The global water-based aerosol spray paint market is witnessing robust growth, driven by increasing environmental regulations and a rising preference for low-VOC (volatile organic compound) coatings across industrial and consumer applications. According to a 2023 report by Mordor Intelligence, the global aerosol paint market is projected to grow at a CAGR of 4.8% from 2023 to 2028, with water-based formulations capturing an expanding share due to stringent emissions standards in North America and Europe. Similarly, Grand View Research estimates that the global architectural coatings market—which includes water-based spray paints—will grow at a CAGR of 5.2% from 2023 to 2030, fueled by sustainability mandates and consumer demand for eco-friendly products. As regulatory pressures mount and corporate sustainability goals intensify, manufacturers are pivoting toward water-based technologies. In this evolving landscape, nine key players have emerged as leaders in innovation, production scale, and environmental stewardship—shaping the future of water-based aerosol spray paint worldwide.

Top 9 Water Based Aerosol Spray Paint Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Aerosol Spray Paint Manufacturers

Domain Est. 1999

Website: aronuniversal.com

Key Highlights: We are leading aerosol spray paint manufacturers providing vibrant, durable, and easy-to-use aerosol paint solutions for all industrial and creative needs….

#2 Custom Aerosol Paint – Color Matching & Formulation

Domain Est. 1996

Website: aexcelcorp.com

Key Highlights: Aexcel offers a selection of general-purpose and rust-preventative aerosol spray paints and primers to fit any purpose. Custom industrial aerosol solutions….

#3

Domain Est. 1999

Website: custom-aerosol.com

Key Highlights: Custom Aerosol Products has been a premier packager of custom-matched touch-up paint for more than 30 years. Our primary customers are manufacturers of products ……

#4 ProXL

Domain Est. 2012

Website: proxl.com

Key Highlights: ProXL is a leading provider of refinishing & painting products for the Automotive and Industrial sectors. Specialising in aerosols and ancillary products….

#5 Spray Paint

Domain Est. 1995

Website: rustoleum.com

Key Highlights: Rust-Oleum spray paints are made for all kinds of surfaces. Whether it’s wood, metal, home décor or crafts, you’ll find a spray paint that fits your needs….

#6 DIY, Craft & Professional Spray Paint Products

Domain Est. 1997

Website: krylon.com

Key Highlights: Krylon® carries a wide range of spray paint products for your DIY, craft or professional spray paint project. View our complete line of spray paint products.Missing: water aerosol…

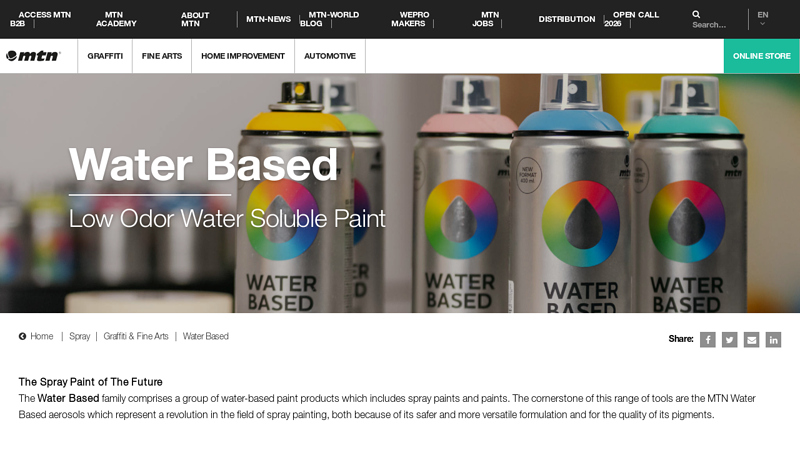

#7 Water Based Spray Paint

Domain Est. 1998

Website: montanacolors.com

Key Highlights: 14-day returnsThe Spray Paint of The Future. The Water Based family comprises a group of water-based paint products which includes spray paints and paints….

#8 Company

Domain Est. 2000

Website: spraymax.com

Key Highlights: As a brand of the Peter Kwasny Group, we benefit from over 60 years of development expertise in the manufacture of aerosol cans….

#9 Company

Domain Est. 2001

Website: kwasny.com

Key Highlights: Peter Kwasny GmbH is a medium-sized family company that has been developing innovative and patented solutions for paint aerosol systems….

Expert Sourcing Insights for Water Based Aerosol Spray Paint

H2: 2026 Market Trends for Water-Based Aerosol Spray Paint

The global market for water-based aerosol spray paint is poised for significant transformation by 2026, driven by environmental regulations, shifting consumer preferences, and technological advancements. As sustainability becomes a central focus across industries, water-based formulations are emerging as the preferred alternative to traditional solvent-based aerosol paints, which are increasingly restricted due to volatile organic compound (VOC) emissions.

1. Regulatory Pressure and Environmental Compliance

Stringent environmental regulations in North America, Europe, and parts of Asia-Pacific—such as the European Union’s REACH and VOC Solvents Emissions Directive—are accelerating the transition toward low-VOC and zero-VOC products. Governments are enforcing tighter limits on emissions, compelling manufacturers to reformulate products or risk penalties. By 2026, compliance with these regulations will be a baseline requirement, making water-based aerosol spray paints a dominant segment in both industrial and consumer markets.

2. Growing Consumer Awareness and Demand for Eco-Friendly Products

Homeowners, DIY enthusiasts, and professional painters are increasingly prioritizing health and environmental safety. Water-based aerosol paints offer reduced odor, lower toxicity, and easier cleanup, making them more attractive for indoor and outdoor use. Brands emphasizing sustainability, recyclable packaging, and non-hazardous ingredients are gaining market share, a trend expected to intensify through 2026.

3. Technological Advancements and Performance Improvements

Historically, water-based aerosol paints have been criticized for slower drying times and lower durability compared to solvent-based counterparts. However, ongoing R&D efforts are addressing these limitations. Innovations in resin technology, propellant systems (e.g., compressed gas or hydrocarbon blends with reduced environmental impact), and spray nozzle design are enhancing application performance, adhesion, and finish quality. By 2026, these improvements will narrow the performance gap, bolstering consumer confidence and adoption rates.

4. Expansion in Application Sectors

The use of water-based aerosol spray paint is expanding beyond traditional DIY and automotive touch-up applications into sectors such as furniture refinishing, arts and crafts, HVAC, and light industrial maintenance. The construction industry, particularly in green building projects, is adopting water-based coatings to meet sustainability certifications like LEED. This diversification will drive volume growth in the aerosol segment.

5. Competitive Landscape and Market Consolidation

Major players such as Rust-Oleum, Krylon (Sherwin-Williams), Montana Colors, and Liquitex are investing heavily in eco-friendly product lines. Smaller niche brands are also entering the market with premium, artist-grade or ultra-low-VOC formulations. By 2026, increased competition is expected to drive innovation and price optimization, while mergers and acquisitions may consolidate the market around sustainability-focused portfolios.

6. Regional Market Dynamics

– Europe will remain a leader in adoption due to robust regulatory frameworks and high environmental awareness.

– North America will see steady growth, supported by green building trends and federal incentives for low-emission products.

– Asia-Pacific represents the fastest-growing region, with rising urbanization, increasing disposable income, and growing industrial activity in countries like China and India. However, regulatory enforcement and consumer education remain challenges.

7. Sustainability and Circular Economy Initiatives

By 2026, leading manufacturers will likely integrate circular economy principles, including aluminum can recycling programs, refillable aerosol systems, and bio-based raw materials. These initiatives will enhance brand loyalty and align with corporate ESG (Environmental, Social, and Governance) goals.

Conclusion

The water-based aerosol spray paint market in 2026 will be defined by sustainability, innovation, and regulatory alignment. As performance gaps close and eco-conscious consumerism rises, water-based products are set to capture a majority share of the aerosol paint market. Companies that invest in R&D, sustainable packaging, and transparent labeling will be best positioned to lead in this evolving landscape.

Common Pitfalls When Sourcing Water-Based Aerosol Spray Paint (Quality & IP)

Sourcing water-based aerosol spray paint presents unique challenges that, if not carefully managed, can compromise product quality, performance, and expose buyers to intellectual property (IP) risks. Being aware of these common pitfalls is essential for making informed procurement decisions.

1. Underestimating Performance Limitations

A frequent mistake is assuming water-based aerosols perform identically to solvent-based counterparts. Key performance pitfalls include:

* Slower Drying Times: Water evaporation is slower than solvent evaporation, leading to longer dry-to-touch and recoat times, increasing production bottlenecks.

* Reduced Adhesion & Durability: May struggle to adhere to non-porous or oily surfaces without meticulous surface prep. Durability (scrub resistance, chemical resistance, UV stability) can be inferior, especially in demanding environments.

* Moisture Sensitivity: High humidity during application can cause blushing, bubbling, or extended drying.

* Limited Gloss & Film Build: Achieving very high gloss finishes or thick film builds can be more challenging.

2. Overlooking Formulation Complexity & Quality Variability

The quality of water-based aerosols varies significantly between suppliers due to complex formulations:

* Inconsistent Pigmentation & Color Match: Poor dispersion can lead to color batch variations and inconsistent opacity. Achieving precise color matching requires rigorous quality control.

* Poor Spray Performance: Formulations prone to nozzle clogging, spitting, or uneven atomization due to improper surfactant or resin selection.

* Settling & Stability Issues: Poorly formulated paints can settle rapidly in the can or destabilize over time (especially under temperature extremes), affecting usability and shelf life.

* Resin & Additive Quality: Using lower-grade resins or inadequate additives (coalescents, thickeners, biocides) directly impacts performance and longevity.

3. Neglecting Substrate Compatibility & Surface Preparation

Assuming universal adhesion is a major error:

* Adhesion Failure: Water-based paints often require specific primers or surface treatments for plastics, metals, or previously coated surfaces. Skipping proper prep leads to peeling.

* Surface Contamination Sensitivity: Grease, oil, or dust significantly impact adhesion more than with some solvent-based paints.

* Moisture on Substrate: Applying to damp or cold surfaces can cause severe adhesion problems and extended drying.

4. Ignoring Application Technique Differences

Applying water-based aerosols requires specific techniques:

* Holding Distance & Overlap: Incorrect distance (usually 15-25 cm) or spray pattern overlap leads to runs, orange peel, or uneven coverage.

* Thinner Coats & Multiple Passes: Attempting to apply thick coats in one pass causes runs and poor drying. Requires building film with light, even coats.

* Environmental Control: Failing to control temperature (typically >10°C/50°F) and humidity (<65-70%) during application and drying.

5. Overlooking Environmental & Regulatory Claims (Greenwashing)

Not all “water-based” paints are created equal regarding environmental impact:

* VOC Content: While generally lower, VOC levels vary. Ensure compliance with specific regional regulations (e.g., EU, US EPA, California).

* Coalescents: Some use high-VOC coalescents (e.g., Texanol) to aid film formation, partially offsetting VOC benefits.

* True Sustainability: Verify claims about recycled content, biodegradability, or renewable raw materials with documentation (e.g., EPDs, certifications).

6. Intellectual Property (IP) Infringement Risks

Sourcing from unreliable suppliers carries significant IP dangers:

* Counterfeit Products: Illegitimate suppliers may produce or distribute knock-offs of branded products, infringing on trademarks and patents.

* Patented Formulations: Core technologies (resins, additives, dispersion methods) are often patented. Sourcing from a supplier using unauthorized patented tech exposes the buyer to contributory infringement liability.

* Trade Secret Theft: Reputable formulators protect unique processes and recipes as trade secrets. Suppliers offering suspiciously cheap “identical” products may have obtained formulas improperly.

* Lack of Transparency: Suppliers unwilling to disclose key raw material sources or provide proof of IP clearance for their technology are a major red flag.

7. Supplier Reliability & Lack of Technical Support

Choosing suppliers based solely on price is risky:

* Inconsistent Supply & Quality: Unreliable manufacturing leads to batch-to-batch variations and supply chain disruptions.

* Inadequate Technical Support: Lack of expertise to troubleshoot application problems, recommend primers, or advise on substrate compatibility wastes time and resources.

* Poor Documentation: Missing or inaccurate SDS, TDS, or regulatory compliance documents create safety and compliance hazards.

Mitigation Strategy: To avoid these pitfalls, conduct thorough due diligence: vet suppliers rigorously, demand proof of quality control (test reports, certifications), insist on IP indemnification clauses in contracts, prioritize suppliers with technical expertise, and always test samples under real-world conditions before large-scale sourcing.

Logistics & Compliance Guide for Water-Based Aerosol Spray Paint

Prepared using H2 (Hazard Statement 2: “Extremely flammable aerosol”)

Version: 1.0 | Date: [Insert Date]

1. Introduction

This guide outlines the logistics, transportation, storage, and regulatory compliance requirements for handling water-based aerosol spray paint. While water-based formulations are generally less hazardous than solvent-based alternatives, they are still classified as aerosols under international regulations and may carry the H2 hazard statement: “Extremely flammable aerosol” due to propellant gases (e.g., LPG, compressed gases) used in the can.

Even with reduced solvent content, these products are regulated as dangerous goods during transport and require strict compliance with safety standards.

2. Product Classification & Hazard Identification

UN Number: UN1950

Proper Shipping Name: AEROSOLS

Class: 2 – Gases (specifically, “Aerosols” as defined in ADR, IMDG, IATA)

Packing Group: II (Medium danger) or III (Low danger) depending on flammability test results

Hazard Statements (GHS):

– H222: Extremely flammable aerosol

– H229: Contains gas under pressure; may explode if heated

– H319: Causes serious eye irritation (if applicable)

– H412: Harmful to aquatic life with long-lasting effects (if applicable)

🛑 Note: Despite being water-based, the propellant (e.g., butane, propane, dimethyl ether) renders the aerosol flammable, hence the applicability of H2.

3. Regulatory Frameworks

3.1 Globally Harmonized System (GHS)

- Labeling must include:

- Pictogram: Flame (for flammability)

- Signal Word: Danger

- H222: “Extremely flammable aerosol”

- Precautionary Statements (e.g., P210: Keep away from heat/sparks/open flames)

3.2 Transport Regulations

- Road (ADR) – Europe

- Sea (IMDG Code) – International maritime

- Air (IATA DGR) – Air transport

- DOT 49 CFR – United States

✅ All modes require classification under UN1950, Class 2, with proper packaging, labeling, and documentation.

4. Packaging Requirements

- Use UN-certified packaging marked for Class 2 aerosols.

- Inner packaging: Aerosol cans must be securely fixed to prevent movement.

- Outer packaging: Strong fiberboard or composite material, capable of passing drop and stacking tests.

- Quantity Limits:

- IATA (Air): Limited to 1 L per aerosol; total net quantity per package restricted (typically ≤ 150 kg or 1,000 L, depending on packing instruction).

- IMDG (Sea): Generally more lenient; check specific packing instruction (P200 or P201).

- ADR (Road): Up to 1,000 L per transport unit without full ADR requirements if under “Limited Quantities” (LQ).

5. Labeling & Marking

Mandatory Labels on Outer Packaging:

– Class 2 (Gas) diamond label (red with flame)

– UN1950

– Proper Shipping Name: “AEROSOLS”

– Orientation arrows (if applicable)

– Limited Quantity (LQ) or Excepted Quantity (EQ) mark if applicable

– GHS labels on individual cans

⚠️ Do not use “non-flammable” labels unless the product has been tested and certified as such.

6. Documentation

6.1 Safety Data Sheet (SDS)

- Must be compliant with GHS and local regulations (e.g., REACH in EU, OSHA HazCom in US).

- Section 2: Must include H222 and other applicable hazard statements.

- Section 14: Transport information must specify UN1950, Class 2, Packing Group, and applicable regulations.

6.2 Transport Documents

- Include:

- Proper shipping name

- UN number

- Class

- Packing group

- Quantity

- Emergency contact

- Signed declaration by shipper (especially for air/sea)

7. Storage Requirements

- Store in a well-ventilated, cool, dry area away from direct sunlight.

- Temperature control: Do not expose to temperatures >50°C (122°F); never store near open flames or heat sources.

- Segregation:

- Keep away from oxidizers (Class 5.1) and ignition sources.

- Not required to be segregated from most other classes under ADR if stored properly.

- Max stack height: Follow manufacturer guidelines (typically 2–3 m).

- Fire protection: Class B fire extinguishers required onsite.

8. Handling & Worker Safety

- Use in well-ventilated areas or with local exhaust ventilation.

- PPE required:

- Gloves (nitrile)

- Safety goggles

- Respiratory protection (if sprayed in enclosed space)

- No smoking, welding, or open flames in handling areas.

- Avoid puncturing or incinerating cans — risk of explosion.

9. Environmental & Disposal Compliance

- Do not dispose of in regular trash if pressurized.

- Empty cans: May qualify as non-hazardous waste if fully depressurized and drained (check local regulations).

- Full or partially full cans: Treat as hazardous waste.

- Follow RCRA (US), WEEE (EU), or local e-waste/hazardous waste rules.

10. Air, Sea, and Road Transport Summary

| Mode | Regulation | Key Restrictions |

|——|————|——————|

| Air (IATA) | IATA DGR | Max 1 L/can; Limited Quantities apply; PI 200 |

| Sea (IMDG) | IMDG Code | P200/P201; proper segregation; stowage away from heat |

| Road (ADR) | ADR 2023 | LQ up to 1,000 L exempt from full regulations; otherwise full ADR applies |

✅ Always check the latest edition of the applicable regulation annually.

11. Emergency Response

- Fire: Use alcohol-resistant foam, CO₂, or dry chemical extinguishers. Cool containers with water from a safe distance.

- Leak: Eliminate ignition sources. Ventilate area. Do not touch damaged cans.

- Spill: Absorb with inert material (e.g., sand). Collect in approved container. Ventilate.

- First Aid:

- Inhalation: Move to fresh air.

- Skin: Wash with soap and water.

- Eyes: Rinse thoroughly for 15 minutes.

Emergency contact: [Insert 24/7 emergency number]

12. Compliance Checklist

✅ SDS includes H222 and transport info

✅ Cans labeled with GHS pictograms and H222

✅ Shipment packed in UN-certified packaging

✅ Transport documents include UN1950, Class 2

✅ Storage area cool, ventilated, fire-safe

✅ Training provided for handling and emergency response

✅ Waste disposal in accordance with local laws

13. Conclusion

Although water-based aerosol spray paints are more environmentally friendly than solvent-based versions, they remain flammable aerosols under hazard statement H222 due to propellant gases. Compliance with UN1950, Class 2 regulations is mandatory across all logistics phases — from storage to transport. Always verify classification through testing (e.g., UN Manual of Tests and Criteria, Part III, sub-section 31.4) and maintain up-to-date documentation.

Prepared by: [Your Company Name] Contact: [EHS/Safety Officer Email/Phone] Review Date: [Next Review Due – e.g., 1 year from issue]

🔐 This document is for informational purposes and does not replace regulatory consultation. Always verify with local authorities and legal counsel.

In conclusion, sourcing water-based aerosol spray paint presents a sustainable and environmentally responsible choice for both industrial and consumer applications. With growing regulatory pressures and increasing awareness of environmental and health impacts, water-based formulations offer a safer alternative to traditional solvent-based paints by reducing volatile organic compound (VOC) emissions, minimizing odor, and improving workplace safety.

Key considerations when sourcing include evaluating product performance—such as adhesion, durability, and dry time—ensuring compliance with environmental regulations (e.g., EPA, EU directives), and selecting reputable suppliers committed to quality and sustainability. Additionally, logistical factors like shelf life, storage requirements, and compatibility with application equipment should be reviewed.

By prioritizing suppliers with strong environmental certifications, transparent ingredient disclosure, and consistent product quality, organizations can meet their operational needs while aligning with sustainability goals. Ultimately, transitioning to water-based aerosol spray paint not only supports regulatory compliance and worker safety but also enhances brand reputation in an increasingly eco-conscious market.