The global infusion therapy market is experiencing steady expansion, driven by rising hospital admissions, increased prevalence of chronic diseases, and growing demand for safe and efficient intravenous (IV) delivery systems. According to a report by Mordor Intelligence, the global IV sets market was valued at approximately USD 4.2 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of over 7.5% through 2029. A key segment within this market is vented IV tubing, which enables safe air venting during fluid administration and is particularly critical in gravity-fed infusion setups. As healthcare facilities prioritize patient safety and regulatory compliance, demand for high-quality vented IV tubing has intensified, prompting innovation and competition among manufacturers. In response, leading medical device companies are enhancing product sterility, precision, and flow control features to meet clinical needs across diverse care settings. This growing market landscape has given rise to a select group of manufacturers that stand out for their technological capabilities, global reach, and adherence to rigorous quality standards. Below is a data-informed overview of the top nine vented IV tubing manufacturers shaping the future of infusion therapy.

Top 9 Vented Iv Tubing Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Medical Vented IV Spike with Cap SP

Domain Est. 1998

Website: directmed.com

Key Highlights: We have decades of experience sourcing & customizing plastic Vented IV Spike with Caps. Let us help you deliver your Medical Device projects on time, ……

#2 Primary and Secondary Administration Sets

Domain Est. 1990

Website: bd.com

Key Highlights: Our BD IV sets are commonly used across hospitals, in a range of configurations, designed to help support your clinical needs in different care areas….

#3 IV Fluid and Drug Delivery

Domain Est. 1992

Website: ushospitalproducts.baxter.com

Key Highlights: We offer clinicians a best-in-class infusion pump and comprehensive portfolio of sets and access devices to administer IV fluids and drugs for patients….

#4 IV Sets Archives

Domain Est. 1996

#5 IV Admin Sets

Domain Est. 1996

Website: boundtree.com

Key Highlights: 1–2 day delivery 7-day returnsBound Tree offers a wide selection of IV administration sets. Shop IV sets by specifications such as drip rate, tubing, and port-type with options ……

#6 I.V. Infusion Sets

Domain Est. 1998

Website: polymedicure.com

Key Highlights: I.V. Infusion Set for Photosensitive Drugs · Protects light sensitive drugs from UV exposure · UV resistant tubing minimizes decomposition of the active ……

#7 EQUASHIELD®’s IV Tubing Sets

Domain Est. 2008

Website: equashield.com

Key Highlights: EQUASHIELD® Tubing Sets integrate our Spike Adaptor or Luer-Lock Adaptor. They fit standard IV bags, enabling safe & efficient administration….

#8 Infusion Sets

Domain Est. 2016

Website: codanusa.com

Key Highlights: CODAN IV Administration sets represent advanced and innovative systems designed for gravity and pressure-controlled infusion therapies….

#9 VENTED INFUSION SET

Domain Est. 2018

Website: nubeno.com

Key Highlights: It consists of a PVC tubing with a bulb-shaped latex attached to one end. The tubing also typically includes a drip chamber, a roller clamp for flow regulation, ……

Expert Sourcing Insights for Vented Iv Tubing

H2: Projected 2026 Market Trends for Vented IV Tubing

The global vented IV tubing market is poised for continued evolution in 2026, driven by persistent clinical needs, technological advancements, and shifting healthcare dynamics. Key trends shaping the market include:

1. Heightened Focus on Patient Safety and Infection Control: The primary driver for vented IV tubing – preventing microbial contamination during fluid administration – remains paramount. Stricter regulatory standards (e.g., FDA, EU MDR) and heightened hospital-acquired infection (HAI) awareness will fuel demand for high-integrity vented systems with advanced microbial filters (e.g., 0.22 µm or 0.2 µm hydrophobic membranes). Features ensuring reliable venting without compromising sterility will be critical differentiators.

2. Integration with Smart Infusion Systems: Vented tubing is increasingly designed for seamless compatibility with smart pumps and closed-loop infusion systems. The trend towards automation for medication safety will drive demand for vented sets that integrate with pump detection features, ensuring proper setup and potentially enabling data transmission (e.g., filter status, fluid type). This enhances safety protocols and workflow efficiency.

3. Growth in Home Healthcare and Ambulatory Settings: The shift towards treating patients outside traditional hospitals, including home infusion therapy and outpatient clinics, will boost demand for reliable, user-friendly vented tubing. Products emphasizing ease of use, clear visual indicators (e.g., for vent status), and robustness for patient self-administration will gain traction. Single-use, pre-primed sets may see increased adoption.

4. Material Innovation and Biocompatibility: Ongoing concerns about DEHP (a plasticizer in PVC) and other additives will accelerate the development and adoption of alternative materials like TPE (Thermoplastic Elastomers), polyolefins, or DEHP-free PVC for vented tubing. Improved biocompatibility, reduced leachables, and enhanced flexibility remain key R&D focuses, impacting product choice and regulatory pathways.

5. Standardization and Regulatory Harmonization: Efforts to harmonize global standards (e.g., ISO 8536-4) for vented IV sets will influence design, testing, and labeling. Manufacturers will need to ensure compliance across major markets (US, EU, APAC), potentially leading to more standardized, globally marketed products. Regulatory scrutiny on filter efficacy and long-term performance will intensify.

6. Cost-Effectiveness and Supply Chain Resilience: Healthcare systems continue to face cost pressures. While safety is non-negotiable, demand for cost-effective solutions without compromising quality will persist. Suppliers demonstrating robust, resilient supply chains (post-pandemic lessons) and efficient manufacturing will hold a competitive advantage. Value analysis teams will scrutinize total cost of ownership.

7. Sustainability Pressures: Environmental concerns are slowly influencing medical device markets. While single-use dominates for sterility, there may be nascent exploration into more recyclable materials or take-back programs, though this is likely a longer-term trend impacting material selection rather than a major 2026 driver for this specific product.

In summary, the 2026 vented IV tubing market will be characterized by a strong emphasis on safety, integration with digital health technologies, adaptation to decentralized care models, and continuous innovation in materials and design, all within a framework of stringent regulation and cost consciousness. Manufacturers focusing on reliability, compatibility, and meeting evolving clinical and regulatory demands will be best positioned for success.

Common Pitfalls in Sourcing Vented IV Tubing: Quality and Intellectual Property Risks

Sourcing vented IV tubing involves more than just finding a low price. Overlooking key quality and intellectual property (IP) concerns can lead to product failures, regulatory setbacks, reputational damage, and legal exposure. Below are critical pitfalls to avoid:

Quality-Related Pitfalls

Inconsistent Material Biocompatibility

Using substandard or non-compliant materials can compromise patient safety. Some suppliers may use cheaper polymers that haven’t been tested for ISO 10993 biocompatibility standards. This increases the risk of cytotoxicity, sensitization, or irritation during clinical use.

Poorly Designed or Non-Functioning Vent Mechanisms

The vent must reliably allow air entry while preventing fluid leakage and microbial ingress. Inferior designs may clog, leak, or fail under pressure, leading to infusion interruptions or contamination. Inadequate testing for bubble point and hydrophobicity can mask these flaws.

Lack of Sterility Assurance

Vented tubing must be terminally sterilized (typically via ethylene oxide or gamma radiation). Sourcing from manufacturers without validated sterilization processes or proper cleanroom environments risks non-sterile products, which can lead to patient infections and recalls.

Inadequate Regulatory Compliance Documentation

Suppliers may claim compliance with FDA 21 CFR, EU MDR, or other regulations but lack full technical files, 510(k) clearances, or CE certificates. Failure to verify documentation can result in shipment rejections or market access delays.

Inconsistent Dimensional and Flow Performance

Variability in inner diameter, wall thickness, or connector tolerances can affect flow rates and compatibility with IV sets and pumps. Poor quality control leads to batch-to-batch inconsistencies, risking clinical performance.

Intellectual Property-Related Pitfalls

Unintentional Design or Patent Infringement

Vented IV tubing may incorporate patented features such as specialized filter membranes, anti-siphon valves, or connector geometries. Sourcing from manufacturers who replicate protected designs without licensing exposes buyers to infringement lawsuits and product seizures.

Use of Counterfeit or Cloned Products

Some suppliers offer “compatible” tubing that closely mimics branded products. These may infringe on design patents or trade dress rights. Even if technically functional, they can trigger legal action and damage brand trust.

Lack of IP Warranty or Indemnification

Many low-cost suppliers do not provide contractual assurances that their products are free from IP violations. Without indemnification clauses, the buyer assumes full liability in case of IP disputes, including legal costs and damages.

Ambiguous Ownership of Custom Designs

When working with contract manufacturers on custom tubing solutions, failure to clearly define IP ownership in contracts can result in disputes. Suppliers may claim rights to design improvements, restricting your ability to switch vendors or scale production.

Mitigation Strategies

To avoid these pitfalls:

– Conduct rigorous supplier audits, including facility inspections and quality system reviews (e.g., ISO 13485 certification).

– Require full regulatory documentation and test reports (biocompatibility, sterility, performance).

– Perform independent product validation and third-party testing.

– Conduct freedom-to-operate (FTO) analyses before finalizing designs.

– Include strong IP indemnification clauses in procurement contracts.

– Work with legal counsel to ensure designs do not infringe existing patents.

By proactively addressing both quality and IP risks, organizations can ensure reliable, compliant, and legally secure sourcing of vented IV tubing.

Logistics & Compliance Guide for Vented IV Tubing

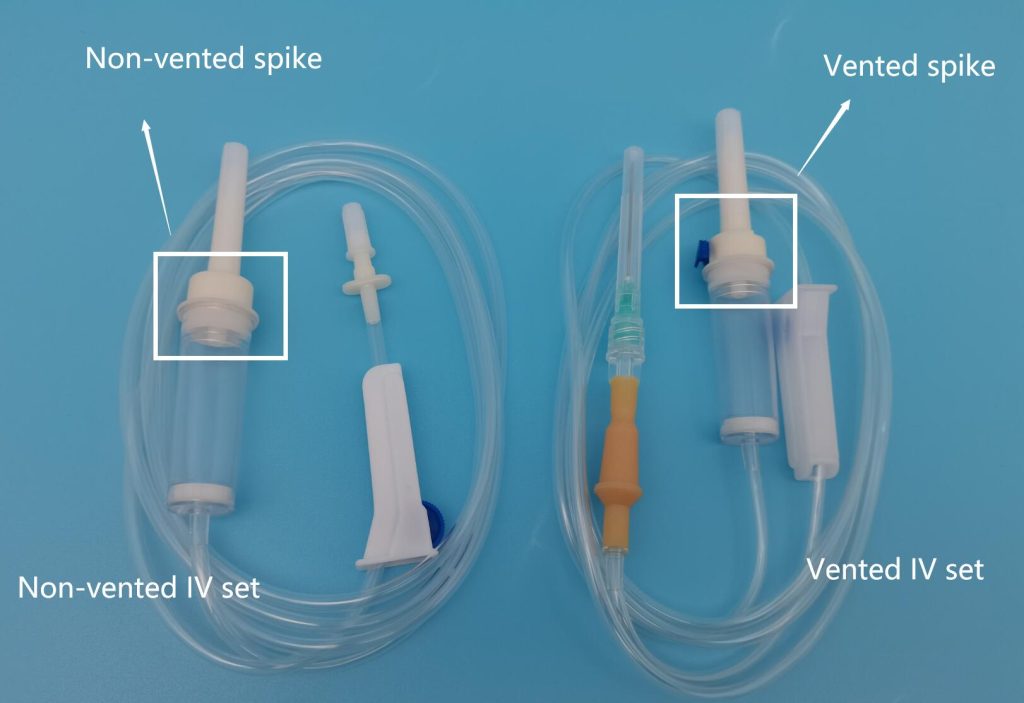

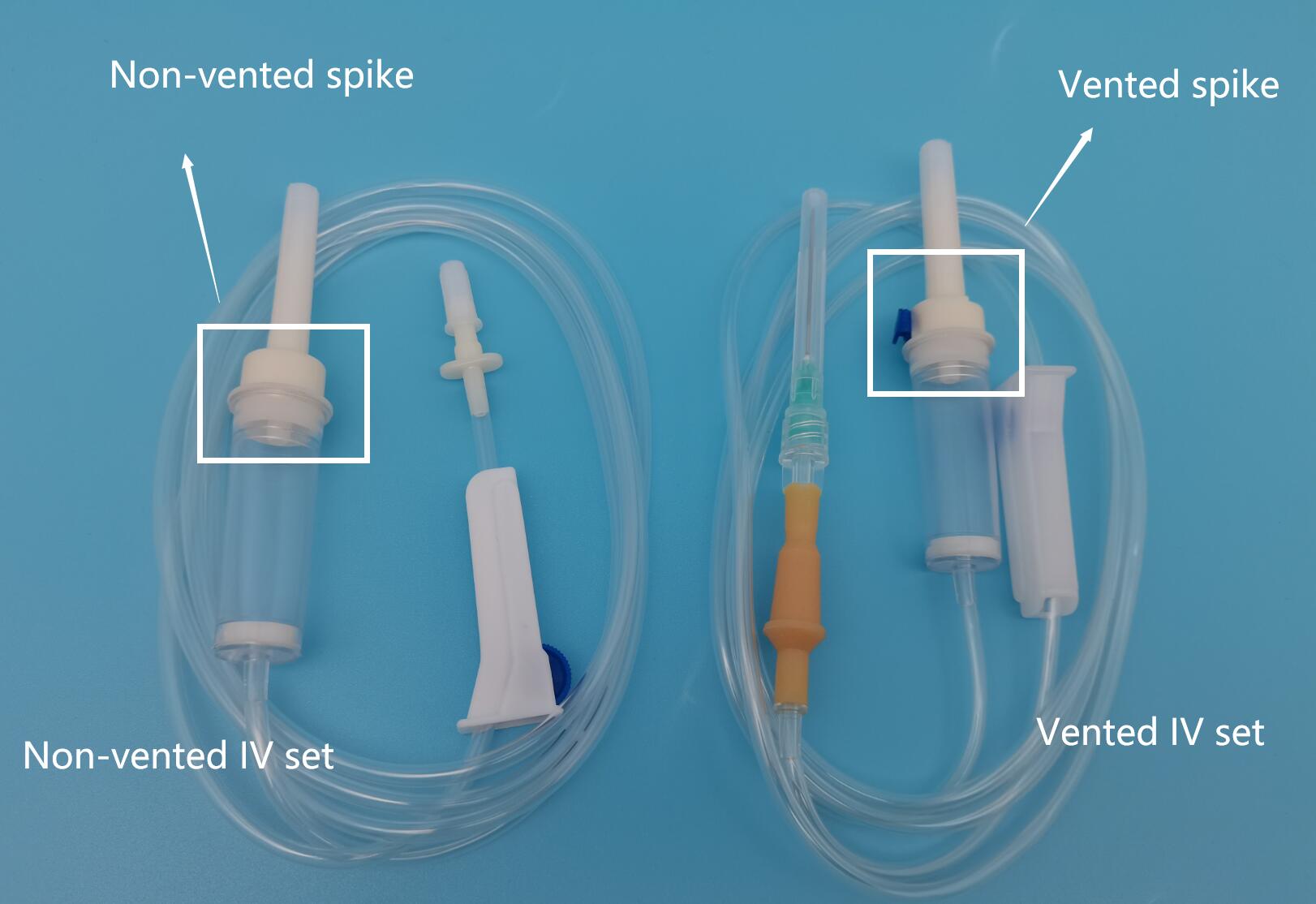

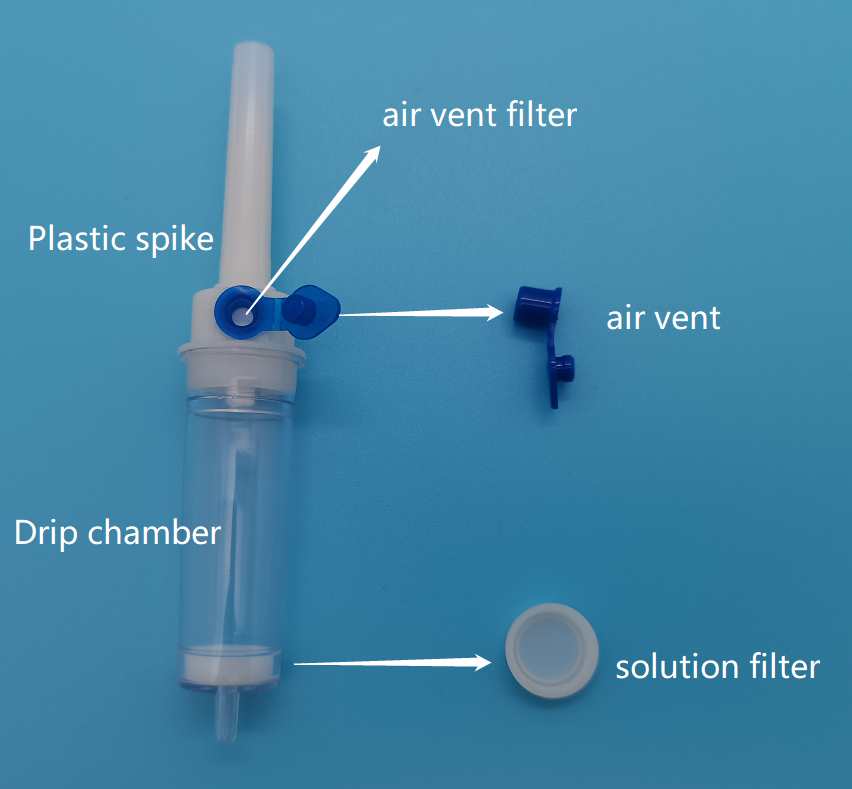

Product Overview and Classification

Vented IV (intravenous) tubing is a medical device used in healthcare settings to deliver fluids, medications, or blood products into a patient’s bloodstream. It includes a vented drip chamber that allows air to escape while maintaining a closed system, enabling the use of non-vented IV bags. This device is typically regulated as a Class II medical device under the U.S. FDA and similar classifications in other global markets (e.g., Class IIa under EU MDR). Understanding its classification is essential for regulatory compliance throughout the supply chain.

Regulatory Requirements and Documentation

Compliance begins with adherence to regional and international regulations. In the United States, vented IV tubing must be registered with the FDA and listed under 21 CFR Part 880.5300 (Intravenous Administration Sets). Manufacturers must maintain a Quality Management System (QMS) compliant with ISO 13485. For the European Union, conformity with the Medical Device Regulation (EU) 2017/745 (MDR) is required, including CE marking, Technical Documentation, and involvement of a Notified Body. Required documentation includes the Device Master Record (DMR), Unique Device Identifier (UDI), labeling per 21 CFR 801 (U.S.) or Annex I of EU MDR, and certificates of conformity.

Packaging and Labeling Standards

Proper packaging ensures sterility and product integrity during transport. Vented IV tubing must be individually sealed in sterile, tamper-evident packaging compatible with validated sterilization methods (typically ethylene oxide or gamma irradiation). Labeling must include UDI (human- and machine-readable), lot number, expiration date, manufacturer details, single-use designation, and regulatory markings (e.g., CE, FDA registration number). Labels must comply with language requirements in target markets and include symbols per ISO 15223-1. Barcodes should align with GS1 standards for traceability in hospital systems.

Storage and Handling Protocols

Vented IV tubing must be stored in a controlled environment: temperatures between 15°C and 30°C (59°F to 86°F), low humidity, and away from direct sunlight or chemical exposure. Products should remain in original packaging until use to prevent contamination or damage. Handling procedures must minimize physical stress (e.g., kinking or crushing) and ensure sterile integrity. Facilities should implement first-expired, first-out (FEFO) inventory practices and conduct regular audits to verify storage compliance.

Transportation and Distribution

Transportation must maintain product integrity and comply with regulatory standards for medical devices. Use validated shipping methods with temperature monitoring where applicable, especially for international shipments. Shipments should be protected from extreme temperatures, moisture, and physical shock. Carriers must be qualified and compliant with Good Distribution Practice (GDP) standards (e.g., WHO GDP, EU GDP guidelines). Documentation accompanying shipments should include packing lists, certificates of conformance, and commercial invoices with accurate HS codes (e.g., 9018.31 for IV administration sets under Harmonized System).

Import/Export Compliance

International logistics require compliance with customs and trade regulations. Exporters must obtain proper export licenses if required and ensure products meet destination country standards (e.g., ANVISA in Brazil, Health Canada, or TGA in Australia). Importers must verify local registration status and appoint an Authorized Representative where mandated (e.g., EU). Accurate customs declarations, including correct product coding, value, and origin, are critical to avoid delays. Sanctions screening and adherence to EAR/ITAR (if applicable) should be part of the compliance framework.

Post-Market Surveillance and Adverse Event Reporting

Compliance extends beyond distribution. Manufacturers and distributors must implement a post-market surveillance (PMS) system to monitor device performance. Any adverse events or malfunctions related to vented IV tubing must be reported per regional requirements: MedWatch in the U.S. (FDA 3500A form), via EUDAMED in the EU, or other national vigilance systems. Field safety corrective actions (FSCAs), such as recalls, require timely communication with regulatory bodies and healthcare providers.

Training and Quality Assurance

Personnel involved in logistics, warehousing, and compliance must receive regular training on GDP, device handling, and regulatory updates. Internal audits and supplier assessments should be conducted annually to ensure ongoing compliance. A robust Corrective and Preventive Action (CAPA) system should be maintained to address non-conformances in the supply chain. Records of training, audits, and quality reviews must be retained per regulatory retention timelines (typically 5–10 years post-product discontinuation).

Conclusion for Sourcing Vented IV Tubing

After a thorough evaluation of suppliers, product specifications, regulatory compliance, and cost-effectiveness, sourcing vented IV tubing requires a strategic approach to ensure patient safety, clinical efficacy, and supply chain reliability. Vented IV tubing remains essential in specific clinical settings—particularly when administering medications from glass vials or where precise air venting is required to prevent vacuum lock and ensure accurate fluid delivery.

Key factors in successful sourcing include adherence to ISO and FDA standards, material quality (e.g., DEHP-free options), compatibility with existing infusion systems, and supplier reliability. Engaging suppliers with proven track records, strong quality management systems, and the ability to meet volume and delivery requirements is critical. Additionally, considering sustainability and long-term cost—not just unit price—helps optimize value.

In conclusion, a well-informed sourcing strategy for vented IV tubing should balance clinical needs, regulatory compliance, and supply chain resilience. By selecting high-quality, compliant products from reputable suppliers, healthcare organizations can ensure safe, effective patient care while maintaining operational efficiency. Regular re-evaluation of suppliers and staying current with medical advancements will further support optimal sourcing decisions over time.