The global modular construction and oil & gas infrastructure sectors are experiencing strong momentum, driving increased demand for specialized equipment like weld skids. According to Grand View Research, the global modular construction market was valued at USD 129.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.5% from 2023 to 2030, fueled by faster project timelines, cost efficiency, and improved quality control. Additionally, Mordor Intelligence projects that the oil & gas engineering and construction market will grow at a CAGR of over 4.8% during the same period, with upstream and midstream infrastructure development playing a key role. As weld skids—prefabricated platforms used for welding piping spools and structural components—remain critical in both onshore and offshore fabrication yards, the need for reliable, high-capacity manufacturers has intensified. In response to these trends, a select group of fabricators has emerged as leaders in capacity, precision, and operational efficiency. Here are the top 9 weld skid manufacturers shaping the industry.

Top 9 Weld Skid Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Process Piping and Skid Systems

Domain Est. 1996

Website: highpurity.com

Key Highlights: Process piping skids are self-contained environments that include the piping, valves, gauges, pressure regulators, flanges and other necessary components and ……

#2 Complex Cab Manufacturers

Domain Est. 1998

Website: mclbody.com

Key Highlights: McLaughlin Body Company are premier off highway equipment manufacturers who specialize in cab engineering, cab manufacturing & assembly….

#3 Jobsite Skid

Domain Est. 1995

Website: airgas.com

Key Highlights: The jobsite skid from Airgas is a high-output, portable welding skid equipped with a MicroBulk gas delivery system that produces ARCAL™ and premium-grade ……

#4 Custom Skids Manufacturing

Domain Est. 1998

Website: acmewelding.com

Key Highlights: Acme manufactures top-tier, heavy-duty portable custom skids designed to endure demanding environments across various industries….

#5 ACE Welding Skids

Domain Est. 2003

Website: acemfginc.com

Key Highlights: The ACE Slide-in Welding Skid is a highly customizable modular design that can be configured to fit all North American brand trucks both regular and long box….

#6 JK Welding

Domain Est. 2003

Website: jkwelding.net

Key Highlights: Oilfield Skids Custom-built skids engineered for durability and safety, fabricated in-house to your spec and schedule….

#7 Skids

Domain Est. 2007

Website: alumareel.ca

Key Highlights: AlumaReel® creates and offers innovative welding products for various industries, including business, commercial, and specialized mobile welding….

#8 Skids

Domain Est. 2014

Website: rivaltruck.com

Key Highlights: The Rival Sloop Skid stands as a purposeful platform designed for secure storage of Welding Machines, Acetylene, Propane, Oxygen, and up to eight Reels….

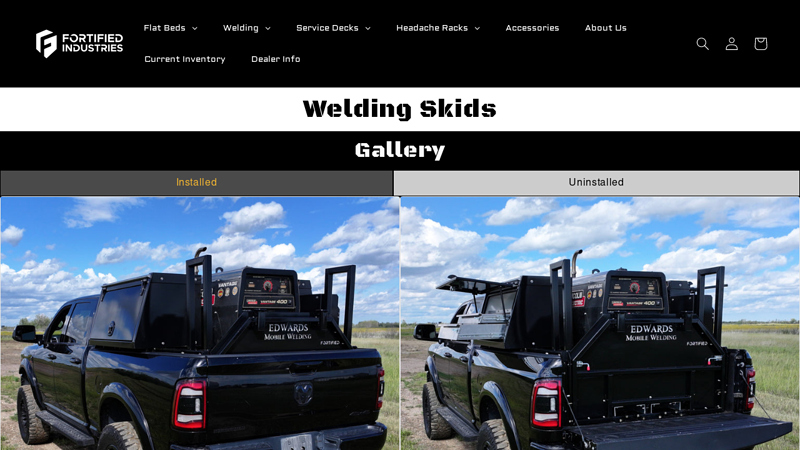

#9 Welding Skid

Domain Est. 2021

Website: fortifiedindustries.com

Key Highlights: The Fortified Welding Skid is designed to be ultra customizable. Laser cut holes are used throughout the skid to mount our lines of accessories and add ons….

Expert Sourcing Insights for Weld Skid

H2: 2026 Market Trends for Weld Skids

The global weld skid market is poised for significant evolution by 2026, driven by advancements in automation, growing demand for modular construction, and increasing investments in energy infrastructure. Weld skids—pre-fabricated, transportable units integrating welding systems for pipeline, oil & gas, and industrial applications—are becoming essential in enhancing operational efficiency and reducing on-site construction time. Key trends shaping the weld skid market in 2026 include:

-

Rise of Automation and Digital Integration

By 2026, weld skids are expected to incorporate higher levels of automation, robotics, and digital twin technologies. Smart weld skids equipped with real-time monitoring, predictive maintenance, and AI-driven weld optimization are gaining traction. This shift enhances precision, reduces human error, and improves safety in hazardous environments, particularly in offshore and remote operations. -

Expansion in Energy Infrastructure Projects

Ongoing and planned investments in oil & gas pipeline networks, LNG facilities, and renewable energy infrastructure (e.g., hydrogen pipelines) are fueling demand for mobile and scalable welding solutions. North America and the Middle East remain key markets due to active pipeline development, while Asia-Pacific shows strong growth driven by industrialization and energy diversification. -

Modularity and Portability Demand

The trend toward modular construction in industrial and energy projects is accelerating the adoption of weld skids. Their reusability, ease of transport, and rapid deployment offer cost and time savings. In 2026, manufacturers are focusing on lightweight, multi-functional skid designs that can be customized for different welding processes (e.g., TIG, MIG, SAW). -

Sustainability and Emission Regulations

Stricter environmental regulations are pushing weld skid manufacturers to develop energy-efficient and low-emission systems. Hybrid or electric-powered weld skids are emerging as alternatives to diesel-driven units, particularly in environmentally sensitive areas or regions with carbon reduction targets. -

Regional Market Dynamics

- North America: Dominates due to shale gas expansion and pipeline maintenance needs. The U.S. leads in adopting automated weld skid solutions.

- Middle East & Africa: Growth driven by large-scale oil & gas projects in Saudi Arabia, UAE, and Nigeria.

-

Asia-Pacific: Rapid industrial growth in India, China, and Southeast Asia supports demand for cost-effective, scalable welding systems.

-

Technological Partnerships and Consolidation

By 2026, strategic collaborations between welding equipment manufacturers, automation firms, and EPC contractors are expected to increase. These partnerships aim to deliver fully integrated weld skid solutions with enhanced control systems and data connectivity.

In conclusion, the 2026 weld skid market will be defined by innovation, sustainability, and adaptability to evolving infrastructure needs. Companies that invest in smart, modular, and eco-friendly weld skid technologies are likely to gain a competitive edge in this expanding market.

Common Pitfalls When Sourcing Weld Skids (Quality and Intellectual Property)

Sourcing weld skids—pre-fabricated, modular assemblies that integrate piping, equipment, and structural components—can deliver significant time and cost savings in industrial projects. However, overlooking key quality and intellectual property (IP) considerations can lead to costly delays, rework, legal disputes, or operational failures. Below are common pitfalls to avoid:

Poor Weld Quality and Non-Compliance with Standards

One of the most frequent issues when sourcing weld skids is inconsistent or substandard welding. Suppliers may use unqualified welders, skip required inspections, or fail to adhere to project specifications and international codes (e.g., ASME, AWS, API, or ISO). This can result in weld defects such as cracks, porosity, or incomplete fusion, compromising the skid’s structural integrity and safety.

Impact: Field rework, project delays, safety hazards, and potential failure under operational stress.

Best Practice: Require documented welding procedures (WPS/PQR), certified welders, third-party inspection (e.g., by an independent NDT provider), and full traceability of materials and welds (including weld maps and MTRs).

Inadequate Quality Control and Documentation

Many suppliers lack robust quality management systems (QMS), leading to missing or falsified inspection reports, non-conformance records, or incomplete documentation. This is especially critical in regulated industries like oil & gas, pharmaceuticals, or power generation.

Impact: Rejection during client or regulatory audits, inability to achieve mechanical completion, and increased liability.

Best Practice: Insist on a supplier with certified QMS (e.g., ISO 9001), define required documentation in the procurement package, and conduct pre-award audits of the fabrication facility.

Ambiguous Ownership of Design and IP

When skid designs are developed by the supplier or a third-party engineering firm, ownership of design drawings, calculations, and proprietary configurations may be unclear. Suppliers often retain IP rights unless explicitly transferred in the contract.

Impact: Restrictions on future modifications, duplication, or integration with other systems; potential licensing fees or legal disputes.

Best Practice: Clearly define IP ownership in the contract—ensure that all design deliverables, including 3D models and fabrication drawings, are transferred to the buyer upon payment. Use work-for-hire clauses where applicable.

Use of Proprietary Components Without Licensing

Some skid suppliers incorporate proprietary equipment or control systems (e.g., specialized pumps, automation software) without securing proper usage rights or transferable licenses for the end user.

Impact: Operational limitations, inability to service or upgrade systems, and potential infringement claims.

Best Practice: Require full disclosure of all third-party components and confirm that necessary licenses are included in the scope and transferable to the buyer.

Insufficient As-Built Documentation

As-built drawings, P&IDs, loop diagrams, and equipment datasheets are often incomplete or delivered late. Without accurate as-built records, maintenance, troubleshooting, and future expansion become extremely difficult.

Impact: Increased downtime, safety risks, and higher lifecycle costs.

Best Practice: Make complete and accurate as-built documentation a contractual deliverable with penalties for non-compliance. Require digital formats (e.g., PDF, DWG, STEP) and metadata consistency.

Geographic and Regulatory Compliance Risks

Suppliers located in regions with lax regulatory enforcement may cut corners on material sourcing, environmental practices, or labor standards. Additionally, skids may not comply with destination country regulations (e.g., PED in Europe, CRN in Canada).

Impact: Customs delays, rejection at site, or non-compliance fines.

Best Practice: Verify supplier compliance with relevant international standards and local regulations. Include compliance certifications in the purchase order.

By addressing these quality and IP-related pitfalls proactively during the sourcing process, organizations can ensure reliable, compliant, and legally secure weld skid deliveries that support long-term project success.

Logistics & Compliance Guide for Weld Skid

Overview

This guide provides essential information for the safe and compliant handling, transportation, and regulatory adherence related to Weld Skid units. It ensures smooth logistics operations while meeting industry and governmental standards.

Packaging and Handling Requirements

Weld Skids must be securely mounted on standardized skid bases with lifting points clearly marked. Use only certified forklifts or cranes to lift the unit, engaging only designated lifting lugs. Protect all sensitive components (e.g., control panels, hoses, valves) with protective covers during handling. Avoid dragging or tilting beyond 10 degrees unless specified by the manufacturer.

Transportation Guidelines

Transport Weld Skids on flatbed trailers or in shipping containers secured with rated tie-down straps or chains at multiple anchor points. Ensure the load is evenly distributed and chocked to prevent shifting. Comply with road weight limits and dimension regulations; oversize load permits may be required for international or cross-state shipments. Provide weatherproof tarps if exposed to the elements during transit.

International Shipping Compliance

For international shipments, complete all export documentation including Commercial Invoice, Packing List, and Certificate of Origin. Classify the Weld Skid under the appropriate HS Code (e.g., 8424.89 for industrial welding machinery). Ensure compliance with Incoterms® 2020 (e.g., FOB, CIF) as agreed with the buyer. Adhere to import regulations of the destination country, including electrical safety and environmental standards.

Regulatory and Safety Standards

Weld Skids must comply with applicable safety and performance standards such as OSHA 29 CFR 1910.254 (welding safety), NFPA 51B (fire prevention), and ANSI Z49.1 (welding safety practices). Electrical components should meet NEC (NFPA 70) and be CE-marked or UL-listed where applicable. Confirm RoHS and REACH compliance for shipments to the EU.

Documentation and Labeling

Affix durable labels indicating weight, center of gravity, lifting points, voltage requirements, and hazard warnings (e.g., high voltage, hot surface). Include a compliance plate with serial number, model, and certification marks. Ship with operation manuals, compliance certificates, and a bill of materials (BOM).

Customs Clearance and Duties

Prepare customs brokers with complete technical specifications and valuation documentation. Anticipate potential duties based on the destination country’s tariff schedule. Retain records for a minimum of five years to support audit or compliance verification.

Installation and Site Compliance

Upon delivery, verify site readiness including proper grounding, ventilation, and access to required utilities (power, gas, water). Conduct a pre-start safety inspection and ensure all personnel are trained per OSHA and manufacturer guidelines before commissioning.

Environmental and Disposal Considerations

Dispose of packaging materials in accordance with local waste regulations. At end-of-life, recycle metal components and handle electrical parts as e-waste per WEEE directives or local environmental codes.

Contact and Support

For logistics or compliance inquiries, contact the manufacturer’s logistics department at [email protected] or +1-800-XXX-XXXX. Provide the skid’s serial number and shipment details for prompt assistance.

Conclusion for Sourcing Weld Skid:

In conclusion, sourcing a weld skid requires a strategic approach that balances quality, cost, delivery timelines, and supplier reliability. A thorough evaluation of potential suppliers, including their welding certifications (such as AWS or ASME), manufacturing capabilities, quality control processes, and past performance, is essential to ensure the skid meets project specifications and industry standards. Additionally, considering logistical factors, long-term support, and total cost of ownership—beyond initial price—will contribute to a successful outcome. By selecting a qualified and dependable vendor, organizations can ensure the weld skid integrates seamlessly into their operations, delivering durability, safety, and operational efficiency over its lifecycle.