The global wheel excavator market is experiencing robust growth, driven by rising infrastructure development, urbanization, and increasing demand for versatile and mobile construction equipment. According to a report by Mordor Intelligence, the global excavator market is projected to grow at a CAGR of over 4.8% from 2024 to 2029, with wheel excavators gaining traction due to their maneuverability and suitability for hard-surface operations in urban environments. Similarly, Grand View Research estimates that the global excavator market size was valued at USD 53.6 billion in 2023 and is expected to expand at a CAGR of 4.6% through 2030, supported by technological advancements and the growing preference for eco-friendly, fuel-efficient machinery. Amid this expansion, leading manufacturers are intensifying innovation in hydraulic efficiency, emission control, and smart controls, positioning wheel excavators as critical assets in modern construction fleets. Below, we spotlight the top 10 wheel excavator manufacturers shaping this evolving landscape through technological leadership, global reach, and strong after-sales support.

Top 10 Wheel Excavator Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 MECALAC, Excavators, Loaders, Backhoe Loaders, Dumpers and …

Domain Est. 1999

Website: mecalac.com

Key Highlights: Mecalac is an international manufacturer of wheel excavators, crawler excavators and wheel loaders. So many innovative and compact machines adapted to the wide ……

#2 ESCO® Mining, Construction and Industrial Products

Domain Est. 2016

Website: global.weir

Key Highlights: We engineer and manufacture reliable ESCO® construction excavator and wheel loader buckets, GET, blades and accessories for all applications. Excavators Wheel ……

#3 Bucket-Wheel Excavators

Domain Est. 1995

Website: takraf.com

Key Highlights: TAKRAF Bucket-Wheel Excavators are continuous mining machines on crawlers used for removing overburden and extracting materials such as clay, sand, gravel, ……

#4 Gradall Excavators

Domain Est. 1996

Website: gradall.com

Key Highlights: Gradall highway speed excavators – the brand that invented rubber tire mobility, delivering huge productivity benefits worldwide….

#5 Hydraulic excavators

Domain Est. 1996

Website: liebherr.com

Key Highlights: Discover the wide range of Liebherr excavators for your application: from cable to hydraulic excavators, from crawler undercarriages to mobile….

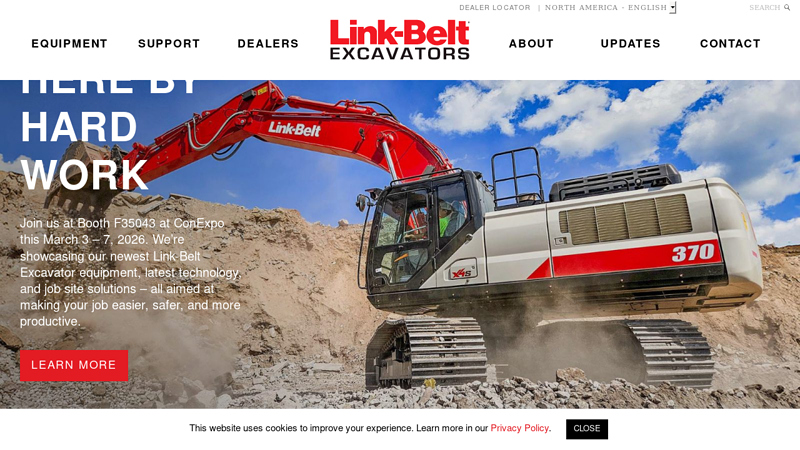

#6 Link Belt Excavators

Domain Est. 1998

Website: en.lbxco.com

Key Highlights: Link-Belt Excavators is proud to offer a wide range of Link-Belt excavators, scrap/material handlers, and forestry equipment….

#7 Excavators & Wheeled Excavators

Domain Est. 2000

Website: volvoce.com

Key Highlights: Volvo offers a range of construction and mining excavation equipment from large crawler excavators or trackhoes to mini excavators, wheeled excavators and ……

#8 LiuGong North America

Domain Est. 2008

Website: liugongna.com

Key Highlights: Explore LiuGong North America’s range of durable and reliable heavy equipment, including excavators, wheel loaders, forklifts, and zero-emission machinery….

#9 Jinggong Excavator

Domain Est. 2020

Website: jinggongexcavator.com

Key Highlights: Jinggong Excavator has 20 years experience in manufacturing mini hydraulic excavator,specialize in wheel excavator,crawler excavator and other construction ……

#10 Wheel Excavators

Domain Est. 2022

Website: na.develon-ce.com

Key Highlights: DEVELON wheel excavators are ideal for challenging job sites that require easy machine mobility and powerful digging capabilities. Get the details….

Expert Sourcing Insights for Wheel Excavator

H2: Key 2026 Market Trends for Wheel Excavators

-

Increased Demand for Compact and Mid-Size Models

By 2026, the wheel excavator market is expected to witness strong growth in demand for compact and mid-size models, particularly in urban construction, infrastructure development, and utility installation projects. Their maneuverability, reduced ground pressure, and suitability for paved surfaces make them ideal for city environments where space is constrained and environmental regulations are strict. -

Rise of Electric and Hybrid-Powered Machines

Driven by global decarbonization goals and tightening emissions regulations (e.g., EU Stage V and U.S. Tier 4 Final), manufacturers are accelerating the development of electric and hybrid wheel excavators. By 2026, battery-electric models are projected to capture a growing share of the market, especially in Europe and North America, where sustainability mandates and customer ESG commitments are influencing procurement decisions. -

Smart Technology and Connectivity Integration

The integration of IoT, telematics, and AI-based fleet management systems is becoming standard in new wheel excavators. By 2026, smart features such as real-time performance monitoring, predictive maintenance, remote operation, and autonomous functions are expected to enhance productivity and reduce downtime. These technologies also support data-driven decision-making for construction site optimization. -

Growth in Emerging Markets

Infrastructure expansion in regions such as Southeast Asia, India, the Middle East, and Africa is fueling demand for cost-effective and versatile equipment. Wheel excavators offer advantages in road construction and municipal projects, where mobility between sites is crucial. Local assembly and partnerships with global OEMs are expected to increase market penetration in these regions by 2026. -

Focus on Operator Comfort and Safety

Manufacturers are prioritizing ergonomic cabs, enhanced visibility, and advanced safety systems (e.g., collision avoidance, roll-over protection). With labor shortages and rising safety standards, equipment that improves operator retention and reduces accident risks will gain preference in the 2026 market landscape. -

Sustainability and Circular Economy Practices

The industry is shifting toward sustainable manufacturing, including the use of recycled materials and remanufactured components. By 2026, OEMs are likely to offer more take-back programs, refurbished machine sales, and service models that support the circular economy—appealing to environmentally conscious customers and reducing total cost of ownership. -

Impact of Government Infrastructure Spending

Public investment in transportation, water systems, and smart cities—such as the U.S. Infrastructure Investment and Jobs Act and EU Green Deal projects—will directly boost demand for wheel excavators. These machines are well-suited for trenching, grading, and utility work, positioning them as key assets in large-scale public works programs through 2026.

Conclusion:

The 2026 wheel excavator market will be shaped by technological innovation, regulatory pressures, and evolving customer needs. Companies that invest in electrification, digitalization, and sustainable solutions are expected to lead the market, while global infrastructure growth will provide significant opportunities across diverse geographies.

Common Pitfalls Sourcing Wheel Excavators (Quality, IP)

Sourcing wheel excavators, especially from less familiar suppliers or regions, presents several risks related to both equipment quality and intellectual property (IP) protection. Being aware of these pitfalls can help mitigate potential issues.

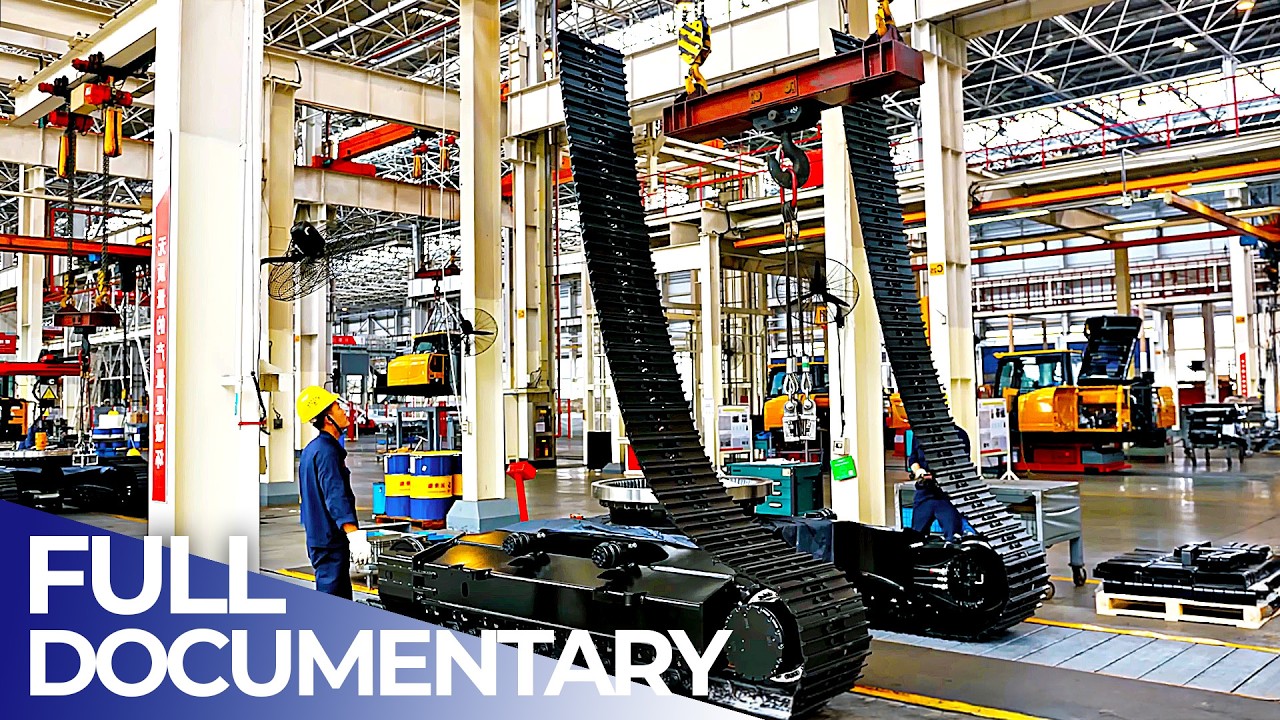

Poor Build Quality and Substandard Components

One of the most frequent issues is receiving wheel excavators constructed with inferior materials or components. Some suppliers may cut costs by using low-grade steel, underperforming hydraulic systems, or unreliable engines. This can lead to premature wear, frequent breakdowns, and increased maintenance costs. Buyers should verify material specifications, conduct factory audits, and request third-party inspections before shipment.

Inadequate or Missing Certifications

Many wheel excavators, particularly from emerging markets, may lack essential international certifications such as CE, ISO, or EPA compliance. Operating uncertified machinery can result in legal liabilities, import restrictions, or insurance complications. Always confirm that the equipment meets the regulatory standards of the destination country.

Misrepresentation of Technical Specifications

Suppliers may exaggerate performance metrics—such as digging depth, engine power, or hydraulic flow—to make their models appear more competitive. This misrepresentation can result in purchasing equipment that fails to meet project requirements. Request detailed technical documentation and consider third-party verification of specs.

Intellectual Property Infringement Risks

Some wheel excavators are produced using designs or components that infringe on established brands’ patents and trademarks. Purchasing such machines may expose the buyer to legal risks, especially in jurisdictions with strong IP enforcement. Ensure suppliers can provide proof of legitimate design rights or licensing agreements.

Lack of After-Sales Support and Spare Parts Availability

Even if the initial purchase price is attractive, sourcing from unreliable suppliers often leads to challenges in obtaining spare parts and technical support. This can result in extended downtime. Confirm the availability of a service network and access to genuine or compatible replacement parts before finalizing the purchase.

Counterfeit or Rebranded Equipment

Some suppliers rebrand used or refurbished excavators as new or clone well-known models. This includes fake serial numbers, falsified manufacturing dates, or imitation branding. Conduct thorough due diligence, including background checks on the supplier and physical inspection of the equipment.

Weak Contractual Protections and Warranty Enforcement

Contracts may lack clear terms on warranty coverage, return policies, or liability for defects. Enforcing warranty claims across borders can be difficult, especially if the supplier operates in a jurisdiction with weak legal frameworks. Work with legal experts to draft robust supply agreements and consider using escrow services for payment protection.

By recognizing these pitfalls and implementing due diligence measures—such as site visits, independent inspections, and legal reviews—buyers can significantly reduce the risks associated with sourcing wheel excavators.

Logistics & Compliance Guide for Wheel Excavator

Overview

This guide outlines the essential logistics and compliance requirements for the transportation, import/export, and operation of wheel excavators. Adherence to these guidelines ensures legal compliance, operational safety, and efficient logistics planning across regions.

Transportation Logistics

Domestic Transport

- Permits and Routes: Confirm oversized load permits if dimensions exceed standard road limits (varies by country/state). Pre-plan routes to avoid low bridges, weak roads, or restricted zones.

- Loading and Securing: Use low-bed trailers or specialized flatbeds. Secure the excavator with certified chains or straps, chocks, and tie-down points. Ensure boom and bucket are properly positioned and locked.

- Weight Distribution: Verify axle load compliance to prevent overloading. Ensure total vehicle weight (excavator + trailer + transport vehicle) stays within legal limits.

International Shipping

- Containerization vs. Ro-Ro:

- Containerized: Suitable for smaller wheel excavators that fit within 40-foot high-cube containers. Requires partial disassembly (e.g., boom, counterweight).

- Roll-on/Roll-off (Ro-Ro): Preferred for larger units. Excavator is driven onto the vessel and secured on deck. Minimal disassembly required.

- Export Packaging: Protect hydraulic lines, control panels, and paint with protective wrap and corner guards. Drain fluids if required by carrier.

- Documentation: Prepare Bill of Lading, Packing List, Commercial Invoice, and Certificate of Origin. Include HS code (e.g., 8429.52 for hydraulic excavators).

Import and Export Compliance

Customs Clearance

- HS Code and Tariffs: Use correct Harmonized System (HS) code (e.g., 8429.52.00 for self-propelled hydraulic excavators). Determine applicable import duties and VAT based on destination country.

- Regulatory Compliance: Verify conformity with local standards (e.g., CE marking for EU, EPA Tier 4 for USA, KC for South Korea). Provide Declaration of Conformity where required.

- Import Restrictions: Some countries require pre-shipment inspections (e.g., SPS, SONCAP, CoC) or prohibit used equipment over a certain age.

Environmental and Emission Standards

- Engine Certification: Ensure engine meets emission standards of the destination market (e.g., EU Stage V, U.S. EPA Tier 4 Final). Provide emission certificate from manufacturer.

- Noise and Fluids: Confirm compliance with noise regulations and proper labeling of hydraulic fluids and coolants.

Safety and Operational Compliance

Operator Certification

- Operators must hold valid certifications (e.g., OSHA in the U.S., CPCS in the UK, or equivalent local license). Training must cover safe operation, hazard awareness, and emergency procedures.

Site Compliance

- Permits and Notifications: Obtain necessary work permits for excavation, especially near underground utilities. Use services like “Call Before You Dig” (e.g., 811 in the U.S.).

- Inspection and Maintenance: Conduct daily pre-operation checks (hydraulics, lights, safety devices). Maintain service logs to comply with local equipment safety regulations.

Documentation Requirements

Required Paperwork Summary

- Transport: Waybill, Oversize Load Permit, Escort Vehicle Details (if applicable)

- Export: Commercial Invoice, Packing List, Bill of Lading, Export License (if controlled)

- Import: Customs Entry Form, Import Duty Payment Proof, Certificate of Conformity, Test Reports

- Operations: Operator Certification, Equipment Inspection Reports, Maintenance Logs

Regional Considerations

- European Union: CE marking, Machinery Directive 2006/42/EC, and RoHS compliance required.

- United States: Comply with OSHA 29 CFR 1926, EPA emissions, and state-specific transport laws.

- Australia/New Zealand: Adhere to AS/NZS standards, Work Health and Safety (WHS) regulations, and road transport rules under NHVR.

Conclusion

Proper logistics planning and regulatory compliance are critical for the seamless movement and operation of wheel excavators. Always verify local requirements and maintain accurate documentation to avoid delays, fines, or safety incidents. Consult with customs brokers, freight forwarders, and regulatory experts when entering new markets.

Conclusion for Sourcing a Wheel Excavator

In conclusion, sourcing a wheeled excavator requires a comprehensive evaluation of project requirements, operational environment, machine specifications, and long-term cost considerations. Wheeled excavators offer enhanced mobility, reduced ground disturbance, and faster transportation between sites compared to their tracked counterparts, making them ideal for urban construction, roadwork, and municipal projects.

Key factors to consider when sourcing include engine power, lifting capacity, reach, attachment compatibility, and compliance with emissions standards. Additionally, choosing between new and used machines should be based on budget, availability, and required warranty or support services. Partnering with reputable manufacturers or suppliers ensures access to quality equipment, reliable after-sales service, and technical support.

Ultimately, a well-informed sourcing decision that aligns performance capabilities with project demands will improve productivity, reduce operational costs, and contribute to the overall success of construction and excavation activities. Prioritizing durability, versatility, and serviceability will maximize return on investment and ensure efficient performance throughout the equipment’s lifecycle.