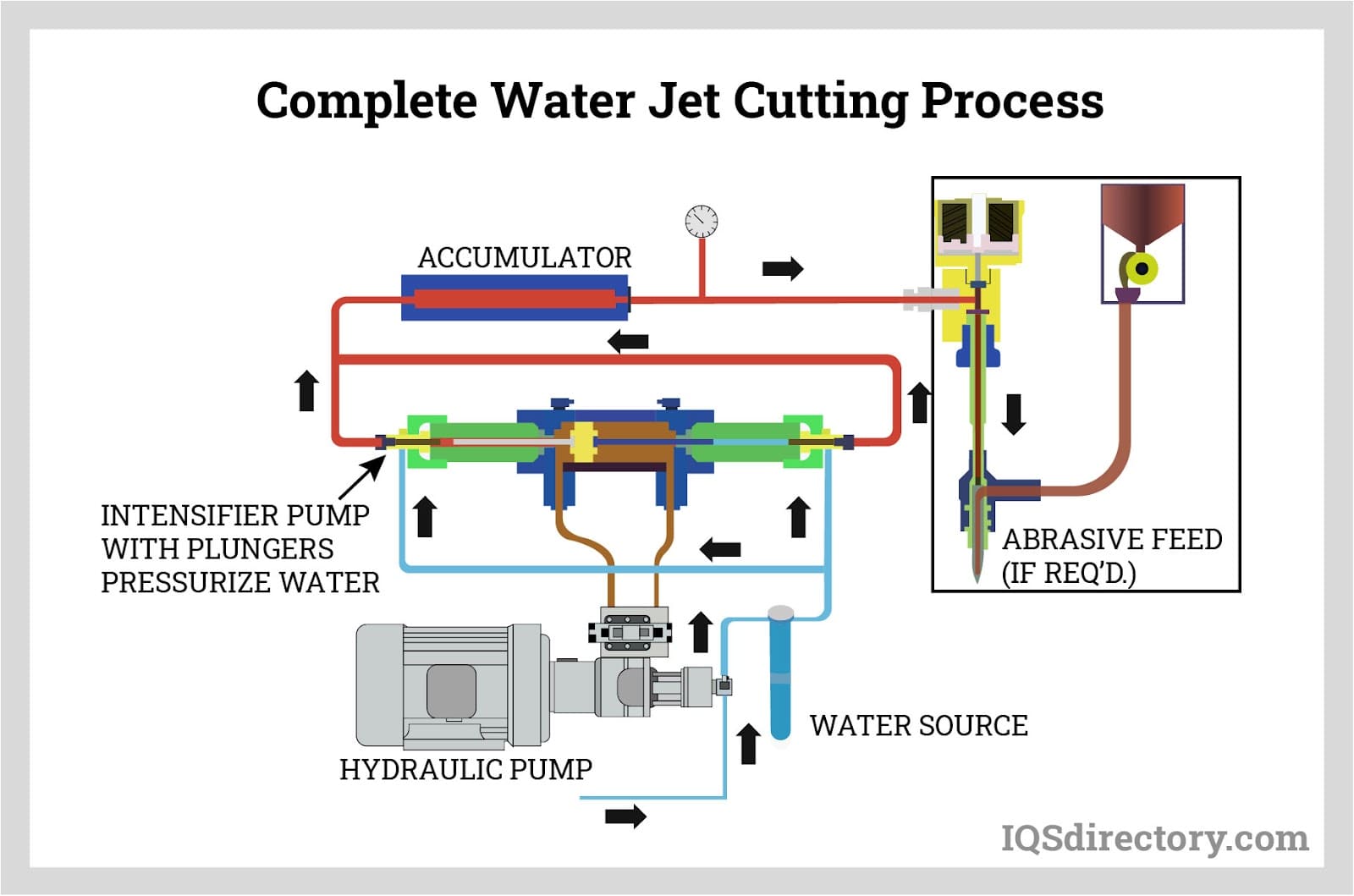

The global waterjet cutting machine market is experiencing robust growth, driven by increasing demand for precision cutting across industries such as automotive, aerospace, and manufacturing. According to a report by Mordor Intelligence, the global waterjet cutting machine market was valued at approximately USD 1.2 billion in 2023 and is projected to grow at a CAGR of over 7.5% from 2024 to 2029. This expansion is fueled by the technology’s ability to cut a wide range of materials—including metals, composites, and stone—without generating heat-affected zones, thereby preserving material integrity. Additionally, rising adoption of ultra-high-pressure (UHP) systems and advancements in automation are enhancing operational efficiency and accuracy. As industries prioritize sustainability and energy efficiency, waterjet cutting emerges as an environmentally friendly alternative to traditional thermal cutting methods. With a competitive landscape marked by technological innovation and regional expansion, identifying the top waterjet cutter manufacturers becomes crucial for businesses seeking reliable, high-performance solutions. Based on market presence, technological capabilities, and product range, the following are the top 10 waterjet cutter manufacturers shaping the industry today.

Top 10 Watter Cutter Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 High

Domain Est. 2002

Website: mecanumeric.com

Key Highlights: MECANUMERIC’s high-pressure waterjet cutting technology can cut a wide range of materials using pure water or water mixed with abrasive for very hard materials….

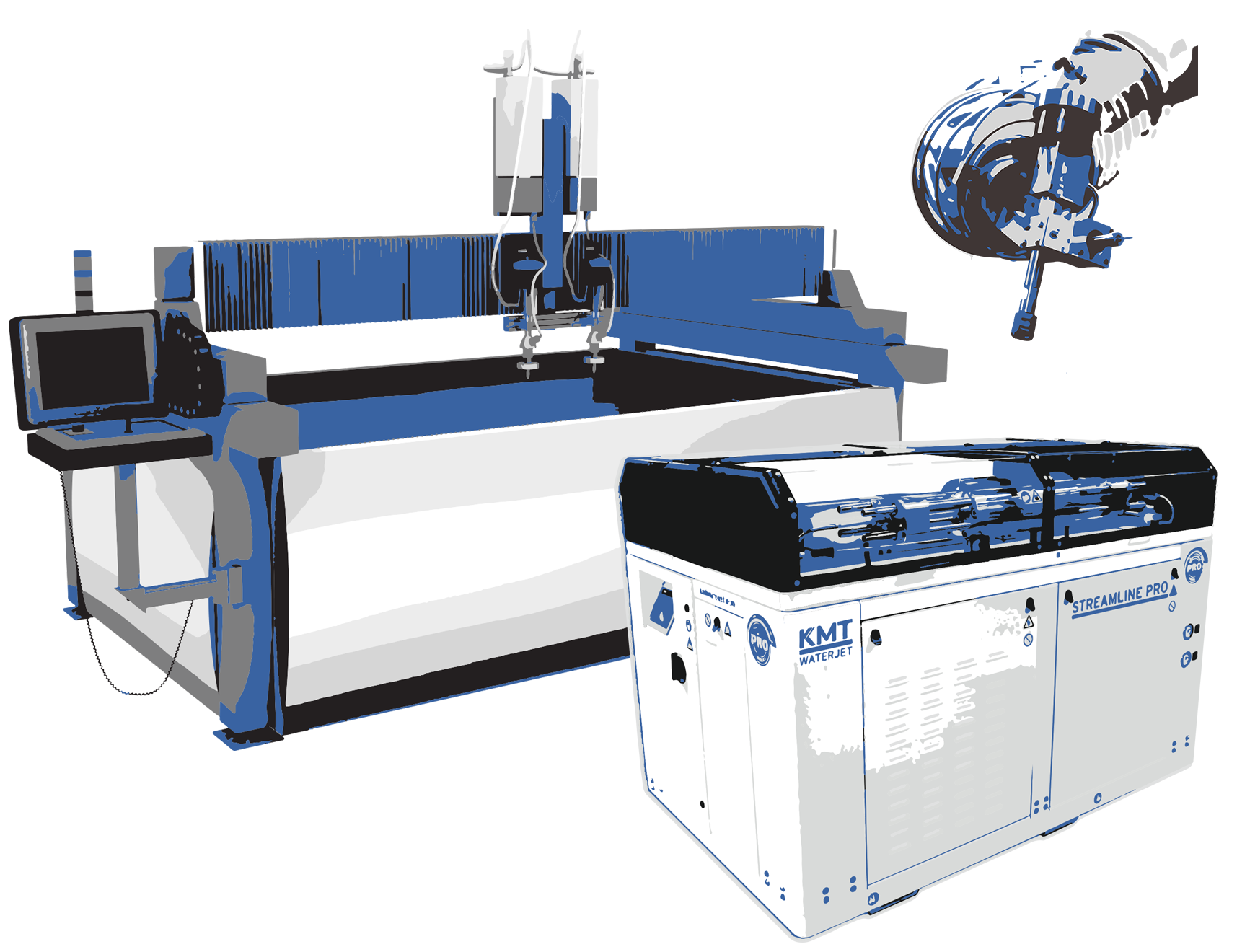

#2 KMT Waterjet

Domain Est. 2003

Website: kmtwaterjet.com

Key Highlights: KMT Waterjet: Pioneers in waterjet cutting technology. Discover pumps, parts, and complete systems for precision solutions….

#3 Walter Tools » Engineering Kompetenz

Domain Est. 2004

Website: walter-tools.com

Key Highlights: Walter has grown to become one of the world’s leading manufacturers of precision tools for metal machining. With around 3800 international employees….

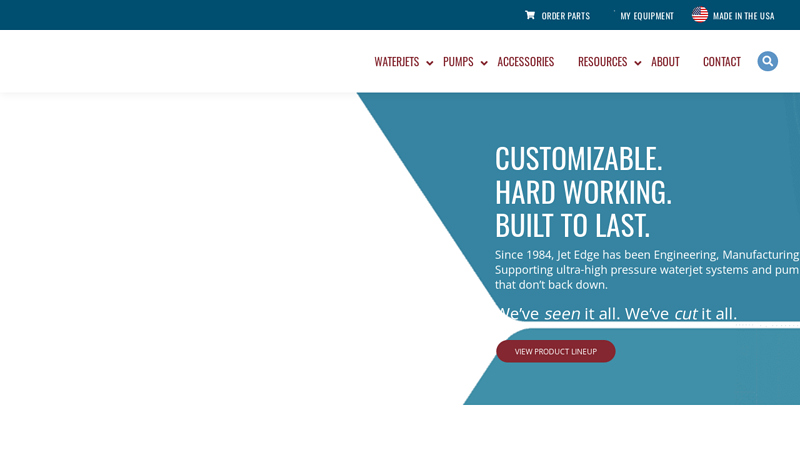

#4 Jet Edge Waterjet Systems

Domain Est. 2018

Website: jetedgewaterjets.com

Key Highlights: Jet Edge Waterjet Systems is a leading manufacturer of waterjet and abrasive waterjet Cutters, ultra high pressure pumps, and accessories….

#5 High Pressure Water Jet and CNC Cutting in Austin, TX

Domain Est. 1998

Website: aquajetinc.com

Key Highlights: Aqua Jet Inc, Local to Austin, TX specializes in precision cutting solutions using advanced high-pressure water jet, abrasive water jet and automated CNC ……

#6

Domain Est. 1998

Website: marzee.com

Key Highlights: Waterjet cutting is a proven process in precision part production. It is able to make complex flat parts out of most any materials including metal, plastic, ……

#7 Tailored Waterjet Solutions

Domain Est. 2000

Website: wardjet.com

Key Highlights: We’ve built and installed thousands of waterjet machines across a diverse industry portfolio to suit specific manufacturing and material cutting needs….

#8 Waterjets – Flow International

Domain Est. 2003

Website: flowwaterjet.com

Key Highlights: Flow is the inventor and world leader in waterjet cutting solutions. With waterjet, you’ve got the versatility to cut any material, any shape, and any size….

#9 Diamond Waterjet: Waterjet Cutting

Domain Est. 2015

Website: diamondwaterjet.com

Key Highlights: Our water jet tables use an abrasive stream of water to precisely cut corners and complex flat parts out of a wide range of materials and thicknesses….

#10 Custom Waterjet Cutting Services

Domain Est. 2015

Website: xometry.com

Key Highlights: Xometry offers using a high-pressure water and abrasive jet to cut metals, plastics, composites, and more without heating or altering material structure….

Expert Sourcing Insights for Watter Cutter

2026 Water Cutter Market Trends: Key Insights and Projections (H2 Focus)

Based on current technological, economic, and environmental trajectories, the water cutter (waterjet cutting) market is poised for significant evolution by 2026. Focusing on the second half of the year (H2 2026), we can anticipate the following key trends shaping the industry:

1. Accelerated Adoption of Ultra-High Pressure (UHP) & Hybrid Systems:

* H2 2026 Driver: Demand for faster cutting speeds, thicker material capability (beyond 200mm), and improved edge quality will peak. Manufacturers will increasingly deploy systems operating at 90,000+ PSI.

* Trend: Wider commercialization of reliable, energy-efficient UHP pumps (e.g., intensifier and direct-drive advancements) will make these systems cost-competitive for mid-volume shops. Hybrid systems combining waterjet with laser (for thin materials) or plasma (for thick conductive materials) on a single platform will gain traction, offering ultimate flexibility for job shops.

2. Deepening Integration of AI, Machine Learning, and Advanced Automation:

* H2 2026 Driver: Intensifying pressure to reduce operational costs, minimize waste, and achieve lights-out manufacturing.

* Trend: AI-powered software will move beyond basic nesting. Expect real-time adaptive control systems that dynamically adjust parameters (pressure, speed, abrasive flow) based on material variations, nozzle wear detection, and cut quality feedback. Robotic arms integrated with 5-axis waterjet heads will become standard for complex 3D part production, especially in aerospace and automotive. Predictive maintenance using IoT sensors will be ubiquitous, minimizing downtime.

3. Sustainability and Eco-Innovation as Core Competitive Advantages:

* H2 2026 Driver: Stricter global environmental regulations (e.g., EU Green Deal), corporate ESG mandates, and rising energy/water costs.

* Trend: Significant focus on:

* Closed-Loop Water Recycling: Near-total water recovery systems will become standard for abrasive cutting, drastically reducing freshwater consumption and wastewater discharge.

* Abrasive Recycling: Efficient on-site garnet recycling systems will mature, cutting abrasive costs by 30-50% and minimizing landfill waste.

* Energy Efficiency: Next-gen pumps and system designs will prioritize lower kWh per meter cut. “Green” abrasives (recycled, lower-impact) will see increased adoption.

* Water-Only Cutting Expansion: Growth in precision food, rubber, composites, and advanced materials processing where cold cutting is essential.

4. Expansion into New Materials and High-Growth Sectors:

* H2 2026 Driver: Demand from emerging technologies and supply chain diversification.

* Trend:

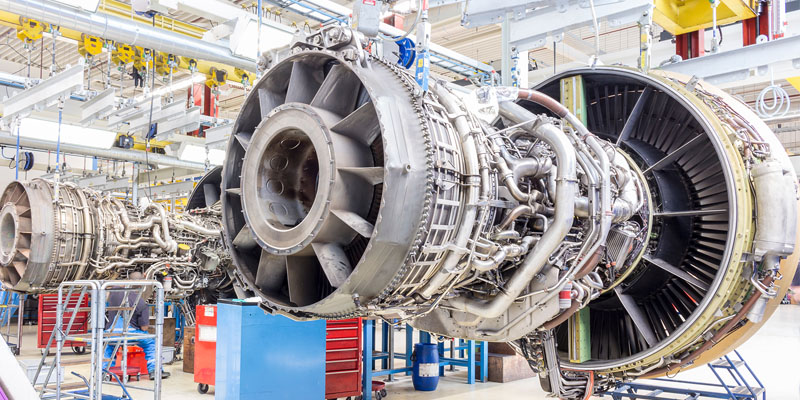

* Aerospace & Defense: Increased use for cutting advanced composites (CFRP, GFRP), titanium, and exotic alloys for next-gen aircraft and drones, leveraging the cold cut advantage.

* Electric Vehicles (EVs): Critical for cutting battery components (busbars, cooling plates), motor laminations (using specialized systems), and lightweight structural parts.

* Renewables: Growth in cutting components for wind turbine blades (composites), solar panel frames, and hydrogen fuel cell stacks.

* Advanced Materials: Processing of ceramics, ultra-high-molecular-weight polyethylene (UHMWPE), and new composite blends.

5. Democratization and Service Model Evolution:

* H2 2026 Driver: Need for accessibility and reduced capital expenditure barriers.

* Trend:

* Compact & Benchtop Systems: More affordable, smaller footprint waterjet systems will enter the market, making the technology accessible to smaller manufacturers, prototyping labs, and educational institutions.

* “Cutting-as-a-Service” (CaaS): Cloud-connected waterjets with remote monitoring and pay-per-cut models will emerge, particularly for specialized applications or low-volume users, reducing upfront investment.

* Enhanced Remote Support: AR/VR-assisted remote diagnostics and training will become standard, improving uptime and reducing service costs.

6. Supply Chain Resilience and Regionalization:

* H2 2026 Driver: Ongoing geopolitical tensions and lessons learned from recent disruptions.

* Trend: Manufacturers and end-users will prioritize suppliers with robust, geographically diversified supply chains for critical components (pumps, nozzles, abrasives). Localized manufacturing and service hubs will grow in importance, particularly in Asia-Pacific and North America.

Conclusion for H2 2026:

The water cutter market in H2 2026 will be characterized by smarter, faster, greener, and more accessible technology. Success will depend on embracing AI-driven automation, achieving significant sustainability gains through closed-loop systems, and targeting high-growth sectors like EVs and advanced materials. Companies investing in UHP, hybrid capabilities, and robust service/support models will be best positioned to capitalize on these converging trends, moving beyond being just cutting tools to becoming integral components of intelligent, sustainable manufacturing ecosystems.

Common Pitfalls When Sourcing Water Cutters (Quality, IP)

Sourcing water cutters—especially high-pressure waterjet cutting machines—requires careful evaluation to avoid significant risks related to quality, performance, and intellectual property (IP). Overlooking key factors can lead to equipment failure, safety hazards, legal issues, and financial loss. Below are common pitfalls to watch for:

Poor Build Quality and Component Selection

Many low-cost water cutters, particularly from less-reputable suppliers, use substandard materials and components. This includes inferior pumps, seals, intensifiers, and abrasive delivery systems that wear quickly and reduce cutting precision. Poor manufacturing tolerances can lead to misalignment, leaks, and frequent downtime. Always verify the quality of core components and request third-party certifications or test reports.

Inaccurate or Exaggerated Performance Claims

Some suppliers inflate machine specifications—such as cutting pressure (e.g., claiming 60,000 psi when actual is lower), cutting speed, or material thickness capacity. This misleads buyers into thinking they are getting high-performance equipment. Always request independent performance validation or on-site demonstrations before purchasing.

Lack of Compliance with Safety and Industry Standards

Water cutters operate under extreme pressures and pose serious safety risks if not built to recognized standards (e.g., ISO 12100, ANSI B11.22). Sourcing machines that don’t meet regional safety or electrical codes can lead to workplace accidents, regulatory fines, or insurance issues. Ensure the supplier provides full compliance documentation.

Inadequate After-Sales Support and Spare Parts Availability

Even high-quality machines require maintenance, but many suppliers—especially overseas ones—fail to provide timely technical support, training, or spare parts. Downtime due to unavailable consumables (nozzles, seals, or abrasive mixers) can severely impact operations. Confirm service network coverage and spare parts lead times before purchase.

Intellectual Property (IP) Infringement Risks

Some manufacturers clone designs or software from established brands without licensing, using proprietary technologies (e.g., pump designs, control algorithms, or nozzle configurations) protected by patents or copyrights. Purchasing such equipment may expose your business to legal liability, especially in markets with strict IP enforcement. Conduct due diligence on the supplier’s IP credentials and avoid unusually low-priced machines that may be knock-offs.

Hidden Software Limitations and Licensing Issues

Modern water cutters rely on sophisticated CNC software for control and optimization. Some systems use pirated or unlicensed software, lack critical features (e.g., nesting, taper control), or impose restrictive update policies. Ensure software is legitimate, upgradable, and compatible with your existing workflows.

Insufficient Documentation and Training

Poorly documented machines—missing operation manuals, maintenance guides, or electrical schematics—make troubleshooting difficult. Inadequate training can lead to improper use, accelerated wear, and safety incidents. Insist on comprehensive documentation and on-site or virtual training as part of the sourcing agreement.

By proactively addressing these pitfalls, buyers can reduce risk, ensure long-term reliability, and protect their investment when sourcing water cutting equipment.

Logistics & Compliance Guide for Water Cutter

This guide outlines the key logistics and compliance considerations for the operation, transport, and maintenance of water jet cutting equipment (commonly referred to as “water cutter”). Adhering to these guidelines ensures safety, regulatory compliance, and efficient operations.

Equipment Handling and Transportation

Water cutting machines are heavy and contain high-pressure components. Proper handling during transport is critical:

- Use certified lifting equipment (e.g., forklifts, cranes) with appropriate load ratings to move the machine.

- Secure the machine on transport vehicles using straps or braces to prevent shifting.

- Protect high-pressure hoses, nozzles, and control panels during transit with protective covers.

- Follow manufacturer guidelines for disassembly and reassembly if required for transport.

Regulatory Compliance

Ensure operations adhere to local, national, and international regulations:

- OSHA (U.S.) or equivalent workplace safety standards: Implement machine guarding, lockout/tagout (LOTO) procedures, and employee training.

- Pressure Equipment Directive (PED) – EU: If operating in Europe, ensure high-pressure components comply with PED standards.

- Environmental Regulations: Manage wastewater containing abrasive particles and contaminants in accordance with EPA or local environmental laws. Use filtration and settling tanks where required.

- Electrical Codes: Confirm electrical connections meet NEC (U.S.) or IEC (international) standards to prevent hazards.

Workplace Safety Requirements

Maintain a safe operating environment:

- Provide operators with personal protective equipment (PPE), including safety glasses, hearing protection, gloves, and steel-toed boots.

- Install emergency stop buttons within easy reach of the operator.

- Post clear safety signage around the machine indicating high pressure and moving parts.

- Conduct regular safety audits and equipment inspections.

Maintenance and Documentation

Proper maintenance ensures compliance and extends equipment life:

- Follow the manufacturer’s maintenance schedule for pumps, seals, nozzles, and filtration systems.

- Keep detailed logs of maintenance, repairs, and component replacements.

- Calibrate pressure gauges and safety valves periodically.

- Train only authorized personnel to perform maintenance tasks.

Waste Disposal and Environmental Controls

Waterjet cutting generates slurry waste that may contain hazardous materials:

- Collect and segregate abrasive waste (e.g., garnet) and metal particles.

- Dispose of waste through licensed hazardous or industrial waste handlers, as applicable.

- Recycle reusable abrasives when possible to reduce environmental impact and costs.

- Monitor pH and contaminants in wastewater before discharge.

Import/Export Considerations (if applicable)

For international shipping:

- Verify customs classifications (HS codes) for waterjet machines and components.

- Ensure compliance with import/export regulations, including ITAR or EAR if applicable.

- Provide technical documentation (e.g., manuals, CE marking, conformity certificates) to customs authorities.

Training and Certification

- Operators must complete formal training on machine operation, safety protocols, and emergency procedures.

- Maintain training records and re-certify staff periodically.

- Ensure supervisors are trained in compliance and regulatory requirements.

By following this guide, organizations can ensure safe, legal, and efficient use of water cutting equipment across all stages of its lifecycle.

Conclusion for Sourcing a Water Jet Cutter

After a thorough evaluation of technical specifications, cost considerations, supplier reliability, and long-term operational needs, sourcing a water jet cutter represents a strategic investment for enhancing manufacturing precision, versatility, and efficiency. Water jet cutting technology offers distinct advantages, including the ability to cut a wide range of materials—such as metals, composites, glass, and stone—without generating heat-affected zones, ensuring high-quality finishes and minimal material waste.

The decision to source from a reputable supplier should be based on equipment performance, after-sales support, warranty coverage, training availability, and integration capabilities with existing systems. Additionally, factoring in operational costs such as maintenance, abrasive consumption, and energy usage will ensure long-term cost-effectiveness.

Ultimately, selecting the right water jet cutter and supplier will significantly improve production capabilities, support capacity expansion, and provide a competitive edge in industries requiring high-precision cutting solutions. Proper due diligence in the sourcing process will maximize ROI and support sustainable manufacturing growth.