The global laminated wood products market has experienced steady expansion, driven by rising demand for sustainable and durable building materials in residential and commercial construction. According to Grand View Research, the global engineered wood market—encompassing laminated products—was valued at USD 29.7 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 7.1% from 2023 to 2030. This growth is fueled by advancements in adhesive technology, increasing adoption of modular construction methods, and a growing emphasis on eco-friendly materials. Wall laminated products, in particular, are gaining traction due to their structural efficiency, design flexibility, and thermal performance. As demand surges across North America, Europe, and the Asia-Pacific region, a select group of manufacturers has emerged as leaders in innovation, quality, and scale. Based on market presence, production capacity, and technological advancement, the following nine companies represent the forefront of the wall laminated manufacturing industry.

Top 9 Wall Laminated Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Mohawk Industries, Inc.

Domain Est. 1996

Website: mohawkind.com

Key Highlights: Sales of ceramic and porcelain floor, wall and exterior tile products, stone surfaces, quartz countertops and porcelain panels in all worldwide markets….

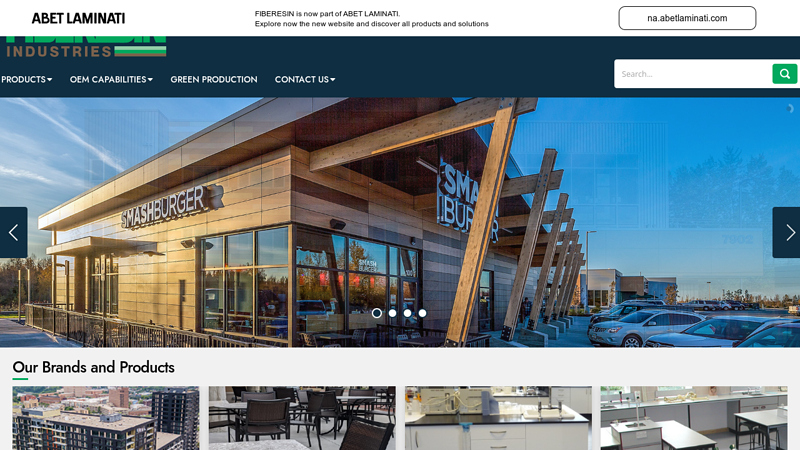

#2 Fiberesin

Domain Est. 1998

Website: fiberesin.com

Key Highlights: Fiberesin is an American manufacturer of decorative construction materials and furniture components from phenolic and laminate panels….

#3 Manilam Laminates

Domain Est. 2018

Website: manilam.com

Key Highlights: Leading Manufacturers of Decorative Laminates. Manilam Industries started its journey back in 2018. An aspirational endeavour that has grown into a thriving ……

#4 Belador Laminates

Domain Est. 2022

Website: beladorlaminate.com

Key Highlights: Belador is a premium manufacturer of laminates and offers a pool of choices for you! With over a decade of expertise and expertise in the laminate industry, ……

#5 Armstrong World Industries

Domain Est. 1995

Website: armstrong.com

Key Highlights: Armstrong World Industries is a leader in the design, innovation and manufacture of ceiling and wall system solutions, transforming how people design, ……

#6 Formica® Brand Laminate

Domain Est. 1997

Website: formica.com

Key Highlights: Crafted for countertops, cabinets, worktops, wall panels and more. Discover Formica ® Laminate for interior spaces. Founded on quality, service and innovative ……

#7 Pionite

Domain Est. 1997

Website: panolam.com

Key Highlights: Our Pionite brand of high pressure laminates caters to traditional tastes with an eye towards versatility. With a broad range of tasteful and timeless designs….

#8 Genesis Products

Domain Est. 2002

Website: genesisproductsinc.com

Key Highlights: Genesis Products optimizes design, performance and value by integrating high-performance laminate materials to create smarter solutions for every space….

#9 Fundermax: Phenolic & High

Domain Est. 2011

Website: fundermax.us

Key Highlights: Fundermax’s phenolic panels are perfect for exterior, interior and lab surfaces. Create powerful and durable designs with our high pressure laminate panels….

Expert Sourcing Insights for Wall Laminated

H2: 2026 Market Trends for Wall Laminated

The global wall laminated market is poised for significant evolution by 2026, driven by shifting consumer preferences, technological advancements, and sustainability imperatives. As architectural and interior design trends increasingly favor durable, low-maintenance, and aesthetically versatile materials, wall laminates are emerging as a preferred solution across residential, commercial, and institutional sectors. This analysis explores key market trends expected to shape the wall laminated industry in 2026 under the H2 (second half) outlook.

1. Surge in Demand for Sustainable and Eco-Friendly Materials

By 2026, environmental sustainability will be a cornerstone of material selection in construction and design. Wall laminates made from recycled content, low-VOC (volatile organic compound) resins, and FSC-certified wood-based substrates are gaining traction. Manufacturers are responding with greener production processes and transparent supply chains to meet regulatory standards and consumer demand for eco-conscious products. Biodegradable and recyclable laminate options are expected to enter mainstream markets, particularly in Europe and North America.

2. Expansion of Digital and 3D Printing Technologies

Advancements in digital printing and 3D lamination technologies are enabling highly customized wall surfaces with intricate textures, realistic wood grains, marble finishes, and even abstract artistic patterns. By H2 2026, these innovations will allow for mass customization at competitive prices, appealing to both high-end residential projects and boutique commercial spaces. The integration of augmented reality (AR) tools in retail will further empower customers to visualize laminate finishes in real-time, accelerating purchase decisions.

3. Growth in Commercial and Healthcare Applications

The commercial sector—including offices, retail spaces, and hospitality—will continue to adopt laminated walls for their durability, hygiene, and aesthetic flexibility. In healthcare facilities, antibacterial and antimicrobial laminates are becoming standard due to their ease of cleaning and resistance to pathogens. With heightened awareness of indoor air quality and infection control post-pandemic, demand for hygienic wall laminates is projected to grow steadily through 2026.

4. Regional Market Diversification

While North America and Europe remain mature markets with steady growth, the Asia-Pacific region—especially India, China, and Southeast Asia—is expected to lead market expansion in H2 2026. Rapid urbanization, rising disposable incomes, and a booming construction industry are fueling demand for cost-effective and stylish interior solutions. Local manufacturing and distribution networks are being strengthened to cater to regional preferences, such as tropical wood finishes or minimalist designs.

5. Integration with Smart Building Systems

Emerging trends point toward the integration of laminated walls with smart building technologies. By 2026, some manufacturers are experimenting with laminates embedded with sensors or conductive layers that can support touch interfaces, lighting elements, or climate-responsive surfaces. Though still in early adoption, these smart laminates represent a high-potential niche segment, particularly in tech-forward commercial developments.

6. Competitive Pricing and Supply Chain Optimization

Ongoing improvements in manufacturing efficiency, including automation and energy-saving curing processes, are helping reduce production costs. This enables more competitive pricing, making wall laminates accessible in price-sensitive markets. Additionally, companies are investing in regionalized supply chains to mitigate global disruptions, ensuring timely delivery and inventory stability heading into H2 2026.

Conclusion

By the second half of 2026, the wall laminated market will be characterized by innovation, sustainability, and diversification. As consumers and businesses alike prioritize aesthetics, functionality, and environmental responsibility, wall laminates are well-positioned to capture a larger share of the global interior surfaces market. Companies that invest in R&D, digital customization, and sustainable practices are likely to lead the industry into its next growth phase.

Common Pitfalls When Sourcing Wall Laminated Products (Quality and Intellectual Property)

Sourcing wall laminated products—such as decorative panels, acoustic wall coverings, or laminated architectural finishes—requires careful attention to both material quality and intellectual property (IP) compliance. Overlooking these areas can lead to product failures, legal disputes, reputational damage, and financial losses. Below are common pitfalls to avoid:

Quality-Related Pitfalls

1. Inconsistent Material Thickness and Adhesion

One of the most frequent quality issues is inconsistent lamination thickness or poor adhesive bonding between layers. This can lead to delamination, bubbling, or warping over time, especially in environments with fluctuating humidity or temperature. Always require sample testing and insist on third-party certification for adhesion strength and dimensional stability.

2. Substandard Core or Backing Materials

Suppliers may use low-grade substrates (e.g., particleboard instead of MDF or subpar acoustic foam) to cut costs. These materials may compromise durability, fire resistance, or sound performance. Verify material specifications and request full composition reports before finalizing orders.

3. Poor Color and Pattern Matching

Wall laminates often need to match across multiple panels or batches. Inconsistent printing, color fading, or texture variation can ruin aesthetic continuity. Request batch samples and ensure the supplier guarantees color consistency (ΔE values) across production runs.

4. Inadequate Testing for Environmental Resistance

Laminates used in commercial or high-traffic areas must resist scratches, stains, UV exposure, and moisture. Failing to validate performance through standardized tests (e.g., ISO 4586 for decorative laminates) can result in premature degradation. Ensure products meet relevant industry standards for the intended application.

5. Lack of Traceability and Certification

Without proper documentation (e.g., fire safety certifications, VOC emissions reports, or sustainability credentials), you risk non-compliance with building codes or green building standards (e.g., LEED, BREEAM). Demand full compliance documentation and audit supplier production facilities if possible.

Intellectual Property-Related Pitfalls

1. Unauthorized Use of Protected Designs or Patterns

Many laminated finishes feature proprietary designs, textures, or digital prints protected by copyright or design patents. Sourcing from suppliers who replicate branded or patented patterns without licensing can expose your company to infringement claims. Always verify the supplier’s right to use and distribute the design.

2. Copycat Products Misrepresented as Originals

Some suppliers market counterfeit or knock-off versions of well-known laminate lines (e.g., mimicking brands like Formica, Wilsonart, or Arpa). These may be labeled ambiguously or use similar names. Conduct due diligence: request proof of brand authorization and compare technical data with original manufacturers.

3. Unclear IP Ownership in Custom Designs

When commissioning custom laminated finishes, ambiguous contracts may leave IP ownership unclear. Suppliers might claim rights to the design or reuse it for other clients. Ensure contracts explicitly transfer all IP rights to your company and include confidentiality and non-disclosure clauses.

4. Hidden Licensing Fees or Royalties

Some designs require ongoing royalty payments to the IP holder. If the supplier fails to disclose this, you could face unexpected costs or cease-and-desist orders later. Confirm whether the product involves licensed designs and who is responsible for associated fees.

5. Inadequate Due Diligence on Supplier Legitimacy

Working with unverified or offshore suppliers increases the risk of IP violations. Verify the supplier’s business credentials, past clients, and compliance history. Consider using IP screening tools or legal counsel to assess potential risks before large-scale orders.

Conclusion

To mitigate risks in sourcing wall laminated products, prioritize suppliers with transparent quality controls, verifiable certifications, and clear IP rights documentation. Conduct thorough audits, insist on contractual protections, and test samples rigorously. Proactive diligence ensures both product performance and legal compliance in your supply chain.

Logistics & Compliance Guide for Wall Laminated Products

This guide outlines the essential logistics and compliance considerations for the safe, efficient, and legally compliant handling, transportation, and storage of wall laminated materials such as high-pressure laminates (HPL), decorative laminates, and laminated wall panels.

Product Handling & Packaging

Wall laminated products require careful handling to prevent surface damage, chipping, or delamination. Always use clean gloves to avoid fingerprints and contamination. Lift sheets or panels with two people or appropriate mechanical aids to avoid bending or stress fractures. Store materials horizontally on flat, level, clean surfaces, supported across the entire length to prevent warping. Use edge protectors and interleave sheets with protective paper or film. Packages must be sealed, labeled clearly, and secured against moisture, dirt, and physical impact during transit.

Transportation Requirements

Ship wall laminates in enclosed, dry vehicles to protect against weather and environmental exposure. Secure loads with straps or braces to prevent shifting, sliding, or vibration damage. Avoid stacking heavy items on top of laminate packages. Maintain stable temperature and humidity conditions during transport to prevent warping or adhesive issues—ideally between 10°C and 30°C (50°F–86°F) with relative humidity under 70%. Provide adequate ventilation if condensation is a risk, especially during temperature fluctuations.

Storage Conditions

Store wall laminates in a clean, dry, indoor environment away from direct sunlight, heat sources, and moisture. Maintain consistent storage conditions: temperatures between 15°C and 25°C (59°F–77°F) and humidity levels between 45% and 60%. Stack materials flat on wooden pallets or racks with sufficient support. Limit stack height according to manufacturer specifications—typically no more than 1.5 meters (5 feet)—to avoid bottom sheet deformation. Rotate stock using a first-in, first-out (FIFO) system to minimize aging effects.

Regulatory Compliance

Ensure all wall laminated products meet relevant regional and international safety and environmental standards. In the U.S., verify compliance with EPA TSCA Title VI for formaldehyde emissions. In the EU, adhere to REACH and Construction Products Regulation (CPR) requirements, including CE marking where applicable. Fire safety ratings must align with local building codes—common standards include ASTM E84 (U.S.) or EN 13501-1 (EU). Maintain up-to-date documentation such as Safety Data Sheets (SDS), test reports, and certificates of conformity.

Import/Export Documentation

For cross-border shipments, prepare complete documentation including commercial invoices, packing lists, bill of lading/air waybill, and certificates of origin. Declare the correct HS (Harmonized System) code—typically 3920.43 or 4412.31 for laminated panels. Verify compliance with destination country regulations on material composition, labeling, and environmental standards. Some regions may require phytosanitary certificates for wooden packaging (ISPM 15 compliance). Engage licensed customs brokers to ensure accurate tariff classification and duty assessment.

Sustainability & Environmental Responsibility

Prioritize suppliers certified under recognized environmental management systems (e.g., ISO 14001). Confirm that laminates use sustainably sourced substrates (e.g., FSC or PEFC-certified wood) and low-emission adhesives. Recycle packaging materials such as cardboard, plastic film, and wooden pallets. Follow local regulations for disposal of damaged or excess laminates, especially those containing resins or formaldehyde-based binders. Document environmental performance metrics to support corporate sustainability reporting.

Conclusion for Sourcing Wall Laminated:

Sourcing wall laminated materials requires a strategic approach that balances quality, cost, durability, and design to meet specific project requirements. Through careful evaluation of suppliers, material specifications, and performance criteria such as moisture resistance, wear tolerance, and aesthetic versatility, it is evident that high-pressure laminates (HPL) and compact laminates offer reliable and cost-effective solutions for wall applications in both residential and commercial settings.

Key considerations in the sourcing process include certification standards (e.g., GREENGUARD, FSC), lead times, customization options, and environmental sustainability. Partnering with reputable manufacturers and suppliers ensures consistent product quality and compliance with industry regulations. Additionally, advancements in digital printing and textured finishes have expanded design possibilities, making laminated walls an increasingly popular choice for modern interiors.

In conclusion, successful sourcing of wall laminated products hinges on thorough market research, clear communication with suppliers, and alignment with project goals—ensuring durability, visual appeal, and long-term value. By prioritizing these factors, stakeholders can achieve efficient, sustainable, and aesthetically pleasing wall solutions across diverse applications.