The global welding equipment and services market continues to expand, driven by rising demand for high-integrity joints across heavy industries such as oil & gas, construction, automotive, and shipbuilding. According to Grand View Research, the global welding equipment market was valued at USD 27.5 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. This growth is fueled by advancements in welding technologies, increasing infrastructure investments, and strict regulatory standards requiring full penetration welds for structural safety and reliability. Full penetration welding—critical for load-bearing and high-pressure applications—has become a benchmark for quality, prompting leading manufacturers to innovate in precision, consistency, and automation. As industries prioritize weld integrity and compliance with international standards like AWS and ISO, a select group of manufacturers has emerged at the forefront, combining engineering excellence with scalable production capabilities. Below are the top eight full penetration welding manufacturers shaping the future of industrial fabrication.

Top 8 Welding Full Penetration Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Fullpenfab

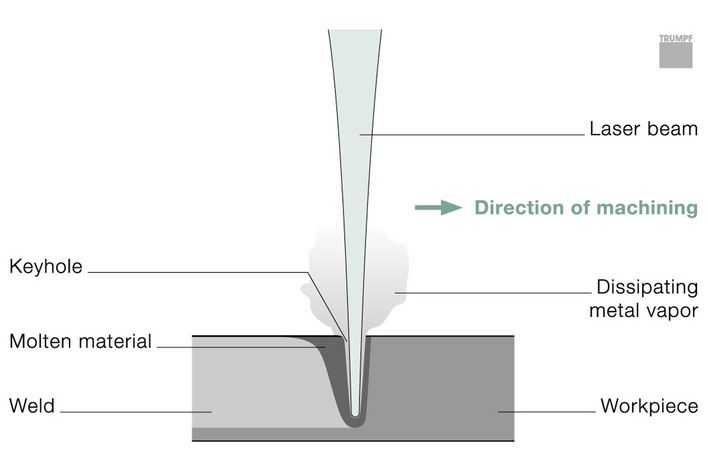

#2 Deep penetration welding

Website: trumpf.com

Key Highlights: This process is used in applications requiring deeper welds or where several layers of material have to be welded simultaneously….

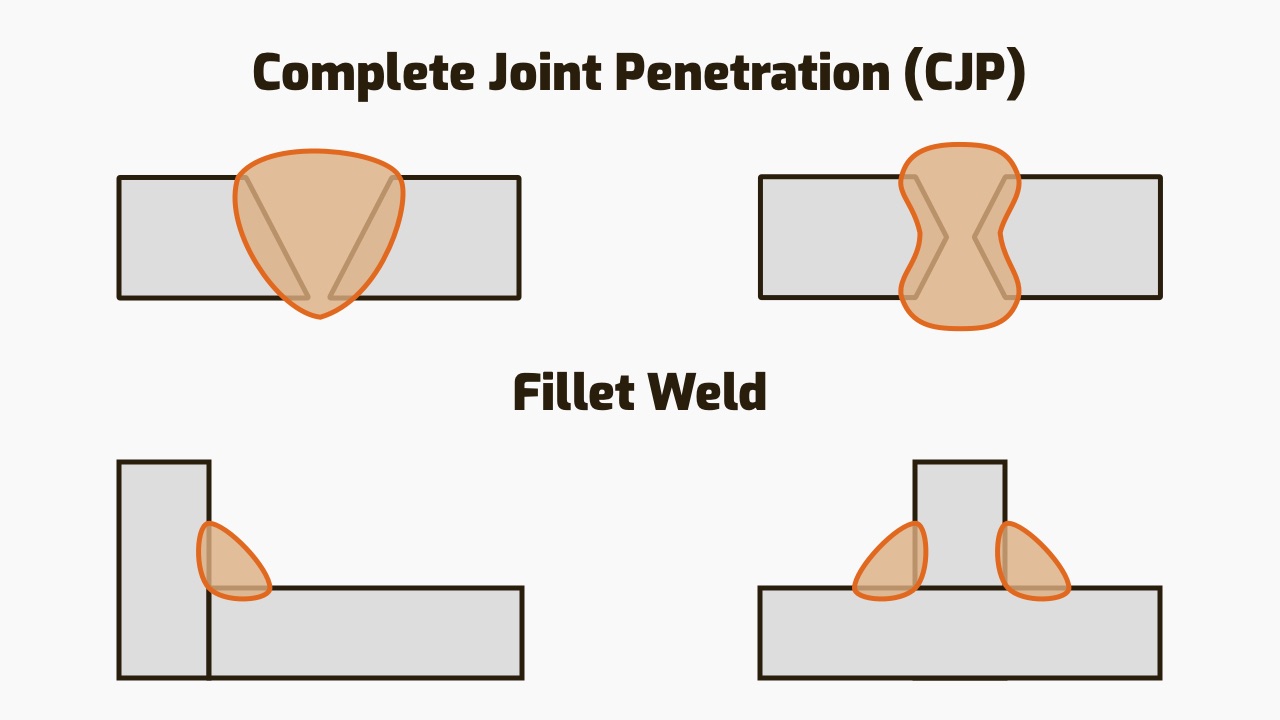

#3 Fabrication and Welding

Website: imships.com

Key Highlights: Butt joints- Welded one side with backing, welded from both sides. (Carbon Steel Backing). Fillet Joints- Partial penetration, full penetration, socket fillet ……

#4 Welding

Website: forneyind.com

Key Highlights: Free delivery over $300 60-day returns31115 Deep Penetration Rust Resolv. Deep Penetration Rust Resolver 1/8″ x 14″ Electrode – 1/2 lb. $6.99. Add to Cart. 31114 Deep Penetration R…

#5 Laser Welding

Website: ipgphotonics.com

Key Highlights: Laser welding is the process of transferring a laser beam’s energy in the form of heat to fuse or join parts. This transferred heat melts the materials to ……

#6 TIG Welding equipment

Website: polysoude.com

Key Highlights: The company manufactures a variety of power sources and orbital welding equipment, like a wide range of open and closed welding heads….

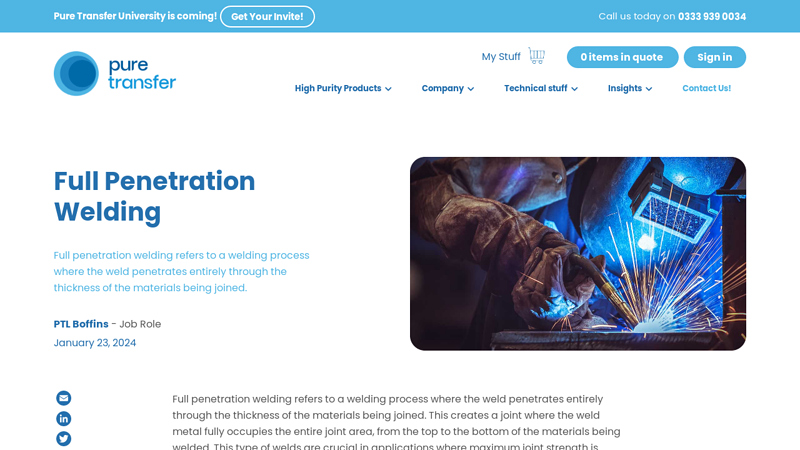

#7 Full Penetration Welding

Website: puretransfer.com

Key Highlights: Full penetration welding refers to a welding process where the weld penetrates entirely through the thickness of the materials being joined….

#8 Deep Dive: Full

Website: enerfab.com

Key Highlights: Full-penetration welds provide strong and durable connections but require careful procedures to ensure complete fusion and integrity….

Expert Sourcing Insights for Welding Full Penetration

H2: 2026 Market Trends for Full Penetration Welding

The global full penetration welding market is poised for significant evolution by 2026, driven by technological advancements, rising industrial automation, and increasing demand across key sectors such as construction, energy, shipbuilding, and heavy machinery. Here’s an analysis of the major market trends expected to shape the industry:

-

Growing Demand in Infrastructure and Construction

Governments worldwide are investing heavily in infrastructure development, including bridges, railways, and high-rise buildings, where structural integrity is paramount. Full penetration welding, known for its superior strength and reliability, is increasingly preferred in critical load-bearing components. This trend is especially pronounced in emerging economies like India, Southeast Asia, and parts of Africa, where urbanization and industrialization are accelerating. -

Expansion in Renewable Energy Projects

The push toward clean energy is boosting demand for full penetration welding in wind turbine towers, offshore platforms, and hydroelectric facilities. Wind energy, in particular, requires robust welded joints capable of withstanding dynamic loads and harsh environmental conditions, making full penetration techniques essential. By 2026, the renewable sector is expected to be one of the fastest-growing end-users of advanced welding technologies. -

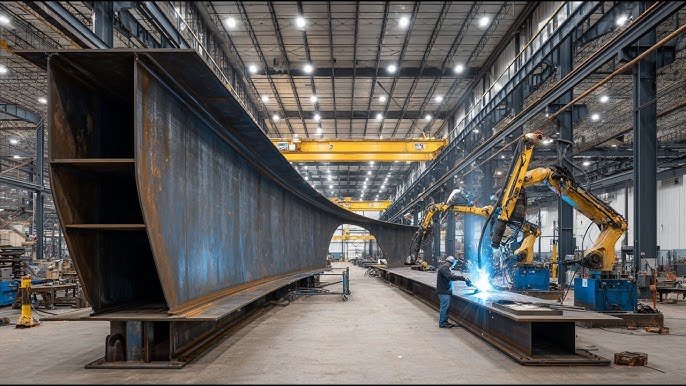

Adoption of Automation and Robotics

Automation in welding processes is gaining momentum, with companies integrating robotic full penetration welding systems to enhance precision, consistency, and productivity. The use of automated TIG (GTAW) and MIG (GMAW) processes with full penetration capabilities is becoming widespread in high-volume manufacturing, such as in the automotive and aerospace industries. Machine learning and real-time monitoring systems are also being incorporated to ensure weld quality and compliance. -

Advancements in Welding Materials and Techniques

Innovations in high-strength, low-alloy (HSLA) steels and advanced alloys are influencing full penetration welding practices. These materials often require precise heat control and specialized procedures, driving demand for skilled labor and advanced welding equipment. Additionally, hybrid welding techniques—such as laser-arc hybrid welding—are being adopted to achieve deeper penetration with higher efficiency, particularly in shipbuilding and heavy fabrication. -

Stringent Safety and Quality Standards

Regulatory bodies and industry standards (e.g., AWS, ISO, ASME) are enforcing stricter quality controls, especially in safety-critical applications. Full penetration welds are frequently mandated in pressure vessels, pipelines, and structural steelwork. As compliance becomes non-negotiable, investment in certified welding procedures, non-destructive testing (NDT), and welder training is expected to rise. -

Sustainability and Energy Efficiency

The welding industry is moving toward greener technologies, with manufacturers developing energy-efficient welding inverters and low-emission processes. By 2026, sustainability will play a larger role in procurement decisions, favoring full penetration methods that minimize material waste and rework through higher first-pass success rates. -

Skills Gap and Workforce Development

Despite technological advances, there remains a global shortage of certified welders proficient in full penetration techniques. To address this, companies and governments are investing in vocational training and digital learning platforms. Virtual reality (VR) welding simulators and AI-assisted training tools are expected to become more common by 2026, helping bridge the skills gap.

In conclusion, the 2026 outlook for full penetration welding is characterized by strong demand from infrastructure and energy sectors, enhanced by automation, material innovation, and stricter quality requirements. Companies that embrace digitalization, workforce development, and sustainable practices will be best positioned to capitalize on emerging opportunities in this evolving market.

Common Pitfalls Sourcing Welding Full Penetration (Quality, IP)

Sourcing welding services or components requiring full penetration welds—especially when high quality and specific Inspection and Testing Plans (ITP) or Inspection Procedures (IP) are mandated—can present several critical challenges. Failure to address these pitfalls can lead to structural failures, rework, delays, and safety hazards. Below are the most common pitfalls:

Inadequate Specification of Welding Standards and Acceptance Criteria

Often, procurement documents fail to clearly define the applicable welding codes (e.g., AWS D1.1, ASME IX, ISO 5817), required quality levels (e.g., CPB, CP C per ISO 3834), and acceptance criteria for defects. Without these, suppliers may interpret requirements loosely, resulting in substandard welds that technically meet a generic “full penetration” description but fail under load or inspection.

Poor Definition of Inspection and Testing Requirements (IP)

A frequent oversight is not detailing the Inspection Plan (IP), including Non-Destructive Testing (NDT) methods (e.g., RT, UT, MT, PT), sampling rates, personnel qualifications (e.g., ASNT Level II/III), and documentation requirements. Ambiguity leads to inconsistent inspection practices and missed defects. For example, assuming 100% radiographic testing without specifying it in the IP can result in only spot checks.

Selecting Suppliers Without Proper Qualification or Certification

Engaging welding subcontractors or fabricators without verifying their welding procedure qualifications (WPS/PQR), welder certifications (WPQ), and in-house quality control systems (e.g., ISO 3834, NADCAP) increases risk. Unqualified suppliers may lack the capability to consistently produce full penetration welds, especially on critical joints.

Incomplete Welding Procedure Specifications (WPS) Review

Procurement teams may accept WPS documents without thorough technical review. Errors such as incorrect preheat/interpass temperatures, mismatched filler metals, or inadequate joint preparation can compromise weld integrity—even if full penetration is claimed.

Overlooking Material Traceability and Compatibility

Full penetration welds are highly sensitive to base material properties and cleanliness. Sourcing without ensuring full material traceability (e.g., MTRs) or verifying compatibility between base and filler metals can lead to cracking, embrittlement, or hydrogen-induced failures, particularly in high-strength steels.

Insufficient Attention to Environmental and Process Controls

Conditions such as humidity, temperature, and surface contamination (e.g., moisture, oil, rust) significantly affect weld quality—especially for processes prone to hydrogen cracking. Suppliers in uncontrolled environments without proper storage or preheat protocols can produce flawed welds despite correct procedures on paper.

Lack of Oversight During Production

Relying solely on final inspection without in-process checks (e.g., root pass verification, interpass cleaning) allows defects to propagate. Without witnessing key stages or conducting hold-point inspections per the IP, critical flaws may go undetected until after completion.

Misunderstanding “Full Penetration” vs. “Effective” Penetration

Some suppliers equate full penetration with through-thickness fusion but neglect root quality, underbead penetration, or sidewall fusion. True full penetration requires continuous, defect-free fusion across the entire joint thickness and along both edges—something often missed without skilled NDT interpretation.

Inadequate Documentation and Record Retention

Failure to require complete welding records—WPS, PQR, WPQ, weld maps, NDT reports, and inspection sign-offs—creates traceability gaps. This complicates audits, liability assessments, and failure investigations, especially in regulated industries like oil & gas or aerospace.

Underestimating Post-Weld Heat Treatment (PWHT) Requirements

For certain materials and service conditions, PWHT is essential to relieve residual stresses and avoid brittle fracture. Omitting or inadequately specifying PWHT in sourcing criteria can result in welds that pass NDT but fail in service due to delayed cracking.

Avoiding these pitfalls requires clear technical specifications, rigorous supplier vetting, detailed inspection planning, and active quality oversight throughout the sourcing and fabrication process.

Logistics & Compliance Guide for Welding Full Penetration – H2 Standard

1. Purpose

This guide outlines the logistics and compliance requirements for performing full penetration welding operations in accordance with the H2 standard. The H2 standard is a widely recognized specification for welding procedures, particularly in industries where hydrogen-induced cracking (HIC) is a concern, such as offshore, oil & gas, and high-pressure applications. This document ensures safe, efficient, and compliant welding practices that meet structural integrity and quality assurance benchmarks.

2. Scope

This guide applies to:

– Welding operations involving full penetration joints

– Materials susceptible to hydrogen cracking (e.g., high-strength steels, quenched and tempered steels)

– Fabrication, repair, and inspection activities in controlled industrial environments

– Personnel involved in welding, supervision, quality control, and logistics management

3. Definitions

- Full Penetration Weld: A weld that extends completely through the joint thickness, providing full strength continuity across the joint.

- H2 Standard: Refers to a hydrogen control level in welding consumables, indicating a maximum diffusible hydrogen content of ≤5 mL per 100g of deposited weld metal.

- Diffusible Hydrogen: Hydrogen that remains mobile within the weld metal and heat-affected zone (HAZ), posing a risk of delayed cracking.

- Preheat & Interpass Temperature: Controlled heating of base material before and between weld passes to mitigate hydrogen cracking risk.

- Welding Procedure Specification (WPS): Documented method for performing compliant welds, qualified under standards such as ISO 15614 or ASME IX.

4. Compliance Requirements

4.1. Material Requirements

- Base materials must be compatible with H2-compliant welding processes.

- Confirm material certification (MTRs) to verify chemical composition and mechanical properties.

- Control storage conditions: store materials in dry, covered areas to prevent moisture absorption.

4.2. Welding Consumables (H2-Compliant)

- Use only welding electrodes, wires, and fluxes certified to H2 standard (≤5 mL/100g diffusible hydrogen).

- Electrodes (e.g., E7018-H4R, E9018M-H2) must be:

- Stored in heated quivers or ovens (typically 110–150°C) after initial baking.

- Baked according to manufacturer’s specifications (e.g., 300–400°C for 1–2 hours).

- Maintain traceability of consumables via batch numbers and certification.

4.3. Welding Procedures

- All full penetration welds must be performed using a qualified WPS compliant with:

- ISO 15614-1 (Metallic materials – Welding procedure test)

- ASME Section IX (for pressure equipment)

- WPS must specify:

- Preheat and interpass temperature ranges

- Maximum heat input

- Electrode type and storage requirements

- Post-weld heat treatment (PWHT), if required

4.4. Preheat & Interpass Temperature Control

- Preheat temperature must be established based on material thickness, carbon equivalent (CE), and hydrogen level.

- Typical preheat: 100–200°C (refer to WPS and applicable code)

- Use calibrated contact thermometers or infrared devices for monitoring.

- Maintain interpass temperature within specified range throughout welding.

- Record all temperature readings for traceability.

4.5. Environmental Controls

- Avoid welding in rain, snow, or high humidity (>80% RH) unless under protective enclosures.

- Use windbreaks and shelters to protect the arc and weld pool from drafts and moisture.

5. Logistics Management

5.1. Material Handling & Storage

- Store welding consumables in climate-controlled cabinets with humidity <50%.

- Use sealed containers for low-hydrogen electrodes; limit exposure time to ≤4 hours outside ovens (unless specified otherwise).

- Label all consumables with:

- Type, grade, batch number

- Baking date and time

- Time removed from oven

5.2. Equipment Requirements

- Use welding machines with stable arc characteristics and precise heat input control.

- Calibrate all equipment (thermometers, ammeters, voltmeters) annually or per QA program.

- Ensure proper grounding and cable integrity to prevent arc instability.

5.3. Personnel Qualifications

- Welders must be certified to applicable standards (e.g., ISO 9606, ASME Section IX).

- Training on H2 handling, moisture control, and hydrogen cracking prevention is mandatory.

- Supervisors and QC inspectors must have NDT and welding inspection qualifications (e.g., CSWIP, CWI).

6. Inspection & Testing

6.1. Non-Destructive Testing (NDT)

- Perform NDT after a minimum 48-hour post-weld delay to allow detection of hydrogen-induced cracks.

- Required methods:

- Ultrasonic Testing (UT) or Radiographic Testing (RT) for full penetration joints

- Magnetic Particle Testing (MT) or Dye Penetrant Testing (PT) for surface defects

- Acceptance criteria per ISO 5817 (Quality Level B or C, depending on application).

6.2. Hardness Testing

- Conduct Vickers hardness testing (HV10) on weld and HAZ if required by code.

- Maximum hardness typically limited to 350 HV to reduce cracking risk.

6.3. Record Keeping

- Maintain records of:

- WPS and PQR (Procedure Qualification Record)

- Welder qualifications

- Preheat/interpass logs

- NDT reports

- Consumable batch traceability

7. Safety & Environmental Compliance

- Enforce PPE requirements: welding helmets, gloves, flame-resistant clothing, respiratory protection (in confined spaces).

- Ensure adequate ventilation to prevent fume accumulation.

- Comply with local regulations (e.g., OSHA, HSE) for hot work permits and fire watch.

8. Non-Conformance & Corrective Actions

- Any deviation from WPS or H2 requirements constitutes a non-conformance.

- Corrective actions include:

- Grinding out and re-welding defective areas

- Re-baking of exposed electrodes

- Requalification of procedure or welder, if necessary

- Document all corrective actions and root causes.

9. References

- ISO 3690:2017 – Determination of hydrogen in deposited metal from arc welding

- ISO 15614-1:2017 – Specification and qualification of welding procedures

- AWS A5.1/A5.5 – Specifications for carbon and low-alloy steel electrodes

- EN 1011-2 – Welding recommendations for steel

- ASME BPVC Section IX – Welding, Brazing, and Fusing Qualifications

10. Revision Control

| Version | Date | Changes Made | Approved By |

|———|————|—————————–|————-|

| 1.0 | 2024-04-01 | Initial release | QA Manager |

Note: This guide must be used in conjunction with project-specific specifications and engineering drawings. Always consult the latest version of applicable standards and regulations.

Conclusion on Sourcing Welding for Full Penetration Joints:

Sourcing welding services for full penetration welds requires a strategic approach focused on quality, compliance, and capability. Full penetration welds are critical in high-stress and safety-sensitive applications, such as structural steel, pressure vessels, and offshore or seismic constructions, where failure is not an option. Therefore, selecting qualified welders, certified welding procedures (WPS/PQR), and accredited fabrication shops is essential.

Key considerations include ensuring welders are certified to relevant standards (e.g., AWS D1.1, ASME IX, ISO 9606), that non-destructive testing (NDT) such as ultrasonic (UT) or radiographic (RT) inspection is performed to verify integrity, and that materials and processes adhere to project specifications. Additionally, a reliable supplier should demonstrate a robust quality management system, traceability, and experience with similar projects.

In conclusion, successful sourcing of full penetration welding demands due diligence in vetting suppliers, strict adherence to industry standards, and continuous quality oversight. Investing in qualified and experienced partners ultimately ensures structural integrity, safety, regulatory compliance, and long-term cost savings by minimizing rework and field failures.