The global UV galvo laser market is experiencing robust growth, driven by increasing demand for high-precision marking and engraving across industries such as electronics, medical devices, and automotive. According to a report by Grand View Research, the global laser marking machines market size was valued at USD 2.8 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.7% from 2023 to 2030. A key contributor to this expansion is the rising adoption of ultraviolet (UV) lasers, particularly those integrated with galvanometer (galvo) scanning systems, due to their ability to deliver cold marking with minimal thermal impact on sensitive materials. Mordor Intelligence further projects that advancements in miniaturization and the proliferation of consumer electronics will continue to fuel demand for non-contact, high-resolution laser solutions. As the technology evolves, a select group of manufacturers has emerged as market leaders, consistently innovating to meet the stringent requirements of modern manufacturing. Below, we highlight the top 9 UV galvo laser manufacturers shaping the industry’s future.

Top 9 Uv Galvo Laser Manufacturers (2026 Audit Report)

(Ranked by Factory Capability & Trust Score)

#1 Sino

Website: galvo-scanner.com

Key Highlights: Welcome to buy customized galvo scanner and laser marking accessories at low price from professional manufacturers and suppliers in China….

#2 International Laser Marking Machine Manufacturer & Supplier …

Website: hunstlaser.com

Key Highlights: Hunst Laser is a laser marking machine manufacturer which represents high quality laser technology and its application expertise….

#3 LaserStar Technologies

Website: laserstar.net

Key Highlights: LaserStar Technologies is a US manufacturer of laser products and has engineered, designed, and built laser systems and solutions for use in high-precision ……

#4 JPT Laser

Website: en.jptoe.com

Key Highlights: As a leading laser manufacturer in China, JPT offers a full range of lasers, including MOPA laser, CW laser, DPSS laser, and diode lasers. JPT delivers ……

#5 Laser Equipment Supplier

Website: radianlaser.com

Key Highlights: Radian Laser Systems designs and manufactures high-end 2D and 3D (3-axis) fiber, CO2, and UV galvanometer-based laser and marking solutions….

#6 Full Spectrum Laser

#7 Finnlaser

#8 Haotian UV Galvo Laser Engraver

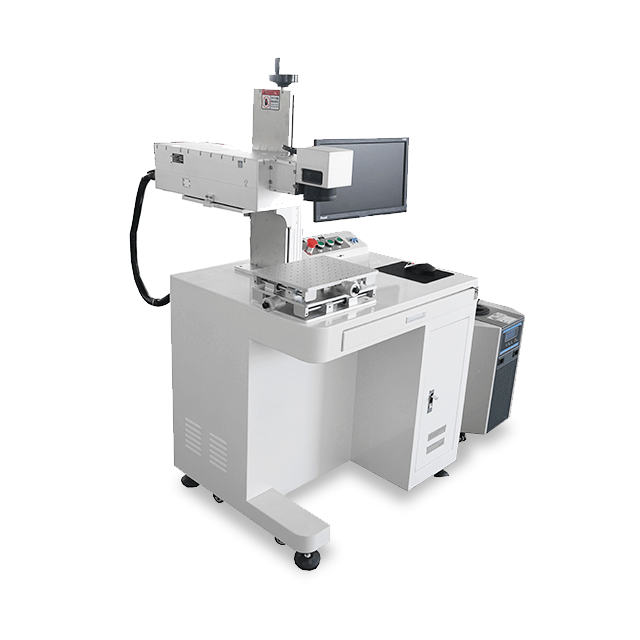

#9 HAOTIAN LASER

Website: haotianlaser.store

Key Highlights: Haotian Laser – Professional Laser Cutting Machines & Engravers. Get high-precision CO2 & fiber laser machines for wood, metal, acrylic, and leather….

Expert Sourcing Insights for Uv Galvo Laser

H2 2026 Market Trends for UV Galvo Lasers

The UV galvo laser market is poised for significant evolution and growth in the second half of 2026 (H2 2026), driven by advancements in technology, expanding applications, and shifting industrial demands. Key trends shaping the market include:

1. Accelerated Adoption in Advanced Electronics & Miniaturization:

* Focus: H2 2026 will see intensified demand for UV galvo lasers in manufacturing next-generation electronics, particularly for high-density interconnect (HDI) PCBs, flexible and rigid-flex circuits, semiconductor packaging (fan-out wafer-level packaging – FOWLP, 2.5D/3D ICs), and ultra-fine feature microvias.

* Driver: The relentless push for smaller, faster, and more powerful devices (5G/6G infrastructure, advanced wearables, AI hardware) necessitates micron and sub-micron precision machining impossible with traditional methods. UV lasers’ cold ablation process minimizes heat-affected zones (HAZ), critical for delicate materials and fine features.

* Trend: Increased demand for higher power (>10W) and higher repetition rate (>500 kHz) UV lasers integrated into multi-axis galvo systems for improved throughput on complex electronic components.

2. Dominance of Higher Power & Pulse Control for Throughput & Quality:

* Focus: A major trend will be the commercialization and widespread adoption of UV lasers with significantly higher average power (15W – 30W range becoming standard for high-end systems) and sophisticated pulse shaping capabilities (burst mode, pulse-on-demand).

* Driver: Manufacturers face intense pressure to increase production yields and reduce costs. Higher power directly translates to faster processing speeds. Advanced pulse control allows optimization of ablation efficiency, minimizes recast, and improves edge quality on challenging materials (e.g., polyimide, ceramics, composites).

* Trend: Systems incorporating real-time process monitoring (e.g., plasma emission sensing) combined with dynamic pulse control will become more common for closed-loop quality assurance in critical applications like medical device manufacturing.

3. Expansion into Emerging Material Processing Applications:

* Focus: Beyond traditional PCB and marking, H2 2026 will see strong growth in UV galvo laser use for processing novel materials:

* Biomedical Devices: Precision cutting/drilling of bioresorbable polymers, microfluidic channels in lab-on-a-chip devices, surface texturing for implants.

* Advanced Packaging: Processing ultra-thin (<50µm) glass and silicon wafers for advanced packaging substrates and interposers.

* Consumer Electronics: Fine engraving on sapphire glass (camera covers, wearables), patterning of OLED layers, and processing of novel composite materials.

* Clean Energy: Selective ablation in thin-film solar cell manufacturing and precision scribing for next-gen battery electrodes.

* Driver: UV lasers’ ability to process a vast array of materials (polymers, ceramics, glasses, thin metals, composites) with minimal thermal damage makes them ideal for these high-value, low-volume applications requiring extreme precision.

4. Integration with Automation & Industry 4.0:

* Focus: UV galvo laser systems will increasingly be designed as modular units seamlessly integrated into fully automated production lines (especially in electronics and medical device manufacturing).

* Driver: The need for traceability, process consistency, and reduced labor costs.

* Trend: Systems will feature enhanced connectivity (OPC UA, MQTT), embedded process monitoring data collection, and compatibility with MES/SCADA systems. AI-driven predictive maintenance for laser sources and galvo scanners will become more prevalent to minimize downtime.

5. Competitive Landscape & Cost Dynamics:

* Focus: The market will remain competitive, with established players (Coherent, IPG Photonics, Spectra-Physics) facing pressure from increasingly capable Asian manufacturers (e.g., JPT Opto-electronics, Maxphotonics, Han’s Laser) offering cost-effective solutions.

* Driver: Price sensitivity in high-volume electronics manufacturing and the need for broader market penetration.

* Trend: While core laser technology costs may stabilize or see slight decreases due to competition and volume, the value shift will be towards integrated solutions (laser + galvo + software + automation interface). Service, reliability, and application support will be key differentiators. Demand for “plug-and-play” galvo heads with simplified integration will grow.

6. Advancements in Galvo Scanner Technology:

* Focus: Galvo scanners will evolve to keep pace with higher power lasers and faster processing demands.

* Trend: Wider adoption of high-speed, high-precision scanners with improved dynamic performance (faster settling times, higher bandwidth). Increased use of lightweight, high-stiffness mirror materials (e.g., SiC, Be) and advanced motor designs. Enhanced thermal management systems will be critical to maintain accuracy under high-duty cycles. Field calibration and distortion correction algorithms will become more sophisticated.

Conclusion:

H2 2026 will be a dynamic period for the UV galvo laser market, characterized by performance-driven growth. Success will hinge on manufacturers delivering higher power, faster, and more intelligent systems capable of meeting the extreme precision and throughput demands of advanced electronics and emerging applications. The integration of these lasers into automated, data-connected production environments will be paramount. While cost competition persists, the focus will shift towards providing reliable, high-performance solutions with strong support, solidifying the UV galvo laser’s role as an indispensable tool in high-tech manufacturing.

Common Pitfalls When Sourcing UV Galvo Lasers (Quality and Intellectual Property)

Sourcing UV galvo lasers—particularly for high-precision applications like marking, engraving, or microfabrication—can be fraught with risks if due diligence is not performed. Two critical areas where buyers often encounter problems are product quality inconsistencies and intellectual property (IP) concerns. Being aware of these pitfalls can help avoid costly mistakes.

Quality-Related Pitfalls

1. Inconsistent Laser Performance and Beam Quality

Many low-cost UV lasers, especially from less reputable suppliers, suffer from inconsistent beam quality (e.g., poor M² factor), unstable output power, and short pulse duration variability. This leads to unreliable marking or processing results, particularly in fine-detail applications.

2. Poor Component Build and Cooling Design

Inferior thermal management (e.g., inadequate cooling systems) can result in rapid degradation of laser diodes and optical components. This reduces the laser’s lifespan and increases downtime and maintenance costs.

3. Substandard Galvanometer and Scanning Optics

The galvo system must match the laser’s performance. Some suppliers pair high-spec lasers with low-quality galvos or F-theta lenses, leading to positioning inaccuracies, distortion, or reduced scan speed.

4. Lack of Proper Testing and Calibration

Reputable manufacturers perform full system integration and calibration. However, some suppliers deliver untested or poorly calibrated units, resulting in alignment issues, focus drift, or inconsistent marking depth.

5. Inadequate After-Sales Support and Warranty

Limited technical support, long lead times for spare parts, or restrictive warranties can render a seemingly affordable laser costly over time, especially if maintenance or repairs are needed.

Intellectual Property (IP) Pitfalls

1. Use of Counterfeit or Cloned Components

Some suppliers use unlicensed or reverse-engineered control boards, laser diodes, or software. This not only raises ethical and legal concerns but also affects reliability and system compatibility.

2. Proprietary Software with Licensing Risks

UV galvo systems often rely on proprietary software for control and path generation. Using software that infringes on third-party IP can expose the buyer to legal liability, especially in regulated industries or international markets.

3. Lack of IP Documentation and Compliance

Reputable suppliers provide clear documentation on component origins, certifications (e.g., CE, FDA), and IP compliance. Opaque supply chains make it difficult to verify whether the product uses legally licensed technology.

4. Risk of Infringement in Export/Import

Importing lasers that incorporate patented technologies without proper licensing can lead to customs seizures, legal disputes, or bans in certain jurisdictions (e.g., the U.S. or EU).

5. Inability to Secure Future Upgrades or Support

If a supplier uses cloned or non-standard IP, they may not be able to offer firmware updates, compatibility with new software, or long-term technical support due to legal constraints.

Mitigation Strategies

- Verify supplier credentials (certifications, customer references, factory audits).

- Request full technical specifications and test reports (including beam profile, power stability, and scan accuracy).

- Ensure software and components are licensed and comply with regional regulations.

- Include IP indemnity clauses in procurement contracts.

- Partner with established OEMs or distributors with transparent supply chains.

By addressing these quality and IP-related pitfalls proactively, buyers can secure reliable, legally compliant UV galvo laser systems that deliver long-term value.

Logistics & Compliance Guide for UV Galvo Laser

Overview

This guide outlines the essential logistics and compliance considerations for the transportation, import/export, installation, and operation of a UV Galvo Laser system. Adhering to these guidelines ensures regulatory compliance, operational safety, and efficient deployment.

Regulatory Compliance

Laser Safety Standards

UV Galvo Lasers are classified as Class 4 lasers under international safety standards (IEC 60825-1). Compliance with local and international laser safety regulations is mandatory. Key requirements include:

– Installation in a controlled environment with proper interlocks and warning signs.

– Use of certified laser safety eyewear appropriate for the UV wavelength (typically 355 nm).

– Implementation of beam enclosures and emergency stop mechanisms.

– Personnel training in laser safety (e.g., ANSI Z136.1 in the U.S.).

Electrical and Equipment Standards

Ensure the laser system meets applicable electrical safety and electromagnetic compatibility (EMC) standards:

– CE Marking (EU): Compliance with the Low Voltage Directive (LVD) and EMC Directive.

– UL/CSA Certification (North America): Required for safe operation and regulatory acceptance.

– FCC Part 15 (U.S.): Ensures minimal electromagnetic interference.

Environmental and Chemical Compliance

UV lasers may involve materials or processes that generate ozone or particulate byproducts. Comply with:

– OSHA (U.S.) or equivalent regulations for workplace air quality.

– Proper ventilation or fume extraction systems.

– Safe handling and disposal of consumables or waste materials in accordance with local environmental laws.

Export and Import Regulations

Export Controls

UV Galvo Lasers may be subject to export control regulations due to their power, precision, or potential dual-use applications:

– U.S. Export Administration Regulations (EAR): Check Commerce Control List (CCL) for ECCN (e.g., 6A003.b.4).

– EU Dual-Use Regulation (EC) No 428/2009: Verify classification and licensing requirements.

– Obtain proper export licenses if shipping to restricted destinations or entities.

Import Requirements

Recipient countries may have specific import rules:

– Provide technical specifications, CE/UL certificates, and conformity documents.

– Declare accurate Harmonized System (HS) codes (e.g., 8515.21 or 8515.80 for laser systems).

– Comply with local customs duties, taxes, and import permits.

Packaging and Transportation

Secure Packaging

- Use shock-absorbent, anti-static packaging to protect sensitive optical and electronic components.

- Include humidity indicators and desiccants if shipping to high-moisture environments.

- Clearly label packages with “Fragile,” “This Side Up,” and “Laser Equipment” warnings.

Shipping Modes and Handling

- Use reputable carriers experienced in handling high-tech industrial equipment.

- For international shipments, ensure compliance with IATA/ICAO regulations if air freight is used.

- Maintain temperature and humidity within manufacturer-specified ranges during transit.

- Avoid rapid altitude changes that may affect sealed optical components.

Installation and Site Preparation

Facility Requirements

- Ensure stable power supply with surge protection and voltage regulation.

- Provide adequate cooling (chiller or HVAC) as specified by the manufacturer.

- Install on a vibration-free, level surface to maintain beam alignment.

Safety Infrastructure

- Designate a controlled access area with interlocks and safety curtains.

- Post required laser warning signs per IEC 60825 or local regulations.

- Equip the site with fire extinguishers suitable for electrical/chemical fires.

Documentation and Records

Required Documentation

Maintain and provide:

– Certificate of Conformity (CE, UL, etc.)

– Technical datasheets and user manuals

– Laser safety compliance reports

– Export licenses and customs declarations (as applicable)

Record Keeping

Retain shipping logs, compliance certifications, maintenance records, and safety training documentation for audit and regulatory purposes (minimum 5–7 years, depending on jurisdiction).

Conclusion

Proper logistics planning and strict adherence to compliance standards are critical for the safe and legal deployment of UV Galvo Laser systems. Always consult with regulatory experts and the manufacturer to ensure full compliance with all applicable rules in your region and destination countries.

Conclusion for Sourcing UV Galvo Laser Systems

Sourcing a UV galvo laser system is a strategic decision that significantly impacts manufacturing precision, efficiency, and product quality—especially in high-resolution applications such as micromachining, PCB depaneling, semiconductor processing, medical device manufacturing, and fine marking on sensitive materials. After evaluating technical specifications, supplier reliability, cost considerations, and long-term support, it is evident that selecting the right UV galvo laser requires a balanced approach.

UV lasers, with their short wavelength (typically 355 nm), offer excellent beam quality and minimal heat-affected zones, making them ideal for delicate and high-accuracy tasks. The integration of high-speed galvanometer scanners further enhances processing speed and positional accuracy. However, performance depends heavily on the quality of core components—such as the laser source, scan heads, optics, and control software.

When sourcing, prioritize suppliers with proven expertise, strong after-sales service, and comprehensive technical support. Consider total cost of ownership, including maintenance, consumables, training, and system scalability, rather than focusing solely on initial price. Additionally, ensure compatibility with existing production lines and future technological upgrades.

In conclusion, investing in a high-quality UV galvo laser system from a reputable supplier ensures superior processing results, operational reliability, and long-term return on investment. Careful evaluation of technical needs and vendor capabilities will lead to a sourcing decision that enhances precision manufacturing capabilities and supports competitive advantage in demanding markets.