The global automotive valve cover assembly market is experiencing steady growth, driven by rising vehicle production, increasing demand for fuel-efficient engines, and stringent emission regulations. According to a 2023 report by Mordor Intelligence, the automotive engine components market—which includes valve cover assemblies—is projected to grow at a CAGR of over 4.5% from 2023 to 2028. Another analysis by Grand View Research estimates that the broader automotive engine market will expand at a CAGR of 6.2% from 2022 to 2030, fueled by technological advancements in engine design and lightweight materials. As engine performance and emissions control become more critical, valve cover assemblies play an increasingly vital role in sealing, noise reduction, and oil containment. This growing demand has led to a competitive landscape marked by innovation in materials such as thermoplastics and aluminum, as well as increased adoption in both ICE and hybrid vehicles. In this evolving market, leading manufacturers are scaling production, investing in R&D, and expanding their global footprint to meet OEM and aftermarket needs.

Top 9 Valve Cover Assembly Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Velan

Domain Est. 1996

Website: velan.com

Key Highlights: A family-owned business, Velan delivers industry-leading valve solutions using cutting-edge technology. We are committed to delivering “quality that lasts.”…

#2 Genuine Nissan Valve Covers

Domain Est. 2001

Website: parts.nissanusa.com

Key Highlights: 30-day returnsProtect your Nissan engine with genuine valve covers designed for perfect sealing and long-lasting performance. Available for all Nissan models….

#3 Engine Valve Cover

Domain Est. 2013

Website: sdzcn.com

Key Highlights: Rating 4.4 (5) SDZ car valve cover has multiple functional elements such as an oil filling connection. Our auto valve cover on engine can be made of plastic or aluminium ……

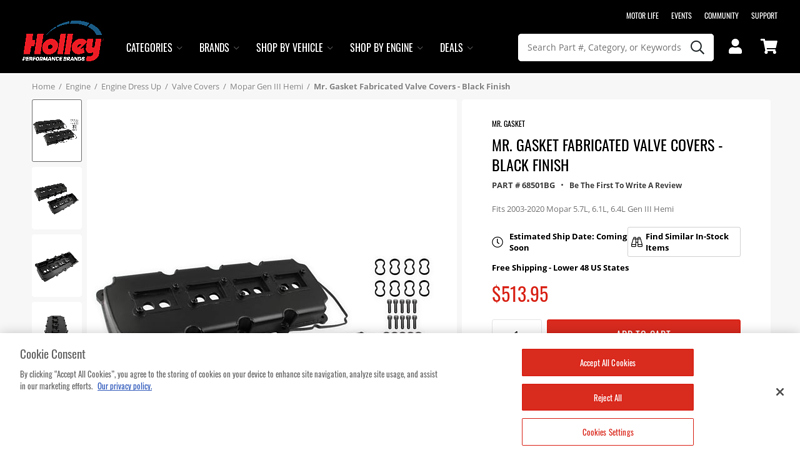

#4 Mr. Gasket Fabricated Valve Covers

Domain Est. 1995

Website: holley.com

Key Highlights: In stock Free delivery over $149These Mr. Gasket Mopar Gen III Hemi valve covers are constructed of 6061 T5 sheet aluminum and precision TIG welded for a great fit….

#5 The Official ARP Web Site

Domain Est. 1997

Website: arp-bolts.com

Key Highlights: To ensure proper sealing of valve covers, ARP manufactures a variety of special application-specific bolt and stud kits. Many professional engine builders ……

#6 Valve Cover Assembly: Airslide: Hopper Car

Domain Est. 1997

Website: salcoproducts.com

Key Highlights: Valve Cover Assembly. Products in this Family. Sanitary Cover Assembly. Part Number: VCP10A · Not Finding a Part? Contact Customer Support….

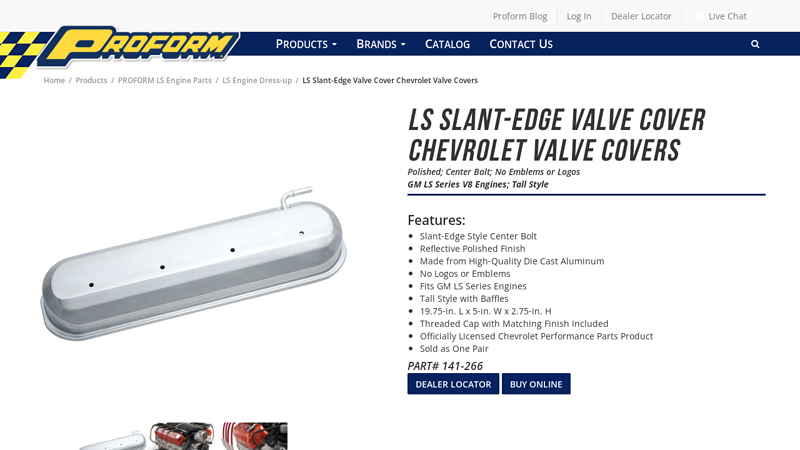

#7 Die Cast; Polished; No Logo; LS Engines

Domain Est. 1997

Website: proformparts.com

Key Highlights: These new valve covers are taller than stock valve covers, and can accommodate a wide variety of large valve train applications….

#8 Valve Covers & Related Parts

Domain Est. 2000

Website: katechengines.com

Key Highlights: 6-day delivery 30-day returnsBrowse Valve Covers & Related Parts Products ; Katech LS Valve Cover & Coil Relocation Package (Dry Sump) · For GM Gen 3 / 4 Engines. Item #: ……

#9 Engine Valve Cover

Domain Est. 2001

Website: dormanproducts.com

Key Highlights: Dorman engine valve covers deliver exact-fit replacements for millions of vehicles on the road today….

Expert Sourcing Insights for Valve Cover Assembly

H2: 2026 Market Trends for Valve Cover Assembly

The global valve cover assembly market is poised for steady growth and transformation by 2026, driven by advancements in automotive technology, stricter emissions regulations, and the rising demand for fuel-efficient and lightweight vehicles. Key trends shaping the market include:

-

Increased Adoption of Lightweight Materials

Automakers are increasingly shifting from traditional cast iron and steel to lightweight materials such as aluminum, composite polymers, and reinforced thermoplastics in valve cover assemblies. This trend is fueled by the need to reduce vehicle weight and improve fuel efficiency, particularly in response to global emission standards. By 2026, lightweight materials are expected to dominate new vehicle platforms, especially in electric and hybrid vehicles. -

Integration with Emission Control Systems

Valve cover assemblies are becoming more integrated with crankcase ventilation systems (PCV) and oil mist separators to meet tightening environmental regulations such as Euro 7 and EPA Tier 4 standards. Enhanced sealing technologies and improved gasket materials are being adopted to minimize oil leaks and hydrocarbon emissions, making the valve cover a critical component in emissions compliance. -

Growth in Electric Vehicle (EV) Applications

While EVs do not have internal combustion engines, many hybrid models and range extenders still utilize valve cover assemblies. Additionally, auxiliary systems in EVs may require specialized valve covers for compressors and pumps. The hybrid vehicle segment is expected to drive incremental demand for advanced valve cover assemblies through 2026. -

Rise in Aftermarket Demand

As the global vehicle fleet ages and maintenance cycles increase, the aftermarket for valve cover gaskets and assemblies is expanding. Leaks and wear are common issues, leading to a robust replacement market. Regions such as North America, Europe, and Asia-Pacific are witnessing strong aftermarket sales due to high vehicle ownership and extended usage periods. -

Technological Innovations and Smart Monitoring

Emerging trends include the integration of sensors within valve cover assemblies to monitor oil pressure, temperature, and contamination levels. These smart components support predictive maintenance and are increasingly adopted in commercial vehicles and high-performance automotive segments, anticipating a rise in connected car ecosystems. -

Regional Market Dynamics

Asia-Pacific, led by China, India, and Japan, will remain the largest market due to high automotive production volumes and growing consumer demand. Meanwhile, North America and Europe are focusing on premium and high-efficiency engine designs, supporting demand for technologically advanced valve cover systems. -

Sustainability and Recycling Initiatives

Manufacturers are investing in recyclable materials and sustainable production processes to align with environmental goals. Closed-loop recycling of aluminum and the use of bio-based polymers are emerging practices expected to gain traction by 2026.

In summary, the 2026 valve cover assembly market will be characterized by innovation in materials, enhanced functionality, and alignment with environmental and efficiency goals. Companies that invest in R&D, sustainability, and smart integration will be best positioned to capitalize on these evolving trends.

Common Pitfalls Sourcing Valve Cover Assembly (Quality, IP)

Sourcing a Valve Cover Assembly involves critical considerations around quality and intellectual property (IP). Overlooking these aspects can lead to performance issues, compliance risks, and legal liabilities. Below are key pitfalls to avoid:

Poor Material and Manufacturing Quality

Using substandard materials or inadequate manufacturing processes can compromise the integrity of the valve cover, leading to leaks, warping, or premature failure. Common issues include inconsistent gasket bonding, porosity in castings, and improper surface finishes. Always verify supplier certifications (e.g., IATF 16949) and conduct sample testing for dimensional accuracy and material composition.

Inadequate Sealing Performance

A frequent quality shortfall is poor sealing, resulting in oil leaks. This often stems from design flaws, low-quality gaskets, or incorrect torque specifications. Ensure the assembly includes high-grade elastomers and validate sealing performance through pressure and thermal cycling tests before mass procurement.

Non-Compliance with OEM Specifications

Sourcing assemblies that deviate from original equipment manufacturer (OEM) specifications—such as port configurations, sensor mounting points, or breather systems—can cause fitment and functionality issues. Always cross-reference part numbers and request detailed technical drawings for verification.

Intellectual Property Infringement Risks

Procuring valve cover assemblies that mimic patented OEM designs without licensing exposes buyers to IP litigation. This is especially prevalent with aftermarket or gray-market suppliers. Conduct due diligence to confirm that the supplier holds proper rights or produces under legitimate licensing agreements.

Lack of Traceability and Documentation

Suppliers that fail to provide batch traceability, material test reports, or IP indemnification clauses increase risk exposure. Insist on comprehensive documentation, including certificates of conformance and design ownership statements, to protect against counterfeit parts and legal disputes.

Overlooking Environmental and Regulatory Standards

Valve covers must comply with emissions and durability standards (e.g., evaporative emissions regulations). Sourcing non-compliant parts—particularly in regions like the EU or California—can result in vehicle recall or market access denial. Confirm adherence to relevant environmental certifications during supplier evaluation.

Logistics & Compliance Guide for Valve Cover Assembly

This guide outlines the essential logistics and compliance requirements for the transportation, handling, storage, and regulatory adherence related to Valve Cover Assemblies. Adherence ensures product integrity, supply chain efficiency, and legal compliance across global markets.

Logistics Requirements

Packaging Specifications

Valve cover assemblies must be packaged in durable, moisture-resistant materials to prevent damage during transit. Use corrugated cardboard boxes with internal foam or molded inserts to immobilize parts and prevent surface scratches or deformation. Each assembly must be individually wrapped in anti-corrosion paper (VCI paper recommended) and sealed in polyethylene bags where applicable. Label packages clearly with part number, quantity, lot/serial number, and handling symbols (e.g., “Fragile,” “Do Not Stack”).

Transportation Guidelines

Ship via ground or air freight depending on delivery urgency and destination. For international shipments, ensure compliance with IATA (air) or IMDG (sea) regulations if hazardous materials (e.g., residual oils or cleaning solvents) are present. Use temperature-controlled transport if required by material specifications (e.g., gaskets sensitive to extreme temperatures). Maintain a secure chain of custody and utilize trackable shipping methods to monitor shipment status.

Storage Conditions

Store valve cover assemblies in a dry, climate-controlled warehouse with temperatures between 10°C and 30°C and relative humidity below 60%. Keep packages off the floor on pallets or shelves to avoid moisture absorption and pest infestation. Implement FIFO (First-In, First-Out) inventory rotation to minimize aging and ensure timely dispatch. Protect from direct sunlight and chemical exposure.

Inventory & Documentation Management

Maintain accurate inventory records with traceability to batch/lot numbers. Utilize barcode or RFID systems for efficient tracking. Retain shipping manifests, packing lists, and certificates of conformance for a minimum of seven years. All logistics documentation must include product description, quantity, shipment date, carrier, and origin/destination details.

Compliance Requirements

Regulatory Standards

Valve cover assemblies must comply with relevant international and regional standards, including:

– ISO 9001:2015 (Quality Management)

– IATF 16949:2016 (Automotive Quality Systems)

– ISO 14001:2015 (Environmental Management)

– ROHS (Restriction of Hazardous Substances) – applicable for materials used

– REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) – for material declarations

Export Controls

Adhere to export regulations such as the U.S. Export Administration Regulations (EAR) or EU Dual-Use Regulation. Verify if the valve cover assembly contains controlled materials or technologies requiring export licenses. Complete proper export documentation, including commercial invoices, packing lists, and certificates of origin. Classify products using the appropriate HS (Harmonized System) code—typically under 8483.20 or 8409.91, depending on application.

Customs Clearance

Ensure all import documentation meets destination country requirements. Provide accurate product descriptions, values, and country of origin. For NAFTA/USMCA regions, submit a Certificate of Origin to claim preferential tariff treatment. Anticipate inspections and maintain compliance with local automotive or industrial equipment import standards.

Environmental & Safety Compliance

Dispose of packaging materials in accordance with local waste regulations (e.g., recycling cardboard and plastics). Comply with OSHA (U.S.) or equivalent workplace safety standards during handling. Provide Safety Data Sheets (SDS) if any components contain regulated substances. Implement spill containment procedures for any residual lubricants.

Traceability & Recall Preparedness

Establish a traceability system linking each valve cover assembly to manufacturing date, shift, and inspection records. In the event of a field issue or recall, this enables rapid identification and containment. Maintain a recall response plan aligned with customer and regulatory expectations.

Following this guide ensures efficient logistics operations and full compliance with global regulatory frameworks for Valve Cover Assembly distribution and use.

Conclusion for Sourcing Valve Cover Assembly

In conclusion, sourcing the valve cover assembly requires a strategic evaluation of several critical factors including quality, cost, supplier reliability, lead times, and compliance with industry standards. After assessing potential suppliers and comparing options, it is evident that selecting a partner with proven manufacturing capabilities, consistent quality control processes, and a track record of on-time delivery is essential to maintaining production efficiency and product integrity.

Prioritizing suppliers who offer durable materials, precise engineering, and competitive pricing—while also supporting just-in-time inventory or flexible ordering—can significantly enhance supply chain resilience and reduce operational downtime. Furthermore, establishing long-term relationships with vetted suppliers fosters improved communication, quicker issue resolution, and opportunities for collaborative improvements.

Ultimately, a well-informed sourcing strategy for the valve cover assembly not only ensures optimal performance and longevity of engine systems but also contributes to overall cost savings and operational reliability. Continuous monitoring and periodic review of supplier performance will be key to sustaining a successful and efficient procurement process.