The global automotive supplier market is expanding rapidly, driven by rising demand for advanced components, electrification, and just-in-time manufacturing processes. According to Mordor Intelligence, the automotive parts and accessories market is projected to grow at a CAGR of over 4.8% from 2024 to 2029, with key vehicle manufacturers like Toyota relying heavily on a tightly integrated network of tier-1 and tier-2 vendors to maintain production efficiency and innovation. As Toyota continues to lead in hybrid technology and lean manufacturing, its vendor ecosystem plays a critical role in delivering high-quality, cost-effective components at scale. These manufacturers—ranging from electronics and powertrain specialists to body and chassis suppliers—are strategically selected based on performance data, geographic proximity, and technological capability. Based on supply chain analyses, production volume metrics, and OEM partnership depth, the following seven companies emerge as Toyota’s most influential vendors, shaping the backbone of its global manufacturing success.

Top 7 Who Is Toyota Vendor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Toyota Boshoku Corporation

Domain Est. 2004

Website: toyota-boshoku.com

Key Highlights: As an interior system supplier and filter manufacturer, we aim to be a truly global company, Toyota Boshoku Corporation….

#2 New Cars, Trucks, SUVs & Hybrids

Domain Est. 1994

Website: toyota.com

Key Highlights: Explore the newest Toyota trucks, cars, SUVs, hybrids and minivans. See photos, compare models, get tips, calculate payments, and more….

#3 Toyota Industries Corporation

Domain Est. 2000

Website: toyota-industries.com

Key Highlights: Since its foundation in 1926, Toyota Industries has provided innovative products, leading changes in the times for 90 years. Today, Toyota Industries has ……

#4 Toyota Tsusho Corporation

Domain Est. 2006

Website: toyota-tsusho.com

Key Highlights: We, the Toyota Tsusho Group, deliver to countries around the world a diverse range of products and services essential for building prosperous and ……

#5 Toyota Motor Corporation Official Global Website

Website: global.toyota

Key Highlights: Toyota Motor Corporation Official Global Website―company, ir, newsroom, mobility, sustainability….

#6 75 Years of TOYOTA

Domain Est. 2006

Website: toyota-global.com

Key Highlights: Toyota Auto Body Co., Ltd. Vehicle body manufacture. Toyota Tsusho Corporation. Machinery, vehicle bodies, material chemicals, vehicle interior materials….

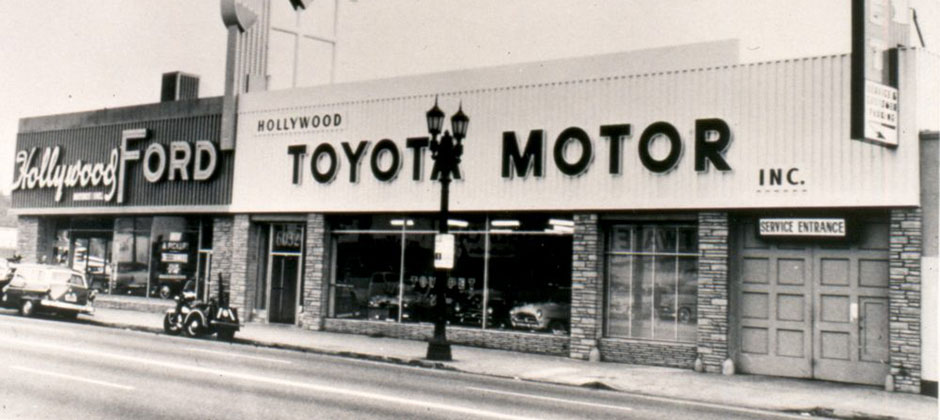

#7 Company History

Domain Est. 1994

Website: pressroom.toyota.com

Key Highlights: Toyota Motor Distributors is founded as the distribution and marketing arm of Toyota Motor Sales. Distribution agreement signed with Service Motor Company (now ……

Expert Sourcing Insights for Who Is Toyota Vendor

H2: 2026 Market Trends for Toyota Vendors

As the automotive industry undergoes rapid transformation driven by electrification, digitalization, and supply chain reconfiguration, Toyota vendors are expected to face significant shifts by 2026. Vendors supplying parts, technology, and services to Toyota—officially known as members of the Toyota Supply Chain or part of the Toyota Group network—will need to adapt to emerging market dynamics. Below are key trends projected to shape the landscape for Toyota vendors in 2026:

-

Accelerated Shift Toward Electrification

By 2026, Toyota is expected to expand its battery electric vehicle (BEV) and hybrid lineup globally. Vendors specializing in internal combustion engine (ICE) components may see reduced demand, while those providing batteries, electric motors, power electronics, and charging infrastructure components will experience increased opportunities. Toyota’s commitment to carbon neutrality by 2050 will drive vendors to innovate in sustainable materials and low-emission manufacturing processes. -

Increased Demand for Semiconductor and Software Solutions

As Toyota integrates more advanced driver-assistance systems (ADAS), connected car features, and over-the-air (OTA) updates, vendors in the semiconductor, AI, and software domains will become increasingly critical. Collaborations with tech-focused suppliers and investments in digital twin technologies, cybersecurity, and data analytics will be essential for vendors to remain competitive. -

Localization and Supply Chain Resilience

Geopolitical uncertainties and past disruptions (e.g., chip shortages, pandemic fallout) have prompted Toyota to prioritize supply chain localization. By 2026, vendors located in or near key production hubs—such as North America, Southeast Asia, and Europe—will have a strategic advantage. Toyota is likely to favor suppliers with dual sourcing capabilities, just-in-time (JIT) adaptability, and robust risk management systems. -

Sustainability and ESG Compliance Requirements

Environmental, Social, and Governance (ESG) standards will become non-negotiable for Toyota vendors. Expect stricter requirements for carbon footprint reporting, use of recycled materials, energy-efficient production, and ethical labor practices. Vendors that achieve certifications such as ISO 14001 or align with Toyota’s Environmental Challenge 2050 goals will be preferred partners. -

Adoption of AI and Smart Manufacturing

Toyota’s continued investment in smart factories and Industry 4.0 technologies will push vendors to modernize their operations. Integration of AI-driven quality control, predictive maintenance, and automated logistics will be expected. Vendors leveraging IoT and real-time data sharing with Toyota’s production systems will gain efficiency and reliability advantages. -

Growth in Aftermarket and Mobility Services

As Toyota expands into mobility-as-a-service (MaaS), car-sharing, and fleet solutions, vendors providing durable components, telematics, and aftermarket support will see new revenue streams. Partnerships supporting circular economy models—such as remanufactured parts and battery recycling—will become increasingly valuable.

In summary, Toyota vendors in 2026 must be agile, technologically advanced, and sustainability-focused. Those that align with Toyota’s long-term vision of innovation, resilience, and environmental stewardship will be best positioned for growth and partnership longevity.

Common Pitfalls When Sourcing Who Is Toyota Vendor (Quality, IP)

When organizations attempt to identify or source information about Toyota’s vendor network, they often encounter significant challenges—particularly concerning quality expectations and intellectual property (IP) protection. Missteps in this process can lead to compliance issues, reputational damage, or legal risks. Below are key pitfalls to avoid:

Misunderstanding Toyota’s Tiered Supplier Structure

Many companies assume that becoming a direct (Tier 1) supplier to Toyota is the only path to engagement. However, Toyota operates a complex multi-tier supply chain. Attempting to bypass proper channels or misrepresenting capabilities to gain access can damage credibility. Suppliers must align with the appropriate tier based on capacity, quality systems, and technical capability.

Overlooking Toyota’s Stringent Quality Standards (e.g., TQS)

Toyota enforces rigorous quality requirements through its Toyota Quality System (TQS), which goes beyond standard ISO certifications. Organizations that fail to invest in robust quality management systems—such as error-proofing (poka-yoke), root cause analysis, and continuous improvement (kaizen)—often struggle to meet Toyota’s expectations. Assuming that standard industry practices are sufficient is a common and costly mistake.

Ignoring the Importance of Long-Term Relationship Building

Toyota values long-term, collaborative partnerships over transactional relationships. Companies that approach sourcing as a one-time sale or fail to commit to ongoing improvement may be disqualified. Trust, transparency, and a willingness to co-develop solutions are essential—but often underestimated—factors in becoming a trusted vendor.

Underestimating Intellectual Property (IP) Risks

Disclosing proprietary technology or design information without proper IP safeguards is a major pitfall. Toyota typically requires detailed technical data during the qualification process, but suppliers must ensure that IP is protected through well-drafted NDAs, clear ownership agreements, and documentation of background IP. Assuming that sharing information freely will improve chances of selection can expose companies to IP theft or unintended licensing.

Failing to Comply with Toyota’s Ethical and Sustainability Requirements

Toyota mandates strict adherence to its Global Supplier Guideline, which includes environmental, labor, and business ethics standards. Companies that neglect compliance in areas like conflict minerals, carbon emissions, or workplace safety may be disqualified—even if their product quality is high. Viewing these requirements as secondary to technical capability is a critical oversight.

Relying on Unverified or Third-Party Claims About Vendor Status

Some companies falsely claim to be “official Toyota vendors” to enhance credibility. Attempting to source or verify vendors through unofficial channels or unverified directories can lead to partnerships with non-compliant or fraudulent entities. Always use Toyota’s official supplier portals or direct engagement processes for validation.

Neglecting Continuous Improvement and On-Site Audits

Toyota regularly conducts on-site audits and expects suppliers to demonstrate ongoing improvement (kaizen). Organizations that achieve initial qualification but then stagnate in quality or delivery performance risk termination. Complacency after onboarding is a frequent downfall.

Avoiding these pitfalls requires thorough due diligence, respect for Toyota’s operational philosophy (The Toyota Way), and a commitment to excellence in both quality and ethics. Engaging legal and compliance experts early—especially regarding IP—can protect your business while building a credible pathway to supplier status.

Logistics & Compliance Guide for Toyota Vendors

This guide outlines key logistics and compliance requirements for suppliers (vendors) doing business with Toyota. Adhering to these standards ensures smooth operations, regulatory compliance, and alignment with Toyota’s global quality and sustainability goals.

1. Supplier Onboarding and Registration

All vendors must complete Toyota’s official supplier registration process. This includes providing company details, quality certifications, and compliance documentation. Vendors will be assigned a unique Toyota Supplier Code and must maintain up-to-date information in Toyota’s supplier portal.

2. Quality Management System (QMS) Requirements

Toyota mandates adherence to IATF 16949 standards for automotive production and related service parts. Vendors must:

- Maintain a certified Quality Management System.

- Conduct regular internal audits and management reviews.

- Implement corrective and preventive actions (CAPA) for non-conformances.

- Submit Production Part Approval Process (PPAP) documentation when required.

3. Logistics and Delivery Standards

Timely and accurate delivery is critical. Vendors must comply with:

- Just-In-Time (JIT) and Just-In-Sequence (JIS) requirements: Deliver parts according to Toyota’s production schedule.

- Kanban System: Use designated Kanban signals for replenishment where applicable.

- Packaging Standards: Use Toyota-approved packaging that ensures part protection, traceability, and efficient handling.

- Labeling: Apply barcodes and labels per Toyota’s specifications (e.g., RFID, 2D barcodes).

- Delivery Schedules: Adhere strictly to delivery windows; late or early deliveries may be rejected.

4. Import/Export and Trade Compliance

For international vendors:

- Comply with customs regulations in both origin and destination countries.

- Provide accurate Harmonized System (HS) codes and commercial invoices.

- Follow U.S. (CBP), EU (Customs Union), and other regional import/export rules.

- Maintain records for audits (minimum 5 years).

- Comply with Toyota’s Restricted Substance List (RSL) and environmental regulations (e.g., REACH, RoHS).

5. Traceability and Documentation

Full traceability from raw material to finished part is required:

- Maintain lot/batch/serial number tracking.

- Provide Certificates of Compliance (CoC) and material test reports upon request.

- Support Toyota’s recall and field action processes with timely traceability data.

6. Sustainability and Environmental Compliance

Toyota vendors must:

- Comply with Toyota’s Global Vision for Sustainability.

- Minimize waste and emissions across operations.

- Report environmental performance metrics (e.g., CO2 emissions, energy use).

- Use conflict-free minerals and sustainable raw materials where applicable.

7. Cybersecurity and Data Protection

Vendors handling Toyota data must:

- Protect sensitive information per Toyota’s Information Security Policy.

- Implement secure data transfer protocols.

- Comply with data privacy laws (e.g., GDPR, CCPA).

- Report data breaches immediately.

8. Continuous Improvement and Audits

Toyota conducts regular logistics, quality, and compliance audits. Vendors are expected to:

- Participate in Toyota-led assessments (on-site or remote).

- Address audit findings promptly.

- Engage in continuous improvement initiatives (e.g., Kaizen, TPS principles).

9. Incident Reporting and Escalation

Any disruption—quality defect, logistics delay, or compliance issue—must be reported immediately to the designated Toyota contact using Toyota’s escalation protocols.

10. Contact and Support

For logistics or compliance inquiries, contact your Toyota Supplier Quality Engineer (SQE) or Logistics Coordinator. Refer to the Toyota Supplier Portal for forms, updates, and training materials.

Note: Requirements may vary by region and product line. Always refer to the latest Toyota Supplier Quality Assurance Criteria (SQAM) and logistics manuals applicable to your contract.

Conclusion: Sourcing and Toyota’s Vendor Network

Toyota’s success in maintaining high-quality standards, operational efficiency, and innovation is closely tied to its strategic sourcing and well-developed vendor network. The company relies on a carefully selected group of global and local suppliers—often referred to as part of the Toyota Production System (TPS) and the Keiretsu model—who are deeply integrated into its manufacturing and development processes. These vendors are chosen based on rigorous criteria, including quality, reliability, cost-efficiency, and commitment to continuous improvement (Kaizen).

Toyota emphasizes long-term partnerships over transactional relationships, fostering collaboration, shared technology, and joint problem-solving with its suppliers. Key vendors include major automotive component manufacturers such as Denso, Aisin, and Toyoda Iron Works—many of which are part of the Toyota Group—and a broader network of third-party suppliers across the globe.

In conclusion, Toyota’s vendor sourcing strategy is a cornerstone of its competitive advantage. By building strong, cooperative relationships with a trusted network of suppliers and maintaining strict oversight and support, Toyota ensures supply chain resilience, innovation, and adherence to its renowned standards of quality and efficiency. Understanding who Toyota’s vendors are involves recognizing not just their identities, but the philosophy and mutual commitment that underpin their collaboration.