The global automatic wall panel manufacturing market is experiencing robust growth, driven by rising demand for energy-efficient building solutions and advancements in smart construction technologies. According to a 2023 report by Mordor Intelligence, the global prefabricated wall panel market was valued at USD 115.6 billion in 2022 and is projected to grow at a CAGR of 5.8% from 2023 to 2028, reaching an estimated USD 162.4 billion by 2028. This expansion is fueled by increasing urbanization, shorter construction timelines, and government initiatives promoting modular construction across North America, Europe, and the Asia Pacific. Additionally, Grand View Research highlights a growing shift toward sustainable building materials, further pushing manufacturers to innovate in automation and precision engineering. In this competitive landscape, leading automatic wall panel manufacturers are leveraging advanced production technologies and scalable solutions to meet evolving industry demands—making it essential to identify the top players shaping the future of modern construction.

Top 10 Wall Automatic Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 GWM Group

Domain Est. 2008

Website: gwm-global.com

Key Highlights: ABOUT GWM. ABOUT GWM · COMPLIANCE · SOCIAL RESPONSIBILITY · INNOVATION. Hi4 · Hi4-T Tank Platform · Coffee AI · Future Technology · NEWS · INVESTOR RELATIONS ……

#2 Wall Panel Technology, Part VII

Domain Est. 2008

Website: componentadvertiser.com

Key Highlights: This Toll-developed infeed system replaced the standard overhead conveyor and dedicated the operator to delivering the next round of top and bottom plates and ……

#3 Page

Domain Est. 2024

Website: gwmuae.com

Key Highlights: Featuring as a global intelligent technology company, GWM covers the entire automotive value chain — from design and R&D to production, sales, and service. It ……

#4 Discover the Wall, RoboJob’s CNC automation solution

Website: robojob.eu

Key Highlights: The Wall: a revolution in manufacturing. Centralized automation for every factory. Meet the Wall, RoboJob’s visionary solution for the Factory of the Future….

#5 WALL AUTO LIVERY

Domain Est. 1995

Website: conoco.com

Key Highlights: WALL AUTO LIVERY, 311 South Blvd, Wall, SD, 57790, 1 (605) 279-2325, Get Directions, Amenities: Diesel, ATM, Conv. Store, Esri Community Maps….

#6 All

Domain Est. 1997

Website: all-wall.com

Key Highlights: From automatic taping tools and texture sprayers to specialty hand tools, All-Wall delivers the right tools with expert support. Our unmatched service ……

#7 Automatic wall catch

Domain Est. 1997

Website: agb.it

Key Highlights: It holds the sash wide open, securing it to the wall. Particularly suitable for doors. However, since the striker is small, it can also be applied to the ……

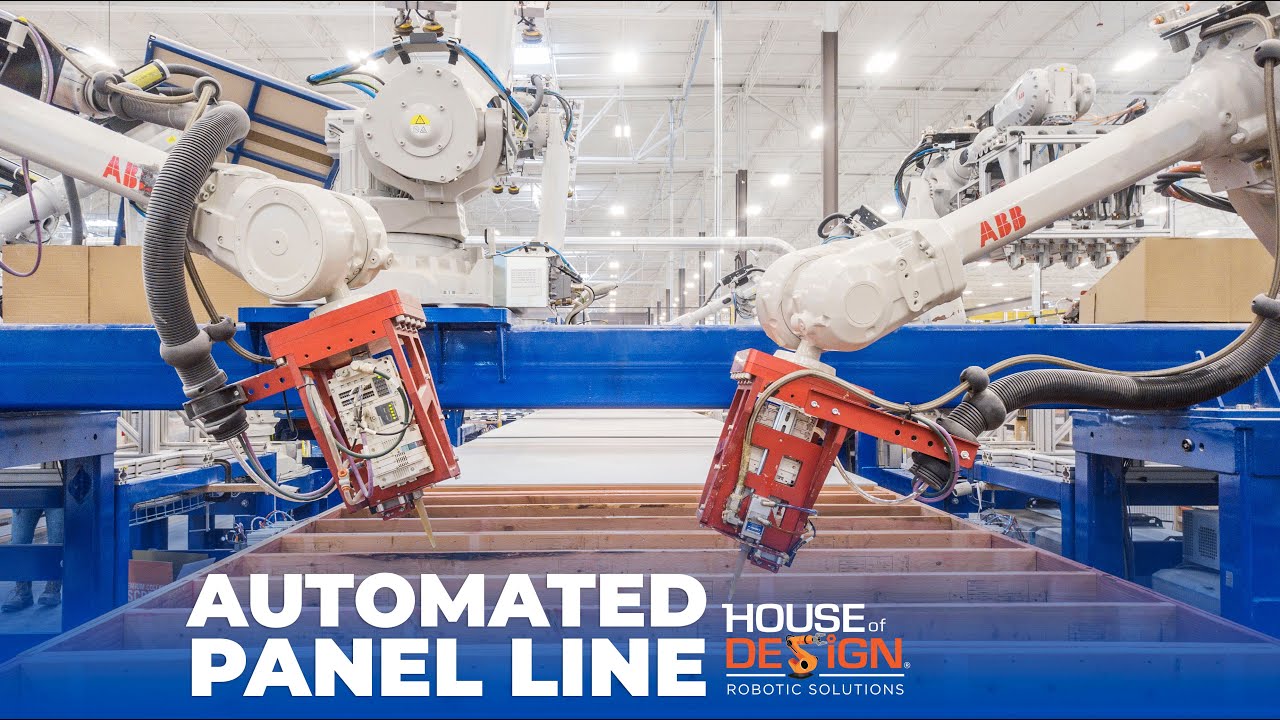

#8 House Production Technologies

Domain Est. 2004

Website: randek.com

Key Highlights: AutoWall enables leading-edge automated manufacturing of wall elements, with great precision and high quality. Accelerated project schedules….

#9 TRUBLUE Auto Belay

Domain Est. 2019

Website: trublueclimbing.com

Key Highlights: Perfect for everyday climbing on most walls · Compatible with TRUBLUE iQ, TRUBLUE iQ+ and TRUBLUE Speed · Mounting heights between 4.5m (14.8ft) – 12.5m (41ft)….

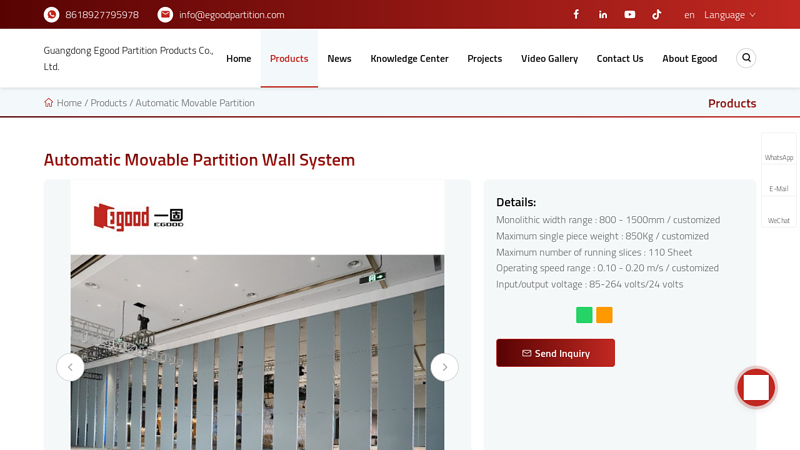

#10 Automatic Movable Partition Wall System

Domain Est. 2019

Website: egmovablewall.com

Key Highlights: Automatic Movable Partition Wall System ; Operating speed range. 0.10 – 0.20 m/s / customized ; Input/output voltage. 85-264 volts/24 volts ; Soundproof treament….

Expert Sourcing Insights for Wall Automatic

H2 2026 Market Trends for Wall Automation

The wall automation market in H2 2026 is poised for significant growth and transformation, driven by converging technological advancements, evolving consumer demands, and broader macroeconomic shifts. Key trends shaping the industry include:

1. AI-Driven Intelligence & Predictive Maintenance

By H2 2026, artificial intelligence will be deeply embedded in wall automation systems. AI-powered controllers will analyze real-time data from embedded sensors to predict component failures before they occur (predictive maintenance), reducing downtime and maintenance costs. Systems will also learn user behavior patterns to autonomously adjust operations—optimizing wall panel alignment, tension, and movement for efficiency and user comfort.

2. Integration with Smart Building Ecosystems

Wall automation will increasingly function as a core component of integrated smart building platforms. Seamless interoperability with HVAC, lighting, security, and energy management systems via unified IoT protocols (e.g., Matter, BACnet) will enable holistic environmental control. For example, automated walls will respond dynamically to occupancy sensors or daylight levels, contributing to energy savings and LEED certification goals.

3. Sustainability and Energy Efficiency Focus

Sustainability will be a major purchasing driver. Manufacturers will emphasize low-power actuators, recyclable materials, and energy-recovery mechanisms. Demand will grow for solar-integrated or kinetic-energy-harvesting wall systems, especially in commercial and high-end residential projects. Regulatory pressure and ESG commitments will accelerate adoption in corporate real estate.

4. Modular and Reconfigurable Design Demand

The rise of hybrid workspaces and flexible interior design will fuel demand for modular wall automation systems. H2 2026 will see increased deployment of reconfigurable acoustic and partition walls in offices, co-working spaces, and multifunctional venues. These systems will offer rapid, quiet reconfiguration to adapt spaces on demand, enhancing space utilization and user experience.

5. Enhanced Cybersecurity and Data Privacy

As wall automation systems become more connected, cybersecurity will be a top concern. By H2 2026, industry standards will require end-to-end encryption, secure over-the-air (OTA) updates, and robust authentication protocols. Manufacturers will prioritize certified security frameworks to protect against unauthorized access and ensure compliance with global data privacy regulations.

6. Expansion in Residential and Luxury Segments

While commercial applications remain dominant, the residential market—particularly luxury homes and smart apartments—will experience accelerated adoption. Homeowners will invest in automated feature walls, sliding partitions, and kinetic art installations, driven by lifestyle aspirations and the influence of high-profile smart home showcases.

Conclusion

H2 2026 represents a pivotal phase for wall automation, transitioning from standalone mechanical systems to intelligent, connected, and sustainable components of the built environment. Companies that innovate in AI integration, interoperability, and eco-design will lead the market, while robust cybersecurity and user-centric flexibility will be essential for competitive differentiation.

Common Pitfalls Sourcing Wall Automatic (Quality, IP)

Sourcing Wall Automatic devices—automated systems or tools named “Wall Automatic” or similar—can present several critical challenges, particularly regarding quality assurance and intellectual property (IP) rights. Overlooking these pitfalls can lead to operational failures, legal disputes, and financial losses. Below are key issues to watch for:

Poor Quality Control and Inconsistent Manufacturing

One of the most frequent issues when sourcing Wall Automatic systems is inconsistent product quality. Suppliers, particularly from regions with lax manufacturing oversight, may deliver units that vary significantly in performance, durability, and safety. Components such as actuators, sensors, or control modules may fail prematurely, leading to system downtime or safety hazards. Without rigorous third-party inspections and clear quality benchmarks in contracts, buyers risk receiving substandard equipment.

Lack of Transparency in Component Sourcing

Wall Automatic devices often integrate multiple subsystems (e.g., motors, electronics, software). Suppliers may use low-cost, unverified components to cut costs, which can compromise reliability and safety. Hidden use of counterfeit or obsolete parts increases the risk of malfunctions and voids warranties. Buyers should demand full bill of materials (BOM) disclosure and conduct audits to verify component authenticity and traceability.

Intellectual Property Infringement Risks

Sourcing from suppliers with weak IP compliance can expose buyers to legal liability. Some manufacturers may replicate patented mechanisms, software algorithms, or design elements without authorization. If the Wall Automatic system incorporates infringing technology, the end-user could face cease-and-desist orders, customs seizures, or litigation—even if unaware of the violation. Always require IP warranties and conduct due diligence on design origins.

Inadequate or Missing Documentation

Proper technical documentation—such as schematics, firmware versions, user manuals, and compliance certifications—is often incomplete or absent when sourcing automated systems. This lack of documentation complicates installation, maintenance, and troubleshooting. It also raises red flags about regulatory compliance (e.g., CE, UL, or RoHS), especially for safety-critical wall-mounted automation.

Software and Firmware Vulnerabilities

Many Wall Automatic systems rely on proprietary software or embedded firmware. Sourcing from unverified vendors may introduce cybersecurity risks, such as backdoors, unpatched vulnerabilities, or lack of update support. Additionally, unclear licensing terms can restrict modification or integration, limiting long-term usability and scalability.

Unclear Ownership of Customizations

When commissioning custom features or integrations for a Wall Automatic system, buyers may assume they own the resulting IP. However, contracts often default to the supplier retaining rights unless explicitly negotiated. This can prevent future modifications, repairs, or resale, creating dependency on the original vendor.

Non-Compliance with Regional Standards

Automated wall systems may need to meet specific electrical, mechanical, or safety codes depending on the deployment region. Suppliers might provide products certified only for their local markets, leading to compliance failures during installation or inspection. Always confirm that certifications are valid for the target country and backed by accredited testing bodies.

Conclusion

To mitigate these risks, conduct thorough supplier vetting, require detailed contractual protections, and engage independent testing and legal review before finalizing procurement. Prioritizing quality and IP integrity ensures reliable, legally sound deployment of Wall Automatic systems.

Logistics & Compliance Guide for Wall Automatic

This guide outlines the essential logistics and compliance procedures for Wall Automatic, ensuring efficient operations and adherence to regulatory standards across all supply chain activities.

Shipping and Distribution

Wall Automatic manages inbound and outbound logistics through a network of approved freight carriers and distribution centers. All shipments must be scheduled in advance using the company’s logistics management system (LMS). Standard lead times for domestic deliveries are 3–5 business days; international shipments may require 7–14 days depending on destination and customs clearance. Temperature-sensitive or hazardous materials require pre-approval and must be labeled and packaged according to IATA, IMDG, or DOT regulations as applicable.

Packaging Requirements

All products must be packaged to prevent damage during transit. Wall Automatic follows ISTA 3A packaging standards for standard shipments. Each package must display a scannable barcode, product SKU, batch number, and handling instructions (e.g., “Fragile,” “Do Not Stack”). Reusable packaging is encouraged where feasible to support sustainability goals. Custom packaging for international markets must comply with local import regulations, including language-specific labeling.

Import and Export Compliance

Wall Automatic adheres to all international trade regulations, including EAR, ITAR (where applicable), and country-specific export control laws. Employees involved in export activities must complete biennial export compliance training. All export shipments require an Electronic Export Information (EEI) filing through the AES if the value exceeds $2,500 or a license is required. Restricted party screening must be conducted prior to every shipment using approved screening tools.

Regulatory Documentation

Complete and accurate documentation is mandatory for every shipment. Required documents include commercial invoices, packing lists, certificates of origin, and Material Safety Data Sheets (MSDS) for regulated goods. For EU-bound shipments, CE marking and Declaration of Conformity (DoC) must accompany products. Records must be retained for a minimum of five years in accordance with 19 CFR Part 163.

Carrier and 3PL Management

Wall Automatic partners with certified carriers and third-party logistics (3PL) providers who comply with ISO 28000 (Security Management Systems for the Supply Chain). All logistics partners must undergo annual compliance audits and provide proof of insurance and cybersecurity protections. Performance metrics, including on-time delivery rate and damage claims, are reviewed quarterly.

Environmental and Safety Compliance

All logistics operations must comply with OSHA, EPA, and local environmental regulations. Spill prevention and response plans are in place for facilities handling hazardous materials. Wall Automatic is committed to reducing carbon emissions through route optimization, fuel-efficient vehicles, and participation in the SmartWay Transport Partnership where available.

Audit and Continuous Improvement

Internal logistics audits are conducted semi-annually to ensure compliance with this guide. Findings are reported to the Compliance Committee, and corrective actions are tracked to resolution. Feedback from customers and logistics partners is used to refine procedures and enhance supply chain resilience.

Conclusion for Sourcing Wall Mount Automation:

Sourcing a wall mount automation system involves careful evaluation of technical specifications, compatibility with existing infrastructure, ease of installation, and long-term maintenance requirements. Whether intended for smart homes, commercial buildings, or industrial environments, automated wall-mounted solutions offer enhanced efficiency, space optimization, and improved user experience. Key considerations such as product reliability, vendor reputation, energy efficiency, and scalability must be prioritized to ensure a successful implementation. Additionally, integrating systems with IoT capabilities and remote control functionality can significantly increase operational flexibility. Ultimately, a well-sourced wall automation solution not only meets current operational needs but also supports future technological advancements, providing a cost-effective and future-ready investment.