The global vacuum sealer market is experiencing robust growth, driven by increasing consumer demand for food preservation solutions and rising awareness of reducing food waste. According to Grand View Research, the global vacuum packaging market was valued at USD 12.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Factors such as the surge in e-commerce, growth in ready-to-eat meals, and stringent food safety regulations are further accelerating adoption across residential and commercial sectors. As demand intensifies, manufacturers of vacuum meal sealers are innovating rapidly—enhancing suction power, integrating smart technology, and improving sealing durability. In this evolving landscape, nine key manufacturers have distinguished themselves through consistent product performance, technological advancement, and strong market reach. These companies are not only shaping current consumer expectations but are also setting the benchmark for next-generation food preservation solutions.

Top 9 Vacuum Meal Sealers Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Magic Vac

Domain Est. 1999

Website: magicvac.com

Key Highlights: FLAEMNUOVA is the Italian and one of the world Leader in development and production of medical devices for aerosol-therapy (nebulizers) and food vacuum sealers.Missing: meal manuf…

#2 Vacuum Sealers

Domain Est. 2015

Website: westonbrands.com

Key Highlights: Free delivery over $200 Free 30-day returnsPro-2300 Stainless Steel Vacuum Sealer Perfect for sous vide and marinating, both compact and heavy-duty models are designed for reliab…

#3 Vacuum Sealing

Domain Est. 1995

#4 Professional vacuum packing with Henkelman

Domain Est. 1998

Website: henkelman.com

Key Highlights: Henkelman offers various possibilities and options such as soft air, liquid control and marinating to make vacuum packaging even easier and more professional….

#5 Sipromac

Domain Est. 1999

Website: sipromac.com

Key Highlights: For over 40 years, Sipromac has used its expertise to manufacture vacuum sealers that are durable, increase food shelf life and eliminate food waste….

#6 and Commercial vacuum sealer, Vacuum Packers, Vacuum …

Domain Est. 1999

Website: vacupack.com

Key Highlights: Vacuum Sealers,Vacuum Food Sealer, MiniPack Vacuum Sealer, Vacuum Packers … Sealers, Chamber Vacuum Sealer, Commercial Vacuum Sealer Machine Online, Vacuum…

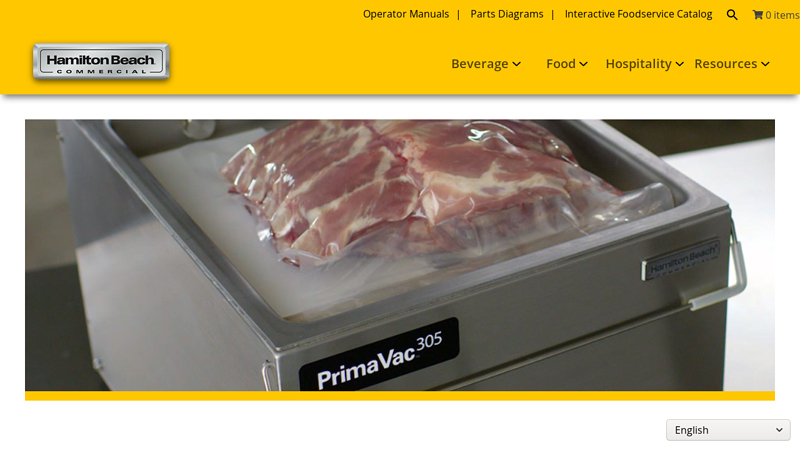

#7 Vacuum Packaging

Domain Est. 2000

Website: hamiltonbeachcommercial.com

Key Highlights: Free delivery 60-day returns…

#8 Vesta Precision

Domain Est. 2017

Website: vestaprecision.com

Key Highlights: Vesta Precision specializes in precision cooking, from vacuum sealing, freezing, and storing to effortlessly cooking restaurant-quality meals with sous vide….

#9 Best Vacuum Packaging Machine

Domain Est. 2004

Website: promarksvac.com

Key Highlights: At Promarks, we proudly serve leading brands with cutting-edge vacuum packaging machines that ensure product freshness, quality, and operational efficiency….

Expert Sourcing Insights for Vacuum Meal Sealers

2026 Market Trends for Vacuum Meal Sealers

As we approach 2026, the vacuum meal sealer market is poised for significant growth and transformation, driven by evolving consumer behaviors, technological advancements, and increased focus on sustainability and food waste reduction. Below is an analysis of the key trends shaping the industry.

Rising Demand for Food Preservation and Waste Reduction

With global concerns over food waste and rising grocery costs, consumers are increasingly turning to vacuum meal sealers as a practical solution for extending the shelf life of perishable goods. According to the United Nations, approximately one-third of all food produced globally is wasted. Vacuum sealing helps reduce spoilage by removing oxygen and inhibiting bacterial growth, thereby preserving freshness. This has become especially important in households seeking cost-effective ways to store bulk purchases and meal prep efficiently. By 2026, demand is expected to surge, particularly in urban and middle-income demographics focused on budgeting and sustainability.

Growth in Meal Prepping and Healthy Eating Trends

The popularity of meal prepping continues to grow, supported by the rise of fitness culture, plant-based diets, and time-strapped lifestyles. Vacuum meal sealers play a critical role in this trend by enabling users to portion, store, and organize meals in advance. Innovations such as portion-controlled sealing and compatibility with sous-vide cooking have further elevated their appeal. In 2026, we anticipate that manufacturers will introduce more user-friendly and compact models tailored to health-conscious consumers who value convenience without compromising nutrition.

Technological Integration and Smart Features

By 2026, vacuum meal sealers are expected to become smarter and more connected. Integration with IoT (Internet of Things) will allow devices to sync with smartphones or kitchen ecosystems, offering features like usage tracking, seal quality alerts, and personalized storage recommendations. Some models may include built-in sensors to detect food type and automatically adjust vacuum levels. Additionally, app-guided tutorials and recipe integration could enhance user engagement, making vacuum sealing a seamless part of digital kitchen management.

Expansion of E-Commerce and Direct-to-Consumer Sales

The shift toward online shopping, accelerated by recent global events, continues to benefit the vacuum meal sealer market. By 2026, e-commerce platforms and direct-to-consumer (DTC) brands are expected to dominate sales channels. Subscription models offering replacement bags, maintenance kits, and upgraded accessories may become standard. Enhanced product visualization through AR/VR and detailed video demonstrations will improve online purchase confidence, particularly in emerging markets.

Sustainability and Eco-Friendly Innovations

Environmental concerns are pushing manufacturers to develop more sustainable vacuum sealing solutions. By 2026, we expect to see a rise in reusable silicone bags, compostable rolls, and energy-efficient sealing mechanisms. Leading brands may adopt circular economy models, offering recycling programs for used parts and packaging. Consumers are increasingly favoring products with lower environmental footprints, and vacuum sealers that emphasize durability, repairability, and reduced plastic use will gain market share.

Market Penetration in Emerging Economies

While North America and Europe currently lead in vacuum sealer adoption, Asia-Pacific, Latin America, and parts of Africa are emerging as high-growth regions. Rising disposable incomes, urbanization, and increased access to home appliances are driving demand. Localized product designs—such as compact units suited for smaller kitchens or multi-voltage models for regions with unstable power—will be crucial for success. By 2026, international brands and local startups alike will compete to capture this expanding market.

Competitive Landscape and Product Differentiation

The vacuum meal sealer market is becoming increasingly competitive, prompting brands to differentiate through design, functionality, and niche targeting. Key players are investing in R&D to develop quieter motors, faster sealing times, and improved portability. Specialized models for marinating, canning, or sealing liquids are gaining traction. In 2026, we anticipate consolidation among smaller brands and increased partnerships with food delivery or meal kit services to create bundled offerings.

Conclusion

The 2026 vacuum meal sealer market will be defined by innovation, sustainability, and consumer-centric design. As households worldwide prioritize food efficiency, health, and environmental responsibility, vacuum sealers will transition from niche appliances to essential kitchen tools. Companies that adapt to these trends—by embracing smart technology, reducing ecological impact, and expanding global access—will lead the next phase of growth in this dynamic industry.

Common Pitfalls When Sourcing Vacuum Meal Sealers (Quality & IP)

Sourcing vacuum meal sealers, especially from overseas manufacturers, presents several risks related to product quality and intellectual property (IP) protection. Being aware of these common pitfalls is crucial for ensuring a successful and legally sound procurement process.

Poor Build Quality and Material Durability

Many low-cost vacuum sealers use substandard plastics and components that degrade quickly with regular use. Sealing bars may fail prematurely, motors can overheat, and vacuum pumps might lack the suction power needed for effective long-term food preservation. This leads to high return rates, customer dissatisfaction, and damage to brand reputation.

Inconsistent Sealing Performance

Inconsistent heat sealing is a frequent issue, resulting in weak or incomplete seals that compromise food safety and shelf life. Poor temperature control, misaligned sealing mechanisms, or inadequate pressure application can cause leaks, rendering the vacuum sealing ineffective and leading to spoiled food.

Underpowered or Inefficient Vacuum Pumps

Some budget models feature vacuum pumps that are either too weak to remove sufficient air or too slow, undermining the core functionality of the device. This reduces the appliance’s effectiveness in preventing freezer burn and extending food freshness, directly impacting consumer satisfaction.

Lack of Safety Certifications and Compliance

Sourcing from unverified suppliers may result in products that lack essential safety certifications (e.g., UL, CE, RoHS). Non-compliant devices can pose electrical, fire, or chemical hazards, leading to regulatory fines, product recalls, or liability issues in target markets.

Intellectual Property Infringement Risks

Manufacturers may copy patented designs, technologies, or branding elements from established brands without authorization. Sourcing such products exposes buyers to legal action for IP infringement, including cease-and-desist orders, customs seizures, and costly litigation, especially in markets with strong IP enforcement.

Counterfeit or Misrepresented Products

Suppliers might provide products that mimic well-known brands or falsely claim features and performance specifications. This not only violates IP rights but also misleads consumers and undermines trust in the sourcing company’s offerings.

Inadequate Documentation and Traceability

Poor recordkeeping from suppliers—such as missing design files, material specifications, or compliance test reports—makes it difficult to verify IP legitimacy or troubleshoot quality issues. This lack of transparency can hinder product development, compliance audits, and post-market support.

Failure to Conduct Proper Due Diligence

Skipping factory audits, sample testing, or IP searches can lead to sourcing from unreliable manufacturers. Without verifying a supplier’s capabilities and legal standing, companies risk receiving defective products or becoming entangled in IP disputes.

Avoiding these pitfalls requires thorough supplier vetting, rigorous quality control, and proactive IP clearance before entering into manufacturing agreements.

Logistics & Compliance Guide for Vacuum Meal Sealers

Product Classification and HS Code

Vacuum meal sealers are typically classified under Harmonized System (HS) code 8509.80, which covers “Electrical appliances with a motor, parts thereof: other.” However, classification may vary by country—verify with local customs authorities. Accurate classification ensures proper duty assessment and compliance with import regulations.

Import/Export Documentation

Ensure all shipments include the following documentation:

– Commercial Invoice (with product description, value, and HS code)

– Packing List (detailing weight, dimensions, and quantity)

– Bill of Lading or Air Waybill

– Certificate of Origin (required by some countries for tariff preferences)

– Product Compliance Certificates (e.g., CE, FCC, RoHS—see below)

Maintain digital and physical copies for audit purposes.

Regulatory Compliance Standards

Vacuum meal sealers must meet safety and environmental standards in target markets:

– CE Marking (Europe): Complies with EU directives including Low Voltage Directive (LVD), Electromagnetic Compatibility (EMC), and RoHS (restriction of hazardous substances).

– FCC Certification (USA): Required if the device emits radio frequency energy (e.g., electronic controls).

– Energy Efficiency (if applicable): Some regions require energy labeling (e.g., EU Energy Label).

– RoHS & REACH (Global): Restrict use of hazardous materials and require chemical substance registration.

Always verify up-to-date regulatory requirements for each destination country.

Packaging and Labeling Requirements

- Packaging must be durable for international shipping and protect against moisture and impact.

- Labels must include:

- Manufacturer/importer name and address

- Model number and serial number (if applicable)

- Voltage and power rating

- Safety warnings in local language(s)

- Compliance marks (e.g., CE, FCC)

- Multilingual labels may be necessary for regional distribution.

Shipping and Transportation

- Use UN-certified packaging if shipping lithium batteries (e.g., for cordless models).

- Follow IATA regulations for air freight and IMDG Code for sea freight when applicable.

- Avoid temperature extremes during transit; store in dry, climate-controlled environments.

- Consider insuring high-value shipments and tracking all consignments.

Customs Clearance and Duties

- Provide accurate product valuation to avoid delays or penalties.

- Be aware of anti-dumping or countervailing duties that may apply based on country of manufacture.

- Work with a licensed customs broker in the destination country to streamline clearance.

- Stay updated on trade agreements that may reduce or eliminate tariffs (e.g., USMCA, EU free trade pacts).

Post-Market Compliance and Recalls

- Maintain a product traceability system (batch/lot tracking).

- Establish a recall protocol in case of safety issues or non-compliance findings.

- Register products with relevant national safety agencies where required (e.g., CPSC in the U.S.).

- Monitor customer feedback and regulatory updates for emerging compliance risks.

Warranty and Support Logistics

- Provide clear warranty terms compliant with local consumer protection laws (e.g., 2-year warranty in the EU).

- Establish local service centers or partner with third-party repair networks.

- Stock spare parts and manage reverse logistics for defective units.

Adherence to this guide ensures efficient global distribution while minimizing legal and operational risks for vacuum meal sealer products.

Conclusion for Sourcing Vacuum Meal Sealers

Sourcing vacuum meal sealers requires a strategic approach that balances quality, cost, functionality, and supplier reliability. After evaluating various suppliers, product features, and market demands, it is evident that selecting the right vacuum sealer involves considering factors such as durability, sealing efficiency, compatibility with different packaging types, and energy consumption. Additionally, assessing suppliers based on certifications, production capacity, lead times, and after-sales support is crucial to ensuring a consistent and reliable supply chain.

For businesses in the food service, retail, or consumer goods sectors, investing in high-performing vacuum sealers enhances food preservation, reduces waste, and supports convenience-focused offerings. Whether sourcing for commercial use or private-label retail, partnering with reputable manufacturers—preferably those offering customization options and compliance with international safety standards—will provide a competitive advantage.

In conclusion, a well-researched sourcing strategy that prioritizes product performance, supplier credibility, and long-term value will lead to successful procurement of vacuum meal sealers, ultimately supporting operational efficiency and customer satisfaction. Regular supplier evaluation and staying informed about technological advancements in vacuum sealing will further ensure continued success in the evolving marketplace.