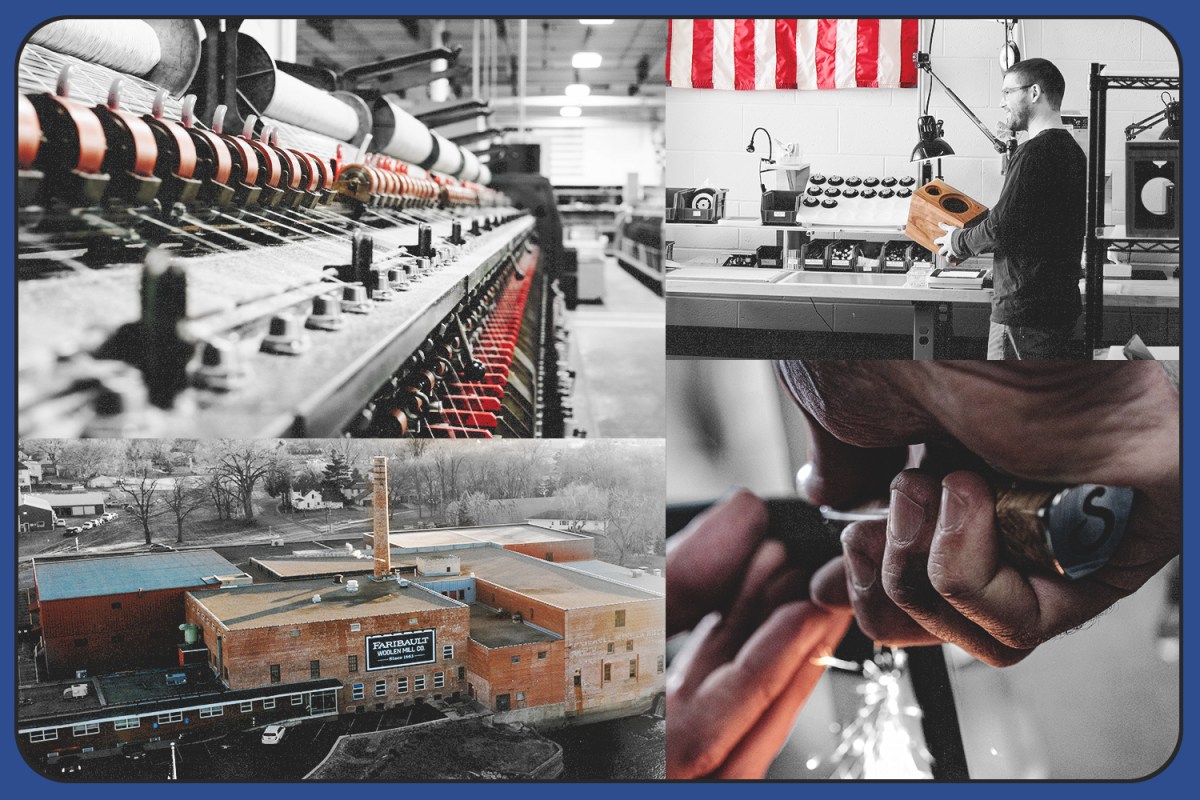

The U.S. wholesale and manufacturing sector continues to demonstrate robust growth, driven by expanding distribution networks, rising demand for domestic production, and increasing e-commerce penetration. According to a 2023 report by Mordor Intelligence, the U.S. wholesale trade market was valued at approximately $6.7 trillion and is projected to grow at a CAGR of 4.2% through 2028. This expansion is further supported by a resurgence in nearshoring and supply chain localization, prompting stronger collaboration between manufacturers and wholesale distributors. Meanwhile, Grand View Research reports that the U.S. manufacturing sector—integral to wholesale supply—was valued at over $2.3 trillion in 2022 and is expected to grow at a CAGR of 2.8% from 2023 to 2030. In this evolving landscape, a select group of wholesale companies have emerged as leaders, combining extensive distribution reach, strategic sourcing capabilities, and scalable partnerships with American manufacturers. These top players not only influence pricing and product availability across industries but also set benchmarks in logistics efficiency and supplier integration. Below is a data-informed look at the top 10 wholesale companies in the U.S. that are shaping the future of manufacturing and distribution.

Top 10 Wholesale Companies In Usa Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1

Domain Est. 1996

Website: bozzutos.com

Key Highlights: Bozzuto’s Inc. is a leading total service wholesale distributor of food and household products to retailers in New England, New York, New Jersey and ……

#2

Domain Est. 2018

Website: universalwholesaleonline.com

Key Highlights: CLINGS AND STICKERS · STOCKINGS · CANDLES · GIFT TAGS · GIFT BOXES · DECORATIONS · ORNAMENTS · GIFT BAGS · CARDS · SANTA HATS · GIFT WRAP….

#3 Sysco

Domain Est. 1994

Website: sysco.com

Key Highlights: Sysco delivers exceptional produce, custom cuts of meat, high-quality seafood, and imported foods offering global flavors….

#4 Two’s Company

Domain Est. 1996

Website: twoscompany.com

Key Highlights: Two’s Company. Wholesale Home Décor, Women’s Fashion, Kids Gifts & so much more!…

#5 C&S Wholesale Grocers

Domain Est. 1996 | Founded: 1918

Website: cswg.com

Key Highlights: C&S Wholesale Grocers is a leader in food solutions across the United States. Founded in 1918, we have a strong heritage of innovation that continues today….

#6 Orgill

Domain Est. 1996

Website: orgill.com

Key Highlights: Orgill was founded in 1847 and today is the fastest-growing independent hardware distributor in the world. The company serves retailers throughout the United ……

#7 Associated Wholesale Grocers

Domain Est. 1997

Website: awginc.com

Key Highlights: Associated Wholesale Grocers supplies stores in more than half the states in the country. We have 9 modern and efficient distribution centers, totaling more ……

#8 Harbor Wholesale

Domain Est. 1999 | Founded: 1923

Website: harborwholesale.com

Key Highlights: Since 1923, Harbor delivers the best national and regional food products available for people on the go….

#9 Wholesale General Merchandise

Domain Est. 2014

Website: wholesalegoodz.com

Key Highlights: Online wholesaler of hats, socks, scarves, tools, batteries, kitchenware, toys, pet supplies, and much, much more….

#10 Breakthru Beverage Group

Domain Est. 2015

Website: breakthrubev.com

Key Highlights: Breakthru Beverage is a leading North American distributor of the world’s top luxury and premium wine, spirits and beer brands….

Expert Sourcing Insights for Wholesale Companies In Usa

2026 Market Trends for Wholesale Companies in the USA

The U.S. wholesale industry is poised for significant transformation by 2026, driven by technological advancement, shifting customer expectations, supply chain evolution, and macroeconomic forces. Wholesale distributors who proactively adapt to these trends will gain competitive advantages, while those resistant to change may face declining market share.

Digital Transformation and E-Commerce Acceleration

Wholesale companies are rapidly investing in digital platforms to meet the growing demand for seamless online ordering, real-time inventory visibility, and self-service capabilities. By 2026, B2B e-commerce is expected to account for over 25% of all wholesale transactions in the U.S., up from under 15% in 2020. Leading wholesalers are integrating advanced e-commerce portals with ERP and CRM systems to provide personalized customer experiences, dynamic pricing, and automated reordering. Mobile-optimized platforms and AI-driven product recommendations will become standard, enhancing customer retention and operational efficiency.

Supply Chain Resilience and Localization

Ongoing global disruptions and rising customer demands for faster delivery are pushing wholesalers to reevaluate their supply chain strategies. By 2026, there will be a notable shift toward nearshoring and regional distribution networks to reduce dependency on overseas suppliers and mitigate risks. Investment in warehouse automation, predictive analytics for demand forecasting, and blockchain for enhanced traceability will strengthen supply chain resilience. Wholesalers are also forming strategic partnerships with local manufacturers and logistics providers to improve inventory turnover and reduce lead times.

Data Analytics and Artificial Intelligence Integration

Data is becoming a core asset for wholesalers aiming to stay competitive. By 2026, AI and machine learning will be widely adopted to optimize pricing strategies, forecast demand with greater accuracy, and streamline inventory management. Predictive analytics will help identify at-risk customers, anticipate market shifts, and improve sales force effectiveness. Wholesalers leveraging data-driven insights will achieve higher margins and faster response times, while also enabling hyper-personalized marketing and customer service.

Sustainability and ESG Compliance

Environmental, social, and governance (ESG) factors are gaining prominence in wholesale operations. By 2026, many large buyers and retailers will require suppliers to demonstrate sustainable practices, including reduced carbon footprints, ethical sourcing, and waste reduction. Wholesalers are responding by optimizing transportation routes, adopting eco-friendly packaging, and investing in energy-efficient distribution centers. ESG reporting will likely become a standard requirement in procurement contracts, influencing supply chain decisions and customer loyalty.

Consolidation and Market Competition

The wholesale sector is experiencing ongoing consolidation as larger players acquire regional distributors to expand market reach and achieve economies of scale. By 2026, this trend will intensify, particularly in fragmented industries like industrial supplies and foodservice distribution. At the same time, niche wholesalers focusing on specialized products or vertical markets (e.g., medical supplies, renewable energy components) will thrive by offering deep expertise and customized solutions. Competition will increasingly center on service differentiation, speed, and digital capabilities rather than price alone.

Evolving Customer Expectations

End-customers’ experiences with B2C e-commerce (e.g., Amazon) are raising expectations in B2B transactions. By 2026, wholesalers must offer Amazon-like experiences: easy navigation, fast shipping, transparent pricing, and responsive support. Millennials and Gen Z buyers, now holding key procurement roles, prioritize digital engagement, transparency, and sustainability. Wholesalers that deliver omnichannel support—integrating phone, chat, email, and self-service portals—will strengthen customer relationships and reduce churn.

In summary, the 2026 U.S. wholesale landscape will be defined by digital maturity, operational agility, and customer-centric innovation. Companies that embrace automation, data intelligence, and sustainable practices while adapting to evolving buyer behaviors will be best positioned for long-term success.

Common Pitfalls When Sourcing Wholesale Companies in the USA (Quality, IP)

Sourcing wholesale suppliers in the USA can offer advantages like shorter lead times and easier communication, but businesses often encounter critical pitfalls—particularly concerning product quality and intellectual property (IP) protection. Avoiding these issues is essential to maintaining brand integrity and avoiding legal and financial risks.

Quality Inconsistencies and Lack of Oversight

One of the most frequent challenges is inconsistent product quality. Not all US wholesale companies maintain rigorous quality control standards, especially smaller or lesser-known suppliers. Buyers may receive samples that meet expectations, only to find bulk orders riddled with defects, material substitutions, or deviations in craftsmanship. Without regular audits or third-party inspections, these inconsistencies can go unnoticed until products reach customers, damaging brand reputation.

Additionally, some wholesalers outsource manufacturing overseas while marketing themselves as “USA-based,” blurring transparency. This hybrid model can introduce supply chain gaps, making it difficult to trace quality issues back to their source.

Intellectual Property Infringement Risks

Partnering with wholesale suppliers in the US does not automatically safeguard your intellectual property. A major pitfall arises when suppliers replicate or resell your proprietary designs, packaging, or product concepts to competing brands. Even under NDAs, enforcement can be difficult, especially if the agreement lacks specificity or jurisdictional clarity.

Moreover, some wholesalers may supply products that already infringe on existing patents, trademarks, or copyrights. If your company distributes these items—even unknowingly—you could face cease-and-desist letters, legal liability, or costly litigation. Conducting thorough IP due diligence on both the supplier and the products they offer is crucial but often overlooked.

Inadequate Contractual Protections

Many businesses fail to establish robust contracts that clearly define quality benchmarks, IP ownership, and usage rights. Vague agreements leave room for disputes over product specifications, liability for IP violations, or unauthorized production. Without clauses covering inspection rights, remedies for non-compliance, and confidentiality, companies are exposed to significant operational and legal risks.

Overlooking Supplier Verification

Relying solely on online directories or trade references without verifying a supplier’s legitimacy increases exposure to fraud. Some wholesalers operate with minimal infrastructure or lack proper business licensing. Conducting background checks, visiting facilities (when possible), and requesting customer references are essential but frequently skipped steps.

Final Thoughts

To mitigate these pitfalls, businesses should implement a structured sourcing strategy that includes vetting suppliers, enforcing clear contracts, performing quality audits, and consulting legal experts for IP protection. Proactive due diligence ensures that partnerships with US wholesale companies enhance—not endanger—your brand’s long-term success.

Logistics & Compliance Guide for Wholesale Companies in the USA

Understanding the Wholesale Industry Landscape

The wholesale industry in the United States plays a critical role in the supply chain, connecting manufacturers with retailers and other business customers. Wholesale companies distribute goods in bulk, often across state lines, which brings both logistical complexity and regulatory responsibility. Success in this sector depends on efficient logistics operations and strict adherence to compliance requirements at federal, state, and local levels.

Key Logistics Considerations for Wholesalers

Supply Chain Management

Effective supply chain management ensures timely procurement, storage, and delivery of goods. Wholesalers should establish strong relationships with suppliers, use demand forecasting tools, and maintain inventory accuracy to avoid stockouts or overstocking.

Warehousing and Inventory Control

Strategic warehouse placement improves delivery times and reduces freight costs. Implementing warehouse management systems (WMS) helps track inventory levels, manage product rotation (e.g., FIFO), and improve order fulfillment accuracy.

Transportation and Distribution

Wholesalers must choose between private fleets, third-party logistics (3PL) providers, or a hybrid model. Key factors include cost, scalability, delivery speed, and service reliability. Compliance with Department of Transportation (DOT) regulations is mandatory when operating commercial vehicles.

Order Fulfillment and Last-Mile Delivery

Efficient order processing and packing procedures streamline fulfillment. Many wholesalers partner with carriers like FedEx, UPS, or regional providers to handle last-mile delivery. Automation and integration with电商平台 can reduce errors and delays.

Regulatory Compliance Requirements

Business Licensing and Registration

Wholesale companies must register with the appropriate state authorities and obtain a business license. An Employer Identification Number (EIN) from the IRS is required for tax purposes. Additionally, wholesalers may need a Seller’s Permit (also known as a Resale Certificate) to buy goods without paying sales tax and resell them tax-free to other businesses.

Sales Tax Compliance

Wholesalers must understand sales tax obligations under the Streamlined Sales Tax (SST) framework and the economic nexus rules established by the South Dakota v. Wayfair, Inc. (2018) Supreme Court decision. They should:

– Collect and remit sales tax where they have nexus.

– Validate resale certificates from business customers to avoid charging sales tax on wholesale transactions.

– Use automated sales tax software (e.g., Avalara, TaxJar) for accuracy.

Federal and State Product Regulations

Depending on the product type, wholesalers may be subject to regulations from agencies such as:

– FDA (Food and Drug Administration) – for food, beverages, dietary supplements, cosmetics, and medical devices.

– CPSC (Consumer Product Safety Commission) – for children’s products and consumer goods.

– EPA (Environmental Protection Agency) – for pesticides, chemicals, and certain equipment.

Compliance includes proper labeling, safety testing, and recordkeeping.

Import and Export Compliance (if applicable)

Wholesalers dealing with international goods must comply with U.S. Customs and Border Protection (CBP) requirements. This includes:

– Accurate Harmonized Tariff Schedule (HTS) classification.

– Payment of applicable duties and tariffs.

– Adherence to Importer Security Filing (ISF) rules.

– Following export controls under the Department of Commerce (e.g., EAR regulations).

DOT and Transportation Regulations

If operating commercial motor vehicles (over 10,001 lbs. or transporting hazardous materials), wholesalers must:

– Register with the FMCSA (Federal Motor Carrier Safety Administration).

– Maintain a USDOT number and, if applicable, an MC number.

– Comply with Hours of Service (HOS), vehicle maintenance, and driver qualification standards.

Recordkeeping and Audits

Wholesale companies must maintain detailed records for tax, safety, and regulatory purposes. Key documentation includes:

– Invoices and purchase orders.

– Resale certificates from customers.

– Inventory logs and shipping records.

– Safety data sheets (SDS) for hazardous materials.

– Driver logs and vehicle inspection reports (if operating fleets).

Regular internal audits help identify compliance gaps and prepare for external audits by tax authorities or regulatory agencies.

Technology and Automation for Compliance and Efficiency

Investing in integrated software systems can streamline both logistics and compliance:

– ERP Systems (e.g., NetSuite, SAP) unify financials, inventory, and order management.

– Compliance Platforms automate sales tax calculation, certificate management, and regulatory reporting.

– Telematics and Fleet Management Tools improve vehicle tracking and DOT compliance.

Best Practices for Ongoing Success

- Stay Updated on Regulatory Changes – Subscribe to alerts from the IRS, state revenue departments, and industry associations.

- Train Employees Regularly – Ensure staff understand compliance responsibilities in procurement, shipping, and customer service.

- Work with Legal and Tax Professionals – Consult experts to navigate complex state tax laws and product regulations.

- Choose Reliable 3PL Partners – Vet logistics providers for compliance history, technology integration, and scalability.

- Implement Risk Management Protocols – Have plans for supply chain disruptions, recalls, or regulatory investigations.

Conclusion

Wholesale companies in the USA must balance efficient logistics operations with rigorous compliance standards. By understanding federal and state regulations, investing in technology, and maintaining accurate records, wholesalers can reduce risk, improve customer satisfaction, and scale sustainably. A proactive approach to logistics and compliance is essential for long-term success in the competitive wholesale marketplace.

In conclusion, sourcing wholesale companies in the USA offers numerous advantages for businesses looking to scale, reduce costs, and access high-quality products. The U.S. wholesale market is diverse and well-developed, featuring reliable suppliers across various industries, strong logistics infrastructure, and transparent business practices. By partnering with reputable wholesale distributors, businesses can benefit from bulk pricing, consistent inventory availability, and faster delivery times—especially beneficial for domestic retailers and e-commerce ventures.

However, successful sourcing requires due diligence: verifying supplier credibility, comparing pricing and minimum order requirements, and understanding terms of service. Utilizing platforms like ThomasNet, SaleHoo, or attending trade shows can help identify trustworthy partners. Additionally, building strong relationships with suppliers can lead to better terms, exclusivity, and long-term growth.

Ultimately, sourcing wholesale in the USA supports operational efficiency and customer satisfaction, making it a strategic move for businesses aiming for sustainability and competitive advantage in the marketplace.