The global RF amplifier market, particularly within the VHF (Very High Frequency) and UHF (Ultra High Frequency) spectrum, is experiencing robust growth driven by rising demand for wireless communication, public safety networks, broadcasting, and defense applications. According to a 2023 report by Mordor Intelligence, the RF amplifier market was valued at USD 12.5 billion in 2022 and is projected to grow at a CAGR of over 7.8% from 2023 to 2028. A key contributor to this expansion is the increasing deployment of VHF/UHF systems in critical communications, including air traffic control, military radios, and land mobile radio (LMR) networks. Additionally, Grand View Research highlights the surge in investments in defense electronics and 5G infrastructure as pivotal drivers, with the military segment alone expected to maintain strong demand for high-efficiency, wideband RF amplifiers. As the need for reliable signal amplification across diverse operating environments grows, manufacturers specializing in VHF/UHF amplifiers are at the forefront of innovation and performance. In this landscape, the following nine companies have emerged as leading suppliers, recognized for their technical expertise, product range, and global market presence.

Top 9 Vhf Uhf Amplifier Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 to Yaesu

Domain Est. 1995

Website: yaesu.com

Key Highlights: Home · About; Products. HF Transceivers/Amplifiers · VHF/UHF Handhelds · VHF/UHF Mobile Transceivers · Repeaters · Microphones · Rotators ……

#2 VHF/UHF Amplifiers

Domain Est. 1996

#3 VHF/UHF Amplifiers

Domain Est. 1996

Website: downeastmicrowave.com

Key Highlights: Down East Microwave is currently offering low level power amplifier/receive amplifier combination unit. Please take a look at our products below….

#4 High Power RF Amplifier

Domain Est. 1999

Website: empowerrf.com

Key Highlights: We provide best in class RF and Microwave amplifiers that go beyond 200V/m CW and 600V/m pulsed for todays demanding Radiated Susceptibility testing ……

#5 UPA

Domain Est. 2014

Website: gdmissionsystems.com

Key Highlights: The UPA-55 Amplifier provides extra power to the URC-200 or URC-200 (V2) Line-of-Sight (LOS) Radio to meet specific mission needs….

#6 Qorvo: Innovative RF and Power Solutions

Domain Est. 2014

Website: qorvo.com

Key Highlights: Qorvo’s advanced RF and power solutions solve complex technical challenges for global customers….

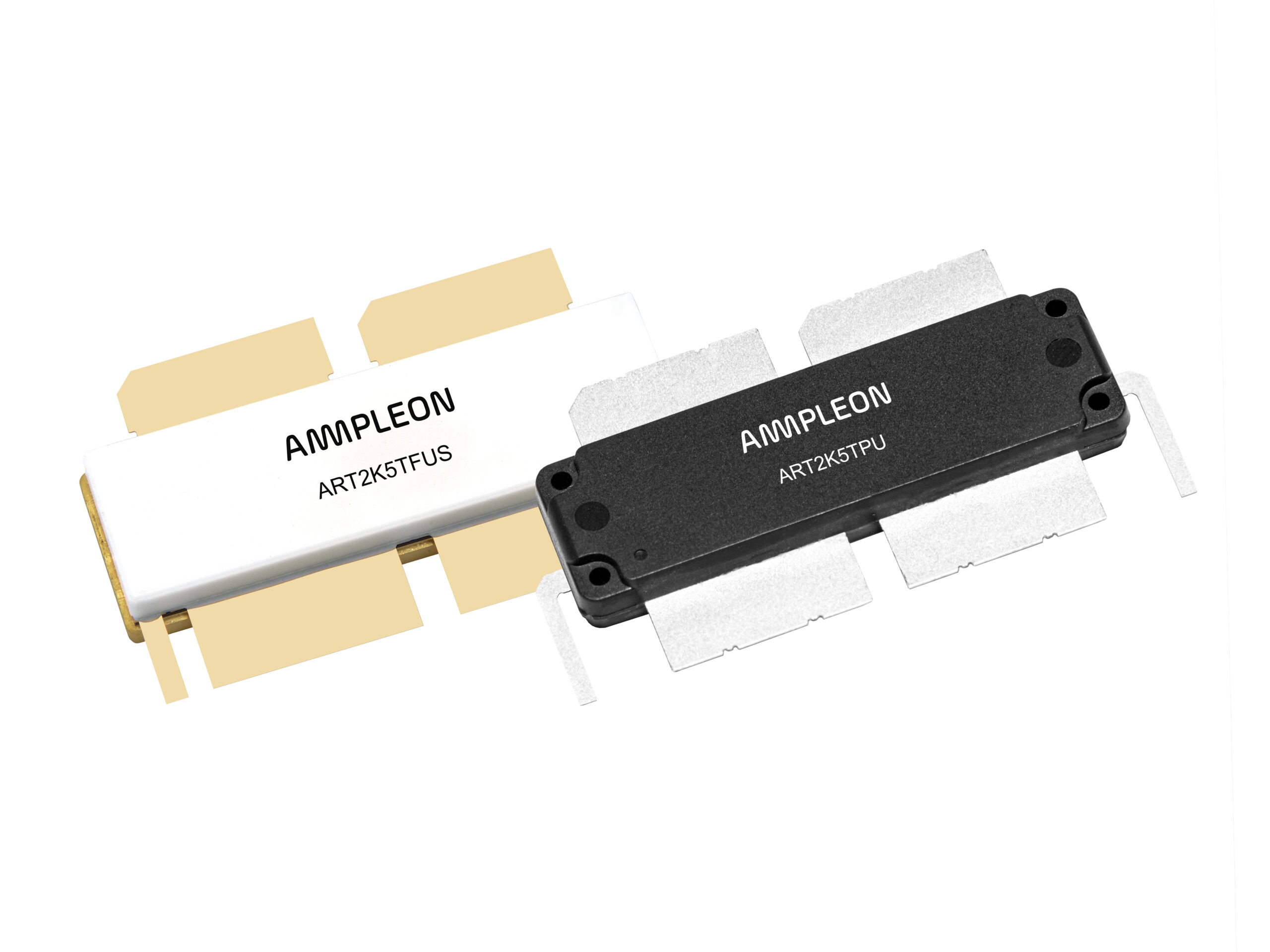

#7 Ampleon

Domain Est. 2015

Website: ampleon.com

Key Highlights: Ampleon is the world’s main supplier of broadcasting transistors designed for 50 V and 65 V nominal operation over the entire FM, VHF and UHF frequency bands….

#8 VHF/UHF Compact Power Amplifier (CPA)

Domain Est. 2019

Website: crescendrf.com

Key Highlights: The CPA is a small, lightweight (3lbs.) single channel amplifier that extends the communication range for legacy and next generation waveforms….

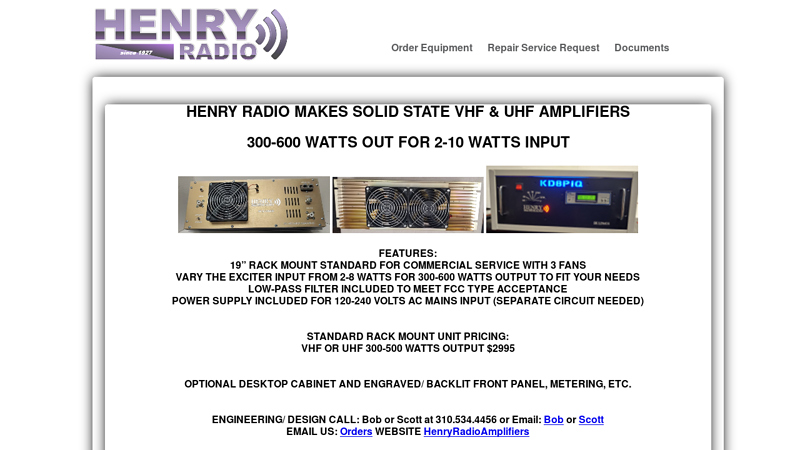

#9 Henry Radio

Domain Est. 2022

Website: henryradioamplifiers.com

Key Highlights: Henry Radio makes a range of RF Amplifiers, VHF Amplifiers, UHF Amplifiers, Ham Radio Amplifiers. Our amps are used in mobile, repeater, wide area paging, ……

Expert Sourcing Insights for Vhf Uhf Amplifier

2026 Market Trends for VHF/UHF Amplifiers

The VHF (Very High Frequency) and UHF (Ultra High Frequency) amplifier market is poised for significant evolution by 2026, driven by technological advancements, expanding applications, and shifting global communication demands. Here’s an analysis of key trends expected to shape the sector:

Growing Demand from Public Safety and Emergency Services

By 2026, public safety agencies worldwide will continue upgrading legacy communication systems to modern, interoperable networks—such as P25 Phase 2 and TETRA—requiring high-reliability VHF/UHF amplifiers. The need for resilient, wide-area coverage during emergencies will drive demand for ruggedized, high-power amplifiers capable of operating in remote or disaster-prone areas.

Expansion of Land Mobile Radio (LMR) Modernization

Industrial, transportation, and utility sectors are investing in LMR modernization to enhance operational efficiency. This shift includes replacing analog systems with digital platforms, increasing the need for amplifiers with improved linearity, efficiency, and spectral cleanliness—especially in UHF bands used for trunked radio systems.

Integration with Broadband and Hybrid Networks

Hybrid communication systems combining traditional LMR with LTE/5G broadband are gaining traction. VHF/UHF amplifiers will play a key role in ensuring seamless voice and data interoperability. By 2026, demand will grow for amplifiers that support multi-band or broadband functionality, enabling coexistence with emerging broadband public safety networks.

Advancements in Semiconductor Technology

The adoption of GaN (Gallium Nitride) and GaAs (Gallium Arsenide) semiconductors will accelerate, replacing older LDMOS-based amplifiers. GaN offers higher power density, better thermal performance, and improved efficiency—critical for compact, energy-efficient amplifiers in mobile and portable applications. This technological shift will enable smaller form factors and lower operating costs.

Focus on Energy Efficiency and Sustainability

With increasing emphasis on sustainability, amplifier manufacturers will prioritize energy-efficient designs. Regulators and end-users alike will favor amplifiers with high efficiency ratings, reducing power consumption and heat generation—especially important for remote base stations powered by solar or backup systems.

Rising Adoption in Defense and Aerospace

Military modernization programs will boost demand for secure, jam-resistant VHF/UHF communication systems. Tactical radios, drones, and battlefield networks will require lightweight, high-performance amplifiers capable of operating in contested electromagnetic environments. Secure, frequency-agile amplifiers will be in high demand.

Growth in Commercial and Industrial IoT Applications

Beyond traditional sectors, VHF/UHF amplifiers will see increased use in industrial IoT (IIoT), smart utilities, and precision agriculture. These applications rely on long-range, low-power communication protocols (e.g., LoRa, Sigfox in sub-GHz bands), creating opportunities for low-power, wide-area network (LPWAN) amplifiers tailored for UHF frequencies.

Supply Chain Resilience and Regional Manufacturing

Geopolitical tensions and supply chain disruptions will push companies to diversify manufacturing and sourcing. By 2026, regional production hubs in North America, Europe, and Asia will expand, with a focus on securing critical components like RF semiconductors and reducing reliance on single-source suppliers.

Regulatory and Spectrum Harmonization Efforts

Ongoing global efforts to harmonize spectrum allocation for public safety and critical infrastructure will impact amplifier design. Manufacturers will need to ensure compliance with evolving standards (e.g., FCC, ETSI), supporting multiple frequency bands and modulation schemes to serve international markets.

Conclusion

By 2026, the VHF/UHF amplifier market will be characterized by innovation in materials, integration with hybrid networks, and expanding applications across public safety, defense, and industrial sectors. Success will depend on agility in responding to regulatory changes, supply chain dynamics, and the growing demand for efficient, reliable, and future-ready RF amplification solutions.

Common Pitfalls When Sourcing VHF/UHF Amplifiers (Quality and Intellectual Property)

Sourcing VHF (Very High Frequency) and UHF (Ultra High Frequency) amplifiers involves technical, legal, and supply chain considerations. While performance and cost are primary concerns, overlooking quality assurance and intellectual property (IP) rights can lead to significant setbacks. Below are common pitfalls to avoid.

Poor Quality Control and Component Sourcing

One of the most frequent issues when sourcing VHF/UHF amplifiers is inadequate quality control, especially when dealing with offshore or low-cost suppliers. Substandard components such as low-grade transistors, capacitors, or PCB substrates can degrade amplifier performance—leading to signal distortion, inconsistent gain, or early failure. Always verify that the manufacturer adheres to recognized quality standards like ISO 9001 or MIL-STD, particularly for applications in defense, aerospace, or public safety communications.

Misrepresentation of Specifications

Some suppliers may exaggerate key performance metrics such as gain, noise figure, output power, or linearity. This misrepresentation can result in amplifiers that fail to meet system requirements under real-world conditions. To avoid this, request third-party test reports or conduct independent lab validation before bulk procurement.

Lack of Traceability and Documentation

A reliable VHF/UHF amplifier should come with full traceability, including component sourcing records, calibration data, and compliance certificates. Absence of such documentation raises red flags about manufacturing consistency and long-term support, especially for regulated industries.

Intellectual Property Infringement Risks

Sourcing amplifiers from unknown or unverified manufacturers increases the risk of IP violations. Some low-cost suppliers may reverse-engineer or clone patented designs, integrating protected circuit architectures or proprietary technologies without authorization. Using such products can expose your organization to legal liability, product recalls, or shipment seizures.

Inadequate Protection of Your Own IP

When customizing amplifiers or working with OEMs, failing to secure IP agreements is another pitfall. Without clear contracts specifying ownership of designs, modifications, and manufacturing rights, your proprietary enhancements could be replicated or sold to competitors by the supplier.

Counterfeit or Grey Market Components

The RF amplifier market is vulnerable to counterfeit parts—especially high-performance GaAs or GaN-based modules. These may appear functional initially but fail prematurely or under load. Always source from authorized distributors or directly from reputable manufacturers to ensure authenticity.

Conclusion

To mitigate these risks, conduct thorough due diligence on suppliers, demand verifiable performance data, insist on quality certifications, and establish clear IP agreements. Investing time upfront ensures reliable, legally compliant VHF/UHF amplifiers that meet technical and regulatory requirements.

Logistics & Compliance Guide for VHF/UHF Amplifier

This guide outlines the critical logistics and compliance considerations for the safe, legal, and efficient handling, transportation, import/export, and operation of VHF/UHF amplifiers. Adherence is essential to avoid regulatory penalties, equipment damage, and operational disruptions.

Regulatory Compliance

Compliance with national and international regulations is mandatory for the legal sale, import, export, and operation of VHF/UHF amplifiers. Non-compliance can result in severe fines, equipment seizure, and operational shutdowns.

Frequency Band & Power Output Regulations

- Jurisdiction-Specific Rules: VHF (30-300 MHz) and UHF (300-3000 MHz) bands are strictly regulated. Permitted frequencies, bandwidths, and maximum effective radiated power (ERP) vary significantly by country and specific band (e.g., public safety, land mobile radio, amateur radio, commercial).

- Licensing Requirements: Operating an amplifier often requires specific licenses for the user (e.g., FCC license in the US, Ofcom license in the UK) and sometimes for the equipment itself (type acceptance).

- Certification Mandates: The amplifier must hold valid certification from the relevant national regulatory body before it can be legally marketed or operated within that jurisdiction. Key certifications include:

- USA: FCC Certification (Part 90 for Land Mobile, Part 97 for Amateur, etc.). Requires an FCC ID.

- Canada: ISED Certification (formerly Industry Canada). Requires an IC certification number.

- European Union: CE Marking, demonstrating compliance with the Radio Equipment Directive (RED) 2014/53/EU.

- Other Regions: Check local requirements (e.g., MIC in Japan, SRRC in China, ANATEL in Brazil, RCM in Australia/NZ).

- Action: Verify the amplifier model’s certification status and validity for every target market. Ensure documentation (FCC ID, IC number, CE DoC) is readily available.

Export Control Regulations

- Dual-Use Concerns: Amplifiers, especially high-power or wideband models, may be subject to export controls due to potential military or intelligence applications (dual-use technology).

- Key Regulations:

- USA: International Traffic in Arms Regulations (ITAR) or Export Administration Regulations (EAR). Most VHF/UHF amplifiers fall under EAR, specifically ECCN (Export Control Classification Number) 5A991 (or potentially higher based on power/frequency). A license may be required for export to certain countries or end-users.

- EU: Dual-Use Regulation (EU) 2021/821.

- Other Jurisdictions: National export control lists (e.g., Wassenaar Arrangement members).

- Action: Determine the correct ECCN or national classification. Screen end-users and destinations against denied parties lists. Obtain necessary export licenses before shipment if required.

Packaging & Handling

Proper packaging and handling protect the sensitive electronic components and ensure the amplifier arrives undamaged.

Packaging Requirements

- ESD Protection: Use static-dissipative or conductive packaging materials (e.g., pink poly bags, metallized shielding bags) for the amplifier and internal components to prevent Electrostatic Discharge (ESD) damage.

- Physical Protection: Employ robust, rigid outer packaging (double-wall corrugated cardboard or a sturdy plastic case) with ample cushioning (foam inserts, molded pulp, bubble wrap) to absorb shocks and vibrations during transit. Securely immobilize the unit within the package.

- Moisture Protection: Include desiccant packs inside moisture-barrier bags or the main package to prevent condensation, especially for international shipping or humid climates.

- Labeling: Clearly label packages with:

- “Fragile”

- “This Side Up”

- “Protect from Moisture”

- Hazardous material labels only if applicable (e.g., batteries included).

- Regulatory labels (FCC, IC, CE) as required on the outer box.

Handling Procedures

- ESD Precautions: Personnel handling the amplifier must use wrist straps connected to a proper ground point and work on ESD-safe mats, especially during unpacking for testing or installation.

- Physical Handling: Avoid dropping or subjecting the unit to strong impacts. Handle by the chassis, not connectors or knobs.

- Storage: Store in a clean, dry, temperature-controlled environment (typically 0°C to 40°C, 10-90% non-condensing humidity) away from direct sunlight, dust, and corrosive chemicals.

Transportation

Selecting the appropriate transportation method and carrier is crucial for timely and safe delivery.

Mode Selection

- Air Freight: Fastest option for international or urgent domestic shipments. Subject to stricter regulations for hazardous materials (check power supply batteries).

- Ground Freight (LTL/FTL): Cost-effective for domestic or regional shipments, especially for larger/heavier units or bulk orders. Less time-sensitive.

- Courier Services (Express): Good balance of speed and tracking for smaller packages, both domestic and international.

Carrier Selection & Documentation

- Specialized Carriers: Consider carriers experienced in handling sensitive electronics or regulated equipment.

- Accurate Documentation: Provide the carrier with a precise commercial invoice (for international), packing list, and any required export documentation (e.g., Shipper’s Export Declaration in the US). Clearly state the contents as “Radio Frequency Power Amplifier” with model number.

- Hazardous Materials (Hazmat): If the amplifier contains batteries meeting specific criteria (e.g., lithium-ion), it may be classified as hazardous for transport (e.g., UN3481). This requires:

- Specialized packaging meeting UN specifications.

- Appropriate Hazmat labels (Class 9).

- A completed Dangerous Goods Declaration.

- Use of certified Hazmat carriers.

- Action: Determine battery type/specs and consult IATA DGR (air), IMDG Code (sea), or ADR (road) regulations. When in doubt, ship batteries separately or consult a Hazmat expert.

Import Procedures

Successfully clearing customs in the destination country requires meticulous preparation.

Required Documentation

- Commercial Invoice: Must detail seller, buyer, goods description (including technical specs like freq. range, power), quantity, value (in destination currency), country of origin, harmonized system (HS) code.

- Packing List: Itemizes contents per package, weights, dimensions.

- Bill of Lading (BOL) / Air Waybill (AWB): Carrier’s contract of carriage.

- Certificate of Origin: May be required for tariff preference or customs verification.

- Regulatory Certifications: Copies of FCC, CE, ISED, or other relevant approval certificates. Essential for customs clearance.

- Import/Export Licenses: If required by the destination country (e.g., specific radio equipment permits beyond the manufacturer’s certification).

Customs Clearance & Duties

- HS Code Classification: Accurately classify the amplifier (e.g., 8517.62.xx for transmission apparatus in many countries). Incorrect classification leads to delays and penalties.

- Duty & Tax Calculation: Import duties, VAT, or GST will be calculated based on the declared value and HS code. Factor these costs into pricing.

- Customs Broker: Using a licensed customs broker in the destination country is highly recommended for complex shipments or unfamiliar markets. They handle documentation, declarations, and communication with customs authorities.

Installation & Operational Compliance

Ensuring the amplifier is installed and used legally and safely is the final critical step.

Site Survey & Frequency Coordination

- Licensing Verification: Confirm the end-user holds the necessary operating license for the intended frequencies and locations.

- Frequency Coordination: For licensed bands (especially public safety, commercial), coordinate frequencies with the relevant authority or frequency coordinator to avoid harmful interference with existing users.

- Site Suitability: Assess the installation site for adequate power, grounding, ventilation, security, and antenna placement.

Installation Best Practices

- Professional Installation: Highly recommended, especially for high-power units or complex RF systems. Follow the manufacturer’s installation manual precisely.

- Proper Grounding: Implement a robust, low-impedance grounding system as per electrical and RF safety codes (e.g., NEC, IEC) and manufacturer specs to protect against lightning and ensure safety.

- RF Safety (RF Exposure): Perform RF exposure assessments, especially near high-power antennas. Implement safety measures (fencing, signage) if required by regulations (e.g., FCC OET Bulletin 65, IC Safety Code 6) to protect personnel and the public.

- Interference Mitigation: Ensure proper filtering and shielding to prevent the amplifier from causing spurious emissions that interfere with other services.

Post-Installation & Maintenance

- Testing & Certification: After installation, verify performance and compliance (e.g., output power, frequency stability, spurious emissions) using calibrated test equipment. Keep records.

- Record Keeping: Maintain logs of installation, testing, maintenance, and any modifications.

- User Training: Train operators on safe and compliant operation, including power levels, frequency settings, and emergency procedures.

- Compliance Audits: Be prepared for potential audits by regulatory authorities to verify continued compliance with licensing and technical standards.

Conclusion for Sourcing VHF/UHF Amplifier:

In sourcing a VHF/UHF amplifier, it is essential to balance performance specifications, reliability, cost, and application requirements. After evaluating various suppliers, technical capabilities, and product offerings, selecting an amplifier that meets the required frequency range, gain, output power, noise figure, and linearity is critical for optimal system performance. Factors such as environmental resilience, power efficiency, and compliance with relevant standards (e.g., MIL-STD, RoHS) further influence the suitability of a candidate amplifier.

Additionally, considerations around supplier reputation, lead times, technical support, customization options, and total cost of ownership play a crucial role in long-term success. Whether for communication systems, broadcasting, radar, or defense applications, a well-sourced VHF/UHF amplifier ensures signal integrity, operational reliability, and scalability.

Ultimately, a thorough evaluation process that aligns technical needs with strategic sourcing goals will result in a robust, future-ready solution—enabling high-performance RF systems with minimal downtime and maintenance.