The global compressor market is experiencing steady expansion, driven by rising industrialization, growing demand for HVAC systems, and increased energy efficiency standards. According to Grand View Research, the global air compressor market was valued at USD 30.3 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. With this momentum, specialized manufacturers like Werther have gained prominence for their precision engineering and reliability in niche applications such as breathing air and high-pressure compressors. As industries from manufacturing to healthcare demand cleaner, more efficient air compression solutions, identifying the top manufacturers becomes critical for quality and performance. Based on market presence, innovation, and technical expertise, the following are the top three Werther compressor manufacturers shaping the industry today.

Top 3 Werther Compressor Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

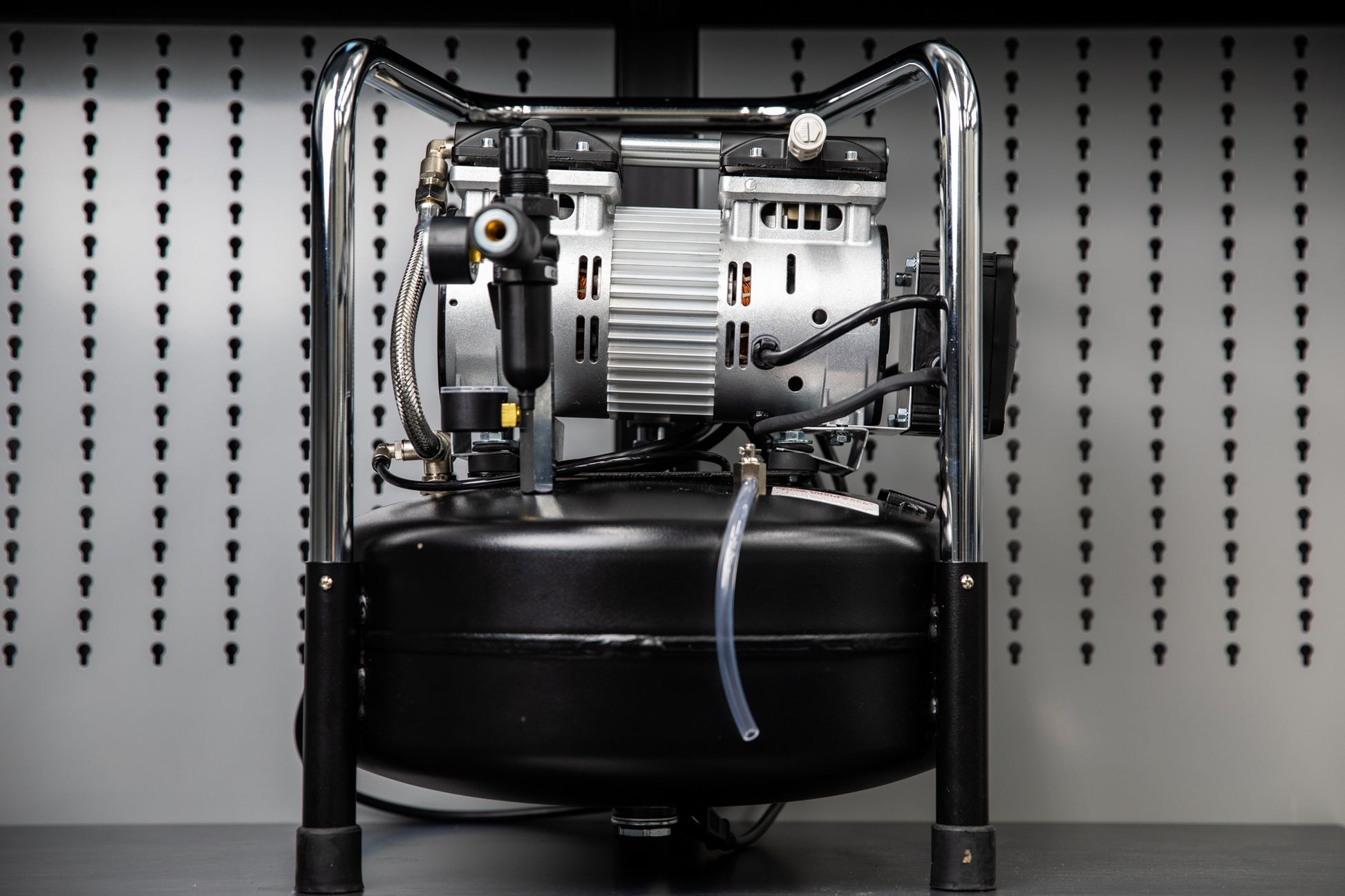

#1 Werther International

Domain Est. 1997

Website: werther.com

Key Highlights: Werther International is an industry-leading manufacturer of rotary screw air compressors, providing reliable, energy-efficient, and quiet air compressor ……

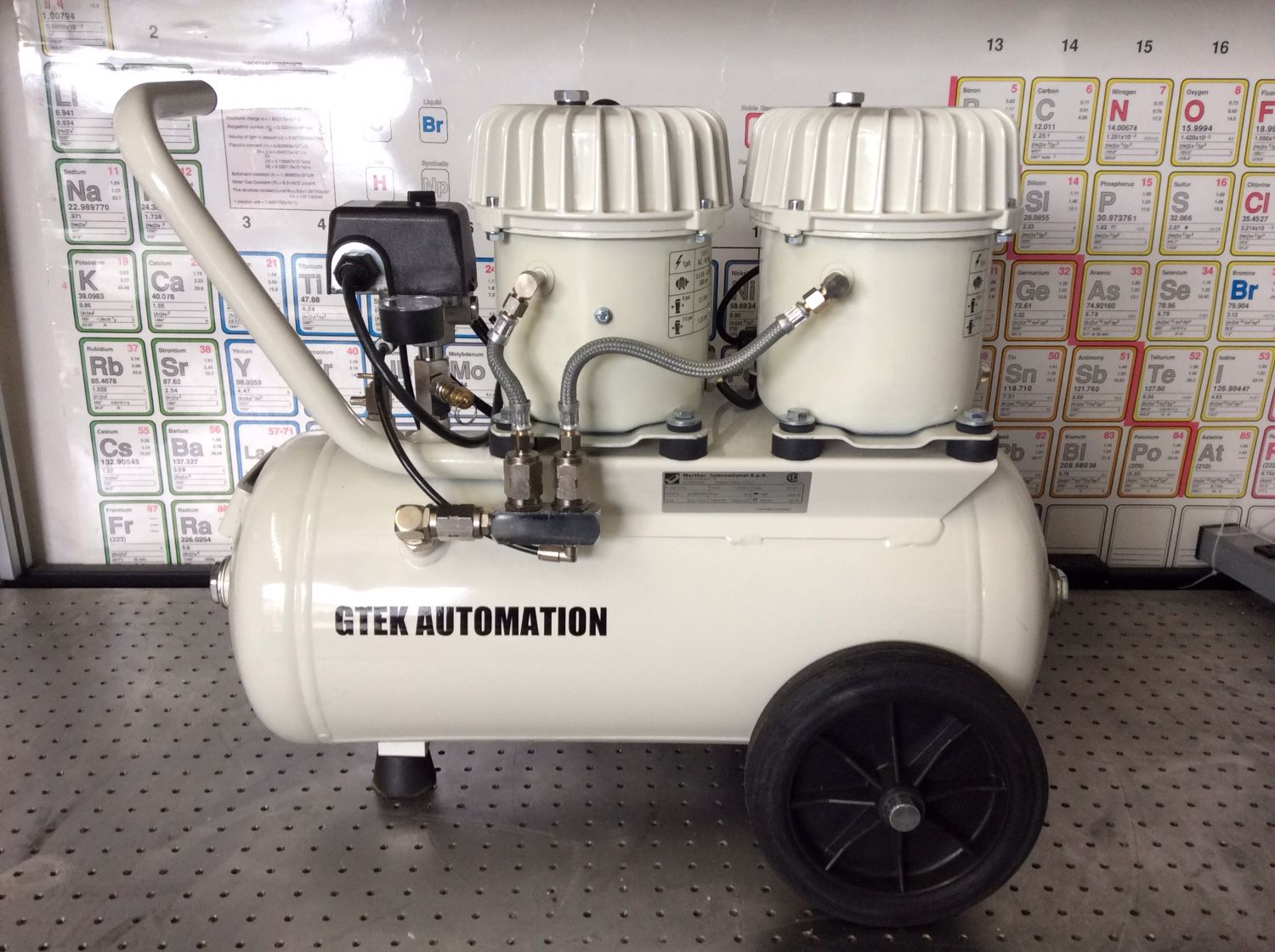

#2 Werther Compressors

Domain Est. 2020

Website: silair.it

Key Highlights: We are a manufacturer of a wide range of professional and medical compressors. All of our compressors are 100% made in Italy….

#3 About us

Domain Est. 2001

Website: wertherint.com

Key Highlights: Werther International is a really dynamic company, which has been working for more than 40 years in the automotive service equipment and air compressor field….

Expert Sourcing Insights for Werther Compressor

H2: Market Trends for Werther Compressor in 2026

As the global industrial and energy sectors evolve rapidly, Werther Compressor is positioned to navigate a dynamic market landscape in 2026. Several macroeconomic, technological, and regulatory trends are expected to shape demand, competition, and innovation in the compressor industry. Below is an analysis of key 2026 market trends impacting Werther Compressor:

-

Increased Demand for Energy-Efficient Compressors

Energy efficiency remains a top priority for industrial users amid rising energy costs and tightening carbon regulations. By 2026, Werther Compressor is likely to benefit from growing demand for variable speed drive (VSD) compressors and smart energy management systems. Compliance with new EU Ecodesign regulations (e.g., ERP Lot 38) will drive upgrades in existing industrial facilities, favoring manufacturers like Werther that offer high-efficiency models. -

Expansion in Renewable Energy and Green Hydrogen Applications

The global push toward decarbonization is accelerating investments in green hydrogen and renewable energy infrastructure. Compressors play a critical role in hydrogen production, storage, and distribution. In 2026, Werther Compressor may see increased opportunities in supplying oil-free and high-pressure compressors for hydrogen refueling stations and electrolysis systems, especially in Europe and North America. -

Digitalization and IoT Integration

The industrial Internet of Things (IIoT) is transforming compressor operations. Predictive maintenance, remote monitoring, and cloud-based analytics are becoming standard expectations. By 2026, Werther Compressor will likely need to enhance its digital offerings—such as integrated sensor systems and mobile diagnostics platforms—to remain competitive and meet customer demands for operational transparency and uptime optimization. -

Regional Shifts in Manufacturing and Industrial Growth

Emerging markets in Southeast Asia, India, and parts of Africa are experiencing rapid industrialization, driving demand for reliable compressed air systems. Werther Compressor may expand distribution channels or explore local partnerships in these regions to capture growth. Meanwhile, reshoring trends in North America and Europe could boost demand for localized manufacturing support, benefiting established European brands like Werther. -

Supply Chain Resilience and Localization

Post-pandemic supply chain disruptions have prompted companies to prioritize resilience. In 2026, Werther Compressor may face pressure to localize components and reduce dependency on single-source suppliers. Investments in nearshoring and modular production could enhance delivery reliability and responsiveness to regional market fluctuations. -

Sustainability and Circular Economy Initiatives

Environmental, social, and governance (ESG) criteria are increasingly influencing procurement decisions. By 2026, Werther Compressor may need to emphasize product longevity, recyclability, and low lifecycle emissions. Offering remanufactured units, leasing models, or take-back programs could align with circular economy trends and differentiate the brand in competitive tenders. -

Competition from Asian Manufacturers

Low-cost competitors from China and South Korea continue to improve product quality and expand globally. While Werther maintains a reputation for engineering precision and durability, it must balance premium positioning with cost competitiveness—possibly through modular product lines or strategic pricing models.

Conclusion:

In 2026, Werther Compressor operates in a market defined by sustainability, digital transformation, and energy transition. Success will depend on the company’s ability to innovate in energy-efficient and hydrogen-ready technologies, strengthen digital service offerings, and adapt to shifting global supply and demand dynamics. By aligning with these trends, Werther can reinforce its position as a trusted provider in the industrial compressor sector.

Common Pitfalls When Sourcing Werther Compressors (Quality & IP)

Sourcing compressors branded as “Werther” can present significant risks, particularly concerning quality assurance and intellectual property (IP) concerns. Being aware of these pitfalls is essential to avoid costly downtime, performance issues, and legal complications.

Misleading Brand Representation and Counterfeit Risk

The name “Werther” is often associated with high-quality German engineering, but in the compressor market, it is frequently used by third-party manufacturers not affiliated with any original German company. This creates a high risk of counterfeit or imitation products falsely implying superior European standards. Buyers may receive units that lack the durability, precision, and performance of authentic industrial compressors, leading to premature failure and increased maintenance costs.

Lack of Quality Control and Inconsistent Performance

Compressors sourced under the “Werther” name—especially from unverified suppliers—often come from manufacturers with lax quality control processes. This can result in inconsistent build quality, substandard materials, and unreliable performance under industrial loads. Without access to original technical documentation, testing reports, or traceability, verifying the actual performance specifications becomes difficult, increasing the likelihood of operational inefficiencies or safety hazards.

Intellectual Property Infringement Concerns

Using or distributing compressors that mimic the branding, design, or trademarks of established European manufacturers under the “Werther” name may constitute intellectual property infringement. Even if unintentional, sourcing such products can expose your company to legal liability, including cease-and-desist orders, fines, or seizure of goods, particularly in markets with strict IP enforcement like the EU or the U.S.

Absence of Genuine Support and Warranty

Genuine OEM compressors come with manufacturer-backed warranties, technical support, and access to replacement parts. “Werther” compressors from dubious sources typically lack verifiable warranties or after-sales service. When issues arise, obtaining spare parts or technical assistance can be nearly impossible, leading to extended downtime and higher long-term costs.

Recommendations

To avoid these pitfalls, conduct thorough due diligence: verify the manufacturer’s credentials, request certification documents (e.g., CE, ISO), and confirm the absence of IP conflicts. Whenever possible, source compressors through authorized distributors or directly from reputable OEMs with established track records and transparent supply chains.

Logistics & Compliance Guide for Werther Compressor

This guide outlines the essential logistics and compliance procedures for handling, transporting, and managing Werther Compressor products in accordance with international standards, safety regulations, and company policies. Adherence to this guide ensures operational efficiency, regulatory compliance, and product integrity.

Product Handling and Storage

Ensure all Werther Compressor units are handled with care to prevent mechanical damage. Store compressors in a dry, temperature-controlled environment, protected from dust, moisture, and direct sunlight. Units should be stored upright on stable, level surfaces with adequate ventilation. Avoid stacking unless specifically approved by Werther’s technical documentation. Use appropriate lifting equipment—such as forklifts with cradles or overhead hoists—when moving heavy units.

Packaging and Labeling Requirements

All Werther Compressors must be shipped in original manufacturer packaging or equivalent protective materials that meet ISTA 3A standards. Each package must display clear, durable labels including:

– Product name and model number

– Serial number (if applicable)

– Gross and net weight

– “Fragile” and “This Side Up” orientation indicators

– HAZMAT classification (if applicable, e.g., units containing oil or refrigerants)

– Compliance markings (CE, UKCA, RoHS, etc.)

Ensure labeling complies with destination country regulations, including language requirements.

Transportation and Shipping

Coordinate shipments through approved freight forwarders experienced in industrial equipment logistics. For international deliveries, comply with Incoterms 2020 (typically FCA or DAP unless otherwise specified). Refrigerant-charged units must be transported in accordance with ADR (road), IMDG (sea), or IATA (air) regulations when applicable. Secure units within transport vehicles to prevent movement during transit. Maintain temperature logs if shipping through extreme climates.

Export Control and Documentation

All exports of Werther Compressor products require proper documentation, including:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– Certificate of Origin

– Export license (if required by destination country or product classification)

Verify compliance with export control regulations such as EAR (U.S. Department of Commerce) or EU Dual-Use Regulation. Classify products using correct HS codes (e.g., 8414.80 for air or vacuum pumps). Screen end-users against denied party lists prior to shipment.

Import Compliance

Importers must ensure compliance with local customs regulations. Duties, taxes, and import permits must be arranged in advance. Provide complete technical specifications and conformity declarations (e.g., EU Declaration of Conformity) to customs authorities. For units containing motors or electronic components, verify compliance with EMC, LVD, and ErP directives in the European Union or equivalent standards (e.g., UL, CSA) in North America.

Environmental and Safety Compliance

Dispose of packaging materials in accordance with local recycling regulations. For end-of-life compressors, follow WEEE (Waste Electrical and Electronic Equipment) guidelines in applicable regions. Train logistics personnel in handling procedures, including PPE use and spill response for oil or refrigerant leaks. Report any incidents involving product damage or non-compliance immediately to Werther Compliance Department.

Recordkeeping and Audits

Maintain complete logistics and compliance records for a minimum of five years. Records must include shipping documents, compliance certifications, audit reports, and training logs. Regular internal audits will be conducted to ensure adherence to this guide. Non-conformities must be documented and corrective actions implemented promptly.

For questions or updates, contact:

Werther Compliance Office

[email protected]

+49 (0)XXX XXXX-0

Conclusion for Sourcing Werther Compressors:

After a thorough evaluation of technical specifications, supply chain reliability, cost-effectiveness, and after-sales support, sourcing Werther compressors presents a viable and strategic option for our operations. Werther’s reputation for quality, energy efficiency, and durability aligns well with our performance and sustainability requirements. The availability of localized service networks and spare parts ensures reduced downtime and long-term operational efficiency.

While initial procurement costs may be slightly higher compared to some alternatives, the total cost of ownership—factoring in reliability, maintenance, and energy savings—makes Werther a competitive and prudent choice. Additionally, their compliance with international standards and environmental regulations supports our commitment to responsible sourcing.

In conclusion, we recommend proceeding with the sourcing of Werther compressors for current and future projects, subject to final commercial negotiations and volume pricing agreements to optimize overall value.