The global water chiller market is witnessing robust expansion, driven by increasing demand for efficient cooling solutions across industrial, commercial, and HVAC applications. According to a report by Mordor Intelligence, the water chiller market was valued at USD 37.5 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2029. This growth is fueled by rising industrialization, stricter energy efficiency regulations, and the expanding need for temperature control in data centers, pharmaceuticals, and food processing industries. With hydro-cooled chillers offering superior energy efficiency and reliability over air-cooled alternatives—especially in large-scale applications—manufacturers specializing in water chiller hydro systems are gaining strategic importance. As competition intensifies and technological innovation accelerates, a select group of manufacturers are leading the charge in performance, sustainability, and global reach. Here are the top 8 water chiller hydro manufacturers shaping the future of industrial cooling.

Top 8 Water Chiller Hydro Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Cold Shot Chillers

Domain Est. 1999

Website: waterchillers.com

Key Highlights: 40+ Years Specializing in Chillers. Reliable Air-cooled & Water-cooled Solutions. Cold Shot Chillers® offers both air-cooled and water-cooled chiller variants ……

#2 Hydro Chillers

Domain Est. 2005

Website: coasteq.com

Key Highlights: Coastline Equipment designs and fabricates Spiral and Immersion Hydro Chillers to preserve the quality of food products and extend shelf life….

#3 Penguin Chillers

Domain Est. 2014

Website: penguinchillers.com

Key Highlights: 21-day returnsAmerican-Made, Efficient Home and Commercial Chillers. Water chillers and glycol chillers for home, industrial, and commercial chilling….

#4 Aqualogic

Domain Est. 1996

Website: aqualogicinc.com

Key Highlights: At Aqua Logic we provide precision design and fabrication of high-performance chillers, custom titanium heat exchangers and components….

#5 Active Aqua

Domain Est. 1999

Website: hydrofarm.com

Key Highlights: Active Aqua is your source for everything related to water in your garden. The offering includes rolling benches, water chillers, water pumps, air stones, ……

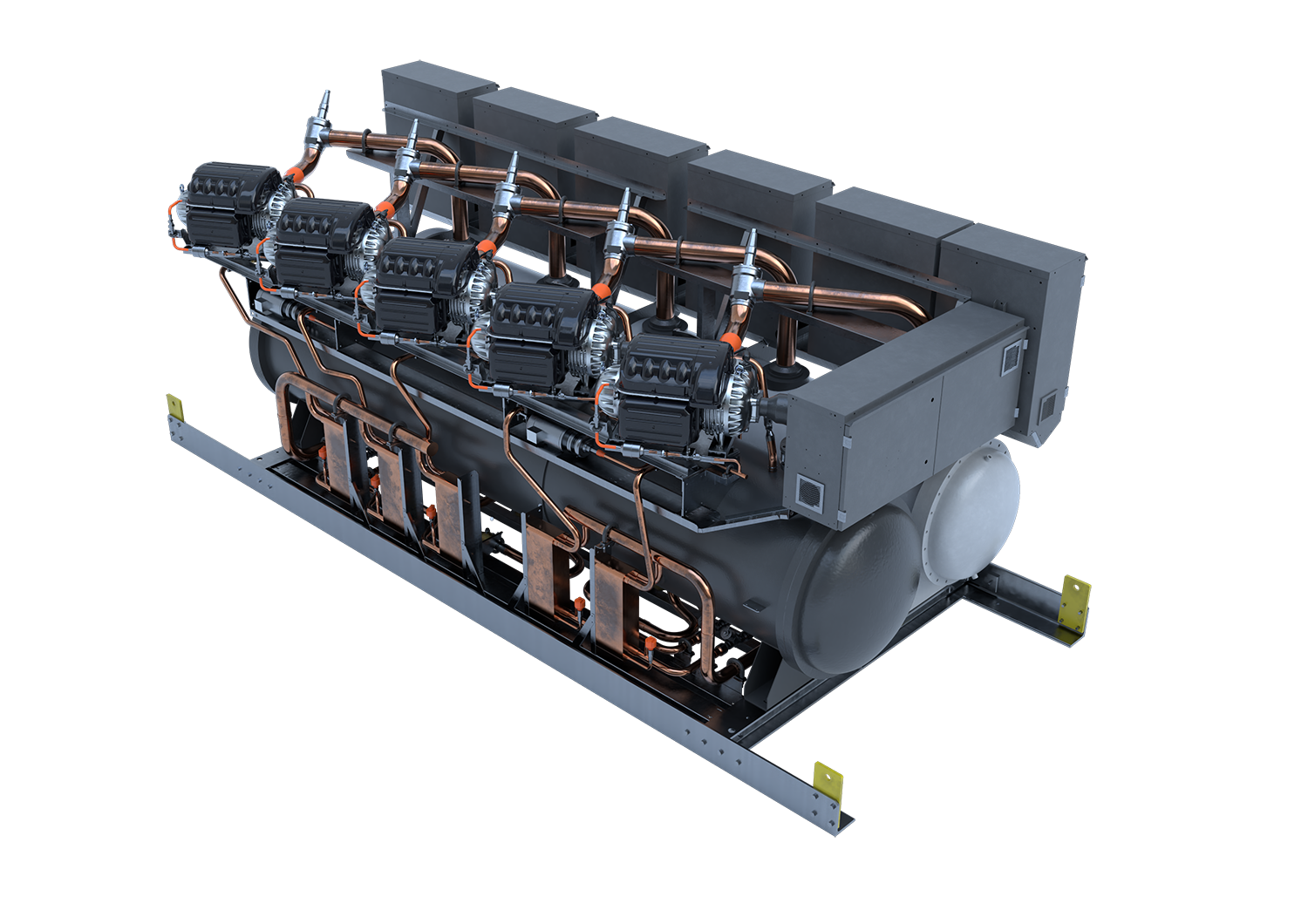

#6 TurboChill™ Hydro Range

Domain Est. 2000

Website: airedale.com

Key Highlights: TurboChill Hydro is a highly efficient water cooled chiller that offers extensive cooling capacity, ranging from 200kW to 3000kW….

#7 Hydro Frost Commercial Hydroponic Water Chiller, 2 HP

Domain Est. 2010

Website: hydrobuilder.com

Key Highlights: In stock $225 deliveryCommercial-grade 2 HP chiller with precise temperature control. Operates on 208-230V with optimal flow for hydroponic systems….

#8 Systems for Hydroponics & Cooling

Domain Est. 2012

Website: activeaquahydroponics.com

Key Highlights: Active Aqua, a Hydrofarm brand, delivers durable hydroponic systems, chillers & cold plunge innovation engineered for strength, precision & performance….

Expert Sourcing Insights for Water Chiller Hydro

H2: Projected 2026 Market Trends for Water Chiller Hydro

As the global demand for energy-efficient and sustainable cooling solutions continues to rise, the water chiller hydro market is poised for significant transformation by 2026. Driven by advancements in technology, stricter environmental regulations, and the growing emphasis on green infrastructure, the hydro-based water chiller segment is expected to experience robust growth and innovation. Below are the key market trends anticipated in 2026:

-

Increased Adoption of Natural Refrigerants

By 2026, a major shift toward low-global warming potential (GWP) and ozone-friendly refrigerants such as ammonia (R717), carbon dioxide (R744), and hydrocarbons (e.g., R290) is expected. Regulatory pressures under the Kigali Amendment and regional policies like the EU F-Gas Regulation will accelerate this transition, especially in industrial and commercial hydro chiller applications. -

Integration with Renewable Energy Systems

Hydro water chillers will increasingly be integrated with solar, wind, and geothermal energy sources to reduce carbon footprints. Smart grid compatibility and hybrid cooling systems will enhance operational efficiency, particularly in regions investing heavily in renewable infrastructure. -

Growth in Green Building Certifications

With the expansion of LEED, BREEAM, and other green building standards, demand for energy-efficient hydro chillers in commercial and residential HVAC systems will surge. Manufacturers will prioritize chillers with high COP (Coefficient of Performance) and low lifecycle emissions to meet certification requirements. -

Smart and IoT-Enabled Chillers

The 2026 market will see widespread deployment of IoT-connected hydro chillers equipped with predictive maintenance, remote monitoring, and AI-driven optimization. These smart systems will enable real-time performance analytics, minimizing downtime and energy consumption. -

Expansion in Emerging Markets

Rapid urbanization in Asia-Pacific, Latin America, and Africa will drive demand for reliable cooling solutions. Countries like India, Indonesia, and Vietnam will see increased installations of hydro chillers in data centers, hospitals, and industrial facilities, supported by government infrastructure investments. -

Modular and Scalable Designs

To meet diverse application needs, manufacturers will focus on modular hydro chiller systems that allow for easy scalability and retrofitting. This trend will appeal to industries requiring flexible cooling capacity without major infrastructure overhauls. -

Focus on Water Conservation and Closed-Loop Systems

Amid growing water scarcity concerns, closed-loop hydro chiller systems that minimize water usage will gain favor. Innovations in dry cooling hybrids and adiabatic pre-cooling will enhance efficiency while reducing reliance on freshwater resources. -

Rising Competition and Consolidation

The market will witness increased competition among key players such as Carrier, Trane, Daikin, and Johnson Controls, leading to strategic mergers, partnerships, and R&D investments. Smaller innovators specializing in sustainable chiller technology may be acquired to accelerate product development. -

Regulatory Push for Energy Efficiency

Governments worldwide will enforce stricter energy performance standards (e.g., updated MEPS – Minimum Energy Performance Standards), compelling manufacturers to innovate and phase out inefficient models. Incentives and subsidies for high-efficiency hydro chillers will further stimulate market growth. -

Sustainability-Driven Procurement

Corporate ESG (Environmental, Social, and Governance) goals will influence procurement decisions, with enterprises favoring hydro chillers that offer transparent lifecycle assessments, recyclable components, and reduced environmental impact.

In summary, the 2026 water chiller hydro market will be shaped by sustainability, digitalization, and regulatory evolution. Companies that invest in eco-friendly technologies, smart integration, and market-specific solutions will be best positioned to capitalize on emerging opportunities.

Common Pitfalls When Sourcing Water Chiller Hydro Systems: Quality and Intellectual Property (IP) Concerns

Sourcing water chiller hydro systems—particularly those involving advanced cooling technologies for hydro applications—can be complex. While cost and performance are primary considerations, overlooking quality assurance and intellectual property (IP) risks can lead to significant operational, legal, and financial consequences. Below are key pitfalls to avoid.

Quality-Related Pitfalls

1. Inadequate Certification and Compliance Verification

Many suppliers, especially from emerging markets, may claim compliance with international standards (e.g., ISO, CE, ASME) without proper certification. Buyers often assume compliance based on documentation alone, without third-party verification. This can result in systems that fail under operational stress, pose safety hazards, or do not meet environmental regulations.

Best Practice: Require certified test reports, factory acceptance tests (FAT), and independent audits. Verify certifications with issuing bodies when possible.

2. Substandard Materials and Components

To cut costs, some manufacturers use inferior-grade materials (e.g., non-stainless steel piping, low-efficiency compressors, or poor heat exchanger alloys). These compromises reduce system lifespan, increase maintenance, and compromise cooling efficiency.

Best Practice: Specify material grades and component brands in contracts. Conduct on-site inspections or request material test certificates (MTCs).

3. Lack of Performance Validation

Suppliers may provide optimistic performance data based on ideal lab conditions rather than real-world hydro-environmental variables (e.g., variable water temperatures, high humidity, or debris in water sources). This leads to underperforming chillers that fail to maintain required cooling loads.

Best Practice: Demand performance guarantees backed by site-specific testing or simulation data. Include penalty clauses for non-performance.

4. Poor Workmanship and Assembly Quality

Even with quality components, poor assembly—such as improper brazing, misaligned pumps, or inadequate electrical insulation—can cause early failures. This is common with contract manufacturers lacking rigorous quality control processes.

Best Practice: Evaluate supplier’s quality management system (e.g., ISO 9001). Request access to production facilities or third-party inspection reports.

Intellectual Property (IP)-Related Pitfalls

1. Risk of IP Infringement

Sourcing from low-cost regions increases the risk of inadvertently purchasing systems that infringe on patented technologies (e.g., proprietary refrigeration cycles, control algorithms, or heat exchanger designs). If your company deploys such systems, you may face legal liability—even if you were unaware of the infringement.

Best Practice: Include IP indemnification clauses in supplier contracts. Require written assurance that products do not violate third-party IP rights.

2. Reverse Engineering and Design Theft

Sharing detailed technical specifications or custom designs with unvetted suppliers may lead to unauthorized replication or resale of your technology. Some suppliers may reverse engineer your chiller design for their own product lines.

Best Practice: Use non-disclosure agreements (NDAs) and limit technical data disclosure to what is essential. Consider engaging suppliers under a trusted legal jurisdiction.

3. Lack of Control Over Proprietary Software and Controls

Modern chillers rely on embedded software for monitoring, diagnostics, and efficiency optimization. Suppliers may retain full ownership and access to this software, limiting your ability to modify, service, or integrate the system independently.

Best Practice: Negotiate licensing terms for firmware/software. Ensure access to APIs, source code (if applicable), or at least full documentation for maintenance and integration.

4. Gray Market Resale and Brand Confusion

OEMs may sell identical or rebranded units through multiple channels, including unauthorized distributors. This can dilute brand value, complicate warranty claims, and expose buyers to counterfeit or refurbished units passed off as new.

Best Practice: Source directly from authorized distributors or manufacturers. Verify serial numbers and warranty registration post-purchase.

Conclusion

To mitigate risks when sourcing water chiller hydro systems, implement a due diligence process that includes technical validation, quality audits, and strong legal safeguards. Prioritize long-term reliability and IP security over short-term cost savings. Partnering with reputable, transparent suppliers—and leveraging legal and technical expertise—ensures both performance integrity and protection of your intellectual assets.

H2: Logistics & Compliance Guide for Water Chiller Hydro

The following guide outlines the essential logistics and compliance considerations for the safe, efficient, and legally compliant handling, transportation, installation, and operation of the Water Chiller Hydro unit. This document is intended for distributors, installers, operators, and maintenance personnel involved in the product lifecycle.

- Transportation & Handling

- Packaging: The Water Chiller Hydro must be shipped in its original, manufacturer-approved packaging to protect against vibration, moisture, and mechanical damage.

- Lifting & Moving: Use appropriate lifting equipment (e.g., forklifts, pallet jacks) and follow weight distribution guidelines. Never lift by internal components or refrigerant lines.

- Orientation: Maintain upright orientation during transport and storage to prevent oil migration and compressor damage.

-

Environmental Protection: Avoid exposure to rain, extreme temperatures, or corrosive environments during transit.

-

Import & Export Compliance

- Documentation: Ensure all shipments include a commercial invoice, packing list, bill of lading, and certificate of origin.

- Regulatory Approvals: Verify that the unit meets local standards (e.g., CE, UKCA, UL, CCC) for the destination market.

- Refrigerant Regulations: The Water Chiller Hydro uses H2 (hydrogen) as a refrigerant. Confirm compliance with international shipping regulations for hydrogen-containing equipment (e.g., IMDG Code, ADR, IATA-DGR).

-

Note: While H2 is non-toxic and non-ozone depleting, it is highly flammable. Units must be certified for safe hydrogen containment and transport.

-

Storage Requirements

- Location: Store indoors in a dry, ventilated, and temperature-controlled environment (5°C to 40°C recommended).

- Duration: Maximum recommended storage period is 12 months. Extended storage requires inspection and possible re-pressurization.

-

Safety: Keep away from ignition sources, oxidizers, and high-traffic areas. Post appropriate warning signage if stored in shared facilities.

-

Installation & Site Compliance

- Permits: Installation may require permits related to pressure systems, gas handling, or HVAC modifications—check local building codes.

- Ventilation: Ensure adequate airflow around the unit to dissipate heat and prevent hydrogen accumulation. Install in well-ventilated or explosion-ventilated rooms if required.

- Electrical: Comply with local electrical codes (e.g., NEC, IEC). Use certified electricians for wiring and grounding.

- Leak Detection: Install hydrogen gas detectors per safety standards (e.g., ISO 22734, NFPA 2) in enclosed spaces.

-

Piping & Connections: Use only approved materials compatible with H2 (e.g., stainless steel or H2-rated copper). Avoid sharp bends and ensure leak-tight joints.

-

Operational Compliance

- Certification: Operators must be trained in hydrogen safety and chiller system management. Certification may be required depending on jurisdiction.

- Monitoring: Regularly monitor system pressure, temperature, and hydrogen levels. Maintain log records for compliance audits.

- Maintenance: Service only by qualified technicians using H2-safe tools and procedures. Follow manufacturer’s maintenance schedule.

-

Emergency Procedures: Establish protocols for hydrogen leaks, fire, or equipment failure. Equip site with fire extinguishers (Class C for electrical/gas fires) and emergency shutoff valves.

-

Environmental & Safety Standards

- Emissions: H2 has zero GWP and ODP, but flaring or venting must be controlled and reported where required.

- Disposal: At end-of-life, decommissioning must follow hazardous material handling regulations. Refrigerant recovery is not required for H2, but pressure vessels must be safely depressurized and recycled.

-

Reporting: Notify relevant authorities of any incidents involving hydrogen release, as mandated by local regulations (e.g., EPA, HSE, OSHA).

-

Documentation & Record-Keeping

- Maintain records of:

- Shipping and customs documentation

- Installation permits and inspections

- Operator training certificates

- Maintenance logs

- Safety audits and incident reports

- Retain records for a minimum of 7 years or as required by local law.

Adherence to this H2-compliant logistics and compliance guide ensures the safe deployment and operation of the Water Chiller Hydro, minimizing risks and maximizing regulatory alignment across global markets. Always consult the latest version of applicable standards and local authorities before implementation.

Conclusion for Sourcing Water Chiller (Hydro System):

In conclusion, sourcing a water chiller for a hydro system requires careful consideration of several key factors, including cooling capacity, energy efficiency, system compatibility, reliability, and operating environment. The selected chiller must effectively maintain optimal water temperatures to ensure efficient hydroponic or aquatic operations, support plant or organism health, and maximize overall system performance. Evaluating reputable suppliers, considering long-term maintenance needs, and balancing initial investment with operational savings are essential for a successful procurement decision. By choosing a properly sized and high-quality water chiller, users can enhance system stability, improve yields, and achieve sustainable, long-term results in their hydro-based applications.