The global laser cleaning market is experiencing robust growth, driven by increasing demand for eco-friendly and precision-based surface treatment solutions across industries such as automotive, aerospace, and manufacturing. According to Grand View Research, the global laser cleaning market size was valued at USD 716.8 million in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 17.3% from 2024 to 2030. This surge is fueled by the technology’s advantages over traditional cleaning methods, including non-abrasiveness, minimal maintenance, and reduced environmental impact due to the absence of chemicals or secondary waste. As industries prioritize automation and sustainability, the demand for reliable laser cleaning systems has intensified—spurring innovation among key manufacturers. In this landscape, nine leading companies have emerged at the forefront, shaping the future of industrial cleaning through advanced laser technologies and scalable solutions.

Top 9 What Is Laser Cleaning Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Laserax

Website: laserax.com

Key Highlights: Laserax works with the world’s leading manufacturers to implement laser cleaning, welding, texturing, and marking solutions….

#2 Clean Laser Systems

Website: cleanlaser.de

Key Highlights: IPG | cleanLASER has been developing and producing high-precision laser systems for cleaning and industrial surface treatment for more than 20 years….

#3 Laser Photonics

Website: laserphotonics.com

Key Highlights: Laser Photonics manufactures reliable, safe, and eco-friendly Laser Cleaning, Laser Cutting, Laser Engraving, Laser Marking, and Laser Welding solutions….

#4 P-laser Industrial laser cleaning

Website: p-laser.com

Key Highlights: we engineer and manufacture the most advanced—and most powerful—pulsed industrial laser cleaning systems on the market, built for both manual and automated ……

#5 Laser cleaning system

Website: laserforcleaning.com

Key Highlights: Laser cleaning offers a non-aggressive, environmentally friendly and inexpensive solution. No damage to the underlying material. Low operating costs….

#6 Laser Cleaning

Website: keyence.com

Key Highlights: Elevate production quality with laser cleaning technology: remove dust, rust, and imperfections efficiently, reducing costs and improving precision….

#7 Laser Cleaning

Website: ipgphotonics.com

Key Highlights: Laser cleaning is a remote process that enables precision material removal, virtually eliminating damage to the underlying material. Selective Cleaning. Laser ……

#8 Netalux

Website: netalux.com

Key Highlights: Discover our award-winning Laser Cleaning Solutions for the world’s most demanding industries. Discover our products and global service now….

#9 Laser Cleaning Technologies

Website: lasercleaningtechnologies.com

Key Highlights: We offer the only fiber-coupled, compact, mobile or stationary laser cleaning units, with 20 to 1600watts of laser power for a wide-range of applications….

Expert Sourcing Insights for What Is Laser Cleaning

What Is Laser Cleaning: 2026 Market Trends Analysis

H2: Advancements in Laser Cleaning Technology Driving Market Growth

By 2026, laser cleaning technology is expected to witness significant advancements that enhance efficiency, portability, and precision. Innovations in fiber laser systems—particularly in pulse duration, wavelength flexibility, and beam quality—are enabling more effective removal of contaminants such as rust, paint, oxides, and oils from metals, composites, and delicate surfaces without substrate damage. These improvements are making laser cleaning viable for industries requiring high precision, such as aerospace, automotive, and heritage conservation.

The integration of artificial intelligence (AI) and machine vision into laser cleaning systems is another key trend shaping the market. Smart laser cleaners can now automatically detect surface conditions and adjust cleaning parameters in real time, improving consistency and reducing operator dependency. This level of automation aligns with the broader Industry 4.0 movement, where predictive maintenance and autonomous systems are becoming standard.

Additionally, the miniaturization of laser cleaning equipment is expanding its applications beyond fixed industrial stations. Handheld and robotic-mounted laser cleaners are gaining traction, particularly in shipbuilding, mold maintenance, and nuclear decommissioning, where access and safety are critical. These portable systems are expected to account for a growing share of the market by 2026, driven by demand for flexible and on-site cleaning solutions.

H2: Increasing Environmental and Regulatory Pressure Favors Laser Cleaning Adoption

Environmental regulations are becoming stricter worldwide, especially in regions like the European Union and North America, where chemical solvents and abrasive blasting methods are under scrutiny due to their environmental and health impacts. By 2026, laser cleaning is poised to benefit significantly from this shift as a green alternative. Unlike traditional cleaning techniques, laser cleaning is non-contact, solvent-free, and generates minimal waste—typically only the ablated particles, which can be easily captured with filtration systems.

Regulatory support for cleaner production methods is accelerating adoption across sectors. For example, the automotive and electronics industries are under pressure to reduce volatile organic compound (VOC) emissions, making laser cleaning an attractive solution for surface preparation and component cleaning. In the maritime industry, regulations on paint removal and anti-fouling treatments are driving shipyards to adopt laser systems to comply with environmental standards.

Furthermore, the growing emphasis on corporate sustainability goals is encouraging companies to invest in eco-friendly technologies. Laser cleaning reduces water usage, eliminates secondary waste streams, and lowers the carbon footprint associated with consumables and disposal. As ESG (Environmental, Social, and Governance) reporting becomes mandatory in many jurisdictions, laser cleaning will be increasingly viewed not just as a technical upgrade, but as a strategic sustainability investment.

H2: Expansion into New Industrial and Niche Applications

By 2026, the laser cleaning market is expected to expand beyond its traditional strongholds in heavy industry into new and emerging applications. One notable growth area is in the renewable energy sector, particularly in the maintenance of solar panels and wind turbine blades. Laser cleaning offers a non-abrasive method to remove dust, pollutants, and biological growth without damaging sensitive surfaces, thereby improving energy efficiency and reducing downtime.

Another emerging application is in the electronics and semiconductor industry, where ultra-precise cleaning is essential. As device components become smaller and more complex, conventional cleaning methods risk damaging microstructures. Laser cleaning, especially with ultrashort pulse lasers, enables residue-free cleaning of circuit boards, connectors, and sensors, supporting advancements in miniaturization and reliability.

The cultural heritage and restoration sector is also adopting laser cleaning for delicate tasks such as removing grime from historical artifacts, sculptures, and building facades. Museums and preservation agencies are increasingly investing in laser systems due to their precision and non-invasive nature, ensuring the integrity of valuable artifacts.

Moreover, the medical device manufacturing industry is beginning to leverage laser cleaning for sterilization and surface activation prior to coating or bonding. This trend is supported by stringent hygiene standards and the need for repeatable, contamination-free processes.

H2: Regional Market Dynamics and Competitive Landscape

The global laser cleaning market is expected to experience uneven growth across regions by 2026, with Asia-Pacific leading in terms of adoption and manufacturing capacity. Countries like China, Japan, and South Korea are investing heavily in automation and advanced manufacturing, driving demand for laser cleaning in automotive, electronics, and shipbuilding industries. China, in particular, is emerging as both a major consumer and producer of laser cleaning equipment, supported by government initiatives in high-tech manufacturing.

In North America and Europe, growth is being fueled by regulatory compliance, R&D investments, and early adoption in aerospace and defense. The presence of key technology developers and system integrators in these regions is fostering innovation and creating robust supply chains. However, higher equipment costs remain a barrier to widespread SME adoption, though leasing models and compact systems are helping to mitigate this issue.

The competitive landscape is becoming increasingly crowded, with established laser manufacturers such as IPG Photonics, TRUMPF, and Han’s Laser expanding their laser cleaning portfolios. At the same time, niche players are entering the market with specialized solutions for robotics integration, AI-driven process control, and portable systems. Strategic partnerships between laser developers and industrial automation firms are expected to accelerate market penetration.

By 2026, the convergence of technological innovation, environmental regulation, and expanding applications will position laser cleaning as a mainstream industrial process, moving from a niche technology to a critical component of sustainable and smart manufacturing ecosystems.

H2. Common Pitfalls in Sourcing Laser Cleaning Technology (Quality, Intellectual Property)

When sourcing laser cleaning solutions, businesses often encounter critical challenges related to quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to operational inefficiencies, legal risks, and financial losses.

-

Compromised Equipment Quality

A major pitfall is selecting low-quality laser cleaning systems to reduce upfront costs. Inferior lasers may offer inconsistent cleaning performance, shorter lifespans, and higher maintenance requirements. Buyers should verify technical specifications, such as laser power stability, beam quality (M² factor), and duty cycle, and request third-party validation or on-site demonstrations. -

Lack of Certification and Standards Compliance

Many suppliers, especially in emerging markets, may not adhere to international safety and performance standards (e.g., ISO, CE, or IEC). Sourcing equipment without proper certifications increases safety risks and may result in non-compliance with industry regulations. -

Inadequate After-Sales Support and Training

Laser cleaning systems require specialized knowledge for operation and maintenance. Sourcing from vendors without robust technical support, documentation, or training programs can hinder integration and lead to downtime. -

Intellectual Property Infringement Risks

Some suppliers may use patented laser technologies without proper licensing. Purchasing such equipment exposes buyers to potential IP litigation, especially when operating in jurisdictions with strict IP enforcement. Due diligence on the supplier’s R&D background, patent portfolios, and original equipment manufacturer (OEM) agreements is essential. -

Hidden Technology Dependencies

Certain laser systems rely on proprietary software or consumables controlled by the supplier. This creates long-term dependency and limits customization or third-party servicing. Buyers should assess openness of software APIs and availability of spare parts. -

Misrepresentation of Capabilities

Some vendors exaggerate cleaning performance (e.g., speed, material compatibility, or surface preservation). Without independent testing or clear performance metrics, organizations may invest in systems unsuitable for their specific applications.

To mitigate these pitfalls, sourcing professionals should conduct thorough supplier vetting, request pilot testing, involve technical experts in evaluations, and include clear quality and IP clauses in procurement contracts.

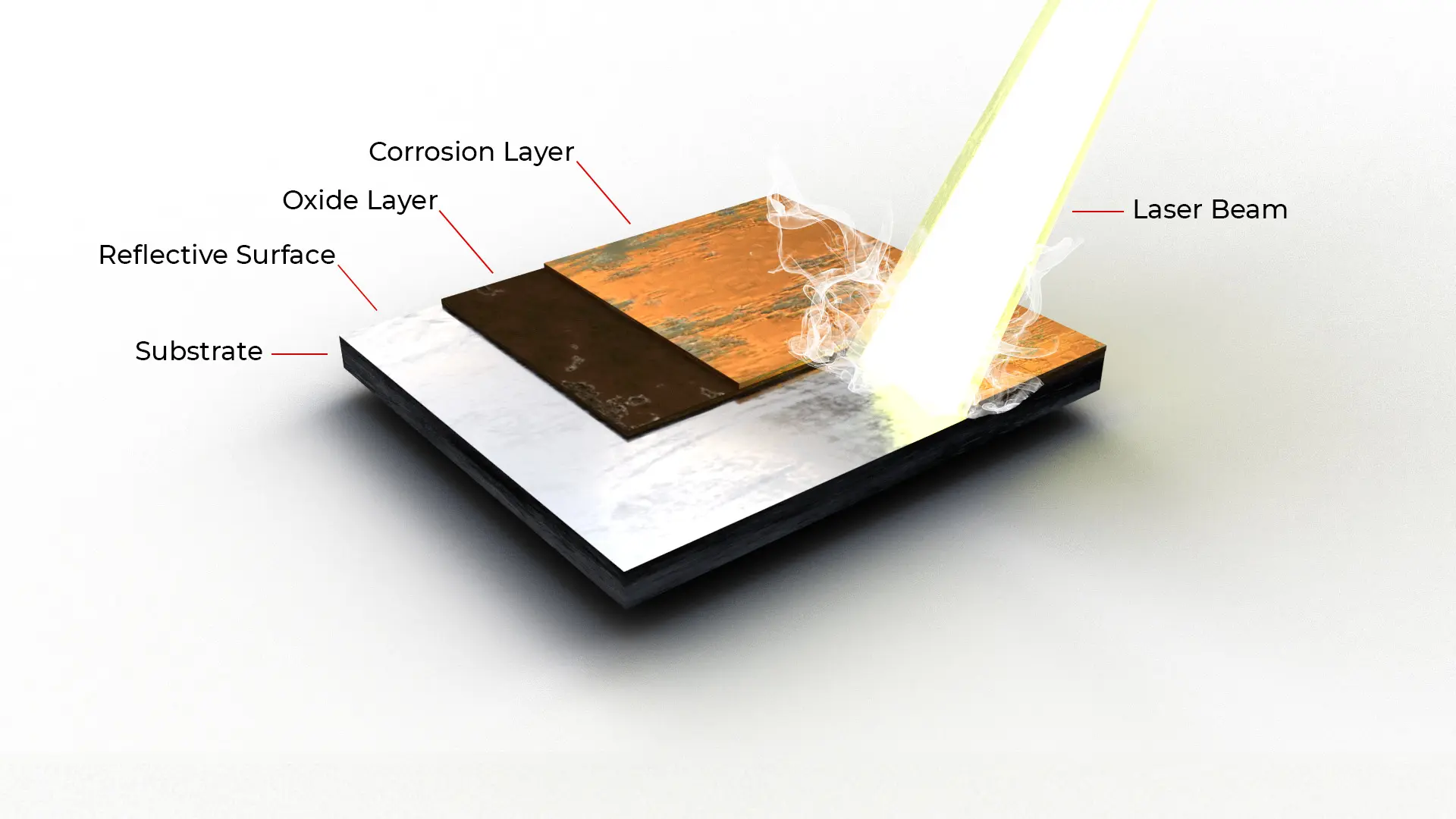

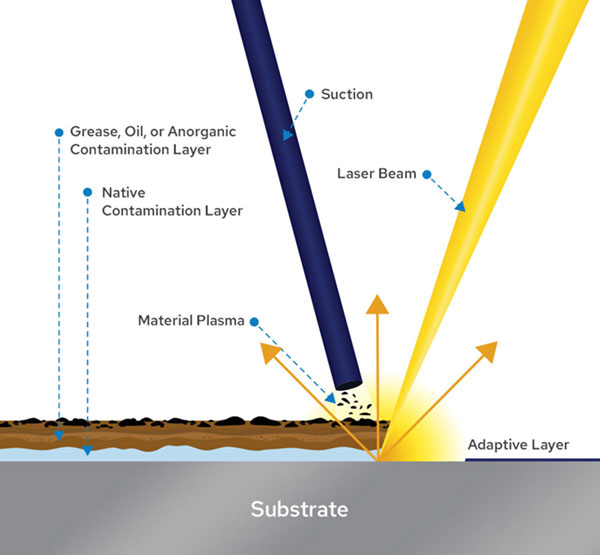

What Is Laser Cleaning

Laser cleaning is a non-abrasive, environmentally friendly method used to remove contaminants, coatings, rust, oxides, and other unwanted substances from various surfaces using high-intensity laser beams. This process works by directing short pulses of laser light onto a surface, where the energy is absorbed by the unwanted material, causing it to vaporize or detach from the substrate without damaging the underlying base material.

The technology is widely used in industries such as automotive, aerospace, heritage restoration, precision engineering, and manufacturing due to its precision, minimal waste production, and lack of secondary pollutants.

Logistics Considerations for Laser Cleaning

When implementing laser cleaning in industrial or commercial operations, several logistical factors must be considered to ensure efficiency, safety, and scalability.

Equipment Transportation and Setup

Laser cleaning systems vary in size—from handheld units to large automated workstations. Transporting these systems requires secure packaging and proper handling due to their sensitive optical and electronic components. Upon arrival, installation should be conducted by trained personnel in a controlled environment to avoid misalignment or damage.

Power and Infrastructure Requirements

Most industrial laser cleaners require stable electrical power (typically 200–480 V AC) and may need cooling systems, exhaust ventilation, or fume extraction units. Adequate workspace with proper grounding and climate control is essential, especially in environments with high humidity or dust.

Consumables and Maintenance

Unlike traditional cleaning methods, laser cleaning does not require chemical solvents or abrasive media. However, routine maintenance of optics, cooling systems, and motion components (in automated systems) is critical. Spare parts such as protective lenses and filters should be included in inventory planning.

Integration with Production Lines

For automated applications, laser cleaning systems can be integrated into existing production lines using robotics or conveyor systems. This requires coordination with process engineers to synchronize cleaning cycles with upstream and downstream operations, minimizing downtime.

Compliance and Safety Regulations

Laser cleaning involves high-energy beams, making regulatory compliance and operator safety paramount.

Laser Safety Standards

Laser cleaning systems are classified under international safety standards such as IEC 60825 and ANSI Z136.1. Most industrial laser cleaners fall under Class 4, indicating a high risk of eye and skin injury. Adequate safety measures include:

- Installation in enclosed, interlocked work zones

- Use of protective eyewear with appropriate optical density

- Warning signs and access control

Workplace Safety and Training

Operators must receive specialized training in laser safety, emergency procedures, and equipment handling. Employers are required to conduct risk assessments and maintain safety documentation in accordance with OSHA (U.S.) or equivalent regional regulations.

Fume and Particle Extraction

Though laser cleaning produces no chemical waste, the vaporization of contaminants generates particulate matter and fumes. Compliance with air quality regulations (e.g., OSHA PELs, EU Directive 2004/37/EC) requires the use of high-efficiency particulate air (HEPA) filtration systems and regular monitoring of airborne contaminants.

Environmental Compliance

Laser cleaning is recognized as a green technology because it eliminates the need for harsh chemicals and reduces waste. Facilities using this method may benefit from reduced regulatory reporting under environmental protection laws such as the U.S. EPA’s Clean Air Act or REACH in the EU, provided emissions are properly controlled.

Documentation and Audits

Companies must maintain detailed records of equipment calibration, maintenance, operator training, and emissions monitoring. These records support compliance during audits by regulatory bodies and enhance traceability in regulated industries like aerospace and medical device manufacturing.

By addressing both logistical and compliance aspects, organizations can safely and efficiently adopt laser cleaning as a sustainable alternative to traditional surface preparation techniques.

Conclusion on Sourcing: What is Laser Cleaning?

Laser cleaning is an advanced, non-abrasive cleaning method that uses high-intensity laser beams to remove contaminants such as rust, paint, oil, oxides, and residues from various surfaces—including metal, stone, and composites. By harnessing the power of focused light, the process selectively vaporizes unwanted layers without damaging the underlying substrate. This precision, combined with its eco-friendly nature—eliminating the need for chemicals or media blasting—makes laser cleaning increasingly attractive across industries such as automotive, aerospace, heritage conservation, and manufacturing.

When sourcing laser cleaning solutions, it is essential to consider factors such as laser power, wavelength, pulse duration, portability, and safety features. Potential buyers should evaluate suppliers based on technical expertise, after-sales support, compliance with safety standards, and proven industry applications. As the technology continues to evolve and become more cost-effective, laser cleaning represents a sustainable and efficient alternative to traditional cleaning methods, positioning it as a worthwhile investment for long-term operational improvements and environmental responsibility.