The global wheel shaft market is experiencing steady growth, driven by rising automotive production and increasing demand for commercial and passenger vehicles. According to a report by Mordor Intelligence, the automotive axle market—closely tied to wheel shaft demand—is projected to grow at a CAGR of over 4.5% from 2024 to 2029. Similarly, Grand View Research valued the global automotive axle market at USD 72.4 billion in 2022 and forecast a CAGR of 5.2% from 2023 to 2030, citing advancements in lightweight materials and the expansion of electric vehicle manufacturing as key growth factors. As OEMs and Tier-1 suppliers prioritize durability, efficiency, and precision engineering, the role of high-performance wheel shafts has become increasingly critical. In this evolving landscape, a select group of manufacturers are leading innovation, scalability, and global supply chain integration—setting the benchmark for quality and reliability in drivetrain components.

Top 10 Wheel Shaft Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

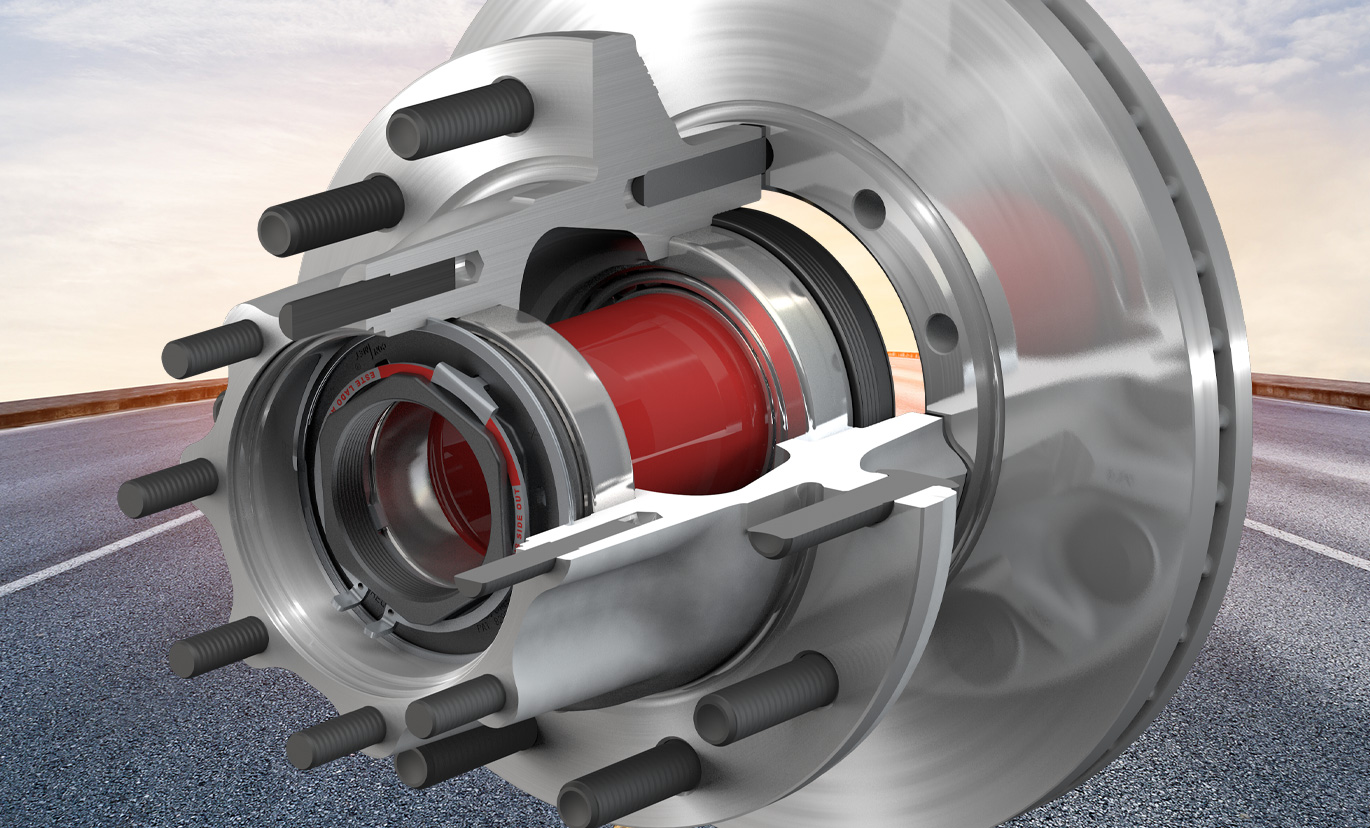

#1 ConMet

Domain Est. 1996

Website: conmet.com

Key Highlights: We supply the commercial vehicle industry with wheel ends, hub assemblies, brake drums, hubs, rotors, aftermarket wheel products & OEM genuine products….

#2 Neapco

Domain Est. 1997

Website: neapco.com

Key Highlights: Neapco is the leading supplier of innovative driveline solutions to Tier One original equipment manufacturers and the global automotive industry….

#3 – ADR Group

Domain Est. 1999

Website: adraxles.com

Key Highlights: ADR GROUP is a market leader in the production of axles, braking systems and suspensions for the agricultural and industrial machines….

#4 Seals, Bearings & Hub Caps for Trucking Industry

Domain Est. 1996

Website: stemco.com

Key Highlights: Put safety first with STEMCO Seals, Bearings & Hub Caps for your fleet. Our products are engineered to save you money and last longer….

#5 Automotive

Domain Est. 1996

Website: nsk.com

Key Highlights: NSK automotive products are now a globally respected brand. Naturally the company supplies a wide variety of bearings, as well as automatic transmission parts….

#6 Driveline

Domain Est. 1997

Website: aam.com

Key Highlights: AAM specializes in the design and manufacture of driveline products, processes and systems, including front axles, rear axles, electric and hybrid driveline ……

#7 GKN Automotive

Domain Est. 2001

Website: gknautomotive.com

Key Highlights: GKN Automotive is a global engineering and manufacturing company dedicated to delivering mass production solutions for mobility….

#8 Dexter Group

Domain Est. 2002

Website: dextergroup.com

Key Highlights: Dexter is the premier supplier of axles, doors, venting products, and related components in the utility trailer, RV, heavy duty, recreational boating, and ……

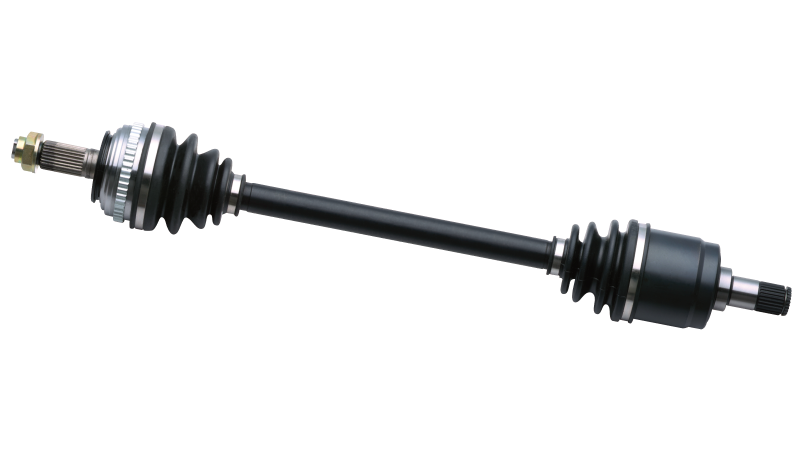

#9 Axle Shafts from Shaftec

Domain Est. 2008

Website: shaftec.com

Key Highlights: Also known as Half Shafts, Axle Shafts are an essential part of a vehicle’s drivetrain. The Axle Shaft transmits rotational power from the transmission into the ……

#10 New Premium CV Axles

Domain Est. 2013

Website: trakmotive.com

Key Highlights: TrakMotive Automotive CV Axles transfer power from the transmission to the drive wheels of a vehicle. They consist of a CV Joint and Drive Shaft….

Expert Sourcing Insights for Wheel Shaft

H2: 2026 Market Trends for Wheel Shaft

The global wheel shaft market is poised for significant transformation by 2026, driven by advancements in automotive technology, evolving regulatory landscapes, and shifting consumer demands. As a critical component of vehicle drivetrains, the wheel shaft sector is adapting to industry-wide shifts toward electrification, lightweight materials, and enhanced performance efficiency.

One of the dominant trends shaping the 2026 wheel shaft market is the rapid growth of electric vehicles (EVs). With automakers globally committing to electrification—such as the EU’s 2035 ICE phase-out and similar initiatives in China and North America—demand for specialized wheel shafts optimized for EV powertrains is rising. Unlike traditional internal combustion engine (ICE) vehicles, EVs often require wheel shafts engineered for higher torque delivery and reduced rotational inertia, prompting innovations in material composition and design.

Lightweighting remains a key driver. Manufacturers are increasingly adopting high-strength steel, aluminum alloys, and composite materials to reduce unsprung mass, improve fuel efficiency (in ICE and hybrid vehicles), and extend EV range. By 2026, the integration of advanced materials is expected to become standard in premium and mass-market vehicles alike, influencing wheel shaft manufacturing processes and supply chains.

Another trend is the increasing use of smart manufacturing and predictive maintenance technologies. With the rise of Industry 4.0, leading suppliers are implementing IoT-enabled monitoring systems to track wheel shaft performance in real time. This enables predictive diagnostics, reduces downtime, and supports the growing demand for reliability in commercial fleets and autonomous vehicles.

Geographically, Asia-Pacific—led by China, India, and Japan—is anticipated to dominate the wheel shaft market in 2026 due to robust automotive production, government support for EV adoption, and expanding infrastructure. Meanwhile, North America and Europe are focusing on high-precision, durable wheel shafts for performance and luxury EVs, driven by stringent safety and emissions standards.

In summary, the 2026 wheel shaft market will be defined by electrification, material innovation, digital integration, and regional production shifts. Companies that invest in R&D, sustainable manufacturing, and strategic partnerships with EV OEMs are likely to gain a competitive edge in this evolving landscape.

Common Pitfalls Sourcing Wheel Shafts: Quality and Intellectual Property Risks

Sourcing wheel shafts, critical components in automotive and industrial applications, presents several challenges, particularly concerning quality consistency and intellectual property (IP) protection. Overlooking these areas can lead to safety hazards, production delays, legal disputes, and reputational damage.

Quality-Related Pitfalls

Inadequate Material Specifications

Procuring wheel shafts without clearly defined material standards (e.g., alloy type, hardness, heat treatment processes) often results in substandard products prone to premature failure. Suppliers may use inferior grades to cut costs, compromising fatigue resistance and load-bearing capacity.

Insufficient Quality Control and Testing

Relying solely on supplier certifications without independent verification—such as non-destructive testing (NDT), dimensional inspections, or metallurgical analysis—can allow defective shafts to enter the supply chain. Lack of on-site audits or process validation increases the risk of undetected manufacturing flaws.

Inconsistent Manufacturing Processes

Variability in forging, machining, and heat treatment processes across suppliers can lead to inconsistent mechanical properties. Without strict process controls and monitoring, even compliant batches may exhibit performance deviations.

Poor Surface Finish and Tolerances

Wheel shafts require precise dimensional tolerances and surface finishes to ensure proper fit, reduce stress concentrations, and prevent wear. Suppliers using outdated equipment or lacking process discipline may deliver components that fail in assembly or service.

Intellectual Property-Related Pitfalls

Unauthorized Reverse Engineering

Some suppliers, particularly in regions with weak IP enforcement, may reverse engineer proprietary shaft designs without permission. This not only violates patents or design rights but also risks compromised performance due to inaccuracies in replication.

Lack of IP Clauses in Contracts

Failing to include explicit IP ownership, confidentiality, and non-disclosure agreements (NDAs) in sourcing contracts exposes original equipment manufacturers (OEMs) to design theft. Suppliers may reuse or resell proprietary designs to competitors.

Grey Market Distribution

Suppliers may produce excess units beyond the agreed volume and sell them on the grey market. This dilutes brand control, introduces counterfeit parts into the supply chain, and can lead to liability issues if substandard copies are used in critical applications.

Weak Traceability and Documentation

Poor documentation of design rights, certifications, and compliance records makes it difficult to defend IP in legal disputes. Without clear audit trails, proving ownership or detecting infringement becomes challenging.

Mitigating these pitfalls requires due diligence in supplier selection, robust contractual protections, rigorous quality audits, and proactive IP management throughout the sourcing lifecycle.

Logistics & Compliance Guide for Wheel Shaft

Overview

A wheel shaft, a critical component in automotive and industrial machinery, requires careful handling throughout the logistics chain to maintain integrity and ensure compliance with international and regional regulations. This guide outlines key considerations for the safe and compliant transportation, storage, and documentation of wheel shafts.

Packaging Requirements

Wheel shafts must be packaged to prevent mechanical damage, corrosion, and contamination during transit. Use protective materials such as rust-inhibiting coatings, VCI (Vapor Corrosion Inhibitor) paper, and wooden or metal crates with cushioning. Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”) and product identification. Ensure packaging complies with ISPM-15 standards if using wooden materials for international shipments.

Transportation Modes

Choose transportation methods based on shaft dimensions, weight, destination, and delivery timelines. For heavy or oversized shafts, flatbed trucks or specialized freight services may be required. In international logistics, intermodal transport (combining road, rail, and sea) is common. Confirm carrier capabilities for secure load lashing and environmental protection, especially in marine or extreme climate routes.

Storage Conditions

Store wheel shafts in a dry, temperature-controlled warehouse to prevent rust and material degradation. Elevate from the floor using pallets and avoid direct contact with moisture or corrosive substances. Implement a first-in, first-out (FIFO) inventory system to minimize aging risks. Regularly inspect stored shafts for signs of damage or corrosion.

Regulatory Compliance

Ensure wheel shafts meet relevant industry standards such as ISO, SAE, or DIN specifications. For export, comply with destination country regulations including CE marking (EU), DOT (USA), or INMETRO (Brazil) as applicable. Adhere to REACH and RoHS directives if shipping to Europe, particularly regarding material composition and restricted substances.

Documentation

Maintain accurate shipping and compliance documentation, including:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– Certificate of Conformity (CoC)

– Material Test Reports (MTR)

– Export license (if required)

Ensure Harmonized System (HS) code 8708.70 (for vehicle axles and shafts) is correctly applied for customs classification.

Hazardous Materials Considerations

While wheel shafts are generally not classified as hazardous, any protective coatings or lubricants used may be subject to transport regulations (e.g., ADR, IATA, IMDG). Declare such substances appropriately and provide Safety Data Sheets (SDS) when required.

Import/Export Controls

Verify if wheel shafts are subject to export controls due to strategic use or dual-use potential (e.g., military applications). Consult national export control lists (e.g., EAR in the U.S.) and obtain necessary licenses when exporting to sanctioned countries or restricted entities.

Traceability & Quality Assurance

Implement a traceability system using batch or serial numbers to track wheel shafts from production to delivery. Maintain quality assurance records to support compliance audits and warranty claims. Align with ISO 9001 or IATF 16949 standards where applicable.

Conclusion

Proper logistics and compliance management for wheel shafts ensures product reliability, regulatory adherence, and customer satisfaction. By following industry best practices in packaging, transport, documentation, and standards compliance, companies can mitigate risks and optimize supply chain performance.

Conclusion for Sourcing Wheel Shaft:

In conclusion, the sourcing strategy for the wheel shaft should focus on balancing cost-efficiency, quality assurance, and supply chain reliability. After evaluating potential suppliers, it is recommended to establish partnerships with vendors that demonstrate strong manufacturing capabilities, adherence to industry standards (such as ISO or TS certifications), and a proven track record of on-time delivery. Conducting regular quality audits and implementing clear performance metrics will ensure long-term reliability. Additionally, maintaining a dual-sourcing approach can mitigate risks related to supply disruptions. By aligning supplier selection with technical specifications and strategic business objectives, the organization can secure a consistent supply of high-quality wheel shafts, supporting overall operational efficiency and product performance.