The global graphite market is experiencing robust growth, driven by rising demand from industries such as automotive, energy storage, and electronics—particularly due to the surge in lithium-ion battery production. According to Grand View Research, the global graphite market size was valued at USD 15.3 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030. This growth is fueled by increasing investments in electric vehicles (EVs) and renewable energy infrastructure, where graphite plays a critical role as an anode material. With over 60% of natural graphite consumed in refractories and batteries, supply chain resilience and material purity have become key competitive differentiators. As demand escalates, a select group of manufacturers has emerged as leaders in producing high-quality graphite materials. Here are the top 9 graphite manufacturers shaping the industry’s future through innovation, scale, and vertical integration.

Top 9 What Is Made Of Graphite Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Resonac Graphite

Domain Est. 2021

Website: graphite.resonac.com

Key Highlights: Resonac’s graphite division produces high-quality electrodes essential for efficient and eco-friendly steel recycling in electric arc furnaces….

#2 Open Knowledge Wiki

Domain Est. 1996

Website: nucleus.iaea.org

Key Highlights: Modern graphite manufacture commences with a high molecular weight hydrocarbon, often natural pitch or a residue of crude oil distillation….

#3 Graphite Material Supplier

Domain Est. 1996

Website: asbury.com

Key Highlights: Asbury offers a wide variety of graphite material options including natural flake graphite, natural amorphous graphite, synthetic, expandable, vein, ……

#4 Of Pencils and Diamonds – Everything About Graphite

Domain Est. 1997

Website: sglcarbon.com

Key Highlights: Graphite is not only found in pencils and diamonds – its field of application is almost unlimited. We present this wonder material in more detail….

#5 Graphite

Domain Est. 1999

Website: imerys.com

Key Highlights: Graphite is a key ingredient used in polymer and rubber compounds for the manufacture of electronic device housings, seals and gaskets, friction parts, heat ……

#6 Graphite (C)

Domain Est. 1999

Website: azom.com

Key Highlights: Graphite can be divided into two main types—natural and synthetic. Natural Graphite. Natural graphite is a mineral composed of graphitic carbon….

#7 Superior Graphite

Domain Est. 2000

Website: superiorgraphite.com

Key Highlights: Superior Graphite specializes in thermal purification, advanced sizing, blending and coating technologies providing Graphite and Carbon based solutions….

#8 Graphite facts

Domain Est. 2002

Website: natural-resources.canada.ca

Key Highlights: Graphite is a non-metallic mineral that has properties similar to metals, such as a good ability to conduct heat and electricity….

#9 AMG Graphite

Domain Est. 2006

Website: gk-graphite.com

Key Highlights: AMG Graphite (Graphit Kropfmühl GmbH) is a leading global supplier of high-purity natural graphite, operating its own mines and vertically-integrated ……

Expert Sourcing Insights for What Is Made Of Graphite

H2: 2026 Market Trends for Products Made of Graphite

As we approach 2026, the global market for products made of graphite is undergoing significant transformation, driven by technological advancements, evolving energy demands, and growing environmental awareness. Graphite, a form of carbon known for its high thermal and electrical conductivity, lubricity, and chemical stability, plays a critical role across various high-growth industries. Below are the key market trends expected to shape the landscape of graphite-based products in 2026:

1. Surge in Demand from the Lithium-Ion Battery Sector

One of the most dominant forces shaping the graphite market is the exponential growth of lithium-ion batteries, particularly for electric vehicles (EVs) and energy storage systems (ESS). Graphite is a primary component of the anode in these batteries, with natural and synthetic graphite both in high demand. By 2026, analysts project that over 70% of graphite consumption will be linked to battery applications. The push for EV adoption—fueled by government mandates, carbon neutrality goals, and consumer demand—is expected to drive a compound annual growth rate (CAGR) of 12–15% in battery-grade graphite.

2. Shift Toward Sustainable and Ethical Sourcing

Environmental, social, and governance (ESG) concerns are reshaping supply chains. With China currently dominating graphite production (around 60–70% of global supply), there is growing concern over environmental degradation and labor practices in mining operations. As a result, manufacturers and EV producers in North America and Europe are prioritizing ethically sourced, low-carbon-footprint graphite. This trend is accelerating investments in alternative sources, such as Canada, Madagascar, and Mozambique, and spurring innovation in recycling spent lithium-ion batteries to recover graphite—an emerging circular economy segment expected to grow rapidly by 2026.

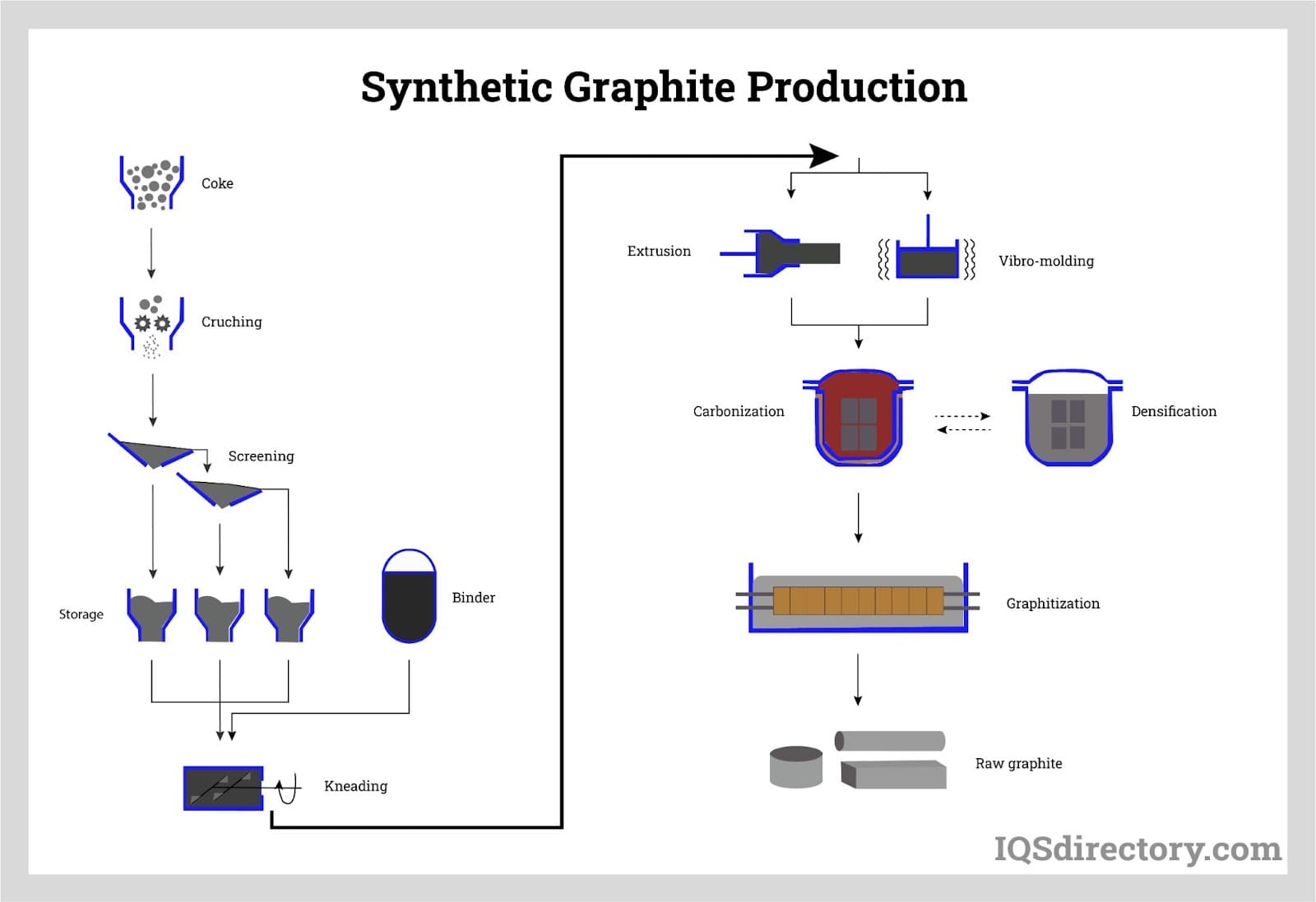

3. Advancements in Synthetic Graphite and Purification Technologies

While natural graphite remains cost-effective, synthetic graphite—which offers higher purity and consistency—is gaining favor in high-performance batteries. By 2026, improvements in purification techniques and reductions in production energy costs (through renewable-powered plants) are expected to narrow the cost gap between natural and synthetic graphite. Additionally, R&D efforts are focused on silicon-graphite composite anodes, which promise higher energy density and faster charging—key requirements for next-generation EVs.

4. Expansion in Nuclear and Aerospace Applications

Beyond batteries, graphite’s use in nuclear reactors (as a neutron moderator) and in aerospace components (due to its strength at high temperatures and low weight) continues to grow. With renewed interest in small modular reactors (SMRs) and next-gen nuclear technologies, demand for nuclear-grade graphite is projected to rise steadily. Similarly, the aerospace and defense sectors are adopting graphite-based composites for lightweight, heat-resistant structures, contributing to market diversification.

5. Price Volatility and Supply Chain Diversification

Geopolitical tensions and export restrictions (e.g., China’s control over rare earths and critical minerals) are prompting countries to secure alternative graphite supplies. The U.S. and EU are investing in domestic processing capabilities and strategic stockpiling. By 2026, this push for supply chain resilience is expected to lead to a more geographically balanced market, reducing dependency on single-source suppliers and mitigating price volatility risks.

6. Growth in Industrial and Lubricant Applications

Traditional uses of graphite in refractories, steelmaking, and industrial lubricants remain stable. However, innovations in graphene-enhanced graphite composites are opening new applications in electronics, coatings, and 3D printing. Though still niche, these high-value applications are anticipated to expand, particularly in advanced manufacturing hubs.

Conclusion

By 2026, the market for products made of graphite will be defined by its pivotal role in the clean energy transition, particularly in battery technology. With increasing demand, technological innovation, and a focus on sustainability, the graphite industry is poised for strategic expansion. Companies that invest in sustainable mining, recycling infrastructure, and next-gen material science will be best positioned to capitalize on these emerging opportunities.

Common Pitfalls When Sourcing Graphite: Quality and Intellectual Property Concerns

Sourcing graphite—especially for high-performance applications in batteries, aerospace, or electronics—requires careful attention to both material quality and intellectual property (IP) risks. Overlooking these aspects can lead to supply chain disruptions, product failures, or legal liabilities.

Quality-Related Pitfalls

1. Inconsistent Purity and Contaminant Levels

One of the most frequent issues is variability in graphite purity. High-purity graphite (99.9%+ carbon) is essential for applications like lithium-ion battery anodes. Sourcing from suppliers without rigorous quality control may result in batches contaminated with metals (e.g., iron, silicon), which degrade battery performance and safety. Always verify certifications (e.g., ISO 9001) and demand batch-specific test reports (e.g., ICP-MS analysis).

2. Misunderstanding Natural vs. Synthetic Graphite Properties

Natural and synthetic graphite differ significantly in structure, cost, and performance. Natural flake graphite may offer lower cost but variable morphology, while synthetic graphite provides consistency at a higher price. Sourcing decisions based solely on cost without aligning material properties to application needs can result in subpar product performance.

3. Inadequate Characterization of Physical Properties

Critical parameters such as particle size distribution, specific surface area (BET), tap density, and crystallinity must be tightly controlled. Poorly characterized graphite can lead to inconsistent electrode coating, reduced energy density, or poor cycle life in batteries. Ensure suppliers provide detailed material data sheets and conduct independent verification.

4. Overlooking Supply Chain Traceability

Graphite sourcing can involve multiple intermediaries, especially with natural graphite from regions like China, Mozambique, or Madagascar. Lack of traceability increases the risk of receiving mixed-origin or recycled material misrepresented as virgin. Implement supply chain audits and require documentation of origin and processing steps.

Intellectual Property-Related Pitfalls

1. Unintentional Use of Patented Graphite Technologies

Many advanced graphite materials—especially surface-modified or coated anode materials—are protected by patents. Sourcing modified graphite without reviewing IP landscapes may lead to infringement claims. Conduct freedom-to-operate (FTO) analyses before integrating new graphite materials into your products.

2. Supplier Claims of “Proprietary” Processes Without Protection

Some suppliers assert their graphite is “proprietary” but lack registered IP, making it difficult to verify uniqueness or prevent reverse engineering. Relying on such materials without contractual safeguards may expose your product to competition or quality drift if the supplier changes processes.

3. Inadequate IP Clauses in Sourcing Agreements

Contracts often fail to address IP ownership of jointly developed materials or customization. Without clear terms, disputes may arise over who owns improvements or formulations. Ensure agreements define IP rights, confidentiality, and permitted use cases.

4. Risk of Technology Leakage During Sampling and Testing

Sharing detailed performance requirements with multiple suppliers during sourcing increases the risk of sensitive application data being exposed. Use non-disclosure agreements (NDAs) and limit technical disclosures to what is absolutely necessary.

By proactively addressing these quality and IP pitfalls, organizations can secure reliable, high-performance graphite supplies while minimizing legal and operational risks.

What Is Made Of Graphite: Logistics & Compliance Guide

Graphite, a form of carbon known for its heat resistance, electrical conductivity, and lubricating properties, is used in a wide range of industrial and consumer applications. Proper logistics and compliance management are essential when transporting, storing, and handling graphite materials due to regulatory classifications, environmental concerns, and safety considerations.

Regulatory Classification and Documentation

Graphite is generally classified as a non-hazardous material under most international transport regulations when in solid form (e.g., blocks, rods, plates). However, powdered or micronized graphite may be subject to different rules due to combustibility risks. Key documentation includes:

- Safety Data Sheet (SDS): Required under GHS (Globally Harmonized System) and OSHA HAZCOM. The SDS must detail physical properties, handling precautions, and emergency measures.

- Bill of Lading and Commercial Invoice: Must accurately describe the material as “Natural Graphite,” “Synthetic Graphite,” or “Graphite Powder” as applicable.

- HS Code: Typically classified under HS 3801 (Artificial graphite; colloidal or semi-colloidal graphite; retorted or calcined anthracite). Accurate coding ensures proper customs clearance and tariff application.

Transportation Guidelines

Graphite in solid forms (e.g., crucibles, electrodes, plates) can be transported via air, sea, or ground using standard freight procedures. Special considerations include:

- Powdered Graphite: Classified as a combustible dust under OSHA and NFPA standards. Requires packaging that prevents dust release and minimizes ignition risks during transit.

- IATA/IMDG Compliance: While solid graphite is generally non-regulated for air and sea freight, powdered forms may require assessment under IATA Dangerous Goods Regulations (DGR) or IMDG Code, particularly if fine particles pose a dust explosion hazard.

- Packaging: Use sealed, moisture-resistant containers. For powders, UN-certified packaging may be necessary depending on particle size and concentration.

Storage and Handling Procedures

Safe storage and handling minimize health, fire, and environmental risks:

- Storage Environment: Store in a dry, well-ventilated area away from strong oxidizers and ignition sources. Avoid accumulation of graphite dust.

- Handling Precautions: Use PPE (gloves, dust masks, safety goggles) when handling fine powders. Implement industrial hygiene practices to control airborne particulates.

- Dust Control: Use local exhaust ventilation and dust collection systems in processing or repackaging facilities to comply with OSHA permissible exposure limits (PELs).

Environmental and Safety Compliance

Graphite is not acutely toxic, but regulatory obligations still apply:

- REACH (EU): Graphite substances must be registered if imported in quantities over 1 tonne/year. Suppliers must provide downstream users with exposure scenarios and safe use guidance.

- TSCA (USA): Confirm compliance with EPA’s Toxic Substances Control Act, especially for manufactured nanoscale graphite materials.

- Waste Disposal: Graphite waste is generally non-hazardous but must be disposed of per local regulations. Recycling is encouraged due to graphite’s value in remanufacturing.

Export Controls and Trade Restrictions

While graphite is not typically a controlled strategic material, certain high-purity or nuclear-grade forms may be subject to export restrictions:

- EAR (Export Administration Regulations): Some synthetic graphite products used in nuclear reactors or missile systems may require licenses under the U.S. Department of Commerce.

- Dual-Use Concerns: Verify if the graphite product meets specifications listed in the Wassenaar Arrangement or other international control lists.

Summary

Proper logistics and compliance for graphite products involve accurate classification, appropriate packaging, adherence to transportation regulations, and fulfillment of documentation and environmental requirements. While most graphite forms are non-hazardous, vigilance is required—especially with powdered or high-purity grades—to ensure safety and regulatory compliance across the supply chain.

In conclusion, sourcing materials made of graphite involves identifying its various forms and applications across industries. Graphite is a versatile material valued for its thermal and electrical conductivity, lubricity, and heat resistance. It is sourced both naturally from mining operations and synthetically through high-temperature processing of carbon materials. Key products made from graphite include lithium-ion battery electrodes, refractories, lubricants, pencils, and components in nuclear reactors and industrial machinery. Sustainable and ethical sourcing is increasingly important due to environmental concerns and rising demand—especially from the renewable energy and electric vehicle sectors. Therefore, responsible procurement practices, including consideration of supply chain transparency, environmental impact, and geopolitical factors, are essential when sourcing graphite-based materials.