The global waterproof paint market is experiencing robust growth, driven by increasing demand for protective coatings in industrial, infrastructure, and construction sectors. According to Grand View Research, the global industrial coatings market was valued at USD 92.9 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030, with waterproof and corrosion-resistant formulations playing a pivotal role in this expansion. Similarly, Mordor Intelligence forecasts the protective coatings market—where waterproof metal paints are a key segment—to grow at a CAGR of over 5.8% during the 2023–2028 period, citing rising infrastructure investments and stringent regulatory standards for asset longevity. As metal corrosion continues to cost industries an estimated USD 2.5 trillion annually (per NACE International), manufacturers are prioritizing high-performance waterproof paints that offer durability, UV resistance, and environmental compliance. This growing demand has spurred innovation among leading suppliers, setting the stage for a competitive landscape of advanced solutions designed specifically for metal substrates. Below, we examine the top 10 manufacturers leading this evolution with data-backed performance, technological innovation, and global reach.

Top 10 Waterproof Paint For Metal Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Endura Paint

Domain Est. 2002

Website: endurapaint.com

Key Highlights: Endura industrial coatings are designed and tested in the world’s harshest environments, from offshore oil rigs to gravel trucks, providing an easy to spray, ……

#2 World Leader in Specialty Coatings

Domain Est. 1996

Website: rpminc.com

Key Highlights: RPM International Inc. owns subsidiaries that are world leaders in specialty coatings, sealants, building materials and related services….

#3 Waterproof Paint For Metal

Domain Est. 2000

Website: makercoating.com

Key Highlights: Maker Coating Systems supplies a range of waterproof metal paints from top UK manufacturers for all of your project needs….

#4 AquaPro Painting & Waterproofing Inc.

Domain Est. 2009

Website: aquapropainting.com

Key Highlights: We provide hi-performance coatings to metal awnings, metal standing seam roofs, and window and door mullions….

#5 STEEL

Domain Est. 1996

Website: steel-it.com

Key Highlights: STEEL-IT coating paints for metal are market champions at corrosion resistance and durability. Loaded with hard-gripping 316L stainless steel micro-flakes….

#6 Commercial Sealants & Waterproofing Products

Domain Est. 1996

Website: tremcosealants.com

Key Highlights: TREMproof® 250GC Single-Component, Rapid Curing, Fluid-Applied Elastomeric Waterproofing Membrane…

#7 POR

Domain Est. 1996

Website: por15.com

Key Highlights: Our state-of-the-art paint systems form an impenetrable barrier that protects surfaces from water, chemicals, salt, U.V. rays, corrosive contaminants, impacts, ……

#8 Roof Sealants, Waterproofing Coatings & Elastomeric Paint

Domain Est. 2003

Website: amesresearch.com

Key Highlights: AMES manufactures and sells waterproofing coatings, roof sealants and more that help protect roofs, basements, foundations, decks and all of your projects….

#9 PPG Protective & Marine Coatings

Domain Est. 2007

Website: ppgpmc.com

Key Highlights: Engineered for the toughest steel profiles, this flexible, 100% solids epoxy intumescent coating provides exceptional fire and corrosion protection. It offers ……

#10 Carlisle Coatings & Waterproofing

Domain Est. 2011

Website: carlisleccw.com

Key Highlights: CCW is an industry leader in construction building materials for waterproofing, and air & vapor barrier. Waterproofing systems built on solid values….

Expert Sourcing Insights for Waterproof Paint For Metal

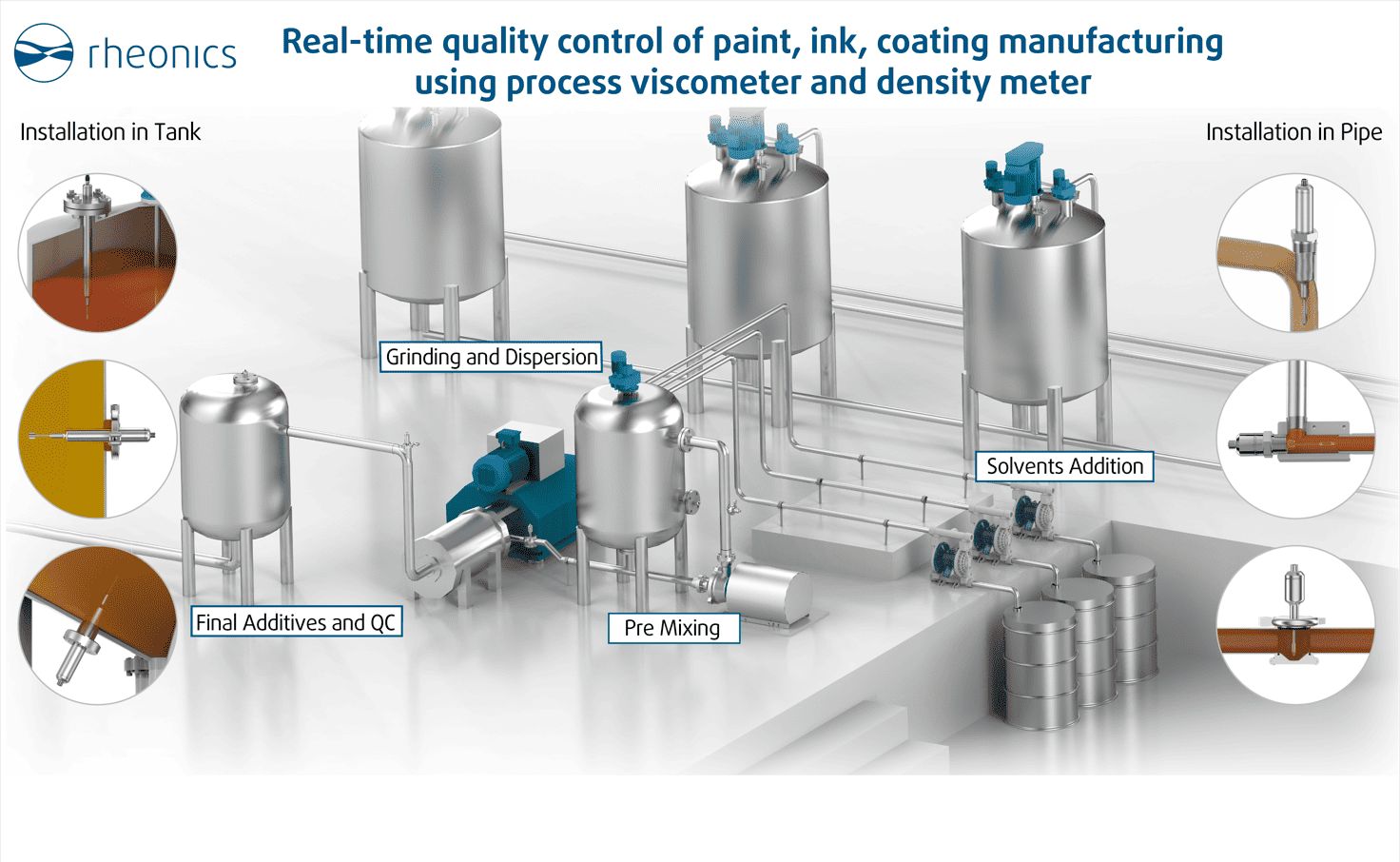

H2: 2026 Market Trends for Waterproof Paint for Metal

The global market for waterproof paint for metal is poised for significant transformation by 2026, driven by technological advancements, growing infrastructure demands, and heightened environmental regulations. This analysis examines key market dynamics shaping the industry in the coming years.

-

Rising Demand from Construction and Infrastructure Sectors

The construction, industrial, and infrastructure sectors are primary consumers of waterproof paint for metal. By 2026, increased investments in urban development, especially in emerging economies across Asia-Pacific, Latin America, and Africa, will boost demand. Infrastructure projects such as bridges, metal roofing systems, and industrial buildings require long-term corrosion protection, making high-performance waterproof coatings essential. -

Shift Toward Eco-Friendly and Sustainable Formulations

Environmental regulations are pushing manufacturers to develop low-VOC (volatile organic compound) and water-based waterproof paints. By 2026, the market will see accelerated adoption of environmentally sustainable products, driven by compliance with REACH (EU), EPA (U.S.), and similar global standards. Bio-based resins and solvent-free technologies will gain traction, appealing to eco-conscious consumers and B2B clients alike. -

Technological Innovation and Smart Coatings

Advancements in nanotechnology and self-healing coatings are set to redefine performance standards. By 2026, smart waterproof paints with enhanced UV resistance, thermal regulation, and corrosion detection capabilities will emerge. These innovations will be particularly valuable in harsh environments such as coastal areas, offshore platforms, and chemical processing plants. -

Growth in Industrial and Automotive Applications

Beyond construction, the industrial manufacturing and automotive sectors are expanding their use of waterproof metal coatings. With increasing production of electric vehicles (EVs) and metal components requiring protection from moisture and rust, demand for durable, lightweight, and conductive-resistant paints will rise. Waterproof coatings will also be critical for protecting battery enclosures and undercarriages. -

Regional Market Expansion

Asia-Pacific is expected to dominate the market by 2026, led by China, India, and Southeast Asian nations due to rapid industrialization and infrastructure development. North America and Europe will maintain steady growth, supported by retrofitting of aging infrastructure and strict building codes. The Middle East will also see growth due to large-scale construction in countries like Saudi Arabia and the UAE. -

Competitive Landscape and Strategic Collaborations

Market consolidation is anticipated, with key players such as PPG Industries, AkzoNobel, Sherwin-Williams, and BASF expanding their product portfolios through R&D and strategic partnerships. By 2026, companies offering integrated coating solutions—combining waterproofing, anti-corrosion, and aesthetic finishes—will hold a competitive edge. -

Price Volatility and Supply Chain Resilience

Fluctuations in raw material prices (e.g., resins, titanium dioxide) may impact profit margins. However, by 2026, manufacturers are expected to adopt more resilient supply chains, including localized production and alternative materials, to mitigate risks and ensure consistent product availability.

In conclusion, the waterproof paint for metal market in 2026 will be characterized by innovation, sustainability, and regional diversification. Companies that prioritize R&D, environmental compliance, and customer-specific solutions will be best positioned to capitalize on emerging opportunities.

Common Pitfalls When Sourcing Waterproof Paint for Metal (Quality and IP Protection)

Sourcing the right waterproof paint for metal surfaces—especially when specific quality standards and Ingress Protection (IP) ratings are required—can be fraught with challenges. Overlooking key factors can lead to premature coating failure, corrosion, safety hazards, and increased lifecycle costs. Below are some of the most common pitfalls to avoid:

1. Prioritizing Low Cost Over Performance and Longevity

One of the most frequent mistakes is selecting a low-cost paint to save on initial expenditure. Cheaper formulations often use inferior resins, pigments, and additives, resulting in poor adhesion, reduced durability, and inadequate waterproofing. This leads to frequent recoating, higher maintenance costs, and potential damage to the metal substrate.

2. Misunderstanding IP Ratings and Their Relevance

Ingress Protection (IP) ratings define the level of protection against solids and liquids. A common error is assuming that any “water-resistant” paint automatically meets a specific IP rating (e.g., IP67). However, IP certification requires rigorous third-party testing of the entire enclosure or system—not just the coating. Using paint without verifying its performance in a certified assembly can result in non-compliance and reliability issues.

3. Ignoring Surface Preparation Requirements

Even the highest-quality waterproof paint will fail if the metal surface isn’t properly prepared. Common oversights include skipping abrasive blasting, inadequate cleaning, or failing to remove rust, oil, or mill scale. Poor surface prep compromises adhesion, leading to blistering, peeling, and underfilm corrosion.

4. Selecting the Wrong Resin Chemistry for the Environment

Not all waterproof paints are created equal. Epoxy, polyurethane, silicone, and acrylic-based coatings each have different strengths. Using an epoxy coating in continuous UV exposure without a topcoat, for example, can lead to chalking and degradation. Similarly, selecting a paint unsuitable for immersion, chemical exposure, or extreme temperatures will compromise performance.

5. Overlooking Curing Conditions and Application Parameters

Many high-performance coatings require specific temperature, humidity, and curing time conditions. Applying paint in cold or damp environments without adjusting procedures can result in improper curing, poor film formation, and reduced waterproofing effectiveness. Always follow manufacturer guidelines for application and curing.

6. Failing to Verify Third-Party Certifications and Test Data

Relying solely on supplier claims without requesting independent test reports (e.g., salt spray resistance, water immersion, adhesion tests) is risky. Ensure the paint has been tested to recognized standards (e.g., ISO, ASTM, NACE) and that documentation is available for review. Lack of verifiable data increases the risk of substandard product selection.

7. Neglecting Compatibility with Existing Coatings or Substrates

When recoating, incompatibility between the new waterproof paint and the existing coating system can cause delamination or chemical reactions. Similarly, certain paints may not adhere well to specific metals (e.g., aluminum vs. carbon steel) without a proper primer. Always confirm compatibility through testing or technical data sheets.

8. Assuming All “Waterproof” Paints Are Suitable for Submersion or High-Pressure Washdown

Some paints are marketed as waterproof but are only designed for light moisture or splash resistance. For applications involving immersion, high-pressure cleaning (e.g., in food processing or marine environments), or constant wet-dry cycling, a more robust system—such as a two-part epoxy or specialized polyurea—is required. Misjudging the exposure level leads to premature failure.

9. Inadequate Quality Control During Application

Even with the right product, poor application techniques—such as incorrect mixing ratios, uneven film thickness, or insufficient coverage—can create weak points. Use proper tools, conduct dry and wet film thickness checks, and train applicators to ensure consistent, high-quality results.

10. Not Planning for Long-Term Maintenance and Inspection

Waterproofing is not a one-time solution. Failing to schedule inspections and maintenance can allow small defects to escalate. Choose coatings that are repairable and monitor performance regularly, especially in harsh environments.

Avoiding these pitfalls requires due diligence, clear specifications, and collaboration with reputable suppliers who provide technical support and verifiable performance data. By focusing on quality, environmental suitability, and proper application, you can ensure durable, reliable waterproof protection for metal assets.

Logistics & Compliance Guide for Waterproof Paint for Metal

Product Classification and Identification

Waterproof paint for metal is typically classified as a chemical product, often falling under industrial coatings. Correct identification is crucial for safe handling, transport, and regulatory compliance.

- Chemical Name: Solvent-based or water-based protective coating for ferrous and non-ferrous metals

- UN Number: Varies by formulation (common examples: UN1263 for flammable liquid, n.o.s.)

- Hazard Class: Typically Class 3 (Flammable Liquids) if solvent-based; may be non-hazardous if water-based

- Proper Shipping Name: “Flammable liquid, n.o.s.” (if applicable)

- Packing Group: II or III depending on flash point and formulation

Always refer to the Safety Data Sheet (SDS) for accurate classification.

Regulatory Compliance

Global Harmonized System (GHS)

Ensure all packaging and SDS comply with GHS standards. Required elements include:

– GHS pictograms (e.g., flame, health hazard)

– Signal words (e.g., “Danger” or “Warning”)

– Hazard statements (e.g., H225: Highly flammable liquid and vapor)

– Precautionary statements

REACH and CLP (Europe)

- REACH (EC 1907/2006): Confirm that all substances in the paint are registered with ECHA.

- CLP Regulation (EC 1272/2008): Classify, label, and package according to EU standards. SDS must be in the official language(s) of the destination country.

EPA and TSCA (USA)

- TSCA (Toxic Substances Control Act): Verify all chemical substances are listed on the TSCA Inventory.

- EPA Regulations: Comply with VOC (Volatile Organic Compound) limits under EPA guidelines, especially in regions like California (CARB compliance).

Other Regional Regulations

- China: Follow GB standards and China REACH (IECSC) requirements.

- Canada: Comply with WHMIS 2015 and DSL (Domestic Substances List).

- Australia: Adhere to NICNAS/AICIS and GHS adoption under Safe Work Australia.

Packaging and Labeling Requirements

Packaging

- Use UN-certified containers suitable for liquids (e.g., steel or plastic drums, jerricans).

- Ensure containers are tightly sealed to prevent leakage and vapor release.

- Inner packaging must withstand pressure changes during transport.

Labeling

- Primary Labels: Include product identifier, GHS pictograms, signal word, hazard statements, and supplier information.

- Secondary Labels: Affix transport hazard labels (e.g., Class 3 Flammable Liquid diamond label).

- Markings: UN number, proper shipping name, and packaging group must be clearly marked.

Transportation Guidelines

Road, Rail, and Air (IATA/ADR)

- ADR (Europe): Follow ADR regulations for road transport of dangerous goods. Documentation must include a transport document with hazard information.

- IATA (Air): If shipping by air, comply with IATA Dangerous Goods Regulations. Air transport of flammable paints is highly restricted and may require special approvals.

- IMDG (Sea): For maritime shipping, follow IMDG Code requirements including stowage and segregation.

Non-Hazardous Formulations

Water-based, non-flammable formulations may be exempt from dangerous goods regulations, but still require proper labeling and documentation.

Storage and Handling

Storage Conditions

- Store in a cool, dry, well-ventilated area away from direct sunlight and ignition sources.

- Keep temperature below 30°C (86°F).

- Segregate from oxidizers and incompatible materials.

Handling Precautions

- Use personal protective equipment (PPE): gloves, goggles, and respirators if necessary.

- Avoid open flames, sparks, and static discharge.

- Ground containers during transfer to prevent ignition.

Safety Data Sheet (SDS) Requirements

Maintain up-to-date SDS (16-section format) available in the local language for all markets. Critical sections include:

– Section 2: Hazard identification

– Section 7: Handling and storage

– Section 8: Exposure controls and PPE

– Section 14: Transport information

– Section 15: Regulatory information

SDS must be reviewed and updated at least every 3 years or when new hazard information becomes available.

Environmental and Disposal Compliance

- Spill Management: Use absorbent materials (e.g., sand, commercial absorbents). Do not flush into drains.

- Waste Disposal: Follow local hazardous waste regulations. Used containers may be considered hazardous waste.

- Environmental Impact: Prevent release into soil or waterways. Comply with local environmental protection laws (e.g., EPA, Environment Canada).

Import and Export Documentation

Ensure all shipments include:

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– SDS

– Certificate of Origin (if required)

– Dangerous Goods Declaration (for hazardous shipments)

Verify import regulations in destination country (e.g., import permits, labeling requirements).

Training and Recordkeeping

- Train staff on GHS, handling, emergency procedures, and transport regulations.

- Maintain records of SDS, shipping documents, training logs, and incident reports for at least 5 years.

Conclusion

Proper logistics and compliance management for waterproof paint for metal ensures safety, avoids penalties, and facilitates smooth international trade. Always consult local regulations and update procedures as standards evolve.

In conclusion, sourcing waterproof paint for metal requires careful consideration of several key factors to ensure long-term protection, durability, and performance. It is essential to select a paint specifically formulated for metal surfaces and designed to resist moisture, corrosion, and environmental stressors such as UV exposure and temperature fluctuations. Epoxy-based or urethane coatings often provide superior adhesion and waterproofing properties.

Additionally, proper surface preparation—cleaning, degreasing, and priming—is critical to the paint’s effectiveness and longevity. When sourcing, prioritize reputable suppliers or manufacturers with proven track records, clear product specifications, and certifications for quality and environmental safety. Considering cost-effectiveness, application ease, and warranty offerings will further support an informed purchasing decision.

Ultimately, investing in high-quality waterproof paint tailored to metal surfaces not only prevents rust and degradation but also extends the lifespan of metal structures, delivering both economic and performance benefits over time.