The global crankshaft market is experiencing robust growth, driven by rising automotive production and increasing demand for high-performance engines, particularly in the V8 segment. According to Mordor Intelligence, the crankshaft market was valued at USD 6.3 billion in 2023 and is projected to grow at a CAGR of over 5.2% from 2024 to 2029. This expansion is fueled by advancements in engine efficiency, the resurgence of performance vehicles, and stringent emissions regulations prompting innovation in engine component design. As V8 engines continue to be favored in premium automotive, marine, and industrial applications, demand for durable, precision-engineered crankshafts has intensified. In response, leading manufacturers are investing in advanced materials like forged steel and nodular cast iron, as well as precision machining technologies to ensure reliability under high-stress conditions. This growing demand landscape sets the stage for the top 10 V8 crankshaft manufacturers that are shaping the future of high-performance powertrains.

Top 10 V8 Crankshaft Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 China Gasoline Engine Crankshaft Manufacturers, Diesel …

Domain Est. 2022

Website: stem-crankshaft.com

Key Highlights: FACTORY is a Company of manufactures and Sale engine parts for diesel and gasoline engines, including Diesel engine crankshafts and Petrol crankshafts, V8 ……

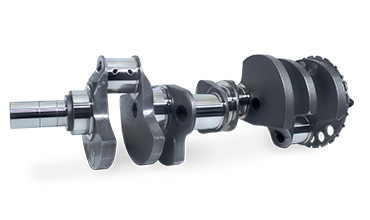

#2 V8 Crankshaft

Domain Est. 2022

Website: dcrfglobal.com

Key Highlights: Please note that for V8 series crankshafts we accept OEM orders only, meaning, we produce the crankshafts based on customer’s own engineering drawing or sample ……

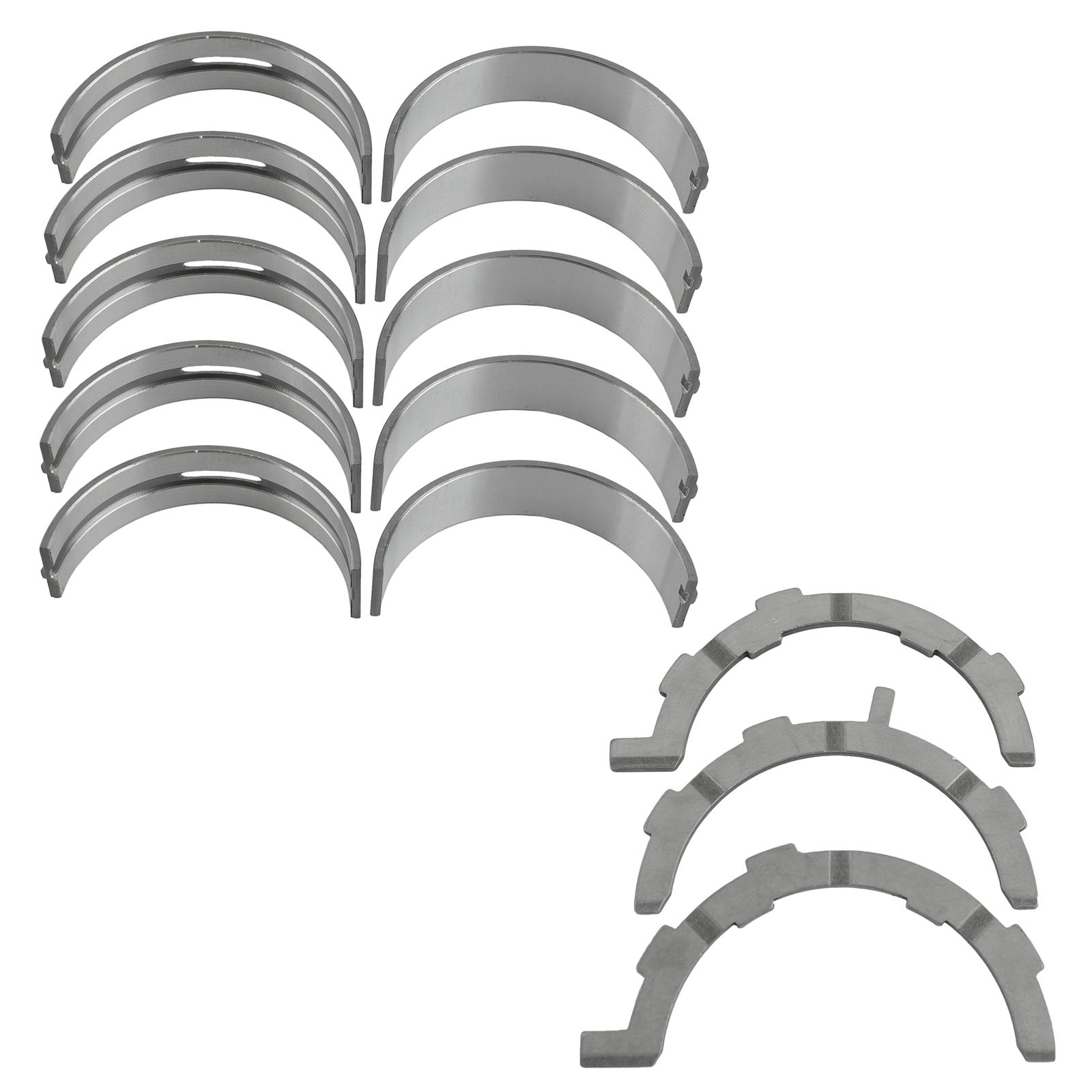

#3 King Engine Bearings

Domain Est. 1999

Website: kingbearings.com

Key Highlights: Engine bearings for automobiles, light to heavy duty trucks, marine, aviation, standby power and other types of internal combustion engines….

#4 Eagle Specialty Products

Domain Est. 2000

Website: eaglerod.com

Key Highlights: Eagle Specialty Products produces high-strength connecting rods and crankshafts for racing engines. (662) 796-7373…

#5 SCAT Crankshafts

Domain Est. 2000

Website: scatcrankshafts.com

Key Highlights: SCAT Crankshafts, based in Redondo Beach, California, offers high performance crankshafts, connecting rods, and rotating assemblies….

#6 Texas Speed and Performance

Domain Est. 2002

Website: texas-speed.com

Key Highlights: We offer a comprehensive range of aftermarket performance products, including air induction, exhaust systems, cylinder heads, camshafts, and stroker engines….

#7 Winberg Crankshafts

Domain Est. 2004

Website: winbergcrankshafts.com

Key Highlights: Winberg Crankshafts | World Class Racing Cranks. Each custom tailored for the perfect fit. Contact Us Tour our facility Shop 2 thirds 303-783-2234…

#8 Crankshafts, Cylinder Heads Rebuild and Repair

Domain Est. 2006

Website: crankshaftsupply.com

Key Highlights: 2–7 day deliveryShop for remanufactured crankshaft kits and cylinder head repair services. Find your crankshaft kit by year, make, model, and engine type….

#9 Our Strength

Domain Est. 2016

Website: internationalcrankshaft.com

Key Highlights: V8 Crankshaft 4-8 Liter Pickup Trucks, Standard size SUVs, Commercial & Military Vehicles. Phone (502) 868-0003…

#10 Custom Crankshafts

Domain Est. 2018

Website: customcrankshafts.com

Key Highlights: We make your ideal custom crankshafts. Crankshaft for V8 cylinders $6,980.00 /ea. We have more than 12 years experiences to make custom crankshafts…

Expert Sourcing Insights for V8 Crankshaft

H2: 2026 Market Trends for V8 Crankshafts – Resilience Amidst Transition

While the broader automotive industry accelerates toward electrification, the V8 crankshaft market in 2026 is projected to demonstrate surprising resilience, driven by specific high-value segments and technological adaptations. Here’s a breakdown of the key trends shaping the market:

1. Niche Demand Sustained by Performance & Luxury Segments

- High-Performance & Sports Cars: Despite EV inroads, demand for V8 engines will remain robust in premium sports cars, supercars, and high-performance sedans where the visceral experience, sound, and linear power delivery are irreplaceable selling points. Brands like Ferrari, Lamborghini (in ICE models), Porsche (911 variants), BMW M, Mercedes-AMG, and Corvette will continue producing V8 engines, ensuring steady crankshaft demand.

- Luxury & Full-Size Vehicles: Full-size luxury sedans (e.g., Lexus LS, Cadillac CT6 potential variants), large SUVs (e.g., Cadillac Escalade, Lincoln Navigator), and premium pickup trucks (e.g., Ford F-150 Raptor, Ram 1500 TRX) will retain V8 options for customers prioritizing towing capacity, smooth power, and brand heritage. This segment provides a stable core market.

- Aftermarket & Restoration: The classic car and muscle car restoration market is a significant driver. Demand for high-quality replacement and performance-enhancing crankshafts (forged, balanced) for iconic V8s (Chevy small-block, Ford FE, Mopar Hemi) will remain strong and potentially grow as vehicle values increase.

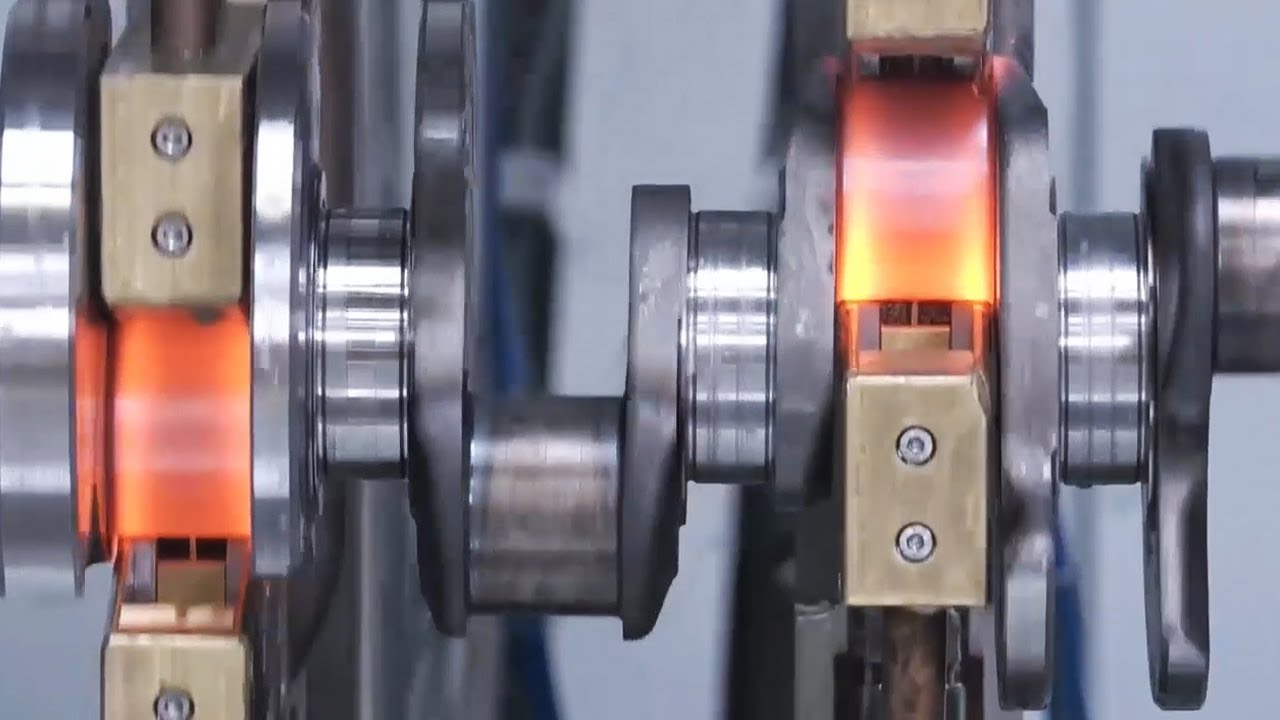

2. Technological Evolution: Lightweighting & Material Advancements

- Material Shift: Expect increased use of advanced materials beyond traditional forged steel. While forged steel remains dominant for performance, exploration of high-strength micro-alloyed steels or even experimental composites for specific high-end applications may continue, focusing on weight reduction without sacrificing strength.

- Precision Engineering: Demand for tighter tolerances, superior balancing (critical for NVH – Noise, Vibration, Harshness), and optimized counterweight designs will intensify. This is driven by the need for smoother operation in luxury vehicles and maximizing efficiency/reliability in performance engines.

- Manufacturing Innovation: Adoption of advanced machining techniques (e.g., high-speed milling, precision grinding with AI/ML optimization) and improved inspection methods (e.g., advanced CMM, vibration analysis) will be crucial for meeting quality demands and reducing waste in a lower-volume production environment.

3. Impact of Electrification & Downsizing: A Constrained but Focused Market

- Volume Decline in Mainstream: The primary headwind remains the significant reduction in V8 production for mainstream passenger cars, sedans, and even some SUVs due to electrification (BEVs, PHEVs) and aggressive engine downsizing (turbocharged V6s, 4-cylinders). This shrinks the overall market volume.

- Hybrid Powertrains: Some high-end V8s will survive as part of high-performance hybrid systems (e.g., Ferrari SF90, Lamborghini Revuelto). The crankshaft in these applications faces unique challenges – potentially higher thermal loads and different stress profiles due to combined ICE/electric power delivery. Design and material requirements may evolve specifically for these hybrid roles.

- Focus on Value over Volume: Suppliers will shift focus from mass-market volume to high-margin, high-performance, and specialized applications. Profitability will come from engineering expertise and serving premium segments rather than sheer unit volume.

4. Supply Chain & Manufacturing Dynamics

- Consolidation & Specialization: The supplier base may see further consolidation, with smaller players exiting. Remaining manufacturers will likely specialize in high-precision, low-to-medium volume production for performance OEMs and the aftermarket.

- Reshoring/Nearshoring: Geopolitical factors and supply chain resilience concerns could accelerate trends toward reshoring or nearshoring critical components like crankshafts, particularly for OEMs producing high-value vehicles domestically.

- Cost Pressures: Despite the premium nature, OEMs will still exert cost pressure. Suppliers will need to leverage automation, process optimization, and material efficiency to maintain profitability in a competitive, lower-volume landscape.

5. Regional Variations

- North America: Remains the strongest market due to enduring demand for pickup trucks, muscle cars, and performance vehicles. The US aftermarket is particularly robust.

- Europe: Demand is concentrated in the ultra-luxury and high-performance segments. Stricter emissions regulations will further limit V8 adoption in mainstream models, but heritage brands will sustain the premium market.

- Asia-Pacific: Growth is primarily in luxury imports and high-end performance vehicles in markets like China, Japan, and South Korea. Domestic production focus remains heavily on smaller engines and EVs.

Conclusion: A Premium, Specialized Market

The V8 crankshaft market in 2026 will be smaller in overall volume compared to its peak but more focused, specialized, and technologically advanced. Success will depend on:

* Deep expertise in high-performance and precision engineering.

* Strong partnerships with premium OEMs and performance aftermarket leaders.

* Agility in adapting to hybrid powertrain requirements.

* Operational excellence to maintain profitability in a lower-volume, high-mix environment.

While the era of the ubiquitous V8 is ending, the crankshaft remains a critical, high-value component in the engines that define automotive passion and performance, ensuring its continued, albeit niche, relevance in 2026.

Common Pitfalls Sourcing V8 Crankshafts: Quality and Intellectual Property (IP) Risks

Sourcing V8 crankshafts—whether for original equipment, performance builds, or replacements—exposes buyers to significant risks if not managed carefully. Two major areas of concern are product quality and intellectual property (IP) infringement. Overlooking these pitfalls can lead to engine failure, safety hazards, warranty voids, or legal liability.

Quality Concerns in V8 Crankshaft Procurement

One of the most critical pitfalls when sourcing V8 crankshafts is compromising on quality. Poorly manufactured or misrepresented components can lead to catastrophic engine damage.

-

Substandard Materials and Heat Treatment: Many low-cost crankshafts use inferior-grade steel or skip critical heat-treating processes like nitriding or induction hardening. This reduces fatigue resistance and durability, increasing the risk of cracking under high load or RPM.

-

Inaccurate Balancing and Machining Tolerances: Precision is paramount in crankshaft design. Off-balance or poorly machined cranks cause excessive vibration, leading to bearing wear, seal failure, and reduced engine lifespan. Counterfeit or non-OEM parts often lack proper dynamic balancing.

-

Lack of Certification and Traceability: Reputable crankshafts come with material certifications (e.g., SAE-J403), heat-treat documentation, and batch traceability. Many aftermarket or gray-market suppliers cannot provide these, raising doubts about authenticity and reliability.

-

Inadequate Surface Finishes: Poor journal surface finishes accelerate wear and reduce oil retention. High-performance applications especially require precise micro-finishing to maintain hydrodynamic lubrication.

Intellectual Property (IP) Infringement Risks

Sourcing crankshafts that mimic OEM or proprietary designs without proper licensing poses serious legal and financial risks.

-

Counterfeit or Clone Crankshafts: Some suppliers produce “pattern” crankshafts that replicate patented designs from major manufacturers (e.g., GM, Ford, or specialty brands like Callies or Eagle). These clones may infringe on design patents, trade dress, or trademarks, exposing buyers to liability.

-

Unauthorized Use of Branding and Part Numbers: Illegitimate vendors may use OEM part numbers or logos to imply authenticity. This misrepresentation violates trademark laws and can mislead consumers into believing they are purchasing genuine components.

-

Supply Chain Transparency Issues: When sourcing from third-party manufacturers or offshore suppliers, verifying IP compliance becomes difficult. Lack of clear documentation increases the risk of receiving or distributing infringing products.

-

Limited Legal Recourse: If a counterfeit or IP-infringing crankshaft fails, the buyer may have no warranty or recourse. Worse, they could be drawn into legal disputes as a distributor or end-user of infringing goods.

Mitigation Strategies

To avoid these pitfalls:

– Source from authorized distributors or reputable manufacturers with verifiable certifications.

– Request material and quality test reports.

– Verify IP rights and ensure parts are either licensed or in the public domain.

– Avoid deals that seem too good to be true—extremely low prices often signal compromised quality or IP issues.

Due diligence in both quality validation and IP compliance is essential to ensure engine reliability and legal safety in V8 crankshaft procurement.

Logistics & Compliance Guide for V8 Crankshaft

Overview

This guide outlines the essential logistics and compliance considerations for the transportation, handling, and regulatory adherence related to V8 crankshafts. Whether shipping domestically or internationally, adherence to these guidelines ensures product integrity, regulatory compliance, and operational efficiency.

Packaging Requirements

V8 crankshafts must be packaged to prevent damage during transit. Use heavy-duty wooden crates or reinforced cardboard with internal foam or cardboard dividers to immobilize the crankshaft. Apply rust-inhibiting coatings or VCI (Vapor Corrosion Inhibitor) paper to protect against corrosion. Clearly label packages with “Fragile,” “This Side Up,” and part identification (e.g., OEM number, engine compatibility).

Transportation Mode Selection

Choose transportation based on shipment size, urgency, and destination. For domestic shipments, palletized freight via LTL (Less-Than-Truckload) or FTL (Full Truckload) is common. For international logistics, sea freight is cost-effective for bulk shipments, while air freight is suitable for urgent or lightweight consignments. Ensure secure strapping and dunnage to prevent shifting during transit.

Import/Export Compliance

V8 crankshafts may be subject to international trade regulations. Verify Harmonized System (HS) code 8483.10 (for crankshafts and camshafts) for accurate customs classification. Prepare a commercial invoice, packing list, and bill of lading/air waybill. For exports from regulated regions (e.g., U.S. EAR or EU dual-use), confirm if the crankshaft contains controlled materials or technologies. Apply for export licenses if required.

Regulatory Standards and Certifications

Ensure crankshafts comply with relevant industry standards such as SAE J403 (steel compositions) or ISO 9001 (quality management). For automotive replacements, adherence to OEM specifications is critical. Provide certification of conformity (CoC) upon request, especially for markets with strict vehicle parts regulations (e.g., EU E-marking, U.S. DOT standards).

Hazardous Materials Considerations

Standard V8 crankshafts are not classified as hazardous. However, if coated with oil, grease, or chemical treatments, evaluate under IATA/IMDG/ADR regulations. Any residual machining fluids must be properly drained and declared. Use absorbent materials in packaging to contain potential leaks.

Customs Clearance and Duties

Work with a licensed customs broker to facilitate clearance. Accurate valuation, country of origin marking, and proper documentation reduce delays. Be aware of bilateral trade agreements (e.g., USMCA, EU-UK Trade Agreement) that may affect duty rates. Retain records for a minimum of five years for audit purposes.

Inventory and Warehouse Handling

Store crankshafts in a dry, climate-controlled environment to prevent rust. Use pallet racking to avoid floor contact and stack no higher than three layers unless designed for vertical stacking. Implement a first-in, first-out (FIFO) inventory system to minimize long-term storage risks.

Traceability and Documentation

Maintain lot traceability from manufacturing to delivery. Include batch numbers, heat treatment records, and inspection reports in the shipping package or digital file. Use serialized barcodes or QR codes for tracking through the supply chain.

Environmental and Disposal Compliance

Dispose of packaging materials in accordance with local environmental regulations. Recycle wood, cardboard, and plastic components where possible. For end-of-life crankshafts, follow scrap metal recycling protocols and comply with EPA or equivalent environmental agency standards.

Conclusion

Proper logistics and compliance management for V8 crankshafts safeguards quality, ensures legal adherence, and enhances customer satisfaction. Regular review of international regulations and internal procedures is recommended to adapt to evolving trade requirements.

Conclusion for Sourcing V8 Crankshaft:

After a thorough evaluation of suppliers, quality standards, cost considerations, and lead times, it is evident that sourcing a V8 crankshaft requires a strategic balance between performance requirements and operational efficiency. High-quality forged crankshafts from reputable manufacturers—whether domestic or international—offer superior strength and durability, making them ideal for high-performance or heavy-duty applications. Cast crankshafts, while more cost-effective, are better suited for standard replacements or lower-stress environments.

Key factors in successful sourcing include verifying material specifications (such as 4340 steel for forged units), ensuring proper machining tolerances, confirming compatibility with engine models, and assessing the supplier’s reliability and track record. Additionally, minimizing supply chain risks through multiple sourcing options and maintaining inventory buffers for critical applications is advisable.

In conclusion, the optimal sourcing strategy for a V8 crankshaft involves partnering with qualified suppliers who meet stringent quality certifications (e.g., ISO, IATF), balancing cost with performance needs, and establishing long-term supplier relationships to ensure consistency, scalability, and technical support. This approach supports both operational reliability and cost-efficiency in engine assembly or rebuild operations.