The global waste oil re-refining market is experiencing robust expansion, driven by increasing environmental regulations, rising demand for sustainable lubricants, and growing industrialization in emerging economies. According to Grand View Research, the global used oil re-refining market size was valued at USD 5.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. A key enabler of efficient oil re-refining, waste oil centrifuges play a critical role in removing contaminants and extending the lifecycle of industrial lubricants. With over 100 million gallons of used oil generated annually in the U.S. alone—much of which can be reclaimed—advanced separation technologies have become essential for compliance and cost recovery. As industries prioritize circular economy practices, the demand for high-performance waste oil centrifuges continues to rise. This growing need has spurred innovation and competition among equipment manufacturers, setting the stage for our data-driven look at the top 10 waste oil centrifuge manufacturers leading the market today.

Top 10 Waste Oil Centrifuge Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

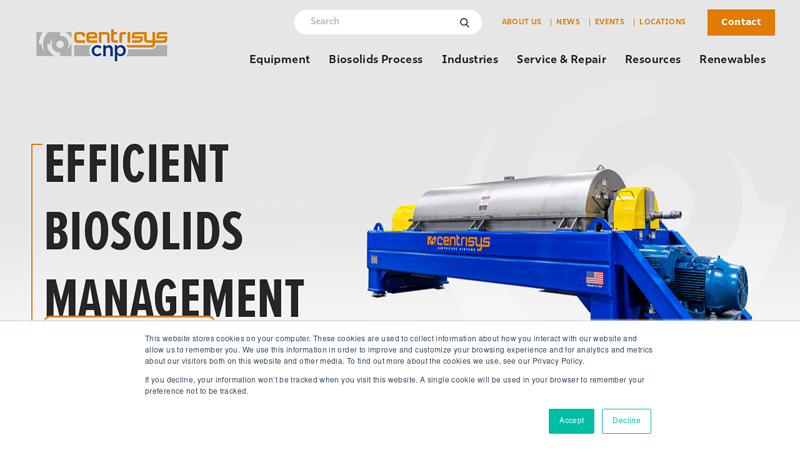

#1 Centrisys/CNP: Decanter Centrifuge Manufacturer

Domain Est. 2017

Website: centrisys-cnp.com

Key Highlights: Trust Centrisys-CNP, an industrial manufacturer of decanter centrifuges & leader in nutrient recovery & sludge optimization for all biosolids management ……

#2 Processing of Oil Sludge

Domain Est. 1996

Website: flottweg.com

Key Highlights: Flottweg centrifuges are used in oil sludge recycling such as treatment of oily waste water, oil sludge from ponds and oily residues from crude oil tanks….

#3 CentraSep: Centrifuge, Separation, Filtration, Liquid

Domain Est. 2000

Website: centrasep.com

Key Highlights: CentraSep Centrifuges is the gold standard for Liquid-Solid Separation & Filtration. Our centrifuges offer a unique design, features & patented technology….

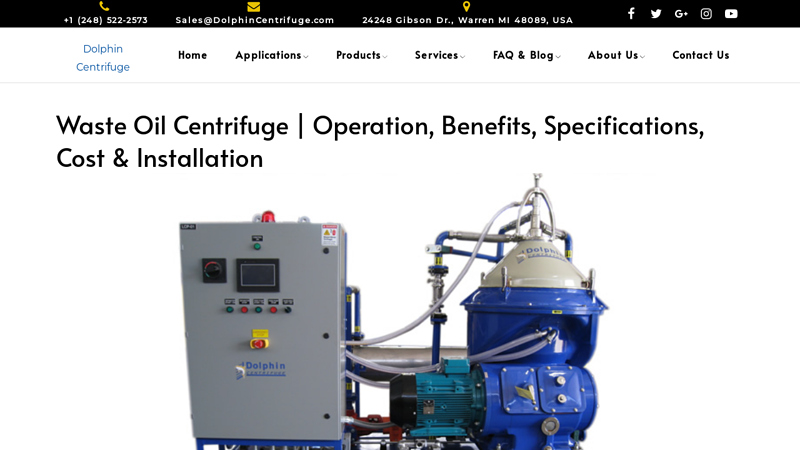

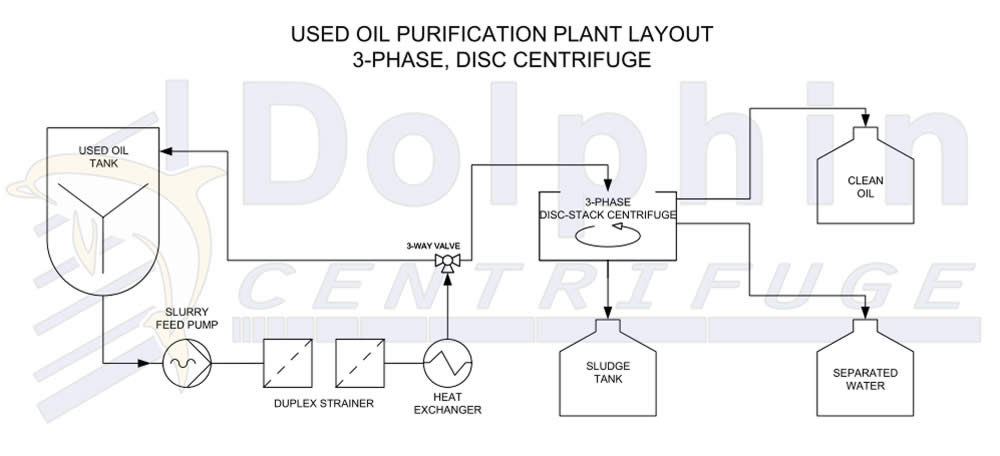

#4 Waste Oil Centrifuge

Domain Est. 2012

Website: dolphincentrifuge.com

Key Highlights: Industrial waste oil centrifuges offer a large processing capacity. Continuous three-phase separation is the key to the efficient separation of waste oils….

#5 HAUS Centrifuge Technologies

Domain Est. 2019

Website: hausworld.com

Key Highlights: HAUS Centrifuge Technologies sells centrifugal decanters and separators for environmental, industrial, and food applications….

#6 Alfa Laval

Domain Est. 1997

Website: alfalaval.com

Key Highlights: Alfa Laval offers a variety of solutions for on-site water and waste treatment plus recovery of water, heat and even products from your process….

#7 Oil Cleaning Centrifuges

Domain Est. 2005

Website: alliedreliability.com

Key Highlights: Allied Reliability’s Spinner II oil cleaning centrifuges are highly efficient, self-contained, oil-cleaning units for bypass and off-line filtration….

#8 US Filtermaxx

Domain Est. 2009

#9 Oil Cleaning System and Oil Recovery Centrifuge Machine …

Domain Est. 2011

Website: oilmaxsystems.com

Key Highlights: Automatic Oil Centrifuging Machine / Oil Recovery Centrifuge Machine · Ask Price. Capacity: 2000 LPH; Material: Mild Steel. Get Best Price….

#10 Spinner II® Centrifuges – WestateSystems.com

Domain Est. 2019

Website: westatesystems.com

Key Highlights: Spinner II® Centrifuges are highly efficient, self-contained, oil cleaning units for bypass and offline filtration of engine lubricants, transmission oil, gear ……

Expert Sourcing Insights for Waste Oil Centrifuge

H2: 2026 Market Trends for Waste Oil Centrifuges

The global waste oil centrifuge market is projected to experience significant growth and transformation by 2026, driven by increasing environmental regulations, the rise in industrial activities, and a growing emphasis on circular economy practices. Below are the key market trends expected to shape the waste oil centrifuge industry by 2026:

-

Stringent Environmental Regulations

Governments and regulatory bodies worldwide are enforcing stricter environmental standards regarding the disposal and recycling of used industrial and automotive oils. The European Union’s Waste Framework Directive and the U.S. EPA’s used oil management standards are pushing industries to adopt advanced purification technologies like centrifugation. By 2026, compliance with these regulations will remain a primary driver for the adoption of waste oil centrifuges. -

Growing Demand for Oil Re-refining

The re-refining sector is expanding as businesses and governments prioritize resource efficiency and waste reduction. Waste oil centrifuges play a crucial role in removing contaminants such as water, sludge, and particulates from used oil, enabling high-quality base oil recovery. The market is expected to benefit from increased investments in re-refining infrastructure, particularly in North America and Asia-Pacific. -

Technological Advancements and Automation

Innovations in centrifuge design—including higher G-force capabilities, improved separation efficiency, and integration with IoT-based monitoring systems—are enhancing performance and reducing operational costs. By 2026, smart centrifuges with predictive maintenance features and real-time data analytics are anticipated to dominate industrial applications, improving uptime and process reliability. -

Rise in Industrial and Automotive Sectors

Expanding manufacturing, shipping, and transportation industries are generating higher volumes of waste lubricant oils. Marine, automotive, and heavy machinery sectors are increasingly adopting on-site waste oil treatment using centrifuges to cut disposal costs and reduce environmental liability. This trend is particularly strong in emerging economies such as India, China, and Southeast Asian nations. -

Shift Toward Sustainable and Closed-Loop Systems

Corporate sustainability goals are driving industries to implement closed-loop oil management systems. Waste oil centrifuges enable on-demand oil recycling, reducing dependency on virgin oil and minimizing waste. By 2026, more companies are expected to integrate centrifugal separation into their sustainability strategies, supported by ESG (Environmental, Social, and Governance) reporting requirements. -

Regional Market Growth Disparities

While North America and Europe lead in market maturity due to established regulations and recycling infrastructures, the Asia-Pacific region is expected to register the highest compound annual growth rate (CAGR) through 2026. Rapid industrialization, increasing vehicle ownership, and improving waste management policies in countries like China and India are key growth catalysts. -

Cost-Effectiveness and ROI Focus

With rising disposal fees and landfill taxes, businesses are turning to waste oil centrifuges as a cost-saving measure. The ability to reuse purified oil on-site offers a quick return on investment (ROI), making centrifuge systems financially attractive. By 2026, payback periods of under two years are expected to become a strong selling point for new installations.

In conclusion, the 2026 waste oil centrifuge market will be defined by regulatory pressure, technological innovation, and a global shift toward sustainable resource management. Companies that invest in efficient, scalable, and smart centrifuge solutions are likely to gain a competitive advantage in this evolving landscape.

Common Pitfalls When Sourcing Waste Oil Centrifuges: Quality and Intellectual Property (IP) Concerns

Sourcing waste oil centrifuges—especially from international or less-regulated markets—can expose buyers to significant risks related to product quality and intellectual property (IP) infringement. Recognizing these pitfalls is essential for ensuring reliable performance, regulatory compliance, and legal safety.

Poor Build Quality and Substandard Materials

One of the most prevalent issues when sourcing waste oil centrifuges is encountering units manufactured with inferior materials and lax quality control. Many low-cost suppliers use substandard alloys, worn tooling, or inadequate welding techniques, leading to premature mechanical failure, imbalanced rotors, or even catastrophic breakdowns under operational stress. These centrifuges often fail to meet industry standards (e.g., ISO 1940 for balancing), resulting in excessive vibration, shorter service life, and increased downtime. Buyers may also discover missing or poorly calibrated safety features, such as vibration sensors or automatic shutdown systems.

Misrepresentation of Performance Specifications

Suppliers may exaggerate key performance metrics such as G-force, throughput capacity, separation efficiency, or power consumption. For instance, a centrifuge advertised with a 10,000 G-force capability might only achieve 6,000 G in real-world conditions due to unverified rotor designs or motor limitations. This misrepresentation can lead to inadequate oil cleaning performance, failure to meet treatment standards, and costly operational inefficiencies. Independent third-party validation of performance claims is often absent in low-priced models.

Lack of Compliance with Safety and Environmental Standards

Many low-cost centrifuges fail to comply with essential international safety and environmental regulations such as CE, ATEX (for explosive atmospheres), or UL certifications. The absence of these certifications not only increases the risk of workplace accidents but can also result in regulatory fines, insurance invalidation, and operational shutdowns. Additionally, non-compliant units may not integrate properly with existing waste oil handling systems, creating bottlenecks or safety hazards.

Intellectual Property (IP) Infringement and Counterfeit Designs

A significant but often overlooked risk is the procurement of centrifuges that infringe on patented technologies. Some manufacturers replicate the design, rotor geometry, or control systems of established brands without licensing, producing “knock-off” versions that mimic high-end models. These counterfeit or reverse-engineered units may appear identical but lack the engineering integrity, durability, and performance of the original. Purchasing such equipment exposes the buyer to potential legal liability, especially in regions with strong IP enforcement (e.g., the EU or North America), where use or resale of infringing products could lead to litigation or seizure.

Limited Technical Support and Spare Parts Availability

Low-cost suppliers, particularly those based overseas, often lack robust technical support networks. Buyers may struggle to obtain timely assistance for installation, troubleshooting, or maintenance. Furthermore, spare parts—especially for patented or proprietary components—may be unavailable, incompatible, or of poor quality. This leads to extended downtimes and higher total cost of ownership, negating any initial price advantage.

Inadequate Documentation and Lack of Traceability

Many budget centrifuges come with incomplete or poorly translated manuals, missing schematics, or no traceable manufacturing records. This lack of documentation complicates maintenance, regulatory audits, and warranty claims. In industries subject to strict environmental or safety reporting (e.g., waste management or marine), the inability to verify equipment compliance or maintenance history can result in non-compliance penalties.

Conclusion

To mitigate these risks, buyers should conduct thorough due diligence: verify supplier credentials, request third-party performance test reports, inspect manufacturing facilities if possible, and ensure IP legitimacy through patent searches or legal consultation. Investing in reputable, certified equipment—even at a higher upfront cost—typically delivers better long-term reliability, safety, and legal protection.

Logistics & Compliance Guide for Waste Oil Centrifuge

Overview and Purpose

This guide outlines the logistical considerations and regulatory compliance requirements for the transportation, handling, storage, and operation of a waste oil centrifuge. Proper adherence ensures environmental protection, regulatory compliance, and operational safety when processing used lubricants and waste oil streams.

Regulatory Classification of Waste Oil

Waste oil is classified as a hazardous or universal waste under various environmental regulations, including the U.S. Environmental Protection Agency (EPA) Resource Conservation and Recovery Act (RCRA). Used oil processed through a centrifuge may contain regulated contaminants such as heavy metals, halogens, or polycyclic aromatic hydrocarbons (PAHs). Confirm local, state, and federal definitions to determine applicable rules.

Transport and Logistics Requirements

Transporting waste oil and centrifuge units requires compliance with Department of Transportation (DOT) hazardous materials regulations (49 CFR) when waste oil is classified as hazardous. Key logistics steps include:

- Proper Labeling: All containers and transport vehicles must display appropriate hazard class labels (e.g., “Used Oil” or “Waste Petroleum”).

- Spill Containment: Vehicles must be equipped with secondary containment and spill kits.

- Manifest System: Use a uniform hazardous waste manifest when transporting off-site for treatment or disposal.

- Licensed Haulers: Engage only DOT-permitted waste oil transporters with appropriate insurance and training.

On-Site Handling and Storage

- Storage Containers: Store waste oil in EPA-compliant, closed, labeled containers (e.g., UN-rated drums or tanks).

- Secondary Containment: All storage areas must have impermeable secondary containment capable of holding 110% of the largest container’s volume.

- Location: Keep storage areas away from storm drains, water sources, and high-traffic zones.

- Inspections: Conduct weekly inspections for leaks, corrosion, or container damage per SPCC (Spill Prevention, Control, and Countermeasure) requirements.

Waste Oil Centrifuge Operation Compliance

- Pre-Treatment Evaluation: Test incoming waste oil for prohibited substances (e.g., free liquids, halogenated solvents) prior to centrifugation.

- Pollution Controls: Ensure centrifuge systems are equipped with vapor controls and oil mist collectors to meet air quality standards (e.g., EPA NESHAP or local air district rules).

- Recordkeeping: Maintain logs of operating parameters (e.g., feed rate, temperature, maintenance) and waste volumes processed.

- Employee Training: Train operators on emergency procedures, PPE use, and OSHA hazard communication standards.

Disposal and Reuse of Output Streams

Centrifuge processing typically separates waste oil into three streams: cleaned oil, sludge, and water. Each stream has distinct compliance obligations:

- Re-refined Oil: If reused on-site or sold, confirm it meets fuel or lubricant specifications and is not classified as waste.

- Sludge: Characterize sludge for hazardous constituents (e.g., TCLP testing). Dispose at a licensed treatment, storage, and disposal facility (TSDF) if hazardous.

- Water Effluent: Test water for oil and grease content. Discharge only if compliant with local pretreatment or NPDES permit standards.

Environmental Permits and Reporting

- Air Permits: Obtain air quality permits if volatile organic compounds (VOCs) are emitted during centrifugation.

- Waste Handling Permits: Facilities processing over 55 gallons of waste oil per month may require state-specific used oil generator registration.

- Annual Reporting: Submit required reports to environmental agencies (e.g., biennial hazardous waste report if applicable).

Emergency Preparedness and Spill Response

- Spill Prevention Plan: Integrate centrifuge operations into facility SPCC or SWPPP plans.

- Response Equipment: Maintain absorbents, booms, and PPE near processing and storage areas.

- Reporting Obligations: Report spills exceeding reportable quantities (e.g., 25 gallons to navigable waters) to local and federal authorities per CERCLA and Clean Water Act.

Recordkeeping and Documentation

Retain for a minimum of three years:

– Waste oil manifests

– Laboratory test results (incoming and outgoing oil, sludge)

– Maintenance records for the centrifuge

– Training logs

– Inspection reports and spill response documentation

International Considerations

For cross-border operations, comply with:

– Basel Convention (for transboundary movement of hazardous waste)

– ADR (Europe) or TDG (Canada) transport regulations

– Country-specific waste classification and import/export permits

Conclusion

Proper logistics and compliance management for waste oil centrifuges reduce environmental risk and legal liability. Regular audits, employee training, and proactive engagement with regulatory agencies are essential for sustained compliance. Consult environmental counsel or a certified waste management consultant to ensure full adherence to all applicable laws.

Conclusion: Sourcing a Waste Oil Centrifuge

In conclusion, sourcing a waste oil centrifuge is a strategic investment that offers significant economic, environmental, and operational benefits. By effectively removing contaminants such as water, solids, and sludge from used oils, centrifuges enhance oil quality, extend lubricant life, and reduce disposal costs. When selecting a centrifuge, key factors such as processing capacity, separation efficiency, ease of maintenance, energy consumption, and compatibility with specific oil types must be carefully evaluated. Additionally, choosing a reliable supplier with technical support and proven experience in waste oil reconditioning ensures long-term performance and return on investment.

Ultimately, integrating a properly sourced waste oil centrifuge into a maintenance or recycling system supports sustainability goals, reduces environmental impact, and contributes to a more efficient and cost-effective operation. As regulatory pressures and waste management costs continue to rise, the adoption of advanced separation technology like centrifugation becomes not just advantageous—but essential—for industries aiming to optimize resource use and uphold environmental responsibility.