The global water filtration systems market is experiencing robust growth, driven by rising concerns over water quality, increasing industrialization, and growing demand for safe drinking water. According to a 2023 report by Mordor Intelligence, the market was valued at USD 31.5 billion in 2022 and is projected to reach USD 48.6 billion by 2028, growing at a CAGR of 7.4% during the forecast period. This expansion is further fueled by stringent government regulations on water quality, rapid urbanization, and heightened consumer awareness about health risks associated with contaminated water. As demand surges, leading manufacturers are investing in advanced filtration technologies such as reverse osmosis, ultrafiltration, and UV disinfection to meet diverse residential, commercial, and industrial needs. Against this backdrop, the following nine companies have emerged as key players shaping the future of water purification, combining innovation, global reach, and proven performance to lead the industry.

Top 9 Water Filtering Systems Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Clack Corporation

Domain Est. 1997 | Founded: 1944

Website: clackcorp.com

Key Highlights: Established in 1944, Clack® has been providing quality residential, industrial, and commercial water treatment components. We deliver precision water ……

#2 Buy AQUAPHOR water filters. Manufacturer’s

Domain Est. 1998

Website: aquaphor.com

Key Highlights: At AQUAPHOR, we design and manufacture reliable and convenient water filters so that you enjoy using them in the kitchen, bathroom or country house — wherever ……

#3 3M Filtration & Separation

Domain Est. 1988

Website: 3m.com

Key Highlights: Systems, devices and components used to separate contaminants from a physical environment for the purposes of purification. Include both air filtration and ……

#4 Kinetico.com

Domain Est. 1996

Website: kinetico.com

Key Highlights: American Made Water Treatment. Built with American craftsmanship, Kinetico systems are designed to provide lasting benefits to homes. Experience water that ……

#5 Whole House Water Filtration & Softening

Domain Est. 1996

Website: pentair.com

Key Highlights: Discover Pentair’s whole house water softening and filtration systems, designed to provide clean, softened water throughout your home!…

#6 Water Filtration Systems

Domain Est. 1997

Website: culligan.com

Key Highlights: Make your water cleaner & safer throughout your home with Culligan’s water filters. Discover our water filtration solutions today….

#7 Clearwater Systems

Domain Est. 1998

Website: clearwatersystems.com

Key Highlights: Our Most Popular Water Treatment Systems · Commercial Reverse Osmosis Systems · Water Coolers · UV Disinfection · Salt Free Water Systems · Drinking Water Systems….

#8 Purification & filtration solutions

Domain Est. 2007

Website: solventum.com

Key Highlights: Learn about our capabilities in biopharmaceutical purification, manufacturing, and water filtration to meet the stringent demands of your industry….

#9 AquaTru

Domain Est. 2013

Website: aquatruwater.com

Key Highlights: AquaTru water purifiers use patented 4-Stage Reverse Osmosis purification that transforms your tap water into pure, delicious, clean water you can trust….

Expert Sourcing Insights for Water Filtering Systems

2026 Market Trends for Water Filtering Systems: Key Drivers and Projections

The global water filtering systems market is poised for significant transformation by 2026, driven by converging environmental, technological, and socio-economic forces. Here are the dominant trends shaping the industry:

H2: Rising Global Water Scarcity and Contamination Concerns

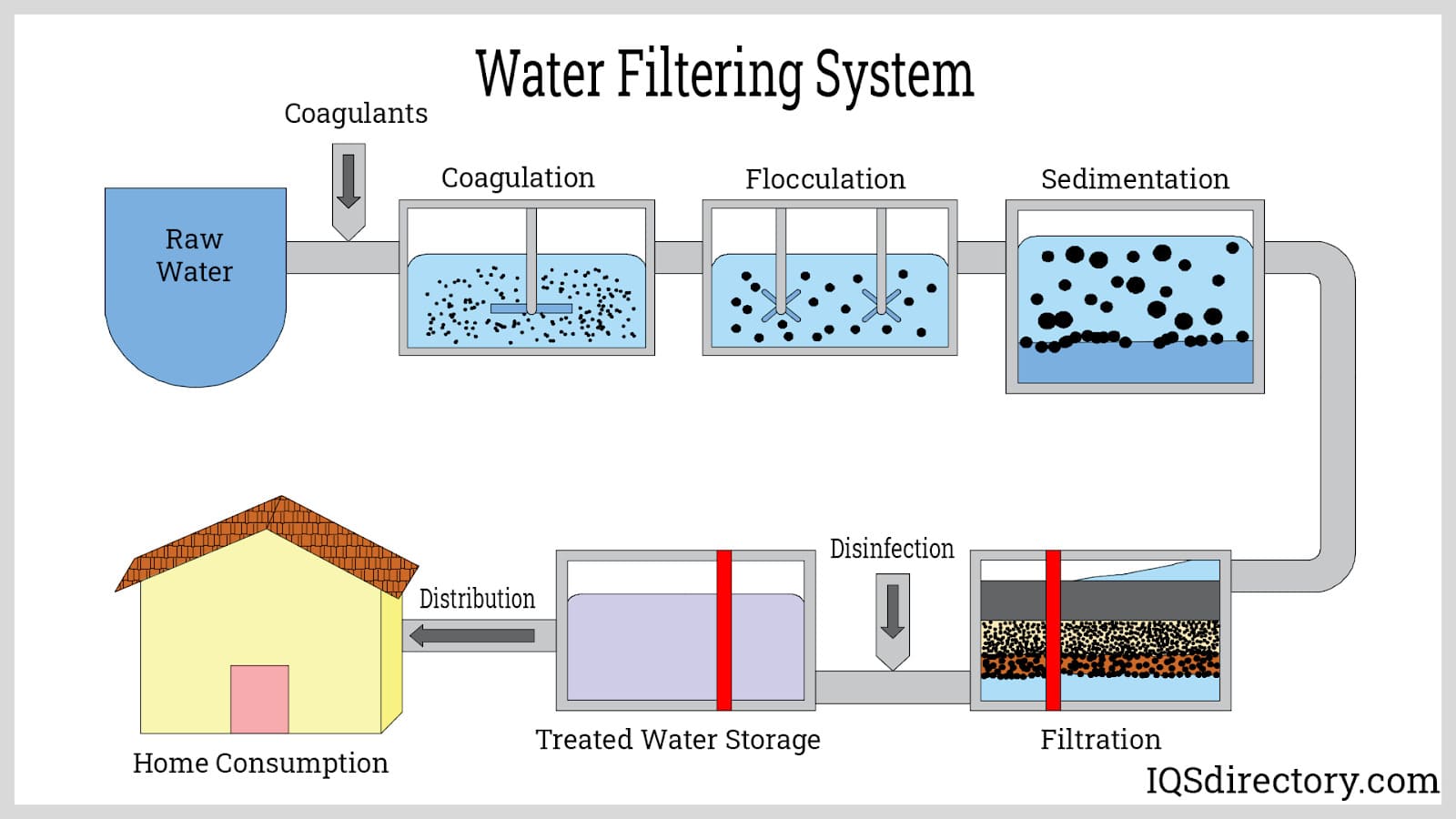

Growing populations, climate change-induced droughts, and industrial pollution are intensifying pressure on freshwater resources. Contaminants like microplastics, PFAS (“forever chemicals”), heavy metals (lead, arsenic), and pharmaceutical residues are increasingly detected in municipal supplies and groundwater. This heightened awareness of water quality risks is a primary catalyst, pushing consumers and municipalities toward advanced filtration solutions. Demand will surge in both developed regions (addressing aging infrastructure and emerging contaminants) and developing economies (lacking reliable clean water access).

H2: Stringent Regulatory Standards and Government Initiatives

Governments worldwide are implementing stricter water quality regulations and investing in infrastructure upgrades. The U.S. EPA’s Lead and Copper Rule Improvements and PFAS monitoring requirements, EU Drinking Water Directive revisions, and similar initiatives in Asia-Pacific are compelling utilities and consumers to adopt more effective filtration technologies. Public funding for water infrastructure projects will directly boost the municipal and industrial filtration segments.

H2: Technological Advancements Driving Efficiency and Smart Integration

Innovation is central to the 2026 landscape:

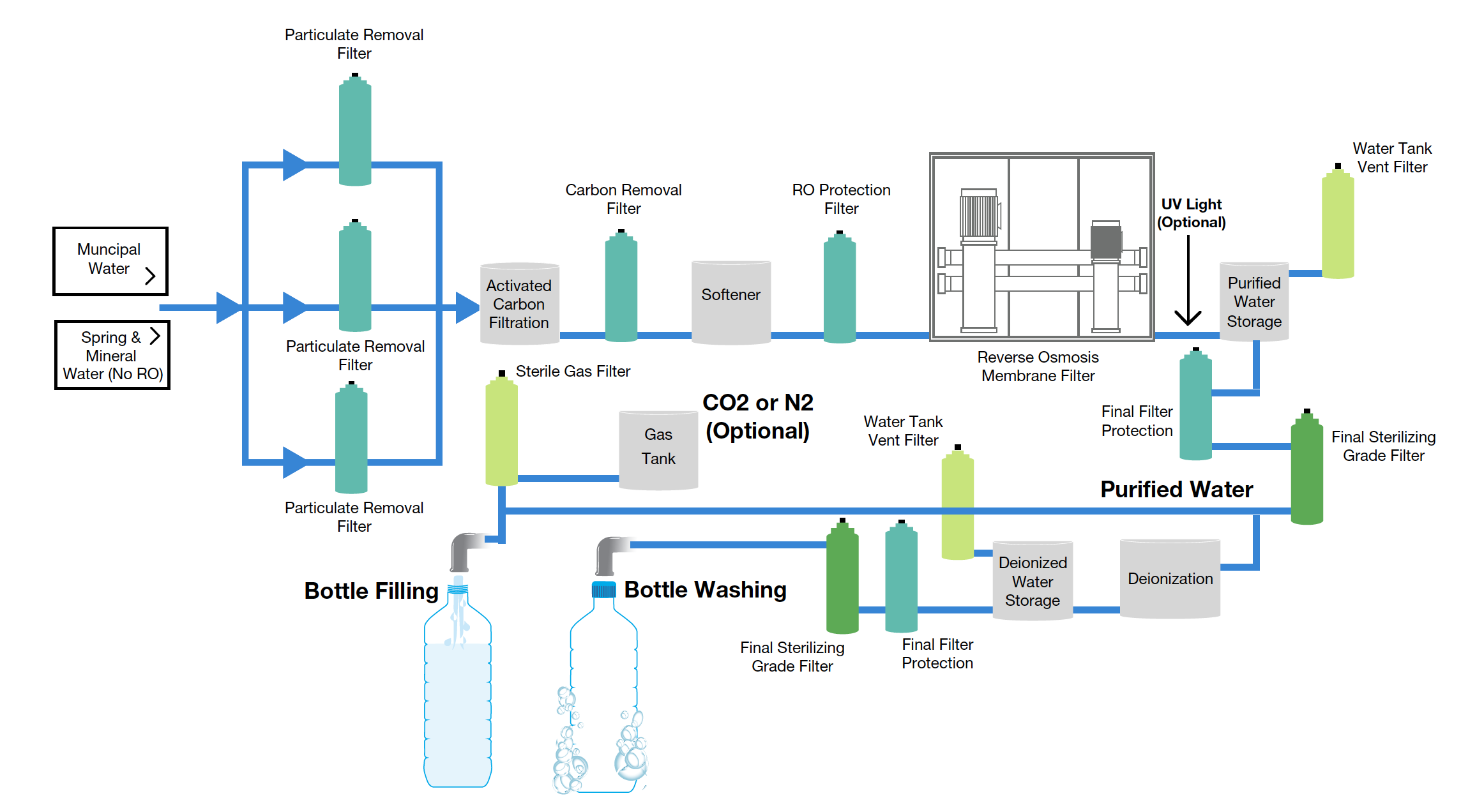

* Advanced Membranes: Wider adoption of next-gen reverse osmosis (RO), nanofiltration (NF), and ultrafiltration (UF) membranes offering higher efficiency, lower energy consumption, longer lifespans, and better rejection of emerging contaminants.

* Smart Filtration Systems: Integration of IoT sensors, Wi-Fi connectivity, and AI for real-time water quality monitoring, filter life tracking, automatic maintenance alerts, leak detection, and remote control via apps. This enhances user convenience and system optimization.

* Point-of-Use (POU) Dominance: Continued strong growth in under-sink, countertop, and faucet-mounted systems, fueled by consumer demand for immediate, high-quality drinking water at the tap, perceived as more reliable than municipal supplies.

H2: Sustainability and Environmental Consciousness

Environmental impact is a major purchasing factor:

* Reduced Plastic Waste: Home filtration systems are a key driver in reducing reliance on single-use plastic bottled water.

* Water and Energy Efficiency: Demand is rising for systems with high recovery rates (minimizing wastewater, especially in RO), low energy consumption (e.g., non-electric gravity filters, efficient pumps), and eco-friendly materials.

* Recyclable/Refillable Components: Manufacturers are focusing on recyclable filter housings and developing refillable cartridge options to minimize plastic waste.

H2: Expansion in Emerging Markets and Diverse Applications

Beyond residential use, significant growth is expected in:

* Commercial & Industrial: Food & beverage, pharmaceuticals, electronics manufacturing, and power generation require ultra-pure water, driving demand for sophisticated industrial filtration.

* Municipal & Municipal Wastewater Reuse: Aging infrastructure upgrades and water scarcity are pushing cities to invest in advanced treatment and water recycling/reuse systems.

* Emerging Economies: Rapid urbanization, industrialization, and government programs in Asia-Pacific (especially India, China), Africa, and Latin America are creating vast markets for affordable, robust point-of-entry (POE) and POU solutions.

H2: Evolving Consumer Preferences and Market Competition

The market is becoming more competitive and consumer-focused:

* Health & Wellness Focus: Marketing emphasizing health benefits (removing contaminants, retaining beneficial minerals) resonates strongly.

* Convenience & Aesthetics: Sleek designs, easy installation, and low maintenance are key selling points.

* Subscription Models: Growth in filter replacement subscription services for convenience and recurring revenue.

* Increased Competition: Entry of new players and consolidation among established ones, leading to innovation and potentially more competitive pricing, alongside greater emphasis on brand trust and certification (NSF/ANSI).

In conclusion, the 2026 water filtering systems market will be characterized by a powerful combination of urgent environmental needs, technological sophistication, regulatory pressure, and heightened consumer awareness. Success will depend on offering effective, sustainable, smart, and user-friendly solutions across diverse segments, from the kitchen sink to large-scale industrial plants.

Common Pitfalls When Sourcing Water Filtering Systems (Quality, IP)

Sourcing water filtering systems involves more than just comparing prices and specifications. Overlooking critical quality and intellectual property (IP) aspects can lead to performance failures, safety risks, legal issues, and reputational damage. Below are common pitfalls to avoid:

1. Prioritizing Cost Over Certified Quality Standards

One of the most frequent mistakes is selecting a supplier based solely on low cost without verifying adherence to recognized quality and safety standards. Substandard filters may use inferior materials that degrade quickly or fail to remove harmful contaminants.

- Pitfall: Assuming all filters labeled “safe” or “certified” meet rigorous testing requirements.

- Solution: Require proof of certification from reputable bodies such as NSF/ANSI (e.g., NSF/ANSI 42, 53, 58, or 401), ISO 9001 for quality management, or regional equivalents (e.g., WRAS in the UK, KIWA in Europe). Verify certifications are current and apply to the exact product model being sourced.

2. Neglecting Material and Construction Quality

Low-cost systems may use subpar plastics, seals, or filtration media that compromise long-term performance and safety.

- Pitfall: Overlooking material compatibility with water chemistry (e.g., chloramine resistance, pH tolerance), leading to leaching or premature failure.

- Solution: Specify materials (e.g., food-grade polypropylene, NSF-compliant carbon) and conduct third-party testing for extractables and durability. Request detailed material safety data sheets (MSDS) and manufacturing process documentation.

3. Inadequate Due Diligence on Supplier IP Rights

Using or sourcing a water filtration system that infringes on patented technology can result in legal action, supply chain disruptions, or forced product recalls.

- Pitfall: Assuming generic or “compatible” systems are free of IP restrictions.

- Solution: Conduct IP landscaping to identify relevant patents (e.g., in membrane design, flow configuration, or sensor integration). Require suppliers to warrant that their products do not infringe third-party IP and to indemnify your organization against claims.

4. Overlooking Design and Process IP in Custom Systems

When co-developing or sourcing custom filtration units, failure to clarify IP ownership can lead to disputes over design rights, manufacturing rights, or future product iterations.

- Pitfall: Not defining in contracts who owns improvements, tooling, or proprietary processes developed during collaboration.

- Solution: Include clear IP clauses in sourcing agreements specifying ownership, licensing rights, and confidentiality. Ensure any proprietary designs or algorithms (e.g., smart monitoring systems) are protected and licensed appropriately.

5. Falling for False or Unverified Performance Claims

Suppliers may exaggerate filter life, flow rate, or contaminant removal efficiency without supporting test data.

- Pitfall: Accepting marketing claims without independent validation.

- Solution: Require performance data from accredited laboratories under real-world conditions. Validate claims against standardized test protocols and request full test reports—not summaries.

6. Ignoring Supply Chain Transparency and Traceability

Lack of visibility into component sourcing increases the risk of counterfeit parts, inconsistent quality, or ethical violations.

- Pitfall: Relying on a single-tier supplier without auditing their sub-suppliers.

- Solution: Implement supply chain mapping and require suppliers to disclose key component origins. Use blockchain or digital traceability tools where feasible, especially for critical filtration media like RO membranes.

7. Failing to Plan for Long-Term Support and Spare Parts

Even high-quality systems can become obsolete or unsupported, leaving users without filters or service.

- Pitfall: Not securing agreements for spare parts, replacement cartridges, or technical support over the product lifecycle.

- Solution: Negotiate long-term supply agreements and verify the supplier’s track record for product support. Ensure backward compatibility and documentation availability.

By proactively addressing these quality and IP-related pitfalls, organizations can mitigate risks, ensure regulatory compliance, and deliver reliable, safe water filtration solutions.

Logistics & Compliance Guide for Water Filtering Systems

Product Classification and Regulatory Framework

Water filtering systems are subject to various regulations depending on their design, application, and destination market. In the United States, the Environmental Protection Agency (EPA) regulates public water systems under the Safe Drinking Water Act (SDWA), while individual filtration units intended for household or commercial use are typically governed by performance standards set by third-party organizations such as NSF International and the American National Standards Institute (ANSI). Key standards include NSF/ANSI 42 (aesthetic effects), NSF/ANSI 53 (health-related contaminants), and NSF/ANSI 58 (reverse osmosis systems). Internationally, compliance may require adherence to regulations such as the EU Drinking Water Directive, Health Canada’s Guidelines for Canadian Drinking Water Quality, or country-specific certifications like WRAS (UK) or AS/NZS 4020 (Australia/New Zealand).

Import and Export Compliance

When shipping water filtering systems across borders, exporters and importers must ensure compliance with customs regulations, tariff classifications, and product safety requirements. Proper Harmonized System (HS) codes must be applied; for example, filtration units may fall under HS code 8421.21 (filters for liquids) or 8421.23 (reverse osmosis appliances), depending on design. Exporters should verify if destination countries require pre-shipment inspections, conformity assessments, or local representation. Additionally, systems containing electronic components may also be subject to electromagnetic compatibility (EMC) and electrical safety standards (e.g., IEC 60335). Documentation such as a Certificate of Conformity (CoC), test reports from accredited laboratories, and technical files must accompany shipments to facilitate customs clearance.

Transportation and Handling Requirements

Water filtering systems often include fragile components such as membranes, housings, and electronic controls. Proper packaging is essential to prevent damage during transit. Units should be packed in sturdy, moisture-resistant containers with internal cushioning to protect against shocks and vibrations. Labeling must include handling instructions (e.g., “Fragile,” “This Side Up”), product specifications, and compliance markings (e.g., CE, NSF, CSA). For large or industrial systems, crating and palletization may be required. Temperature-sensitive components, such as certain membranes or resins, must be stored and transported within manufacturer-specified temperature ranges to maintain performance and warranty validity.

Storage and Inventory Management

Maintaining proper storage conditions is crucial for preserving the integrity of water filtering components. Systems and replacement parts should be stored in a clean, dry, temperature-controlled environment, ideally between 40°F and 100°F (4°C to 38°C), unless otherwise specified by the manufacturer. Exposure to direct sunlight, extreme temperatures, or high humidity can degrade materials and reduce shelf life. Inventory management systems should track batch numbers, manufacturing dates, and expiration dates (especially for consumables like carbon blocks or RO membranes) to ensure first-in, first-out (FIFO) rotation and prevent the use of obsolete or degraded components.

Installation and Field Compliance

On-site installation of water filtering systems must adhere to local plumbing codes, electrical standards, and health regulations. Certified technicians should follow manufacturer guidelines and ensure systems are properly connected, grounded (if applicable), and tested for leaks and performance. In commercial or municipal applications, installation may require permits and post-installation inspections by regulatory authorities. Documentation, including as-built drawings, compliance certificates, and operation manuals, must be provided to the end user and retained for audit purposes.

Maintenance, Monitoring, and Recordkeeping

Ongoing compliance requires regular maintenance, monitoring, and recordkeeping. Filters and membranes must be replaced according to usage and water quality conditions, with logs maintained to demonstrate adherence to recommended service intervals. For regulated applications (e.g., healthcare, food service), water quality testing must be conducted periodically, and results documented to meet health code requirements. Digital monitoring systems with remote alerts can help ensure timely maintenance and provide verifiable compliance data.

End-of-Life and Environmental Responsibility

Disposal of used water filters and components must comply with environmental regulations. Some filter media (e.g., those containing heavy metals or silver-impregnated carbon) may be classified as hazardous waste and require special handling. Manufacturers and distributors should provide take-back programs or recycling guidance where available. Logistics plans should include protocols for the environmentally responsible return or disposal of end-of-life units, in accordance with local waste management laws and extended producer responsibility (EPR) schemes.

Training and Documentation

All personnel involved in the logistics, installation, and servicing of water filtering systems should receive appropriate training on handling procedures, safety protocols, and compliance requirements. Comprehensive documentation—including user manuals, compliance certificates, test reports, and maintenance logs—must be maintained and made accessible for audits, regulatory inspections, and customer support. Digital recordkeeping systems can streamline compliance reporting and ensure long-term traceability.

In conclusion, sourcing water filtering systems requires a comprehensive evaluation of water quality needs, filtration technologies, cost-effectiveness, scalability, and supplier reliability. It is essential to match the filtration solution to the specific contaminants present in the water source, whether chemical, biological, or particulate. Different technologies—such as reverse osmosis, activated carbon, UV disinfection, or ceramic filters—offer distinct advantages depending on the application, be it residential, commercial, or industrial. Additionally, ongoing maintenance requirements, energy consumption, and filter lifespan should be considered to ensure long-term efficiency and sustainability. Partnering with reputable suppliers who provide certification, compliance with safety standards, and strong after-sales support further enhances system performance and user confidence. Ultimately, a well-sourced water filtration system not only ensures safe, clean water but also contributes to health protection, environmental responsibility, and operational reliability.