The global vapor corrosion inhibitor (VCI) market is experiencing robust growth, driven by increasing demand for advanced corrosion protection solutions across industries such as automotive, aerospace, electronics, and defense. According to Grand View Research, the global corrosion inhibitors market was valued at USD 8.37 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of over 5.6% during the forecast period of 2023–2028, citing rising infrastructure investments and stringent regulations around asset longevity and maintenance. A key segment within this market is VCI packaging—particularly VCI bags—due to their effectiveness in safeguarding metal components during storage and shipping without the need for additional greasing or coatings. As industries prioritize non-toxic, environmentally compliant, and cost-efficient preservation methods, the demand for high-performance VCI bags has surged, prompting innovation and expansion among leading manufacturers worldwide. The following list highlights the top nine VCI bag manufacturers leading this growth through technological advancement, global reach, and product reliability.

Top 9 Vapor Corrosion Inhibitor Bags Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Green Packaging Inc.: VCI Products

Domain Est. 2009

Website: green-vci.com

Key Highlights: Green Packaging is a distributor of industrial packaging materials offering rust and corrosion prevention. Protect metal parts with our VCI Packaging ……

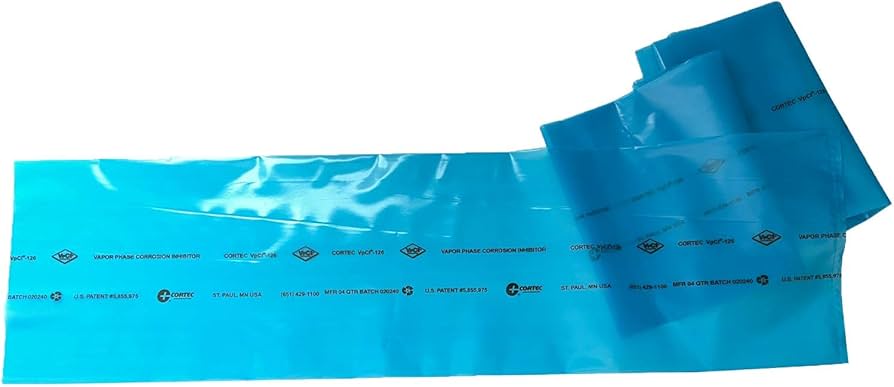

#2 VCI Bags, VCI Corrosion Protection Film, VCI Packaging Films

Domain Est. 1996

Website: cortecvci.com

Key Highlights: At Cortec®, we make premium VCI (vapor corrosion inhibitor) films and bags under the VpCI® brand name—a distinguishing mark of quality in ……

#3 VCI Anti

Domain Est. 1998

Website: itape.com

Key Highlights: IPG’s VCI2000® brand anti-corrosion packaging comes in a variety of forms such as VCI poly bags, VCI papers, VCI emitters, and VCI films….

#4 ZERUST® ICT® Zipper VCI Bags

Domain Est. 1999

Website: zerust.com

Key Highlights: ZERUST®/EXCOR® ICT® Zipper VCI Bags provide convenient and proven protection against corrosion for metals in shipping and storage for years….

#5 Vapor Corrosion Inhibitor (VCI) Storage Bags

Domain Est. 1999

#6 VCI2000: VCI Packaging

Domain Est. 2001

Website: vci2000.com

Key Highlights: VCI2000® offers a large selection of VCI Packaging products such as: VCI bags VCI Gusseted bags, Shrink & Stretch VCI Papers, VCI Emitters and VCI systems….

#7 Rust Prevention Packaging

Domain Est. 2004

Website: armorvci.com

Key Highlights: Our VCI (vapor corrosion inhibitor) coated papers, films, VCI bags and emitters provide the anti-corrosion protection you’re looking for….

#8 VCI Films and Bags

Domain Est. 2004

Website: daubertcromwell.com

Key Highlights: Daubert Cromwell specializes in providing quality Volatile Corrosion Inhibitor (VCI) anti-corrosion films and other products and services….

#9 Multipurpose VCI Poly Bags

Domain Est. 2009

Website: zerustproducts.com

Key Highlights: In stock Free delivery over $40Zerust Multipurpose VCI Poly Bags protect metal tools, machine parts, engines or other metal items normally prey to rust and corrosion damage….

Expert Sourcing Insights for Vapor Corrosion Inhibitor Bags

H2: 2026 Market Trends for Vapor Corrosion Inhibitor (VCI) Bags

The global market for Vapor Corrosion Inhibitor (VCI) bags is projected to experience significant growth by 2026, driven by increasing demand across key industrial sectors, technological advancements, and a growing emphasis on asset preservation and sustainability. Below is an analysis of the major trends shaping the VCI bag market in 2026:

-

Rising Industrial Demand Across Automotive and Manufacturing Sectors

The automotive and heavy manufacturing industries continue to be primary consumers of VCI bags, particularly for protecting metal components during storage and transit. As global automotive production recovers and expands—especially in emerging economies—demand for effective corrosion protection solutions like VCI bags is escalating. In 2026, just-in-time manufacturing and extended supply chains further amplify the need for reliable, long-term corrosion prevention, positioning VCI technology as a critical packaging solution. -

Growth in Defense and Aerospace Applications

Defense and aerospace industries are increasingly adopting VCI bags to safeguard sensitive equipment, weapons, and aircraft parts from humidity and salt exposure. With rising defense budgets in regions such as North America, Asia-Pacific, and the Middle East, procurement of corrosion-inhibiting packaging is expected to rise. VCI bags are favored for their lightweight nature, ease of use, and ability to protect complex geometries, making them ideal for military logistics and aerospace maintenance. -

Technological Advancements and Product Innovation

By 2026, manufacturers are introducing next-generation VCI bags featuring multi-layer films, enhanced vapor diffusion control, and eco-friendly formulations. Innovations include biodegradable VCI bags and those compatible with recycling streams, addressing environmental concerns. Additionally, smart VCI packaging with humidity indicators or RFID tracking is gaining traction, offering real-time monitoring and improved inventory management for high-value goods. -

Sustainability and Regulatory Pressures

Environmental regulations are pushing companies to adopt greener alternatives to traditional plastic packaging. In response, VCI bag producers are developing recyclable, compostable, or bio-based VCI films. The European Union’s Green Deal and similar initiatives worldwide are accelerating this shift. By 2026, sustainable VCI bags are expected to capture a growing market share, especially among environmentally conscious manufacturers and exporters. -

Regional Market Expansion

Asia-Pacific is anticipated to be the fastest-growing market for VCI bags in 2026, fueled by industrialization in countries like India, Vietnam, and Indonesia, and increasing exports of machinery and electronics. North America and Europe maintain strong demand due to established industrial bases and stringent quality standards. Meanwhile, Latin America and the Middle East are emerging as new growth regions, driven by infrastructure development and energy sector investments. -

E-Commerce and Logistics Growth

The expansion of global e-commerce and cross-border logistics has increased the need for protective packaging solutions. VCI bags are being adopted not only for bulk industrial shipments but also for smaller, high-value items shipped directly to consumers or technicians. This trend is especially evident in sectors like consumer electronics, tools, and medical devices. -

Competitive Landscape and Strategic Partnerships

The VCI bag market in 2026 is characterized by consolidation and collaboration. Major players such as Cortec Corporation, Henkel AG, and 3M are expanding their product portfolios and forming strategic alliances with packaging distributors and logistics companies. Regional manufacturers are also investing in R&D to improve performance and reduce costs, intensifying competition.

Conclusion

By 2026, the VCI bag market is set to grow steadily, supported by industrial modernization, technological innovation, and sustainability trends. Companies that invest in eco-friendly materials, smart packaging integration, and region-specific solutions are likely to lead the market. As corrosion-related losses remain a significant economic burden, VCI bags will continue to play a vital role in preserving metal assets across global supply chains.

Common Pitfalls Sourcing Vapor Corrosion Inhibitor (VCI) Bags – Quality and Intellectual Property (IP) Risks

Sourcing Vapor Corrosion Inhibitor (VCI) bags involves significant risks related to both product quality and intellectual property (IP) protection. Overlooking these pitfalls can lead to ineffective corrosion protection, financial losses, supply chain disruptions, and legal liabilities.

Quality-Related Pitfalls

1. Inconsistent or Inadequate VCI Emission:

Low-quality VCI bags often fail to emit the correct concentration of corrosion-inhibiting vapors consistently over the required time frame. This results in inadequate protection, especially in challenging environments (high humidity, temperature fluctuations, long storage durations). Without proper certification or third-party testing data, buyers cannot verify emission performance.

2. Poor Material Integrity and Durability:

Substandard bags may use weak or non-uniform film materials that tear easily during handling or packaging. This compromises the controlled release of VCI compounds and exposes the protected items to environmental moisture and contaminants.

3. Incorrect or Undisclosed VCI Chemistry:

Suppliers may use ineffective or outdated VCI formulations, or fail to disclose the exact chemical composition. This is particularly risky when protecting sensitive metals (e.g., electronics, mixed metals), as incompatible VCI chemistries can cause staining, fretting, or accelerated corrosion.

4. Lack of Certification and Compliance Documentation:

Reputable VCI bags should meet international standards (e.g., ASTM D6038, MIL-PRF-22019, JIS Z-1535). Sourcing from suppliers who cannot provide test reports, Material Safety Data Sheets (MSDS), or RoHS/REACH compliance documentation increases the risk of non-compliance and product failure.

5. Inadequate Shelf Life and Performance Validation:

Some VCI bags degrade over time or lose effectiveness before the claimed shelf life expires. Without access to accelerated aging tests or real-world performance data, buyers risk purchasing expired or underperforming products.

Intellectual Property (IP) Pitfalls

1. Counterfeit or Reverse-Engineered Products:

The VCI market is prone to counterfeit goods that mimic branded packaging but contain inferior or ineffective formulations. These products may infringe on the IP of original manufacturers and offer no reliable protection.

2. Unauthorized Use of Patented Technology:

Many VCI formulations and bag designs are protected by patents. Sourcing from non-licensed manufacturers may inadvertently involve the use of patented IP without permission, exposing the buyer to legal risk, especially in regulated industries or export markets.

3. Lack of Transparency in Formulation Ownership:

Suppliers may not disclose whether they develop their own VCI chemistry or license it from third parties. This lack of transparency complicates IP due diligence and increases the risk of using proprietary technology without proper authorization.

4. Brand and Trademark Infringement:

Unethical suppliers may use logos or brand names similar to established VCI manufacturers to mislead buyers. Purchasing such products not only risks performance failure but may also implicate the buyer in trademark infringement if the goods are distributed commercially.

5. Weak Contractual IP Protections:

Procurement agreements that fail to include clauses on IP ownership, warranty of non-infringement, and indemnification leave buyers vulnerable if IP disputes arise. Without these safeguards, the buyer may bear legal and financial responsibility for IP violations committed by the supplier.

Mitigation Strategies

- Require full technical documentation, including test reports, MSDS, and compliance certificates.

- Source from authorized distributors or directly from IP holders to avoid counterfeit or infringing products.

- Conduct third-party lab testing of sample batches to verify VCI performance and material quality.

- Include strong IP warranties and indemnification clauses in supplier contracts.

- Perform supplier audits to assess manufacturing processes, quality control, and IP compliance practices.

By proactively addressing these quality and IP pitfalls, organizations can ensure reliable corrosion protection and minimize legal and operational risks in their supply chain.

Logistics & Compliance Guide for Vapor Corrosion Inhibitor (VCI) Bags

Overview of VCI Bags

Vapor Corrosion Inhibitor (VCI) bags are specialized packaging materials designed to protect metal components from corrosion during storage and transportation. These bags release corrosion-inhibiting molecules that form a protective molecular layer on metal surfaces, preventing oxidation without the need for oils or coatings. Due to their chemical nature, VCI bags require careful handling, storage, and shipping in compliance with relevant regulations.

Regulatory Classification and Identification

VCI bags often contain volatile organic compounds (VOCs) or other chemically active substances that may be regulated under international, national, and regional frameworks. While the bags themselves are generally classified as non-hazardous under transport regulations (e.g., IATA, IMDG, ADR), the chemical additives may require proper documentation.

- UN Number: Typically not assigned if the bag is considered a “packaging with adsorbed hazardous substance” and meets exemption criteria.

- Proper Shipping Name: Often shipped as “Not Restricted” or “Not Subject to Regulations” if below threshold concentrations.

- Safety Data Sheet (SDS): Required under OSHA’s Hazard Communication Standard (29 CFR 1910.1200) and GHS. Ensure SDS is available for each VCI formulation, detailing hazards, handling, and disposal.

International Transport Regulations

VCI bags must comply with key transportation regulations depending on the mode and region:

Air Transport (IATA DGR)

- Most VCI bags are exempt from IATA dangerous goods regulations if they meet the criteria of “articles containing dangerous goods” under Special Provision A193.

- Confirm with the manufacturer that the VCI emission rate and chemical content fall within permitted limits.

- Packaging must be intact and sealed to prevent vapor release during transport.

Sea Transport (IMDG Code)

- Generally not classified as hazardous if the VCI concentration is below reportable thresholds.

- Check whether the packaging qualifies for limited or excepted quantities provisions.

- Mark packages appropriately and provide a transport document referencing the product’s non-hazardous status.

Road Transport (ADR – Europe)

- Subject to ADR if VCI chemicals exceed concentration limits defined in Annex I.

- Most commercial VCI bags are exempt under packaging exemptions (e.g., 3.5, limited quantities).

- Ensure proper labeling and documentation if classified as hazardous.

Storage and Handling Requirements

Proper storage maximizes VCI effectiveness and ensures compliance:

- Temperature and Humidity: Store VCI bags in a cool, dry place (typically 15–30°C; 59–86°F), away from direct sunlight and moisture.

- Sealed Packaging: Keep unused bags in original sealed packaging to preserve VCI potency.

- Ventilation: Use in well-ventilated areas during packaging operations; avoid prolonged inhalation of emitted vapors.

- Compatibility: Do not use with non-ferrous metals unless specified by the manufacturer. Confirm compatibility with plastics, rubbers, or electronics in enclosed environments.

Environmental, Health, and Safety (EHS) Compliance

- REACH (EU): Ensure VCI chemicals are registered, and SVHCs (Substances of Very High Concern) are below threshold levels.

- RoHS & REACH Exemptions: Verify compliance if used in electronics packaging.

- Proposition 65 (California): Check if any VCI components are listed as carcinogens or reproductive toxins; provide warnings if required.

- Waste Disposal: VCI bags are generally non-hazardous waste. Dispose of according to local regulations. Incineration may be acceptable; landfill disposal should follow municipal guidelines.

Packaging and Labeling

- Clearly label VCI bags with product name, batch number, expiration date, and handling instructions.

- Include instructions such as “For Corrosion Protection of Metals Only” and “Keep Sealed When Not in Use.”

- If regulated, apply appropriate hazard labels (e.g., GHS pictograms) and shipper declarations.

Best Practices for Supply Chain Management

- Supplier Qualification: Source VCI bags from certified suppliers providing full regulatory documentation (SDS, compliance certificates).

- Training: Train logistics and warehouse staff on proper use, storage, and emergency procedures.

- Audit and Traceability: Maintain records of batch numbers, SDS, and shipping documents for traceability and compliance audits.

- Shelf Life Monitoring: Use first-in, first-out (FIFO) inventory practices. Most VCI bags have a shelf life of 1–2 years when unopened.

Conclusion

VCI bags offer effective corrosion protection but require careful attention to regulatory and logistical requirements. By understanding classification rules, maintaining proper documentation, and adhering to storage and handling best practices, organizations can ensure safe, compliant, and efficient use of VCI packaging across global supply chains. Always consult the manufacturer’s specifications and regulatory experts when in doubt.

Conclusion for Sourcing Vapor Corrosion Inhibitor (VCI) Bags:

After evaluating various suppliers, product specifications, and performance requirements, it is clear that sourcing high-quality Vapor Corrosion Inhibitor (VCI) bags is essential for effective long-term corrosion protection of metal components during storage and transportation. The selection process should prioritize suppliers offering certified, consistent VCI formulations tailored to the specific metals and environmental conditions involved. Key factors such as bag material durability, VCI emission rates, shelf life, and compliance with industry standards (e.g., MIL-PRF-22019, ASTM) must be rigorously assessed.

Cost-effectiveness should not compromise performance; instead, a balance between quality, reliability, and value should guide procurement decisions. Establishing relationships with reputable manufacturers or distributors who provide technical support, batch testing, and custom packaging options will ensure ongoing protection and operational efficiency.

In conclusion, a strategic sourcing approach—centered on product performance, supplier credibility, and long-term cost savings—will maximize the benefits of VCI technology, safeguarding metal assets and reducing maintenance and replacement costs across the supply chain.