The global water softener market is experiencing robust growth, driven by increasing concerns over water quality, rising industrial demand, and growing residential investments in water treatment solutions. According to Grand View Research, the global water softener market size was valued at USD 2.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.8% from 2023 to 2030. This expansion is fueled by heightened awareness of the adverse effects of hard water on plumbing systems, appliances, and skin health, particularly in regions with high mineral content in water supplies. Additionally, stringent environmental regulations and advancements in ion-exchange and salt-free softening technologies are reshaping the competitive landscape. As demand surges across North America, Europe, and the Asia-Pacific, a select group of manufacturers are leading innovation, scalability, and market reach. Here’s a data-driven look at the top 10 water softener manufacturers shaping the future of water treatment.

Top 10 Water Softener Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

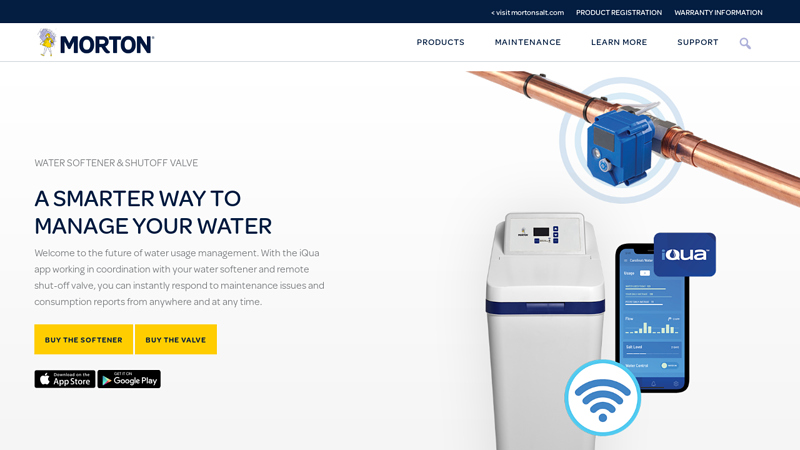

#1 Morton Water Softeners and Whole Filtration Systems

Domain Est. 2017

Website: mortonwatersofteners.com

Key Highlights: The #1 brand of water softener salt in the United States; Range of water treatment products to meet your household water needs; Morton Look-Ahead Technology …Missing: manufactur…

#2 Water Treatment

Domain Est. 1997

Website: rainsoft.com

Key Highlights: Our water and air treatment systems meet the highest industry standards, and are assembled and shipped from our Chicago factory. Better Taste. INGREDIENT- ……

#3 Residential Water Softeners

Domain Est. 1994

Website: aosmith.com

Key Highlights: A. O. Smith brings the best water treatment products to your home. Every product is obsessively engineered for high performance and energy efficiency….

#4 Water Softeners and Water Refiner Systems

Domain Est. 1995

Website: ecowater.com

Key Highlights: A water softener from EcoWater will reduce hard water minerals such as calcium and magnesium from your home water….

#5 Kinetico.com

Domain Est. 1996

Website: kinetico.com

Key Highlights: Explore Water Softeners A Kinetico Water Softener will provide your family with abundant clean, soft water on demand….

#6 Whole House Water Filtration & Softening

Domain Est. 1996

Website: pentair.com

Key Highlights: Discover Pentair’s whole house water softening and filtration systems, designed to provide clean, softened water throughout your home!…

#7 Hague Quality Water

Domain Est. 1996 | Founded: 1960

Website: haguewater.com

Key Highlights: Since 1960, Hague Quality Water has been manufacturing water treatment products you can trust. Enter your Zip Code to find your nearest dealer….

#8 Water Softener Systems

Domain Est. 1997

Website: culligan.com

Key Highlights: With a Culligan water softener, everything that involves water gets better. Find the best water softener for your home here….

#9 Novo Water

Domain Est. 2009

Website: novowater.com

Key Highlights: More than 50 years of manufacturing high-efficiency, professional-grade water treatment systems · Third party tested and certified to the industry’s highest ……

#10 Fleck Systems by US Water Systems

Domain Est. 2013

Website: flecksystems.com

Key Highlights: $8.95 delivery · 30-day returnsWater softeners and backwashing filters that utilize the proven reliability of the Fleck valve. Fleck has led the way for more than 50 years in adva…

Expert Sourcing Insights for Water Softener

H2: 2026 Market Trends for Water Softeners

The global water softener market is projected to undergo significant transformation by 2026, driven by rising awareness of water quality, technological advancements, and increasing residential and commercial infrastructure development. Key trends shaping the market include:

-

Growing Demand for Smart Water Softeners

By 2026, smart water softeners equipped with IoT (Internet of Things) capabilities are expected to dominate new installations. These systems offer remote monitoring, automatic regeneration scheduling, real-time water usage analytics, and integration with home automation platforms. Consumers are increasingly favoring convenience, efficiency, and data-driven insights, pushing manufacturers to innovate in connectivity and user interface design. -

Shift Toward Salt-Free and Eco-Friendly Systems

Environmental concerns and regulatory pressures are accelerating the adoption of salt-free water conditioners and template-assisted crystallization (TAC) systems. Unlike traditional ion-exchange softeners, these technologies avoid brine discharge, reducing environmental impact and complying with stricter water discharge regulations in regions like California and the European Union. -

Expansion in Emerging Markets

Rapid urbanization and improving living standards in Asia-Pacific, Latin America, and the Middle East are fueling demand for water treatment solutions. Countries such as India, China, and Brazil are witnessing increased investment in residential construction and municipal water infrastructure, creating new opportunities for water softener manufacturers. -

Rising Awareness of Hard Water Damage

Educational campaigns by industry players and public health organizations are highlighting the negative effects of hard water on appliances, plumbing, skin, and hair. This growing awareness is translating into higher consumer adoption rates, particularly in suburban and rural areas with naturally high mineral content in water sources. -

Integration with Whole-Home Water Filtration Systems

Water softeners are increasingly being bundled with comprehensive filtration systems that remove chlorine, sediments, heavy metals, and other contaminants. This trend reflects a broader consumer preference for holistic water quality solutions, especially among health-conscious households. -

Regulatory Influence and Incentives

Governments and utilities are introducing rebates and incentives for energy-efficient and low-water-waste appliances. By 2026, compliance with standards such as ENERGY STAR and WaterSense is expected to become a key differentiator for water softener brands, influencing purchasing decisions in both residential and commercial sectors. -

Consolidation and Innovation Among Key Players

Major companies like Culligan, Pentair, EcoWater, and Kinetico are investing heavily in R&D and strategic acquisitions to expand product portfolios and global reach. Competition is fostering innovation in efficiency, design, and sustainability, with a focus on compact, maintenance-free units suitable for modern homes.

In summary, the 2026 water softener market will be characterized by technological sophistication, environmental responsibility, and expanding global reach. As consumers and regulators prioritize water efficiency and quality, the industry is poised for sustained growth and transformation.

Common Pitfalls When Sourcing Water Softeners (Quality and IP)

Sourcing water softeners involves more than just comparing prices and capacities. Overlooking critical quality and intellectual property (IP) aspects can lead to poor performance, safety hazards, legal risks, and long-term costs. Here are the most common pitfalls to avoid:

1. Prioritizing Low Cost Over Build Quality

Focusing solely on the lowest upfront price often results in substandard materials and construction. Cheap softeners may use:

- Thin-walled plastic tanks prone to cracking under pressure or UV exposure

- Low-grade resin that degrades quickly, reducing softening efficiency

- Poorly engineered control valves leading to inconsistent regeneration and water waste

Result: Shorter lifespan, frequent repairs, inconsistent water quality, and higher total cost of ownership.

2. Ignoring Certification and Compliance

Failing to verify third-party certifications can compromise safety and performance. Key certifications include:

- NSF/ANSI Standard 44 for health effects and performance

- WRAS (UK) or KTW/W270 (EU) for material safety in potable water systems

- Regional electrical safety standards (e.g., CE, UL)

Result: Use of non-compliant units may violate local regulations, pose health risks, and void insurance.

3. Overlooking IP and Brand Authenticity

Purchasing from unauthorized suppliers or gray market channels increases the risk of:

- Counterfeit products with fake certifications

- Rebranded or cloned units infringing on original designs and software

- Lack of genuine firmware, leading to malfunction or security vulnerabilities

Result: Legal liability, lack of warranty support, and potential IP infringement claims from original manufacturers.

4. Assuming All Resins Are Equal

Not all ion exchange resins perform the same. Low-quality resins may:

- Have lower capacity, requiring more frequent regeneration

- Be susceptible to chlorine or iron fouling

- Degrade faster, releasing fines into the water

Result: Reduced efficiency, higher salt and water consumption, and poor water quality.

5. Neglecting Control Valve Software and IP

Modern softeners rely on proprietary control algorithms for efficiency. Pitfalls include:

- Unauthorized copies using reverse-engineered firmware

- Outdated or non-upgradable software lacking leak detection or remote monitoring

- No access to manufacturer software updates or technical support

Result: Inefficient operation, inability to diagnose issues, and cybersecurity risks in smart models.

6. Skipping Site-Specific Water Testing

Sourcing a softener without analyzing local water conditions (hardness, iron, pH, flow rate) leads to:

- Undersized or oversized units

- Inadequate pre-treatment for iron or sediment

- Resin fouling and premature failure

Result: Poor performance, increased maintenance, and early system failure.

7. Overlooking Warranty and After-Sales Support

Choosing suppliers with weak or voidable warranties creates long-term risk. Watch for:

- Warranties voided by unauthorized installers or non-OEM parts

- Limited technical support and spare parts availability

- No access to genuine service networks

Result: Downtime during failures and costly third-party repairs.

Conclusion

To avoid these pitfalls, conduct thorough due diligence: verify certifications, source from authorized distributors, insist on OEM components and software, and ensure compatibility with local water conditions. Investing in quality and respecting IP safeguards performance, compliance, and long-term value.

Logistics & Compliance Guide for Water Softener

Overview

This guide outlines the key logistics considerations and compliance requirements for the transportation, storage, installation, and disposal of water softeners. Adhering to these guidelines ensures safe handling, regulatory compliance, and optimal performance of water softening systems.

Regulatory Compliance

Environmental Regulations

Water softeners must comply with environmental standards related to salt discharge and wastewater. In many regions, including the United States and the European Union, regulations restrict brine discharge into municipal sewer systems due to chloride content. Operators should:

– Verify local wastewater discharge permits.

– Follow EPA or equivalent national guidelines on brine management.

– Consider salt-efficient or non-salt-based alternatives where restrictions apply.

Drinking Water Safety Standards

Water softeners that treat potable water must meet health and safety certifications:

– NSF/ANSI Standard 44: Ensures material safety, structural integrity, and performance for residential water softeners.

– NSF/ANSI Standard 61: Certifies that materials in contact with drinking water do not leach harmful contaminants.

– Products should bear NSF certification marks to confirm compliance.

Electrical and Plumbing Codes

Installation must adhere to local and national codes:

– Comply with the National Electrical Code (NEC) if the unit includes electrical components.

– Follow International Plumbing Code (IPC) or local plumbing regulations for piping, backflow prevention, and drainage.

– Ensure a licensed plumber or qualified technician performs installations.

Transportation & Handling

Packaging and Labeling

- Units must be securely packaged to prevent damage during transit.

- Use original manufacturer packaging with protective foam or corner guards.

- Label packages with:

- “Fragile” and “This Side Up” indicators.

- Hazard warnings if applicable (e.g., salt brine tank contents).

- Handling instructions (e.g., “Do not tilt,” “Keep dry”).

Shipping Requirements

- Use freight carriers experienced in handling appliances.

- For international shipments, comply with ISPM 15 for wooden pallets.

- Maintain proper documentation including:

- Commercial invoice.

- Packing list.

- Certificates of compliance (NSF, CE, etc.).

Storage Guidelines

Environmental Conditions

- Store in a dry, temperature-controlled environment (ideally 40°F to 100°F / 4°C to 38°C).

- Avoid exposure to freezing temperatures to prevent internal cracking.

- Protect from direct sunlight and moisture to avoid degradation of materials.

Inventory Management

- Implement FIFO (First In, First Out) rotation to ensure older stock is used first.

- Keep sealed salt (for regeneration) in airtight containers to prevent caking.

- Inspect stored units periodically for packaging integrity and moisture damage.

Installation & Site Preparation

Location Requirements

- Install on a level, solid surface near the main water line and a floor drain.

- Ensure adequate clearance for maintenance and regeneration cycles.

- Provide access to a grounded electrical outlet if required.

Water and Drain Connections

- Use compatible piping materials (e.g., copper, PEX, or CPVC).

- Install a bypass valve for service access.

- Connect drain line with an air gap to prevent backflow contamination.

Maintenance & Disposal

Routine Maintenance

- Monitor salt levels monthly and refill as needed.

- Clean brine tank annually to remove sediment.

- Sanitize system periodically to control microbial growth.

End-of-Life Disposal

- Recycle metal and plastic components where possible.

- Dispose of spent resin according to local hazardous waste regulations (some resins may contain trace heavy metals).

- Drain and clean brine tanks before discarding.

- Check with local waste authorities for e-waste handling if the unit contains electronic controls.

Documentation & Record Keeping

- Retain product compliance certificates (NSF, CE, RoHS, etc.).

- Keep installation records, maintenance logs, and disposal receipts.

- Provide end-users with operation manuals and compliance documentation.

Conclusion

Proper logistics and compliance management ensures water softeners operate safely and effectively while meeting legal and environmental obligations. Regular audits and staff training on handling procedures and regulatory updates are recommended to maintain adherence.

In conclusion, sourcing water softener manufacturers requires a strategic approach that balances product quality, cost-efficiency, scalability, and reliability. Thorough due diligence—including evaluating certifications, production capabilities, R&D investment, and after-sales support—is essential to identify trustworthy partners. Manufacturers from regions such as China, Europe, and North America each offer distinct advantages in terms of technology, pricing, and compliance standards. Building long-term relationships with manufacturers who prioritize innovation, sustainability, and customer service will not only ensure a consistent supply of high-performing water softeners but also support competitive differentiation in a growing global market. Ultimately, successful sourcing hinges on aligning manufacturer capabilities with business goals to deliver reliable, high-quality water treatment solutions to end users.