The global inner tubes market is experiencing steady growth, driven by continued demand in two-wheelers, commercial vehicles, and agricultural machinery—especially in emerging economies across Asia-Pacific and Latin America. According to a report by Mordor Intelligence, the global tire inner tubes market was valued at USD 2.8 billion in 2023 and is projected to reach USD 3.7 billion by 2029, growing at a CAGR of approximately 4.7% during the forecast period. This growth is sustained by factors such as the prevalence of bias-ply tires in developing regions, rising vehicle ownership, and the need for cost-effective repair solutions in rural and off-road transport. Amid this expanding landscape, a select group of manufacturers dominate production, combining legacy expertise, extensive distribution networks, and consistent quality to maintain leading positions. Here are the top 8 vehicle inner tube manufacturers shaping the industry’s trajectory.

Top 8 Vehicle Inner Tubes Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Inner Tube, Rubber Flaps, Tire Tubes

Domain Est. 2020 | Founded: 1992

Website: florescencetube.com

Key Highlights: Qingdao Florescence Co., Ltd is a leading and professional inner tube manufacturer since 1992. Our products mainly include inner tubes for car, bus &truck ……

#2 Viaz Tyres

Domain Est. 2022

Website: viaztyres.com

Key Highlights: Viaz Tyres specializes in high-quality butyl tubes for bicycles, motorcycles, passenger cars, and industrial vehicles. We also provide auto lubricants, ……

#3 Inner Tube Manufacturer

Domain Est. 1997

Website: firestonetubes.com

Key Highlights: Bridgestone America’s tube manufacturer provides quality synthetic & natural rubber inner tubes for on & off the highway located in Russellville, Arkansas….

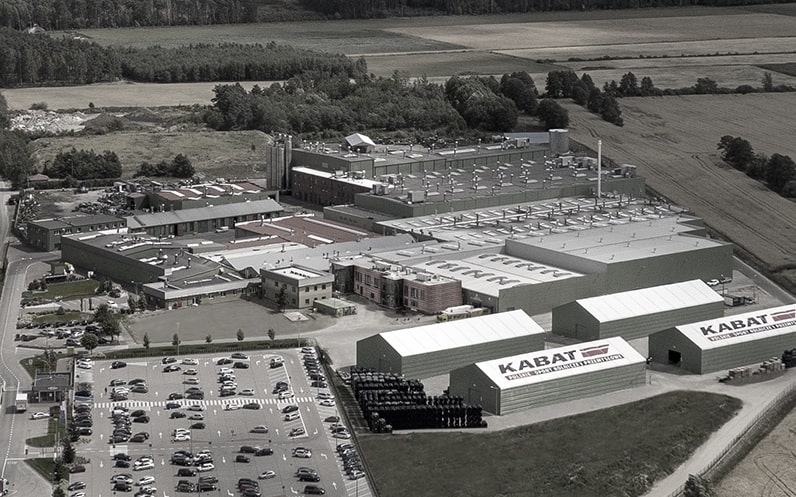

#4 Kabat Tire Polish Tire and Tube Manufacturer – Kabat Tyre

Domain Est. 2001

Website: kabat.pl

Key Highlights: We’re a Polish manufacturer of agricultural tyres and solid tyres for forklifts, inner tubes, flaps, rubber profiles, rubber compounds and the broad category ……

#5 Dolfin Rubbers

Domain Est. 2022 | Founded: 1995

Website: dolfintyres.com

Key Highlights: Dolfin Rubbers Limited has been engaged in the manufacturing of premium-grade tyre tubes for various vehicles since 1995. With years of experience and ……

#6 Inner Tubes for Collector Vehicles

Domain Est. 1999

#7 to TBC Brands

Domain Est. 2010

Website: tbcbrands.com

Key Highlights: TBC Brands is the largest marketer of private brand tires in North America….

#8 Tubes for All Applications

Domain Est. 2022

Website: trelleborg-tires.com

Key Highlights: Trelleborg Tires offers a full range of high-quality inner tubes to ensure airtight performance and extended service life in all applications….

Expert Sourcing Insights for Vehicle Inner Tubes

H2: 2026 Market Trends for Vehicle Inner Tubes

The global market for vehicle inner tubes is expected to experience moderate but strategic shifts by 2026, influenced by evolving transportation demands, technological advancements, and regional economic developments. While the trend toward tubeless tires continues to dominate in passenger vehicles, inner tubes remain relevant in specific segments, driving targeted growth in niche markets.

-

Steady Demand in Commercial and Heavy-Duty Vehicles

Inner tubes are expected to maintain strong usage in trucks, buses, and off-road construction vehicles, especially in emerging economies. Regions such as South Asia, Africa, and Southeast Asia continue to rely on inner tube-based tire systems due to lower maintenance costs, ease of repair, and compatibility with older vehicle fleets. By 2026, increasing freight and logistics activities in these regions will sustain demand for durable inner tubes. -

Growth in Two-Wheeler and Agricultural Sectors

The two-wheeler market, particularly in India, Indonesia, and parts of Latin America, remains a key driver for inner tube consumption. Motorcycles and scooters in these regions often use tubed tires due to cost sensitivity and road conditions. Similarly, agricultural machinery in rural areas relies on inner tubes for their resilience on rough terrain. These applications are projected to contribute significantly to volume growth by 2026. -

Material Innovation and Sustainability Focus

Manufacturers are investing in halogenated butyl rubber and eco-friendly compounds to improve air retention and reduce environmental impact. By 2026, there will be a noticeable shift toward recyclable and longer-lasting inner tube materials, aligning with global sustainability goals. Some producers are exploring biobased rubber alternatives to reduce dependency on petroleum-based synthetics. -

Regional Market Divergence

While North America and Western Europe continue their decline in inner tube usage due to the dominance of tubeless technology, markets in Africa, South Asia, and the Middle East are expected to account for over 60% of global inner tube demand by 2026. Local manufacturing expansion and government infrastructure projects will further support regional consumption. -

Impact of E-Mobility and Light EVs

The rise of electric two-wheelers and rickshaws in urban Asia is creating new opportunities for specialized lightweight inner tubes. These vehicles often operate in stop-start environments with heavy loads, making robust, repairable tubed systems preferable in certain conditions. Inner tube manufacturers are adapting designs to meet the unique pressure and heat dissipation needs of electric fleets. -

Aftermarket and Repair Segment Growth

The repair and replacement segment will remain a key revenue source. With rising vehicle ownership in developing countries, cost-effective inner tube repairs are preferred over full tire replacement. By 2026, a growing network of local service centers and mobile repair units will bolster aftermarket sales.

In conclusion, while the overall relevance of inner tubes is diminishing in high-income markets, their strategic importance in developing regions and specialty applications ensures sustained market presence through 2026. Innovation, localization, and alignment with infrastructure development will be critical success factors for manufacturers aiming to capitalize on these evolving trends.

Common Pitfalls Sourcing Vehicle Inner Tubes (Quality, IP)

Sourcing vehicle inner tubes can seem straightforward, but several critical pitfalls related to quality and intellectual property (IP) can lead to product failures, customer dissatisfaction, and legal risks if not carefully managed.

Quality-Related Pitfalls

Inconsistent Rubber Formulation and Material Quality

Using substandard or inconsistent rubber compounds (e.g., low-grade natural rubber or excessive reclaimed rubber) leads to poor elasticity, increased susceptibility to leaks, and shorter lifespan. This results in high failure rates and warranty claims.

Poor Manufacturing Tolerances and Seam Integrity

Inadequate control during vulcanization or seam bonding can produce tubes with weak seams or uneven wall thickness. These flaws are primary causes of blowouts and air loss, especially under sustained pressure or temperature changes.

Incorrect Sizing and Fitment Issues

Sourcing tubes that do not precisely match OEM specifications—either in diameter, valve type, or stretch characteristics—can lead to pinching during installation, uneven wear, and premature failure. Misfitting tubes compromise tire performance and safety.

Valve Stem Defects and Compatibility

Low-quality valve stems made from brittle rubber or poorly bonded to the tube can crack or leak. Additionally, using incorrect valve types (e.g., Schrader vs. Presta) or incompatible stem lengths for specific wheel rims leads to installation problems and air loss.

Inadequate Testing and Quality Control

Suppliers lacking rigorous in-line and batch testing (e.g., air retention, burst pressure, and visual inspection) may ship defective tubes. Without proper QC protocols, consistency across production runs cannot be guaranteed.

Intellectual Property (IP)-Related Pitfalls

Unauthorized Use of Branded Designs or Logos

Sourcing tubes bearing counterfeit logos, trademarks, or design elements of well-known brands (e.g., Michelin, Goodyear) exposes buyers to IP infringement claims, customs seizures, and reputational damage.

Copying Patented Valve or Tube Designs

Some manufacturers hold patents on unique valve mechanisms, tube construction methods, or performance features. Sourcing generic tubes that replicate these protected innovations—even unintentionally—can result in legal liability and supply chain disruptions.

Lack of IP Due Diligence in Supplier Vetting

Failing to verify that suppliers have the right to manufacture and sell the product, or to request IP indemnification clauses in contracts, leaves buyers exposed to third-party litigation and financial penalties.

Grey Market or Diverted Goods

Purchasing tubes intended for specific regional markets or distribution channels (e.g., tubes diverted from OEM contracts) may violate licensing agreements and trigger IP-related disputes, even if the product is genuine.

Avoiding these pitfalls requires thorough supplier audits, material specifications, quality assurance testing, and legal review of product designs to ensure both performance reliability and IP compliance.

Logistics & Compliance Guide for Vehicle Inner Tubes

Overview

Vehicle inner tubes are essential components for certain tire systems, particularly in commercial, agricultural, and specialty vehicles. Transporting and distributing inner tubes requires adherence to specific logistics practices and regulatory compliance standards to ensure product integrity, safety, and legal conformity across domestic and international supply chains.

Classification and Tariff Codes

Vehicle inner tubes are typically classified under the Harmonized System (HS) code 4013.10, which covers “Inflatable ball bladders and new pneumatic inner tubes for tires.” Accurate classification is crucial for import/export declarations, tariff assessments, and customs clearance. Specific sub-classifications may vary by country; verify with local customs authorities or a licensed customs broker.

Packaging and Handling Requirements

Proper packaging ensures inner tubes remain undamaged during storage and transit:

– Inner tubes should be coiled neatly and secured with non-abrasive ties.

– Use protective packaging such as polybags or cardboard boxes to prevent punctures and exposure to dust, moisture, and UV light.

– Avoid over-compression or stacking excessive weight, which may cause deformation.

– Clearly label packages with product details, size specifications, and handling instructions (e.g., “Do Not Stack,” “Protect from Sunlight”).

Storage Conditions

To maintain product quality:

– Store in a cool, dry, and well-ventilated area.

– Maintain temperatures between 10°C and 25°C (50°F to 77°F).

– Avoid exposure to direct sunlight, ozone sources (e.g., electric motors), and chemicals such as oils, solvents, and acids.

– Keep away from sharp objects and sources of heat.

Transportation Regulations

- Inner tubes are generally not classified as hazardous materials under international transport regulations (e.g., IMDG, IATA, ADR), provided they are not inflated.

- Inflated inner tubes may be subject to pressure-related restrictions; deflating before shipment is recommended.

- Use enclosed vehicles or containers to protect from weather and contamination during transit.

- Secure loads to prevent shifting that could damage packaging.

Import and Export Documentation

Ensure the following documents are prepared and accurate:

– Commercial invoice detailing product description, quantity, value, and HS code.

– Packing list specifying number of inner tubes per package and total gross/net weights.

– Bill of lading or air waybill.

– Certificate of origin (required by some countries for tariff preferences).

– Import permits or approvals, if required by the destination country.

Regulatory Compliance

- REACH (EU): Ensure compliance with registration, evaluation, authorization, and restriction of chemicals. Rubber components must not contain restricted substances above threshold levels.

- RoHS (EU): While primarily for electronics, certain auxiliary components (e.g., valve stems with electronic sensors) may fall under scope.

- DOT (USA): No direct DOT regulation for inner tubes, but alignment with FMVSS for tire safety systems is recommended.

- Country-Specific Standards: Some markets may require certification (e.g., INMETRO in Brazil, CCC in China); verify requirements based on destination.

Environmental and Disposal Considerations

- Used inner tubes are classified as waste rubber and must be disposed of or recycled in accordance with local environmental regulations.

- Encourage end-of-life recycling through certified rubber reprocessing facilities.

- Comply with Extended Producer Responsibility (EPR) schemes where applicable.

Quality Assurance and Traceability

- Maintain batch traceability for quality control and recall preparedness.

- Conduct periodic inspections of stock to detect aging or degradation.

- Partner with suppliers who provide material test reports and compliance documentation.

Conclusion

Adhering to logistics best practices and compliance requirements ensures the safe, efficient, and legal movement of vehicle inner tubes across global markets. Regular review of regulatory updates and close coordination with logistics providers and customs authorities are essential for supply chain resilience.

In conclusion, sourcing vehicle inner tubes requires a strategic approach that balances quality, cost, reliability, and compliance with industry standards. It is essential to evaluate suppliers based on their manufacturing capabilities, material quality, certifications, and track record for on-time delivery. Developing strong supplier relationships, conducting regular quality audits, and staying informed about market trends and technological advancements can significantly enhance sourcing efficiency. Additionally, considering sustainability and supply chain resilience will support long-term success. By implementing a well-structured sourcing strategy, organizations can ensure a consistent supply of high-performing inner tubes that meet operational demands and contribute to overall vehicle safety and performance.