The global welding equipment and fabrication market continues to expand, driven by rising demand in construction, energy, automotive, and heavy industrial sectors. According to Grand View Research, the global welding equipment market was valued at USD 25.9 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.6% from 2023 to 2030. Similarly, Mordor Intelligence projects sustained growth in industrial fabrication, with increasing emphasis on structural integrity and safety standards fueling demand for high-quality weld full penetration services. This growing need for reliable, defect-free welding has elevated the importance of manufacturers capable of delivering consistent, code-compliant full penetration welds—critical in applications requiring maximum strength and durability. In this landscape, a select group of manufacturers have distinguished themselves through advanced technology, rigorous quality control, and proven performance across high-stakes industries. The following analysis highlights the top 8 full penetration weld manufacturers leading innovation and reliability in the sector.

Top 8 Weld Full Penetration Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Industrial

Website: microtechwelding.com

Key Highlights: Ideal for welding thicker materials or performing full-penetration welds; Compatible with a wide variety of metals used across industries; Deeper penetration ……

#2 Fullpenfab

#3 Fabrication and Welding

Website: imships.com

Key Highlights: IMS maintains full time welders, pipefitters, and fabricators on staff. Welder qualifications are maintained in accordance with NAVSEA S9074-AQ-GIB-010/248….

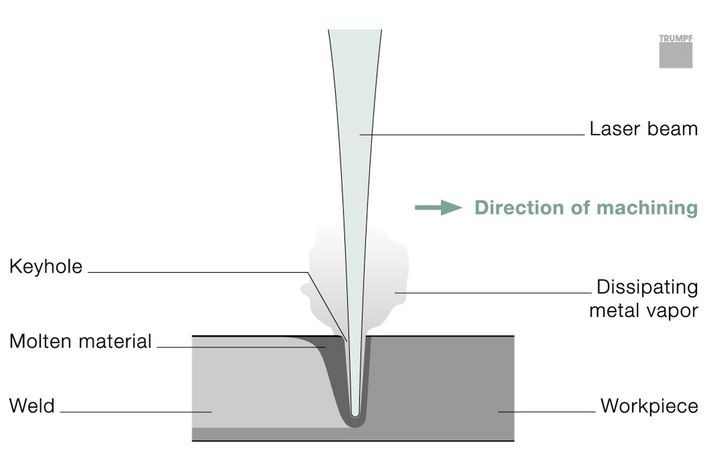

#4 Deep penetration welding

Website: trumpf.com

Key Highlights: This process is used in applications requiring deeper welds or where several layers of material have to be welded simultaneously….

#5 Welding

Website: forneyind.com

Key Highlights: Free delivery over $300 60-day returns31115 Deep Penetration Rust Resolv. Deep Penetration Rust Resolver 1/8″ x 14″ Electrode – 1/2 lb. $6.99. Add to Cart. 31114 Deep Penetration R…

#6 Laser Welding

Website: ipgphotonics.com

Key Highlights: Laser welding is a flexible process that can be performed with or without filler material and is used to create seams and joints that are narrow, wide, shallow, ……

#7 Deep Dive: Full

Website: enerfab.com

Key Highlights: Full-penetration welds provide strong and durable connections but require careful procedures to ensure complete fusion and integrity….

#8 Full Penetration Welding

Website: puretransfer.com

Key Highlights: Full penetration welding refers to a welding process where the weld penetrates entirely through the thickness of the materials being joined….

Expert Sourcing Insights for Weld Full Penetration

H2: Market Trends for Weld Full Penetration in 2026

The global market for full penetration welding is poised for significant transformation by 2026, driven by advancements in manufacturing technologies, stringent safety regulations, and growing demand across key industrial sectors such as construction, energy, automotive, and shipbuilding. Full penetration welds—known for their superior strength, structural integrity, and reliability—are becoming increasingly essential in high-stress and safety-critical applications.

One of the dominant trends shaping the 2026 landscape is the integration of automation and digitalization in welding processes. Automated welding systems, including robotic welding cells and AI-driven monitoring tools, are enhancing precision and consistency in full penetration welds. These technologies reduce human error, improve throughput, and ensure compliance with international standards such as ISO 5817 and AWS D1.1. The adoption of real-time weld monitoring and adaptive control systems is expected to rise, particularly in heavy industries where structural failure is not an option.

Another key trend is the growing emphasis on sustainability and material efficiency. As industries strive to reduce carbon footprints, manufacturers are optimizing welding procedures to minimize energy consumption and material waste. Advanced techniques like laser-hybrid welding and pulsed gas metal arc welding (GMAW-P) are gaining traction due to their ability to achieve full penetration with lower heat input, reducing distortion and post-weld correction needs.

The energy sector, especially in offshore wind and oil & gas infrastructure, continues to drive demand for high-integrity full penetration welds. With increasing investments in renewable energy projects and aging pipeline replacements, the need for durable, corrosion-resistant welds in challenging environments is escalating. This has led to greater use of high-strength low-alloy (HSLA) steels and nickel-based alloys, necessitating specialized welding procedures and skilled labor.

Additionally, the global shortage of skilled welders is pushing companies toward standardized welding procedures and certification programs. In 2026, we expect to see expanded use of virtual reality (VR) training and digital twin simulations to upskill welders and ensure consistent quality in full penetration joints.

Geographically, Asia-Pacific remains the largest market due to rapid industrialization in countries like China and India, while North America and Europe lead in technological innovation and regulatory compliance. The convergence of advanced materials, smart manufacturing, and sustainability goals will define the future of full penetration welding, making it a cornerstone of modern structural engineering and industrial safety by 2026.

Common Pitfalls Sourcing Weld Full Penetration (Quality, IP)

Sourcing full penetration welds with guaranteed quality and integrity presents several common challenges that can compromise safety, performance, and compliance. Being aware of these pitfalls is essential for effective procurement and project success.

Inadequate Specification of Weld Quality Requirements

Often, procurement documents fail to clearly define acceptable quality standards for full penetration welds. Vague terms like “high quality” without referencing specific codes (e.g., AWS D1.1, ASME IX, ISO 5817) or acceptance criteria for discontinuities (such as porosity, undercut, or lack of fusion) can lead to inconsistent interpretations. This ambiguity results in welds that may visually appear sound but do not meet required mechanical or structural performance standards.

Insufficient Qualification of Welding Procedures and Personnel

A frequent oversight is not verifying the validity and scope of Procedure Qualification Records (PQRs) and Welder Performance Qualifications (WPQs). Using unqualified or expired procedures or welders can lead to inconsistent weld quality. It’s critical to ensure that the welding procedures match the base materials, joint designs, and positions required for the project, and that welders are certified accordingly.

Poor Control Over Inspection and Non-Destructive Testing (NDT)

Assuming that full penetration equates to full integrity without proper inspection is a major risk. Relying solely on visual inspection (VT) is insufficient. Full penetration welds require comprehensive NDT methods such as radiographic testing (RT), ultrasonic testing (UT), or phased array ultrasonic testing (PAUT) to detect internal flaws. Pitfalls include inadequate NDT coverage, use of unaccredited inspectors, or failure to define inspection frequency and acceptance levels in the purchase order.

Lack of Traceability and Documentation

Full penetration welds in critical applications demand full traceability of materials, procedures, personnel, and test results. A common pitfall is accepting incomplete or missing documentation, such as mill test reports, weld maps, inspection reports, or NDT certifications. Without proper records, verifying compliance during audits or failure investigations becomes nearly impossible.

Overlooking Environmental and In-Process Conditions (IP)

Ignoring in-process conditions such as preheat temperature, interpass temperature, shielding gas purity, or ambient humidity can severely affect weld integrity. Suppliers in different climates or facilities may not control these parameters adequately, leading to hydrogen-induced cracking (especially in high-strength steels) or other defects. Failing to specify and monitor these conditions in the procurement process increases the risk of weld failure.

Selecting Vendors Based Solely on Cost

Choosing a supplier based only on the lowest bid often leads to compromised quality. Budget vendors may cut corners by using less experienced welders, skipping required inspections, or employing substandard materials. This short-term saving can result in long-term costs due to rework, delays, or structural failures.

Failure to Conduct Supplier Audits or Pre-Qualification

Procuring full penetration welds without auditing a supplier’s welding facilities, quality management system (e.g., ISO 3834), or past performance is a significant oversight. Without due diligence, there’s no assurance that the supplier can consistently meet technical and quality requirements.

Avoiding these pitfalls requires clear specifications, rigorous documentation, qualified personnel, thorough inspection protocols, and strategic supplier selection grounded in quality—not just cost.

H2: Logistics & Compliance Guide for Weld Full Penetration

Achieving full penetration welds requires strict adherence to logistics and compliance protocols to ensure structural integrity, safety, and regulatory acceptance. Below is a comprehensive guide covering key aspects:

H2: Pre-Welding Logistics & Planning

1. Design & Specification Review:

– Verify welding procedure specifications (WPS) and procedure qualification records (PQR) are approved and match project requirements.

– Confirm joint design (e.g., V-groove, U-groove, double-V) meets full penetration criteria per codes (e.g., AWS D1.1, ASME BPVC Section IX, ISO 5817).

– Ensure material compatibility (base metals and filler metals) is documented.

2. Material Handling & Storage:

– Store base materials in a dry, clean environment to prevent contamination (e.g., moisture, rust, oil).

– Label and segregate materials by grade and heat number to prevent mix-ups.

– Store filler metals (especially low-hydrogen types) in controlled ovens per manufacturer guidelines (typically 250–300°F / 120–150°C).

3. Equipment Readiness:

– Calibrate welding machines, ammeters, and voltmeters according to maintenance schedules.

– Prepare required tools: grinders, chipping hammers, wire brushes, preheat equipment (torches, induction heaters).

– Validate gas delivery systems (shielding gas type, purity, flow rate) for GMAW, GTAW, or FCAW.

4. Personnel Qualification:

– Ensure welders are certified for the specific process, material, position, and thickness per applicable standards.

– Maintain up-to-date welding certification records and verify scope of authorization.

H2: Compliance During Welding Execution

1. Joint Preparation & Fit-Up:

– Bevel edges to specified angles and root faces using approved methods (plasma, machining, grinding).

– Achieve tight, consistent root gaps (typically 1–3 mm) and proper alignment (no mismatch > 10% of thickness or 3 mm, per AWS D1.1).

– Clean joint surfaces to remove scale, paint, moisture, and contaminants within 25 mm of the groove.

2. Preheat & Interpass Temperature Control:

– Apply preheat as specified in WPS (based on material thickness, grade, and ambient conditions).

– Monitor with calibrated contact pyrometers or temperature-indicating crayons.

– Maintain interpass temperature within specified range to prevent hydrogen cracking.

3. Welding Process Control:

– Follow WPS parameters: current, voltage, travel speed, polarity, shielding gas.

– Use back-gouging or backing bars (ceramic, copper, or consumable inserts) as needed to ensure root penetration.

– Perform root pass with adequate heat input to achieve full penetration and fusion.

4. Real-Time Quality Checks:

– Conduct visual inspection after each pass for defects (porosity, undercut, cracks).

– Verify penetration via witness marks or temporary backing removal (if applicable).

– Document weld progression with tracking logs (weld map, welder ID, date, joint ID).

H2: Post-Welding Compliance & Documentation

1. Post-Weld Heat Treatment (PWHT):

– Apply PWHT if required by code or WPS to relieve residual stresses.

– Record time-temperature profiles with calibrated chart recorders.

2. Non-Destructive Testing (NDT):

– Schedule and perform required NDT methods:

– Radiographic Testing (RT) or Ultrasonic Testing (UT) for volumetric inspection of full penetration welds.

– Magnetic Particle (MT) or Dye Penetrant (PT) for surface crack detection.

– Ensure NDT personnel are certified (e.g., ASNT Level II or III).

3. Defect Remediation:

– Follow approved repair procedures for any discontinuities.

– Limit repairs to allowed number of passes per code (e.g., AWS D1.1 limits repairs to two attempts).

– Re-NDT repaired areas.

4. Documentation & Traceability:

– Compile full compliance package:

– WPS/PQR

– Welder certifications

– Preheat/interpass records

– NDT reports with acceptance documentation

– Final inspection reports

– As-built weld maps

– Archive records per project or regulatory retention policies (typically 5–10 years).

H2: Regulatory & Code Compliance

Applicable Standards:

– AWS D1.1/D1.1M: Structural Welding Code – Steel

– ASME BPVC Section IX: Welding Qualifications

– API 1104: Welding of Pipelines and Related Facilities

– ISO 3834: Quality requirements for fusion welding

– EN 1090: Execution of steel structures (for EU projects)

Key Compliance Focus:

– Full penetration verification (through thickness)

– Hydrogen control (for high-strength steels)

– Traceability of materials and welders

– Independent third-party inspection (if required)

Adherence to this logistics and compliance guide ensures full penetration welds meet structural, safety, and regulatory requirements across industries such as construction, oil & gas, and heavy manufacturing.

Conclusion on Sourcing Full Penetration Welds:

Sourcing full penetration welds requires a strategic approach that balances quality, compliance, cost, and supplier capability. Full penetration welds are critical in high-integrity applications where structural strength, safety, and longevity are paramount—such as in pressure vessels, structural steel, pipelines, and offshore or seismic-resistant constructions. Therefore, selecting qualified welding fabricators with certified procedures (e.g., WPS/PQR), experienced welders (e.g., certified to ASME, AWS, or ISO standards), and robust quality control processes—including NDT (RT, UT, MT, PT)—is essential.

Effective sourcing involves thorough vetting of suppliers, ensuring they have the proper equipment, skilled personnel, and track record in executing full penetration welds to required codes and standards. Additionally, clear technical specifications, proper documentation, and oversight during production help mitigate risks of defects such as incomplete fusion, porosity, or cracking.

In conclusion, successful sourcing of full penetration welds hinges on partnering with reliable, certified fabricators and maintaining rigorous quality assurance throughout the supply chain. Investing in proper qualification and inspection upfront significantly reduces the risk of costly rework, field failures, and safety hazards, ultimately ensuring structural integrity and project success.