The global gallium metal market is experiencing robust growth, driven by increasing demand in semiconductor applications, LED production, and emerging technologies such as 5G and power electronics. According to Mordor Intelligence, the gallium market is projected to grow at a CAGR of over 7.2% from 2023 to 2028, fueled by rising adoption of gallium arsenide (GaAs) and gallium nitride (GaN) in high-frequency and energy-efficient devices. As of 2024, Asia-Pacific dominates both production and consumption, benefiting from concentrated refining capabilities in China and Japan, alongside growing electronics manufacturing in South Korea and Taiwan. With supply chains tightening and demand surging—particularly for high-purity (99.999% and above) gallium—sourcing from reliable, vertically integrated manufacturers has become critical for procurement teams. This report identifies the top nine manufacturers and suppliers of gallium metal worldwide, evaluating them on purity standards, production capacity, geographic reach, and compliance with environmental and export regulations to support strategic sourcing decisions.

Top 9 Where To Buy Gallium Metal Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 High-Purity Gallium Metal

Domain Est. 1993

Website: goodfellow.com

Key Highlights: Free deliveryGoodfellow supplies 4N to 6N Purity Gallium (Ga) materials in pellet form for advanced industrial, scientific, and research applications. Browse our range!…

#2 Supplier of Gallium (Ga) for industry

Domain Est. 2003

Website: altichem.com

Key Highlights: Altichem is the supplier you need for the purchase of Gallium (Ga) for industry. Ask Altichem, an expert in trading industrial chemicals in Europe, ……

#3 Gallium Products

Domain Est. 2006

Website: neomaterials.com

Key Highlights: Neo Rare Metals are global gallium manufacturers. We manufacture and distribute gallium in North America, Europe, China, Japan and Korea….

#4 Gallium

Domain Est. 1995

Website: indium.com

Key Highlights: Indium Corporation sells gallium compounds, including gallium trichloride and gallium oxide used in manufacturing a number of high-tech ……

#5 Gallium (Ga)

Domain Est. 1995

Website: fishersci.com

Key Highlights: 4–8 day delivery · 30-day returnsBrowse a full range of Gallium (Ga) products from leading suppliers. Shop now at Fisher Scientific for all of your scientific needs….

#6 Gallium

Domain Est. 1996

Website: stanfordmaterials.com

Key Highlights: Stanford Advanced Materials (SAM) offers high-quality Gallium Nitride Powder at the most competitive price. We have two decades’ experience in supplying metal ……

#7 Gallium Suppliers

Domain Est. 1998

Website: americanelements.com

Key Highlights: Gallium qualified commercial & research quantity preferred supplier. Buy at competitive price & lead time. In-stock for immediate delivery….

#8 Gallium

Domain Est. 2004

Website: en.vitalchem.com

Key Highlights: Vital Materials supplies high-purity gallium used across the compound semiconductor industry, supporting advanced devices based on GaAs, GaN, and GaSb….

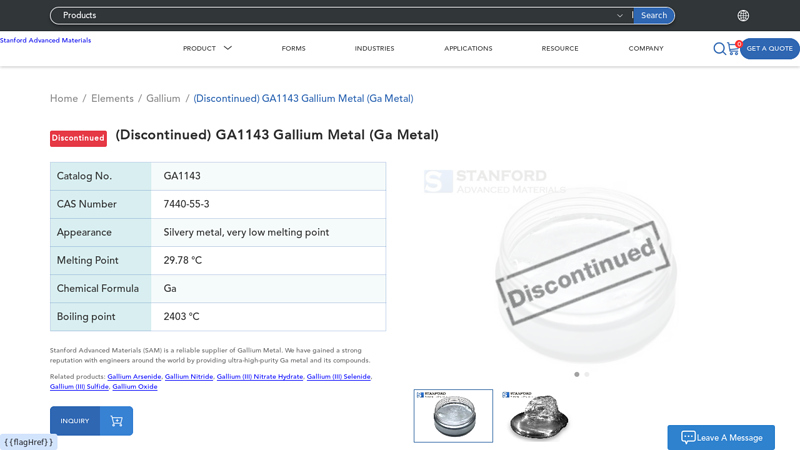

#9 Gallium Metal (Ga Metal)

Domain Est. 2013

Website: samaterials.com

Key Highlights: Starting from $100.00 In stockSAM is a respected supplier of gallium metal around the world. We provide ultra-high purity gallium metal (up to99.999999%) at competitive prices….

Expert Sourcing Insights for Where To Buy Gallium Metal

H2: 2026 Market Trends for Where to Buy Gallium Metal

As we approach 2026, the global market for gallium metal is undergoing significant transformation driven by technological advancements, supply chain realignments, and growing demand in high-tech industries. Gallium, once a niche byproduct of aluminum and zinc processing, is now a critical material in semiconductors, optoelectronics, and renewable energy technologies. Understanding where to buy gallium metal in 2026 requires an analysis of evolving sourcing patterns, geopolitical dynamics, and industry-specific demand drivers.

1. Rising Demand in Semiconductor and 5G Technologies

The primary driver of gallium demand in 2026 is its use in gallium nitride (GaN) and gallium arsenide (GaAs) semiconductors. These materials are essential for high-frequency, high-efficiency devices used in 5G infrastructure, electric vehicles (EVs), and power electronics. As GaN-based power devices gain market share over traditional silicon components, demand for primary gallium metal is projected to grow at a compound annual growth rate (CAGR) of 8–10%. Buyers are increasingly sourcing gallium directly from producers with certified high-purity (6N to 7N) capabilities to meet manufacturing standards.

2. Shift in Supply Chain Geography

Historically, China has dominated gallium production, accounting for over 90% of global supply. However, in 2026, strategic diversification efforts are reshaping procurement channels. Due to export restrictions and supply security concerns, countries like the U.S., Japan, and members of the European Union are investing in domestic refining and recycling initiatives. As a result, buyers are turning to emerging suppliers in Canada (e.g., 5N Plus), Germany (H.C. Starck), and South Korea, where ethical sourcing and supply chain transparency are prioritized.

3. Growth of Gallium Recycling and Secondary Supply

With limited natural reserves and environmental concerns, recycling gallium from semiconductor manufacturing waste and end-of-life electronics is gaining momentum. In 2026, recycled gallium is expected to meet up to 25% of global demand. Buyers are increasingly purchasing from specialized recyclers and integrated material companies that offer closed-loop supply models, particularly in the EU and North America where circular economy policies are enforced.

4. Digital Procurement Platforms and Market Transparency

The process of buying gallium metal is becoming more streamlined through B2B digital platforms and commodity exchanges. Companies like Metal.com and specialized chemical marketplaces now provide real-time pricing, certification tracking, and secure logistics for high-purity gallium. These platforms are helping smaller tech firms and research institutions access reliable sources without long-term contracts, increasing market participation.

5. Regulatory and ESG Considerations

Environmental, Social, and Governance (ESG) standards are now critical factors in procurement decisions. Buyers in 2026 prefer suppliers that provide auditable sourcing records, low-carbon production methods, and compliance with initiatives like the Responsible Minerals Initiative (RMI). This trend is pushing traditional producers to improve traceability and sustainability, influencing where and how gallium is purchased.

Conclusion

In 2026, the market for purchasing gallium metal is characterized by diversification, technological urgency, and heightened sustainability standards. Buyers are advised to source from geopolitically stable regions, prioritize certified high-purity suppliers, and consider partnerships with recyclers to ensure supply resilience. As gallium becomes increasingly vital to next-generation technologies, strategic procurement will be key to maintaining competitive advantage.

Common Pitfalls Sourcing Gallium Metal: Quality and Intellectual Property Risks

Sourcing gallium metal requires careful due diligence to avoid significant quality and intellectual property (IP) pitfalls. As a critical material used in semiconductors, photovoltaics, and advanced alloys, the consequences of poor sourcing decisions can include production delays, product failures, legal disputes, and reputational damage.

Quality-Related Pitfalls

1. Inadequate Purity Verification

Many suppliers advertise high-purity gallium (e.g., 99.99%, 5N), but actual purity may fall short due to insufficient analytical testing or misleading labeling. Key impurities like zinc, copper, silicon, and iron can drastically impact performance in semiconductor applications. Always insist on independent, certified test reports (e.g., ICP-MS, GDMS) from reputable third-party labs rather than relying on supplier-provided certificates of analysis (CoA) alone.

2. Contamination During Handling and Packaging

Gallium is highly reactive with certain materials and prone to surface oxidation. Poor handling practices—such as using non-inert containers, improper sealing, or exposure to moisture—can introduce contaminants or form oxides that compromise material integrity. Ensure suppliers use high-purity plastic or glass containers under inert atmosphere (e.g., argon) and maintain cleanroom-grade packaging environments.

3. Inconsistent Physical Form and Homogeneity

Gallium may be supplied as ingots, pellets, or liquid, but inconsistent form or poor homogeneity can affect downstream processing. For example, inhomogeneous distribution of trace elements in an ingot can lead to uneven doping in epitaxial growth. Verify that the supplier controls solidification processes and provides material with consistent physical properties.

4. Lack of Traceability and Batch Control

Without full traceability from mine to final product, it’s difficult to diagnose quality issues or ensure regulatory compliance. Reputable suppliers should provide batch-specific documentation, including origin of raw materials, processing history, and quality control records. Absence of such data increases the risk of receiving adulterated or non-compliant material.

Intellectual Property-Related Pitfalls

1. Unlicensed or Illegally Sourced Material

Gallium is often a byproduct of aluminum or zinc processing, and in some regions, its extraction and sale are subject to strict environmental and export controls. Sourcing from unlicensed or informal suppliers may involve material obtained in violation of national regulations or IP-protected refining processes. This poses legal risks and can lead to supply chain disruptions or customs seizures.

2. Exposure to Proprietary Process Information

When working with smaller or less-established suppliers, there may be pressure to disclose sensitive application details or processing requirements. Unscrupulous vendors could misuse this information to reverse engineer proprietary technologies or target your customers. Always use non-disclosure agreements (NDAs) and limit technical disclosures to what is strictly necessary.

3. Infringement via Counterfeit or Recycled Material

Some suppliers may offer “virgin” gallium that is actually recycled or reclaimed from electronic waste without proper purification. If this material contains residues of patented compounds or alloys, its use could inadvertently infringe on third-party IP. Additionally, counterfeit gallium—such as gallium alloys misrepresented as pure—can lead to both performance issues and legal exposure.

4. Weak Contractual Protections

Generic supply agreements often fail to address IP ownership, confidentiality, and liability for IP infringement. Ensure contracts explicitly state that the supplier warrants the material is free from third-party IP claims, indemnifies the buyer against such claims, and respects confidentiality obligations throughout the relationship.

To mitigate these risks, prioritize suppliers with proven compliance records, transparent sourcing practices, and strong IP governance. Conduct on-site audits when possible and consider using specialized procurement intermediaries with expertise in critical materials.

Where To Buy Gallium Metal: Logistics & Compliance Guide

Purchasing gallium metal—whether for research, industrial applications, or electronics manufacturing—requires careful attention to logistics and regulatory compliance due to its classification as a strategic material and potential dual-use concerns. This guide outlines the essential steps and considerations for sourcing gallium metal responsibly and efficiently.

Understand Gallium Regulations and Restrictions

Gallium is subject to export controls in several countries, especially in its refined form, due to its use in semiconductor and defense technologies. The U.S. Department of Commerce’s Bureau of Industry and Security (BIS) includes gallium in the Commerce Control List (CCL), particularly gallium arsenide and gallium nitride compounds, but elemental gallium may also require licensing depending on purity, quantity, and destination. Similarly, the European Union and China regulate gallium exports. Before purchasing, verify the legal requirements in both the exporting and importing countries. A valid export license may be required, especially for shipments outside of approved trade regions.

Choose a Reputable and Compliant Supplier

Select suppliers with a proven track record in handling strategic metals and who provide full documentation, including Certificates of Analysis (CoA), Material Safety Data Sheets (MSDS), and proof of legal sourcing. Reputable suppliers typically operate within regulated markets such as the U.S., Germany, Japan, or South Korea. Avoid unverified online marketplaces or suppliers unable to provide compliance documentation. Ensure the supplier adheres to OECD Due Diligence Guidelines for Responsible Supply Chains of Minerals.

Verify Purity and Form Specifications

Gallium is available in various purities (e.g., 99.99%, 99.999%, 99.9999%) and forms (ingots, pellets, liquid in sealed containers). Confirm that the supplier can meet your technical requirements. High-purity gallium (5N or 6N) often has stricter export controls. Ensure the packaging is appropriate for safe transport—typically sealed under inert atmosphere due to gallium’s tendency to oxidize and its low melting point (29.76°C).

Coordinate International Shipping and Customs Clearance

Engage a freight forwarder experienced in handling controlled materials. Provide complete and accurate documentation, including commercial invoices, packing lists, and export licenses (if applicable). Misdeclaration of gallium as a non-controlled item can lead to shipment delays, fines, or seizure. Classify the product using the correct HS (Harmonized System) code—commonly 8112.99 for unwrought gallium—and include end-use statements if required.

Ensure Safe Handling and Storage Upon Delivery

Gallium is not highly toxic but requires careful handling. It can wet and embrittle certain metals (e.g., aluminum), so store it in plastic or glass containers. Maintain temperatures below its melting point to avoid spillage. Provide staff with safety training and ensure proper ventilation. Dispose of waste in accordance with local environmental regulations.

Maintain Records for Audit and Compliance

Keep detailed records of all transactions, including supplier agreements, shipping documents, licenses, and end-use certifications. These records are essential for audits and regulatory compliance, particularly if your organization is subject to export control laws.

By following these logistics and compliance steps, you can securely and legally source gallium metal while minimizing risks and ensuring smooth operations.

In conclusion, sourcing gallium metal requires careful consideration of purity, quantity, supplier reliability, and compliance with shipping and safety regulations. Reliable sources include specialized chemical suppliers such as Sigma-Aldrich, Alfa Aesar, and American Elements, which offer high-purity gallium for research and industrial applications. Online industrial marketplaces like Alibaba or ThomasNet can provide cost-effective bulk options, particularly from international manufacturers, but require due diligence to verify authenticity and quality. When purchasing, ensure the supplier provides certification of analysis (COA), complies with relevant regulations (e.g., REACH, RoHS), and uses appropriate packaging to prevent leakage. For small or experimental quantities, local scientific supply companies or educational distributors may be suitable. Ultimately, prioritizing reputable suppliers with transparent quality control processes will ensure a safe and effective acquisition of gallium metal for your specific needs.