The global laser market is experiencing robust growth, driven by rising demand across industrial, medical, and telecommunications sectors. According to Grand View Research, the global fiber laser market size was valued at USD 2.67 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. Meanwhile, UV lasers are gaining traction in precision applications such as semiconductor manufacturing, micro-machining, and medical device production. Mordor Intelligence reports that the UV laser market is expected to grow at a CAGR of over 6.5% during the forecast period of 2023–2028, fueled by advancements in diode-pumped solid-state (DPSS) technologies and increasing miniaturization in electronics. As industries seek higher precision, efficiency, and lower operational costs, the competition between UV and fiber laser manufacturers has intensified. This evolving landscape has positioned key players at the forefront of innovation, each leveraging unique technological strengths to capture market share. Below, we examine the top eight manufacturers shaping the UV laser and fiber laser ecosystems, evaluating their product portfolios, market strategies, and technological differentiators.

Top 8 Uv Laser Vs Fiber Laser Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

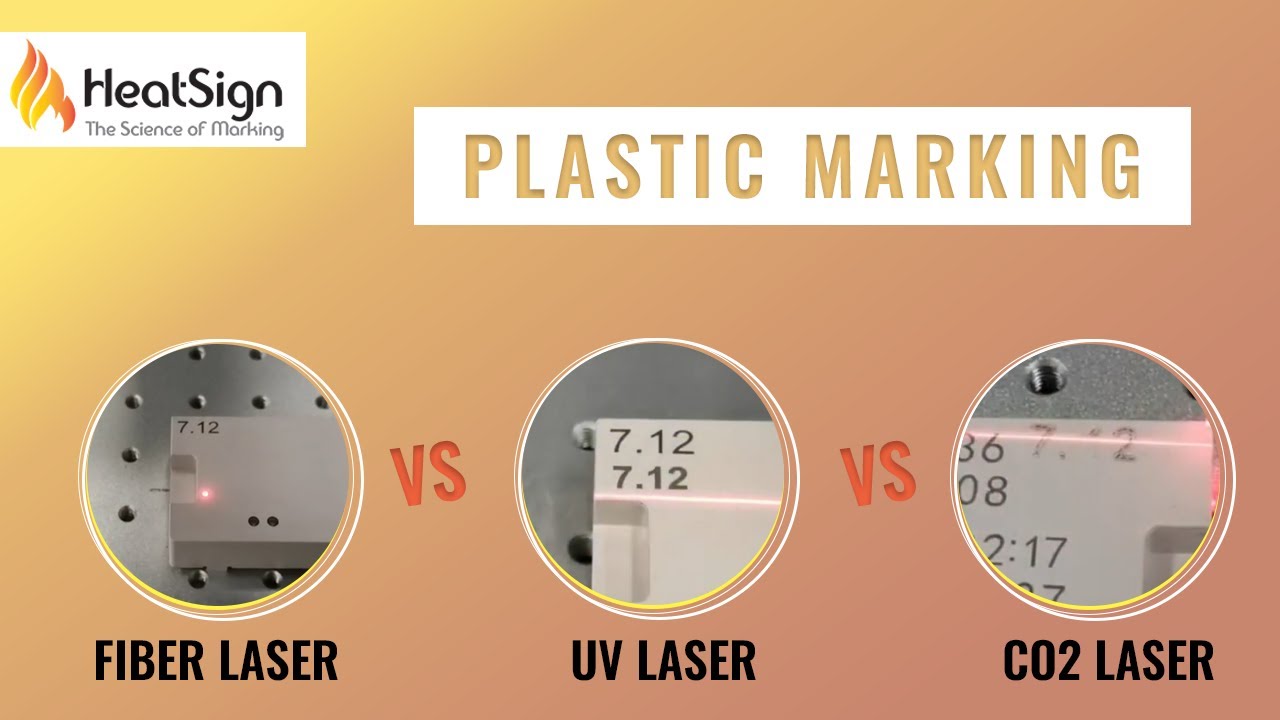

#1 UV vs. Fiber Laser Marking

Website: sabreen.com

Key Highlights: Fiber lasers typically cost 30–50% less than UV lasers of comparable capability, with operating costs continuing this advantage through lower ……

#2 UV Laser vs Fiber Laser Engraver: What’s the Difference?

Website: keyence.com

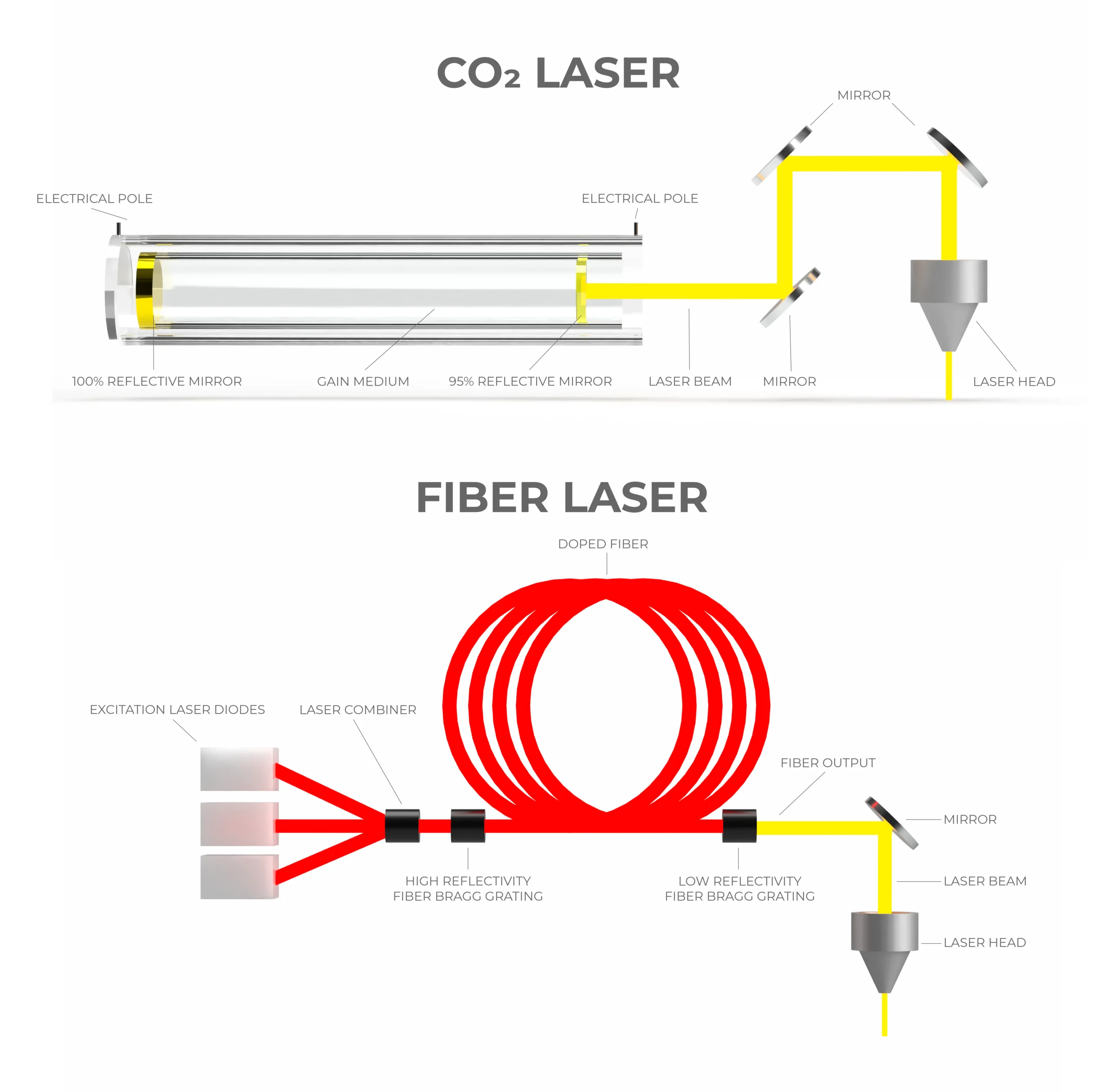

Key Highlights: From a foundational standpoint, a UV laser vs a fiber laser differ greatly. UV lasers use ultraviolet light, while fiber lasers use an infrared light….

#3 UV Lasers vs. Fiber Lasers

Website: laserax.com

Key Highlights: Taken all together, fiber lasers are efficient, reliable tools for performing high-speed marking of materials that aren’t heat sensitive. They’ ……

#4 Galvo Fiber vs. UV Lasers

Website: fslaser.com

Key Highlights: UV lasers, or ultraviolet lasers, emit at a much shorter wavelength—typically around 355nm—and operate using a method known as “cold marking.” ……

#5 UV Laser Vs. Fiber Laser

Website: nmlaser.com

Key Highlights: UV lasers specialize in fine, low-heat processing. Fiber lasers excel in deep, fast, and durable marking on metals and hard surfaces….

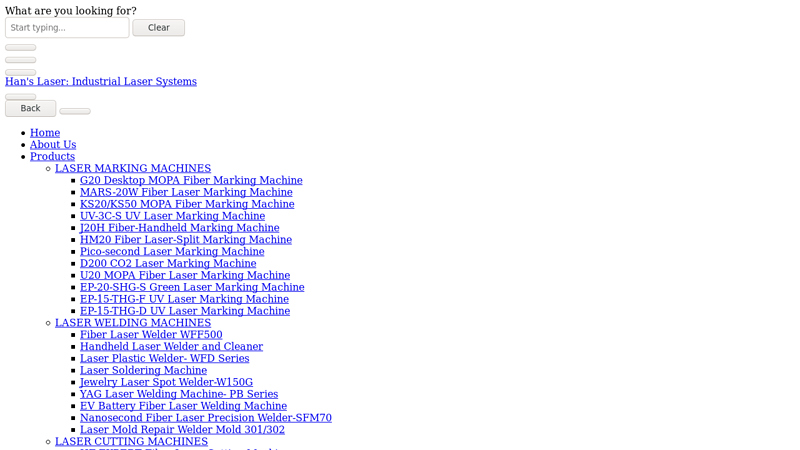

#6 Fiber or UV Laser Marking

Website: hanslaserus.com

Key Highlights: Both fiber laser and UV laser marking machines bring distinct advantages to the table, making them indispensable tools in modern manufacturing. Fiber lasers are ……

#7 IPG Photonics

Website: ipgphotonics.com

Key Highlights: IPG Photonics manufactures high-performance fiber lasers, amplifiers, and laser systems for diverse applications and industries. Discover your solution….

#8 Fiber Vs UV Lasers – Which is Best for You?

Website: videojet.com

Key Highlights: Fiber lasers are well-suited for high-density materials and applications requiring high-speed marking and deep contrast, UV lasers are ideal for sensitive ……

Expert Sourcing Insights for Uv Laser Vs Fiber Laser

H2: Market Trends Comparison – UV Laser vs. Fiber Laser (2026 Outlook)

As industrial manufacturing, electronics, and medical device sectors continue to evolve, laser technologies remain at the forefront of precision processing. By 2026, the competitive landscape between ultraviolet (UV) lasers and fiber lasers is expected to reflect divergent yet complementary growth trajectories driven by technological advancements, industry demands, and application-specific requirements.

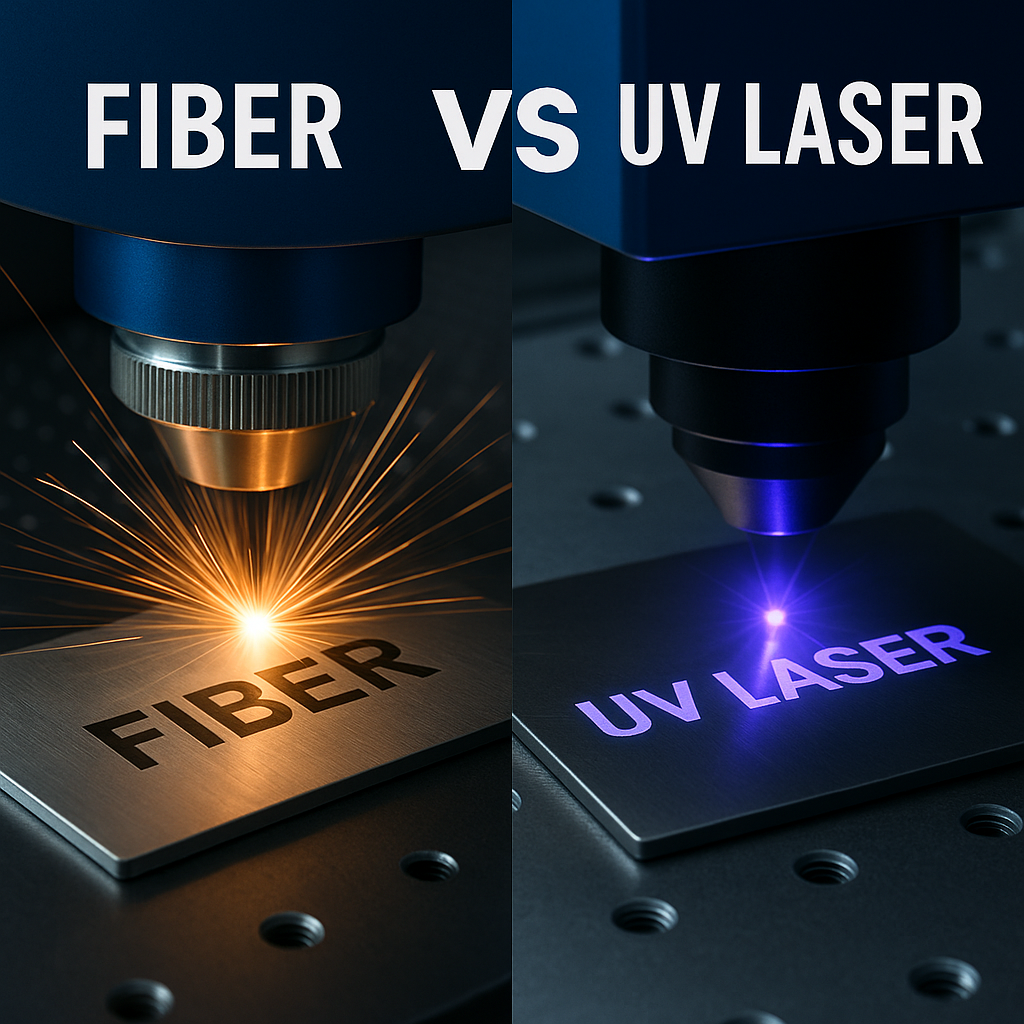

1. Technology Differentiation and Application Niches

UV Lasers (2026 Outlook):

UV lasers, operating at shorter wavelengths (typically 355 nm), excel in high-precision, cold ablation processes. By 2026, their market growth will be primarily fueled by the rising demand in microfabrication, semiconductor packaging, PCB (printed circuit board) drilling, and medical device manufacturing. The non-thermal nature of UV laser processing minimizes heat-affected zones (HAZ), making them ideal for delicate materials such as polyimide, glass, and ceramics.

Key drivers:

– Miniaturization of electronic components (e.g., 5G devices, wearables).

– Growth in flexible and rigid-flex PCB markets.

– Increased adoption in life sciences for biochip fabrication and surgical tool marking.

Market analysts project a compound annual growth rate (CAGR) of 9–11% for UV lasers through 2026, with Asia-Pacific (particularly China, South Korea, and Taiwan) leading adoption due to dense electronics manufacturing ecosystems.

Fiber Lasers (2026 Outlook):

Fiber lasers, primarily operating in the near-infrared spectrum (1,060–1,080 nm), dominate high-power industrial applications such as cutting, welding, and marking metals. By 2026, fiber lasers are expected to maintain a larger market share overall due to their efficiency, reliability, lower maintenance, and scalability in power (from watts to multi-kilowatts).

Key drivers:

– Expansion in electric vehicle (EV) production requiring precision welding of battery components.

– Growth in aerospace and heavy machinery industries.

– Advancements in pulsed fiber lasers enabling finer engraving and surface structuring.

The global fiber laser market is projected to grow at a CAGR of 7–8% through 2026, with strong demand in automotive, metal fabrication, and additive manufacturing sectors.

2. Cost and Operational Efficiency

- UV Lasers: Higher initial investment and operational costs due to complex optical components and shorter lifespans of laser crystals/diodes. However, their precision reduces post-processing needs, offering long-term savings in high-tolerance applications.

- Fiber Lasers: Lower cost per watt, higher wall-plug efficiency (up to 30–40%), and minimal maintenance make fiber lasers more economical for high-throughput industrial environments.

By 2026, cost reductions in diode pumping and improved crystal longevity may narrow the gap for UV lasers in mid-tier applications.

3. Innovation and Hybrid Trends

A notable trend by 2026 will be the integration of both technologies within hybrid manufacturing systems. For example:

– UV lasers used for fine feature patterning on sensor arrays, followed by fiber laser welding of housing components.

– Smart factories adopting multi-laser workstations to optimize throughput and precision.

Additionally, advances in ultrafast fiber lasers (picosecond and femtosecond) are blurring the performance gap, enabling fiber systems to perform some traditionally UV-dominated tasks, especially in transparent material processing.

4. Regional and Sectoral Adoption

- Asia-Pacific: Dominates both UV and fiber laser demand, driven by electronics, EVs, and consumer goods manufacturing.

- North America & Europe: Strong in high-end medical, aerospace, and R&D applications, favoring UV lasers for precision and fiber lasers for robust industrial use.

Conclusion

By 2026, fiber lasers will continue to lead in market volume and revenue due to broad industrial applicability and cost-effectiveness. UV lasers, though smaller in market size, will grow faster in specialized high-precision domains. The future lies not in competition, but in complementarity, as manufacturers increasingly deploy both technologies in integrated production environments to meet the dual demands of speed and micron-level accuracy.

Common Pitfalls When Sourcing UV Lasers vs. Fiber Lasers (Quality and Intellectual Property)

When selecting between UV lasers and fiber lasers for industrial applications such as marking, engraving, or micromachining, sourcing decisions must carefully consider both quality assurance and intellectual property (IP) risks. Failing to do so can lead to performance issues, legal complications, and long-term cost overruns. Below are key pitfalls to avoid in each area.

Quality-Related Pitfalls

Underestimating Pulse Stability and Beam Quality in UV Lasers

UV lasers, particularly diode-pumped solid-state (DPSS) types, are sensitive to thermal fluctuations and optical alignment. Poorly manufactured systems may exhibit inconsistent pulse energy and degraded beam quality (e.g., M² > 1.3), leading to uneven marking or ablation. Buyers often overlook the importance of active cooling systems and robust optical sealing, which are critical for maintaining performance in industrial environments. In contrast, fiber lasers generally offer superior beam quality and stability, but low-cost variants may use substandard pump diodes or spliced fibers, reducing longevity.

Overlooking Lifetime and Maintenance Costs

UV lasers typically have shorter lifespans due to crystal degradation and frequent consumables (e.g., nonlinear crystals). Sourcing from vendors without transparent Mean Time Between Failures (MTBF) data can result in unexpected downtime. Fiber lasers, while more durable, can suffer from pump diode failure if sourced from manufacturers cutting corners on thermal management or component quality. Always request third-party reliability testing reports and service history data before procurement.

Ignoring Environmental Robustness

UV lasers are more sensitive to dust, humidity, and vibration due to their complex optical paths. Sourcing units without proper IP-rated enclosures or shock absorption can compromise performance, especially in harsh factory conditions. Fiber lasers, with their monolithic design, are inherently more robust, but low-quality fiber delivery systems or connectors can introduce alignment issues over time.

Intellectual Property (IP) and Compliance Pitfalls

Procuring Counterfeit or IP-Infringing Components

The laser market, especially in regions with lax enforcement, is prone to counterfeit or cloned technology. UV laser systems may illegally replicate patented frequency conversion techniques or optical designs from leading OEMs. Similarly, some fiber laser sources duplicate control algorithms or seed laser designs protected by IP. Sourcing without verifying the manufacturer’s IP compliance—through legal documentation, original design certifications, or direct OEM partnerships—can expose buyers to liability, product seizures, or forced redesigns.

Lack of Transparency in Supply Chain Origins

Many suppliers outsource core components (e.g., laser diodes, crystals, or fiber gain modules) without disclosing the true origin. This opacity increases the risk of inadvertently sourcing from blacklisted entities or using components under export control (e.g., ITAR/EAR regulations). Always demand a full bill of materials and country-of-origin documentation, particularly when operating in regulated industries like aerospace or medical devices.

Inadequate Software and Firmware Licensing

Modern laser systems rely on proprietary control software. Some low-cost suppliers bundle unlicensed or pirated firmware, which can lead to instability, lack of updates, or legal action. Ensure that software licenses are genuine and transferable, especially if integrating the laser into a larger system where compliance audits may occur.

By proactively addressing these quality and IP-related pitfalls, organizations can mitigate risks and ensure reliable, legally sound laser integration in their manufacturing processes. Due diligence in vendor qualification, component traceability, and compliance verification is essential when choosing between UV and fiber laser technologies.

Logistics & Compliance Guide: UV Laser vs Fiber Laser

When integrating laser systems into industrial, manufacturing, or marking applications, understanding the logistical and compliance considerations for different laser types is essential. This guide compares UV (Ultraviolet) lasers and Fiber lasers across key logistics and regulatory aspects to support safe, efficient, and compliant operations.

Regulatory Classification & Laser Safety

Both UV and Fiber lasers are classified under international and national laser safety standards, such as IEC 60825 (International) and 21 CFR 1040.10 (U.S. FDA). However, their classification and safety requirements differ due to wavelength and operational characteristics.

-

UV Lasers: Typically operate at wavelengths between 355 nm and 365 nm. These shorter wavelengths fall into higher risk categories due to potential photochemical effects on skin and eyes, even at low power levels. UV lasers are often classified as Class 3B or Class 4, requiring stringent engineering controls (e.g., interlocks, enclosures) and administrative procedures (e.g., laser safety officer).

-

Fiber Lasers: Commonly emit at 1064 nm (infrared), placing them in the near-IR spectrum. While also often Class 4 due to high power, the primary hazard is thermal (burns, fire), not photochemical. Safety measures focus on beam containment, protective eyewear rated for 1064 nm, and area control.

Compliance Tip: UV lasers may require additional documentation and hazard assessments due to their photochemical risks, especially in environments with human exposure.

Environmental & Operational Requirements

Environmental conditions directly impact laser performance, lifespan, and compliance with operational standards.

- UV Lasers:

- Sensitive to temperature and humidity fluctuations. Require stable, climate-controlled environments.

- Generate ozone as a byproduct due to photochemical reactions in air, necessitating exhaust ventilation or air filtration systems (especially relevant for cleanroom or indoor settings).

-

May require clean power supplies and surge protection due to complex diode-pumped solid-state (DPSS) architecture.

-

Fiber Lasers:

- More robust and tolerant of variable environmental conditions (e.g., dust, temperature swings).

- Minimal byproduct generation—no ozone or harmful emissions under normal operation.

- Lower maintenance and fewer environmental controls needed, simplifying integration into industrial environments.

Logistics Insight: Fiber lasers are generally easier and less costly to install in non-climate-controlled or high-throughput facilities.

Transportation & Handling

Proper handling during shipment and installation ensures safety and preserves equipment integrity.

- UV Lasers:

- Often include sensitive optical components (crystals, mirrors) vulnerable to shock and vibration.

- Require specialized packaging with shock absorption and humidity control.

-

May need customs documentation highlighting laser classification (especially for international shipments under IMDG or IATA regulations).

-

Fiber Lasers:

- Solid-state design with no moving or delicate internal optics makes them more rugged.

- Simpler packaging and lower risk of damage during transport.

- Still subject to hazardous goods regulations if battery-backed or high-voltage, but generally less restrictive than UV systems.

Compliance Note: All Class 3B and 4 lasers must be shipped with proper labeling and safety documentation per national transport regulations.

Installation & Site Compliance

Facility readiness and regulatory alignment are critical for deployment.

- UV Lasers:

- Installation may require dedicated exhaust systems, UV-blocking enclosures, and interlocks tied to facility safety systems.

- Compliance with OSHA (U.S.) or equivalent workplace safety standards for chemical (ozone) and radiation hazards.

-

May need approval from environmental health and safety (EHS) departments prior to operation.

-

Fiber Lasers:

- Easier to integrate with standard safety enclosures and interlocks.

- Fewer ancillary systems required (e.g., no exhaust for ozone).

- Generally faster commissioning and lower site modification costs.

Logistics Advantage: Fiber lasers typically offer faster deployment and lower site preparation costs.

Maintenance & Service Logistics

Ongoing maintenance impacts uptime, costs, and compliance with operational safety.

- UV Lasers:

- DPSS design involves more components (laser diodes, frequency-tripling crystals) that degrade over time.

- Require regular alignment and periodic replacement of consumables.

-

Service may demand certified technicians due to complexity and higher risk classification.

-

Fiber Lasers:

- Minimal maintenance due to monolithic fiber design—no realignment needed.

- Long diode lifetimes (often 100,000+ hours).

- Remote diagnostics and support widely available, reducing service call frequency.

Compliance Insight: Maintenance records for both types must be retained per regulatory requirements, but UV systems may require more frequent audits due to higher risk profiles.

End-of-Life & Waste Disposal

Proper disposal is essential for environmental compliance and safety.

- UV Lasers:

- May contain hazardous materials (e.g., certain optical coatings, electronic components).

- Ozone-generating components may require special handling.

-

Subject to WEEE (EU) and similar e-waste regulations; recycling through certified vendors is mandatory.

-

Fiber Lasers:

- Generally contain fewer hazardous materials.

- Fiber components are inert and non-toxic.

- Still subject to electronic waste regulations, but disposal is typically simpler.

Best Practice: Both types should be decommissioned by certified technicians and disposed of via approved hazardous waste channels where applicable.

Summary: Key Logistics & Compliance Differences

| Factor | UV Laser | Fiber Laser |

|——————————|——————————————-|——————————————-|

| Safety Classification | Often Class 3B/4; photochemical hazard | Typically Class 4; thermal hazard |

| Ventilation Required | Yes (ozone mitigation) | No (unless fumes from material processing)|

| Environmental Sensitivity| High (temp, humidity, power stability) | Low to moderate |

| Transport Risk | High (sensitive optics) | Low (robust design) |

| Installation Complexity | High (enclosures, exhaust, interlocks) | Moderate (standard safety measures) |

| Maintenance Frequency | Higher (alignment, consumables) | Low (solid-state, long lifetime) |

| Disposal Complexity | Moderate to high (hazardous materials) | Low (fewer hazardous components) |

Final Recommendations

- Choose UV Lasers when high-precision, cold marking on sensitive materials (e.g., plastics, PCBs) is required—accept higher compliance and logistical demands.

- Opt for Fiber Lasers for robust, low-maintenance industrial marking, engraving, or cutting—ideal for scalable, compliant operations with minimal overhead.

Always consult local regulations, involve a Laser Safety Officer (LSO), and ensure proper training, documentation, and engineering controls regardless of laser type.

Conclusion: Sourcing UV Laser vs Fiber Laser

When deciding between sourcing a UV laser and a fiber laser, the choice ultimately depends on the specific application requirements, material properties, precision needs, and budget considerations.

UV lasers (typically 355 nm) excel in high-precision, cold processing applications. Their shorter wavelength enables minimal heat-affected zones, making them ideal for delicate materials such as polymers, ceramics, and semiconductors. UV lasers are preferred in industries requiring micro-machining, fine marking, PCB fabrication, and medical device manufacturing where high resolution and clean, precise cuts are critical.

On the other hand, fiber lasers (commonly 1064 nm) offer superior power efficiency, longer operational lifetimes, and lower maintenance. They are highly effective for metal cutting, welding, and deep engraving, especially on materials like steel, aluminum, and other conductive metals. Fiber lasers are more cost-effective for high-speed industrial applications and provide excellent return on investment in high-volume production environments.

In summary, choose a UV laser when precision, minimal thermal impact, and processing of sensitive or non-metallic materials are paramount. Opt for a fiber laser when working with metals, requiring higher throughput, and seeking durability and cost efficiency. Evaluating these factors will guide the right sourcing decision to match technical needs with operational goals.