The global vertical axis wind turbine (VAWT) market is gaining momentum as industries and governments seek resilient, scalable, and space-efficient renewable energy solutions. According to a 2023 report by Mordor Intelligence, the global small wind turbine market—where vertical eolic generators hold a growing share—is projected to expand at a CAGR of 7.8% from 2023 to 2028. This growth is driven by rising urban renewable energy demand, advancements in blade design and material efficiency, and the suitability of vertical turbines for low-wind environments and built-up areas. As decentralized energy systems gain traction, vertical eolic generators are emerging as a strategic alternative to traditional horizontal axis turbines, especially in distributed power applications. With increasing innovation and regional pilot projects, the competitive landscape is evolving rapidly—positioning key manufacturers to capitalize on both on-grid and off-grid opportunities worldwide. Here’s a data-driven look at the top 10 vertical eolic generator manufacturers shaping the future of urban and distributed wind energy.

Top 10 Vertical Eolic Generator Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Controller Inverter, Generator, Horizontal Wind Turbine

Domain Est. 2021

Website: flytpower.com

Key Highlights: Flyt New Energy Technology Co.,Ltd., is a professional manufacturer of small and medium-size wind turbine systems and relevant accessories….

#2 GOLDWIND

Domain Est. 2000

Website: goldwind.com

Key Highlights: As a world-top wind turbine manufacturer, we are committed to providing integrated wind power solutions, including wind farm sitting, design, and construction; ……

#3 GEVI

Domain Est. 2022

Website: geviwind.com

Key Highlights: The first self-training vertical wind turbine. · AI-powered for up to 60% more energy. · GEVI develops smart vertical axis wind turbines, adapting to any wind and …Missing: eoli…

#4 Ryse Energy

Website: ryse.energy

Key Highlights: Ryse Energy is an impact-driven, innovative, off-grid renewable energy technology company, providing clean, affordable, reliable, and resilient green ……

#5 Wind Turbines

Domain Est. 1997

Website: us.vestas.com

Key Highlights: Discover the global leader in sustainable wind energy. We offer a range of onshore wind turbines and offshore wind turbines for your new wind project….

#6 Oy Windside Production Ltd

Domain Est. 1998

Website: windside.com

Key Highlights: Windside wind turbines are designed for performance, reliability, & safety in extreme wind conditions up to 60 m/s (216 km/h), and all weather conditions….

#7 Windspire Verticle Axis Wind Turbines, 750W, 2kW, 3kW, 5kW …

Domain Est. 2009

Website: windspireenergy.com

Key Highlights: Every wind turbine Is Completely Made In Reedsburg, Wisconsin, USA. All wind turbines are available in custom colors. Free Wind study provided for your location….

#8 SeaTwirl enables floating wind power wherever it is needed

Domain Est. 2010

Website: seatwirl.com

Key Highlights: SeaTwirl develops floating vertical-axis wind turbines that are easier to build, install, and maintain. Our purpose is to enable floating wind wherever it is ……

#9 ArborWind Vertical Axis Wind Turbines

Domain Est. 2010

Website: arborwind.com

Key Highlights: ArborWind is bringing to wind power what has been lacking—Proven, stable and economical power generation in a Vertical Axis Wind Turbine….

#10 Flower Turbines

Domain Est. 2013

Website: flowerturbines.com

Key Highlights: Our vertical axis wind turbines are the perfect solution to your energy needs. Combining beauty with function, our sustainable energy solutions deliver ……

Expert Sourcing Insights for Vertical Eolic Generator

2026 Market Trends for Vertical Axis Wind Turbines (VAWTs)

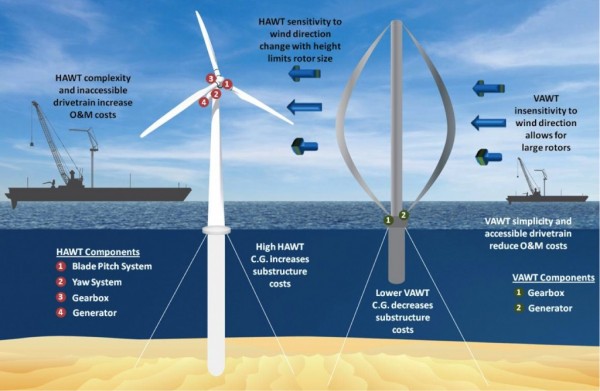

The global market for Vertical Axis Wind Turbines (VAWTs) is poised for significant evolution by 2026, driven by urbanization, distributed energy needs, and technological advancements. While Horizontal Axis Wind Turbines (HAWTs) dominate large-scale wind farms, VAWTs are carving out a distinct and expanding niche in specific applications. Key trends shaping the 2026 landscape include:

1. Urban and Built Environment Integration Accelerating

VAWTs are increasingly recognized as ideal for urban settings due to their omnidirectional wind capture, lower noise profiles, and compact designs. By 2026, expect widespread deployment on rooftops, integrated into building facades, and within smart city infrastructure. Cities aiming for carbon neutrality will adopt VAWTs as part of decentralized energy systems, particularly where space and wind turbulence limit HAWT feasibility. Architectural integration will become a design standard in sustainable urban developments.

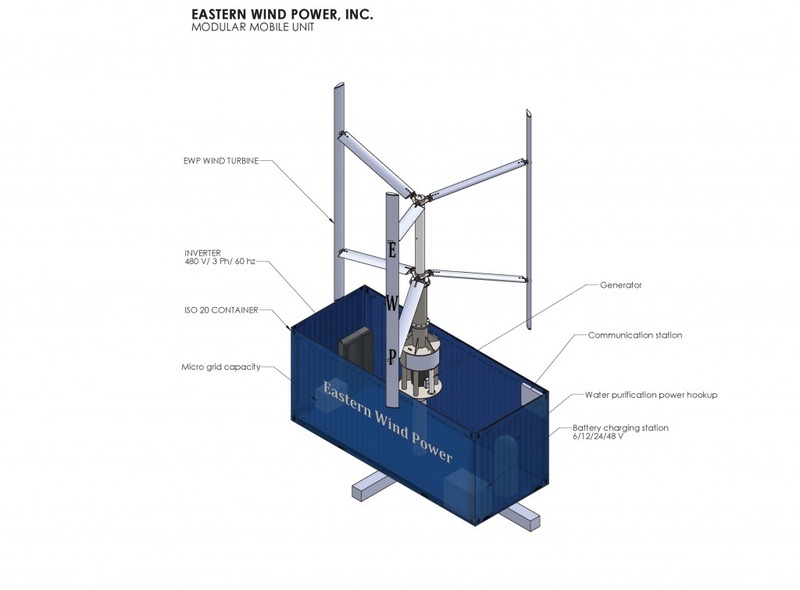

2. Hybrid Renewable Systems Driving Adoption

The convergence of wind with solar PV and energy storage is a major growth catalyst. VAWTs complement solar by generating power during low-light hours and in turbulent wind conditions typical of cities. By 2026, hybrid VAWT-solar microgrids will be common in off-grid and backup power applications for telecom towers, remote monitoring stations, and rural electrification projects, especially in emerging markets.

3. Technological Innovation Enhancing Efficiency and Reliability

Persistent criticism of VAWTs’ lower efficiency is being addressed through advanced materials (e.g., carbon fiber blades), aerodynamic refinements (e.g., helical designs, active pitch control), and improved generator technology (e.g., direct-drive permanent magnet generators). By 2026, next-generation VAWTs will achieve significantly higher capacity factors, reducing the levelized cost of energy (LCOE) and improving return on investment, making them more competitive.

4. Policy and Incentive Support Expanding Globally

Government initiatives promoting decentralized renewable energy and net-zero building standards will bolster VAWT adoption. By 2026, regions like the EU, North America, and parts of Asia-Pacific are expected to offer targeted incentives for small-scale wind and building-integrated renewables. Streamlined permitting for urban wind installations will further accelerate market penetration.

5. Niche Commercial and Industrial Applications Maturing

Beyond urban settings, VAWTs will gain traction in specific commercial and industrial (C&I) applications by 2026. These include powering remote sensors, street lighting, EV charging stations, and agricultural operations. Their low maintenance and resilience in turbulent flows make them suitable for harsh or isolated environments where grid access is limited or unreliable.

6. Sustainability and Circular Economy Focus Rising

As environmental scrutiny increases, VAWT manufacturers will prioritize recyclable materials and modular designs to extend product lifecycles. By 2026, sustainability certifications and end-of-life recycling programs will become competitive differentiators, aligning with broader ESG goals in the renewable sector.

In conclusion, while VAWTs will remain a complementary technology to HAWTs, their unique advantages position them for robust growth in distributed and urban energy markets by 2026. Success will depend on continued innovation, supportive policies, and strategic integration within hybrid renewable ecosystems.

Common Pitfalls When Sourcing Vertical Axis Wind Turbines (Quality and Intellectual Property)

Sourcing Vertical Axis Wind Turbines (VAWTs), also known as vertical eolic generators, presents unique challenges that buyers must carefully navigate. Beyond cost and performance, critical pitfalls related to quality assurance and intellectual property (IP) can significantly impact project success, long-term reliability, and legal compliance.

Quality-Related Pitfalls

1. Inadequate Performance Validation

Many VAWT manufacturers overstate power output and efficiency, particularly in low-wind conditions. Unlike standardized horizontal-axis turbines, VAWTs often lack rigorous third-party certification (e.g., IEC 61400). Buyers risk investing in units that fail to meet promised energy yields, especially in turbulent or variable wind environments typical of urban installations.

2. Poor Material and Structural Integrity

Low-cost VAWTs may use substandard materials (e.g., low-grade composites, uncoated metals) that degrade rapidly under UV exposure, moisture, and mechanical stress. This leads to premature fatigue, blade deformation, or tower failure. Without access to independent structural testing data, buyers may inherit high maintenance or replacement costs.

3. Lack of Long-Term Durability Data

VAWTs are less prevalent than horizontal models, resulting in limited field performance history. Suppliers may not provide proven track records over 5–10 years. Without verified durability data, assessing lifecycle costs and return on investment becomes speculative.

4. Inadequate Certification and Compliance

Many VAWTs—especially from emerging manufacturers—lack compliance with international safety, noise, and grid-connection standards. Sourcing units without certifications (e.g., CE, UL, ISO) can result in installation delays, regulatory penalties, or insurance issues.

Intellectual Property-Related Pitfalls

1. Risk of IP Infringement

Some VAWT designs, particularly helical or Darrieus variants, are protected by active patents. Sourcing from manufacturers that replicate patented technologies without licensing exposes buyers to legal liability, import bans, or forced decommissioning. Due diligence on the originality and freedom-to-operate of a design is essential.

2. Ambiguous Ownership of Custom Designs

When collaborating on bespoke VAWT projects, contracts may fail to clearly assign IP rights. This can lead to disputes over ownership of innovations, modifications, or data collected during operation. Without clear agreements, buyers may lose control over future development or resale rights.

3. Lack of Technical Documentation and Support

Suppliers, especially smaller or offshore vendors, may withhold detailed engineering specifications, control algorithms, or maintenance protocols—potentially protected as trade secrets. This limits the buyer’s ability to service, upgrade, or independently verify performance, creating long-term operational dependency.

4. Counterfeit or Clone Products

The VAWT market includes unbranded or reverse-engineered units that mimic established designs. These clones often lack quality control and may infringe on registered IP. Buyers risk poor performance, safety hazards, and legal exposure when unknowingly purchasing counterfeit systems.

Mitigation Strategies

To avoid these pitfalls, conduct thorough due diligence: verify third-party test reports, request references and site visits, audit manufacturing processes, and engage legal experts to review IP rights and contractual terms. Prioritize suppliers with transparent documentation, valid certifications, and a clear IP position to ensure reliable, compliant, and legally secure deployment.

Logistics & Compliance Guide for Vertical Axis Wind Turbines (VAWTs)

Overview

This guide outlines key logistics and compliance considerations for transporting, installing, and operating Vertical Axis Wind Turbines (VAWTs). Due to their unique design and deployment environments—often urban, commercial, or off-grid—the logistics and regulatory requirements differ from traditional horizontal-axis turbines.

Transportation & Handling

- Component Packaging: VAWTs are typically shipped in modular kits (blades, central shaft, generator, base, and control system). Ensure all components are packed with protective materials to avoid damage during transit.

- Transport Modes: Depending on size, VAWTs may be transported via truck, rail, or containerized shipping. Oversized components may require special permits and route planning.

- Site Access: Confirm that delivery routes and installation sites accommodate crane access, lifting equipment, and component dimensions. Urban installations may require night deliveries to minimize disruption.

- On-Site Storage: Store components in a secure, dry area. Avoid prolonged exposure to moisture or extreme temperatures before installation.

Regulatory Compliance

- Zoning and Land Use: Verify local zoning laws permit wind energy installations. Many municipalities have height restrictions, setback requirements, and noise limits that apply to VAWTs.

- Permitting: Obtain necessary permits for construction, electrical connection, and grid interconnection (if applicable). This may include building, electrical, and environmental permits.

- Environmental Regulations: Assess potential impact on local wildlife, especially birds and bats, even though VAWTs are generally considered lower risk. Some jurisdictions require environmental impact assessments.

- Noise Standards: Ensure the turbine’s operational noise complies with local ordinances, typically between 35–45 dB at residential boundaries.

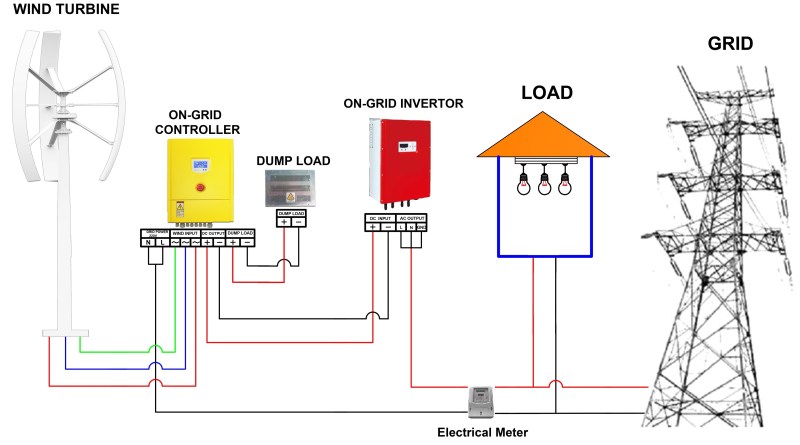

Electrical & Grid Integration

- Grid Connection: If connecting to the utility grid, comply with IEEE 1547 standards (or local equivalents) for interconnection, power quality, and safety.

- Inverter Certification: Use inverters certified to UL 1741 (or IEC 62109) standards, ensuring compatibility with local grid requirements.

- Metering and Net Metering: Install bi-directional meters where net metering is available. Confirm utility-specific requirements for meter placement and data reporting.

Safety & Installation Standards

- Structural Integrity: Foundations must be designed to withstand wind loads, vibration, and seismic activity per local building codes (e.g., IBC, Eurocode).

- Electrical Safety: Installation must follow NEC (NFPA 70) in the U.S. or IEC 60364 internationally, including grounding, overcurrent protection, and disconnect switches.

- Worker Safety: Use qualified personnel for installation. Follow OSHA (or equivalent) guidelines for working at heights and with electrical systems.

Import/Export Considerations (International Projects)

- Customs Documentation: Prepare commercial invoices, packing lists, and certificates of origin. Classify VAWT components under correct HS codes (e.g., 8502.31 for wind-powered generators).

- Import Duties & Taxes: Research tariff rates and potential exemptions for renewable energy equipment in the destination country.

- CE Marking / International Certifications: For EU markets, ensure compliance with CE marking requirements, including the Machinery Directive and Electromagnetic Compatibility (EMC) Directive. Other regions may require KC (Korea), CCC (China), or RCM (Australia) marks.

Maintenance & Decommissioning Compliance

- Routine Inspections: Schedule regular checks per manufacturer guidelines to ensure structural and electrical integrity. Maintain logs for compliance audits.

- Waste Management: At end-of-life, recycle components (metals, composites, electronics) in accordance with local environmental laws (e.g., WEEE Directive in the EU).

- Decommissioning Plan: Some jurisdictions require a decommissioning plan and financial assurance to cover removal costs.

Documentation & Recordkeeping

- Maintain records of:

- Permits and approvals

- Manufacturer specifications and warranties

- Installation certifications

- Inspection and maintenance logs

- Grid interconnection agreements

Proper documentation ensures ongoing compliance and supports asset valuation and insurance requirements.

Conclusion: Sourcing a Vertical Axis Wind Turbine (VAWT) – Key Considerations

Sourcing a vertical axis wind generator (VAWT) presents a compelling option for renewable energy generation, particularly in urban environments, off-grid applications, or areas with turbulent and variable wind conditions. Unlike traditional horizontal axis wind turbines (HAWTs), VAWTs offer advantages such as omnidirectional wind acceptance, lower noise levels, simpler maintenance, and a more compact design, making them suitable for integration into built environments.

However, sourcing decisions must be made with careful evaluation of several factors. While VAWTs generally have lower efficiency and scalability compared to HAWTs, advancements in blade design, materials, and power electronics are improving their performance. It is essential to select a reliable manufacturer with a proven track record, robust product certifications (such as IEC standards), and strong technical support.

Additionally, site-specific conditions—wind speed patterns, turbulence, space availability, and local regulations—must be assessed to ensure optimal performance and return on investment. Cost considerations should include not only the initial procurement and installation but also long-term durability, maintenance requirements, and expected energy output.

In conclusion, vertical axis wind generators are a promising component of decentralized and sustainable energy systems when appropriately matched to the application and environment. A strategic sourcing approach—focusing on technology suitability, supplier reliability, and lifecycle performance—will maximize the benefits and ensure successful integration of VAWTs into the energy mix.