The global automotive interior components market is experiencing robust growth, fueled by rising vehicle production, increasing consumer demand for comfort and aesthetics, and the proliferation of electric vehicles requiring premium interiors. According to Mordor Intelligence, the automotive interior market was valued at USD 96.7 billion in 2023 and is projected to reach USD 130.2 billion by 2029, growing at a CAGR of approximately 5.2% during the forecast period. A key segment within this space is vehicle interior carpets, which are evolving with advancements in material science, sound insulation, and sustainability. As automakers and Tier-1 suppliers increasingly prioritize lightweight, eco-friendly, and customizable interior solutions, carpet manufacturers are expanding their R&D and production capabilities. Based on market presence, innovation, and global reach, the following are the top 10 vehicle interior carpet manufacturers shaping the future of automotive interiors.

Top 10 Vehicle Interior Carpet Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Engineered Solutions & Seating Systems for Automotive and Others …

Domain Est. 1999

Website: hopeglobal.com

Key Highlights: Hope Global is a preferred Tier 1/OEM manufacturer specializing in automotive interiors, wire carriers, and seating integration systems….

#2 Flooring

Domain Est. 1996

Website: accmats.com

Key Highlights: Made with true automotive grade carpet, we offer seven original materials plus our premium Essex carpet. In addition we manufacturer Vinyl flooring….

#3 Replacement Carpet Kits for Cars, Trucks, Vans, Suvs ON SALE …

Domain Est. 1999

Website: automotiveinteriors.com

Key Highlights: 8–13 day deliveryWe offer molded automotive replacement carpets for cars, trucks, vans, and suvs. These kits are generally produced in 2 business days and ship factory direct….

#4 Automotive

Domain Est. 2003

Website: dorsettind.com

Key Highlights: Dorsett has been the major manufacturer of replacement carpet for the automotive aftermarket, providing carpet in full rolls to distributors, manufacturers, ……

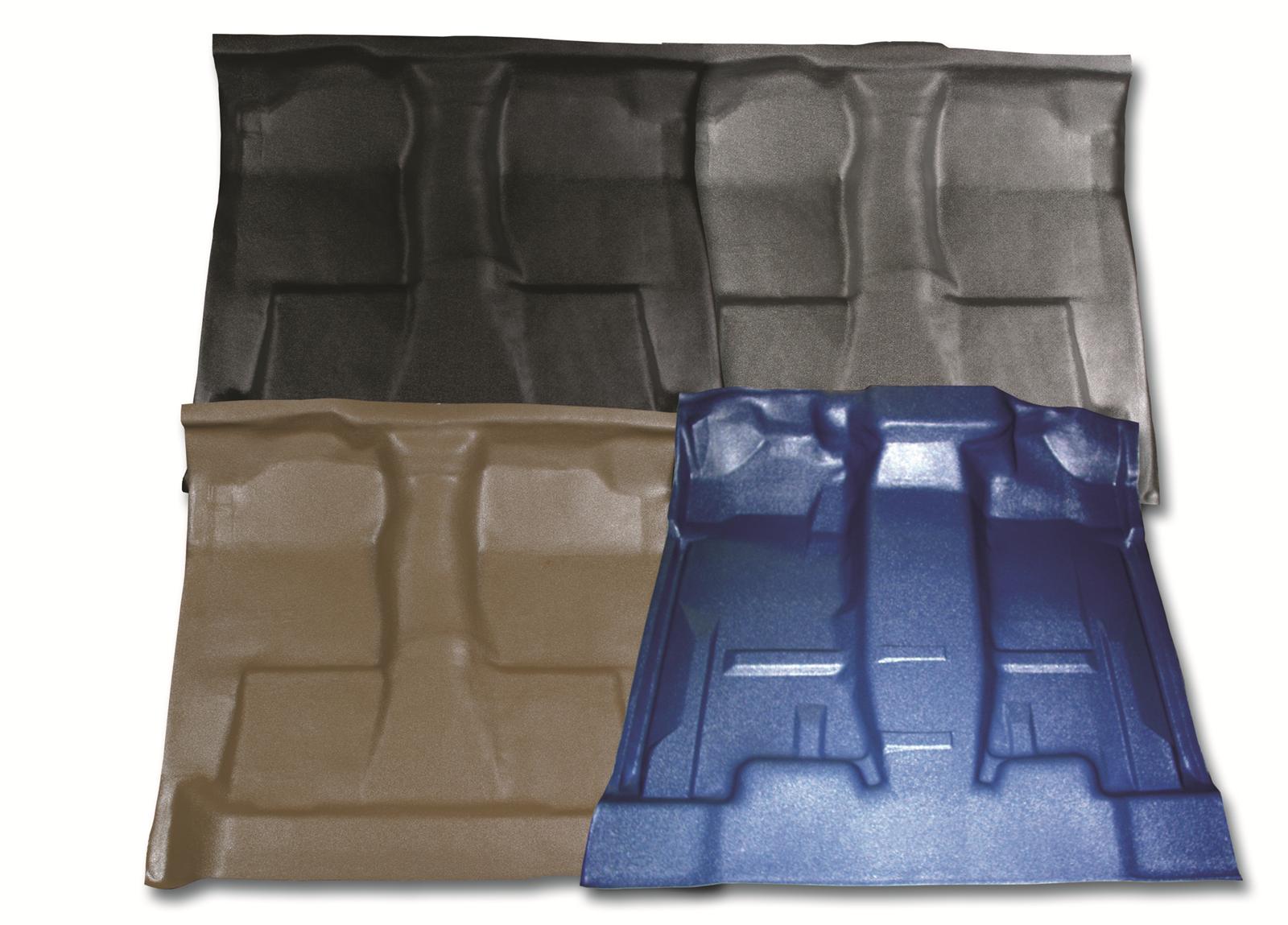

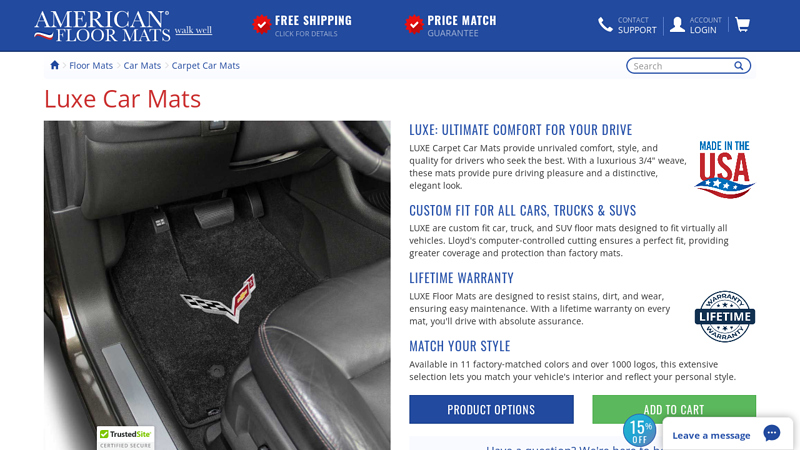

#5 Luxe Car Mats

Domain Est. 2006

Website: americanfloormats.com

Key Highlights: Free delivery over $100 10-day returnsAvailable in 11 factory-matched colors and over 1000 logos, this extensive selection lets you match your vehicle’s interior and reflect your p…

#6 Factory Interiors

Domain Est. 2013

Website: factoryinteriors.com

Key Highlights: Wide range of Auto Carpet Floor Mats and Accessories for cars trucks and SUVs. Custom made to order for your vehicles exact year make and model using only ……

#7 Classic Auto Carpet

Domain Est. 2016

Website: classicautocarpet.com

Key Highlights: Classic Auto Carpet is a proud distributor of OEM-Quality Carpet & Vinyl, Floors Mats, Trunk Mats and Sound Deadeners….

#8 Carpet Sets

Domain Est. 1997

Website: originalauto.com

Key Highlights: Carpet Sets. We pride ourselves on distributing the highest quality automotive carpets available for vehicles from the mid ’50s to present….

#9 Interior Carpeting for Classic Cars

Domain Est. 1999

Website: legendaryautointeriors.com

Key Highlights: 60-day returnsOur classic car carpets are made from a range of high-quality fibers to provide you with the best possible texture, look and feel….

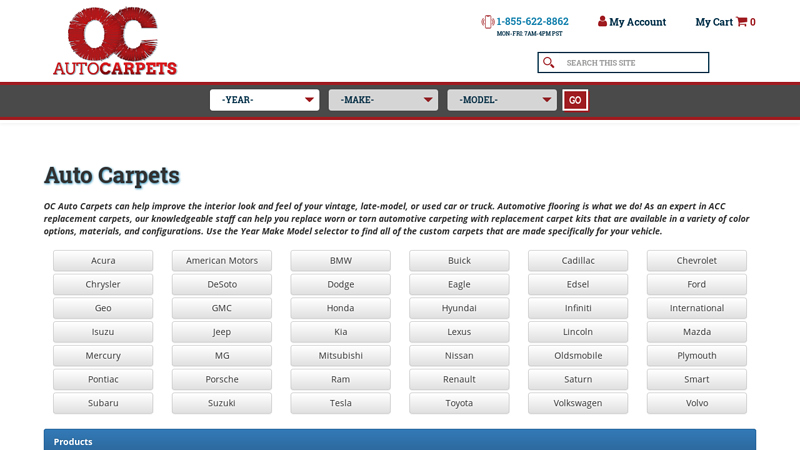

#10 Auto Carpets

Domain Est. 2012

Website: ocautocarpets.com

Key Highlights: 4-day deliveryUpdate your worn or torn interior flooring with ACC replacement carpets. Experts in automotive flooring and carpet for any year make model….

Expert Sourcing Insights for Vehicle Interior Carpet

H2: 2026 Market Trends for Vehicle Interior Carpet

As the automotive industry evolves rapidly, the vehicle interior carpet market is poised for significant transformation by 2026. Driven by shifts in consumer preferences, technological advancements, and sustainability imperatives, this sector is undergoing a renaissance. Below are the key trends shaping the vehicle interior carpet market in 2026 under the H2 (Hydrogen Economy and High-Performance Materials) framework, reflecting both material innovation and broader environmental goals.

1. Shift Toward Sustainable and Recyclable Materials

By 2026, sustainability will be a dominant force in automotive interior design. Vehicle interior carpets are increasingly being manufactured from recycled and bio-based materials. Leading automakers are adopting carpets made from recycled PET bottles, regenerated nylon (e.g., ECONYL), and plant-based polymers to reduce carbon footprints. Regulatory pressures in Europe and North America, along with ESG (Environmental, Social, and Governance) commitments, are accelerating this shift. OEMs are also designing carpets for easier disassembly and recycling at end-of-life, aligning with circular economy principles.

2. Integration with Hydrogen-Powered Vehicles (H2)

As the hydrogen economy gains momentum, particularly in commercial fleets and luxury segments, vehicle interiors—including carpets—are being redesigned to meet the specific requirements of hydrogen fuel cell vehicles (FCVs). These vehicles demand materials with higher resistance to moisture and chemical exposure due to the presence of hydrogen systems. Carpets used in H2 vehicles are being engineered with antimicrobial, anti-static, and enhanced durability features. Additionally, manufacturers are focusing on lightweight carpet solutions to improve overall vehicle efficiency and extend hydrogen range.

3. High-Performance Materials and Smart Textiles

The use of high-performance materials such as thermoplastic olefins (TPO), solution-dyed nylon, and polypropylene is expanding. These materials offer superior stain resistance, UV stability, and lower VOC (volatile organic compound) emissions. In 2026, smart carpet technologies are emerging—integrating sensors for occupancy detection, temperature regulation, and even health monitoring (e.g., detecting driver fatigue through foot pressure patterns). These innovations are particularly prominent in autonomous and premium electric and hydrogen vehicles.

4. Customization and Premiumization

Consumers are demanding greater personalization in vehicle interiors. By 2026, OEMs and Tier-1 suppliers are offering customizable carpet options in color, texture, and branding (e.g., illuminated logos, embroidered patterns). This trend is strongest in the luxury and electric vehicle (EV) segments, where interior ambiance plays a key role in brand differentiation. Digital printing and advanced tufting technologies are enabling cost-effective small-batch customization.

5. Lightweighting for Efficiency

With fuel efficiency and extended range being critical in both EVs and H2 vehicles, lightweighting remains a priority. Carpet manufacturers are developing thinner, denser, and multi-functional underlay systems that reduce weight without sacrificing comfort or noise insulation. The integration of carpet with sound-dampening and thermal insulation layers further enhances efficiency and contributes to quieter cabin experiences.

6. Regional Market Dynamics

Growth in the Asia-Pacific region—especially China and India—is driving demand for cost-effective yet durable interior carpets. Meanwhile, Europe leads in sustainable innovation due to stringent environmental regulations like the EU End-of-Life Vehicles Directive. North America is seeing increased adoption of high-performance, recyclable carpets, particularly in light of federal clean energy and hydrogen initiatives.

Conclusion

By 2026, the vehicle interior carpet market will be characterized by a convergence of sustainability, technological integration, and alignment with the hydrogen economy (H2). The industry is transitioning from a commodity-focused model to one centered on innovation, environmental responsibility, and enhanced user experience. As hydrogen-powered vehicles gain traction and high-performance materials become standard, interior carpets will play a crucial role in defining the next generation of automotive interiors.

Common Pitfalls in Sourcing Vehicle Interior Carpet (Quality, IP)

Sourcing vehicle interior carpet involves navigating a complex landscape of quality standards, material specifications, and intellectual property (IP) considerations. Failing to address key pitfalls can lead to product failures, supply chain disruptions, or legal challenges. Below are common issues encountered during the sourcing process, particularly related to quality and intellectual property.

1. Inconsistent Material Quality

One of the most frequent pitfalls is receiving carpets that vary in material quality across batches. Differences in fiber type (e.g., nylon vs. polyester), pile density, backing materials, or color fastness can impact both aesthetics and durability. Sourcing from suppliers without rigorous quality control systems often results in inconsistent thickness, tuft pull strength, or resistance to wear and UV degradation—critical factors in automotive environments.

2. Non-Compliance with Automotive Standards

Vehicle interior carpets must meet stringent industry standards such as ISO/TS 16949 (now IATF 16949), FMVSS 302 (flammability), and OEM-specific requirements. A common mistake is assuming general textile certifications are sufficient. Suppliers unfamiliar with automotive norms may deliver products that fail emissions tests (e.g., low VOC) or acoustic performance benchmarks, leading to rejection or costly rework.

3. Poor Fit and Dimensional Accuracy

Even minor deviations in cut dimensions or 3D shaping can prevent proper installation in the vehicle. This often stems from inadequate tooling or lack of first-article inspection (FAI) processes. Suppliers may use generic molds instead of OEM-approved dies, resulting in misalignment with trim panels, seat mounts, or floor components.

4. Inadequate Testing and Validation

Many suppliers provide samples that pass initial checks but fail under real-world conditions. Pitfalls include insufficient testing for abrasion resistance, color fading, moisture absorption, and dimensional stability under temperature extremes. Without access to proper environmental and mechanical test data, buyers risk field failures and warranty claims.

5. Intellectual Property Infringement Risks

Vehicle interior carpet designs—especially 3D molded or branded patterns—may be protected by design patents, copyrights, or trade dress. Sourcing from third-party suppliers without verifying IP ownership can lead to infringement claims, particularly when reverse-engineering OEM parts. Using logos, stitch patterns, or embossed textures without authorization exposes buyers to legal liability.

6. Unauthorized Subcontracting and Gray Market Goods

Some suppliers outsource production without disclosure, increasing the risk of counterfeit or non-approved materials. Gray market carpets—recycled, surplus, or diverted OEM stock—may appear authentic but lack traceability and warranty coverage. This compromises brand integrity and may violate OEM supply agreements.

7. Lack of Traceability and Documentation

Automotive sourcing requires full material traceability (e.g., batch numbers, raw material sources) and documentation (e.g., COC – Certificate of Conformance, PPAP submissions). Suppliers that fail to provide auditable records create compliance risks, especially during recalls or quality audits.

8. Overlooking Sustainable and Regulatory Requirements

Modern vehicles demand eco-friendly materials and compliance with regulations like REACH, RoHS, and ELV. Sourcing carpets containing restricted substances (e.g., certain phthalates or heavy metals) or non-recyclable composites can result in shipment rejections or market access issues.

Conclusion

To mitigate these pitfalls, buyers should conduct thorough supplier audits, require full compliance documentation, validate IP rights, and implement robust quality assurance protocols. Partnering with certified automotive textile suppliers and leveraging OEM-approved specifications are key to ensuring reliable, legal, and high-performing vehicle interior carpet sourcing.

Logistics & Compliance Guide for Vehicle Interior Carpet

Overview

This guide outlines the essential logistics and compliance requirements for the transportation, storage, and regulatory adherence of vehicle interior carpet components used in automotive manufacturing and aftermarket supply chains. Proper handling ensures product quality, supply chain efficiency, and compliance with international and regional standards.

Packaging Requirements

Vehicle interior carpets must be packaged to prevent damage during transit and storage. Use moisture-resistant materials to avoid mold or mildew, especially in humid climates. Corrugated cardboard boxes, plastic wraps, or reusable containers are standard. Label all packages with part numbers, batch/lot numbers, production dates, and handling instructions (e.g., “Do Not Stack”, “Protect from Moisture”).

Storage Conditions

Store carpets in dry, temperature-controlled environments (15–25°C, 30–60% relative humidity) to prevent warping, odor development, or material degradation. Keep away from direct sunlight and chemical exposure. Stack pallets safely to avoid crushing lower layers and rotate stock using FIFO (First In, First Out) principles.

Transportation Standards

Use enclosed, clean transport vehicles (trucks, containers) to protect from dust, moisture, and contamination. Secure loads to prevent shifting. For international shipping, comply with ISPM 15 regulations for wooden pallets (heat-treated and stamped). Maintain temperature and humidity logs if transporting through extreme climates.

Regulatory Compliance

Ensure vehicle interior carpets meet relevant safety and environmental standards:

- FMVSS 302 (U.S.): Flammability resistance—carpets must not propagate flame beyond specified limits.

- ECE R118 (Europe): Fire safety for materials used in motor vehicles.

- REACH (EU): Registration, Evaluation, Authorization, and Restriction of Chemicals—ensure restricted substances (e.g., phthalates, azo dyes) are absent or within limits.

- RoHS (EU/China): Restriction of hazardous substances in electrical and electronic components (if applicable to backing or fasteners).

- VOC Emissions (e.g., GB/T 27630 in China, VDA 276 in Germany): Limit volatile organic compounds to ensure cabin air quality.

Documentation and Traceability

Maintain full documentation, including:

– Certificate of Conformity (CoC) for each batch

– Material Safety Data Sheets (MSDS/SDS)

– Test reports for flammability, emissions, and chemical content

– Batch/lot traceability records for recall management

Import/Export Considerations

For cross-border shipments:

– Classify under correct HS Code (e.g., 5702.31 or 5702.41 for tufted carpets).

– Provide accurate commercial invoices, packing lists, and certificates of origin.

– Comply with destination country’s automotive interior regulations and customs duties.

Sustainability and End-of-Life

Adhere to Extended Producer Responsibility (EPR) laws where applicable. Design for recyclability using mono-materials or clearly separable components. Document recycling instructions and support take-back programs in regions with strict end-of-life vehicle (ELV) directives (e.g., EU ELV Directive 2000/53/EC).

Quality Assurance and Audits

Conduct regular audits of logistics partners and manufacturing sites. Validate compliance through third-party testing labs accredited to ISO 17025. Perform periodic shipment inspections to verify packaging integrity and material condition.

Incident Response and Recalls

Establish a recall protocol in case of non-compliance or safety issues. Ensure rapid communication with customers, regulators, and logistics providers. Maintain a product tracking system capable of identifying affected batches across the supply chain.

Conclusion for Sourcing Vehicle Interior Carpet:

Sourcing vehicle interior carpet requires a strategic approach that balances quality, cost, durability, and compliance with automotive standards. After evaluating suppliers, materials, and manufacturing capabilities, it is evident that selecting a reliable partner with expertise in automotive textiles and custom solutions is crucial. Key considerations such as material composition (e.g., nylon, polyester, recycled fibers), color fastness, acoustic and thermal insulation properties, and resistance to wear and environmental conditions must align with vehicle specifications and brand expectations. Additionally, sustainability and supply chain resilience are increasingly important factors in modern automotive sourcing.

In conclusion, a successful sourcing strategy involves thorough due diligence, long-term supplier collaboration, and adherence to industry regulations to ensure the interior carpet not only enhances passenger comfort and aesthetics but also meets performance and sustainability goals. By prioritizing these elements, automakers and tier suppliers can achieve a high-quality, cost-effective, and eco-conscious interior solution that supports overall vehicle value and customer satisfaction.