The global car battery market is experiencing robust growth, driven by rising vehicle production, increasing demand for replacement batteries, and the gradual expansion of the electric vehicle (EV) sector. According to Grand View Research, the global automotive battery market size was valued at USD 59.3 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This growth is further fueled by advancements in battery technology, stricter vehicle emission regulations, and the need for reliable starting, lighting, and ignition (SLI) batteries across internal combustion engine vehicles. As demand surges, particularly in emerging markets across Asia-Pacific and Latin America, wholesale suppliers and auto parts distributors are turning to leading manufacturers capable of delivering high-quality, cost-effective car batteries at scale. In this evolving landscape, identifying the top wholesale car battery manufacturers has become critical for businesses aiming to secure reliable supply chains and maintain competitive advantage.

Top 10 Wholesale Car Battery Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Wholesale Batteries, Inc.

Domain Est. 1998

Website: wholesalebatteries.net

Key Highlights: Wholesale Batteries is a multi-level distributor that serves retail, commercial/industrial, fleets, Original Equipment Manufacturers (OEM), ……

#2 Battery Store, Inc.

Domain Est. 1995 | Founded: 1979

Website: batterystore.com

Key Highlights: Battery Store Inc. has been a trusted leader in the wholesale battery distribution industry since 1979 working with top tier brands partners….

#3 Battery Wholesale Inc.

Domain Est. 2007

Website: batterywholesaleinc.com

Key Highlights: Battery Wholesale Inc. is Open to the Public. We buy, sell and service batteries of all sizes. Free battery testing! We buy junk batteries….

#4 Auto Batteries

Domain Est. 2015

Website: a1batterycompany.com

Key Highlights: We specialize in 6V and 12V batteries for cars, boats, motorcycles, tractors, RVs, buses, semi-trucks, and industrial batteries for forklifts and solar systems….

#5 Interstate Batteries

Domain Est. 1996

Website: interstatebatteries.com

Key Highlights: The Interstate MTX car battery line offers premium performance and long life and includes both the AGM battery or EFB battery you need for your start-stop ……

#6 Quality Deep Cycle Batteries

Domain Est. 1997

Website: usbattery.com

Key Highlights: Reliable, deep cycle batteries from U.S. Battery Mfg Co. High-quality 6V, 8V, 12V, 24V, and 48V batteries deliver power you can depend on!…

#7 Battery Wholesale

Domain Est. 1998

#8 Crown Battery

Domain Est. 1998

Website: crownbattery.com

Key Highlights: Crown Battery, the Power Behind Performance. Designed with advanced plate and internal construction to be the finest engineered batteries available….

#9 Battery Wholesale

Domain Est. 2005

Website: battery-wholesale.com

Key Highlights: 30-day returnsBatteries for your vehicle, boat, tools, portable devices & more! Custom pack assembly available. Your One-Stop Battery Shop….

#10 Buy EDCON Car Batteries

Domain Est. 2017

Website: edconbat.com

Key Highlights: EDCON batteries are a powerful starting force and a reliable power source for a growing number of modern vehicle electronic systems and devices….

Expert Sourcing Insights for Wholesale Car Battery

2026 Market Trends for Wholesale Car Battery

The wholesale car battery market is poised for significant transformation by 2026, driven by technological advancements, evolving consumer demands, and global shifts toward electrification. As automotive industries worldwide accelerate their transition to electric and hybrid vehicles, the dynamics of battery supply, distribution, and technology are reshaping the wholesale landscape. This analysis explores key trends expected to define the wholesale car battery market in 2026.

Rising Demand for Advanced Lead-Acid and AGM Batteries

Despite the growth of electric vehicles (EVs), internal combustion engine (ICE) vehicles and start-stop systems will continue to dominate many global markets through 2026. This sustained reliance on traditional automotive platforms is fueling demand for advanced lead-acid and absorbed glass mat (AGM) batteries, which offer superior performance in vehicles with energy-intensive electronics and regenerative braking. Wholesale distributors are increasingly stocking high-performance AGM and enhanced flooded batteries (EFB) to meet OEM and aftermarket demand, particularly in emerging markets where ICE vehicles remain prevalent.

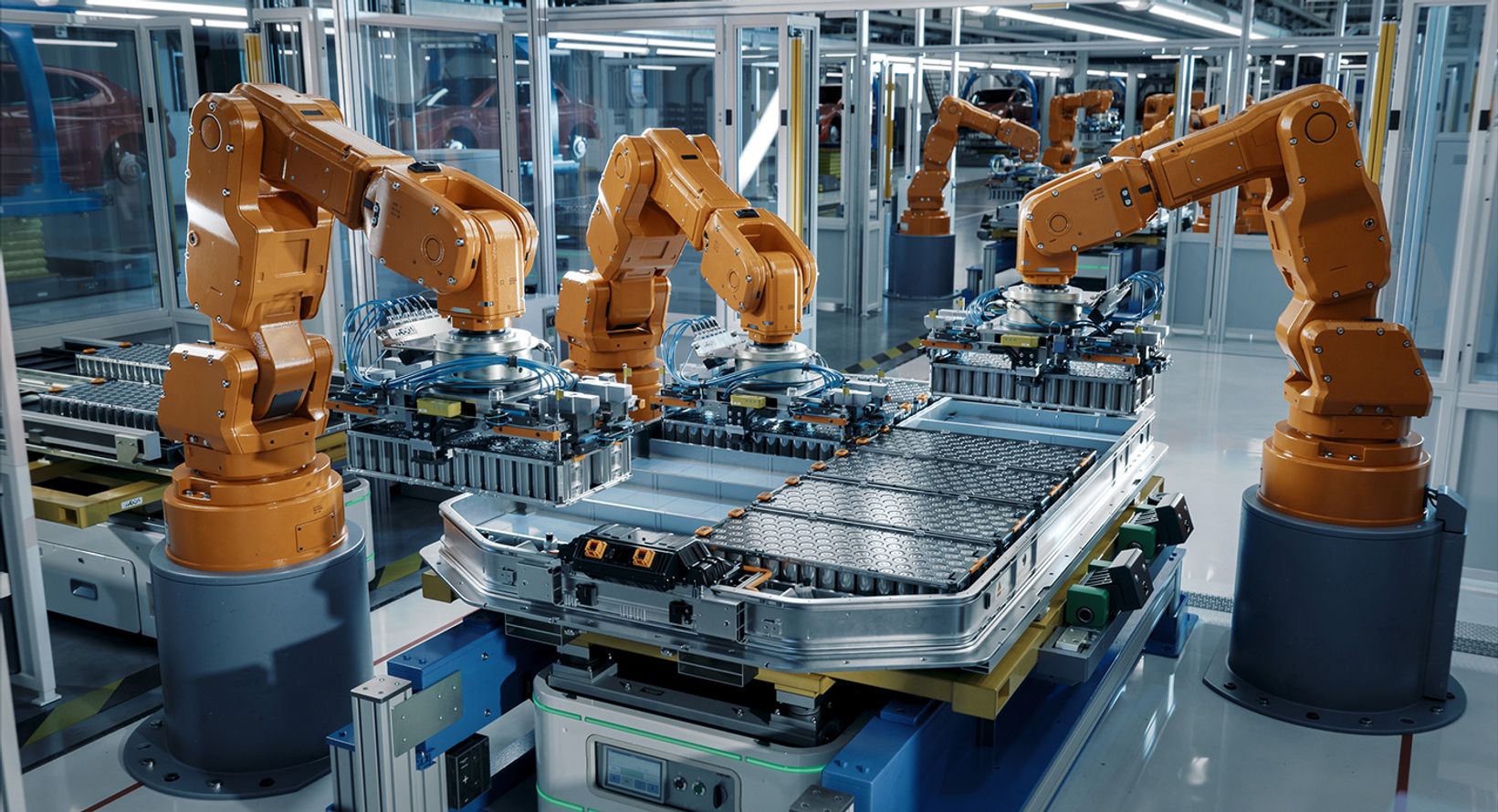

Growth in Electric Vehicle (EV) Battery Distribution

The surge in EV adoption is creating new opportunities in the wholesale battery sector, particularly for lithium-ion (Li-ion) battery packs and replacement modules. By 2026, wholesale networks are expected to expand to include EV-specific battery components, including modular packs, battery management systems (BMS), and refurbished units. Distributors are forming strategic partnerships with battery recyclers and second-life battery providers to offer cost-effective solutions for fleet operators and independent repair shops, contributing to a circular economy in the automotive battery space.

Expansion of Aftermarket and E-Commerce Channels

The automotive aftermarket is a critical driver of wholesale car battery sales. By 2026, e-commerce platforms are expected to play a dominant role in wholesale distribution, enabling faster delivery, real-time inventory tracking, and broader geographic reach. B2B digital marketplaces are streamlining procurement for auto repair shops and fleet managers, reducing lead times and improving supply chain efficiency. Additionally, data analytics and AI-powered inventory systems are helping wholesalers forecast demand more accurately, minimizing overstock and stockouts.

Sustainability and Regulatory Pressures

Environmental regulations are increasingly influencing the wholesale car battery market. By 2026, stricter mandates on battery recycling, carbon emissions, and material sourcing will require wholesalers to adopt sustainable practices. The European Union’s Battery Regulation and similar policies in North America and Asia are pushing for higher recycling rates and transparency in supply chains. As a result, wholesalers are prioritizing partnerships with certified recyclers and investing in closed-loop recycling systems to remain compliant and appeal to eco-conscious customers.

Regional Market Diversification

Market growth will vary significantly by region. Asia-Pacific, led by China and India, is expected to be the fastest-growing region due to rising vehicle ownership and infrastructure development. In contrast, North America and Europe will see increased demand for premium and specialty batteries, driven by aging vehicle fleets and high adoption of advanced driver-assistance systems (ADAS). Wholesalers are adapting by localizing inventory, offering region-specific product lines, and complying with regional safety and environmental standards.

Price Volatility and Raw Material Challenges

The wholesale car battery market will continue to face price fluctuations due to volatility in raw material costs, particularly lithium, cobalt, and lead. Geopolitical tensions and supply chain disruptions may affect availability and pricing through 2026. To mitigate risks, wholesalers are diversifying suppliers, entering long-term contracts, and exploring alternative chemistries such as lithium iron phosphate (LFP), which offer lower costs and improved safety.

Conclusion

By 2026, the wholesale car battery market will be shaped by a dual demand for traditional and advanced battery technologies, digital transformation in distribution, and increasing regulatory scrutiny. Success will depend on agility, sustainability, and strategic investment in logistics and technology. Wholesalers who adapt to these trends will be well-positioned to capitalize on the evolving automotive energy landscape.

Common Pitfalls When Sourcing Wholesale Car Batteries (Quality and Intellectual Property)

Sourcing wholesale car batteries can be a lucrative business venture, but it comes with several risks—particularly concerning product quality and intellectual property (IP) issues. Understanding and avoiding these common pitfalls is essential for building a reliable and legally compliant supply chain.

Poor Quality Control

One of the most significant challenges when sourcing wholesale car batteries is ensuring consistent quality. Many suppliers, especially from regions with less stringent manufacturing regulations, may offer batteries that appear identical to reputable brands but are made with substandard materials.

- Inconsistent Performance: Low-quality batteries may have reduced cold-cranking amps (CCA) or shorter lifespans, leading to customer dissatisfaction and high return rates.

- Safety Risks: Poorly manufactured batteries can leak, overheat, or even explode under stress, posing safety hazards and potential liability.

- Lack of Certification: Reputable batteries should meet international standards (e.g., ISO, CE, SAE). Suppliers may falsify certifications or omit them entirely.

Solution: Always request third-party test reports, conduct factory audits, and start with small trial orders to evaluate performance before scaling up.

Counterfeit and IP-Infringing Products

The car battery market is rife with counterfeit goods that mimic well-known brands such as Optima, Interstate, or Bosch. These knock-offs not only violate intellectual property rights but also damage your brand reputation.

- Trademark Infringement: Selling batteries with logos or branding that resemble established companies can lead to legal action, product seizures, or fines.

- Patent Violations: Some battery designs, technologies (e.g., AGM or gel cell), or casing innovations are patented. Unauthorized replication can result in IP litigation.

- Gray Market Goods: Some suppliers offer “genuine” branded batteries at suspiciously low prices—these may be stolen, expired, or diverted goods not intended for your market.

Solution: Verify suppliers’ authorization to distribute branded products. Use legal agreements that include IP indemnification clauses and avoid suppliers offering “branded” batteries at prices too good to be true.

Misleading Specifications and Labeling

Many wholesale suppliers exaggerate battery performance metrics on packaging or in product listings.

- Overstated Capacity or CCA: Some batteries are labeled with inflated amp-hour (Ah) or CCA ratings that do not reflect real-world performance.

- False Marketing Terms: Terms like “maintenance-free” or “long-life” may be used without standardized backing.

- Lack of Transparency: Missing or vague information about chemistry (lead-acid, AGM, lithium), warranty, or manufacturing date.

Solution: Request independent lab testing, compare specifications with industry benchmarks, and include detailed performance clauses in purchase agreements.

Unreliable Supply Chain and Logistics

Even if the initial product quality is acceptable, inconsistent supply can disrupt operations.

- Inconsistent Batch Quality: Different production batches may vary significantly in quality due to poor process control.

- Long Lead Times and Delays: Especially with overseas suppliers, shipping delays or customs issues can impact inventory and customer satisfaction.

- Lack of After-Sales Support: Poor warranty handling or refusal to replace defective units increases long-term costs.

Solution: Establish clear service-level agreements (SLAs), work with suppliers who offer warranties, and maintain relationships with multiple vendors to mitigate risk.

Conclusion

Sourcing wholesale car batteries requires due diligence to avoid pitfalls related to quality and intellectual property. Conduct thorough supplier vetting, verify certifications, protect against IP risks, and prioritize transparency and reliability in your supply chain. By doing so, you can build a sustainable and trustworthy business in the competitive automotive battery market.

Logistics & Compliance Guide for Wholesale Car Battery Distribution

Overview

Distributing car batteries at the wholesale level involves complex logistics and strict regulatory compliance due to the hazardous nature of lead-acid batteries. This guide outlines key considerations for safe, legal, and efficient operations.

Transportation & Handling

Proper handling and transportation are essential to prevent leaks, spills, and damage.

– Use UN-certified packaging designed for lead-acid batteries.

– Ensure batteries are securely fastened and upright during transit to avoid electrolyte leakage.

– Avoid stacking non-reinforced pallets; limit vertical stacking to manufacturer-recommended levels.

– Train staff in safe manual handling techniques to reduce injury risk.

– Implement spill containment protocols, including absorbent materials and neutralizing agents on-site and in transport vehicles.

Regulatory Compliance

Wholesale battery distributors must comply with federal, state, and international regulations.

– DOT (Department of Transportation) Regulations (49 CFR): Classify lead-acid batteries as Class 8 corrosive hazardous materials if they contain free liquid electrolyte. Proper labeling, placarding, and shipping documentation are required.

– EPA Battery Management Standards: Comply with the U.S. Environmental Protection Agency’s standards under the Resource Conservation and Recovery Act (RCRA) for handling, storage, and disposal.

– State Regulations: Many states (e.g., California, New York) have additional battery recycling and handling laws. Verify local requirements for registration and reporting.

– REACH & RoHS (for International Trade): Ensure compliance when importing/exporting batteries into the EU or other regions with chemical and hazardous substance restrictions.

Storage Requirements

Safe storage minimizes fire, chemical exposure, and environmental risks.

– Store in a dry, well-ventilated, temperature-controlled facility away from direct sunlight.

– Use non-conductive, acid-resistant shelving or pallets with spill containment trays.

– Separate batteries from incompatible materials (e.g., flammables, oxidizers).

– Clearly label storage areas with hazard signs (e.g., corrosive, electrical hazard).

– Conduct regular inspections for case damage, leaks, or terminal corrosion.

Recycling & Return Programs

Wholesale distributors often manage take-back programs as part of compliance and customer service.

– Partner with certified battery recyclers adhering to EPA and state standards.

– Maintain detailed records of battery returns, including quantities, dates, and destination recyclers.

– Offer reverse logistics solutions for retailers and installers to return used batteries.

– Ensure transportation of spent batteries complies with hazardous waste rules (e.g., manifesting under RCRA).

Documentation & Recordkeeping

Accurate documentation supports compliance and traceability.

– Maintain Safety Data Sheets (SDS) for all battery types.

– Keep shipping manifests, recycling certificates, and regulatory filings for at least three years.

– Track inventory using a system that logs lot numbers, dates, and customer shipments for recalls or audits.

– Use electronic record management systems where possible for efficiency and audit readiness.

Training & Safety

Employee preparedness reduces risk and enhances operational reliability.

– Conduct regular training on hazardous material handling, emergency response, and PPE use.

– Provide staff with acid-resistant gloves, goggles, face shields, and aprons.

– Post emergency procedures, including acid spill response and first aid.

– Perform drills for fire, spill, and exposure incidents at least annually.

Carrier & Third-Party Coordination

Selecting compliant logistics partners is critical.

– Use carriers with HAZMAT certification and experience in battery transport.

– Verify carriers’ insurance coverage and safety records.

– Include compliance clauses in contracts, requiring adherence to DOT and EPA standards.

– Audit third-party logistics (3PL) providers regularly for storage and handling practices.

Final Recommendations

- Stay updated on regulatory changes through industry groups like the Battery Council International (BCI).

- Invest in automation and tracking technology to improve inventory and compliance management.

- Build relationships with certified recyclers and logistics partners for seamless operations.

- Conduct periodic internal audits to ensure ongoing compliance and safety.

Note: This guide provides general guidance. Always consult legal and regulatory experts for jurisdiction-specific compliance.

In conclusion, sourcing wholesale car batteries requires careful consideration of several key factors to ensure profitability, reliability, and long-term success. It is essential to partner with reputable suppliers or manufacturers who offer high-quality, durable batteries that meet industry standards. Conducting thorough market research helps identify demand trends, competitive pricing, and preferred battery types in your target region. Additionally, evaluating logistics, warranty terms, minimum order quantities, and after-sales support can significantly impact your bottom line and customer satisfaction.

Establishing strong relationships with suppliers, negotiating favorable terms, and staying updated on technological advancements—such as AGM or lithium-ion options—will give your business a competitive edge. Sustainability and proper recycling programs are also increasingly important, both for compliance and brand reputation. By implementing a strategic sourcing approach, businesses can secure cost-effective, reliable inventory that meets customer needs while building a sustainable and profitable operation in the growing automotive battery market.