The global venturi pump market is experiencing steady growth, driven by increasing demand across industrial, wastewater treatment, and chemical processing sectors. According to Grand View Research, the global ejector and eductor pump market—of which venturi pumps are a key segment—was valued at USD 2.1 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth is fueled by the technology’s reliability, lack of moving parts, and suitability for handling corrosive or abrasive fluids. Mordor Intelligence further highlights rising adoption in oil & gas and power generation industries, particularly for vacuum generation and fluid transfer in harsh environments. As operational efficiency and maintenance reduction become critical priorities, venturi pumps are gaining traction for their simplicity and durability. With North America and Europe leading in adoption and Asia-Pacific witnessing the fastest growth due to industrial expansion, the competitive landscape is evolving. Here are the top 7 venturi pump manufacturers shaping the market through innovation, global reach, and technical excellence.

Top 7 Venturi Pumps Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Venturi Jet Pumps

Domain Est. 1999

Website: venturipumps.com

Key Highlights: With over 20 years experience in the Power & Process Industry, Venturi Jet Pumps is a leading manufacturer in Venturi Process Equipment….

#2 Venturi Vacuum Pump Manufacturers Suppliers

Domain Est. 2014

Website: vacuumpumpmanufacturers.com

Key Highlights: Discover top venturi vacuum pump suppliers in the USA. Order custom-engineered, user-friendly products online at discounted rates….

#3 EST Venturi Systems: Custom Engineered Venturi Systems

Domain Est. 2020

Website: est-venturisystems.com

Key Highlights: We’re a reliable venturi system manufacturer based out of The Woodlands, TX, but we do business worldwide. We offer a wide range of products to fit our client’ ……

#4 Venturi Pumps

Domain Est. 1997

Website: updateltd.com

Key Highlights: MULTI VENTURI VACUUM PUMP MODEL 50 MULTI VENTURI VACUUM PUMP MODEL 50. Part Number: VAC-50. Sale Price $730.00 /EACH….

#5 Air Venturi

Domain Est. 2005

Website: airventuri.com

Key Highlights: Discover the power of air with Air Venturi, a leading innovator in high-performance airguns. Shop our collection of PCP air rifles, pistols, pellets, ……

#6 Vacuum generator

Domain Est. 2007

Website: coval-inc.com

Key Highlights: Venturi vacuum pumps are used for all normal vacuum gripping applications. Compact and light, venturis may be installed close to the suction pads….

#7 Venturi Supply

Domain Est. 2023

Website: venturisupply.com

Key Highlights: As a united family of companies, Venturi Supply specializes in providing mission-critical pipe, valve and fittings solutions, as well as value-added services….

Expert Sourcing Insights for Venturi Pumps

H2: 2026 Market Trends for Venturi Pumps

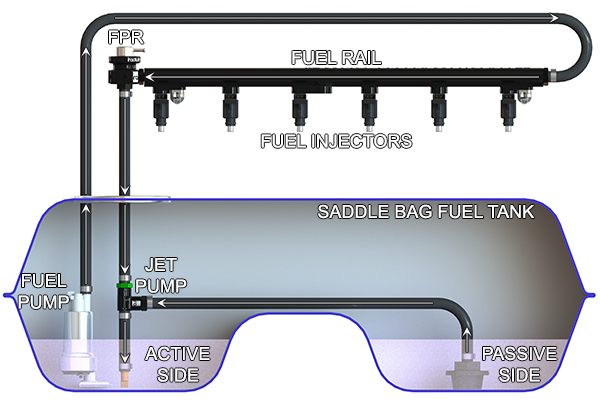

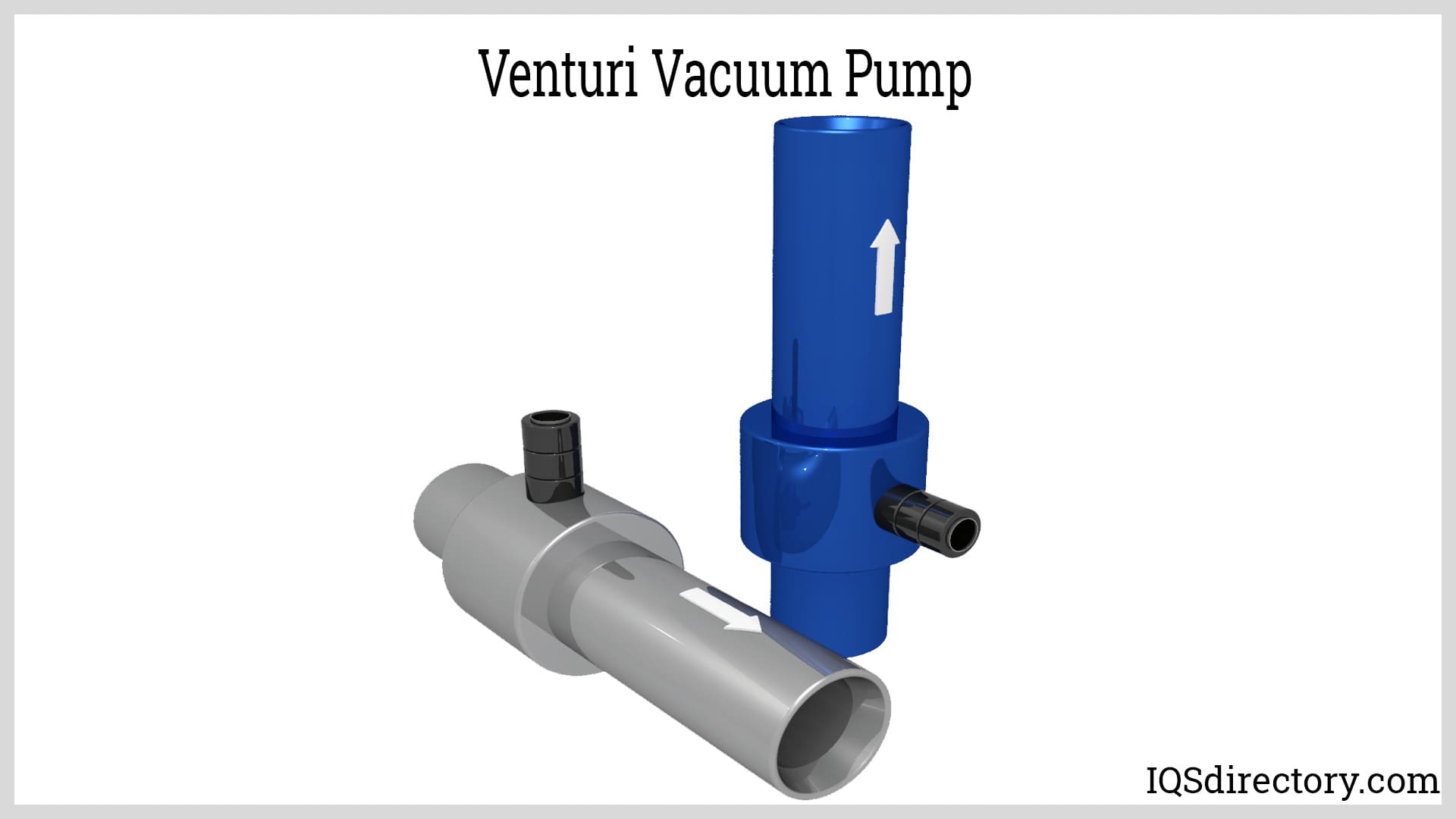

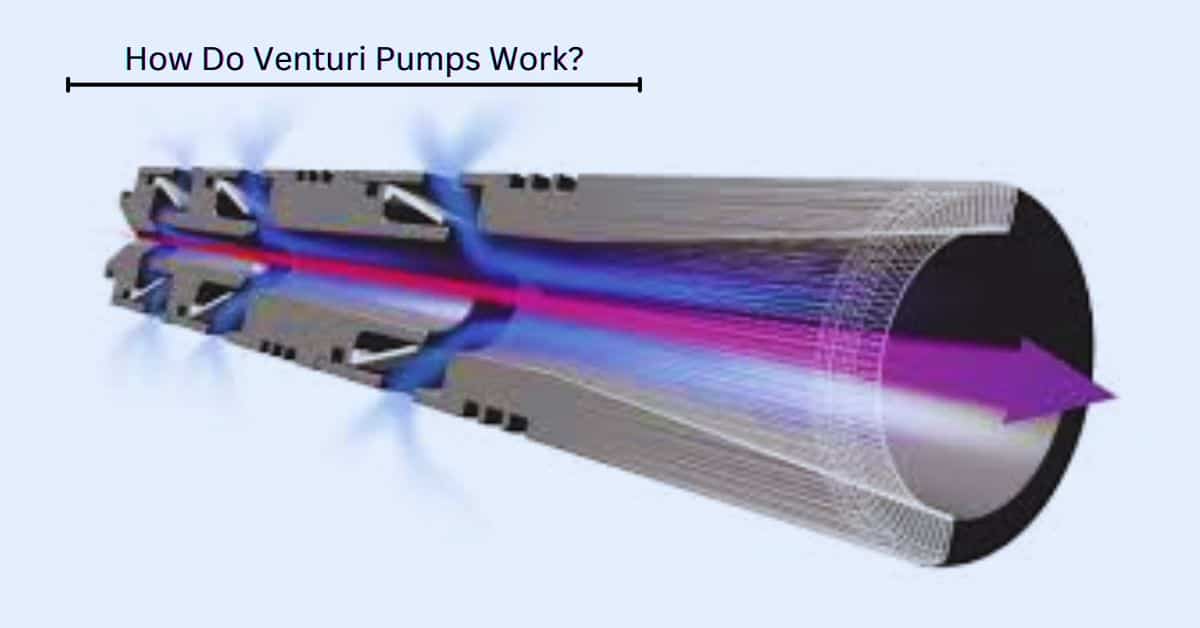

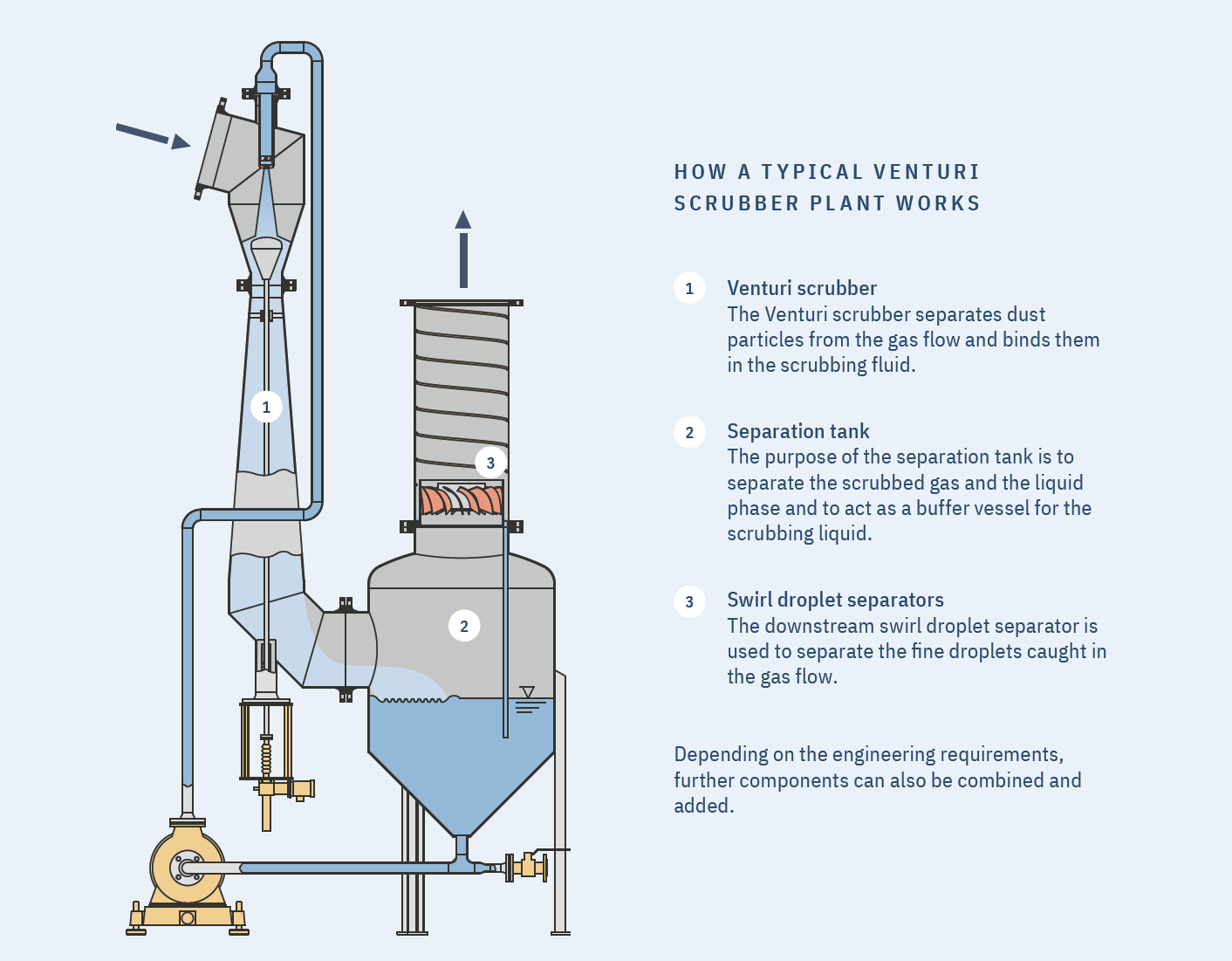

The global market for Venturi pumps is poised for steady growth through 2026, driven by increasing demand across industrial, water treatment, and chemical processing sectors. These pumps—known for their simplicity, reliability, and lack of moving parts—leverage the Venturi effect to move fluids using differential pressure, making them ideal for applications requiring low maintenance and high durability.

Rising Demand in Water and Wastewater Treatment

A primary driver of Venturi pump adoption is the expanding need for efficient aeration and chemical dosing in municipal and industrial wastewater treatment plants. As governments worldwide strengthen environmental regulations, facilities are upgrading infrastructure to meet stricter effluent standards. Venturi injectors are increasingly used in ozone and chlorine dosing systems due to their precise mixing capabilities and resistance to clogging, especially when handling slurries or chemically aggressive media.

By 2026, the water treatment segment is expected to account for over 35% of the Venturi pump market, particularly in emerging economies in Asia-Pacific and Africa where urbanization and industrialization are accelerating water infrastructure development.

Growth in Industrial Automation and Process Optimization

Manufacturers are integrating Venturi-based vacuum systems into automated production lines, especially in packaging, material handling, and semiconductor manufacturing. The compact, energy-efficient design of Venturi vacuum generators aligns with Industry 4.0 initiatives focused on modular, scalable, and low-maintenance solutions. With compressed air widely available in industrial environments, Venturi systems offer quick deployment and fail-safe operation.

Advancements in nozzle design and materials (e.g., reinforced polymers and corrosion-resistant alloys) are enhancing efficiency and extending service life, further boosting adoption in high-purity and hazardous environments.

Expansion in Oil & Gas and Chemical Industries

In the oil and gas sector, Venturi pumps are employed for chemical injection, wellhead deliquification, and produced water handling. Their intrinsic safety—no electrical components or sparks—makes them suitable for explosive atmospheres. As offshore and remote onshore operations seek reliable fluid transfer solutions, Venturi technology is gaining favor.

Similarly, in chemical manufacturing, the ability to handle aggressive fluids without seals or motors reduces leakage risks and maintenance costs. The global push toward safer, more sustainable chemical processes is expected to increase Venturi pump integration in closed-loop systems and emergency shutdown applications.

Regional Market Dynamics

North America and Europe will maintain strong market shares due to stringent environmental compliance and modernization of aging infrastructure. However, the Asia-Pacific region—especially China, India, and Southeast Asia—is projected to register the highest compound annual growth rate (CAGR) through 2026, fueled by industrial expansion and government investments in clean water and smart cities.

Technological and Sustainability Trends

Key innovations shaping the 2026 outlook include:

– Hybrid systems combining Venturi pumps with digital controls for real-time flow monitoring and optimization.

– Energy recovery designs that recapture pressure from waste streams, improving overall system efficiency.

– Smart sensors integrated into Venturi injectors to enable predictive maintenance and remote diagnostics.

Sustainability is also a growing influencer. With no moving parts, Venturi pumps offer lower lifecycle emissions and reduced material waste. As industries adopt circular economy principles, demand for passive, durable fluid handling equipment is expected to rise.

Conclusion

By 2026, the Venturi pump market will be characterized by technological refinement, regulatory support, and cross-sector adoption. While competition from electric and rotary pumps persists, the unique advantages of Venturi systems—simplicity, safety, and adaptability—position them for sustained growth, especially in critical infrastructure and automation applications. Market forecasts suggest a CAGR of approximately 5.8% from 2022 to 2026, with the global market value approaching USD 1.2 billion.

Common Pitfalls Sourcing Venturi Pumps (Quality, IP)

Sourcing Venturi pumps effectively requires careful attention to both quality assurance and intellectual property (IP) considerations. Overlooking these aspects can lead to performance issues, supply chain disruptions, and legal risks. Below are the key pitfalls to avoid:

Quality-Related Pitfalls

- Inadequate Material Specifications: Assuming standard materials are sufficient without verifying compatibility with the specific fluid, temperature, pressure, and environmental conditions. Using substandard alloys or plastics can lead to premature failure, leaks, or contamination.

- Poor Dimensional Accuracy and Tolerances: Venturi performance is highly sensitive to internal geometry (throat diameter, converging/diverging angles). Suppliers with lax manufacturing controls may produce units outside critical tolerances, resulting in significantly reduced suction performance or inefficiency.

- Lack of Performance Testing and Certification: Relying solely on theoretical calculations or supplier claims without requiring actual performance test data (e.g., suction flow vs. drive pressure curves, NPSH requirements) under standardized conditions. This leads to uncertainty in system integration and potential underperformance.

- Inconsistent Manufacturing Processes: Sourcing from suppliers without robust quality management systems (e.g., ISO 9001) increases the risk of batch-to-batch variability, affecting reliability and system performance consistency.

- Insufficient Surface Finish and Internal Smoothness: Rough internal surfaces or burrs in the Venturi throat and diffuser increase turbulence and friction losses, directly reducing pumping efficiency and suction capability.

Intellectual Property (IP)-Related Pitfalls

- Infringement of Patented Designs: Sourcing pumps that incorporate patented geometries, multi-stage arrangements, or specialized features without proper licensing. This exposes the buyer to legal action, injunctions, and financial penalties, especially in regulated industries or export markets.

- Unlicensed Use of Proprietary Performance Data: Utilizing a supplier’s performance curves, sizing software, or technical documentation without authorization, particularly if those are protected by copyright or trade secret laws.

- Reverse Engineering Risks: Attempting to replicate a competitor’s high-performance Venturi design based on a purchased unit without analyzing existing patents or securing design rights. This can lead to unintentional IP violations.

- Ambiguous Ownership in Custom Designs: Failing to establish clear contractual terms defining IP ownership when commissioning a custom Venturi pump design. Without a written agreement, disputes may arise over who owns the resulting design, limiting future manufacturing or modification rights.

- Sourcing from Suppliers with Questionable IP Practices: Procuring from manufacturers known to copy or reverse-engineer leading brands, which may result in receiving counterfeit or infringing products that compromise system integrity and expose the buyer to downstream liability.

Mitigation Strategy: To avoid these pitfalls, conduct thorough supplier audits, demand material certifications and performance test reports, perform IP due diligence (patent searches), and establish clear contractual terms regarding specifications, quality standards, and IP rights—especially for custom designs.

Logistics & Compliance Guide for Venturi Pumps

Overview

Venturi pumps, also known as eductor or jet pumps, operate on the Venturi effect to move fluids or gases using a motive fluid (typically steam, air, or liquid). Due to their widespread use in industrial, chemical, and pharmaceutical applications, proper logistics handling and regulatory compliance are critical to ensure safety, performance, and legal adherence.

Regulatory Compliance Considerations

International and Regional Standards

- ISO 9001: Applies to quality management systems for design, manufacture, and distribution. Ensure suppliers and manufacturers are certified.

- ASME B31.3: Relevant for pumps used in process piping systems involving hazardous fluids.

- ATEX/IECEx: Required if venturi pumps are used in potentially explosive atmospheres (e.g., petrochemical facilities). Verify equipment category and marking.

- PED (Pressure Equipment Directive 2014/68/EU): Applies to venturi pumps operating above specific pressure-volume thresholds in the European Union. Classification depends on fluid group and maximum allowable pressure.

- REACH & RoHS: Ensure materials used in construction (e.g., seals, housings) comply with substance restrictions in the EU.

Material & Environmental Compliance

- Material Traceability: Maintain mill test certificates (MTCs) for wetted parts, especially in sanitary or corrosive environments.

- Chemical Resistance Documentation: Provide compatibility charts detailing resistance to common process fluids (e.g., acids, solvents).

- Environmental Regulations: Comply with local emissions standards if motive fluid is steam or compressed air vented to atmosphere.

Logistics Handling & Transportation

Packaging Requirements

- Use robust, weather-resistant packaging with internal bracing to prevent vibration damage.

- Seal all ports with protective caps or plugs to prevent ingress of contaminants.

- Include desiccants if stored or shipped in humid environments.

- Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”).

Shipping & Documentation

- Hazard Classification: Most venturi pumps are non-hazardous; however, if packaged with lubricants or motive fluid sources (e.g., compressed gas), classify accordingly under IATA/IMDG as applicable.

- Export Controls: Verify if pumps contain controlled technologies (e.g., dual-use items under EU Dual-Use Regulation or U.S. EAR).

- Customs Documentation: Include commercial invoice, packing list, certificate of origin, and compliance certificates (e.g., CE, CRN for Canada).

Storage Guidelines

- Store indoors in a dry, temperature-controlled environment (typically 5°C to 40°C).

- Avoid direct sunlight and corrosive atmospheres.

- Elevate units off the floor using pallets to prevent moisture absorption.

- Rotate stock based on first-in, first-out (FIFO) principle for long-term storage.

Installation & Operational Compliance

Pre-Installation Verification

- Confirm compliance with local plumbing, mechanical, and safety codes.

- Verify motive fluid supply (e.g., pressure, flow rate) matches pump specifications.

- Inspect for shipping damage before installation.

Safety & Monitoring

- Install pressure relief devices if the system can be over-pressurized.

- Use appropriate PPE during maintenance due to potential fluid ejection or noise exposure.

- Conduct periodic inspections per manufacturer-recommended intervals.

Documentation & Recordkeeping

- Maintain records of compliance certifications, test reports, and material traceability.

- Keep shipping logs, customs filings, and delivery confirmations for audit readiness.

- Provide end-users with operation and maintenance manuals, including compliance statements.

Conclusion

Adhering to logistics and compliance protocols ensures the safe, efficient, and legal deployment of venturi pumps. Always consult local regulations and manufacturer guidelines to address application-specific requirements. Regular audits and staff training further support compliance across the supply chain.

Conclusion on Sourcing Venturi Pumps

In conclusion, sourcing venturi pumps offers a cost-effective, reliable, and maintenance-free solution for applications requiring fluid transfer, gas-liquid mixing, or vacuum generation. Their simple design—relying on fluid dynamics rather than moving parts—makes them highly durable and suitable for harsh or sterile environments. When sourcing venturi pumps, it is essential to consider factors such as material compatibility, flow rate requirements, operating pressure, and the specific application (e.g., wastewater treatment, chemical dosing, aquaculture, or industrial vacuum systems).

Careful evaluation of supplier reliability, customization options, and total cost of ownership—rather than just initial price—will ensure long-term performance and efficiency. Additionally, working with reputable manufacturers who provide technical support and quality certifications can enhance system integration and operational safety.

Overall, venturi pumps represent a smart sourcing choice for industries seeking robust, energy-efficient, and scalable pumping solutions with minimal maintenance demands.